Q1 2022 Oregon and Southwest Washington Real Estate Market Update

The following analysis of select counties of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Oregon added 20,400 new jobs in the first quarter of 2022, leaving the state only 36,000 shy of its pre-pandemic peak. I predicted in the fourth quarter 2021 Gardner Report that a full job recovery would occur by this summer. If the current pace of job growth continues, that forecast will be accurate. The Southwest Washington economy— being far smaller—recovered all the jobs lost to COVID-19 last summer. Employment levels in Klickitat and Skamania counties are still modestly lower than before the pandemic, but solid growth in Clark and Cowlitz counties more than offset the shortfall elsewhere. Oregon’s unemployment rate was 3.8%, which is still lower than the pre-pandemic low of 3.4% but impressive all the same given the growing labor force. The jobless rate in Southwest Washington was 5.1%.

Oregon and Southwest Washington Home Sales

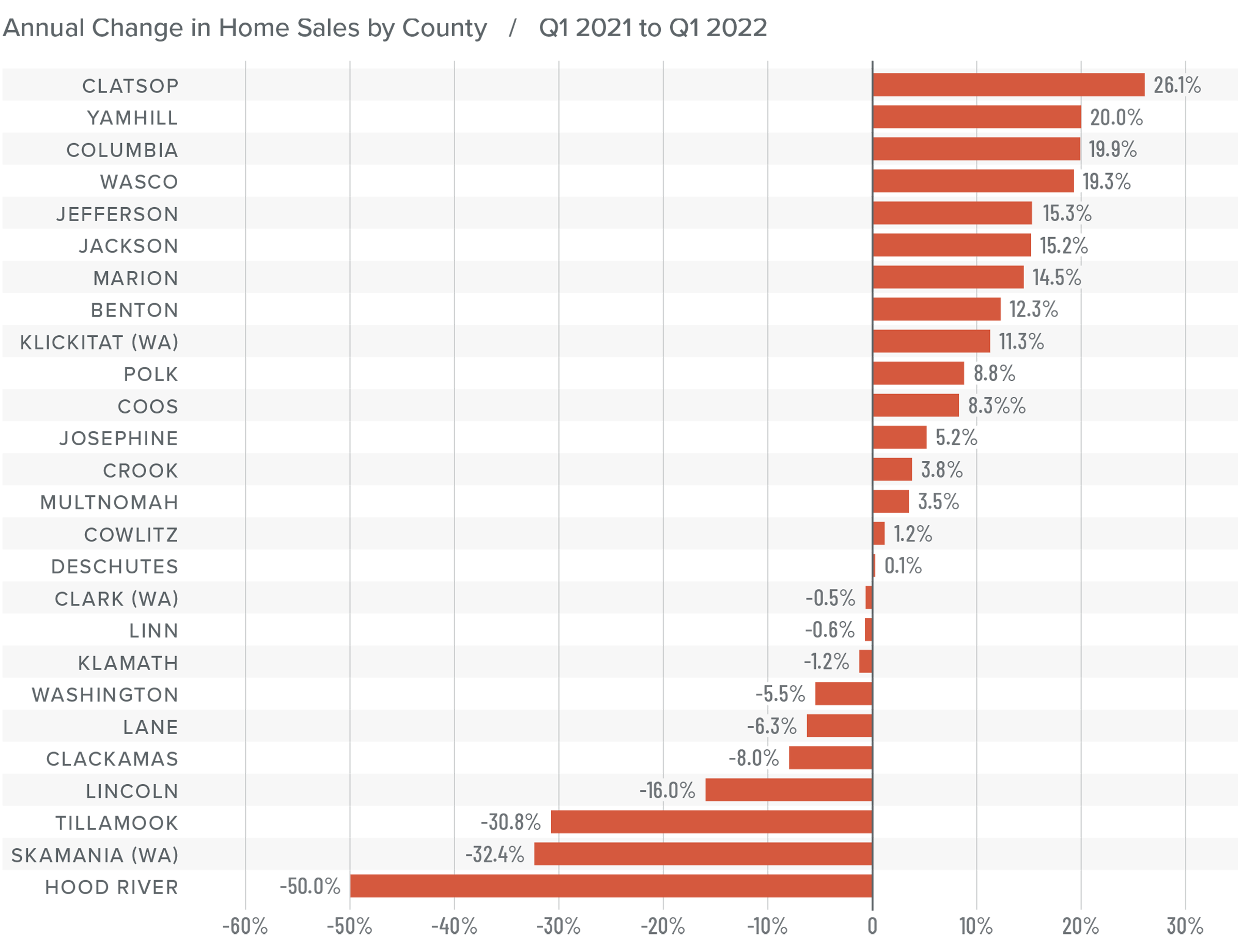

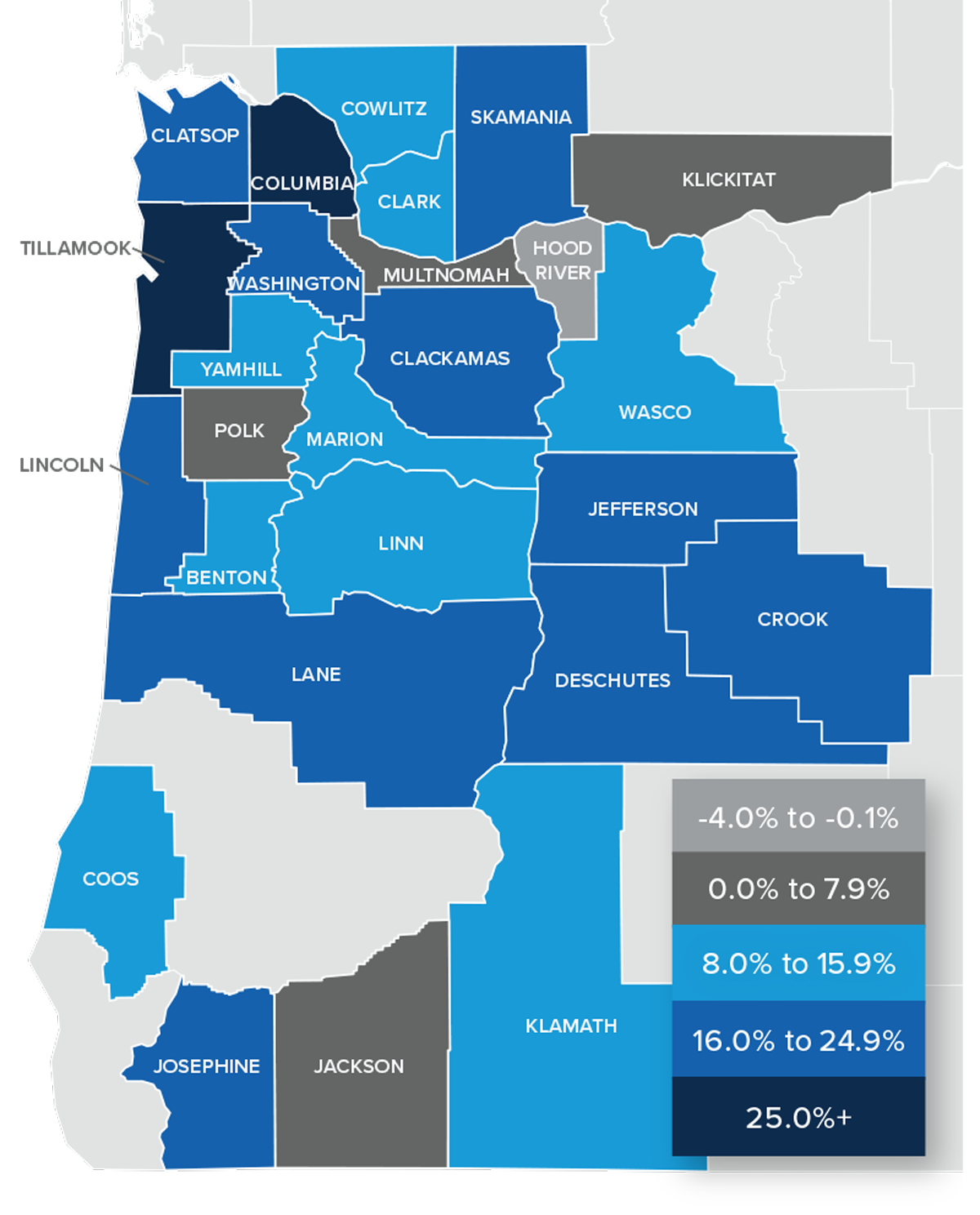

❱ In the first quarter of 2022, 13,837 homes sold, which is an increase of 1.1% compared to the same period a year ago, but 22.5% lower than in the prior quarter.

❱ Compared to a year ago, sales rose in more than half of the markets in this report. The areas where sales fell were mainly small markets that can fluctuate dramatically. That said, sales dropped in the more populous Clackamas and Lane counties, but I attribute this to low inventory levels.

❱ Although the number of transactions dropped significantly from the final quarter of 2021, this was more a function of inventory constraints than slack demand.

❱ Listing activity has not seen its spring bump yet, and it will be interesting to see if this happens sooner than usual given the spike in mortgage rates in the first quarter.

