The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Year over year, Idaho added 24,900 jobs, representing a solid growth rate of 3%. All of Idaho’s metropolitan areas saw year-over-year nonfarm job gains. Pocatello experienced the greatest increase at 5.5%, followed by Boise (3.7%), Idaho Falls (3.1%), Coeur d’Alene (2.9%), Twin Falls (.4%), and Lewiston (.3%). The state unemployment rate was 2.6%, matching the rate of the first quarter of 2022. The Boise metro area matched the state’s jobless rate of 2.6% and equaled the rate during the same period in 2022. This is rather impressive given that the labor force has grown by over 9,800 persons, or 2.4%. Clearly new jobs are being created at a very solid pace. My current forecast is that employment will rise by 17,000 jobs, which would represent a growth rate of 2 percent.

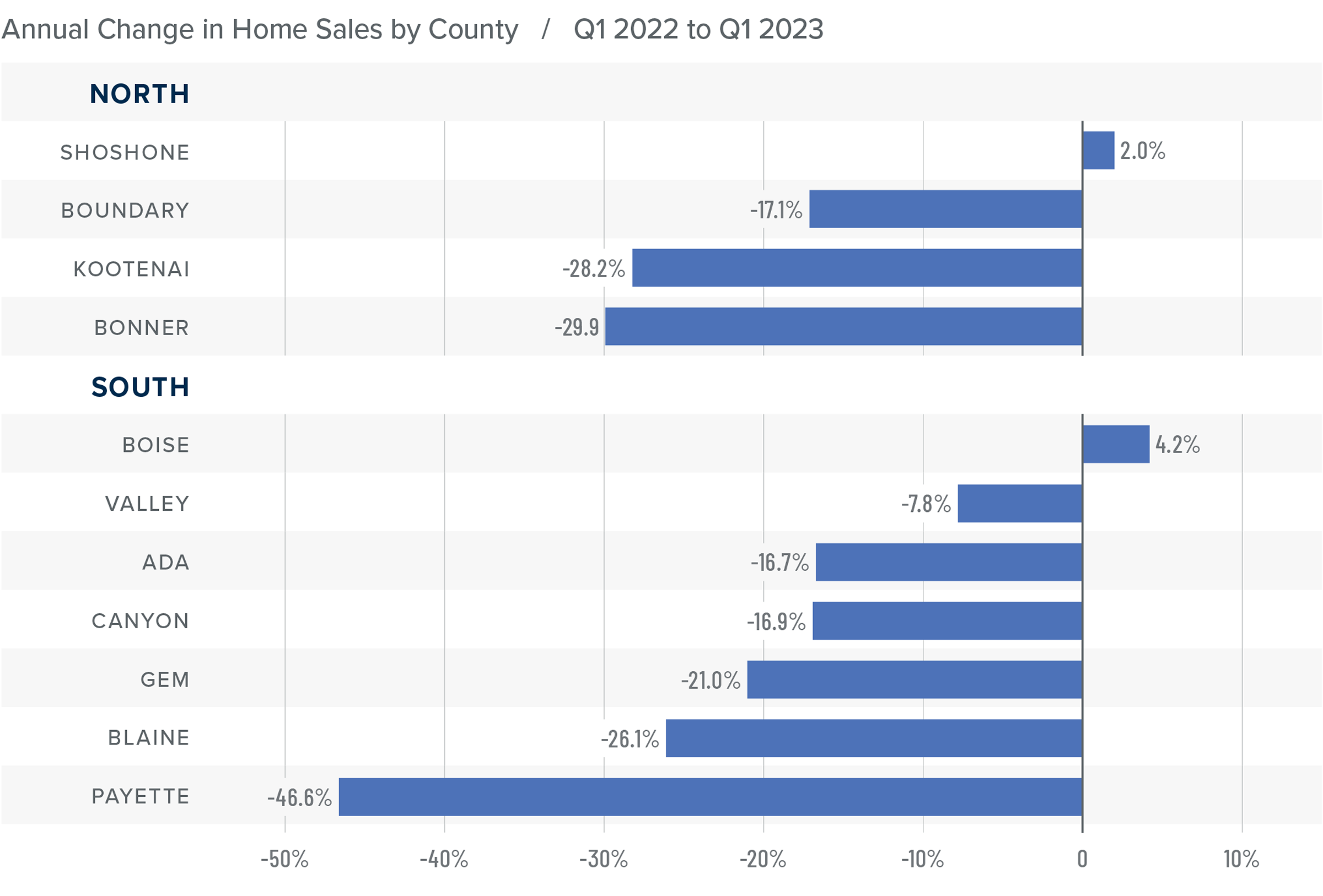

