The following analysis of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Washington State continues to recover from the massive COVID-19-induced decline in employment. Following the loss of 556,000 jobs between February and April, the state has now seen the return of 332,500 workers. That said, Washington employment is still down almost 225,000 jobs. Locally, the Eastern Washington market area lost almost 47,000 jobs, but has seen 31,500 of them return.

The unemployment rate, which peaked at 14.7%, continues to decline and now stands at 8.7%. I would note, though, that it is still above the year-ago rate of 5%. The job recovery that started in May continues, but I am seeing a slowdown in the number of jobs returning. This is not a surprise as it matches the rest of the state as well as the country as a whole. I expect the pace of jobs returning will increase, but that is not likely until a vaccine for COVID-19 is freely available.

HOME SALES

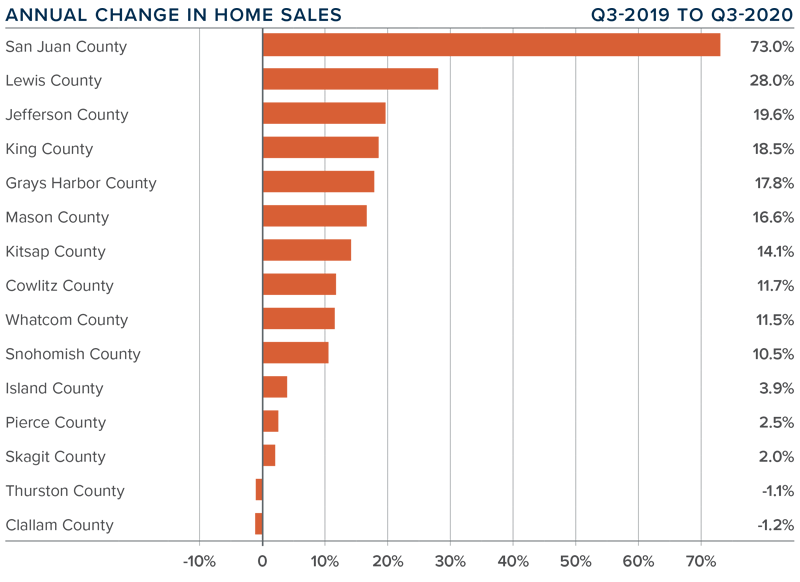

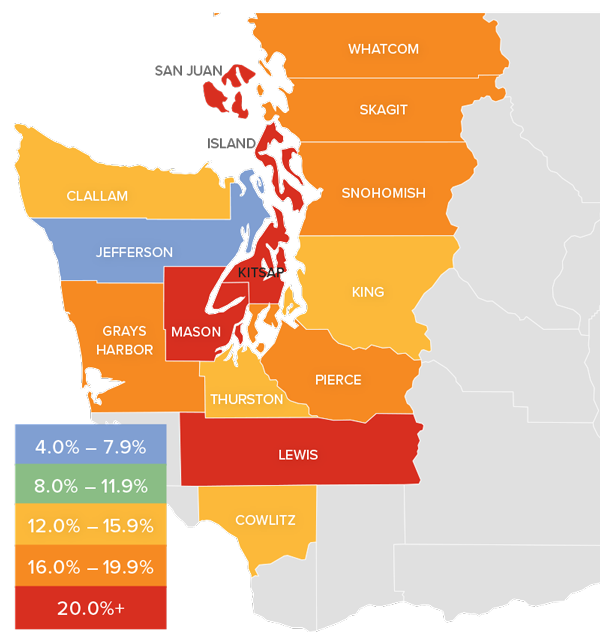

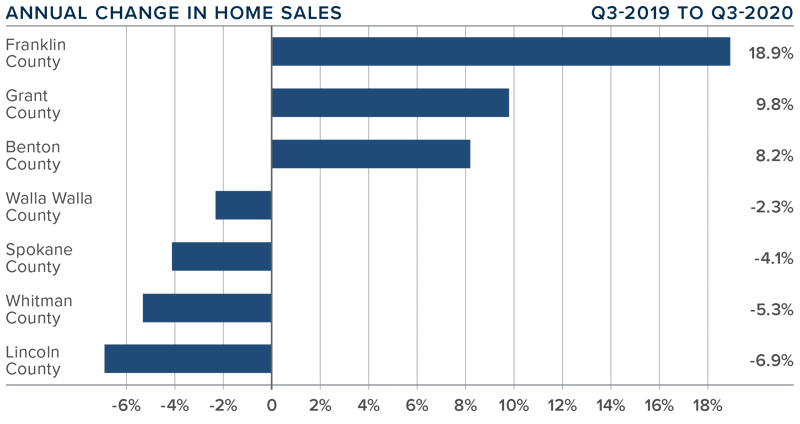

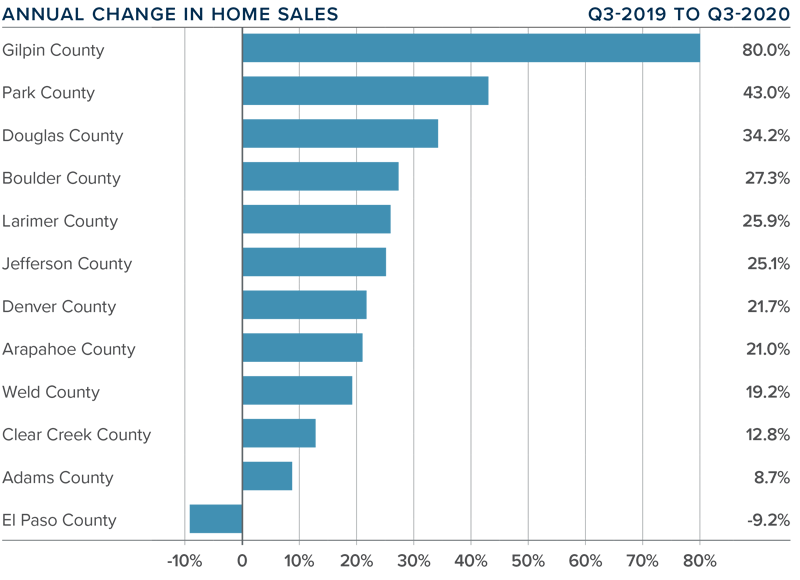

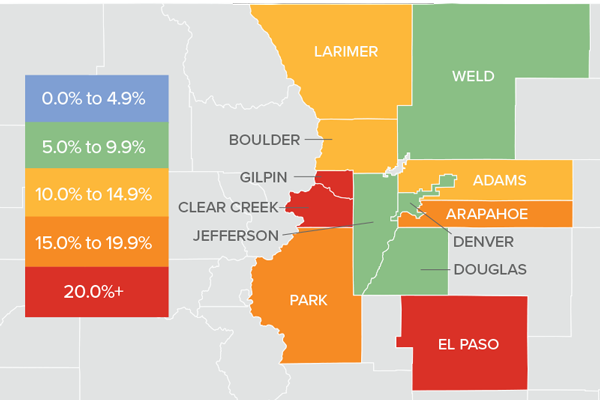

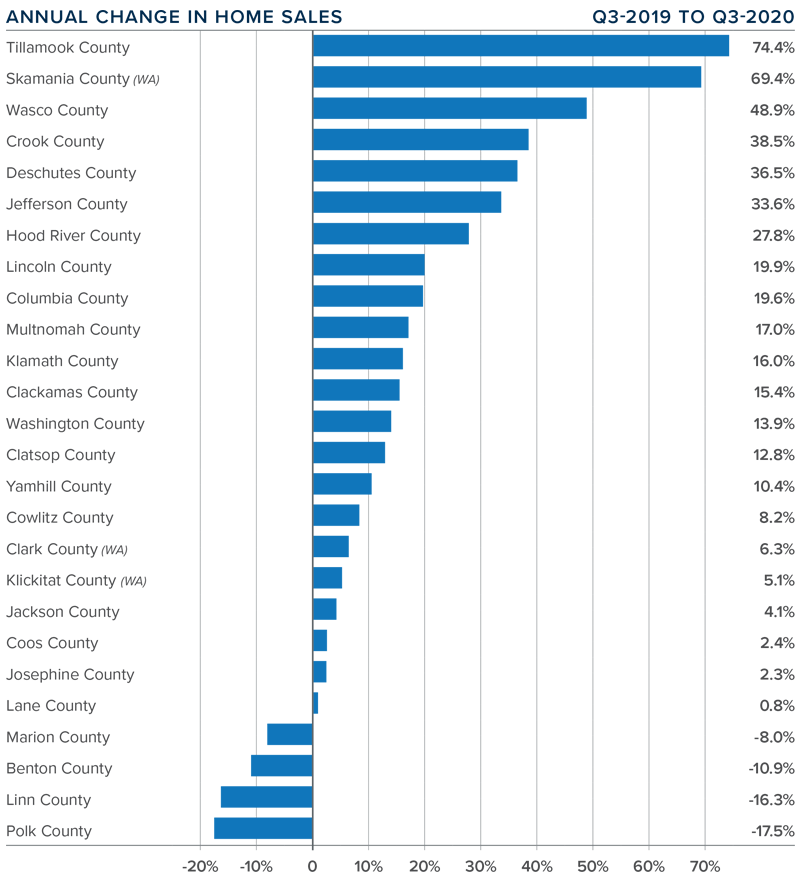

- Home sales throughout Eastern Washington eked out a very modest 0.3% increase compared to the same quarter in 2019, with a total of 4,202 homes trading hands.

- The average number of homes for sale in the quarter was a significant 51.5% lower than a year ago, which may explain some markets experiencing lower sales. Inventory levels remain well below historic averages.

- Sales activity rose in three counties but dropped in four. However, the markets where sales activity contracted saw only modest drops.

- Pending home sales were lower than a year ago, but they were 11.9% higher than in the second quarter of 2020, suggesting that closings in the fourth quarter will be positive.