Oregon and Southwest Washington Home Prices

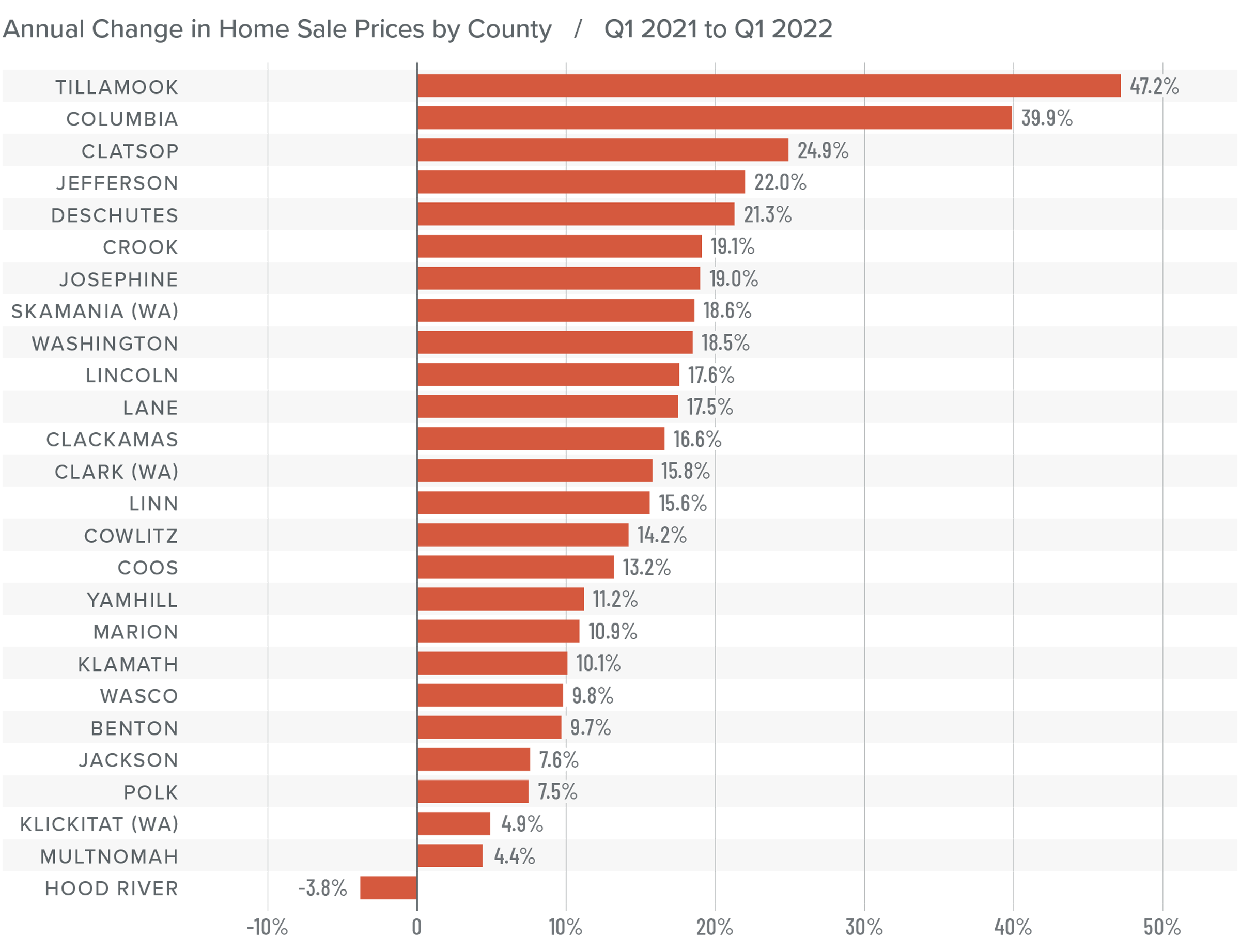

❱ The pace of home-price growth is still tapering, yet prices rose by 13.2% year over year, which is well above the state’s long-term average.

❱ Compared to the final quarter of 2021, average prices rose 2.5%, which is particularly impressive given rising financing costs.

❱ All counties contained in this report except Hood River had higher sale prices than a year ago, with significant increases in Tillamook and Columbia counties. Almost three-quarters of the markets saw prices rise more than 10%.

❱ The spike in mortgage rates has yet to have a significant impact on prices. However, it will be interesting to check back in the second quarter because if there is an impact, this is when we would likely see it.

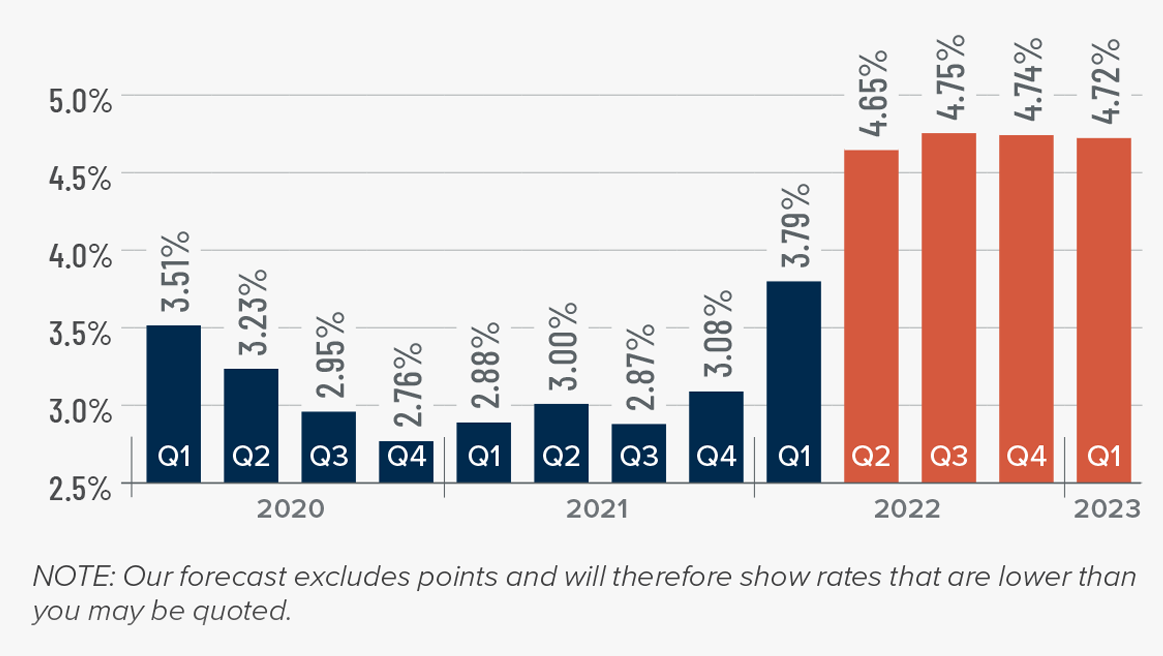

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The speed of the surge in rates is due to the market having quickly priced in the seven-to-eight rate increase that the Fed is expected to implement this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

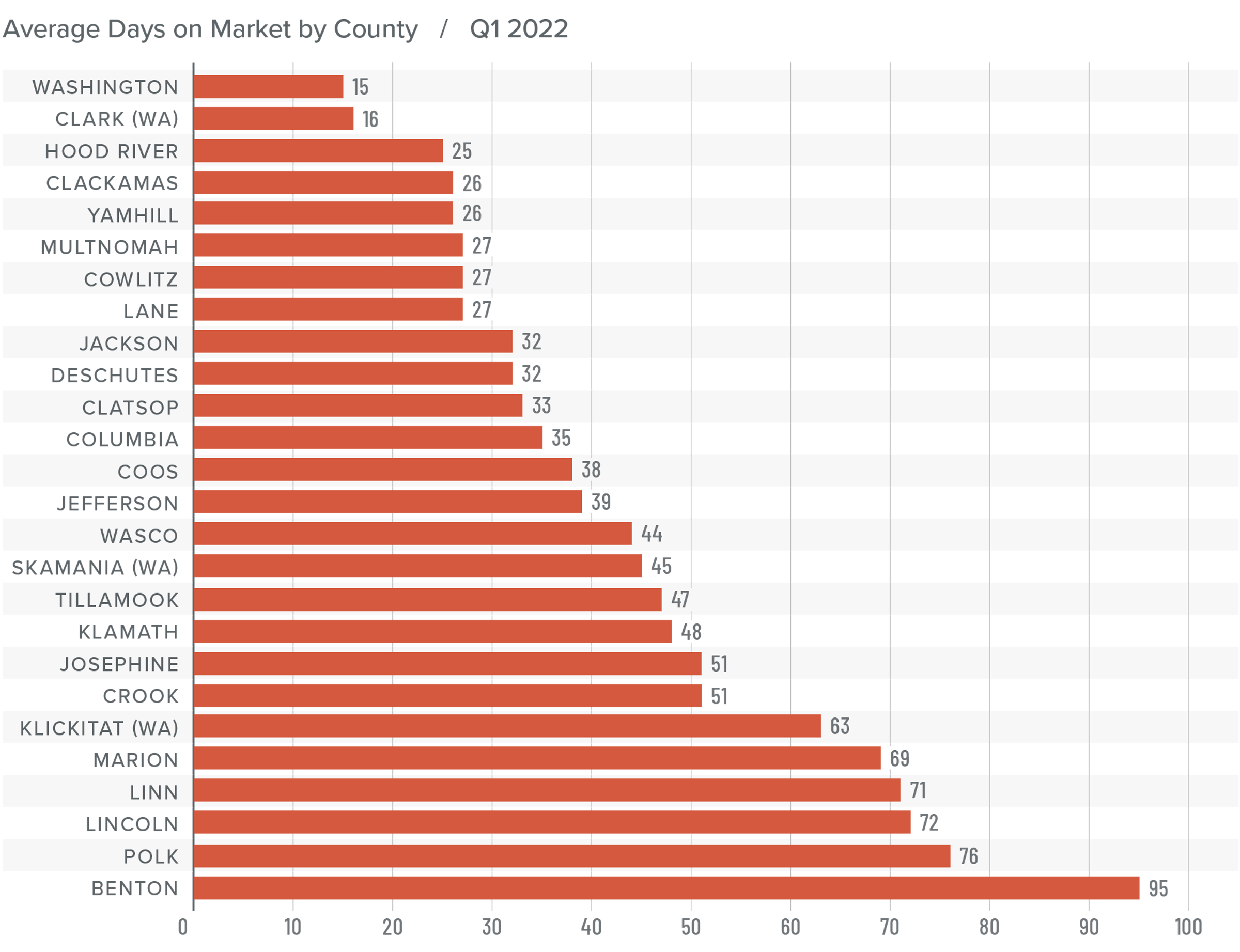

Oregon and Southwest Washington Days on Market

❱ The average number of days it took to sell a home in the region dropped by six compared to a year ago, but it took ten more days for a home to go under contract compared to the fourth quarter of 2021.

