The following analysis of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The Washington State economy added 83,900 new jobs over the past 12 months, representing an annual growth rate of 2.5%. This is a slowdown from last quarter, but employment growth remains well above the national rate of 1.6%. Employment gains continue to be robust in the private sector, which was up by 2.8%. The public sector (government) grew by a more modest 1.1%.

The Eastern Washington region added 7,077 new jobs over the past 12 months, representing an annual growth rate of 1.6%. The unemployment rate for the counties covered by this report was 5%, down marginally from 5.1% a year ago.

HOME SALES ACTIVITY

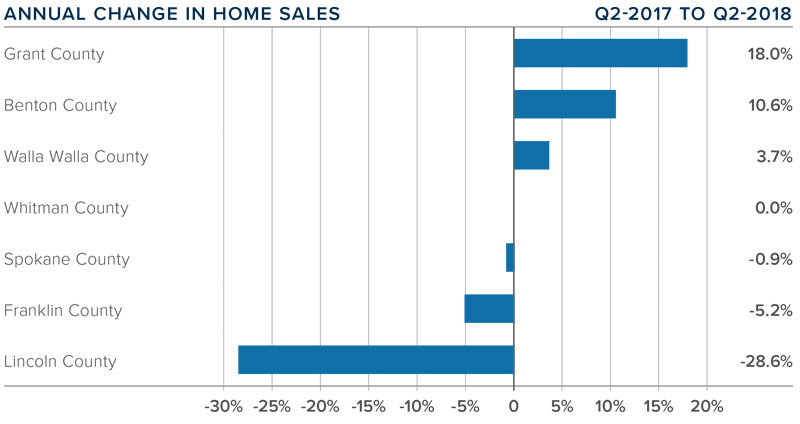

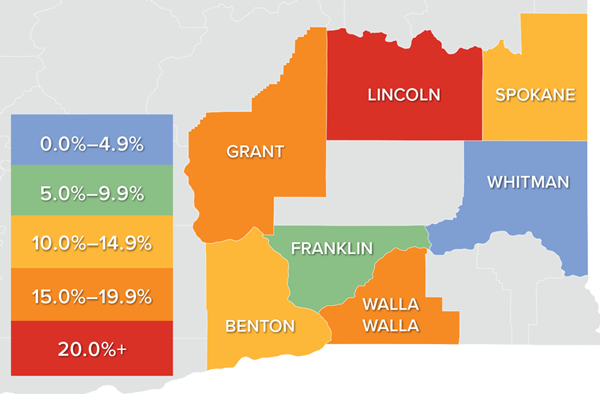

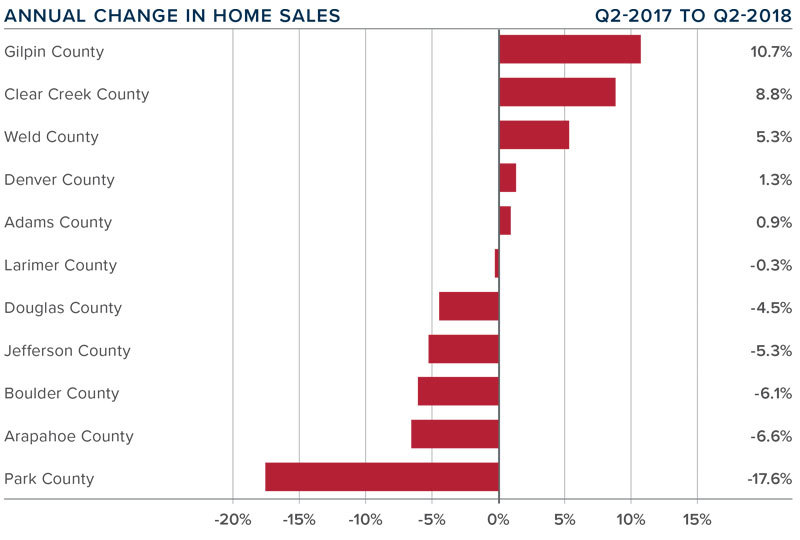

- Home sales throughout Eastern Washington continue to outperform the long-term average, but an increase in listings in a couple of counties has taken the “froth” off the market. Total sales rose by 2.1% over the same quarter in 2017 to 3,878 units.