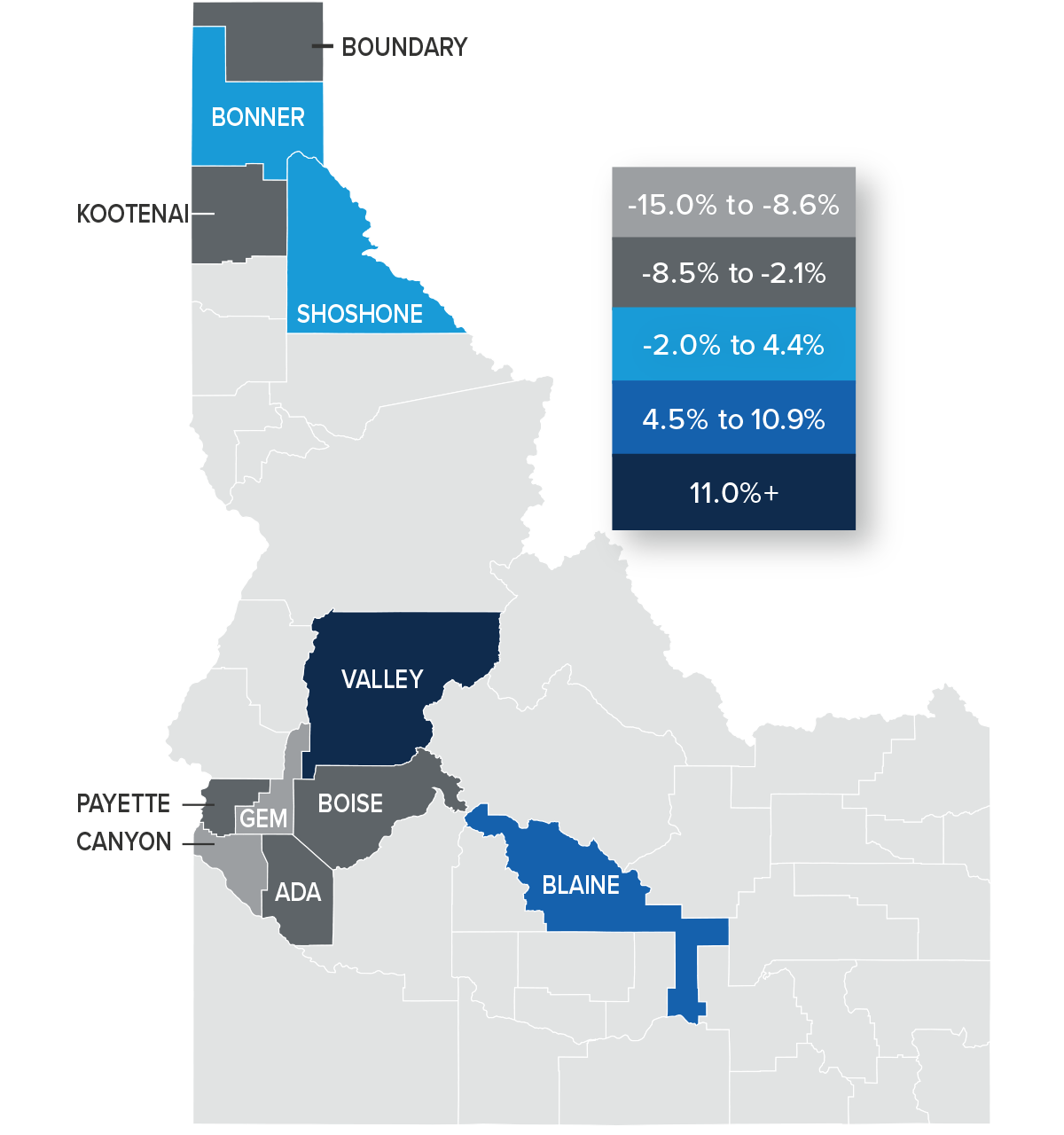

Idaho Home Sales

❱ In the first quarter of 2023, 4,205 homes sold, which was down 19.5% from the first quarter of 2022 and 2.3% lower than in the fourth quarter of last year.

❱ Although listing activity was significantly higher than the first quarter of 2022, it was down 27% from the fourth quarter of 2022. All counties had fewer homes on the market.

❱ Compared to the same period in 2022, sales fell in all but two markets covered by this report. Compared to the fourth quarter of last year, sales fell in all the Northern Idaho markets, but rose in Canyon, Ada, and Blaine counties in the southern part of the state.

❱ Even with fewer listings, pending sales in the quarter were up 36.9% from the fourth quarter of 2022, suggesting that sales growth may improve in the second quarter of this year.

