This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

2026 is already proving to be a busy news year for the housing market, starting with our first number to know:

$200 billion

That’s the total value of mortgage-backed securities that President Trump announced on January 8th he’s directed “his Representatives” to purchase, with a stated goal of reducing mortgage interest rates. A big new buyer of mortgages will tend to bid their prices up, which – for bonds – means pushing interest rates down.

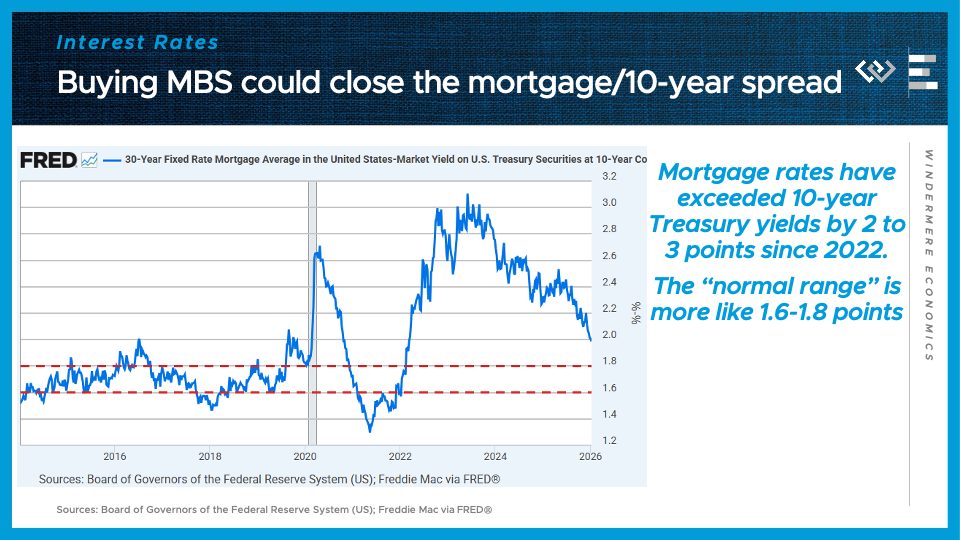

For the last 3 years, mortgage rates have been unusually high relative to the benchmark 10-year Treasury rate, which has been gradually compressing back to a normal range, and this buying spree, evidently by Fannie Mae and Freddie Mac, should accelerate that process of shrinking the spread.

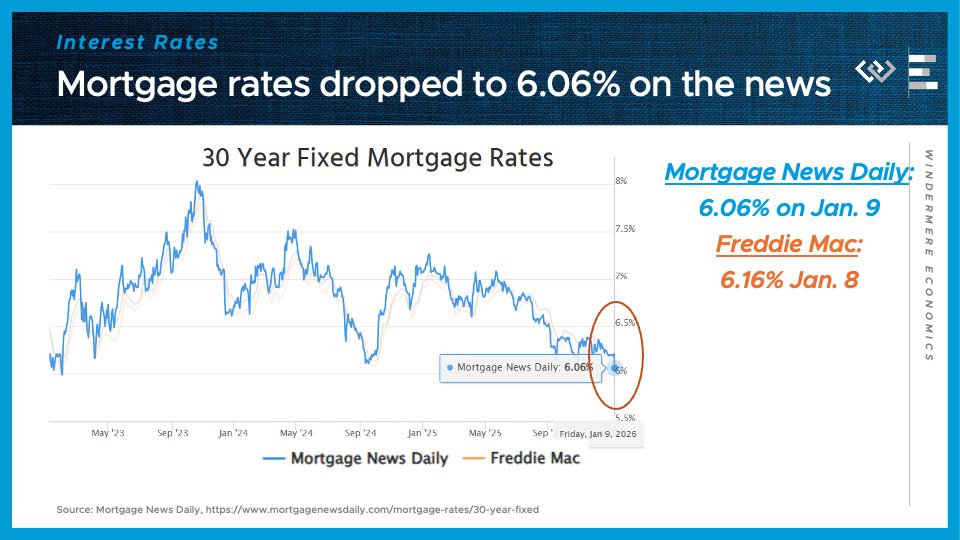

Markets have taken this announcement quite seriously. In just the first day of trading after Trump’s announcement, mortgage rates dropped 15 basis points, bringing us to our second number to know right now:

6.06%

That was Mortgage News Daily’s average 30-year mortgage rate on Friday, January 9th, and that marks the lowest mortgage rate they’ve reported in almost 3 years. Now – trading has been unusually volatile, and there are still a lot of unanswered questions about this new program, but there’s no doubt that in the short term, it has begun moving markets, and I think SOME highly qualified buyers and sellers who start to see mortgage rates in the 5% range will be more motivated to transact this spring.