❱ The average time it took to sell a home in the first quarter of 2022 was 43 days.

❱ Sixteen of the 26 counties covered in this report saw days on market drop from the first quarter of 2021, but only 5 counties saw average market time drop compared to the fourth quarter of last year. This is likely a function of seasonality, and I expect this to correct itself as we enter the spring buying season.

❱ Homes sold the fastest in Washington County, where it took an average of only 15 days for a home to sell. An additional seven counties saw an average market time of less than a month.

Conclusions

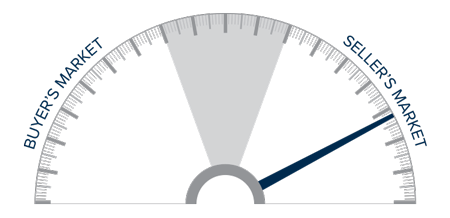

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Despite higher rates and rising prices, buyers continue to be very motivated. As such, I don’t foresee any significant downturn in demand. However, home price growth could start to taper in the coming months, which is not a bad thing.

Given remarkably low inventory levels and solid demand, home sellers still have the upper hand, though we will have to wait and see how prices will be impacted by higher mortgage rates. As such, I am leaving the needle in the same position it was last quarter.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q4 2021 Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Slow and steady is how I would describe Oregon’s job recovery following the massive COVID-19-related job losses that were seen in the spring of 2020. To date, more than 224,000 of the 285,000 jobs that were lost have returned. I’m not forecasting a full job recovery until early next year due to labor shortages and a gap between current job openings and the skills of the labor force. That said, I still expect jobs will be added in reasonable numbers as we move through 2022. Given that Southwest Washington is a far smaller market, I’m not surprised that it has already recovered all the pandemic-induced job losses, and subsequently grown by an additional 4,000 jobs. Even though the pace of the job recovery in Oregon has been relatively muted, the unemployment rate continues to trend lower and now stands at 4.2%. While this is a decent number, it is still well above the pre-pandemic low of 3.4%. The jobless rate in Southwest Washington was a solid 3.5%.

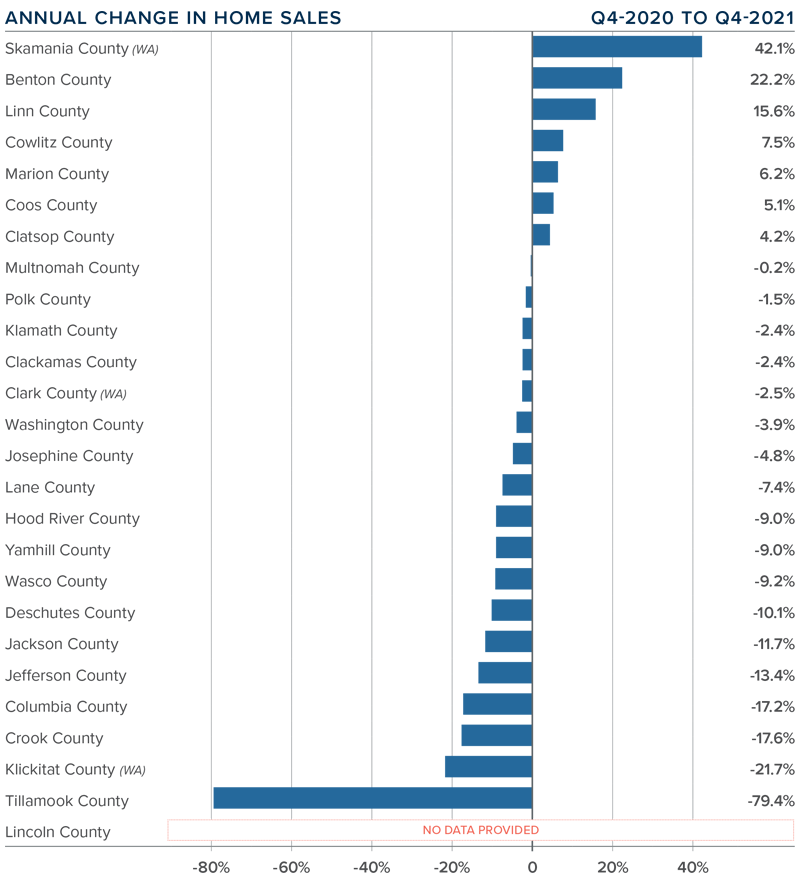

oregon and southwest washington Home Sales

❱ During the final quarter of 2021, 17,862 homes sold, a drop of 3.6% compared to a year ago. This was mainly a result of a lack of homes for sale rather than an indication that the market is softening.

❱ Compared to the third quarter of 2021, all but four counties saw lower sales activity, which is likely due to seasonality changes in the market.

❱ Total sales were down from a year ago; however, several counties did report increases. Although most of these counties sold a relatively low number of homes, it was good to see that the drop was not across the entire region.

❱ Listing activity remains well below normal levels. Some of the drop in listings may be due to the rise of the Omicron variant of COVID-19.

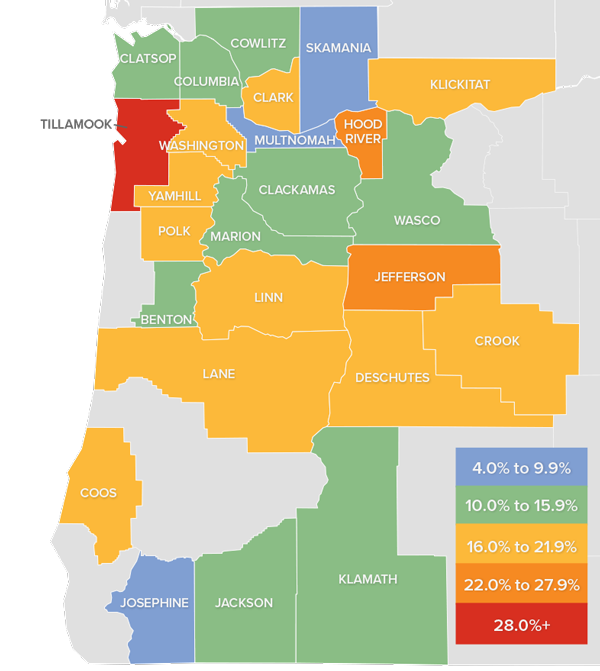

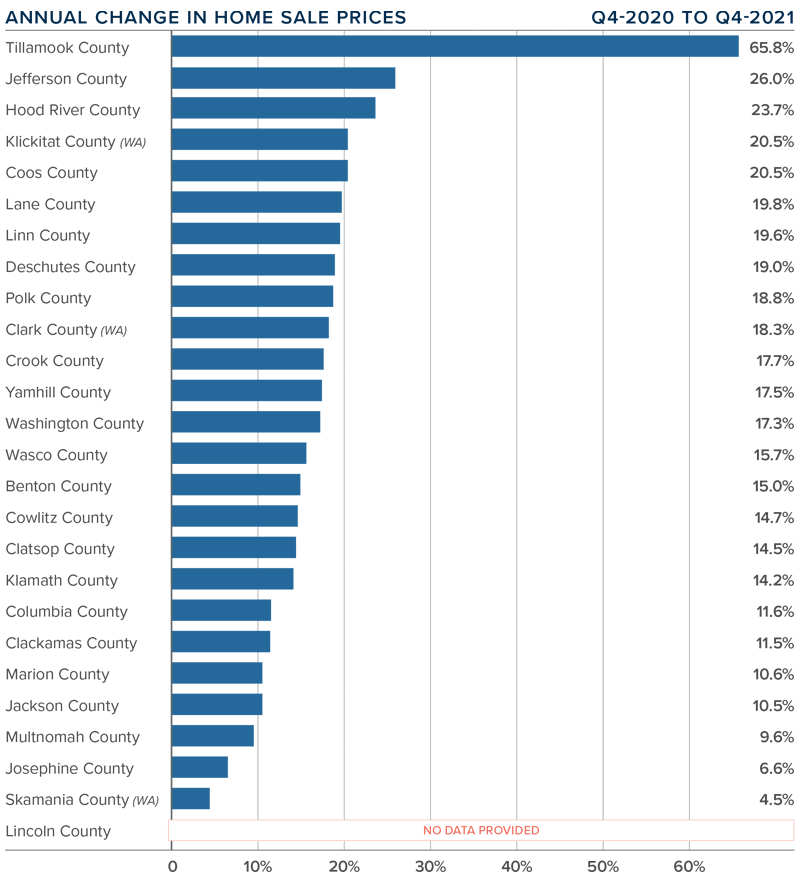

oregon and southwest washington Home Prices

❱ Price growth continued the downward trend that started last summer but prices still rose by 14.6%, which is well above the long-term average.

❱ Compared to the third quarter of last year, 11 counties saw lower sale prices, which is likely due to seasonality changes in the market. The remaining 15 counties experienced price growth.

❱ All counties contained in this report had higher sale prices than a year ago, with very significant increases in Tillamook County. All but three counties showed double-digit appreciation.

❱ Mortgage rates in the quarter rose from 2.87% to 3.18%, which may also have contributed to the slowdown in the rapid pace of appreciation in the region.

