The American people have spoken and they have elected Donald J. Trump as the 45th president of the United States. Change was clearly demanded, and change is what we will have.

The election was a shock for many, especially on the West Coast where we have not been overly affected by the long-term loss in US manufacturing or stagnant wage growth of the past decade. But the votes are in and a new era is ahead of us. So, what does this mean for the housing market?

First and foremost I would say that we should all take a deep breath. In a similar fashion to the UK’s “Brexit”, there will be a “whiplash” effect, as was seen in overnight trading across the globe. However, at least in the US, equity markets have calmed as they start to take a closer look at what a Trump presidency will mean.

On a macro level, I would start by stating that political rhetoric and hyperbole do not necessarily translate into policy. That is the most important message that I want to get across. I consider it highly unlikely that many of the statements regarding trade protectionism will actually go into effect. It will be very important for President Trump to tone down his platform on renegotiating trade agreements and imposing tariffs on China. I also deem it highly unlikely that a 1,000-mile wall will actually get built.

It is crucial that some of the more inflammatory statements that President-Elect Trump has made be toned down or markets will react negatively. However, what is of greater concern to me is that neither candidate really approached questions regarding housing with any granularity. There was little-to-no-discussion regarding housing finance reform, so I will be watching this topic very closely over the coming months.

As far as the housing market is concerned, it is really too early to make any definitive comment. That said, Trump ran on a platform of deregulation and this could actually bode well for real estate. It might allow banks the freedom to lend more, which in turn, could further energize the market as more buyers may qualify for home loans.

Concerns over rising interest rates may also be overstated. As history tells us, during times of uncertainty we tend to put more money into bonds. If this holds true, then we may see a longer-than-expected period of below-average rates. Today’s uptick in bond yields is likely just temporary.

Proposed infrastructure spending could boost employment and wages, which again, would be a positive for housing markets. Furthermore, easing land use regulations has the potential to begin addressing the problem of housing affordability across many of our nation’s housing markets – specifically on the West Coast.

Economies do not like uncertainty. In the near-term we may see a temporary lull in the US economy, as well as the housing market, as we analyze what a Trump presidency really means. But at the present time, I do not see any substantive cause for panic in the housing sector.

We are a resilient nation, and as long as we continue to have checks-and balances, I have confidence that we will endure any period of uncertainty and come out stronger.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

