It is a seemingly simple question. However, discovering the worth of your home is more complicated than it might seem. Sites like Zillow, Redfin, Eppraisal, and others have built-in home valuation tools that make it seem easy, but how accurate are they? And if you get three different answers, which one do you believe? Online valuation tools have become a pivotal part of the home buying and selling process, but they’ve proven to be highly unreliable in certain instances. What these valuation tools have made clear is that real estate agents are as vital to the process of pricing a home as they ever were—and maybe even more so now.

Every online valuation tool has its limitations. Most are readily acknowledged by their providers, such as “Zestimate” from Zillow, which clearly states that it offers a median error rate of 4.5%. That may not sound like a lot, but keep in mind that 4.5% amounts to a difference of about $31,500 for a $700,000 home. For Redfin and Trulia, there are similar variances. When you dig deeper into these valuation tools, it’s no wonder that there are discrepancies. They rely on a range of different sources for information, some more reliable than others.

Redfin’s tool pulls information directly from multiple listing services (MLSs) across the country. Others negotiate limited data sharing deals with those same services, relying on public and homeowners’ records alike. This can lead to gaps in coverage. These tools can serve as helpful pieces of the puzzle when buying or selling a home, but the acknowledged error rate is a reminder of how dangerous a heavy reliance on them can be.

Nothing compares to the level of detail and knowledge a professional real estate agent offers when pricing a home. An algorithm can’t possibly know about the unique characteristics of neither a home nor its neighborhood. Curious about what improvements you can make to get top dollar or how buyer behaviors are shaping the market? They cannot provide an answer there, either. That can only be delivered by a trusted professional whose number one priority is getting you the best price in a time frame that meets your needs.

If you’re curious about your home’s value, Windermere offers a tool that provides a series of evaluations on your property and the surrounding market. And once you’re ready, we're happy to connect you with a Windermere agent who can clarify this information and perform a Comparative Market Analysis to get an even more accurate estimate of what your home could fetch in today’s market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

The average home price in the region rose 10.2% year-over-year to $580,180. Prices dropped by amodest 0.8% between the third and fourth quarters of 2019.

The average home price in the region rose 10.2% year-over-year to $580,180. Prices dropped by amodest 0.8% between the third and fourth quarters of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

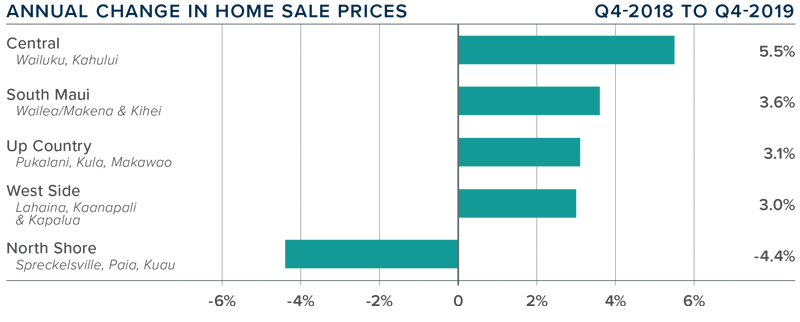

The average home price in the region rose 8.1% year-over-year to $934,302 and was up 5% compared to the third quarter of 2019.

The average home price in the region rose 8.1% year-over-year to $934,302 and was up 5% compared to the third quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

