The following analysis of select counties of the Northwest Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Jobs continue to be added in Northwest Oregon. Though we continue to creep toward a full recovery of the jobs lost to the pandemic, employment levels are still down more than 38,000 jobs. The unemployment rate in the region was 5% and has been trending higher as the total number of jobs falls, albeit modestly. The Southwest Washington market also continues to perform well, but the pace of job growth has certainly tapered. Unemployment was on the decline through mid-summer but has started to rise again. The unemployment rate in November was 5.2%, which was the highest level since September 2021.

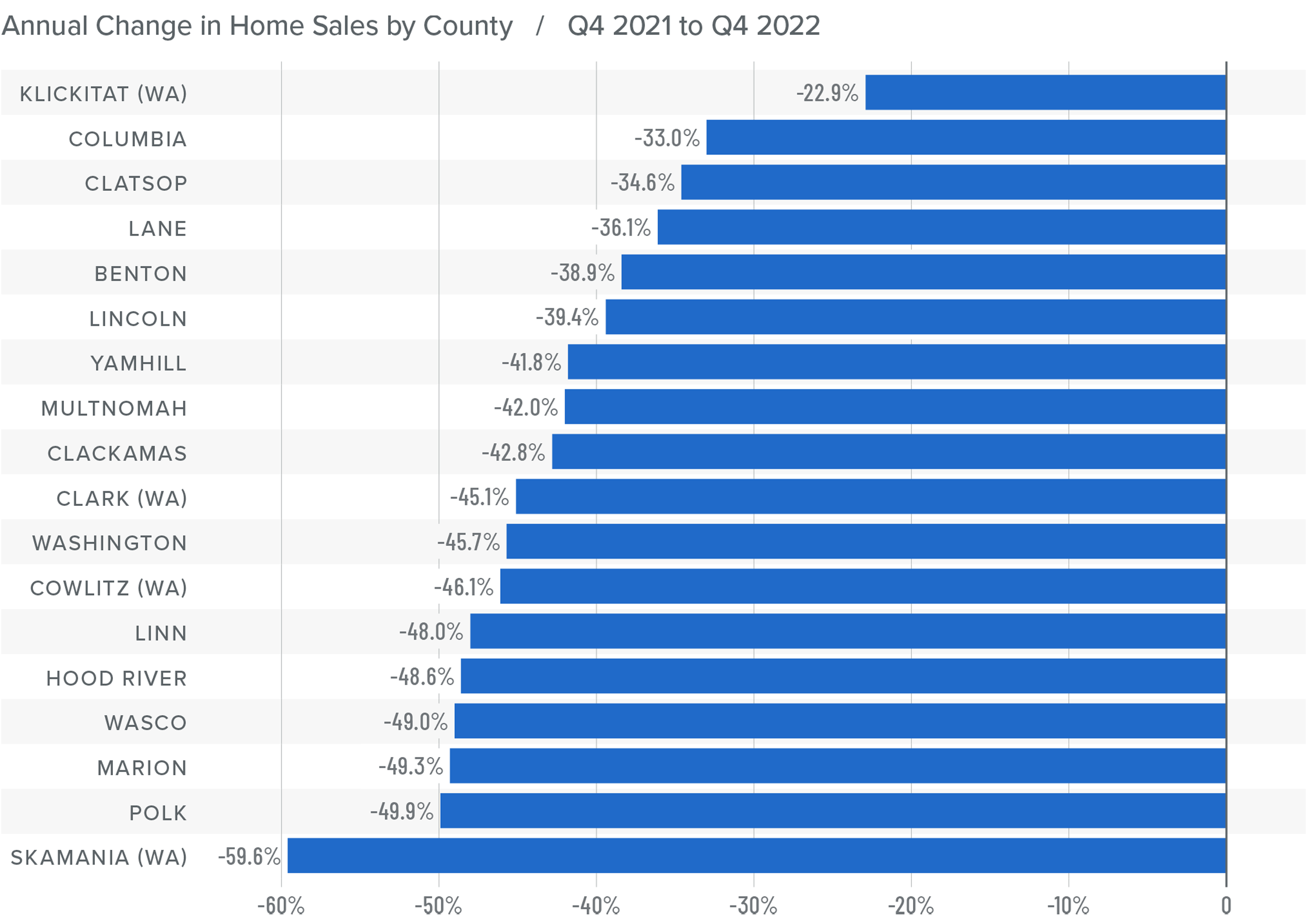

Northwest Oregon and Southwest Washington Home Sales

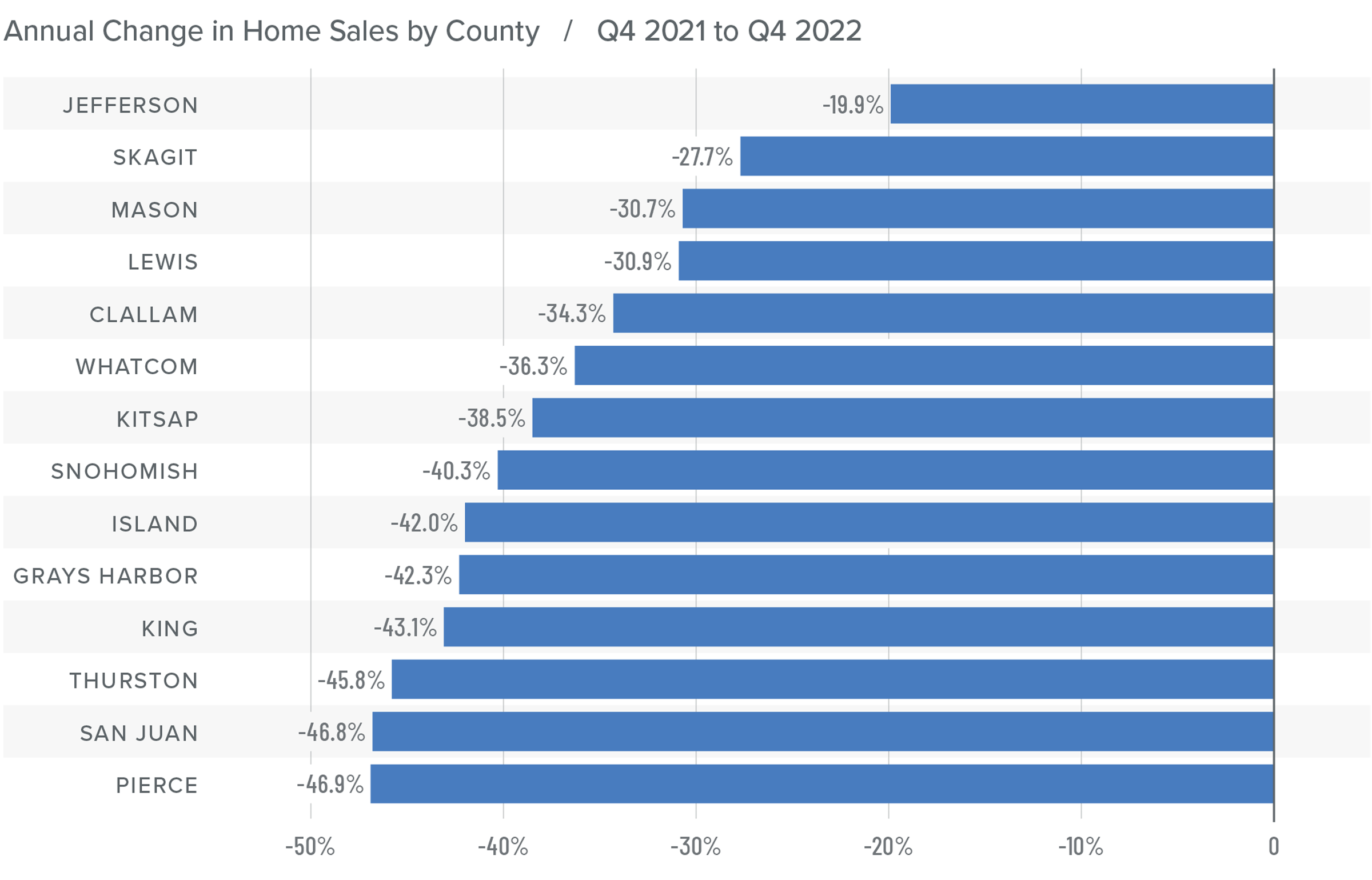

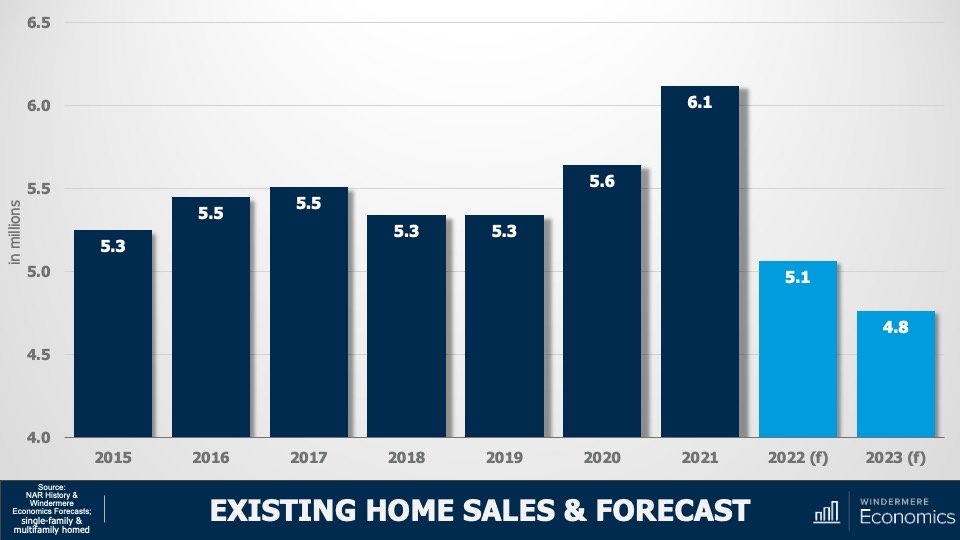

❱ In the final quarter of 2022, 8,434 homes sold, representing a drop of 43.4% from the same period in 2021.