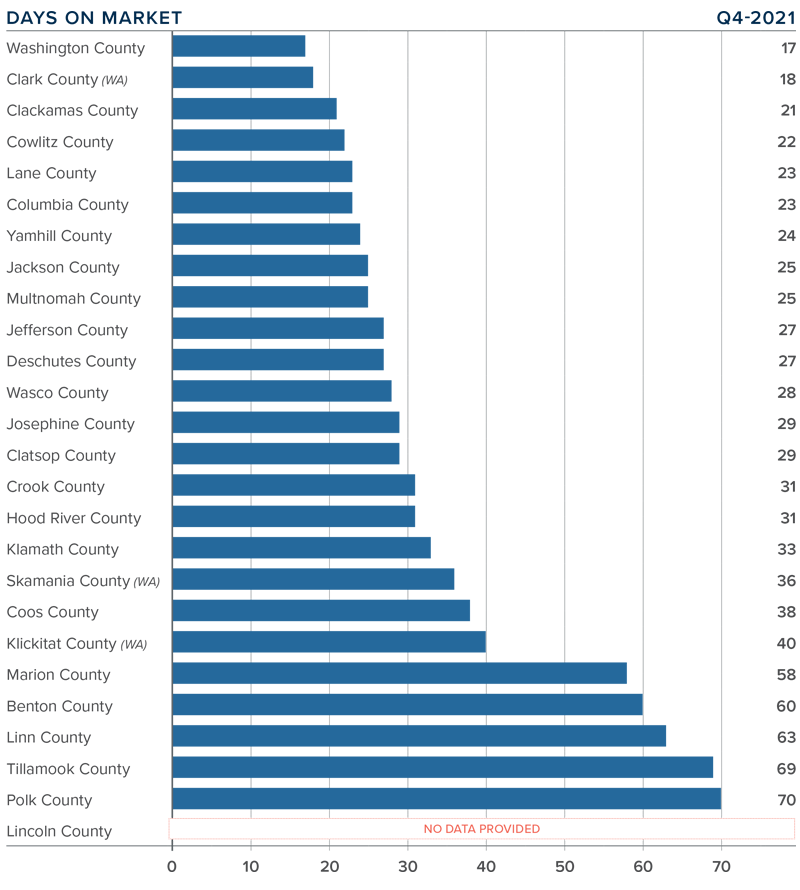

Days on Market

❱ The average number of days it took to sell a home in the region dropped 13 days compared to the final quarter of 2020. It took 2 more days for a home to sell compared to the third quarter of the year.

❱ The average time it took to sell a home in the final quarter of 2021 was 33 days.

❱ All counties except one (Polk) saw the length of time it took to sell a home drop compared to a year ago. Market time in all but four counties increased compared to the third quarter of 2021.

❱ Homes again sold the fastest in Washington County, where it took an average of only 17 days for a home to go under contract. An additional 13 counties saw the average market time drop to below a month.

Conclusions

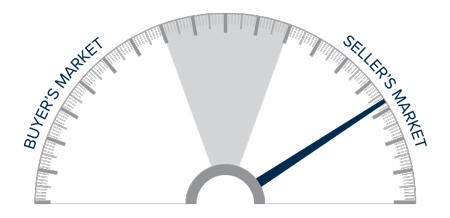

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although Oregon’s job recovery has not been as robust as many would like, its impact on the housing market really has been minimal as demand remains strong and buyers continue to take advantage of historically low mortgage rates.

Strong demand—in concert with low levels of supply and favorable financing rates—has caused prices to rise at well-above average rates. In the coming year, I believe the pace of growth will slow in the face of rising mortgage rates, which I have forecasted will reach 3.7% by fourth quarter. In addition to this, many markets are experiencing affordability constraints, which could also slow the pace of price increases.

As we move into 2022, I still believe prices will continue to rise, but the significant increases we’ve experienced over the past two year are likely behind us. While home sellers still have the upper hand, I am moving the needle a little more toward the center. The spring buying season will be a good test for buyers and sellers alike and should give me more clarity as to what the year will hold.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q3 2021 Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Following a significant slowdown in the pace of the job recovery in Oregon this summer, employment growth was picking up until rising COVID infections started to impact the country, which led to lower hiring. Of the more than 285,000 Oregon-based jobs that were shed at the onset of the pandemic, 204,700 have returned. Oregon is still down by almost 81,000 positions. The Southwest Washington area also saw a similar slowdown, but it is a far smaller market and, therefore, less impacted. In fact, this area has now recovered all but 600 of the more than 22,000 jobs that were lost. Oregon’s unemployment rate has fallen below 5% but remains 1.5% higher than before the pandemic hit. Notably, the jobless rate in Southwest Washington currently stands at 4.7%, only marginally above the pre-pandemic low of 4.3%.

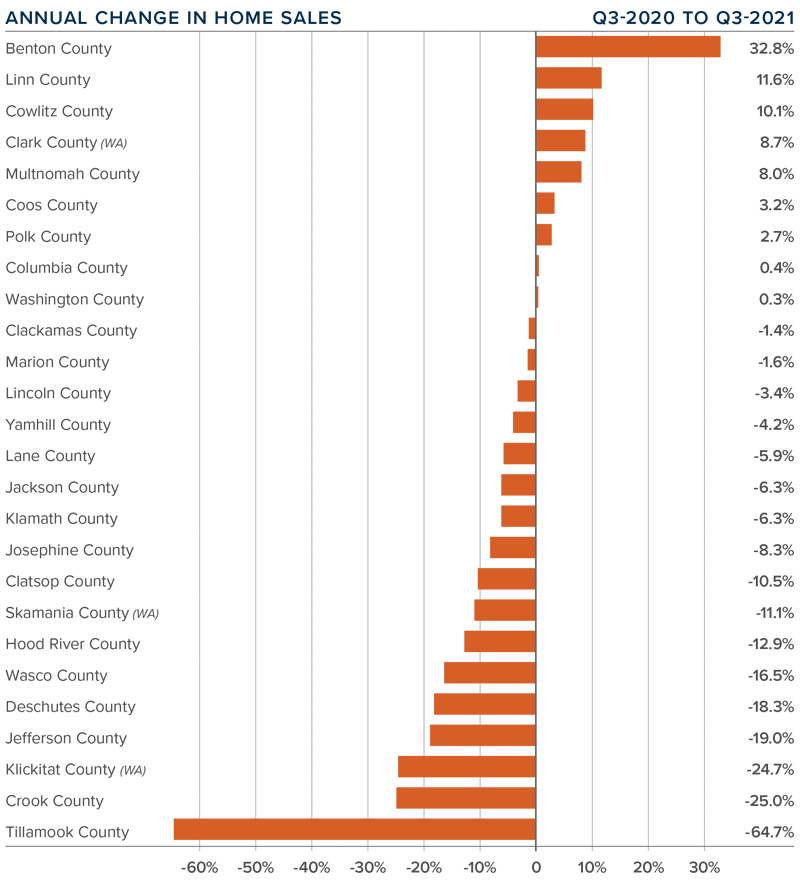

oregon and southwest washington Home Sales

❱ In the third quarter of the year, 21,119 sales occurred, a drop of 1.2% compared to a year ago but 7.4% higher than in the second quarter of this year.

❱ Sales were higher in all but five counties compared the second quarter, but the drop in sales was very small in all of these markets.

❱ Sales activity was mixed across the region, with sales rising in 9 counties and dropping in 17. Benton, Linn, and Cowlitz counties saw significant increases. The greatest drop in sales was in Tillamook County, but small markets often exhibit significant swings, so this doesn’t concern me at the moment.

❱ Although demand has softened, low inventory levels have slowed the market modestly. I am hopeful the market will see an uptick in the number of listings, but I do not expect there will be enough to meet demand until next spring.

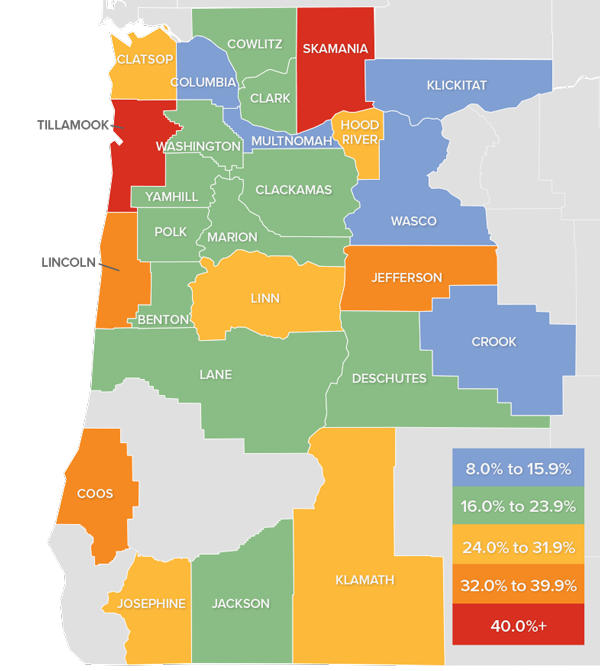

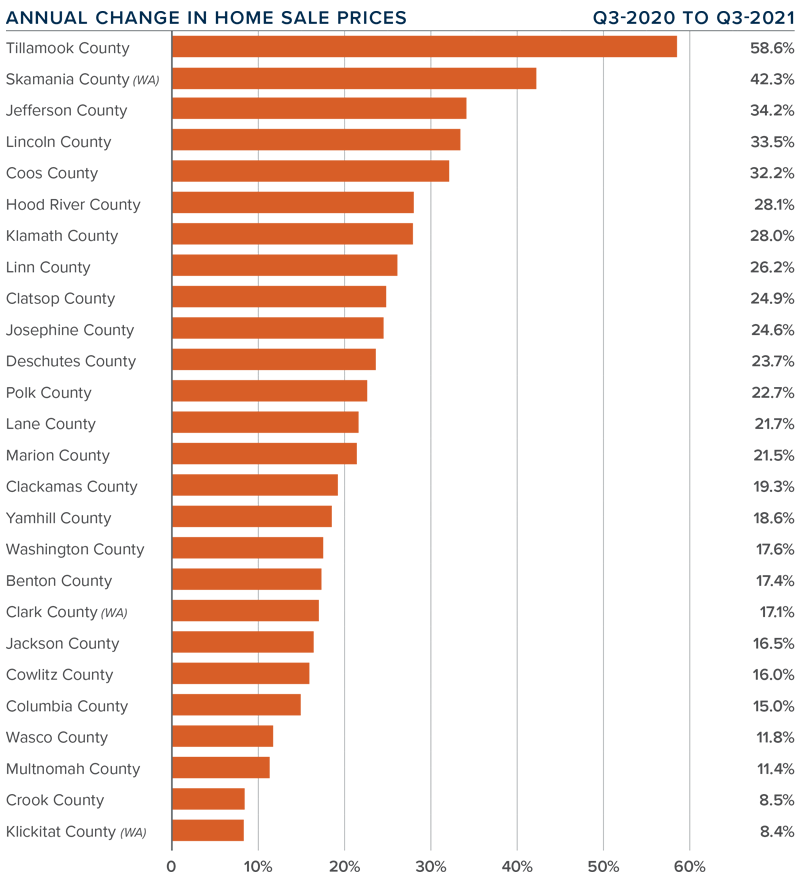

oregon and southwest washington Home Prices

❱ Home price growth slowed very modestly from the pace of the second quarter but was still 18.2% higher than in the third quarter of 2020. Prices were also 2.5% higher than in the second quarter of this year.

