The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

HOME SALES

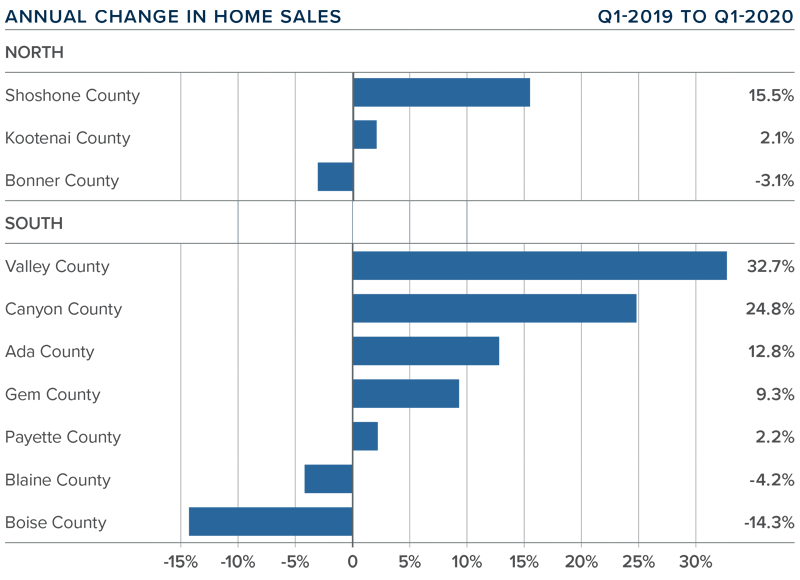

- During the first quarter of 2020, 5,128 homes were sold, representing a solid increase of 12.6% compared to the first quarter of 2019 but down 9.9% compared to the fourth quarter of 2019.

- In Northern Idaho, Shoshone County experienced a significant increase in sales — up 15.5% over the first quarter of 2019. There was a modest increase in Kootenai Country and a very slight contraction in Bonner County. In Southern Idaho, sales rose by double digits in Valley, Canyon, and Ada counties. Blaine and Boise counties showed a modest decline in sales.

- Year-over-year sales growth was positive in two of three of the Northern Idaho counties, and sales rose in all but two Southern Idaho market areas over the same period a year ago.

- Pending sales rose in the quarter, suggesting that closed sales in the second quarter will be positive regardless of COVID-19.

HOME PRICES

![]() The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.

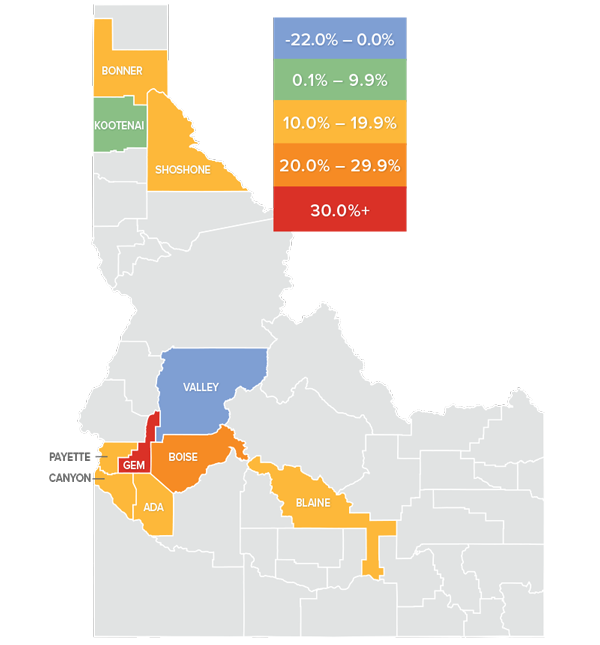

The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.- In Northern Idaho, Bonner County led the market with the strongest annual price growth, but there were solid gains in all counties. In Southern Idaho, Gem County saw prices rise a very significant 37.5%, and there were double-digit increases in all counties other than Valley.

- Prices rose in all Northern Idaho counties covered by this report compared to the first quarter of 2019, and rose in all but one Southern Idaho county.

- Inventory continues to be an issue, which is driving up home prices. Listing activity was down 7.2% compared to the first quarter of 2019. Listing activity was also down 8.8% compared to the final quarter of 2019.

DAYS ON MARKET

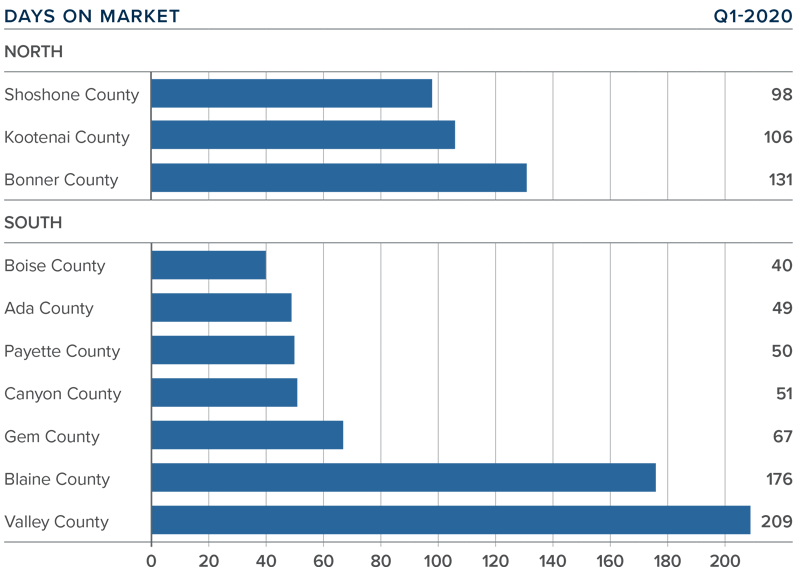

- It took an average of 112 days to sell a home in Northern Idaho, and 92 days in the southern part of the state covered by this report.

- In Northern Idaho, days on market dropped across the board. In Southern Idaho, market time dropped in Boise and Payette counties but rose in the other areas covered by this report.

- The average number of days it took to sell a home in the region dropped 2 days compared to the first quarter of 2019 but was up 21 days compared to the final quarter of 2019.

- Homes sold the fastest in Boise and Ada counties.

CONCLUSIONS

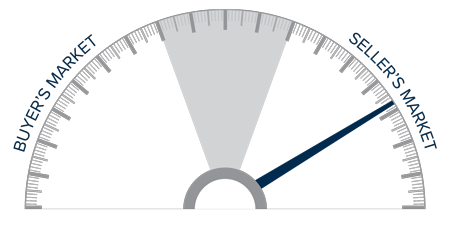

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see

a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.

The average home price in the region rose 11.3% year-over-year to $382,601. Prices were 1.5% higher than in the fourth quarter of 2019.