The following analysis of select counties of the Central Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Central Washington added 5,831 jobs over the past 12 months, representing a decent 2.3% growth rate and a pleasing turnaround from the jobs losses during the final quarter of 2022. Looking across the counties contained in this report, we saw solid gains in Douglas County (+3.3%) Kittitas County (+2.6%), Chelan County (+2.5%), and Yakima County (+2.4%). Okanogan County did add jobs, but only at an annual rate of .4%. The seasonally adjusted unemployment rate in Central Washington was 6.8%, which was up from 5.7% a year ago. The lowest unemployment rate was in Chelan County, where it was 5.5%. The area’s highest jobless rate was in Yakima County, where 7.4% of the labor force was without work.

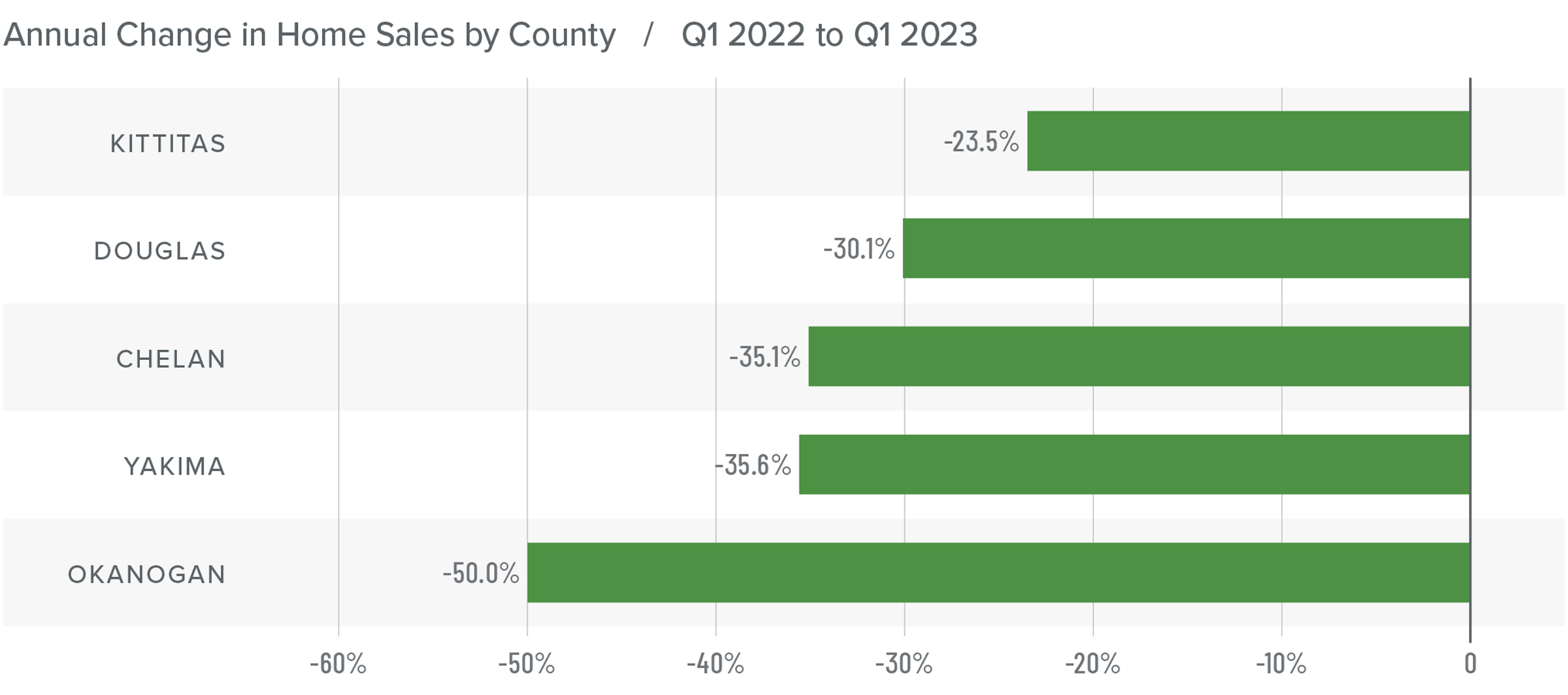

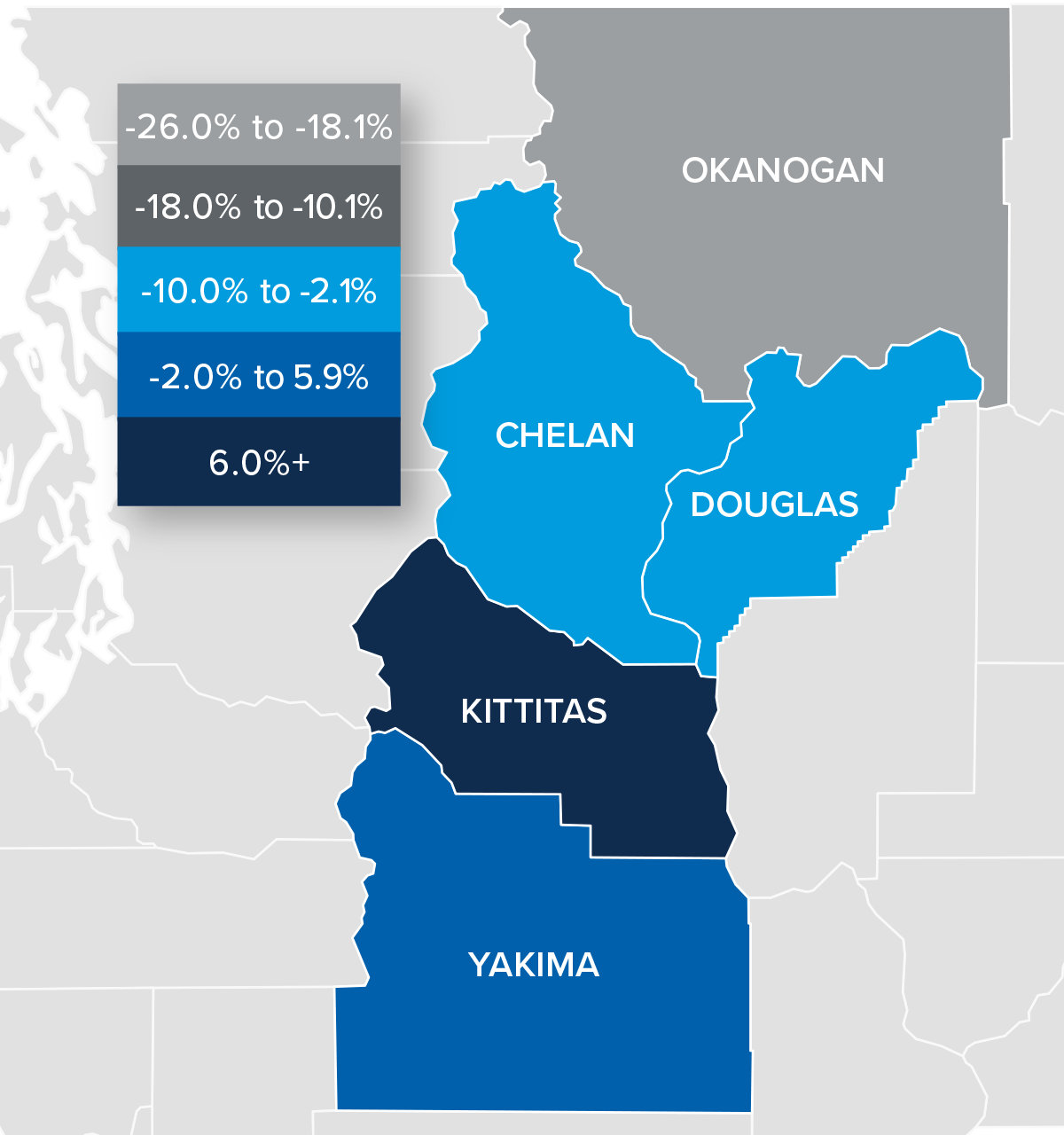

Central Washington Home Sales

❱ Central Washington had 611 home sales in the first quarter of 2023, representing a decline of 35% from the same quarter in 2022.

❱ Pending sales, which are an indicator of future closings, rose 13.5% compared to the fourth quarter of last year, suggesting that the market may start to show some growth as we enter the spring market.

❱ Year over year, sales fell significantly across the board. The number of homes sold was down 35.1% from the final quarter of 2022.

❱ Inventory levels fell 45.4% quarter over quarter, which may be one of the reasons for such lackluster sales activity.