❱ Four counties—Crook, Hood River, Multnomah, and Tillamook—saw home prices drop, but the change was minimal and not a cause for concern.

❱ All counties contained in this report had higher home prices than a year ago, with very significant increases in Tillamook and Skamania counties. All but two counties saw double-digit appreciation.

❱ Home prices have been running very hot and must start to cool at some point. While I am forecasting mortgage rates will increase in 2022, it will not be enough to impact prices significantly. However, diminishing housing affordability in many markets will start to slow appreciation, which should come as a relief to home buyers.

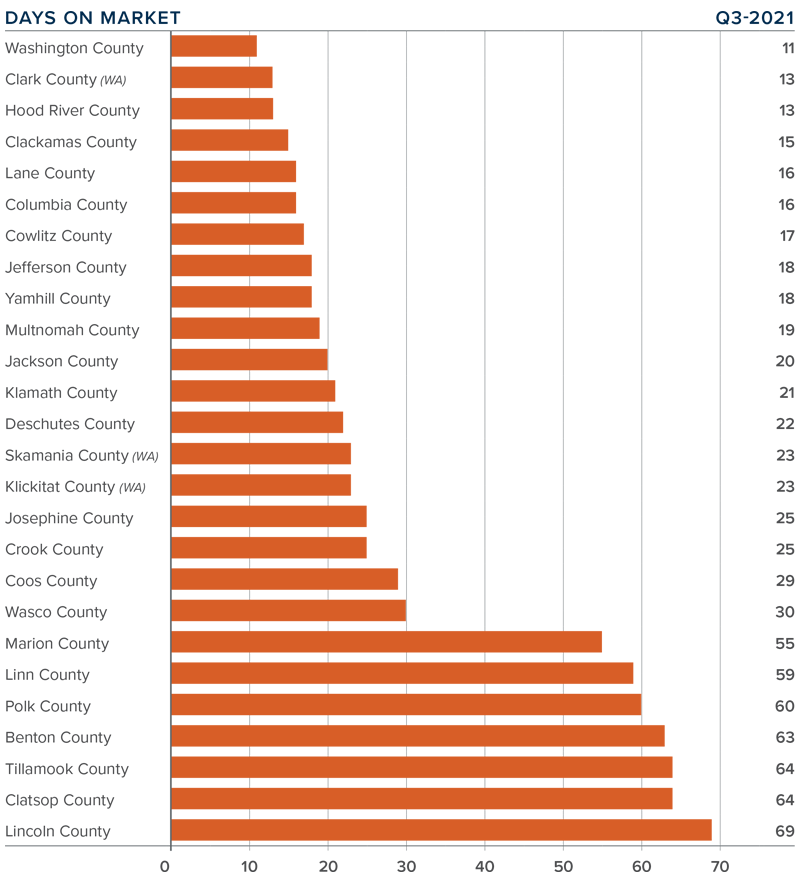

Days on Market

❱ The average number of days it took to sell a home in the region dropped 29 days compared to the third quarter of 2020. It took 5 fewer days to sell a home compared to the second quarter of this year.

❱ The average time it took to sell a home in the third quarter of 2021 was 31 days.

❱ All counties saw the length of time it took to sell a home drop compared to a year ago, but half of the counties contained in this report saw market time increase compared to the second quarter of 2021.

❱ Homes again sold the fastest in Washington County, where it took an average of only 11 days for a home to sell. An additional 17 counties saw average market time drop to below a month.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The region’s housing market is sending mixed messages, with the pace of sales, price growth, and days on market starting to slow in some areas. Overall, the data is still very positive, but buyers continue to be hobbled by low levels of inventory and many simply aren’t prepared to pay what is being asked. This is evident given the change in list prices, which have softened in many markets.

While the housing market remains staunchly in favor of sellers, I think we are slowly reaching an apex and may start to move toward a more balanced market. However, I don’t see that happening until next year, and it’s not guaranteed. Home sellers still have the upper hand but, given all the factors described in this report, I am leaving the needle in the same spot as last quarter.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q2 2021 Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The recovery of the jobs lost due to the pandemic continued in the second quarter, but at a significantly slower pace than in the first quarter. Of the more than 285,000 Oregon-based jobs shed during the pandemic, 181,800 have now returned. Though this is positive, state employment is still down more than 100,000 jobs. As I predicted last quarter, it is now clear that Oregon’s efforts to pull back on reopening due to rising COVID-19 cases slowed the velocity of the job recovery, but there was growth in the second quarter.

In Southwest Washington, 16,980 of the more than 22,000 jobs that were lost have returned, and they are returning more quickly than in Oregon.

More hiring has allowed the unemployment rate in Oregon to drop from 6% at the end of the first quarter to 5.6% in June. The jobless rate in Southwest Washington currently stands at 6%, its lowest level since the pandemic took hold.

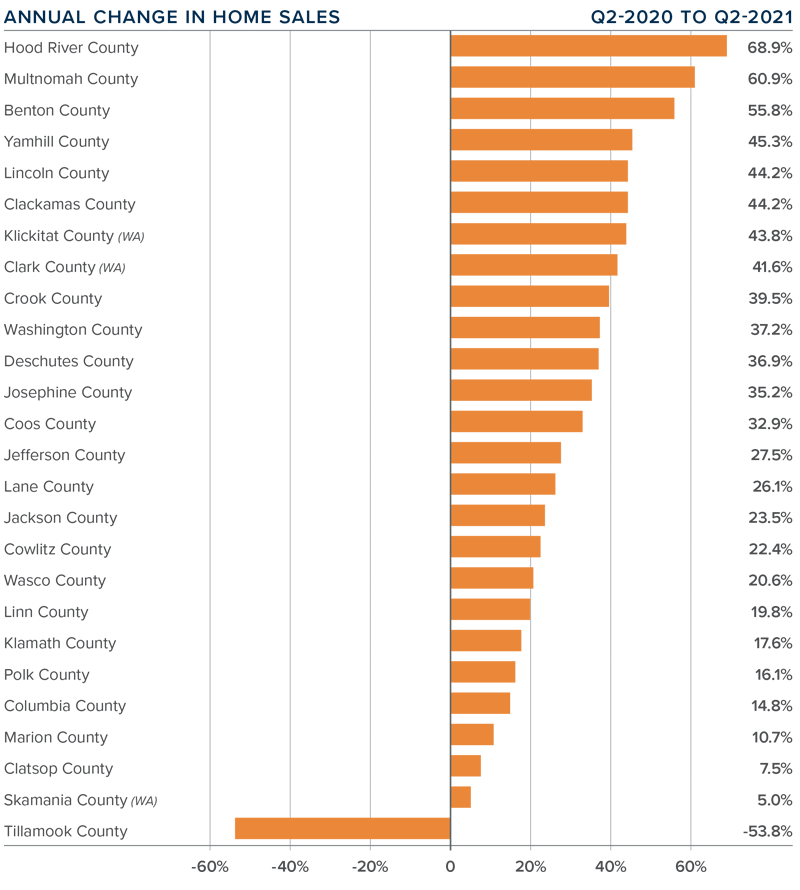

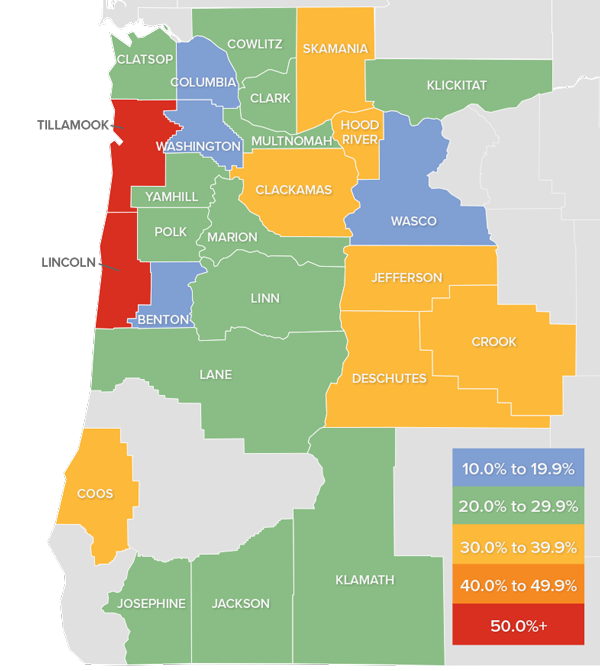

oregon and southwest washington Home Sales

❱ In the second quarter of the year, 19,614 homes sold, an increase of 37% from the second quarter of 2020. Although an increase was certainly expected given where we were last year, I was also very pleased to see a 59% increase in sales from the first-quarter figure.