- Sales rose fastest in Grant County, which increased 18% versus a year ago. Lincoln County saw a significant drop in sales, but, because it is a very small market, I am not troubled.

- Year-over-year, home sales rose in three counties, and three counties saw a drop. Whitman County saw exactly the same number of sales as a year ago.

- The number of homes for sale was down 16.1% from the second quarter of 2017 but we saw solid gains in listings in Franklin and Benton Counties. Low inventory remains an issue.

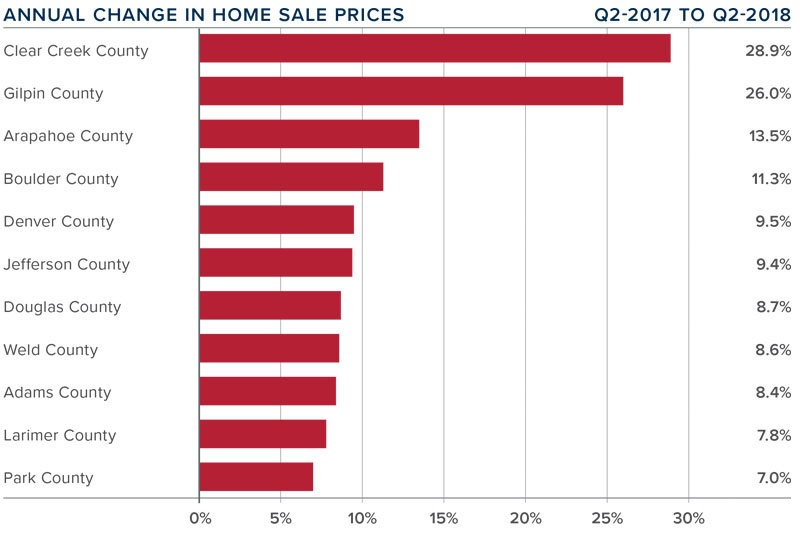

HOME PRICES

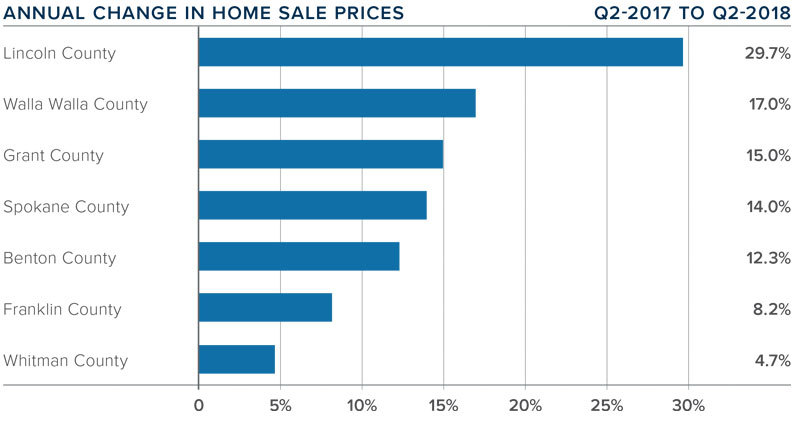

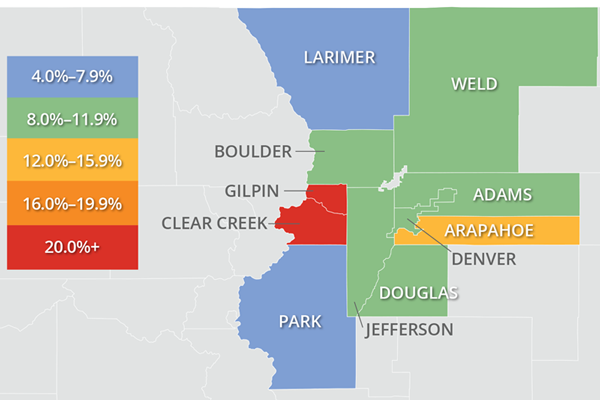

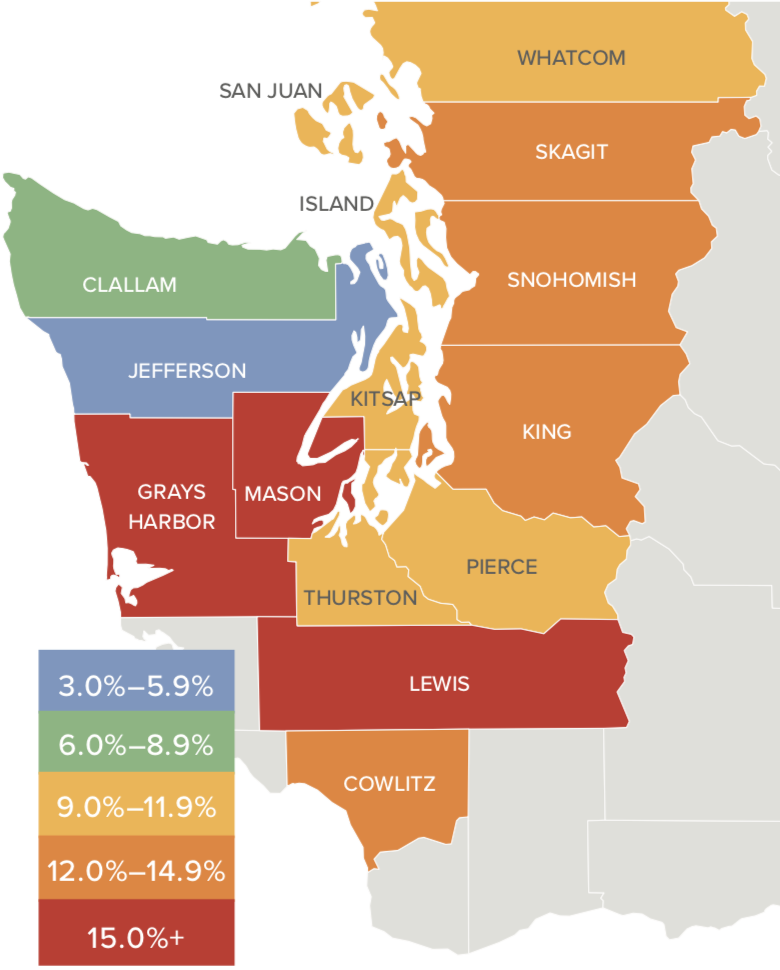

- Year-over-year, the average home price in Eastern Washington rose 13.3% to $271,752. Price growth has been moderating, but most counties are still seeing double-digit growth in sale prices.

- Although Franklin and Benton Counties saw an increase in listings last quarter, low inventory throughout the region continues to drive prices higher. This is unlikely to change as we move into the normally busy summer market.

- All the counties in this report saw prices rise compared to the second quarter of 2017. Lincoln County led the way with an increase of 29.7%.

- The takeaway here is that home-price growth continues at above-average rates, even with rising mortgage rates.