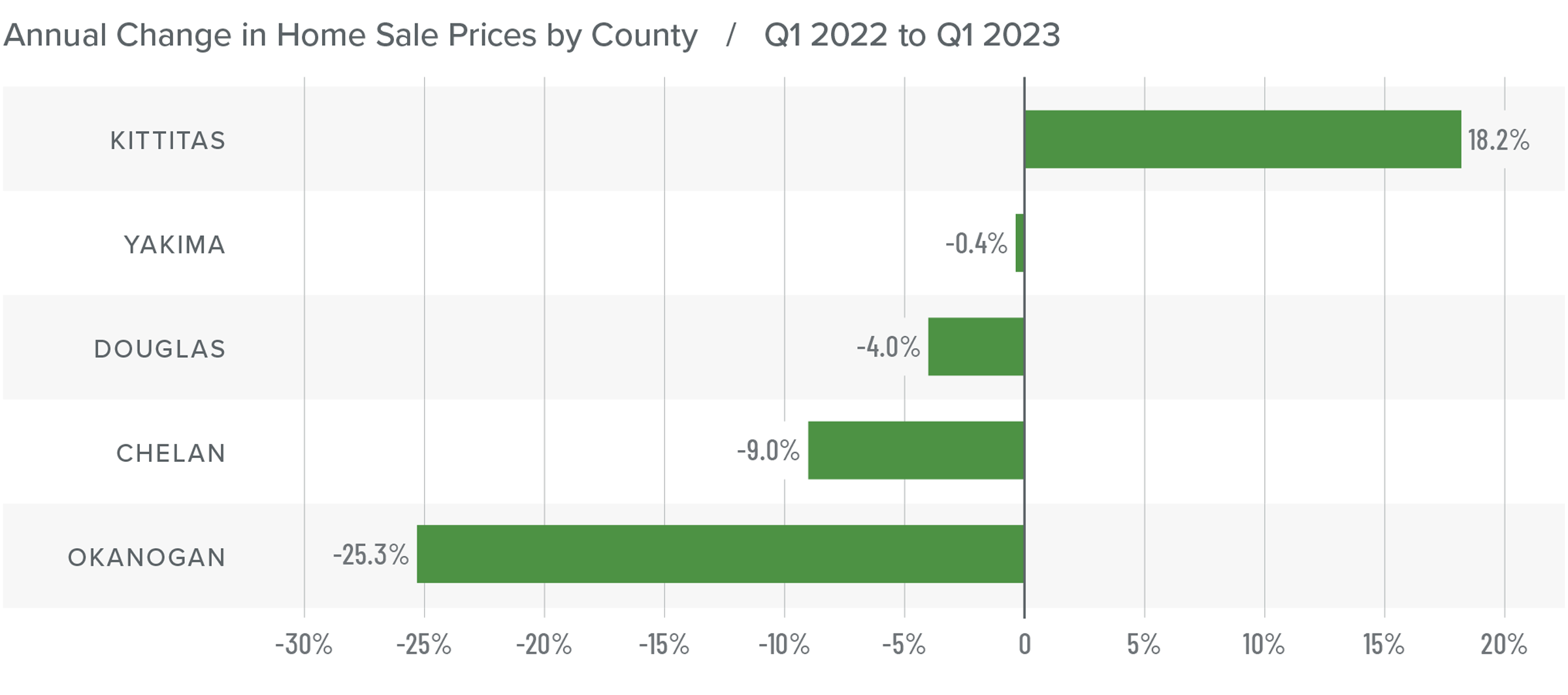

Central Washington Home Prices

❱ The average home price in Central Washington rose 1.5% year over year to $461,312. Prices were down 5.7% compared to the fourth quarter of 2022.

❱ Median listing prices rose 5.8% compared to the fourth quarter of 2022, but all markets were not even. While listing prices rose in Yakima and Chelan counties, they fell in the rest of the market areas.

❱ All counties except Kittitas saw prices fall from both the same period in 2022 and from the final quarter of last year.

❱ The market appears to still be adjusting to higher financing costs. It’s likely that there will be further price declines as we move through the spring, but I don’t think it will continue much past that point. Look for prices to stabilize in the summer after which time they’ll start trending higher again.