Another number to know right now:

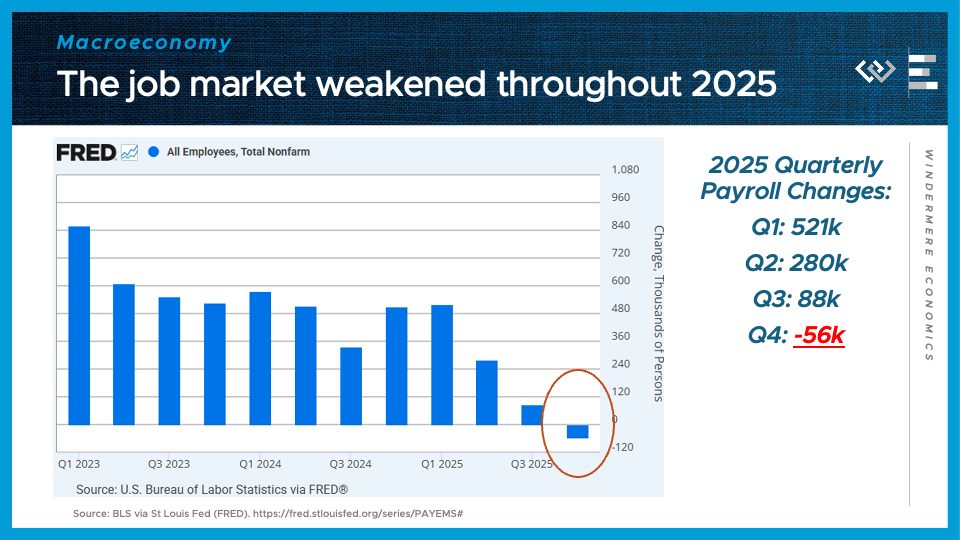

56,000

That’s the number of jobs lost on net over the fourth quarter of 2025, capping a year of slowing, and finally shrinking, payrolls in the U.S. economy. Now, other data shows economic activity held up fine in the fourth quarter, so this is not the beginning of a recession, but slowing job growth could help explain why home purchases disappointed in the fourth quarter, despite lower mortgage rates than in late 2024.

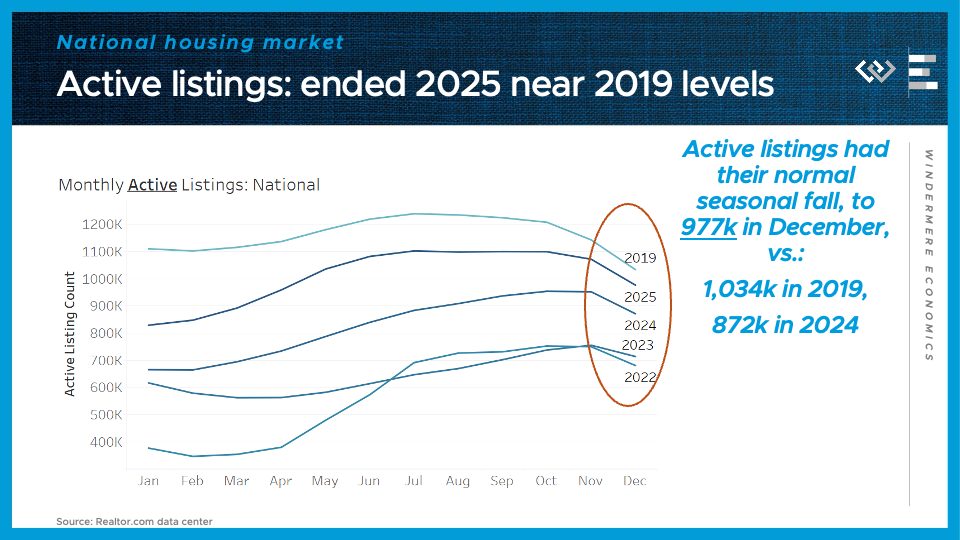

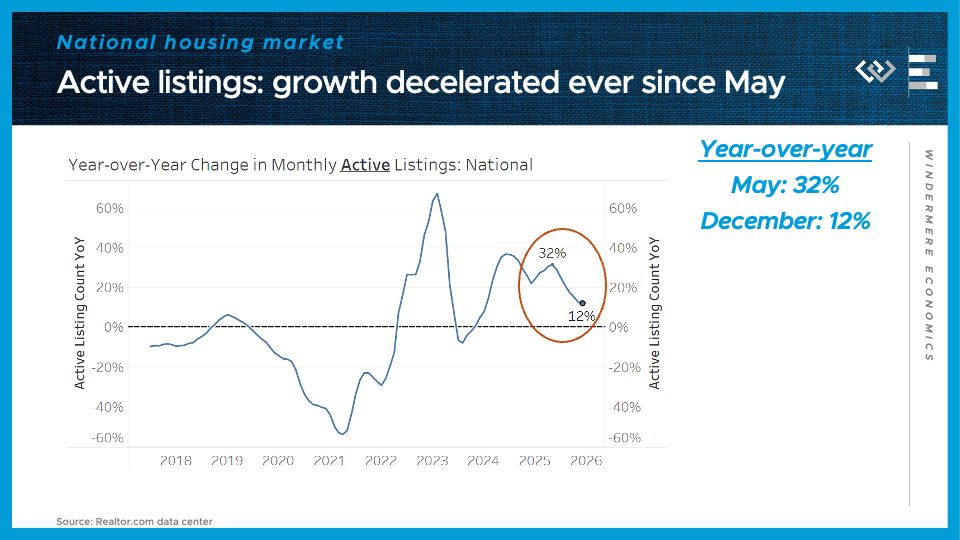

Speaking of housing, 2025 ended with the housing market still just shy of an important benchmark I’ve been watching: the moment when active inventory recovers to its pre-pandemic, 2019 levels. The year ended with just under a million active listings, vs just over a million 6 years ago on the eve of the Covid pandemic.

That is still up substantially from this time last year, but the trend of year-over-year listing growth clearly slowed over the course of 2025. That helps explain why 2025 went down as the year of cooling and normalization, but NOT anything like a fire sale or glut of unsold homes. Rather, it’s a market that made a lot of progress back toward normalcy, foretelling a healthy, balanced market in the year ahead.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link