Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the March 2025 data from the Northwest MLS.

Last month, we saw a sudden pullback in pending sales, and those chickens came home to roost with fewer closed sales in May.

Many of these impacted closed sales originated from the weeks in April following Trump’s “Liberation Day”, when the stock market had dropped sharply, and a lot of buyers paused their home searches. Now, we saw the stock market fully recover by May, and while it’s still a little too early to tell, there are indications that the housing market is also getting back on track.

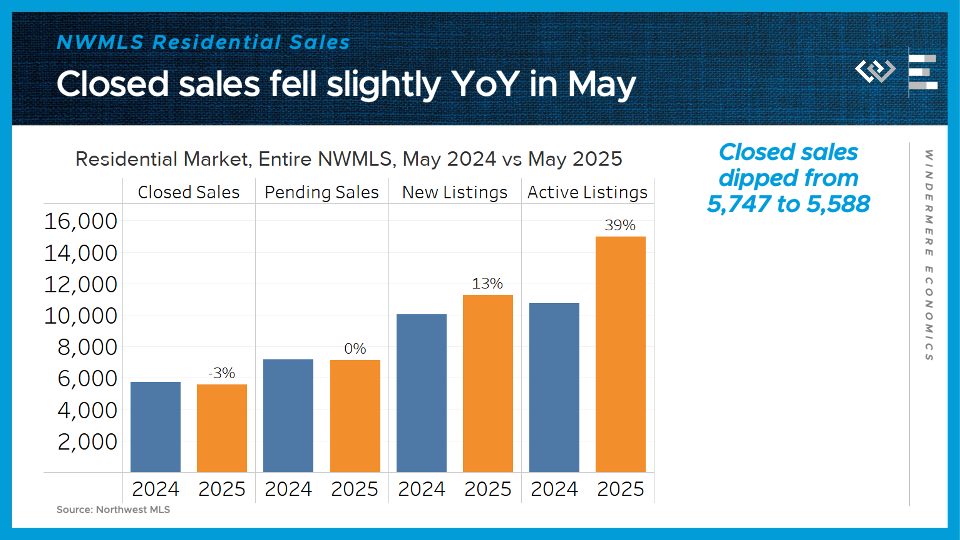

Here are the four key metrics I watch to track supply and demand in the market: closed and pending sales, which tell us a lot about demand; and listings – new and active – which tell us a lot about supply.

Across the Northwest MLS, closed sales of single-family homes fell 3% in May from their year-ago levels, after growing 1% in April. Pending sales, which are more of a real-time demand indicator, were flat from last year, a promising rebound after falling 4% year-on-year in April.

On the supply side, about 13% more new listings hit the market this May, and the tally of active listings ended the month 39% higher than May 2024’s inventory. Buyers are still seeing a lot more options than they had last spring, but one little glimmer of an inflection point here is that year-over-year inventory growth has stopped accelerating higher.

Finally: the median price for those closed single-family home sales fell 1% from last year, to $677,500. The extra inventory and cautious buyers have brought price appreciation to a halt for now.

Putting it all together: closed sales, and home prices, stepped down slightly from last year at this time, which we were expecting after the weak demand signals in April’s data. But the pending sales data suggest that buyers started coming back in May.

Now I’ll dig into details for the four counties encompassing the greater Seattle area.

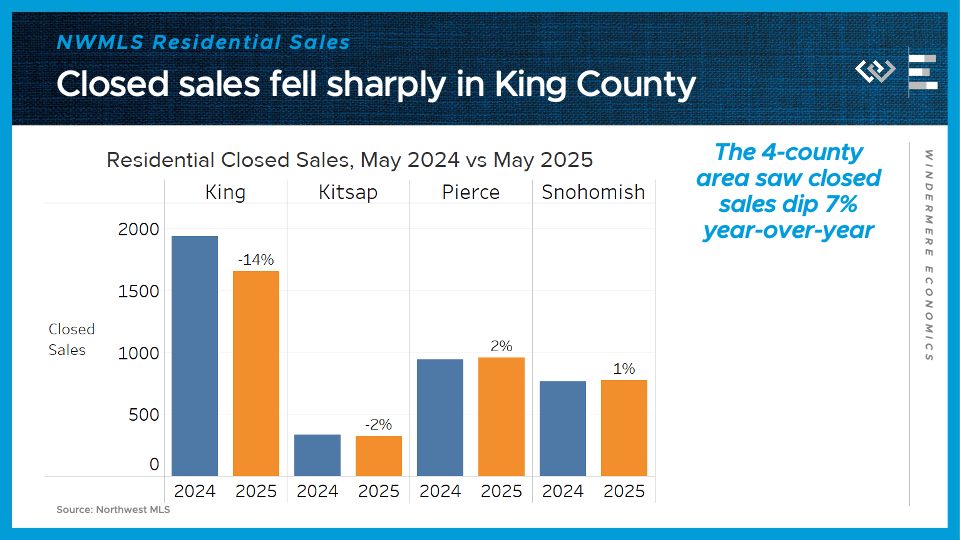

Residential closed sales dipped 7% year over year here in the 4-county region, led by a 14% drop in King County. Closed sales dipped 2% in Kitsap County; climbed 2% in Pierce County, including Tacoma; and climbed 1% in Snohomish County, including Everett. The 3 counties other than King held up surprisingly well, given that all 4 counties had seen sizeable pending sales declines in April. Maybe some buyers came back and closed quickly in May!

