ECONOMIC OVERVIEW

Colorado added 45,800 non-agricultural jobs over the past 12 months, a growth rate of 1.8%. Within the metropolitan market areas included in this report, annual employment growth was seen in all areas other than Grand Junction (where employment was stable) with substantial growth seen in Fort Collins (4.6%) and Greeley (3.5%).

In August, the unemployment rate in the state was 2.2%, down from 3.1% a year ago. The lowest reported unemployment rates were again seen in Fort Collins at just 1.8%. The highest rate was in Grand Junction, at a very respectable 3.0%. It is still reasonable to assume that all the markets contained within this report will see above-average wage growth given the very tight labor market.

HOME SALES ACTIVITY

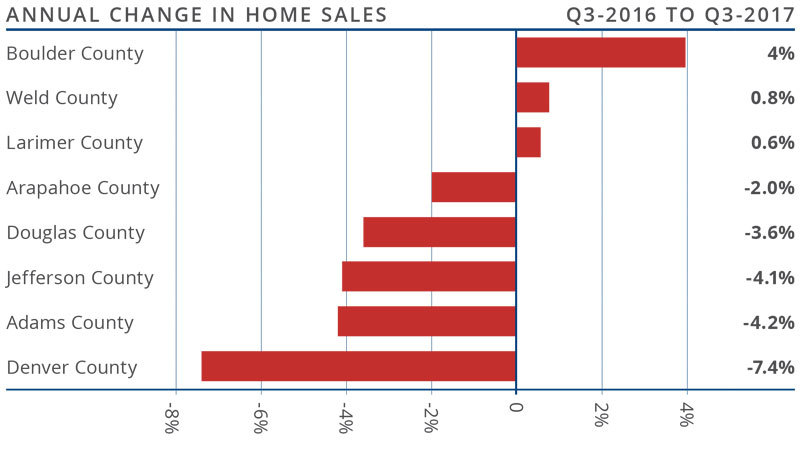

- There were 17,140 home sales during the third quarter of 2017, which was a drop of 3.3% from the same period in 2016.

- Sales rose the fastest in Boulder County, which saw sales grow 4% more than the third quarter of 2016. There were marginal increases in Weld and Larimer Counties. Sales fell in all the other counties contained within this report.

- Home sales slowed due to very low levels of available inventory. Listing activity continues to trend at well below historic averages, with the total number of homes for sale in the third quarter 5.5% below the level seen a year ago.

- The takeaway here is that sales growth has stalled due to the lack of homes for sale.

HOME PRICES

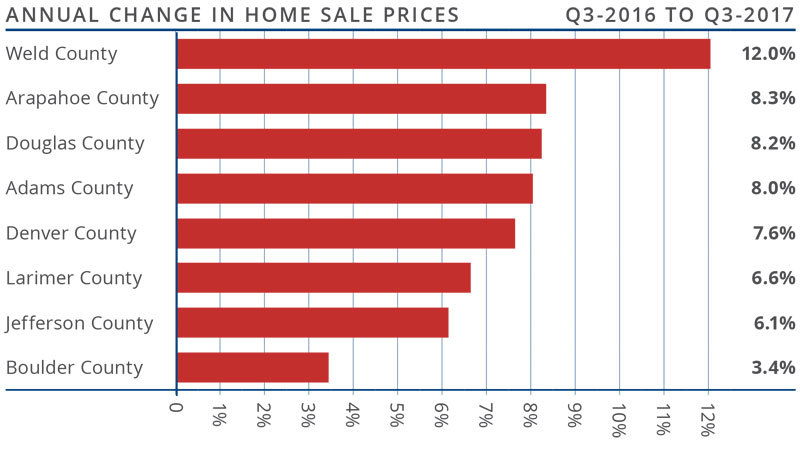

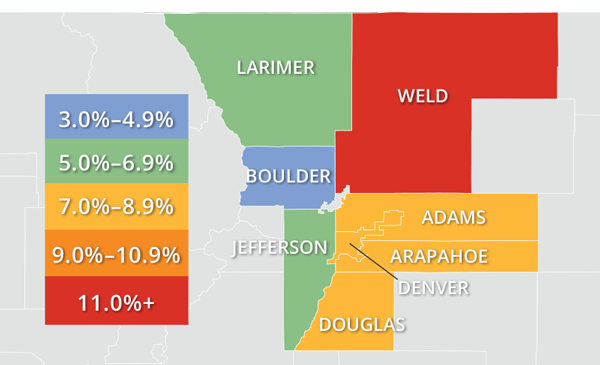

![]() With substantial competition for the few available homes, prices continue to rise. Average prices were up 7.5% year-over-year to a regional average of $428,602.