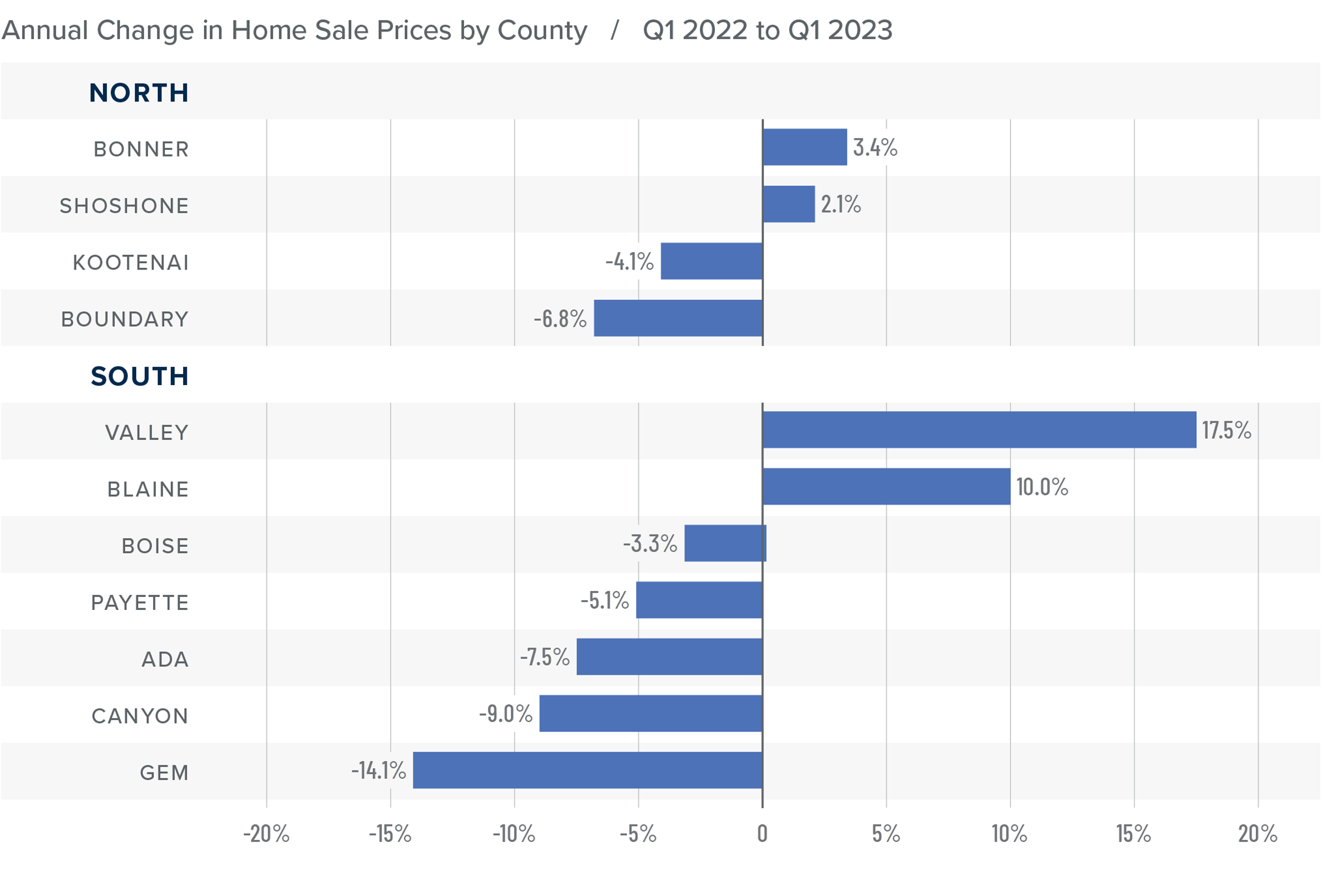

Idaho Home Prices

❱ The average home price in the region fell 6% year over year to $576,130. Prices were 5.4% lower than in the fourth quarter of 2022.

❱ Compared to the fourth quarter of 2022, prices only increased in Shoshone County. In the southern part of the state, prices rose in Valley, Payette, Gem, Boise, and Blaine counties.

❱ Both the northern and southern market areas saw counties split, with prices rising in around half while contracting in the other half. Year over year, prices fell 6.4% in the south and 4% in the north.

❱ Median listing prices in the first quarter were up by only .9% over the fourth quarter of last year. Interestingly, listing prices were up more than 10% in the populous Ada County, which many believed would see significant downward price pressure after the rapid growth over the past few years.

