ECONOMIC OVERVIEW

The State of Oregon added 30,600 new jobs over the past 12 months, representing an annual growth rate of 1.7%. Although job growth continues to slow, solid gains were still seen in the Construction (+7,400), Education & Health Services (+6,400), and Leisure & Hospitality (+5,200) sectors.

Oregon’s unemployment rate was in record low territory for all of 2017, diving to 3.6% in May of 2017, before drifting up to 4.2% by November. It is clear that the annual average unemployment rate for the whole of 2017 will be the lowest on record.

HOME SALES ACTIVITY

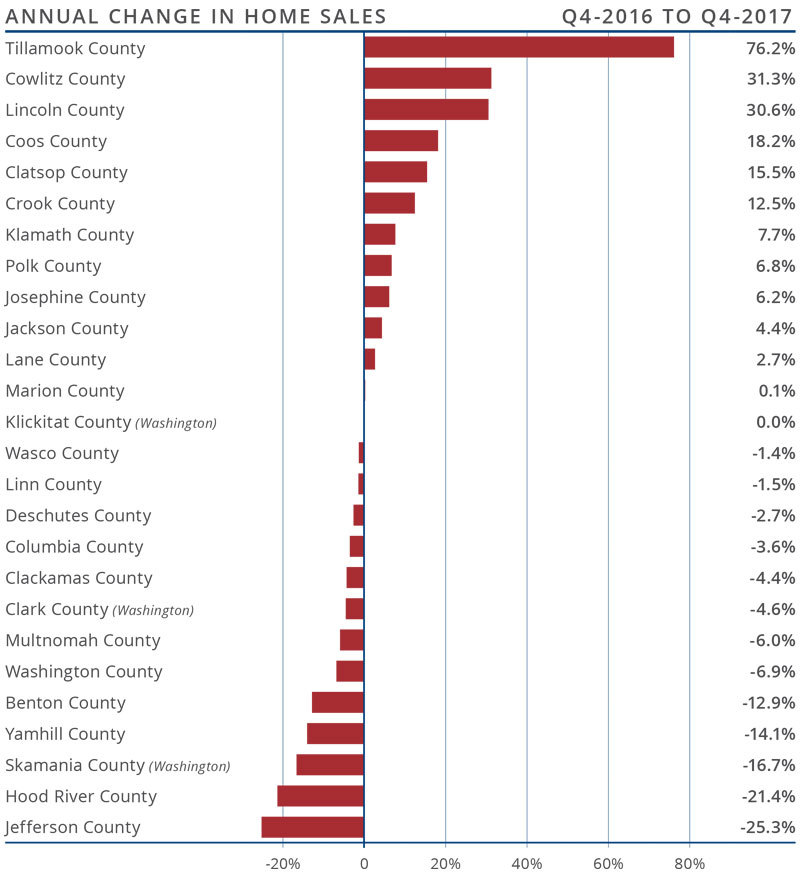

- Fourth quarter home sales dropped by a very modest 1.5% compared to the same period last year, with a total of 15,314 homes sold.

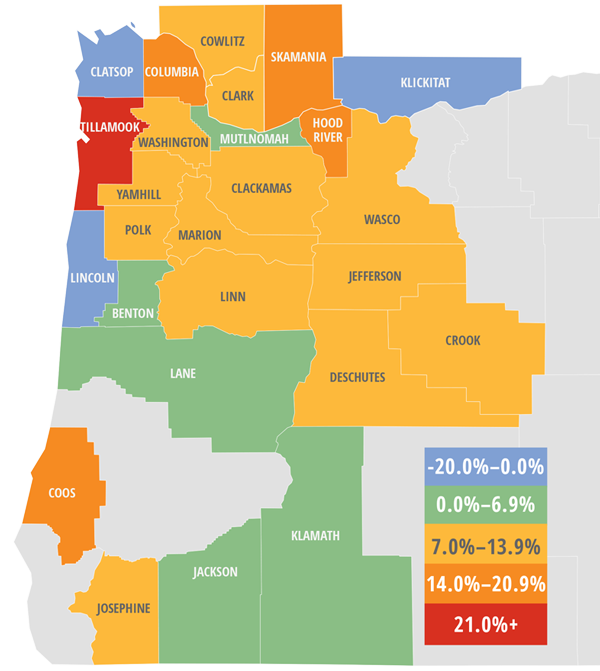

- Sales rose the fastest in Tillamook County, which saw a 76.2% increase over the fourth quarter of 2016. There were also noticeable sales increases in Cowlitz, Lincoln, Coos, Clatsop, and Crook Counties. Home sales fell the most in Jefferson, Hood River, Skamania, and Yamhill Counties.

- Year-over-year sales rose in 12 counties, remained static in one, and dropped in the other 13.

- Although sales were a mixed bag, I still contend that any drop in sales was due to low levels of available inventory rather than declining demand.

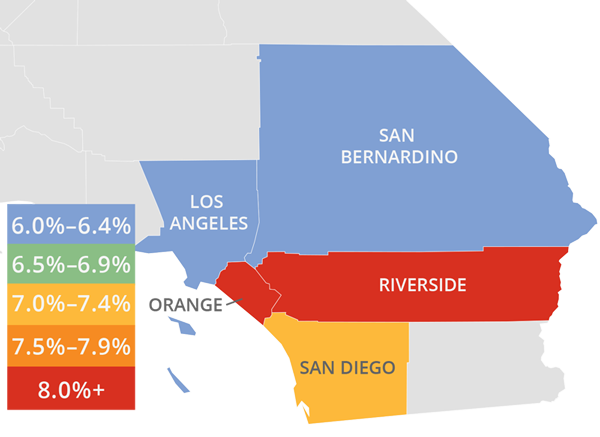

HOME PRICES

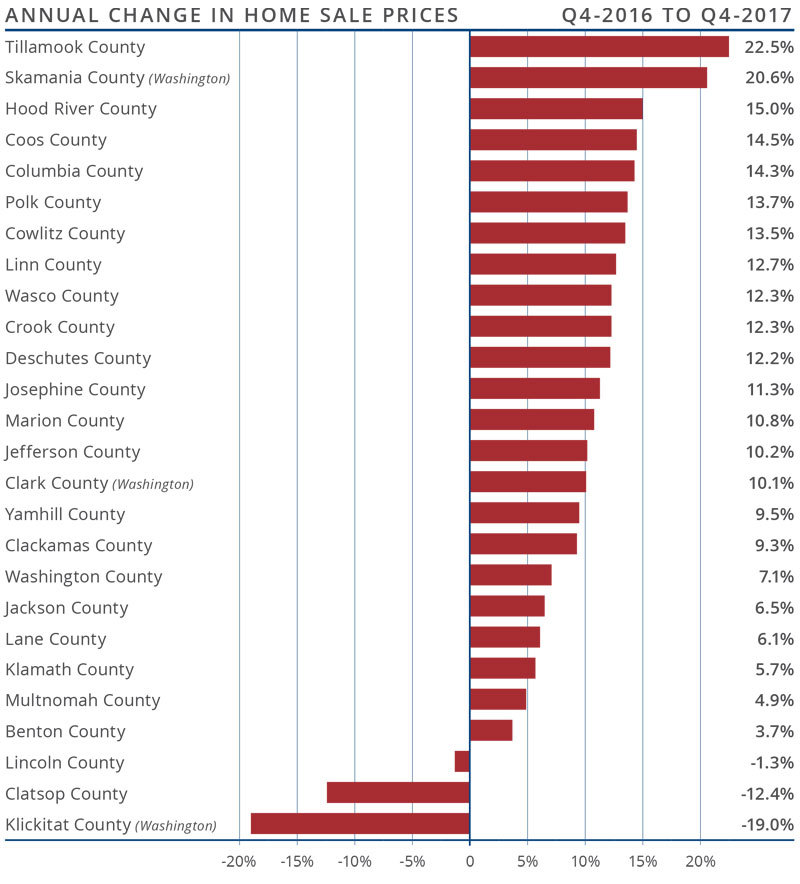

- The average home price in the region rose 7% year-over-year to $363,110. This is down 1.4% from the third quarter of 2017.

- Tillamook County led the market with the strongest annual price growth. Homes there sold for 22.5% more than a year ago.

- All counties other than Klickitat, Clatsop, and Lincoln experienced rising prices when compared to the fourth quarter of 2016. The majority of counties saw significant, double-digit increases.

- This slowdown in price growth is likely due to buyers feeling priced out of the market.

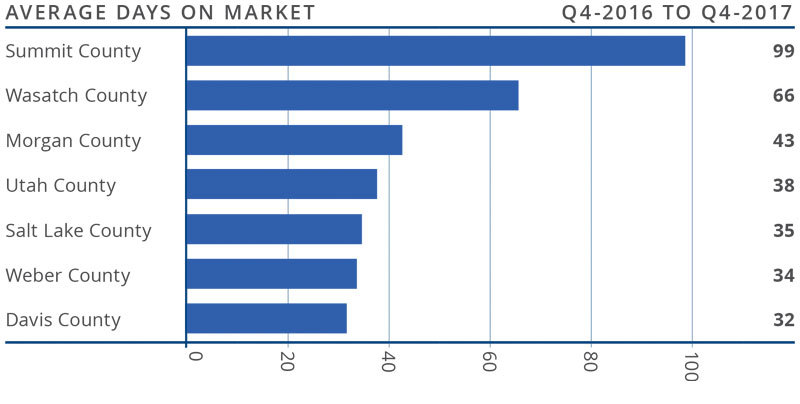

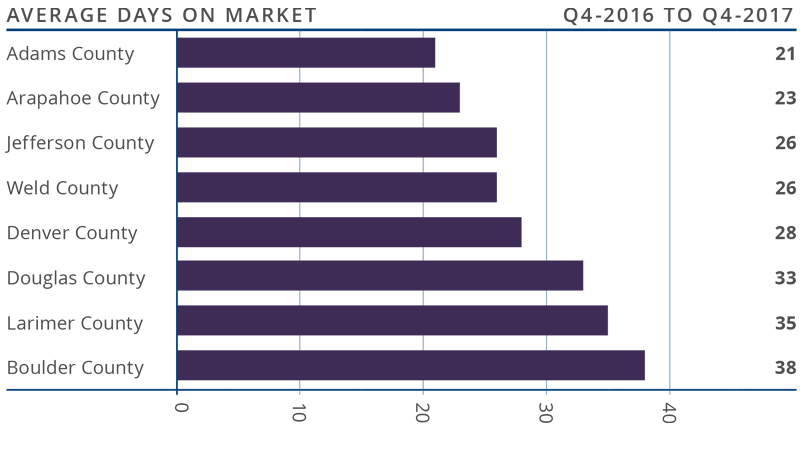

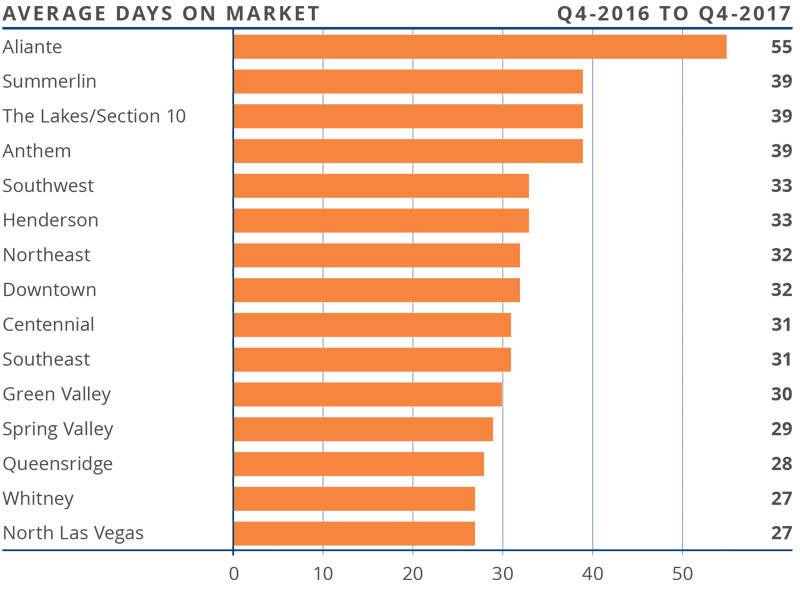

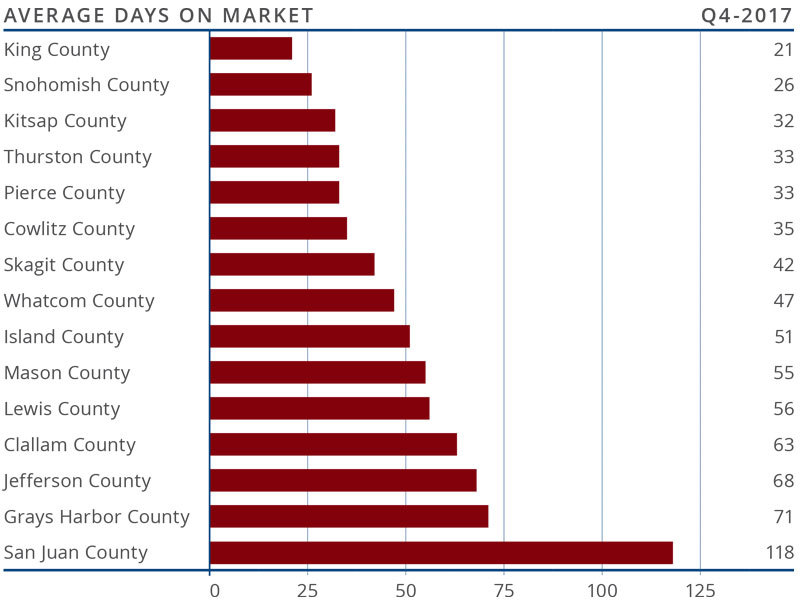

DAYS ON MARKET

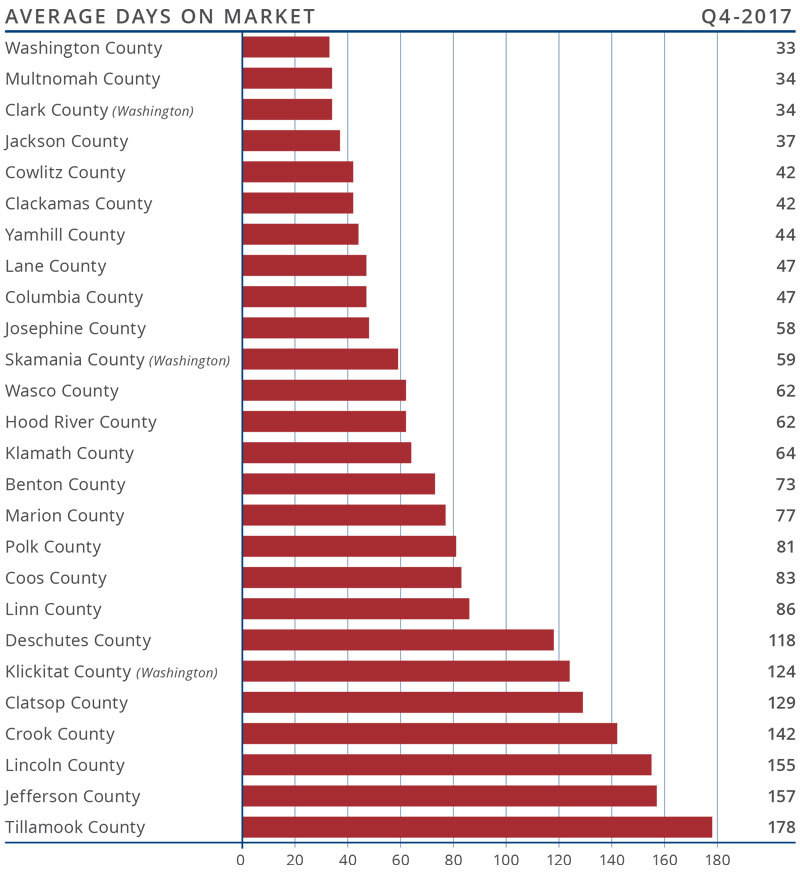

- The average number of days it took to sell a home in the region dropped by 7 days from the fourth quarter of 2016, but was up 13 days from the third quarter of this year.

- The average time it took to sell a home in the region last quarter was 80 days.

- Eight counties saw the length of time it took to sell a home rise compared to a year ago, but I still do not see this as troublesome. Listings are scarce during the winter months, and it’s not unusual for buyers to wait until spring in anticipation of more choices in the market.

- Once again, homes sold the fastest in Washington and Multnomah Counties, where it took an average of 33 and 34 days, respectively, for homes to sell.

CONCLUSIONS

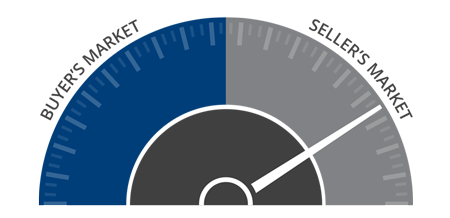

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. Housing markets throughout Oregon continue to benefit greatly from the healthy regional economy.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. Housing markets throughout Oregon continue to benefit greatly from the healthy regional economy.

The Oregon/Southwest Washington housing market remains fairly strong and, given that inventory levels are unlikely to increase as we head toward the traditionally busier spring market, sellers remain firmly in the driver’s seat. That said, price growth and home sales have slowed, so I am leaving the needle in the same position as last quarter.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

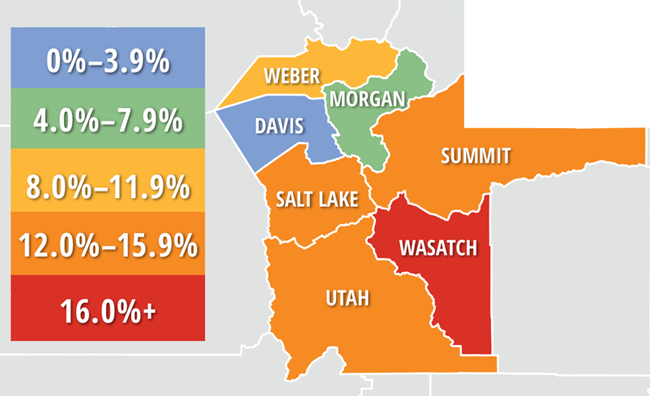

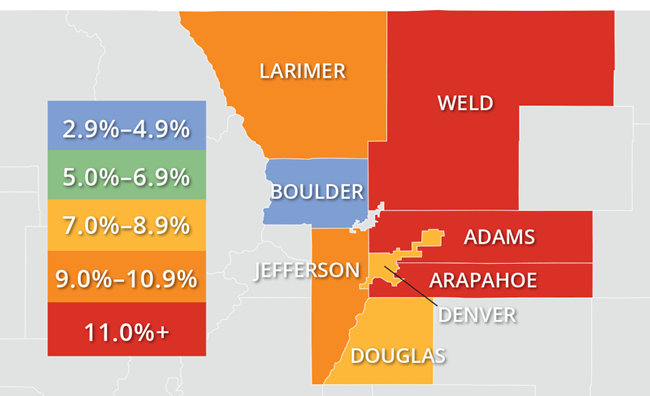

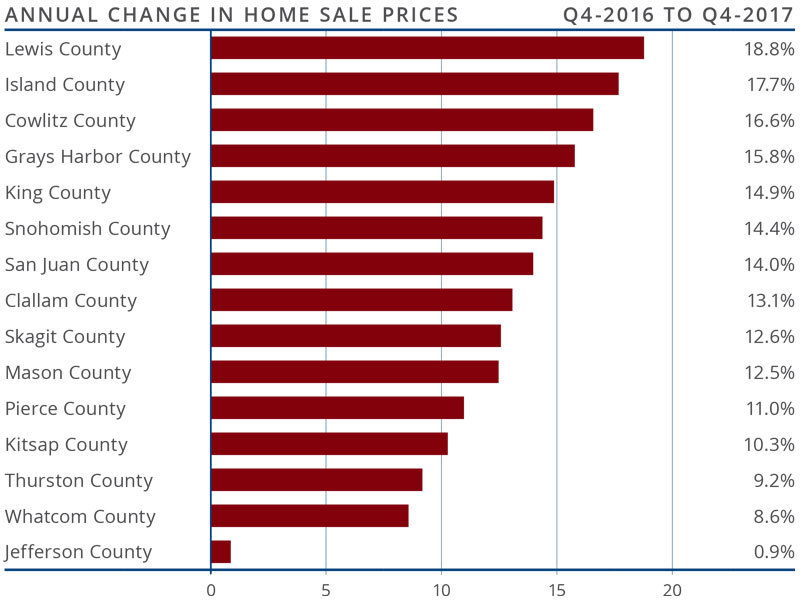

Given the considerable competition for the few homes for sale in the fourth quarter, prices continue to rise at fairly rapid rates. Prices in the region were up 11.6% yearover-year to an average of $342,507.

Given the considerable competition for the few homes for sale in the fourth quarter, prices continue to rise at fairly rapid rates. Prices in the region were up 11.6% yearover-year to an average of $342,507.

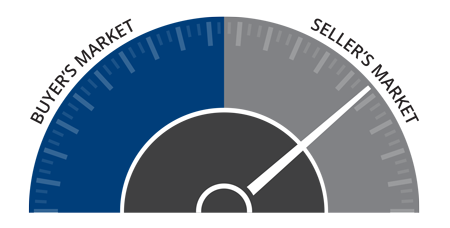

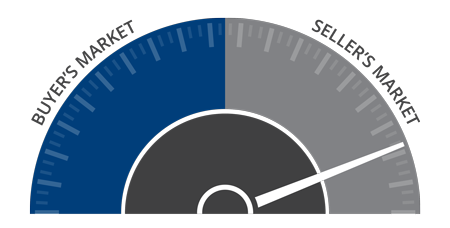

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I left the needle at the same point as third quarter. Supply issues persist and this continues to create competition for well-priced and well-located homes. The increase we’re seeing in the amount of time it takes to sell a home may suggest that the market is either getting weary of all the competition or buyers are delaying their purchase until there are more homes to choose from.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I left the needle at the same point as third quarter. Supply issues persist and this continues to create competition for well-priced and well-located homes. The increase we’re seeing in the amount of time it takes to sell a home may suggest that the market is either getting weary of all the competition or buyers are delaying their purchase until there are more homes to choose from.

With continued competition for the limited number of available homes, prices continued their upward trend. Average prices were up 9.8% year-over-year to a regional average of $431,403, which was slightly higher than the third quarter of 2017.

With continued competition for the limited number of available homes, prices continued their upward trend. Average prices were up 9.8% year-over-year to a regional average of $431,403, which was slightly higher than the third quarter of 2017.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

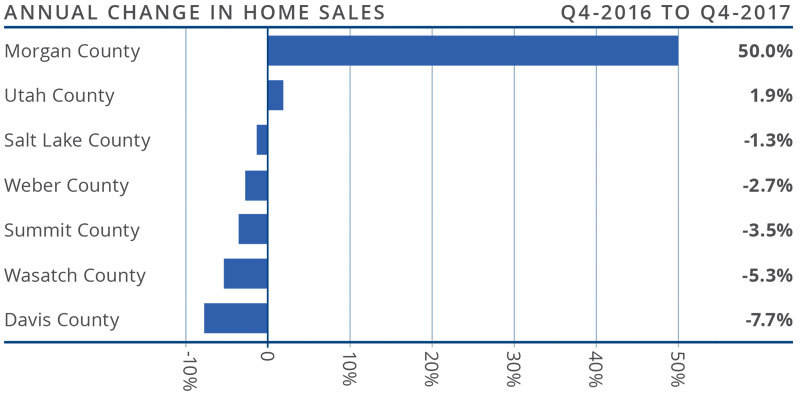

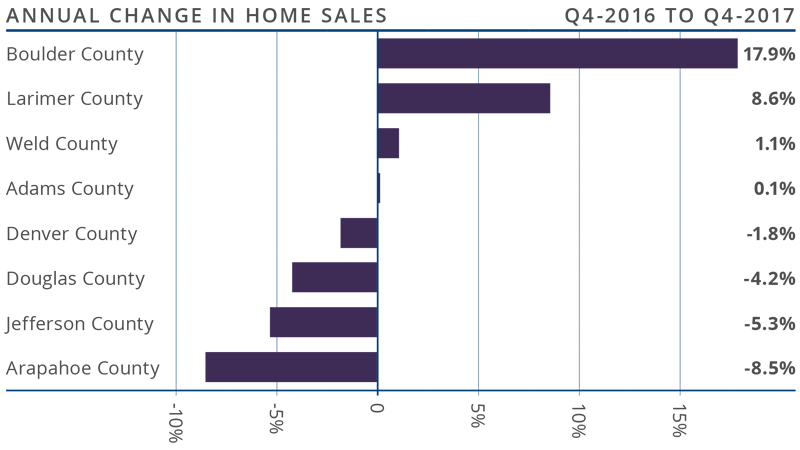

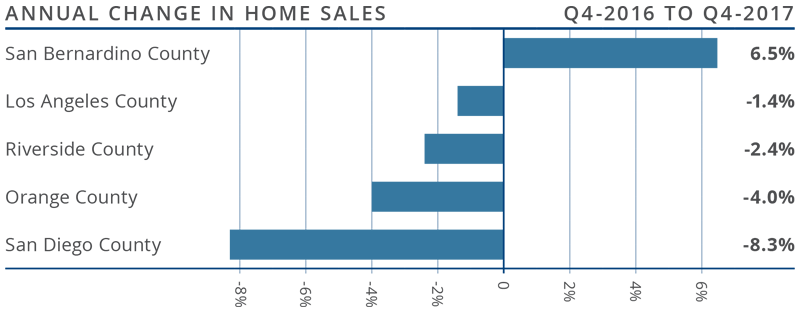

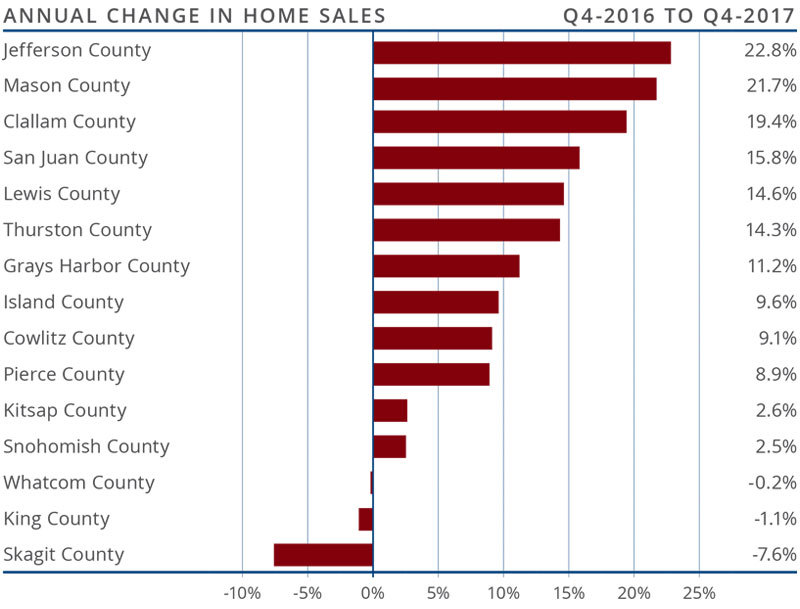

There were 45,342 home sales in the final quarter of 2017. This was 2.4% lower than the same period in 2016.

There were 45,342 home sales in the final quarter of 2017. This was 2.4% lower than the same period in 2016.

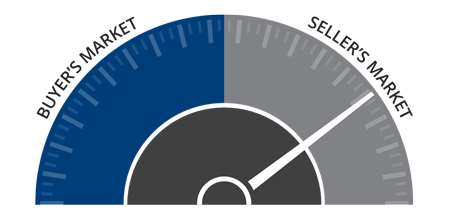

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Employment in the Las Vegas metropolitan area continues to moderate but, with a year-over-year employment growth rate of 2.7%, the region is still performing well above the national average of 1.4%. Over the past 12 months, the area has added 25,500 new jobs. This has led to a respectable unemployment rate of 5.3%. This is the same rate as a year ago, but that should not be any cause for concern, as we have seen a fairly large increase in the labor force, which can slow the drop in the unemployment rate.

Employment in the Las Vegas metropolitan area continues to moderate but, with a year-over-year employment growth rate of 2.7%, the region is still performing well above the national average of 1.4%. Over the past 12 months, the area has added 25,500 new jobs. This has led to a respectable unemployment rate of 5.3%. This is the same rate as a year ago, but that should not be any cause for concern, as we have seen a fairly large increase in the labor force, which can slow the drop in the unemployment rate.

The speedometer reflects the state of the region’s housing market using housinginventory, price gains, home sales, interest rates, and larger economic factors. Employment growth in Clark County, although slowing modestly, is still very positive. This, when combined with low inventory levels and competitive mortgage rates, will push home prices higher. Given these factors, I have moved the speedometer a little further in favor of sellers.

The speedometer reflects the state of the region’s housing market using housinginventory, price gains, home sales, interest rates, and larger economic factors. Employment growth in Clark County, although slowing modestly, is still very positive. This, when combined with low inventory levels and competitive mortgage rates, will push home prices higher. Given these factors, I have moved the speedometer a little further in favor of sellers.

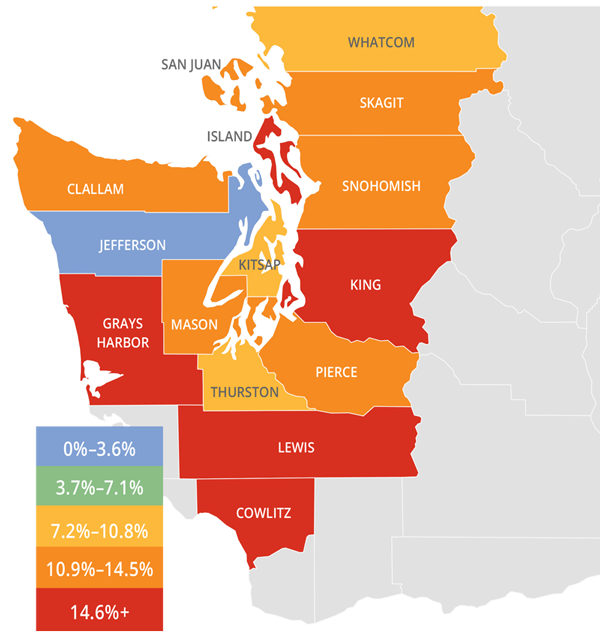

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

Because of low inventory in the fall of 2017, price growth was well above long-term averages across Western Washington. Year-over-year, average prices rose 12% to $466,726.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the fourth quarter of 2017, I have left the needle at the same point as third quarter. Price growth remains robust even as sales activity slowed. 2018 is setting itself up to be another very good year for housing.