The following analysis of select Maui real estate markets is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

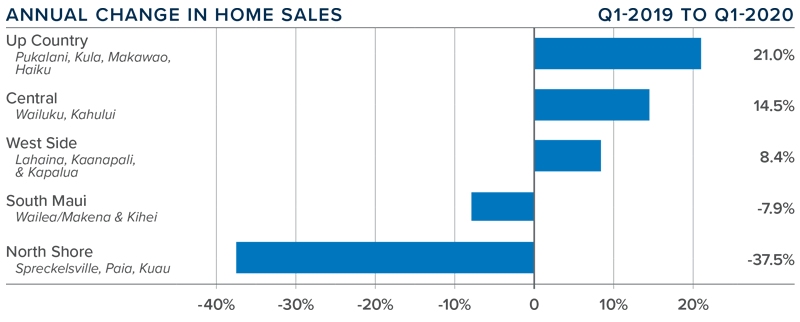

HOME SALES

- In the first quarter of 2020, 545 homes sold. This was an increase of 3% over the first quarter of 2019, but a drop of 1.1% from the fourth quarter of 2019.

- Not all markets saw a drop in sales, with notable increases in the Up Country and Central markets compared to the first quarter of 2019.

- The rise in sales came as aggregate inventory levels rose 6.3%. Clearly, the market did not experience any effects from COVID-19 in the first quarter. It will be interesting to see how the numbers look in the second quarter.

- Pending home sales were up 0.4% compared to the fourth quarter of 2019, suggesting that second quarter closings may be reasonably good.

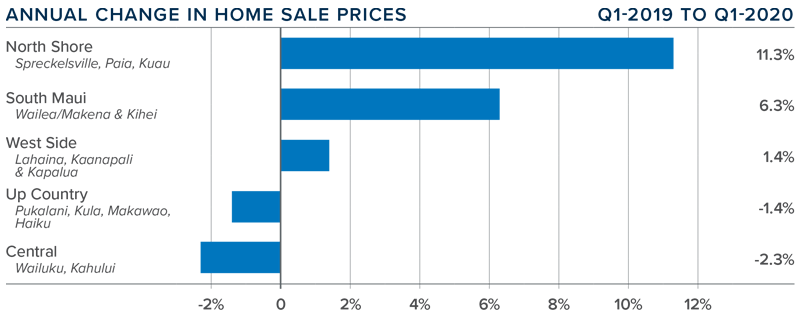

HOME PRICES

![]() The average home price in the region rose 2.6% year-over-year to $880,006 but was down 5.8% compared to the final quarter of 2019.

The average home price in the region rose 2.6% year-over-year to $880,006 but was down 5.8% compared to the final quarter of 2019.- Affordability remains a significant issue. As we move through the second quarter, I will be interested to see how demand reacts to COVID-19. Any significant slowdown in demand will put downward pressure on home prices.

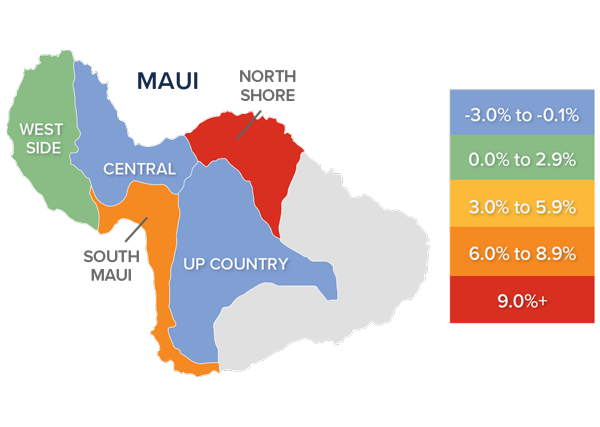

- Price changes on Maui were uneven, rising in three areas and falling in two. There were significant price gains in the North Shore market area.

- It is too early to say what effects COVID-19 will have on housing values on Maui. I will be watching this closely, specifically as it pertains to buyers of vacation homes.