❱ Year over year, listing activity was significantly higher but remained well below the long-term average. This suggests that high financing costs and affordability constraints are still impacting the market.

❱ Home sales fell across the board relative to the same time the previous year and the third quarter of 2022.

❱ Buyers have more homes to choose from than they have seen since 2019, yet many are still sitting on the fence. This may be because they are waiting for prices to fall further, mortgage rates to come down, or, likely, both. It will be interesting to see if buyer mentality changes in the spring.

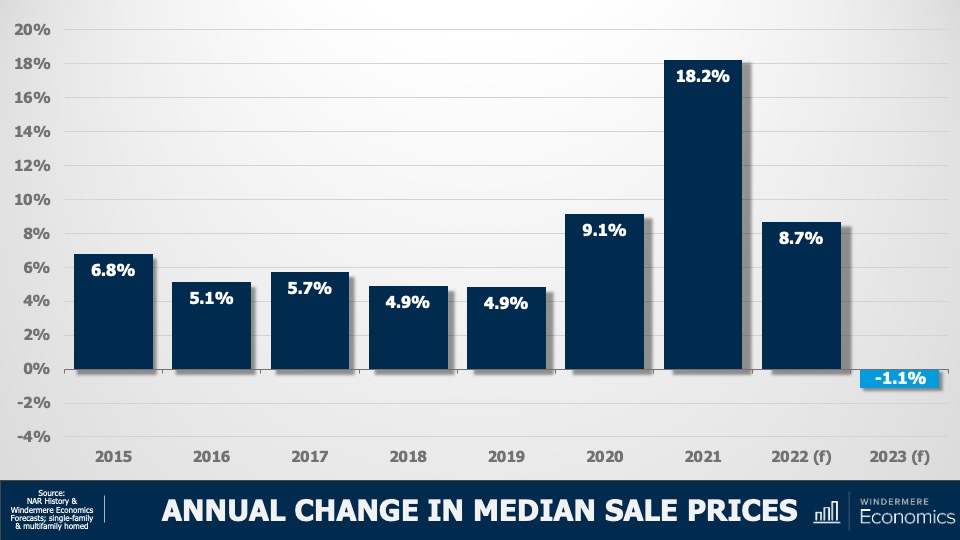

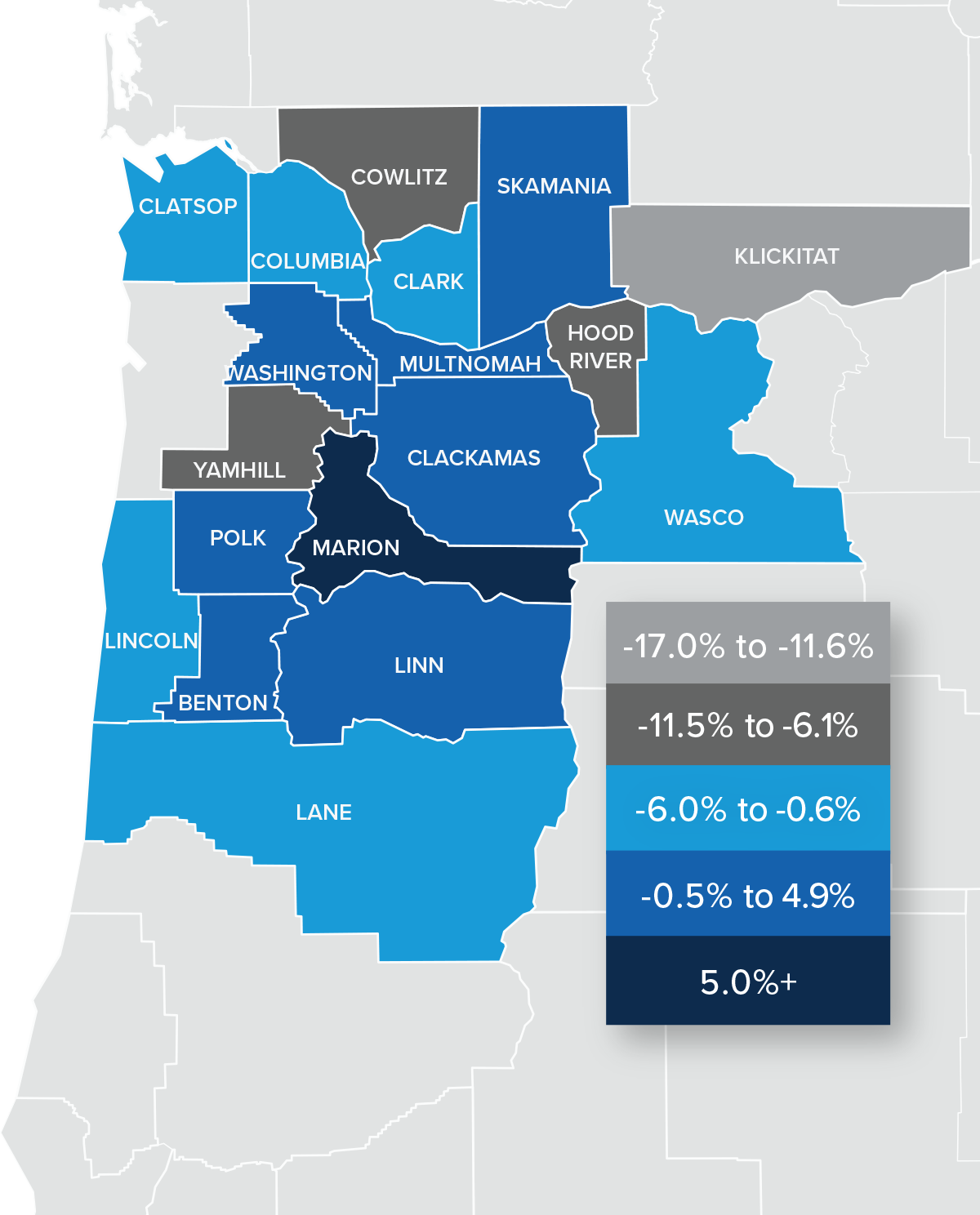

Northwest Oregon and Southwest Washington Home Prices

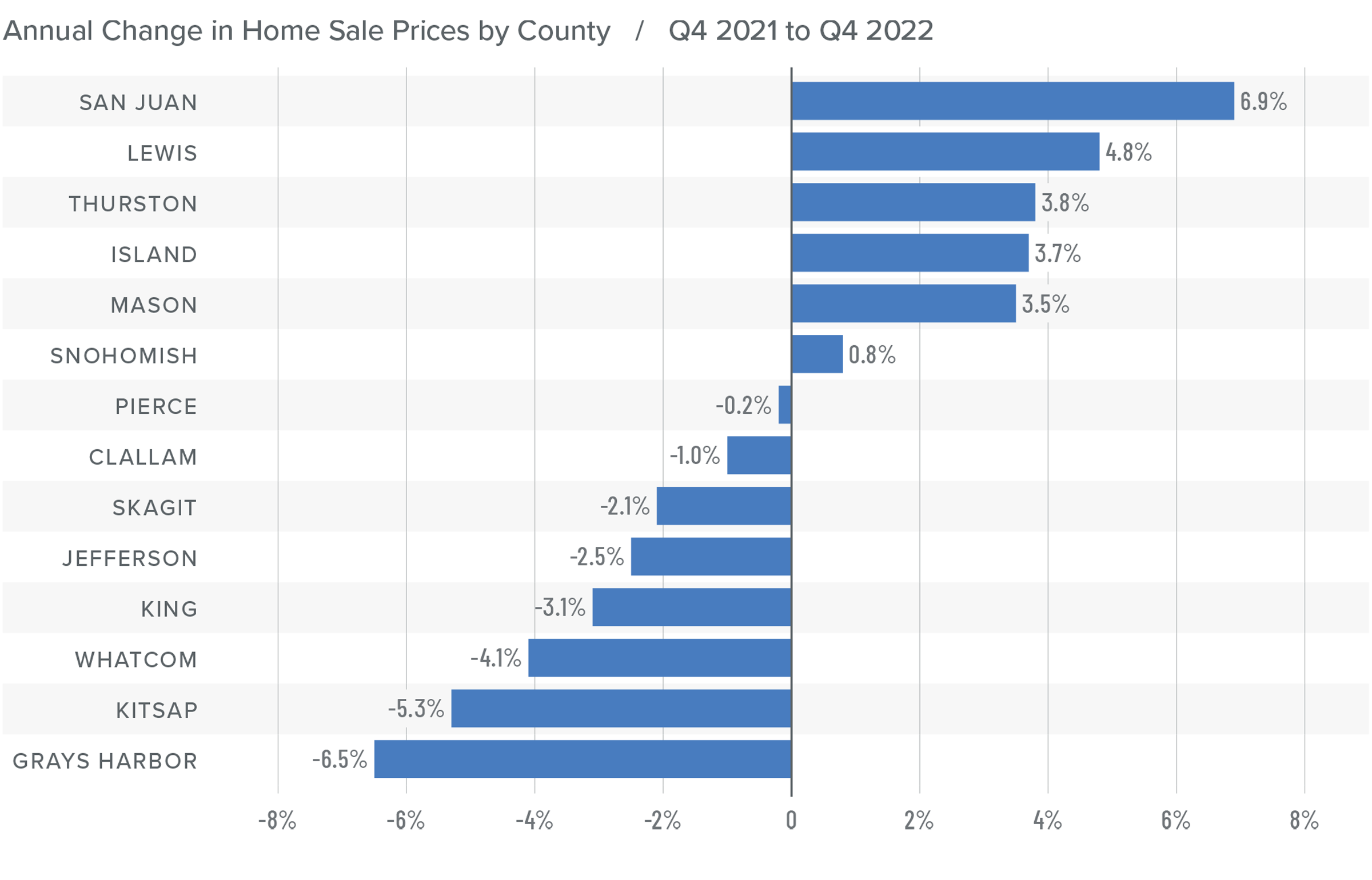

❱ The average home sale price in the region matched that of the same period the year prior, but it was down 5.6% compared to the third quarter of 2022.