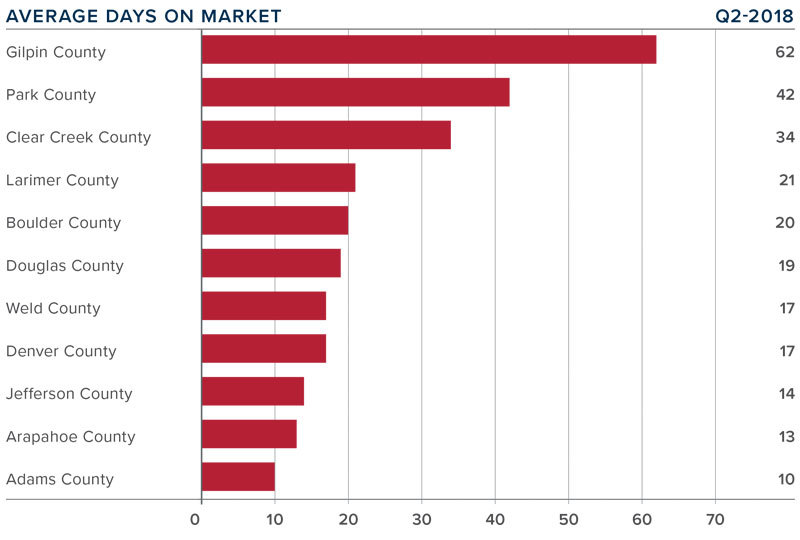

DAYS ON MARKET

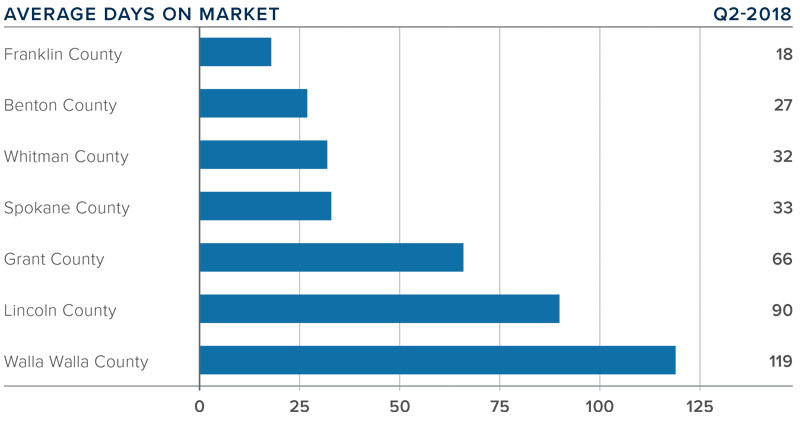

- The average number of days it took to sell a home dropped by 12 days when compared to the second quarter of 2017.

- The average time it took to sell a home in Eastern Washington last quarter was 55 days.

- Every county saw the time it took to sell a home either remain static or drop compared to the same quarter in 2017.

- Whitman County had the biggest drop in days on market. The time it took to sell a home there fell by 29 days compared to the second quarter of 2017.

CONCLUSIONS

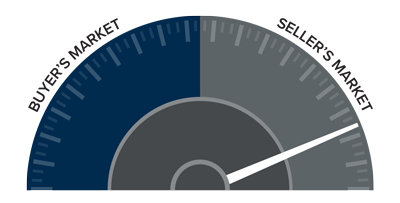

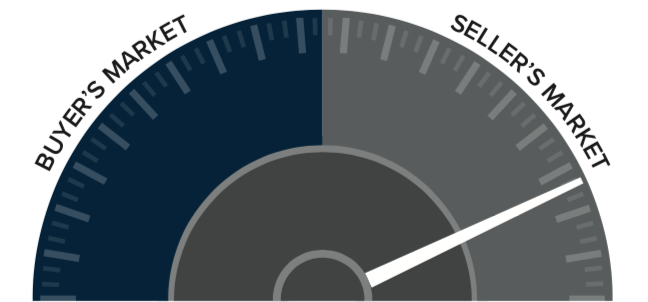

This speedometer reflects the state of the regions real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

As mentioned previously, listing activity continues to rise in Franklin and Benton Counties, which is positive news for buyers in those areas. That said, the overall trend in Eastern Washington remains in favor of home sellers, so I moved the needle a little more in their direction.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

ECONOMIC OVERVIEW

ECONOMIC OVERVIEW

As inventory is still fairly scarce, growth in home prices continues to trend well above the long-term average. Prices in Western Washington rose 12.2% over last year to $526,398.

As inventory is still fairly scarce, growth in home prices continues to trend well above the long-term average. Prices in Western Washington rose 12.2% over last year to $526,398.

Thanks to the generosity of Windermere agents, staff, franchise owners, and the community, the

Thanks to the generosity of Windermere agents, staff, franchise owners, and the community, the