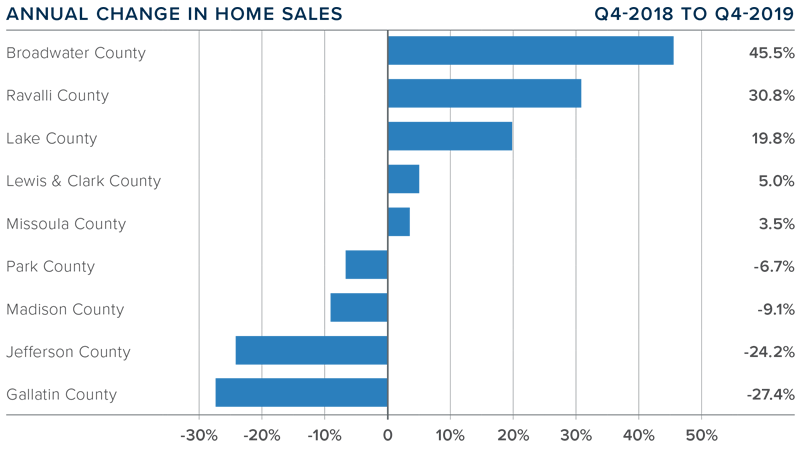

Year-over-year home prices fell 4.6% compared to the same period a year ago to an average of $345,617.

Year-over-year home prices fell 4.6% compared to the same period a year ago to an average of $345,617.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