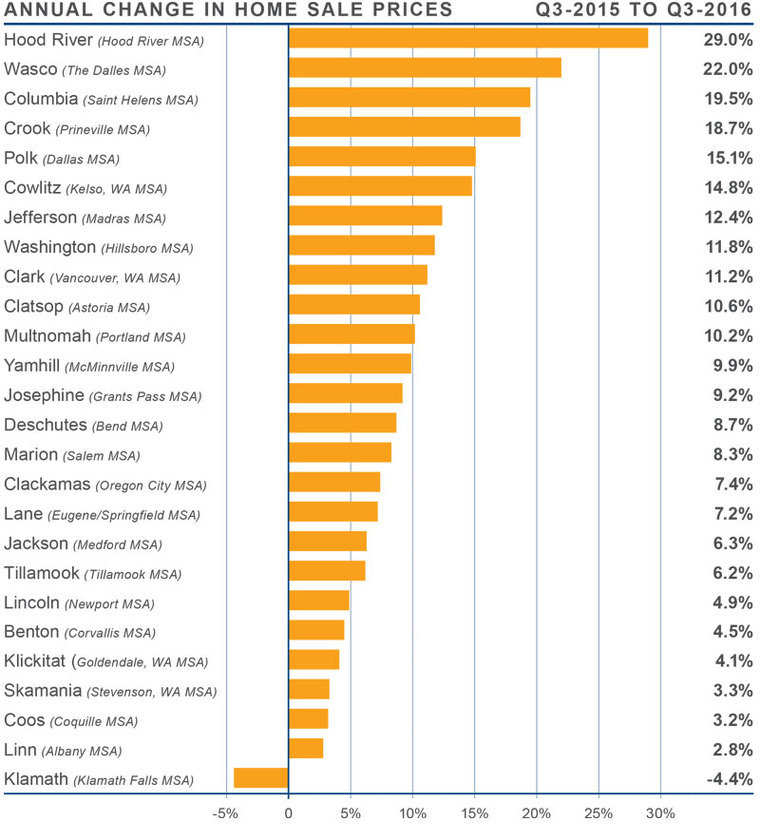

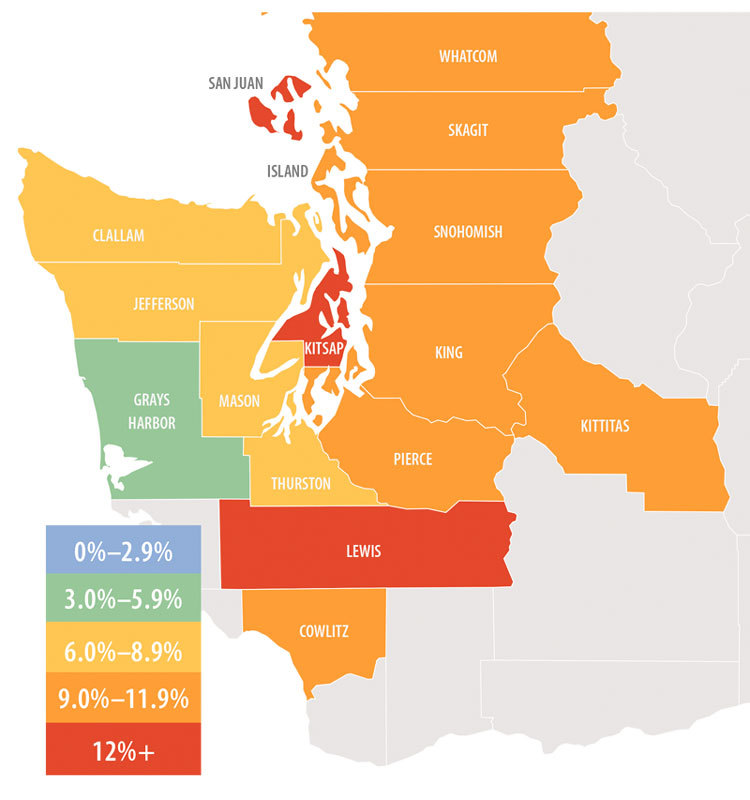

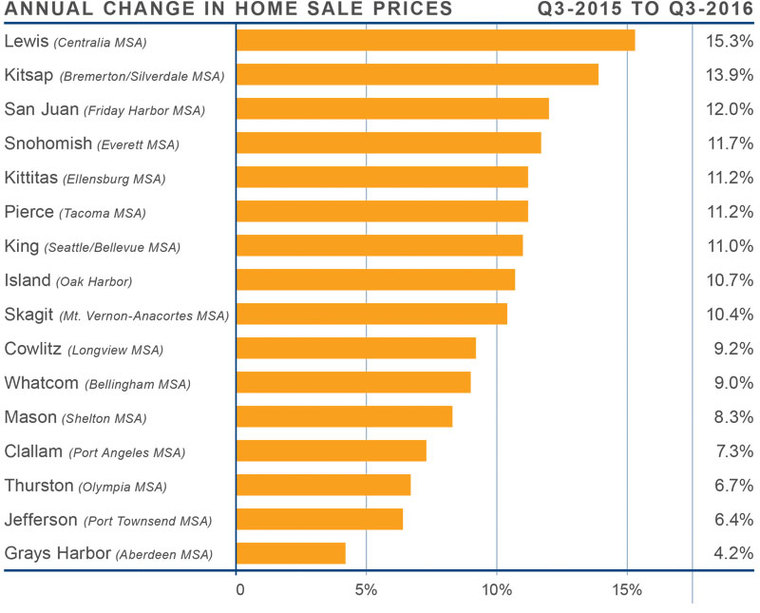

Average home prices over the past year rose by 8.1% to $335,000. This is down from 10.5% seen in the second quarter of the year. This may be an indicator that home price growth is beginning to revert toward historic averages.

Average home prices over the past year rose by 8.1% to $335,000. This is down from 10.5% seen in the second quarter of the year. This may be an indicator that home price growth is beginning to revert toward historic averages.

