Hello and welcome to this rather special episode of Mondays with Matthew. I’m Windermere Real Estate’s Chief Economist, Matthew Gardner.

Now, if you wonder what’s special about this particular episode, well the answer is twofold.

Firstly, I started these videos at the onset of the COVID-19 epidemic back in March and this is the 35th episode of Mondays with Matthew – where has the time gone? Anyway, it will be the last one for this year and I wanted to take just a moment to thank all of you for taking time out of your busy schedules to watch my videos. It makes this economist very happy to think that you are still getting value out of my musings.

But there’s another reason that I am excited and it’s because, after many, many late nights poring over spreadsheets, I am now ready to share my 2021 US housing forecast with you so, without further ado, let’s get to it!

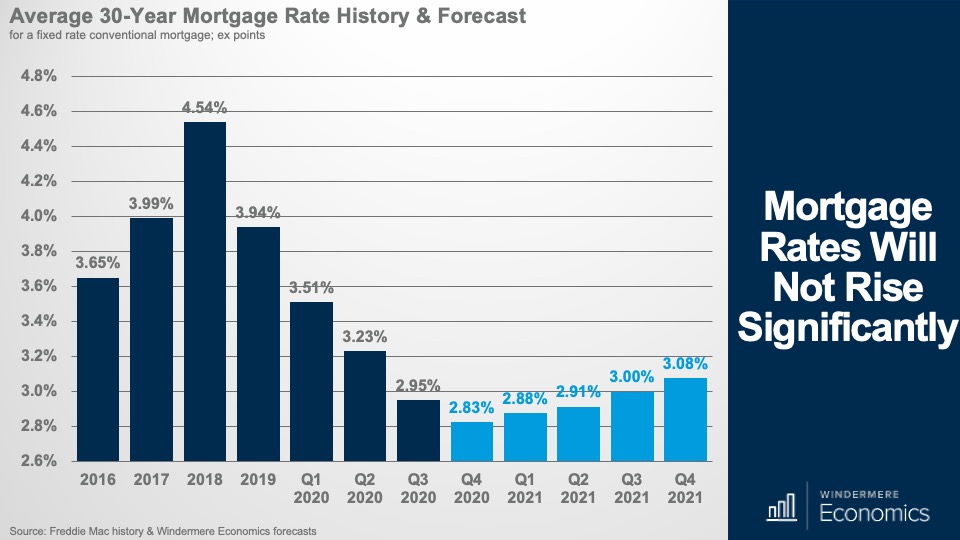

I’m starting off with my mortgage rate forecast.

As you will all be very aware, we have spent the entire year watching mortgage rates break record lows almost every week which, along with other factors, has helped drive housing demand significantly higher, but how low can rates go?

Well, my forecast suggests that rates will likely bottom out in the current quarter but that said, I do not anticipate them rising much as we move through 2021.

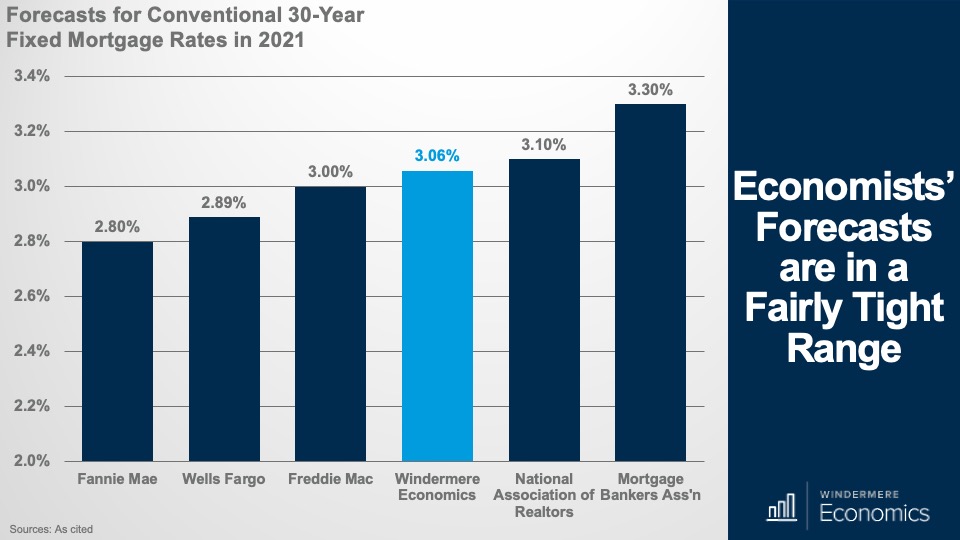

Now, I always like to see how my forecasts compare to others, so I spoke with a few housing economists across the country to see where they were regarding rates, and – as you can see – we are all in a pretty tight range for next year. I will tell you that my friends over at Fannie Mae were pretty defensive about their very optimistic forecast – I guess that we will see.