❱ Relative to the third quarter of 2022, average prices fell across the board. Columbia, Hood River, Lincoln, and Wasco counties saw double-digit declines.

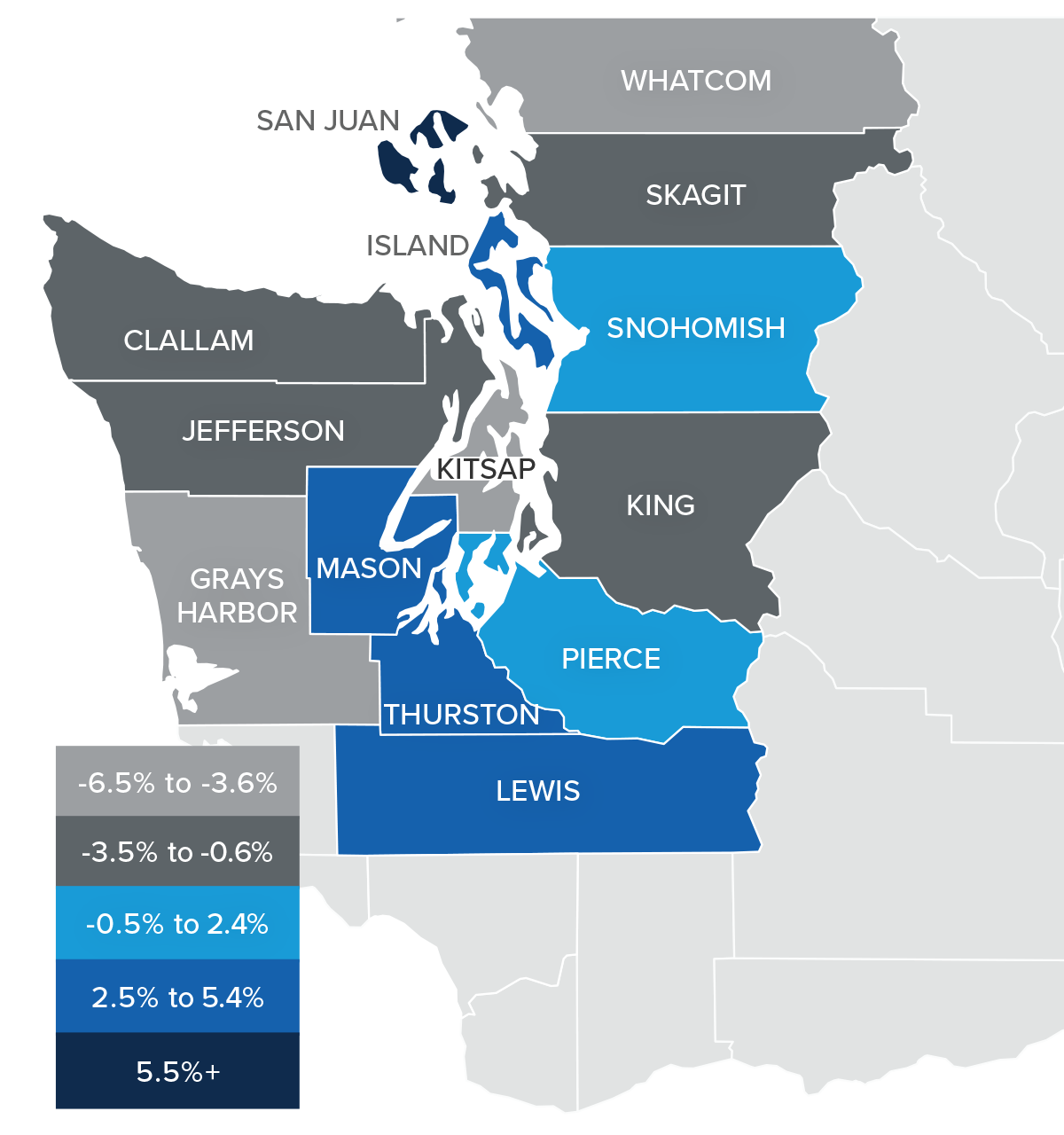

❱ Prices in all but seven counties fell year over year. Where prices did rise, the pace of growth was far lower than the market has seen in a number of years.

❱ Several markets appear to show listing prices either stabilizing or increasing modestly. It is possible that some markets have adjusted to account for higher mortgage rates. It will be interesting to see if this continues as we move into the spring market, or if we will see prices erode further.