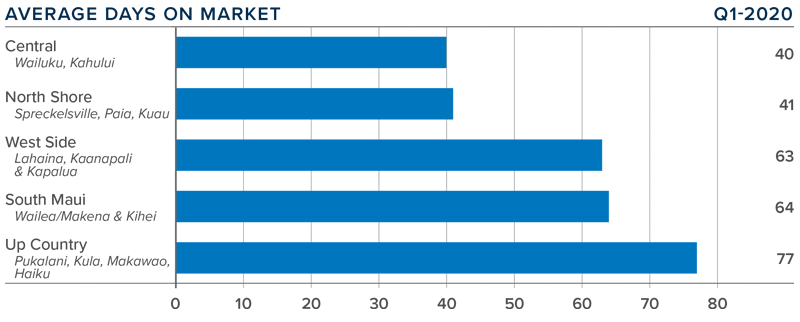

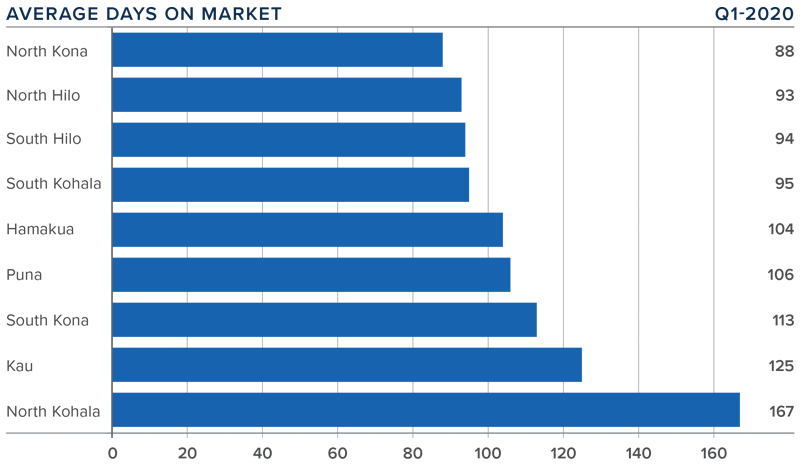

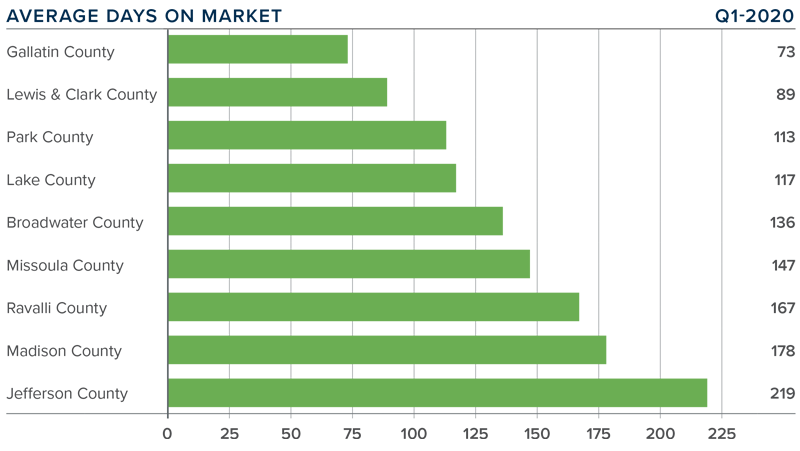

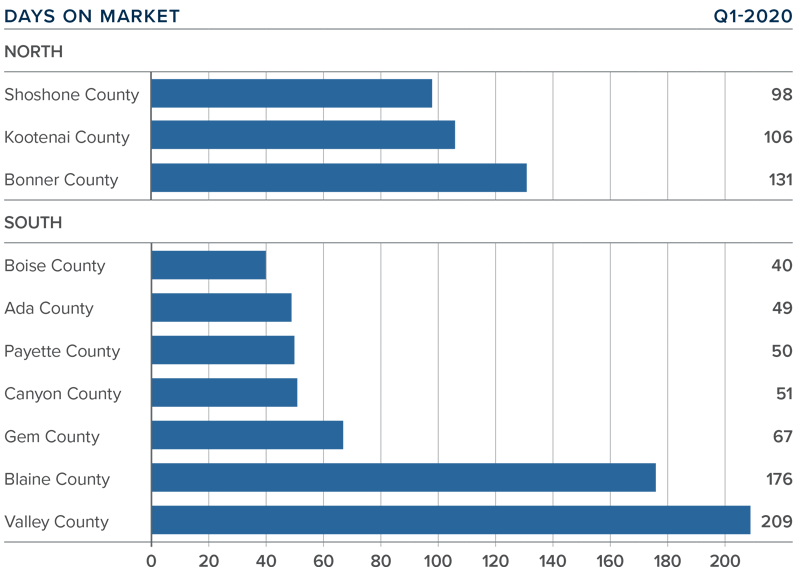

DAYS ON MARKET

- The average number of days it took to sell a home on Maui dropped 17 days compared to the first quarter of 2019.

- In the first quarter it took an average of 57 days to sell a home, with the Central market selling at the fastest pace. Up Country homes are taking the longest time to sell.

- The amount of time it took to sell a home dropped in all markets other than South Maui.

- It is likely we will see the length of time it takes to sell homes on Maui trend higher until the effects of COVID-19 are fully realized.

CONCLUSIONS

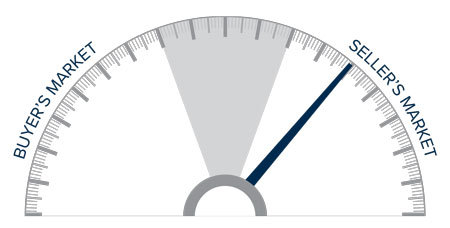

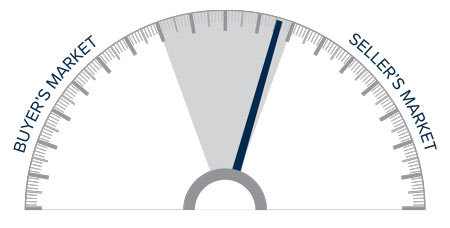

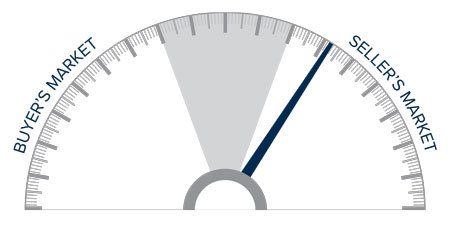

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

The average home price in the region rose 2.6% year-over-year to $880,006 but was down 5.8% compared to the final quarter of 2019.