With substantial competition for the few available homes, prices continue to rise. Average prices were up 7.5% year-over-year to a regional average of $428,602.- Slower appreciation in home values was again seen in Boulder County, but the trend is still positive.

- Appreciation was strongest in Weld County, which saw prices rise 12%.

- Due to an ongoing imbalance between supply and demand, home prices will continue to appreciate at above-average rates for the foreseeable future.

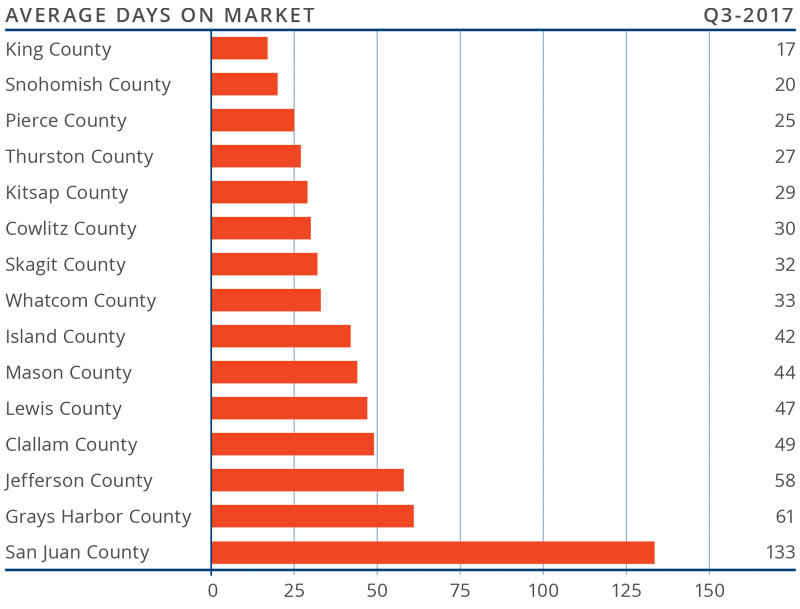

DAYS ON MARKET

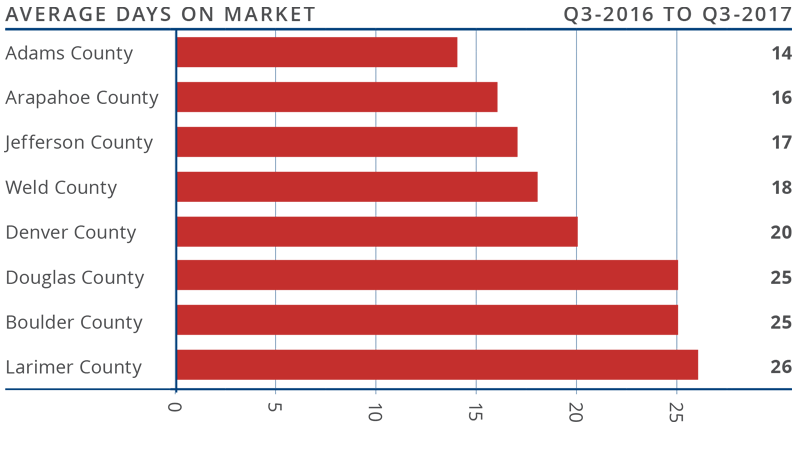

- The average number of days it took to sell a home dropped by one day when compared to the third quarter of 2016.

- Homes in all counties contained in this report took less than a month to sell. Adams County continues to stand out as it took an average of just two weeks to sell a home there.

- During the third quarter, it took an average of 20 days to sell a home. This is up by 3 days compared to the second quarter of this year.