❱ The largest increase in sales from the first quarter was in the greater Portland metro area, but all counties contained in this report experienced more transactions.

❱ Sales rose in every county other than Tillamook compared to a year ago, but this is a very small market that regularly experiences extreme swings in the number of sales. In markets where sales rose, all but two of them saw double-digit gains.

❱ Demand remains strong but supply is still lagging. More buyers are getting off the fence after mortgage rates rose in the first quarter. Although rates have pulled back somewhat, the specter of them rising has generated a lot of competition for the homes that are available.

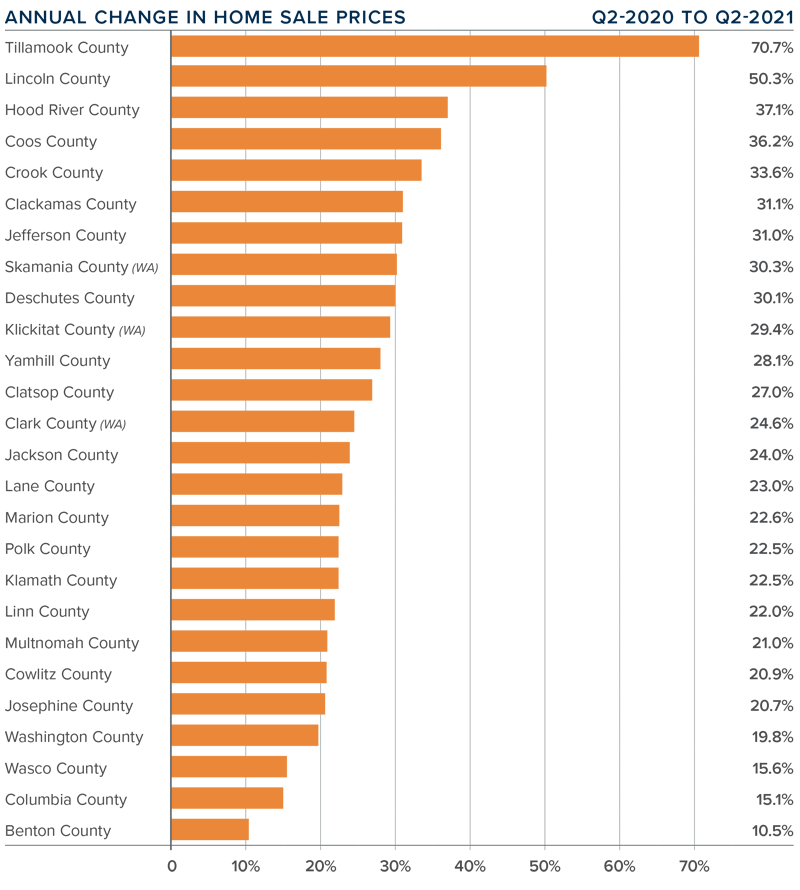

oregon and southwest washington Home Prices

❱ The average home price in the region continues to soar. Prices were up 26.1% year over year to $532,397 and were 5.8% higher than in the first quarter of the year.

❱ Relative to a year ago, Tillamook County again led the market with the strongest annual price growth, but it is a very small market prone to significant swings. The most expensive market was Hood River County, where the average sale price was $728,700.

❱ All counties contained in this report saw prices rise more than 10%. Prices in Jackson, Klickitat, and Wasco counties were lower than in the first quarter, but I do not see this as being pervasive and I expect them to pick back up as we move through the rest of the year.

❱ Prices continue to rise at an astonishing pace, but many areas are hitting an affordability ceiling. This, in concert with modest increases in mortgage rates, is likely to temper price growth—but just not yet. This year, prices will continue to increase at well above the long-term average.

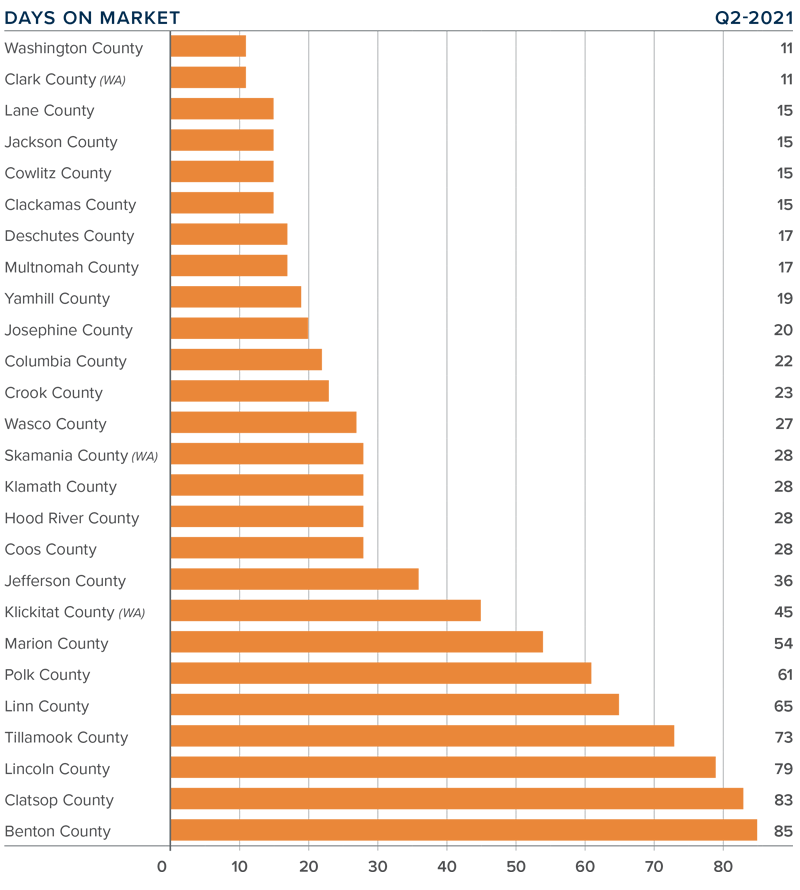

Days on Market

❱ The average number of days it took to sell a home in the region dropped 30 days compared to the second quarter of 2020. It took 16 fewer days to sell a home compared to the first quarter of this year.

❱ The average time it took to sell a home in the second quarter of 2021 was 35 days.

❱ With the exception of Benton County, which was up nine days, every county saw the length of time it took to sell a home drop compared to a year ago. Benton was also the only county that saw market time rise compared to the first quarter of 2021.

❱ Homes again sold the fastest in Washington County, where it took only 11 days for the average home to go under contract. An additional 16 counties saw the average market time drop to below a month.

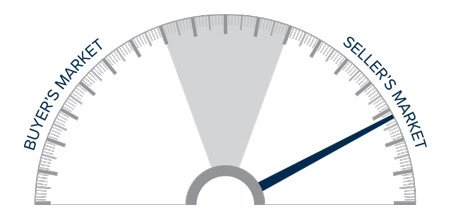

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home sales continue to grow, and robust demand is causing prices to rise significantly, resulting in a market that strongly favors sellers. The additional supply of homes that I’m predicting for 2021, combined with modestly rising interest rates, may start to slow the momentum in price growth, but for now I have moved the needle further in favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q1 2021 Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The region’s job recovery, which stalled in the fall of 2020, has picked up again and I am hopeful this will continue.

Of the more than 285,000 Oregon jobs that were shed at the onset of the pandemic, 153,000 have now returned. Although employment levels are still 132,000 below the prior peak in February of 2020, the trend is again heading in the right direction. That said, rising COVID-19 infections have led the state to pull back on reopening and it is uncertain how this might impact the job market this spring. In Southwest Washington, 10,400 of the 22,000 jobs that were lost have returned and the trajectory appears to be similar to Oregon’s. With more jobs returning, the unemployment rate in Oregon continues to trend lower and now stands at 6% — a significant improvement from the 14.9% rate last April. The jobless rate in Southwest Washington currently stands at 6.7%, matching the level at the end of 2020.

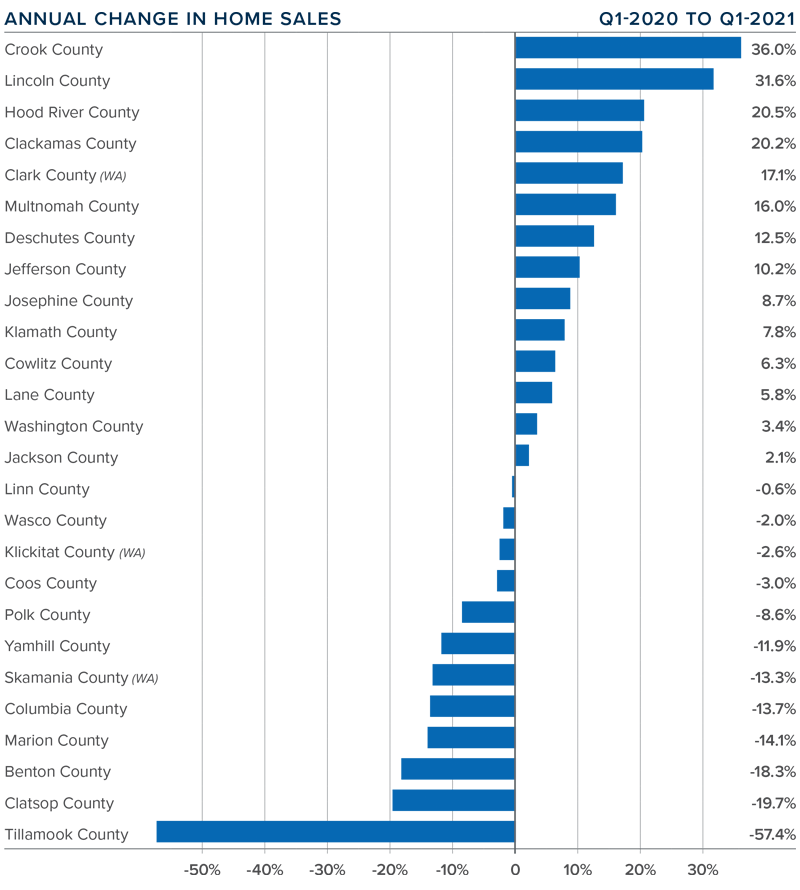

oregon and southwest washington Home Sales

❱ In the first quarter of 2021 sales rose 7.1% compared to the same period a year ago, with a total of 12,342 homes sold.