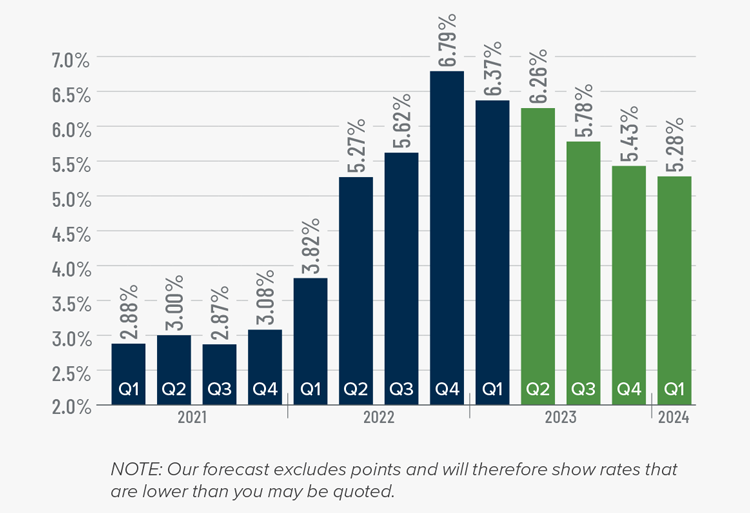

Mortgage Rates

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

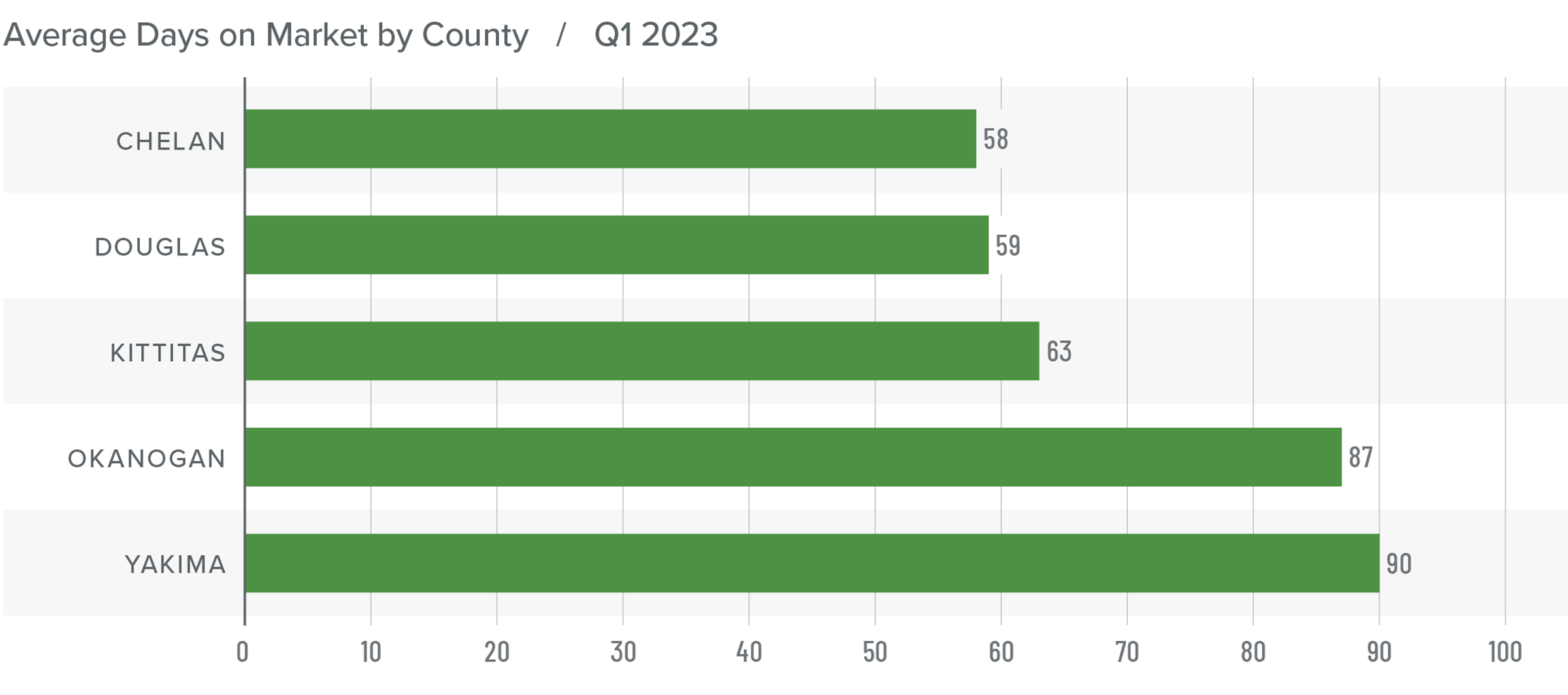

Central Washington Days on Market

❱ The average time it took to sell a home in Central Washington in the first quarter of 2023 was 71 days.

❱ During the first quarter, it took 18 more days to sell a home in Central Washington than it did during the same period of 2022.

❱ Year over year, all counties saw average market time rise. This was also the case compared to the fourth quarter of 2022.

❱ On average, it took 17 more days to sell a home in the first quarter of 2023 than it did in the final quarter of last year.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Employment growth has turned around and, although the jobless rate is higher than I would like it to be, I do not see the labor market being an impediment to home sales. Mortgage rates are firmly to blame for the decreased number of sales. The data suggests that home sellers should be benefitting from lower inventory levels, higher pending sales, and higher list prices. However, lower home sales and prices, as well as increased market time, tend to favor buyers.

If the mortgage market stabilizes, I expect that rates will continue to trend lower. This and the pullback in home prices should further favor buyers. Ultimately, I do not see either buyers or sellers really having the upper hand. As such, I have left the needle in the area suggesting balance but tilted just a hair in favor of home buyers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link