- Demand remains strong, and well-positioned, well-priced homes continue to sell very quickly.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

In the third quarter of 2017, I have chosen to leave the needle where it was in the second quarter. Homes are still scarce; however, there is a small slowdown in price growth and a decline in both closed and pending sales. This may suggest the market is either getting weary of all the competition or that would-be buyers are possibly putting off buying until they see more choices in the number of homes for sale.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

If you are in the market to buy or sell, we can connect you with an experienced agent here.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

With substantial competition for the few available homes, prices continue to rise. Average prices were up 7.5% year-over-year to a regional average of $428,602.

With substantial competition for the few available homes, prices continue to rise. Average prices were up 7.5% year-over-year to a regional average of $428,602.

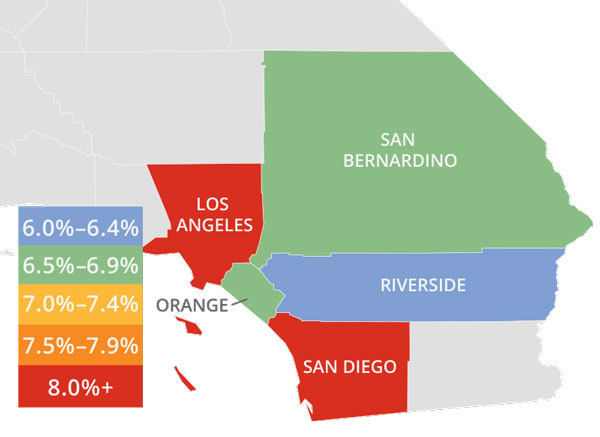

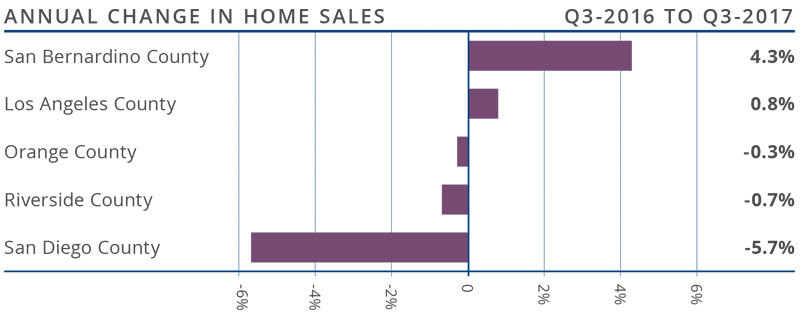

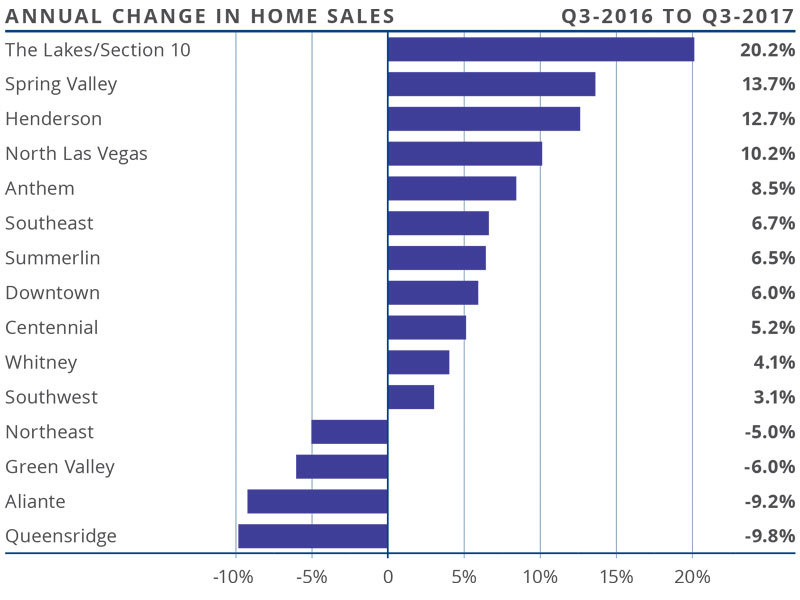

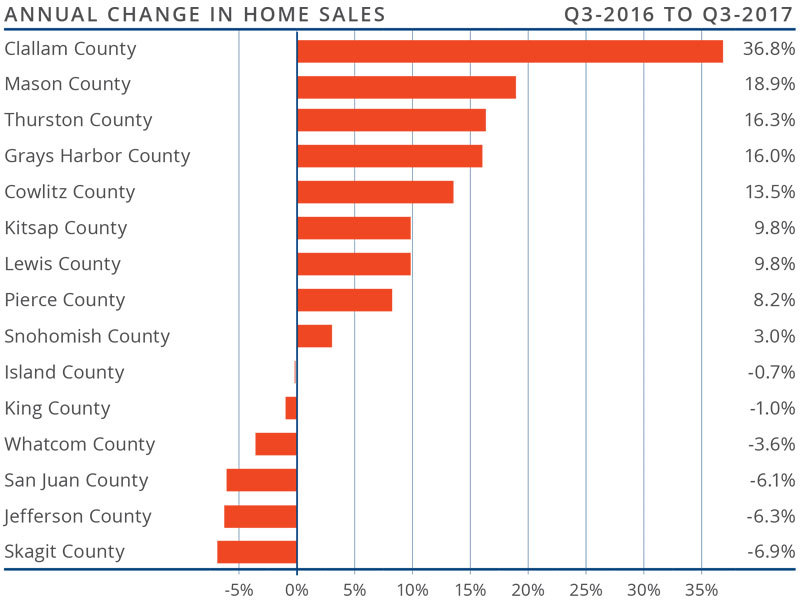

There were 51,906 home sales in the third quarter of this year. This was 0.5% lower than the same period in 2016, and 4.8% lower than in the second quarter of this year.

There were 51,906 home sales in the third quarter of this year. This was 0.5% lower than the same period in 2016, and 4.8% lower than in the second quarter of this year.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