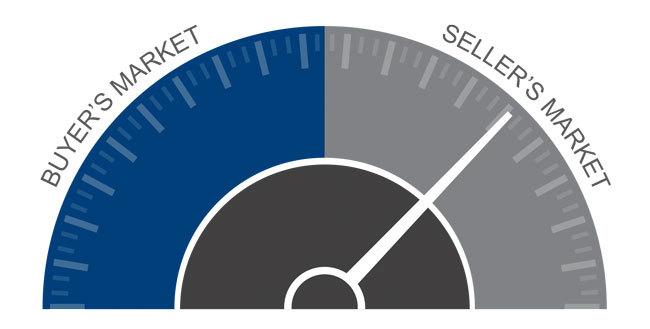

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. Economic growth continues to trend well above the nation, and this region is one of the fastest growing in the country. The housing market continues to benefit greatly from this economic vitality. That said, the modest decline in home sales and prices is worthy of note. This suggests that peak price growth is now behind us and that we will start to see a slowing in the upward trend of home values. This actually is not a bad thing because tapering home prices will ultimately lead to a rise in the number of home sales, which still remain below historic averages. As such, I have moved the needle a little toward buyers, however, it certainly remains a seller’s market.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. Economic growth continues to trend well above the nation, and this region is one of the fastest growing in the country. The housing market continues to benefit greatly from this economic vitality. That said, the modest decline in home sales and prices is worthy of note. This suggests that peak price growth is now behind us and that we will start to see a slowing in the upward trend of home values. This actually is not a bad thing because tapering home prices will ultimately lead to a rise in the number of home sales, which still remain below historic averages. As such, I have moved the needle a little toward buyers, however, it certainly remains a seller’s market. Matthew Gardner is the Chief Economist for