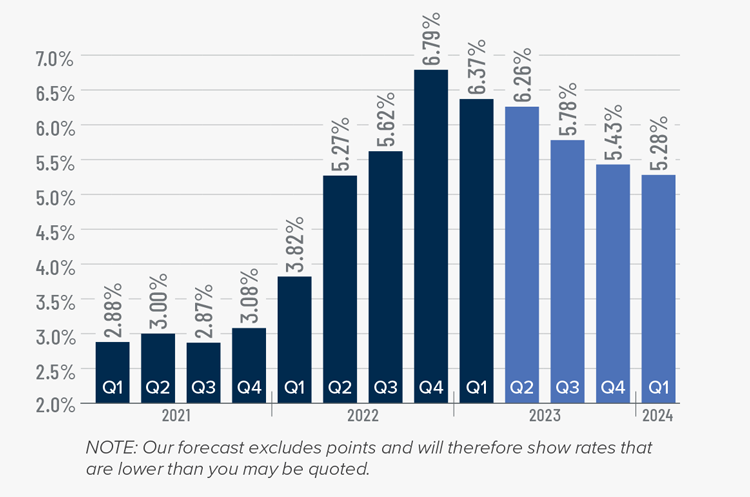

Mortgage Rates

Rates in the first quarter of 2023 were far less volatile than last year, even with the brief but significant impact of early March’s banking crisis. It appears that buyers are jumping in when rates dip, which was the case in mid-January and again in early February.

Even with the March Consumer Price Index report showing inflation slowing, I still expect the Federal Reserve to raise short-term rates one more time following their May meeting before pausing rate increases. This should be the catalyst that allows mortgage rates to start trending lower at a more consistent pace than we have seen so far this year. My current forecast is that rates will continue to move lower with occasional spikes, and that they will hold below 6% in the second half of this year.