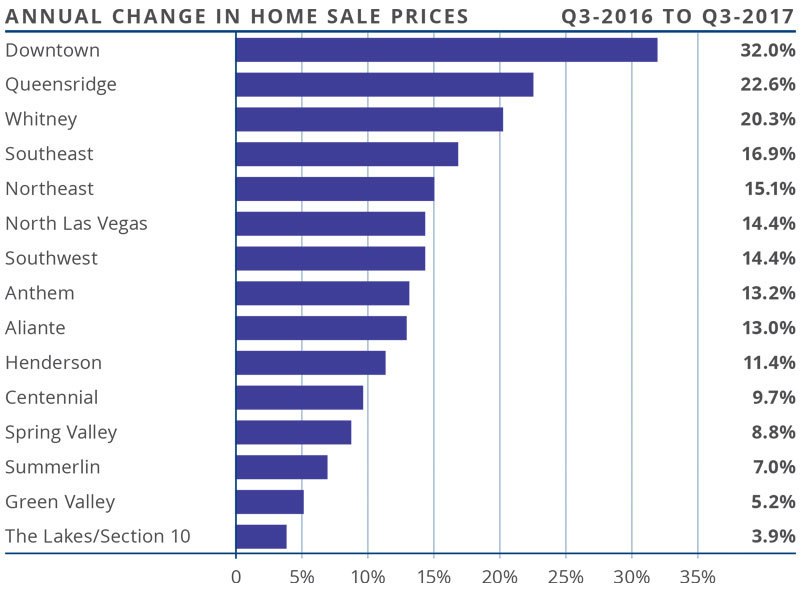

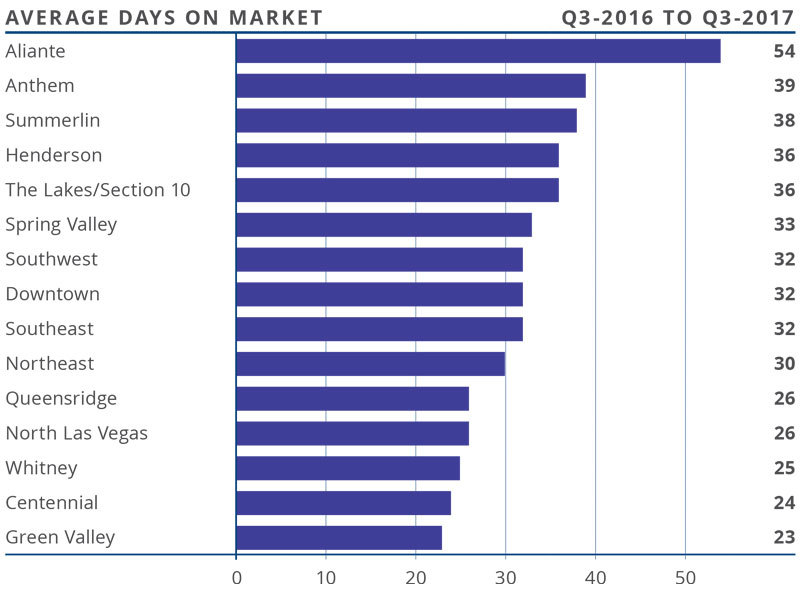

Employment in the Las Vegas metropolitan area continues to moderate from the substantial growth of the past few years, but the region still experienced impressive annual employment growth of 3%. The market has added 28,400 new jobs over the past 12 months. With this growth in employment, the unemployment rate came in at 5.2%.

Employment in the Las Vegas metropolitan area continues to moderate from the substantial growth of the past few years, but the region still experienced impressive annual employment growth of 3%. The market has added 28,400 new jobs over the past 12 months. With this growth in employment, the unemployment rate came in at 5.2%.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home

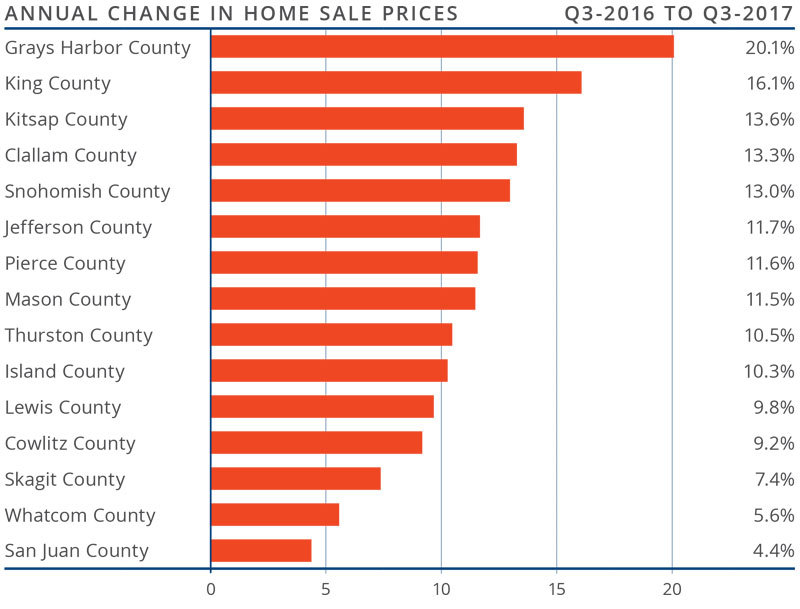

Given tight supply levels, it is unsurprising to see very solid price growth across the Western Washington counties. Year-over-year, average prices rose 12.3% to $474,184. This is 0.9% higher than seen in the second quarter of this year.

Given tight supply levels, it is unsurprising to see very solid price growth across the Western Washington counties. Year-over-year, average prices rose 12.3% to $474,184. This is 0.9% higher than seen in the second quarter of this year.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the third quarter of 2017, I have left the needle at the same point as the second quarter. Though price growth remains robust, sales activity has slowed very slightly and listings jumped relative to the second quarter. That said, the market is very strong and buyers will continue to find significant competition for accurately priced and well-located homes.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. For the third quarter of 2017, I have left the needle at the same point as the second quarter. Though price growth remains robust, sales activity has slowed very slightly and listings jumped relative to the second quarter. That said, the market is very strong and buyers will continue to find significant competition for accurately priced and well-located homes.