❱ Sales rose in 14 counties but dropped in 12. As I mentioned in the last edition of the Gardner Report, most of the counties that saw sales drop were small and these markets can see significant swings. It appears as if this trend continues as smaller markets again saw lower sales.

❱ Following the trend seen last fall, sales were lower than fourth quarter. This can be attributed to a very significant lack of homes for sale rather than a slowdown in demand.

❱ Housing demand remains strong and is only being impacted by a lack of supply. Additionally, buyers are even more active today given the recent rise in mortgage rates. I expect an increase in inventory and sales in the coming year as homeowners who are able to continue working remotely sell and move to more affordable markets.

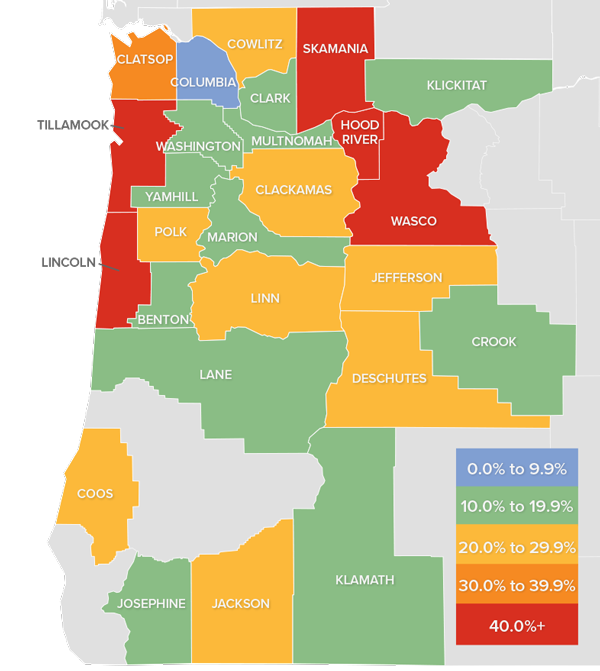

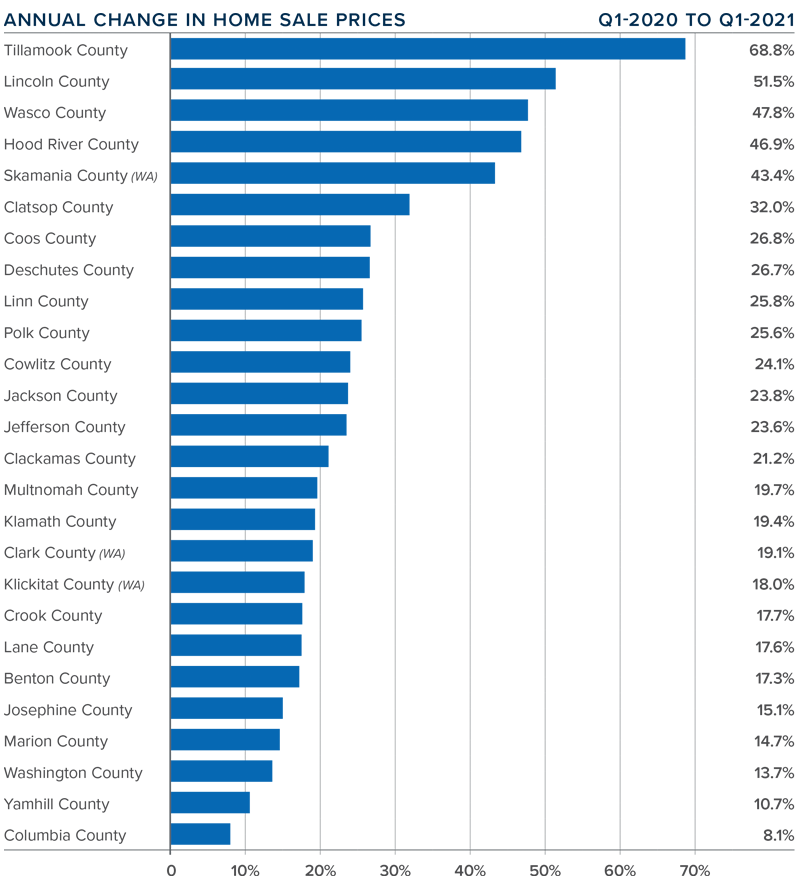

oregon and southwest washington Home Prices

❱ Home prices in the region continue to skyrocket. The average sale price was up 21.7% year over year to $503,089. Prices were 5.7% higher than in the fourth quarter of 2020.

❱ Tillamook County led the market with the strongest annual price growth, but this is a very small market prone to significant swings. The most expensive market was Hood River County, where the average sale price was $694,333.

❱ Prices were higher in all counties contained in this report, with double-digit appreciation in all but one.

❱ Home prices continue to rise at a very significant pace, but I anticipate some headwinds—mainly in the form of higher mortgage rates—that may cool the market somewhat. That said, the pace of appreciation will remain above its longterm average throughout 2021.

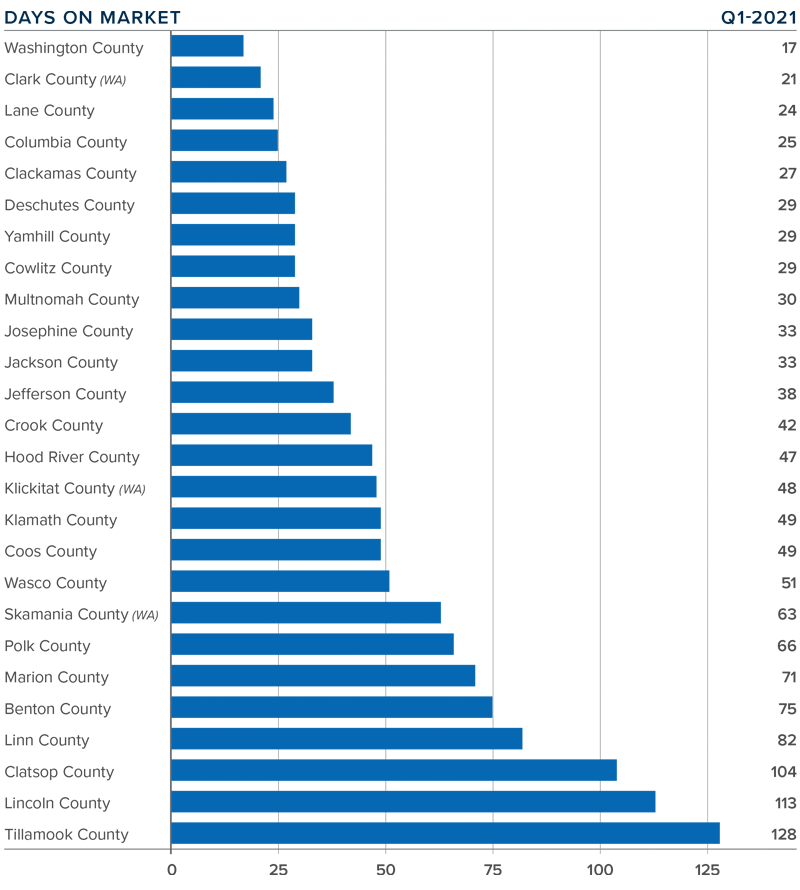

Days on Market

❱ The average number of days it took to sell a home in the region dropped 30 days compared to the first quarter of 2020. It took 6 fewer days to sell a home compared to the final quarter of last year.

❱ The average time it took to sell a home in the first quarter of 2021 was 51 days.

❱ All but one county (Tillamook, +1 day) saw the length of time it took to sell a home drop compared to a year ago.

❱ Homes again sold fastest in Washington County, where it took 17 days to sell. An additional eight counties saw the average market time drop to below a month.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home sales continue to grow, and robust demand is causing prices to rise significantly, resulting in a market that strongly favors sellers. The additional supply of homes that I’m predicting for 2021, combined with modestly rising interest rates, may start to slow the momentum in price growth, but for now I have moved the needle further in favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Q4 2020 Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

Although it is encouraging to see jobs return to the region following the massive contraction caused by COVID-19, it is clear the recovery is losing steam. Oregon lost 285,200 jobs when the economy essentially closed last spring, but the state has now recovered 131,700 of them. This is certainly good news, but it must be acknowledged that statewide employment is still 153,500 jobs short of the levels we saw in February. In Southwest Washington, 11,000 of the jobs lost have returned but, like Oregon, the pace of recovery has stalled.

The unemployment rate in Oregon is improving as jobs return, with the rate dropping from a peak of 14.9% in April to 6% at the end of the year. The unemployment rate in Southwest Washington dropped from 14.6% to 7%. The recovery has slowed, which is not surprising given the increase in new COVID-19 infections. I still anticipate that more jobs will be added as we move through 2021, but I am expecting that the pace of growth won’t improve significantly until vaccines become readily available.