And looking further out – where my crystal ball fogs over just a little – the brave souls who are putting out forecasts for 2022 are showing rates not moving much higher even then, with Fannie Mae at an average of 2.9%, Wells Fargo at 3.1% and the Mortgage Bankers Association a little higher at 3.6%.

The bottom line here is that we are all pretty confident that although rates will start to rise, the increase will be modest, and I personally don’t see it impacting housing demand at all.

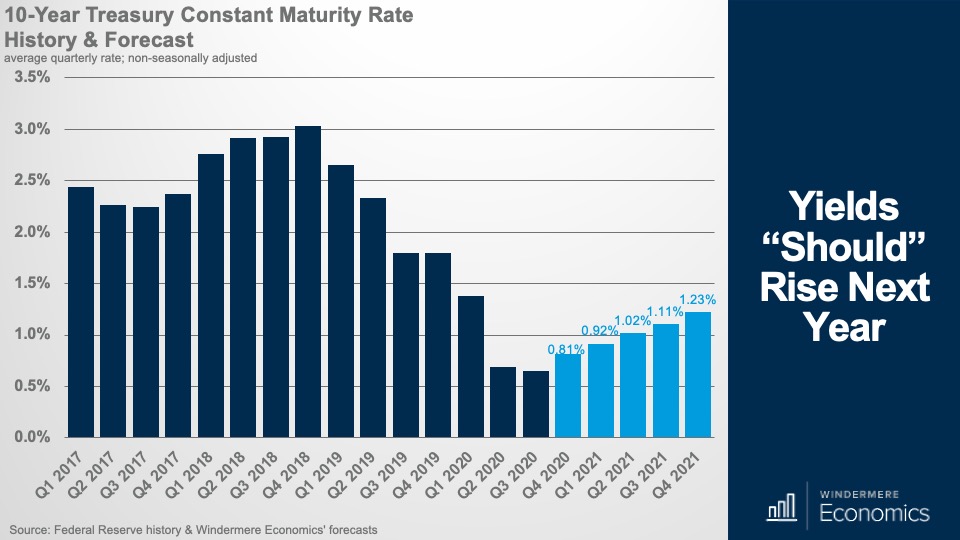

And to explain why we will see rates rise, 30-year fixed-rate mortgages are pretty directly correlated with the yield on 10-year treasuries, and you can see here that my forecast shows these rising – albeit modestly – next year and, naturally if this occurs, rates will follow.

But there are 2 reasons that might stop rates rising – at least by too much, even if Treasury yields do head higher. First is the COVID-19 vaccine. You see, if it takes longer to distribute, or if we chose not to take it, then the economy could take another dip and, if that happens, treasury yields will likely pull back, and rates could drop again. But I remain hopeful that this will not be the case.

And second is the Fed. As long as they continue to buy mortgage-backed securities, rates are actually insulated from rising treasury yields.