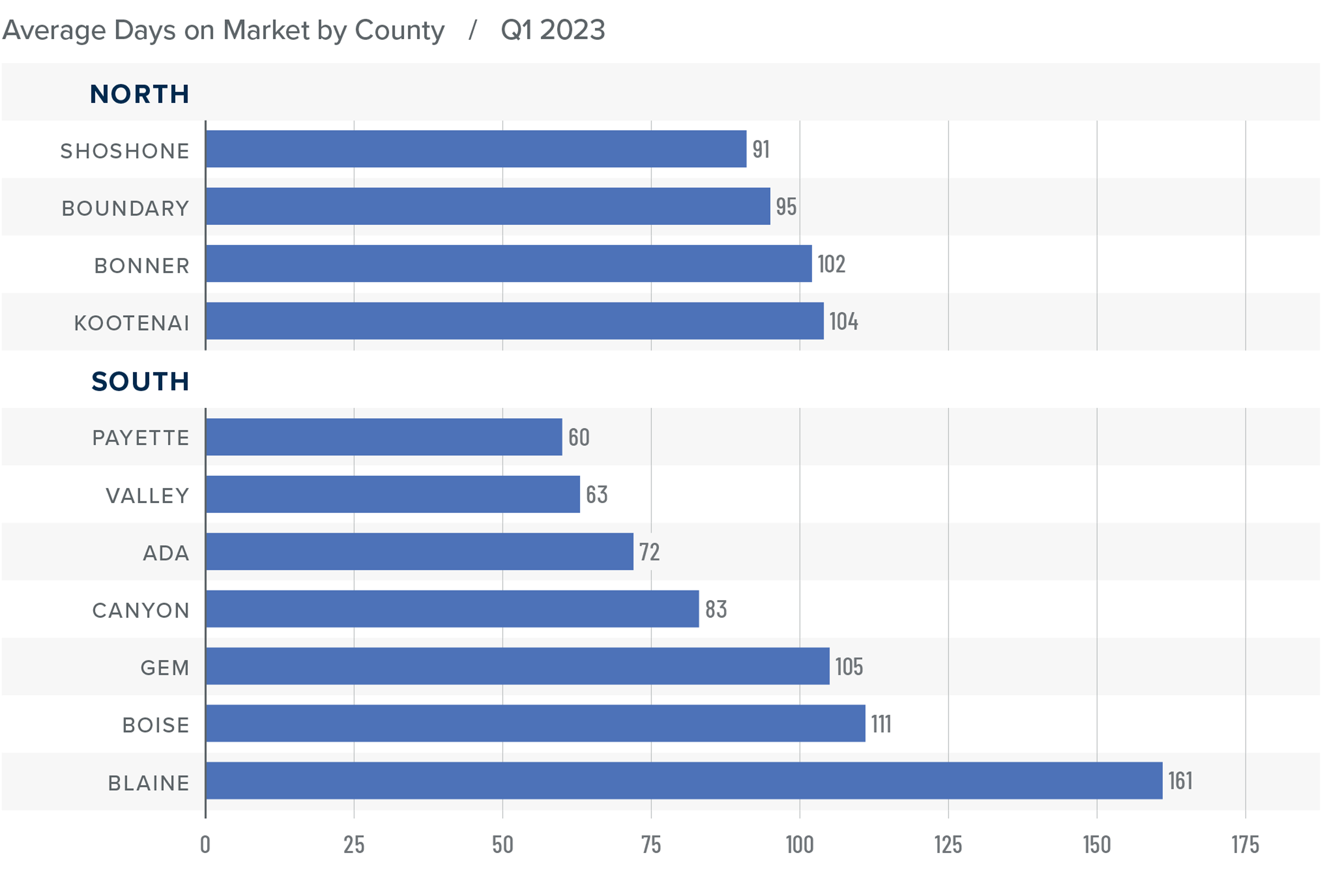

Idaho Days on Market

❱ The average time it took to sell a home in the region rose 33 days compared to the same quarter of 2022 and was 22 days longer than in the final quarter of 2022.