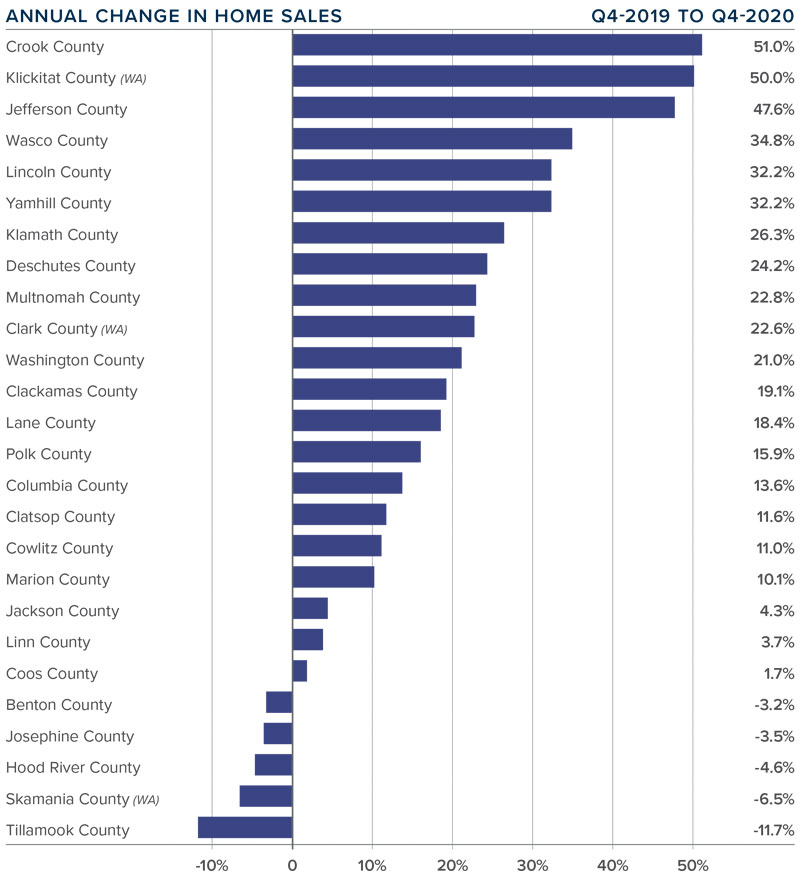

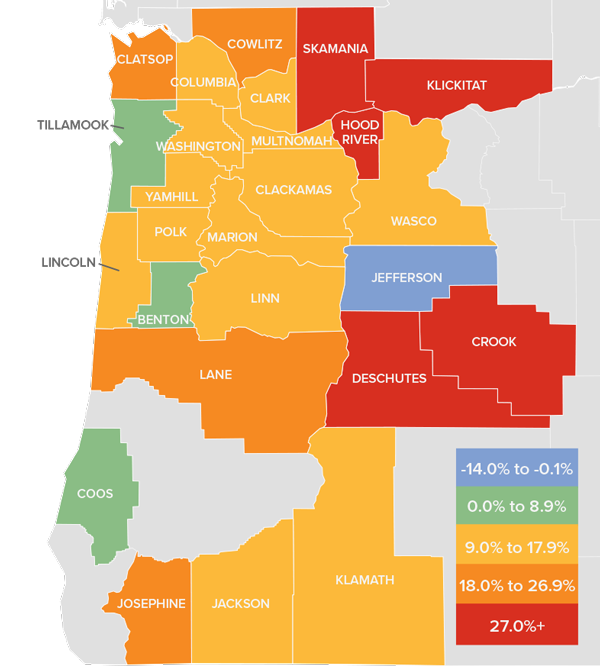

oregon and southwest washington Home Sales

❱ The final quarter of 2020 was a good one for home sales. Total transactions were up 18.1% compared to the same period a year ago, with a total of 18,216 sales closing.

❱ Sales rose in a majority of counties, but five counties saw modest declines. However, these are small markets that can be subject to significant swings.

❱ Sales were lower than in the third quarter, but this can be attributed to seasonality and a significant lack of inventory.

❱ The housing market continues to impress, and I expect we will see more transactions as we move through 2021. Demand will come from owners who no longer need to live close to their offices as they move away from the more expensive counties to areas where they see more value.

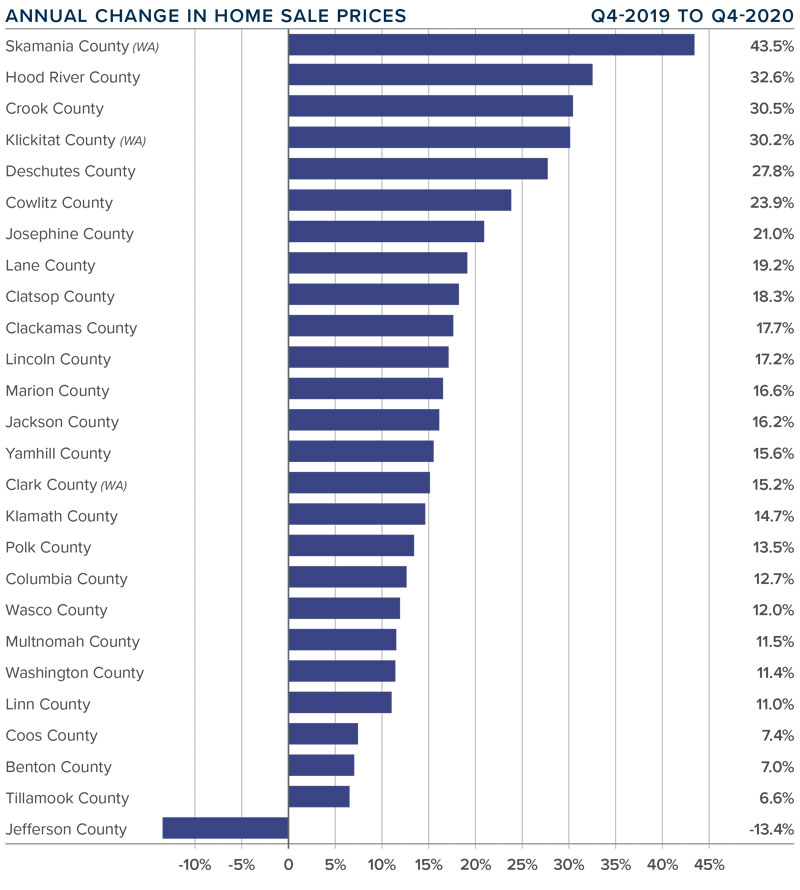

oregon and southwest washington Home Prices

❱ The average home price in the region rose a very significant 16.5% year-over-year to $476,051. Home prices were 3.4% higher than in the third quarter of 2020.

❱ Skamania County led the market with the strongest annual price growth, but this is a very small market prone to significant swings. Prices were lower in Jefferson County but, again, this is a very small market.

❱ All but one of the counties contained in this report experienced price growth compared to the final quarter of 2019. All but four counties experienced double-digit appreciation.

❱ Home prices are rising at a very significant pace, but mortgage rates are unlikely to drop much further and income growth remains muted. As such, I expect to see price growth start to slow this year.

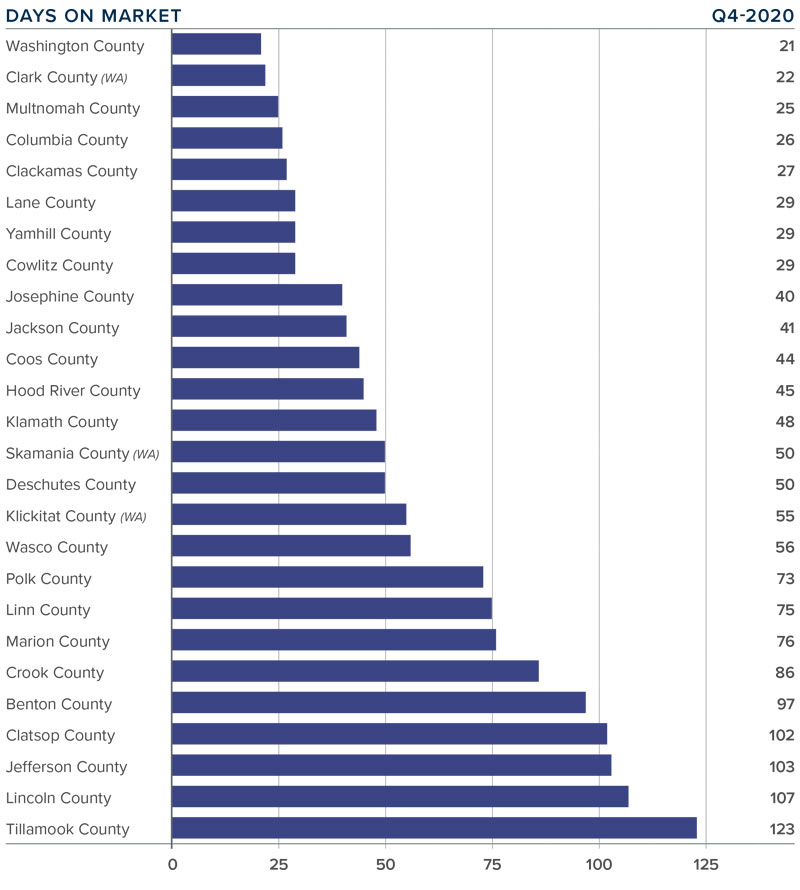

Days on Market

❱ The average number of days it took to sell a home in the region dropped 19 days compared to the fourth quarter of 2019. It took 4 fewer days to sell a home compared to the third quarter of 2020.

❱ The average time it took to sell a home in the fourth quarter was 57 days.

❱ All but one county (Benton, +7 days) saw the length of time it took to sell a home drop compared to a year ago.

❱ Homes again sold fastest in Washington County, where it took only 21 days to sell.

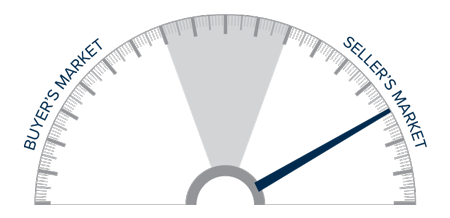

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Sales and prices are significantly higher, and demand for housing is very much in place. This favors home sellers who are still in control of the market. I do expect to see listing activity rise this year, which, in concert with modestly rising interest rates, will likely start to take some of the steam out of the market. However, any moderation in the market has yet to appear.

Given these factors, I have moved the needle further in the favor of sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Oregon and Southwest Washington Real Estate Market Update

The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link