Matthew Gardner is the Chief Economist for

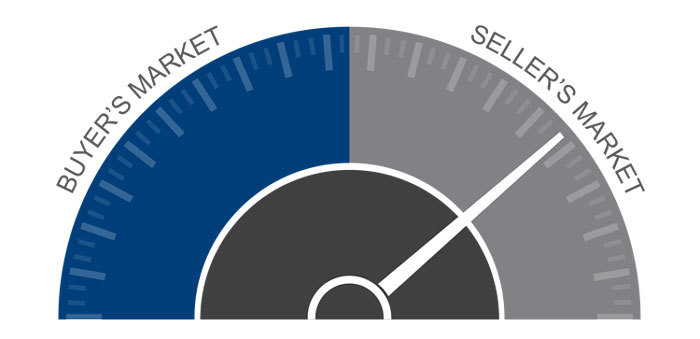

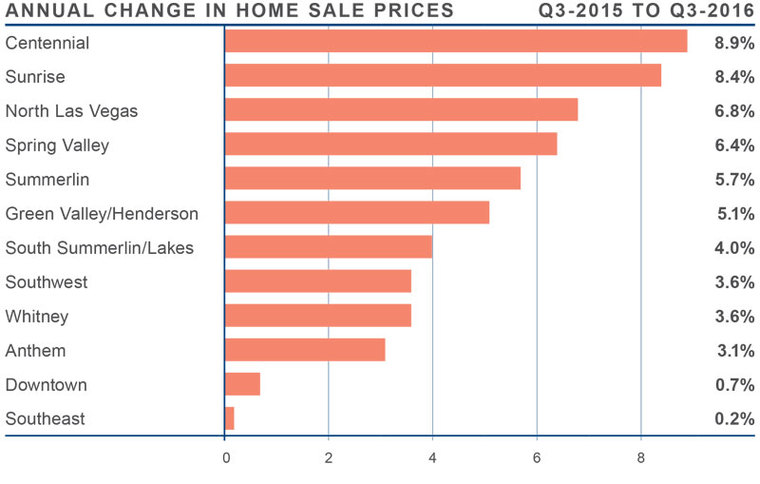

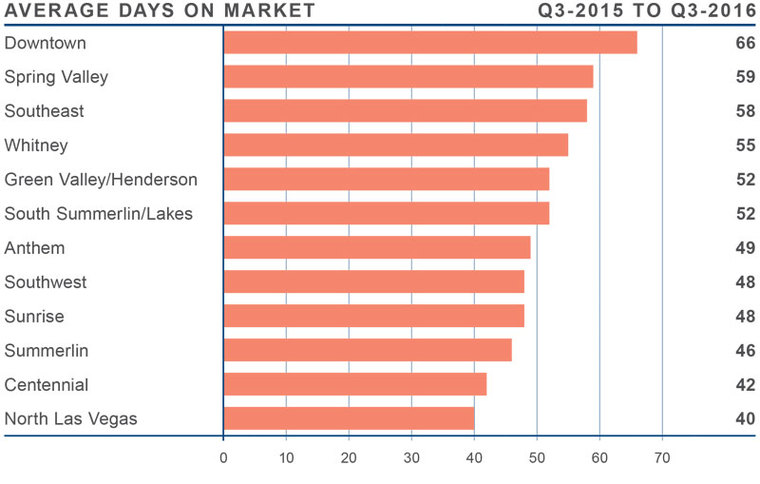

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. Employment growth in Clark County has resumed and I believe that it is this growth that is continuing to drive home sales. Inventory levels have risen substantially over the past six months and, while they are below the levels of a balanced market, they are headed in the right direction. Home prices are increasing at a reasonable pace but there are some sub-markets that are over-performing at the present time. This is not a concern, as I think buyers will start to be more selective regarding the neighborhoods that they want to move to. This process will allow some markets to appreciate at levels higher than the regional averages. I have moved the speedometer a little more in favor of sellers, as price growth is higher across the board and, even with the rise in listing activity, sellers still have the upper hand.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. Employment growth in Clark County has resumed and I believe that it is this growth that is continuing to drive home sales. Inventory levels have risen substantially over the past six months and, while they are below the levels of a balanced market, they are headed in the right direction. Home prices are increasing at a reasonable pace but there are some sub-markets that are over-performing at the present time. This is not a concern, as I think buyers will start to be more selective regarding the neighborhoods that they want to move to. This process will allow some markets to appreciate at levels higher than the regional averages. I have moved the speedometer a little more in favor of sellers, as price growth is higher across the board and, even with the rise in listing activity, sellers still have the upper hand.

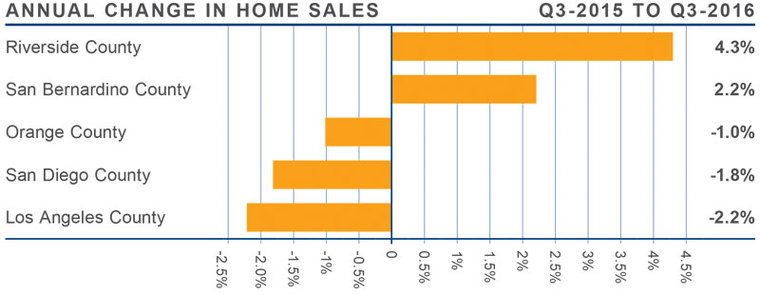

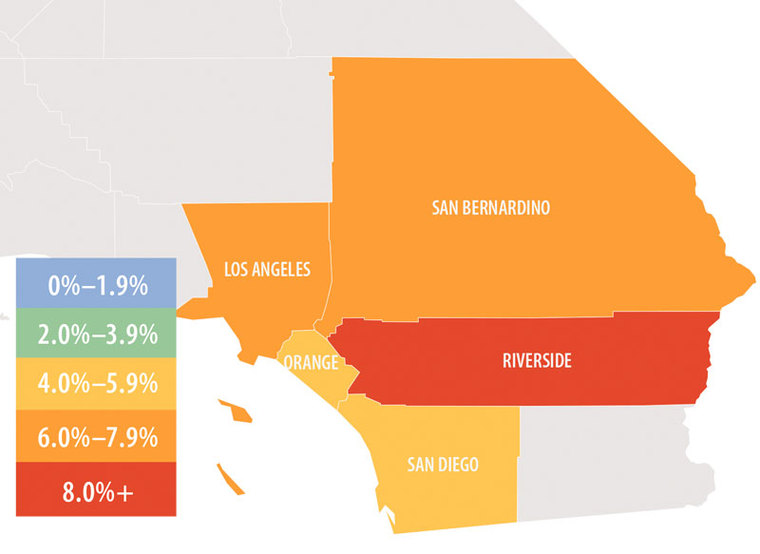

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. The regional economy continues to add jobs and this continues to increase the demand for housing.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates and larger economics factors. The regional economy continues to add jobs and this continues to increase the demand for housing.

As demand continues to exceed supply, we are continuing to see upward pressure on home prices. In the third quarter, average prices rose by a substantial 10.2% and are 3.2% higher than seen in the second quarter of this year.

As demand continues to exceed supply, we are continuing to see upward pressure on home prices. In the third quarter, average prices rose by a substantial 10.2% and are 3.2% higher than seen in the second quarter of this year.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. For the third quarter of 2016, I am moving the needle very slightly toward the buyers. This is entirely due to the recent increase in inventory levels that I believe will continue through the rest of the year. That said, the region remains steadfastly a seller’s market.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. For the third quarter of 2016, I am moving the needle very slightly toward the buyers. This is entirely due to the recent increase in inventory levels that I believe will continue through the rest of the year. That said, the region remains steadfastly a seller’s market.