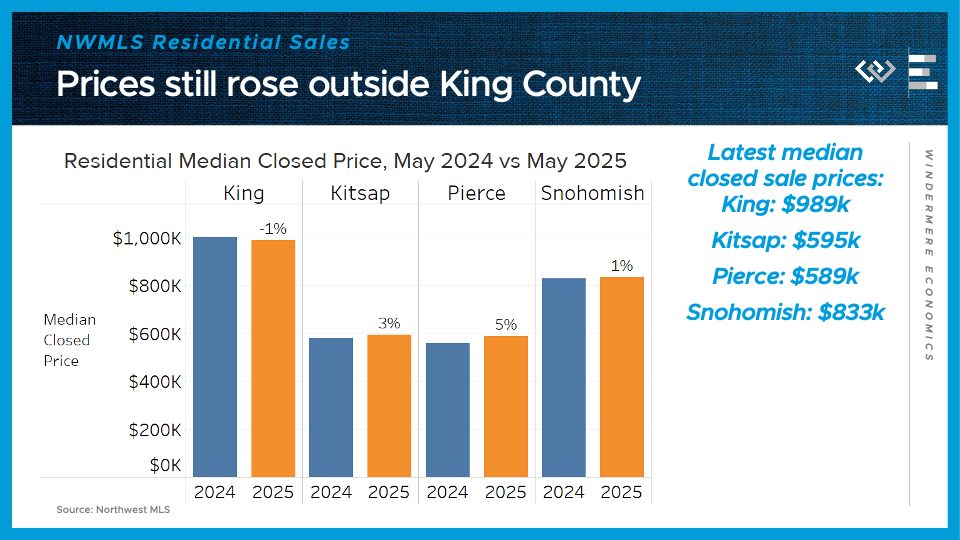

Similarly, King County saw the only median sale price decline, by 1.2%, back down just below a million dollars, while median prices kept climbing modestly in Kitsap and Pierce Counties, and just barely climbed in Snohomish County.

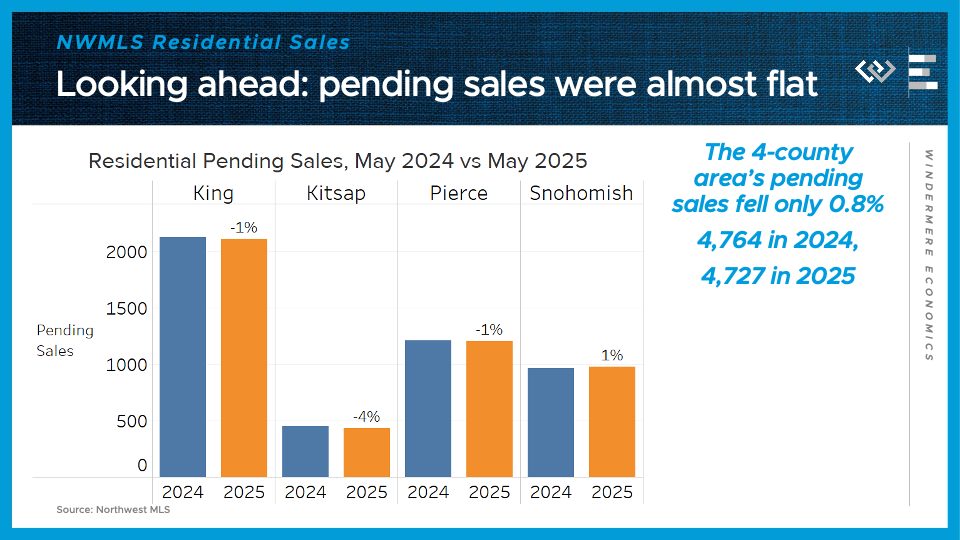

Looking ahead, pending sales dropped only 0.8% in the 4-county area: 0.8% in King, down 4% in Kitsap, down 0.7% in Pierce, and up 0.8% in Snohomish County. That’s a strong indication that local market activity has rebounded a bit after the shock in April around new tariff announcements.

On the supply side, the 4-county greater Seattle area had just over 8,100 active listings at the end of May, up 45% from the same time last year. Just like in April, the inventory growth is especially dramatic in King and Snohomish Counties, where listings are up 58% and 54% respectively. Kitsap inventory is only up 8% year-over-year.

All in all, this report confirmed that greater-Seattle-region buyers stepped back in April, but gave some promising indications that buyers returned at nearly year-ago levels in May. Economic uncertainty is still the watchword, and mortgage rates have unfortunately settled in at a higher range of around 7%. But buyers shopping now will definitely benefit from the most inventory in years, helping them find the perfect fit, all while facing less competition from other buyers than we’ve seen in recent spring selling seasons.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link