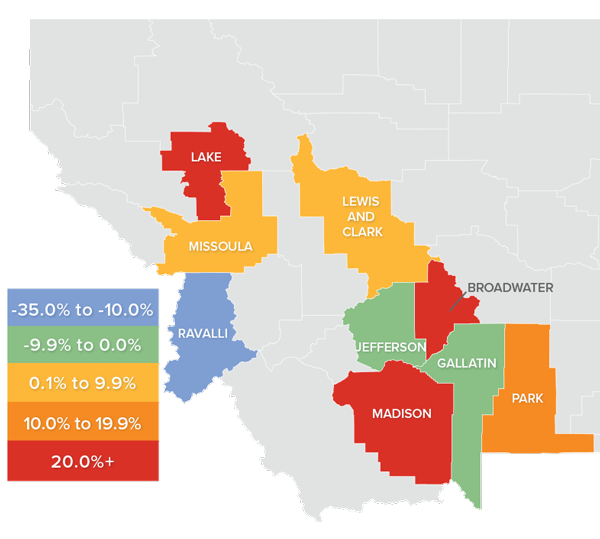

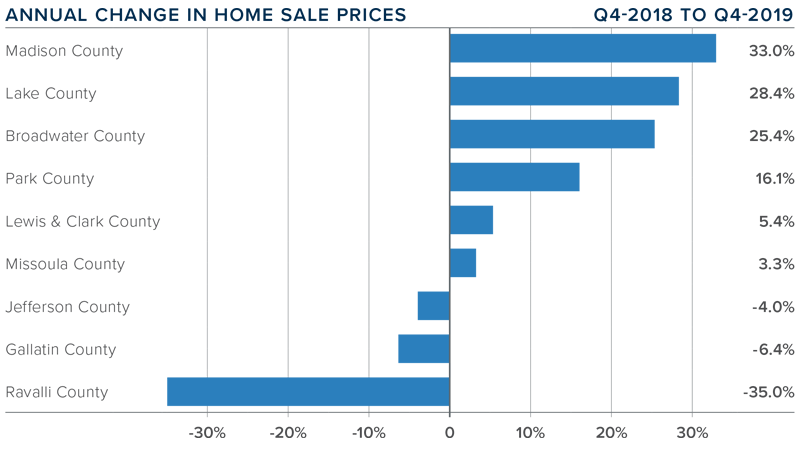

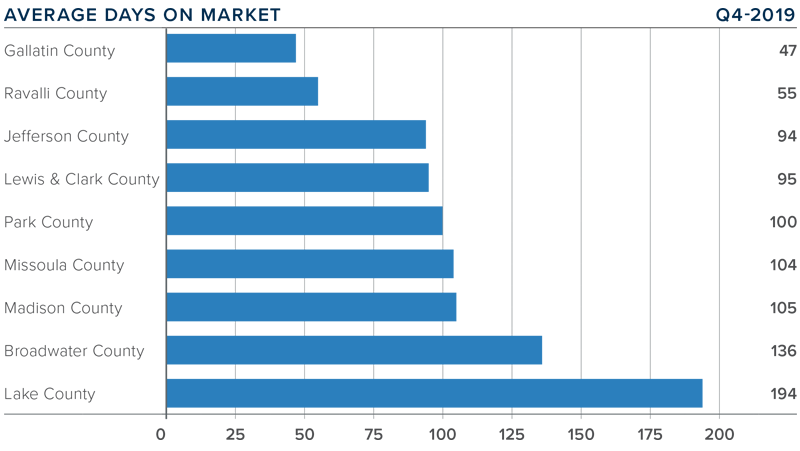

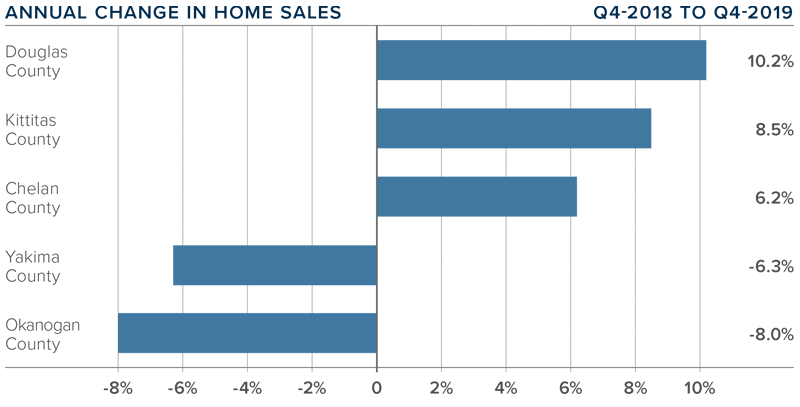

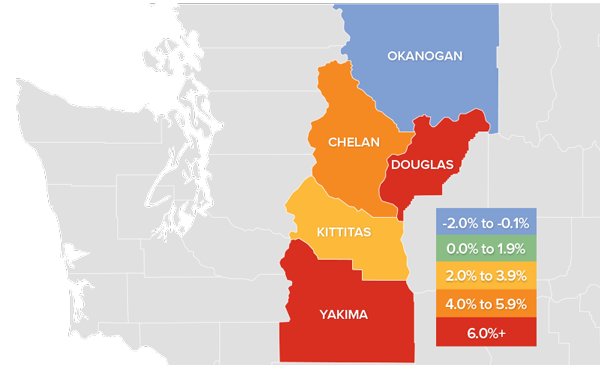

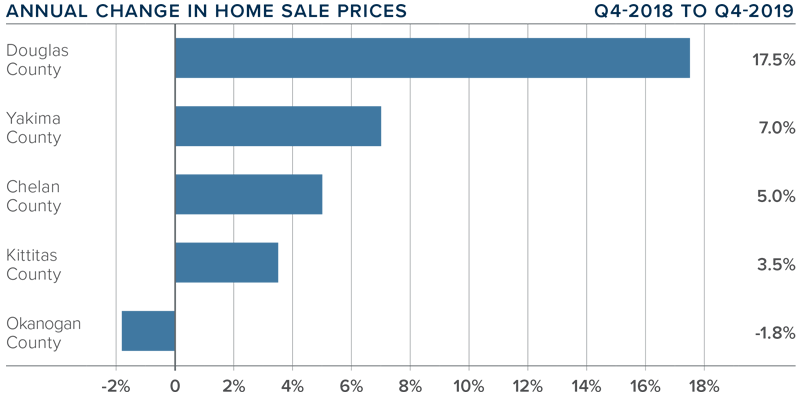

Year-over-year, the average home price in the region rose 7.7% to $352,643. Price growth continues to trend well above the long-term average, with limited inventory pushing prices higher.

Year-over-year, the average home price in the region rose 7.7% to $352,643. Price growth continues to trend well above the long-term average, with limited inventory pushing prices higher.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Image Source:

Image Source: