The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Following a trend that started last fall, job growth in Idaho continues to moderate. The addition of 18,400 new jobs year-over-year represents an annual growth rate of 2.5%. This is to be expected at this point in the economic cycle, but it’s worth noting that the current rate of job growth remains well above the national average of 1.6%.

In May, the state unemployment rate was 2.8%, marginally lower than the 2.9% rate of a year ago. The state remains at full employment, though it is interesting to note that the employment rate remained below 3% even as the labor force rose 2%, suggesting that the economy remains very robust as there are still job openings to accommodate new workers.

HOME SALES

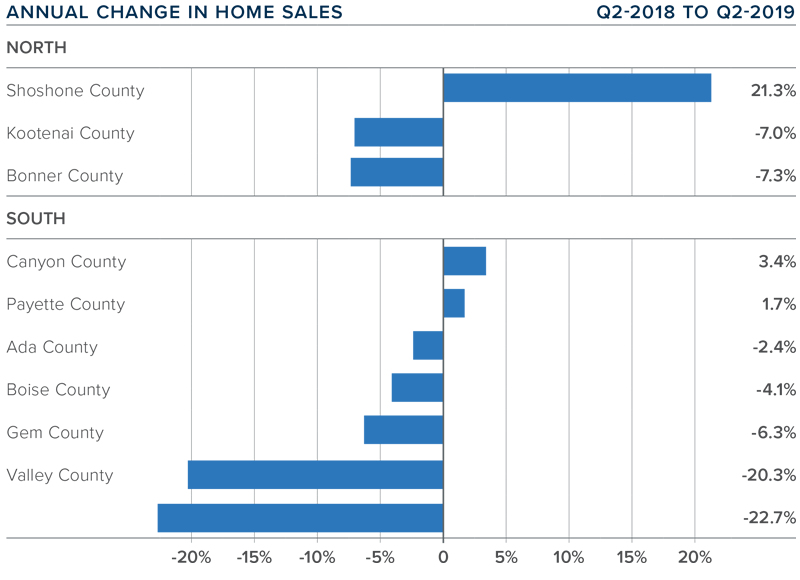

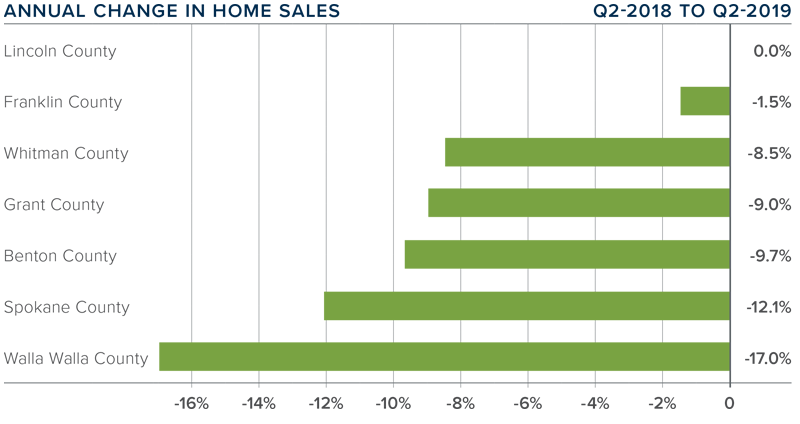

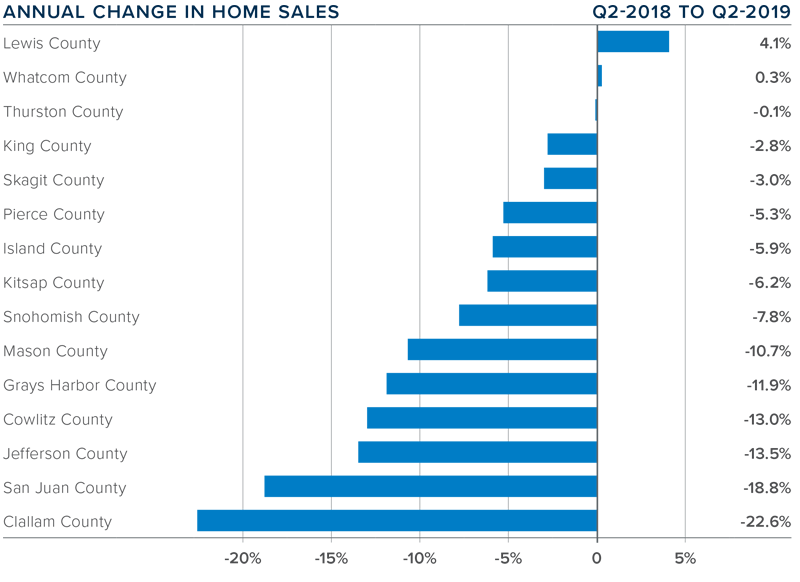

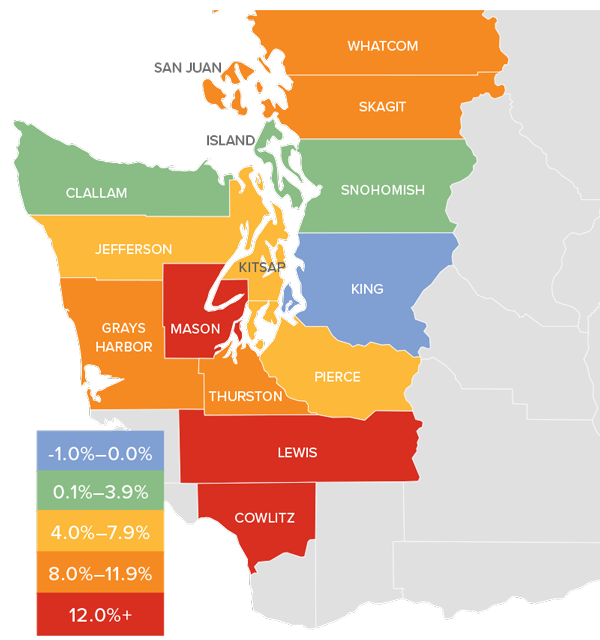

- 6,936 homes were sold during the second quarter of 2019, representing a modest drop of 2.8% from the second quarter of 2018.

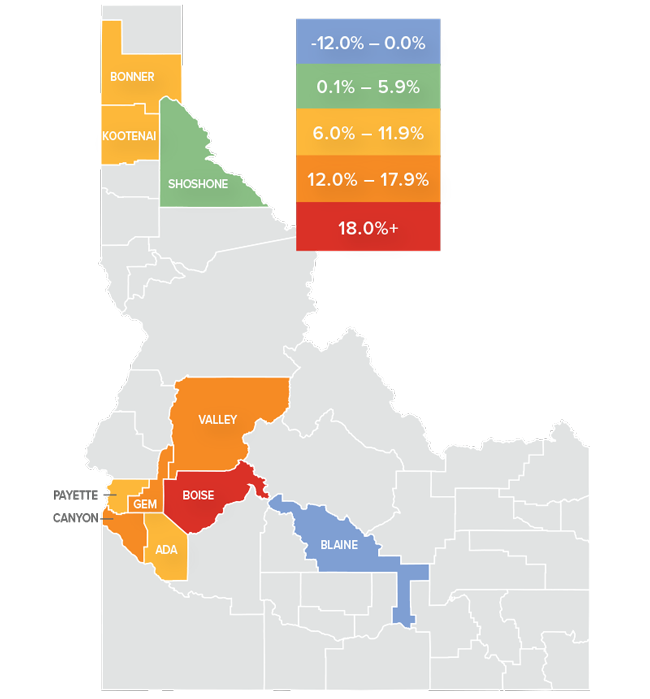

- In Northern Idaho, Shoshone County was the only county to experience sales growth, with sales up by 21.3% over the second quarter of 2018. There was a modest decline in sales in the other two counties. In Southern Idaho, Canyon and Payette counties had modest sales growth, but the rest of the region experienced lower sales activity.

- Year-over-year sales growth was positive in just one of the Northern Idaho counties. Sales rose in two Southern Idaho market areas relative to the same period a year ago.

- Pending sales rose in the quarter, suggesting that closed sales next quarter are likely to be an improvement over current figures.

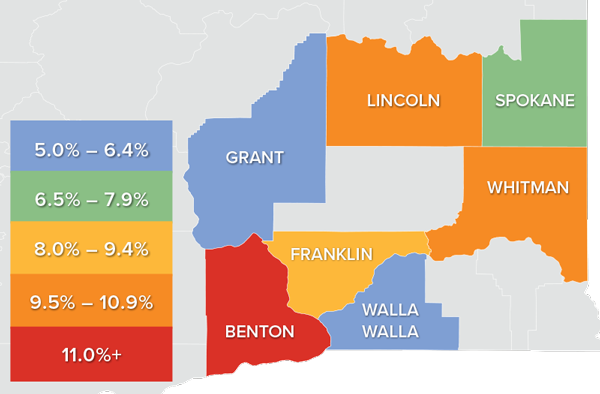

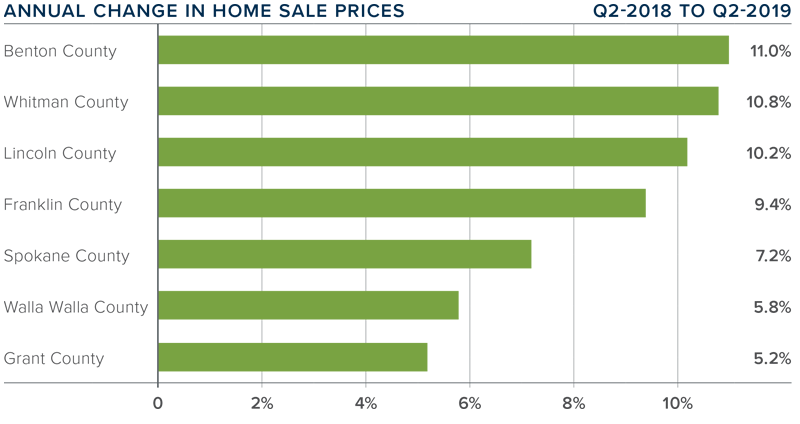

HOME PRICES

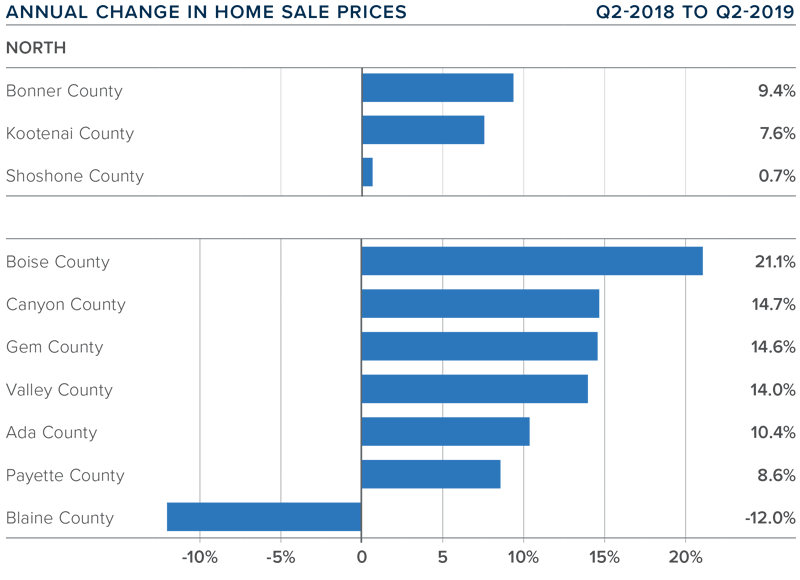

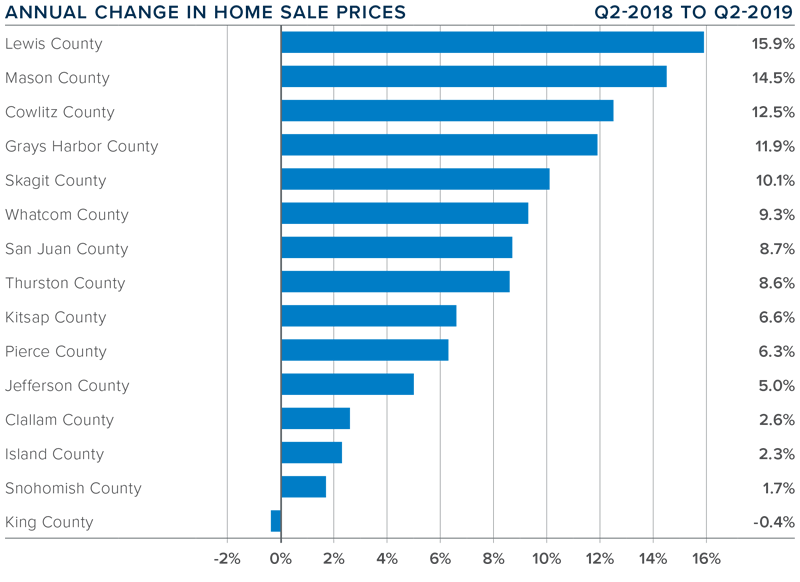

- The average home price in the region rose 7.8% year-over-year to $358,406 and was 3.2% higher than the first quarter of this year.

- In Northern Idaho, Bonner County led the market with the strongest annual price growth. Kootenai County also saw solid price growth. In Southern Idaho, small Boise County saw prices rise a very significant 21.1%, but this is an anomaly.

- There were price increases in all but one county compared to the second quarter of 2018. The outlier was Blaine County, where prices dropped 12%. Blaine County is a very small market that can be prone to significant swings, so I am not too concerned at the present time. That said, it is the most expensive market, and this may be having an impact on values.

- Inventory continues to be an issue, which is driving up home prices. I expected to see more homes come on the market in the late spring, but that wasn’t the case. Until there are more listings, price growth will continue at above-average levels.

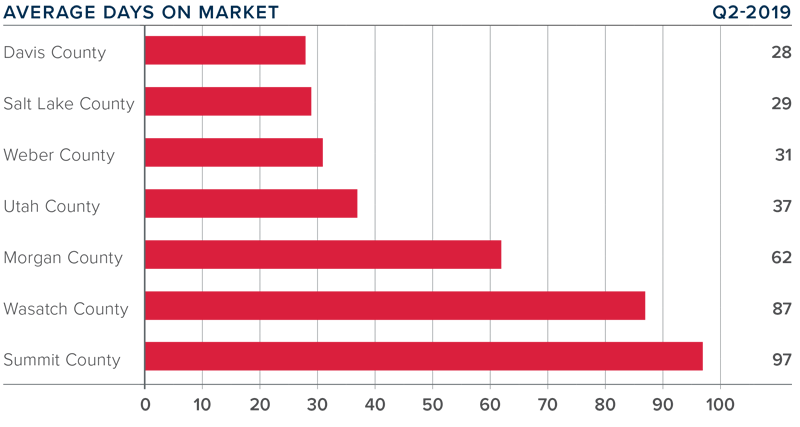

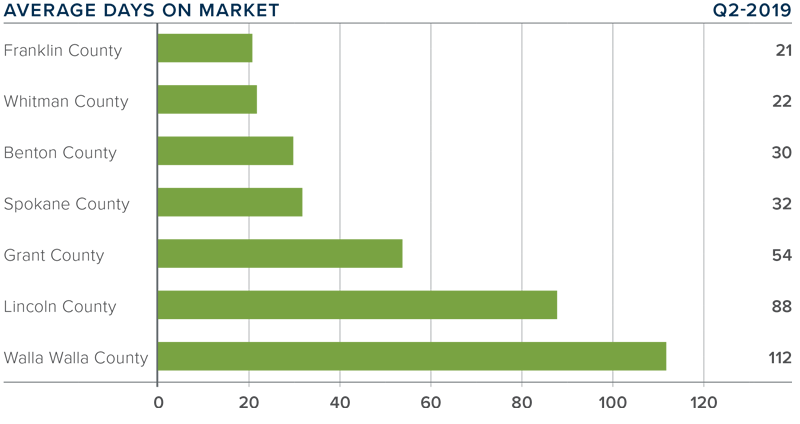

DAYS ON MARKET

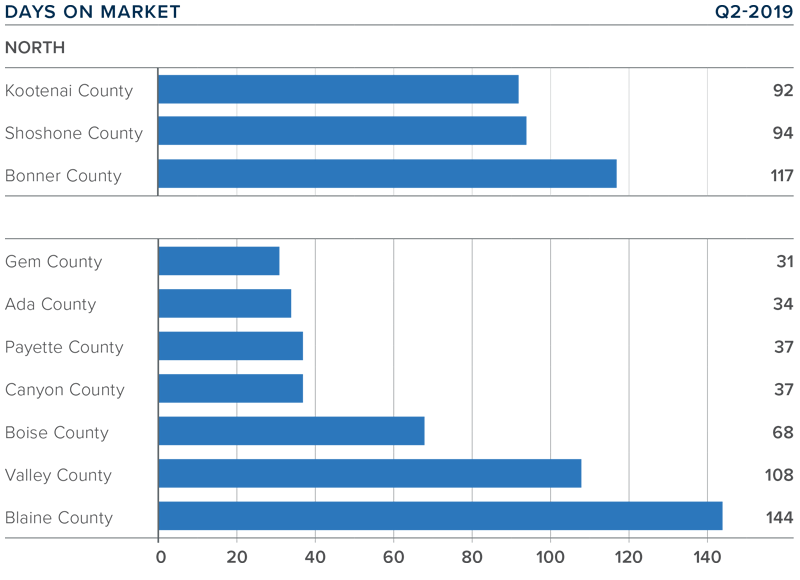

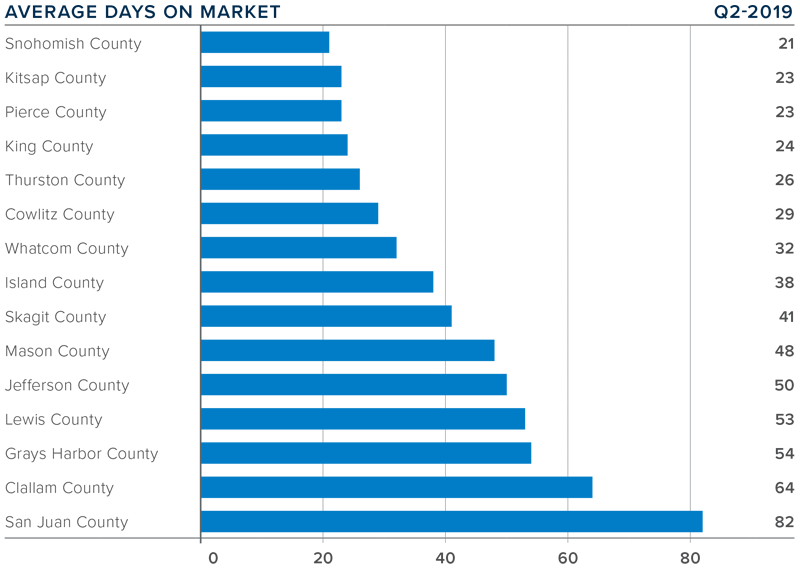

- It took an average of 101 days to sell a home in Northern Idaho, and 66 days in the southern part of the state covered by this report.

- The average number of days it took to sell a home in the region dropped 6 days compared to the second quarter of 2018 and was 24 days lower than in the first quarter of the year.

- In Northern Idaho, days on market dropped in Bonner and Shoshone counties, but rose marginally in Kootenai. In Southern Idaho, market time dropped in all but Ada, Canyon, and Valley counties, but the change was very modest.

- Homes sold fastest in Gem and Ada counties, where it took an average of 31 and 34 days, respectively.

CONCLUSIONS

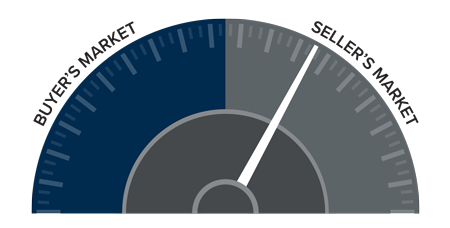

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Job growth continues to slow from the frenetic pace of the past few years but is still very impressive. Economic vitality leads to demand for homeownership and this bodes well for the Idaho market. Home sales are being held back by the lack of inventory and this is leading to higher prices. As such, it remains a sellers’ market so I have moved the needle just a little more in their direction.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

Matthew also sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the WA Center for Real Estate Research; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

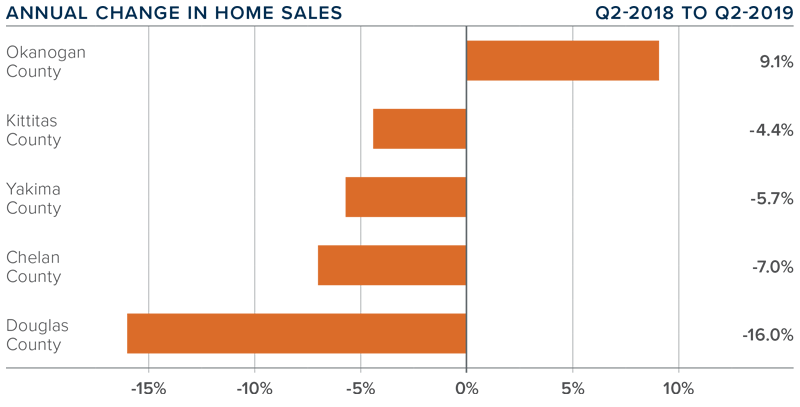

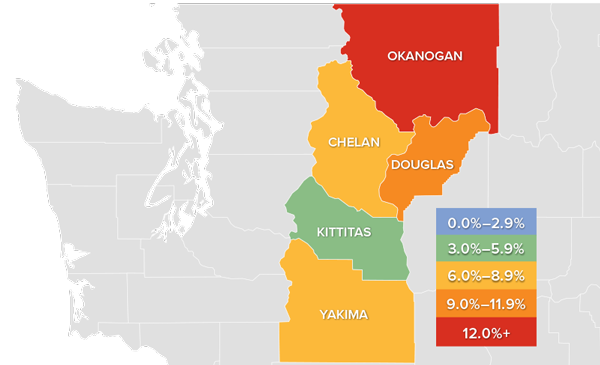

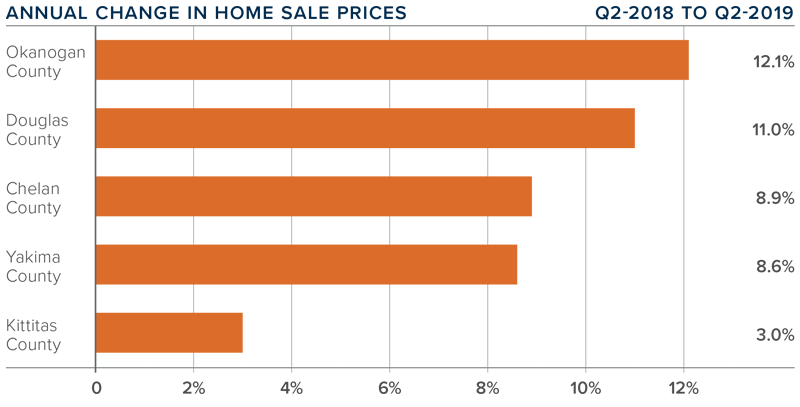

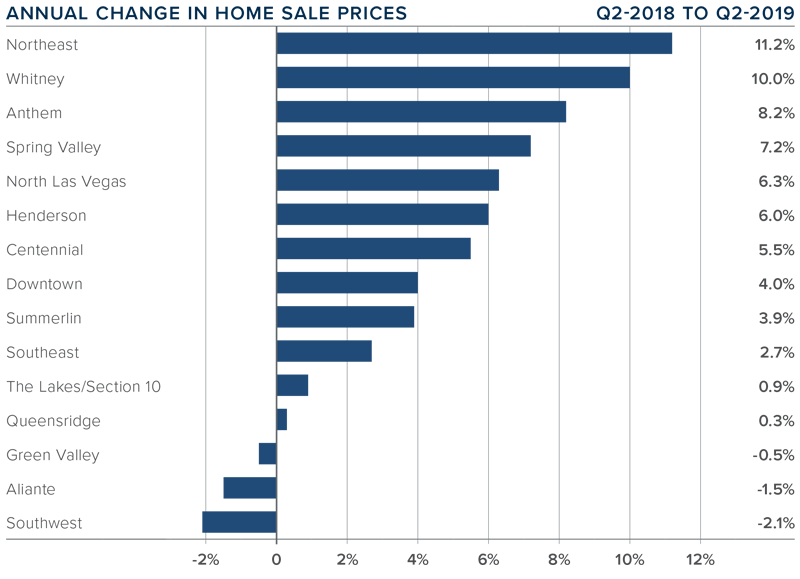

Year-over-year, the average home price in the region rose 7.2% to $340,677. Price growth continues to trend well above the long-term average. Inventory growth has not yet been sufficient to meet demand and is pushing prices higher.

Year-over-year, the average home price in the region rose 7.2% to $340,677. Price growth continues to trend well above the long-term average. Inventory growth has not yet been sufficient to meet demand and is pushing prices higher.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

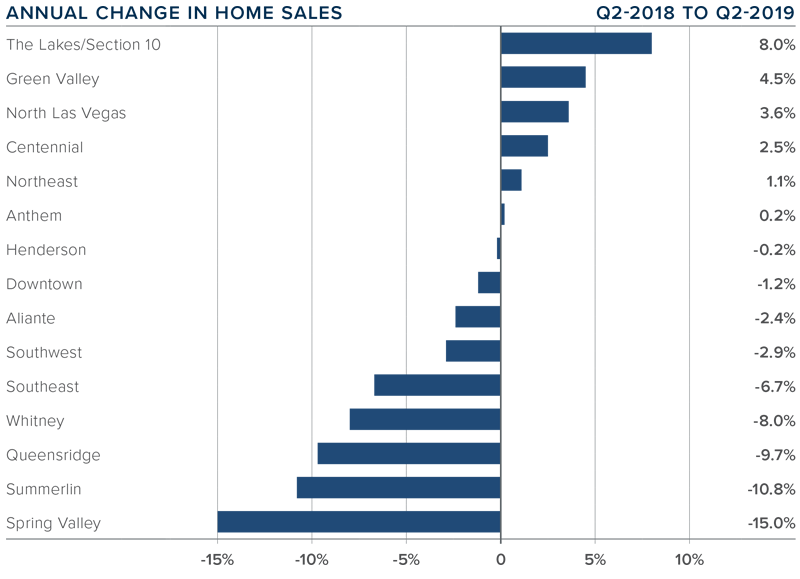

Year-over-year, average prices in the region were flat but were 5.3% higher than in the first quarter of 2019.

Year-over-year, average prices in the region were flat but were 5.3% higher than in the first quarter of 2019.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home prices continue to trend higher, but the rate of growth has taken a pause, with the average home price in the region rising by just 2.3% year-over-year to $490,575.

Home prices continue to trend higher, but the rate of growth has taken a pause, with the average home price in the region rising by just 2.3% year-over-year to $490,575.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Year-over-year price growth in Western Washington continues to taper. The average home price during second quarter was $540,781, which is 2.8% higher than a year ago. When compared to first quarter of this year, prices were up 12%.

Year-over-year price growth in Western Washington continues to taper. The average home price during second quarter was $540,781, which is 2.8% higher than a year ago. When compared to first quarter of this year, prices were up 12%.

Windermere Medford

Windermere Medford