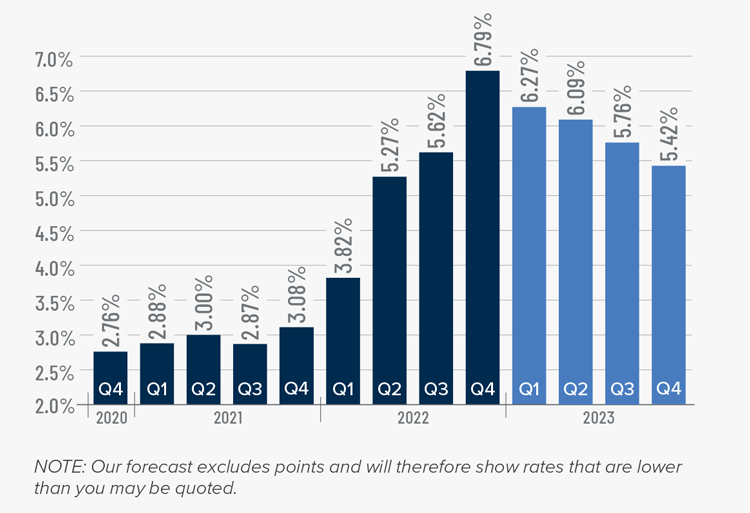

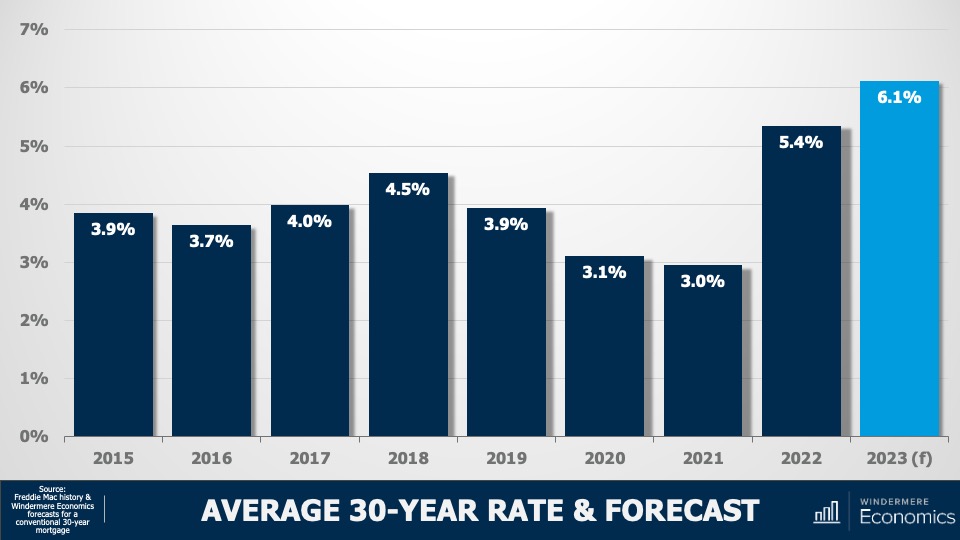

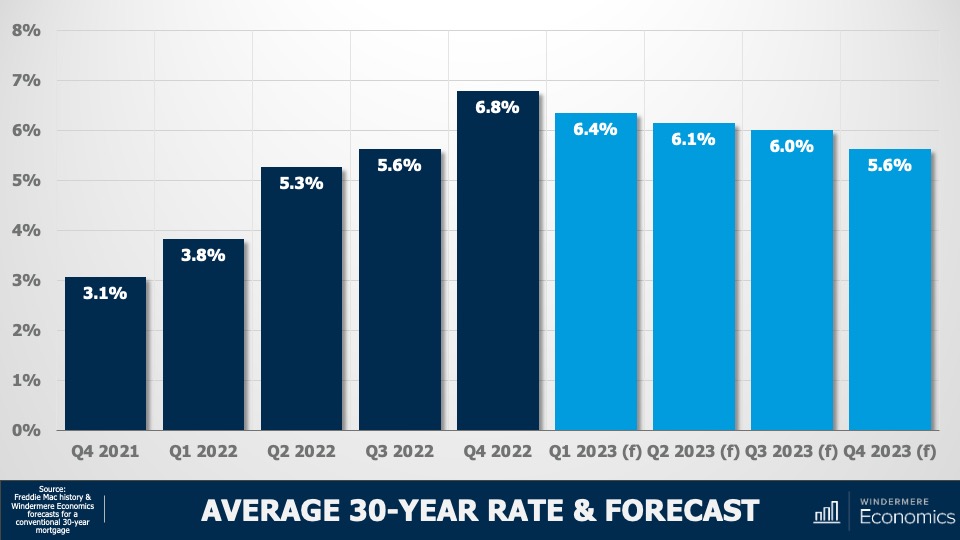

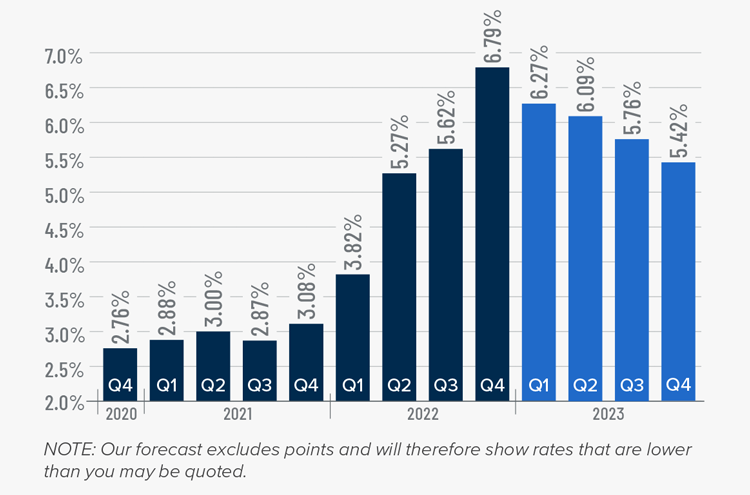

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

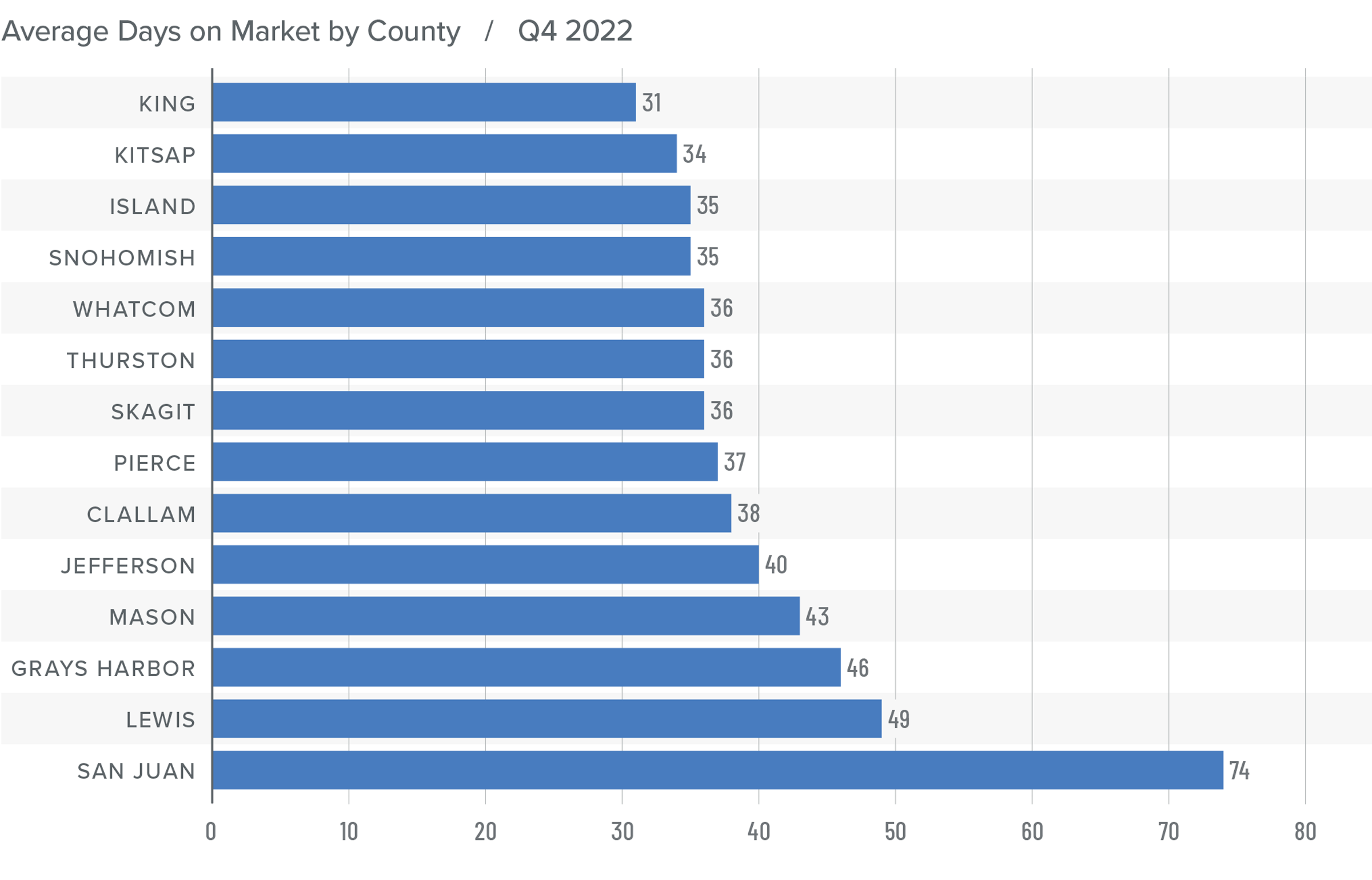

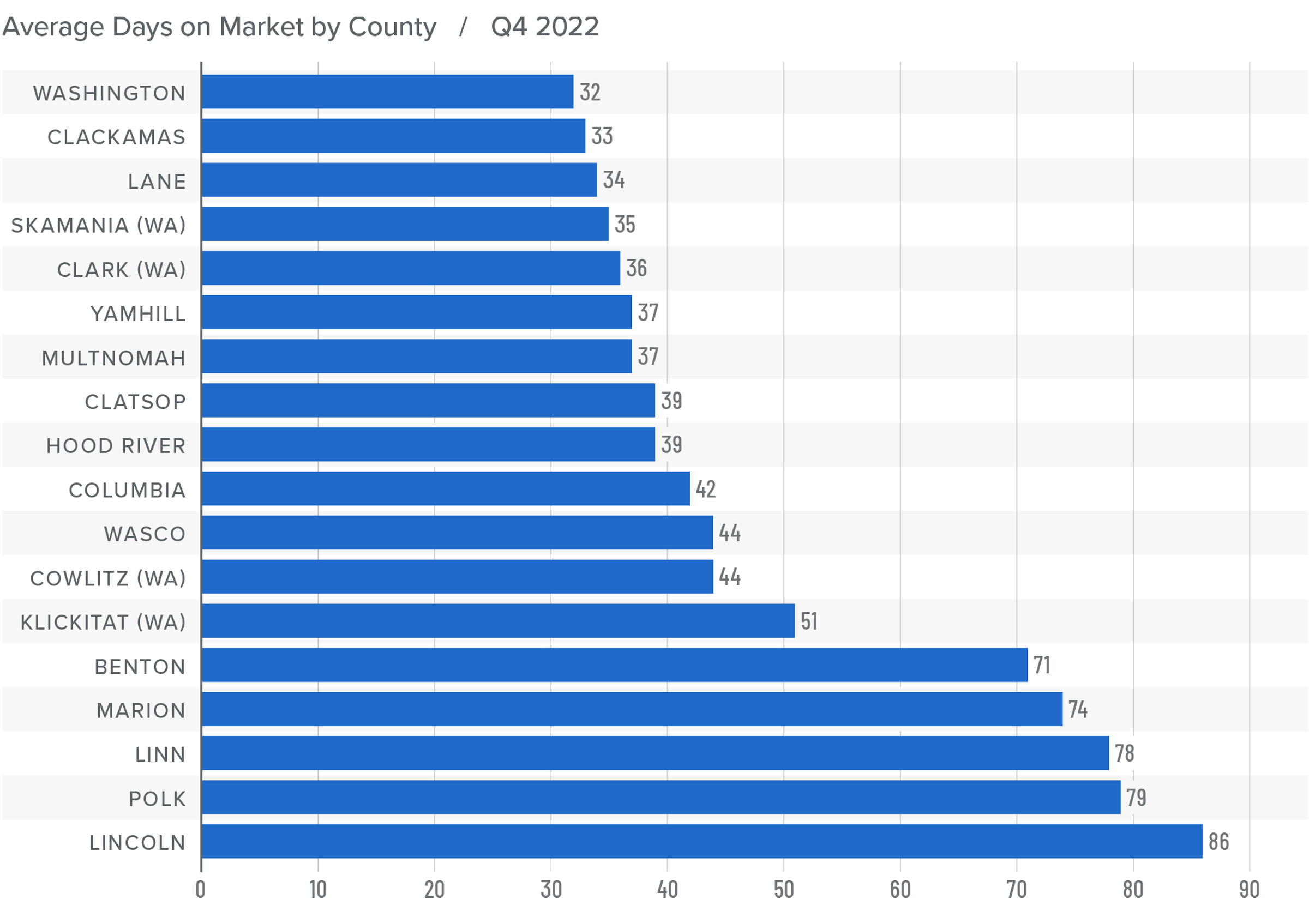

Northwest Oregon and Southwest Washington Days on Market

❱ The average time it took to sell a home in the region rose 12 days compared to the same period the previous year. It took 11 more days for homes to sell than it did in the third quarter of 2022.

❱ The average time it took to sell a home in the final quarter of 2022 was 50 days.

❱ Skamania County was the only area where market time fell compared to the same period the prior year. Relative to the third quarter of 2022, market time fell in Benton and Skamania counties.

❱ Longer market time is a function of additional supply. While this gives buyers more choice, it also causes uncertainty in the housing market. As a result, buyers are significantly more cautious than they have been in quite some time.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

I believe the market will remain somewhat soft as we move through the spring, but with many sellers believing that prices have found a bottom (as indicated by the stabilization in listing prices), buyers may not end up in as strong a position as they might think.

The market is, without a doubt, closer to balance than it has been in over a decade. As such, I have moved the needle as close to the balance line as we have seen in a very long time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link