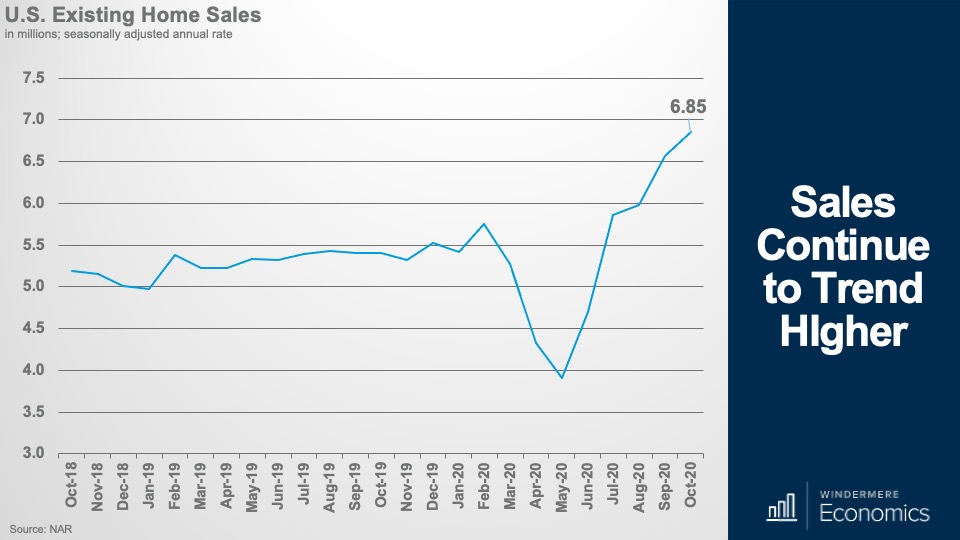

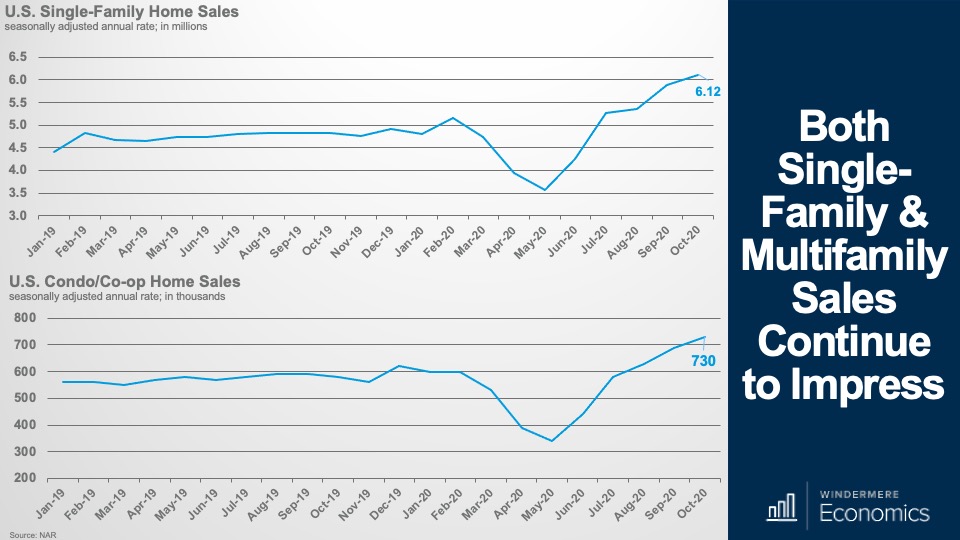

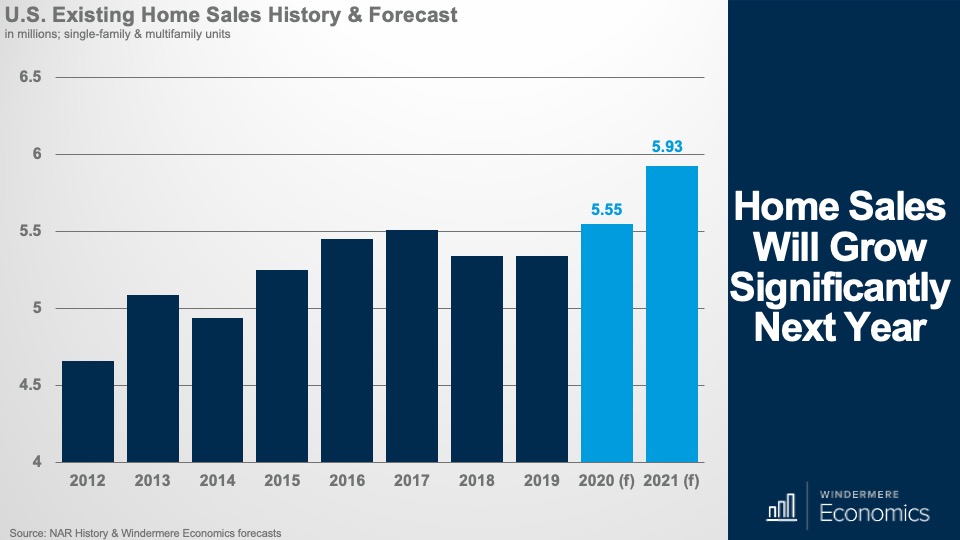

OK – on to sales, and here I am specifically looking at existing homes – I will address new homes shortly.