❱ In both Northern and Southern Idaho, days on market rose in all counties compared to the same period in 2022. Compared to the fourth quarter of 2022, market time rose in every county other than Gem County in Northern Idaho.

❱ It took an average of 98 days to sell a home in Northern Idaho and 94 days in the southern counties covered by this report.

❱ Homes sold fastest in Payette County in the southern part of the state and in Shoshone County in Northern Idaho.

Conclusions

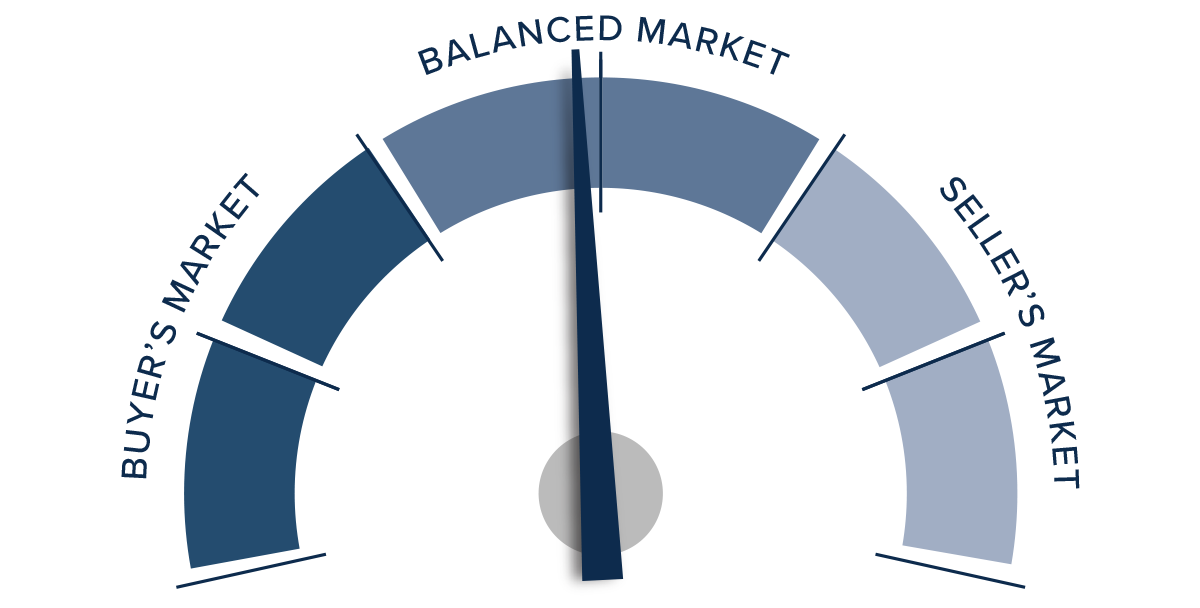

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The housing market has certainly slowed as it adjusts to higher mortgage rates and significantly lower affordability. Over the past few months, I have heard suggestions that the Idaho market was sure to crash after the rapid increase of prices through the pandemic period, especially as financing costs are more than double what they were in 2021. Although prices are adjusting in many markets, I do not expect to see any systemic declines for one simple reason: supply levels are still remarkably low and are not likely to rise to a level where any market is oversupplied. This will provide a floor for prices and stop them from falling much further than where they are today.

Slower sales activity, lower prices, and longer days on market favor home buyers. However, lower inventory levels, higher pending sales, higher absorption rates, and higher listing prices favor home sellers. As such, I am leaving the needle close to the midpoint of neutral territory. Although buyers are still able to find deals, sellers of well-positioned, appropriately priced homes will still see competition for them, given how few homes are available.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link