The average home price in the region rose 2.6% year-over-year to $880,006 but was down 5.8% compared to the final quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

The average home price in the region continued to rise in the first quarter, with a year-over-year increase of 10.4% to an average of $404,316. Prices were a modest 0.3% higher than in the fourth quarter of 2019.

The average home price in the region continued to rise in the first quarter, with a year-over-year increase of 10.4% to an average of $404,316. Prices were a modest 0.3% higher than in the fourth quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Year-over-year prices were essentially static (+0.4%) and averaged $371,555. That said, prices were up 7.5% compared to the final quarter of 2019.

Year-over-year prices were essentially static (+0.4%) and averaged $371,555. That said, prices were up 7.5% compared to the final quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.

The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

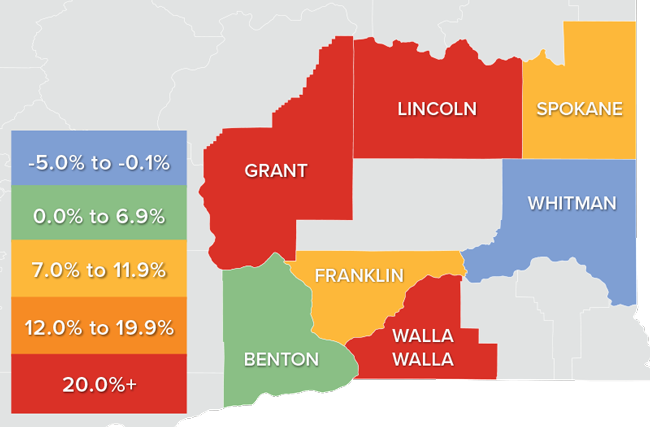

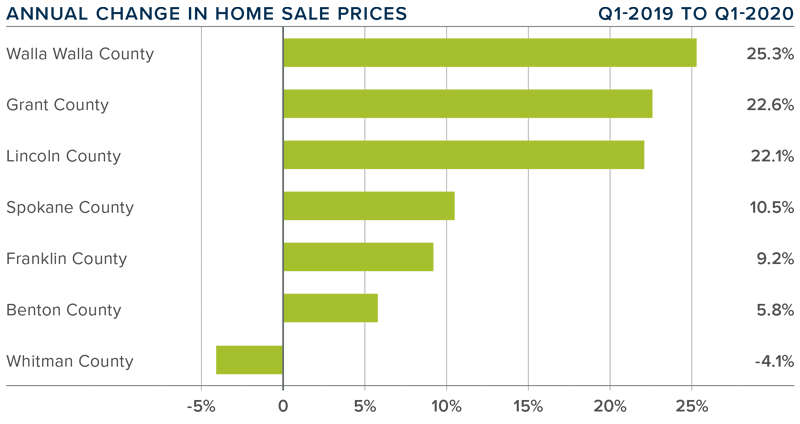

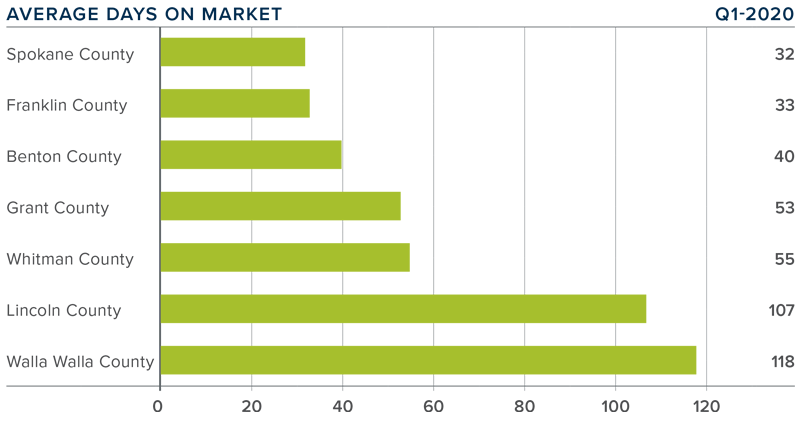

Year-over-year, the average home price in Eastern Washington rose a significant 10.9% to $297,590. Prices were also 0.2% higher than in the fourth quarter of 2019.

Year-over-year, the average home price in Eastern Washington rose a significant 10.9% to $297,590. Prices were also 0.2% higher than in the fourth quarter of 2019.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.