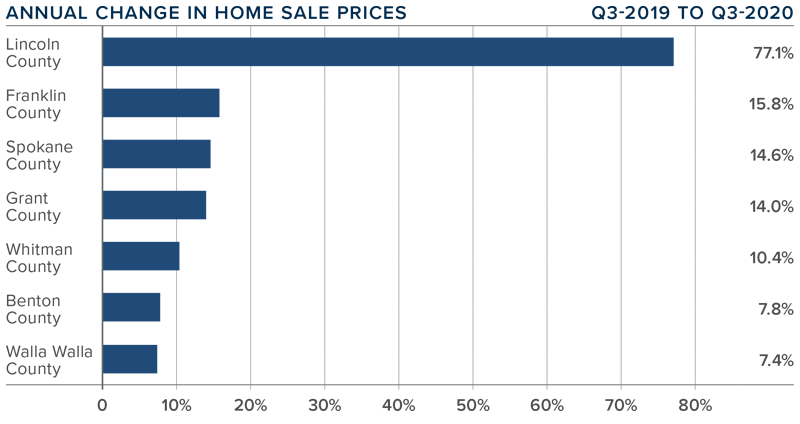

HOME PRICES

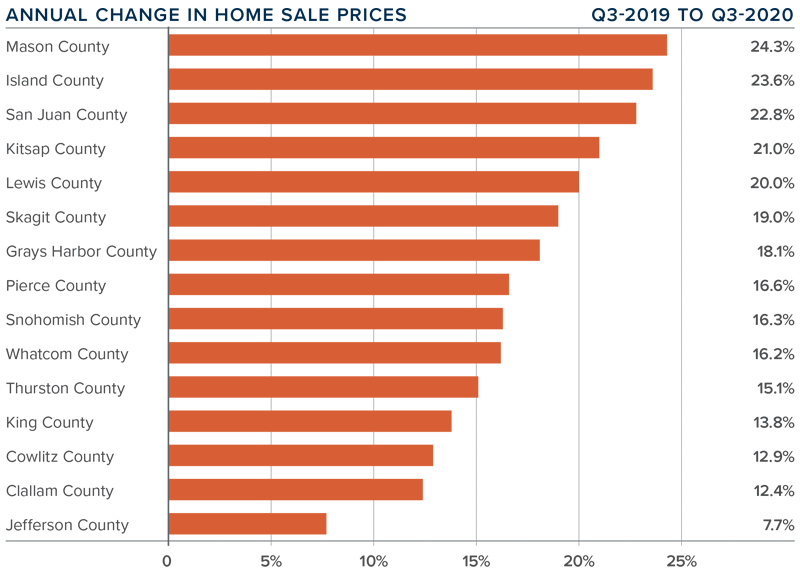

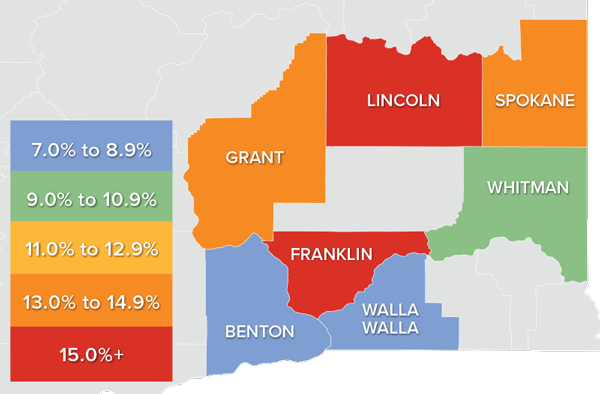

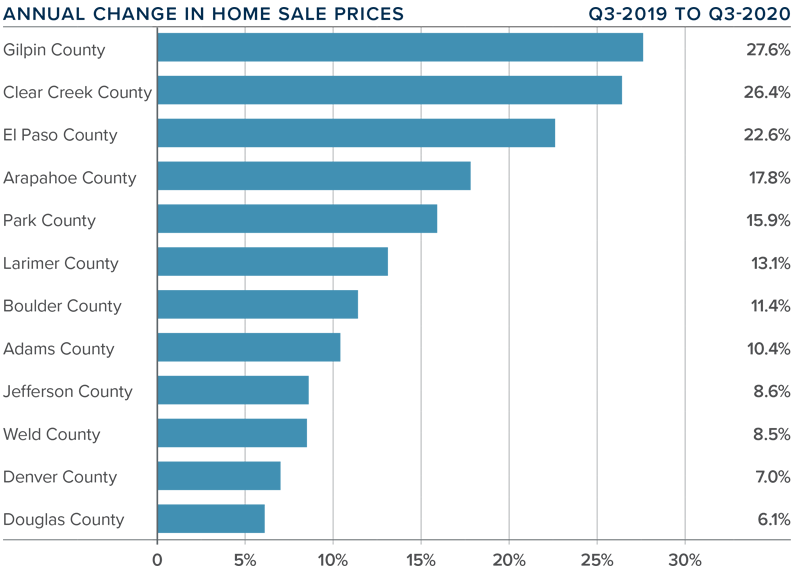

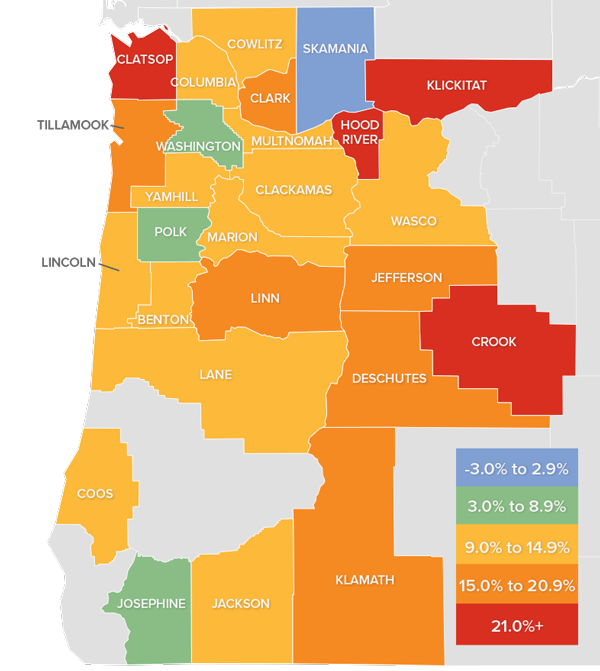

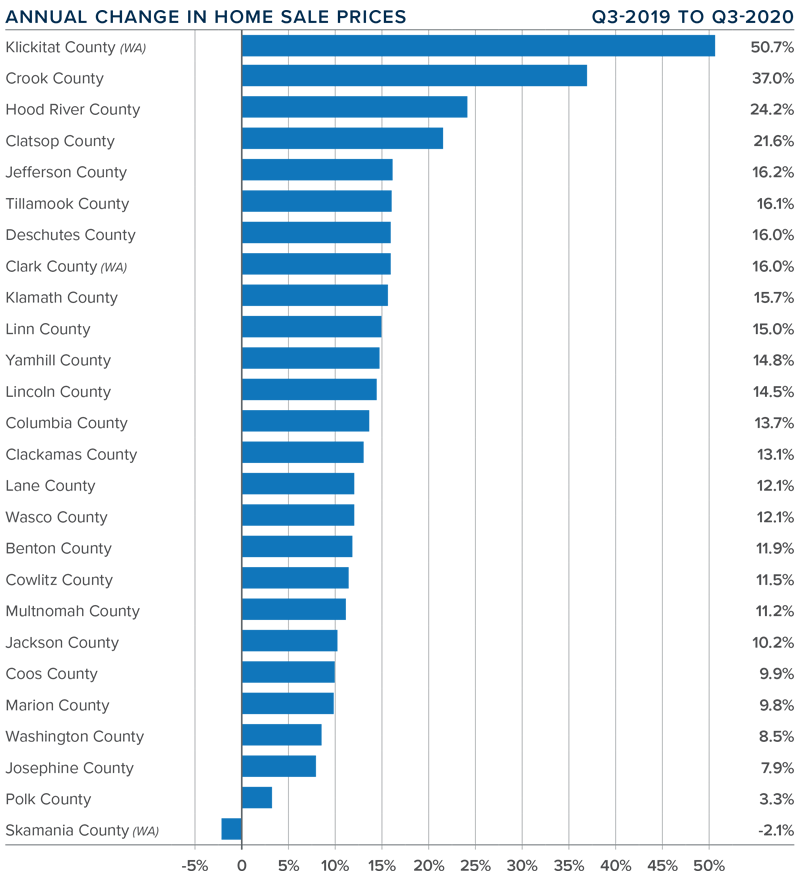

- Year-over-year, the average home price in Eastern Washington rose 13% to $343,215. Sale prices were also 7.8% higher than in the second quarter of 2020.

- The increase in sales proves demand is strong, and limited supply is making the market very competitive. This is pushing prices higher.

- Prices rose in every county in Eastern Washington. Lincoln County saw a very significant increase, though this is not surprising because small markets can experience large swings in price. We also saw double-digit increases in an additional four counties.

- The takeaway is that average home-price growth in Eastern Washington remains well above the long-term average due to inventory constraints combined with very favorable mortgage rates.