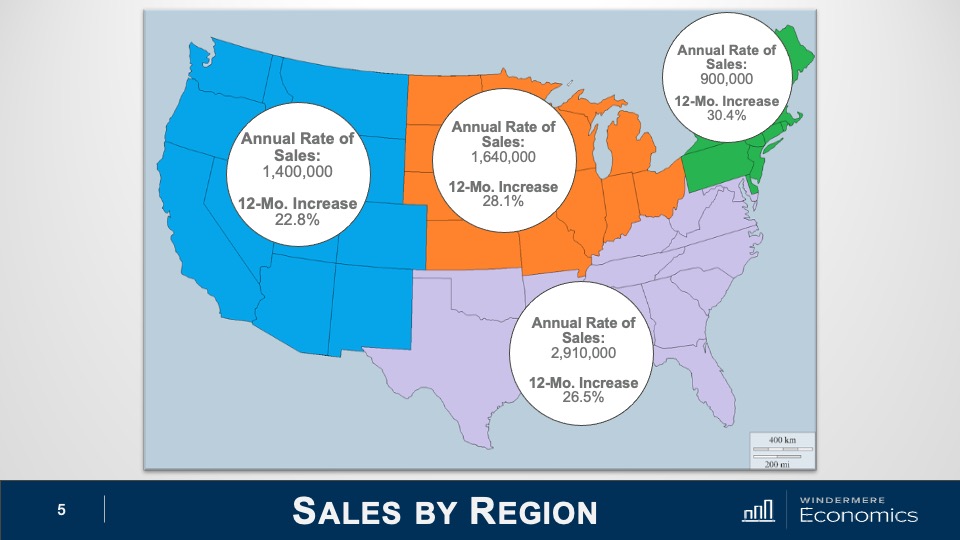

My forecast is for sales this year to have risen by 3.9%, but sales in 2021 should be up by 6.9%, and that’s a level we haven’t seen since 2006.

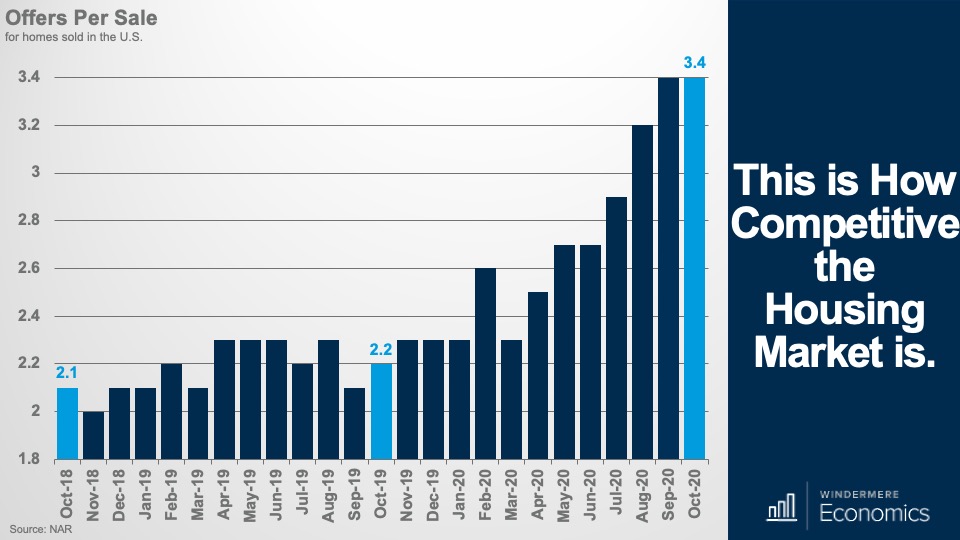

But in order for sales to rise to this extent, we need more inventory, and I do expect to see more listings next year and it will likely be, at least partially, due to COVID-19 with some household’s new ability to work from home removing the need to live close to their offices. But there will be others who will move simply because their current homes just aren’t set up for remote working.

Although I see a lot of homeowners moving due to work-from-home I believe that a lot of them will not move that far away. You see, the theory that we will all be working from home full-time is – in my opinion – likely overblown – and I would contend that a lot of them will end up blending their workweek with some days at home and some days at their offices and, if I am correct, I see many households still staying within reasonable proximity of their workplaces.