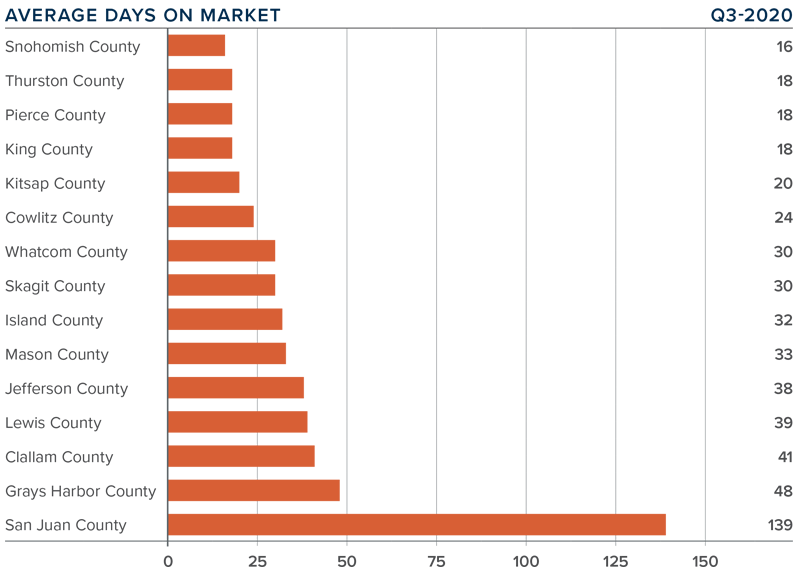

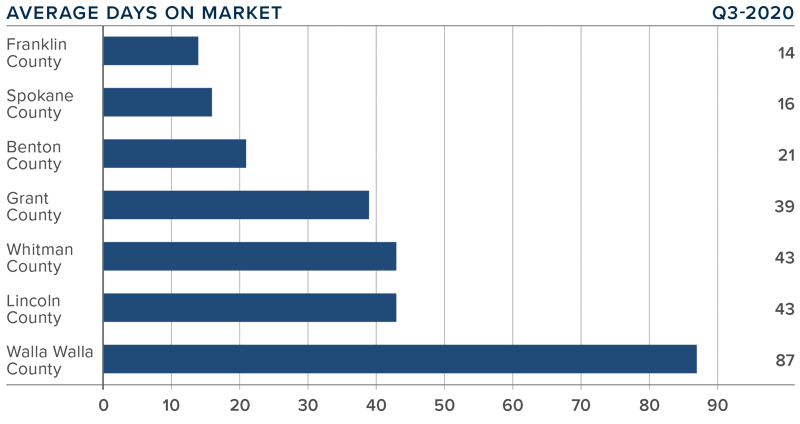

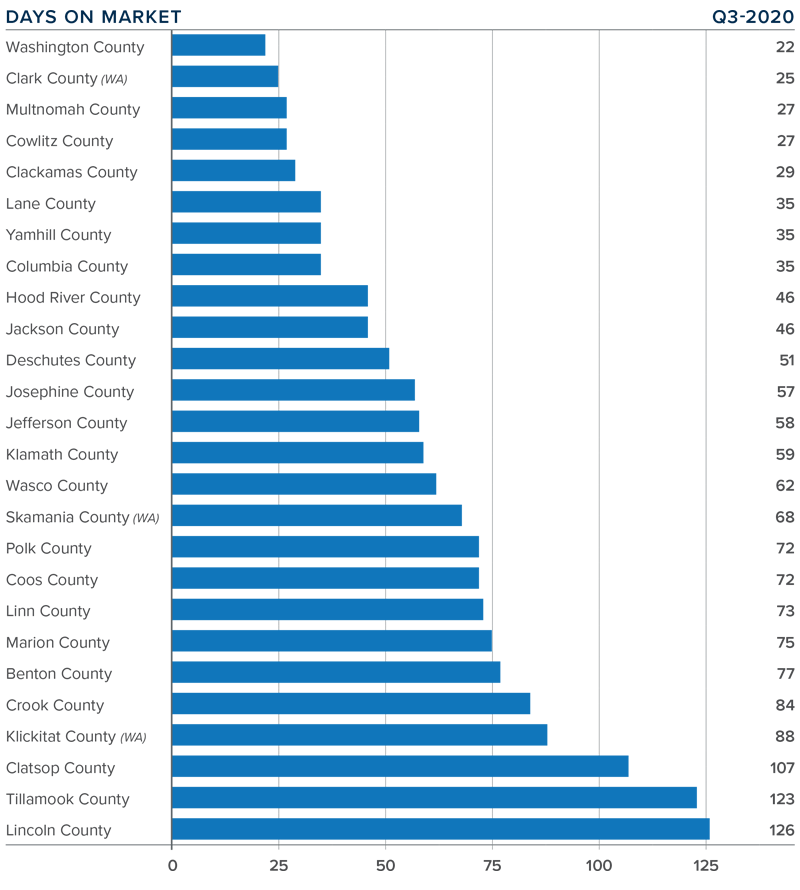

DAYS ON MARKET

- The average time it took to sell a home in Eastern Washington in the third quarter of 2020 was 38 days.

- During the third quarter, it took nine fewer days to sell a home in Eastern Washington than it did a year ago.

- All markets other than Whitman, where the length of time remained static, saw the length of time it took to sell a home drop compared to the third quarter of 2019.

- It took four fewer days to sell a home in the third quarter than it did in the second quarter of 2020.

CONCLUSIONS

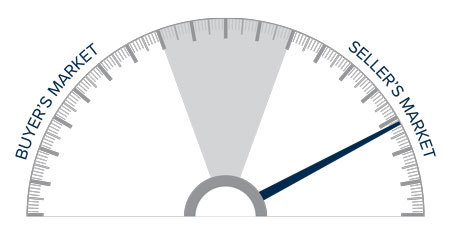

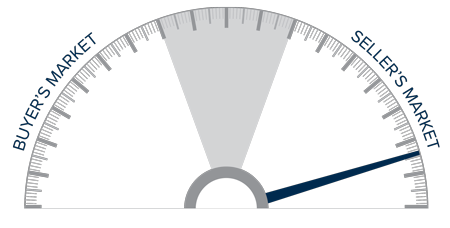

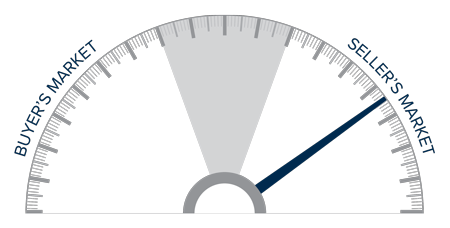

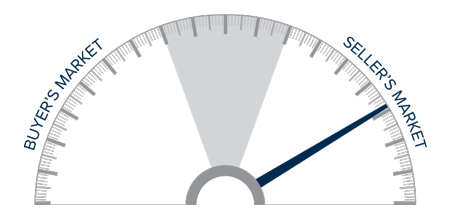

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand is in place, with buyers competing for the limited number of homes that are available to purchase. The lack of inventory has heated the market and is pushing listing prices higher, which is translating into higher sale prices as well. I do not anticipate any significant drop in demand but, at some point, affordability will start to act as a headwind to price gains. That said, I am not seeing that yet and have, therefore, moved the needle further in favor of home sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real

This speedometer reflects the state of the region’s real