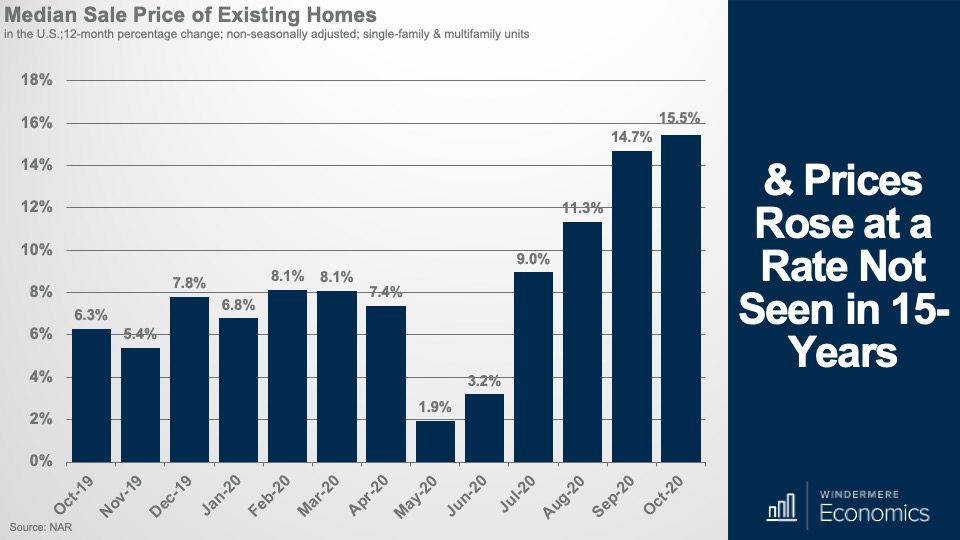

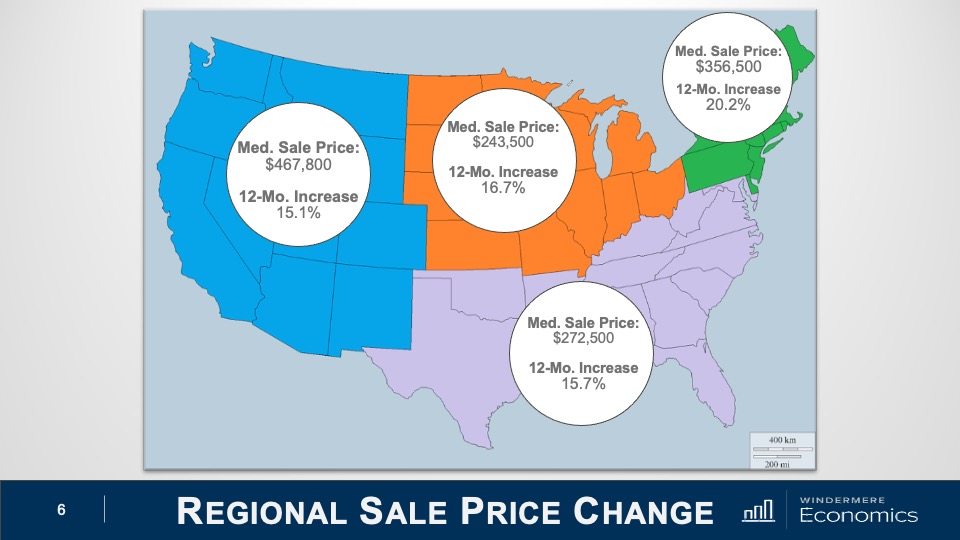

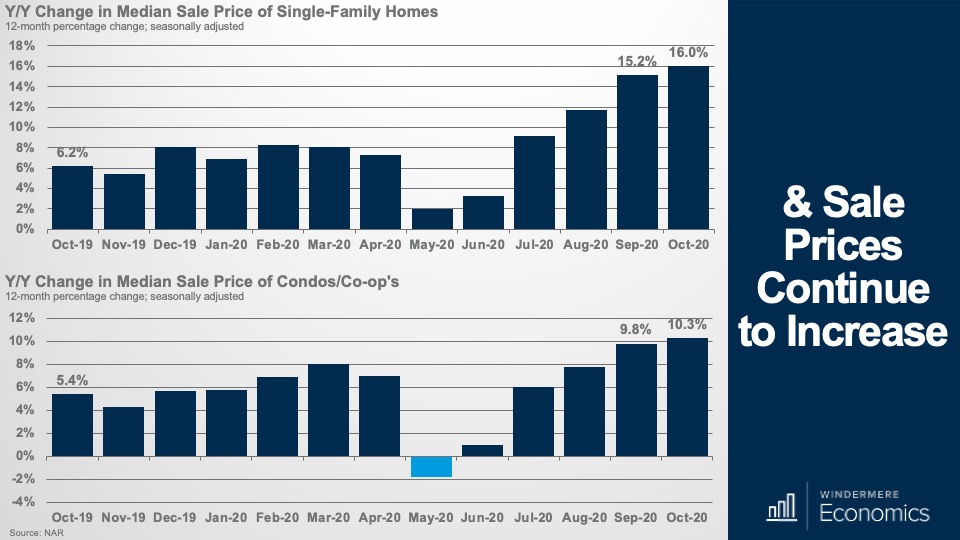

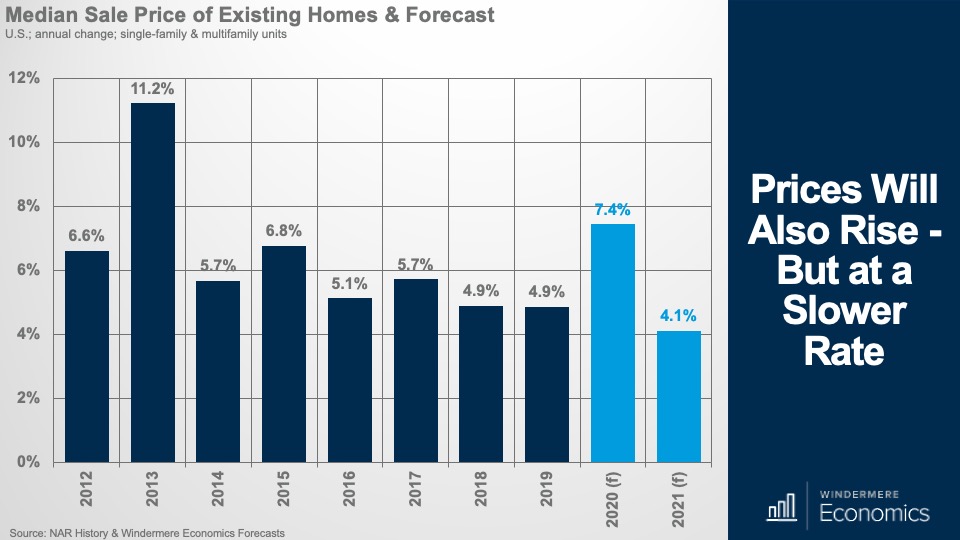

Turning our attention now to sale prices, well this year has been very impressive so far and we should see sale prices in 2020 ending up 7.4% higher than we saw in 2019. Now, this is quite remarkable, and I say this because I took a look at the 2020 forecast, I put out last year and I was forecasting price growth closer to 4% than 7%.

But COVID-19 changed all that. Mortgage rates dropped, households decided for several reasons to move and, in concert with a historically low level of homes available to buy, prices have risen significantly.

Now – and as I have said for years – there must always be a relationship between incomes and home prices, and mortgage rates dropping can only allow prices to rise by so much.

And, along with other factors, it’s partly due to affordability issues that I see prices rising by a more modest 4.1% in 2021.

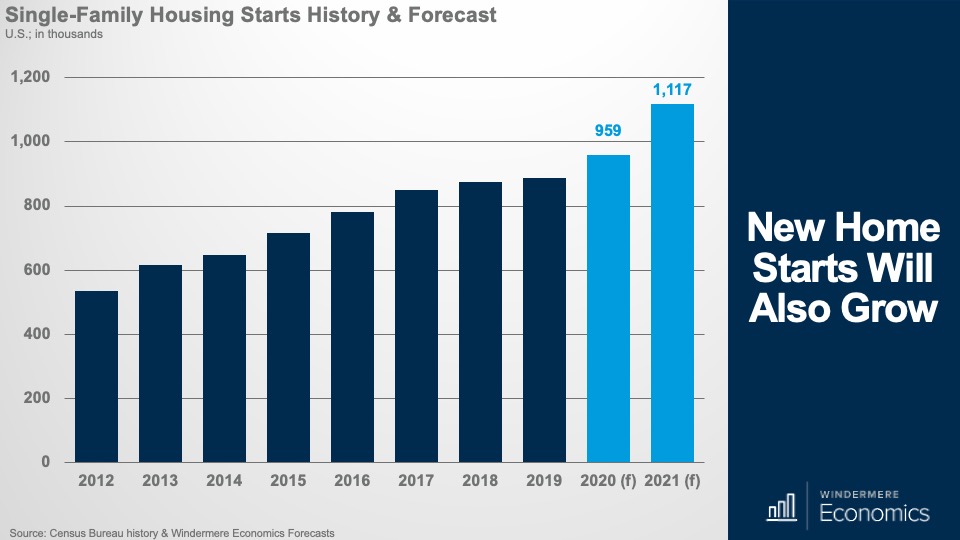

OK – looking now at the new home market – and for the purposes of this discussion I am just looking at the single-family market – so far this year we have seen a significant jump in new home sales and this very robust demand has encouraged builders to start construction of more homes and my forecast for single-family housing starts shows them rising by 8% this year, but next year I’m seeing starts up by a very significant 16.4%.

This is good news for several reasons, the biggest of which is that more new construction will add to supply and that should take some of the demand and price pressure off the resale market.

And with more starts, I expect to see sales rising with an increase of 21.5% this year and a further 18.7% in 2021. Notably, this will put new home sales at a level again that we haven’t seen since 2006.

But I do have one concern regarding the new home market, and my worry is all about cost.

Builders want to do what they do best, and that’s build homes, but they have to reconcile the costs to build a home, which are extremely high today, with the prices that would-be buyers can afford.

Now I see them managing this issue by looking to areas where land is cheaper and where there is still demand from buyers who, as we just talked about, are now looking at markets further away from major job centers.

The bottom line is that the new construction market will see very solid gains next year.

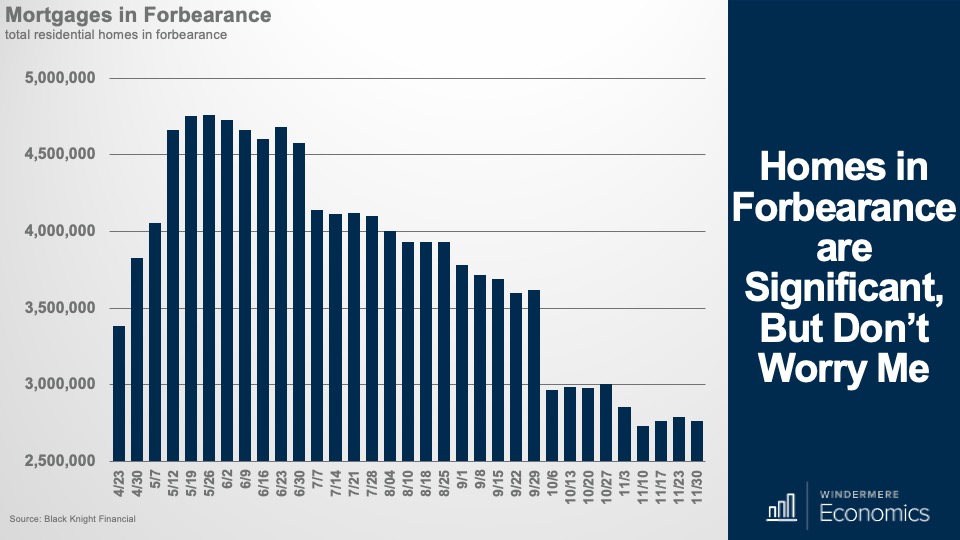

And finally, it would be remiss of me if I weren’t to address the one thing that is troubling a lot of brokers – and their clients –and that’s forbearance.

Although we saw a modest uptick in active forbearance plans earlier last month, I think it’s important to put things in perspective.

Despite small increases in the number of homes we saw entering the program, the number of active forbearances is still down by 8% (or 246,000 homes) from the end of October.

In total, as of November 30, there are 2.76 million homeowners in active forbearance plans and that represents approximately 5.2% of all mortgages but again, for perspective, the number of owners in forbearance is down by almost 2 million from the peak back in May – that’s a drop of 42%.

So, let’s talk about this for a bit.

As is human nature, there are some out there predicting that the housing market is going to crash again purely because of the number of owners in forbearance – all 2.76 million of them –will be foreclosed on when forbearance ends next spring, and this flood of foreclosed homes will lead to a spike in supply and this will lead prices to drop in a manner similar to 2008.

I get the theory, and I guess that at face value you might say that it seems plausible, but is it?

Although there’s no getting around the fact that foreclosures will rise next year as forbearance terms end, will it really be that dramatic?I think not.

There are several reasons why I’m not overly pessimistic about this. Although I see foreclosures rising next year, I actually expect the numbers to be very mild when compared to the carnage we saw between 2008 and 2010.

Why do I think this? Well, the housing bubble burst for very different reasons than we are currently experiencing. Back then there was a frenzy of reckless lending, irresponsible borrowing, and the unbridled speculation that did nothing more than set the housing market up for a crash. And crash it did. Home prices collapsed, and millions lost their homes.

But, back in March of this year – when COVID-19 really kicked in – homeowners were actually in a very good place. Credit standards were still very tight, down payments were significant, and the housing market, along with the economy as a whole, was extremely healthy and that’s the difference.

The COVID-19 pandemic has primarily hit renters, but it has impacted a lot of homeowners too and, as much as I am very sorry to say that we will see a rise in mortgage defaults and foreclosures but as the housing market muscles its way through the current economic downturn, I see foreclosures forming more of a trickle rather than a flood.

And, to support this, my colleagues over at ATTOM Data Solutions are currently forecasting more than 200,000 homeowners are likely to default next year but, if there is a longer-term Coronavirus related slowdown in the economy, the foreclosure count could get as high as 500,000 homes.

But as dramatic as their projections may seem, it’s worth noting a few things.

One. During the Great Recession, foreclosure filings spiked with 1.65 million American homes going into foreclosure in the first half of 2010, but this is well above the most pessimistic forecasts for foreclosures next year and even if defaults rise dramatically, they’ll still come in well below the levels we saw following the bursting of the housing bubble.

Two. As I talked about earlier, home prices have risen steadily since 2012 and homeowners have built up large reserves of equity. This is the total opposite of the situation we saw in 2008.

And it’s because home values have been rising, a lot of borrowers in forbearance will be able to escape foreclosure by simply selling – we know that there is more than enough demand and they will sell to make sure that they get the equity out of their homes rather than to potentially lose it because of foreclosure.

Third. Lenders really have no stomach for a repeat of the foreclosure crisis we saw back in 2008.

Today, I am seeing lenders positioning themselves to use a more-cooperative, less-punitive approach to delinquent borrowers and that they will do a better job of keeping people in homes.

And finally. Many, but not all, of the owners in forbearance, will not enter foreclosure because they will be able to catch up on their past-due amounts by paying more each month and some may be allowed to add the past-due amount to the end of the mortgage by lengthening its term.

The bottom line is that the housing market, and homeowners, are in a much better position today than they were back in the bubble days. Homeowners today have far more options to avoid foreclosure, and equity is surely helping to keep many afloat. Put it this way, even if today’s rate of foreclosures doubles, it will still only hit a mark that’s more in line with a historically normalized range.

Ultimately, I’m not concerned that we will see the housing market collapse because of forbearance.

And finally, a few more nuggets to think about.

Even if we ignore concerns over forbearance, there are still some talking about a housing bubble purely because prices have risen so rapidly over the past several years but I, along with my colleagues, just don’t see it. It is true that prices have been rising at above-average rates, but fundamentals are still in place. As I mentioned earlier, borrowers are well qualified, and they have solid equity in their homes.

But, as I have shown you, price growth is set to slow and I think that, because of this slowdown in price increases, there will surely be some homeowners who will think that the market has collapsed just because real estate agents aren’t telling them what they want to hear as far as the value of their home is concerned. What they need to understand is that the market isn’t collapsing, it’s just normalizing.

Sellers have had the upper hand for a very long time now, and many may have forgotten what a normal housing market looks like.

In the early days of the pandemic, it is true that buyers did gravitate toward the suburbs and I know this because 57% of buyers who bought between April and June of this year chose suburban locations and this compares with 50% before the pandemic. But it’s hardly the exodus from cities that some had speculated, and I would also note that there was even a small uptick in urban home purchases in that 3-month period – 12% before the pandemic, and 14% after. Meanwhile, sales actually fell a little in small towns and rural areas in the same timeframe, so I do not anticipate a massive move to the countryside.

Yes! You’ve heard this from me for a long time now. First-time buyers will be a major force again this year – and for years to come – brokers need to figure out how to work with them. Their numbers are only going to grow.

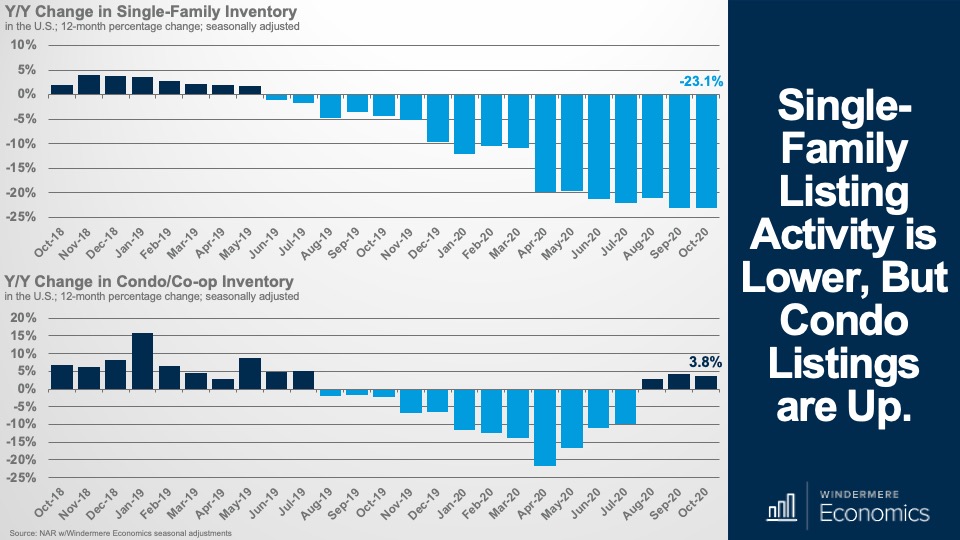

Condos – Hmmm this is interesting. Although I don’t see the condo market collapsing across the country – although I do see significant issues in markets like Manhattan and San Francisco – I am seeing inventory levels rise fairly significantly as opposed to single-family homes for sale whose numbers continues to drop but, for now, there still appears to be demand as sales are higher too. My concern is really in regard to the urban condominium market. You see, for many, the primary reasons to buy a downtown condo are twofold. Convenient access to work, and lifestyle.

Well, some won’t have to live close to work if they are working a majority – or all – of the time from home and secondly, if we lose some of the lifestyle reasons to live in a city – restaurants, retail, and the like, well that takes away some of the rationale behind buying a downtown condo.

There’s no need to panic yet but I will be watching urban condo markets to see if demand continues to keep up with rising supply. If it doesn’t, then we may well see prices softening.

And finally, well done, you made it through 2020!

So, there you have it. My 2021 US housing forecast.

I really hope that you have found this video – and the ones I have published before – of use to you and your clients.

As always, take care out there, and remember to wear your masks.

In all seriousness though, it really has been an honor to speak with you all this year and, hopefully, we will meet again –in person this time – at some point next year.

So, between now and then, stay safe, have a wonderful holiday, and here’s to a great 2021 for all of us.

Bye now.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link