Developers are not building enough single-family homes to keep up with demand. The reason why? Cost. Windermere's Chief Economist, Matthew Gardner explains why new construction is so cost prohibitive and how to shift the trend.

Developers are not building enough single-family homes to keep up with demand. The reason why? Cost. Windermere's Chief Economist, Matthew Gardner explains why new construction is so cost prohibitive and how to shift the trend.

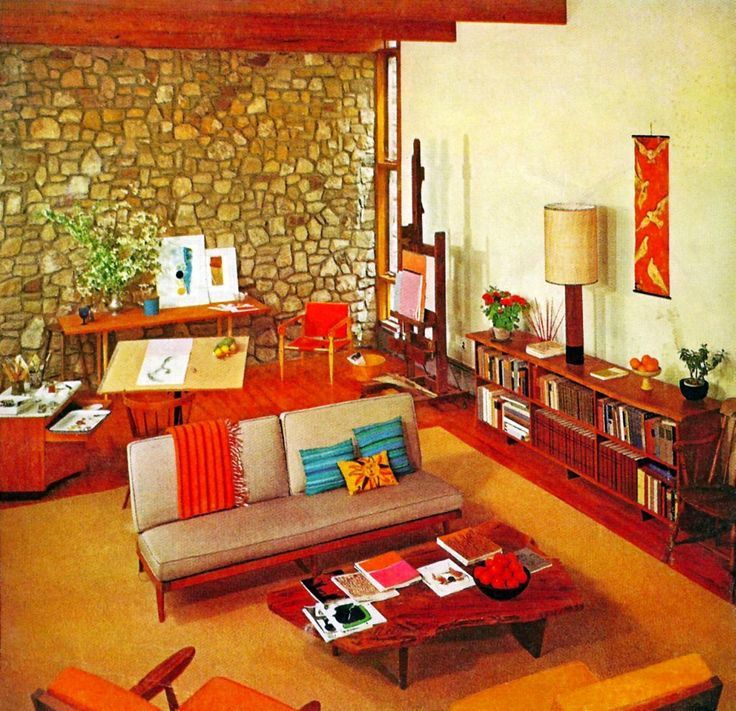

As we celebrate our 45th anniversary here at Windermere, we’re feeling a bit nostalgic. The fundamentals of helping our clients buy and sell homes haven’t changed much over the past 45 years, but the way we decorate our homes sure has. Let’s take a trip down memory lane and explore interior design trends from the past four decades—the good (farmhouse sinks), the bad (macramé owls), and the ill-advised (carpeted bathrooms!).

1970s

Inspired by the hippie movement, interior design in the 1970s centered around bringing the outdoors inside. Wood paneling could be found in bedrooms and basements alike, and wood accents adorned appliances in the kitchen.

Earth tones dominated throughout the house. If your refrigerator wasn’t avocado or burnt sienna and your shag carpet wasn’t harvest gold, you were not keeping up with the times.

1980s

In the 1980s, we wanted to make homes as cozy as possible, which for a lot of folks meant chintz, Laura Ashley–inspired florals, and tons of pastels.

The “country” look gained huge popularity during this decade as well. Even high-rise city apartments were filled with objects that seemed more at home on a ranch in Texas, including bleached cow skulls and weathered-wood dining tables and chairs.

1990s

Perhaps as a reaction to the excess of the decade before, the 1990s saw a rise in Japanese-inspired minimalism. Sparsely furnished rooms with rock gardens, clean lines, and simple colors were all the rage.

On the opposite end of that spectrum was the shabby chic craze. Distressed furniture, soft colors, and oversized textiles combined to create this look.

Texturized walls were also a big hit. Wall paper and paint brushes were out, and sponges became the way to get the chicest look for your home.

2000s

It’s hard to believe, but we’re nearly a decade out from the early aughts. And that perspective makes it easier to spot trends that felt of-the-moment only a few years ago but are waning in popularity today. One example is Tuscan-style kitchens. It seemed every new home—especially homes on the upper end of the market—included a kitchen with stone tiles, granite countertops, hanging vines, and beige and tan tones.

Another popular item from the early 2000s that is now facing a bit of a backlash is mason jars. Once a staple of homes looking to incorporate a rustic feel, mason jars are now so common in decorating both homes and restaurants that they no longer feel special or nostalgic.

Today

Trends are always evolving, but if you’re looking for some cutting-edge interior design ideas for 2018, here are a couple to consider.

Embrace super saturated colors, especially warmer tones like yellow and red. These bold hues no longer need to be saved for accent pieces like pillows or lamps. Larger pieces of furniture and entire walls make a bigger splash.

Incorporate geometric patterns. There’s really no wrong way to get on board with this trend. Whether your couch features large circles, you add patterned backsplash in your kitchen, or you cover your ceiling with octagonal wallpaper, geometric shapes will help your home feel fresh.

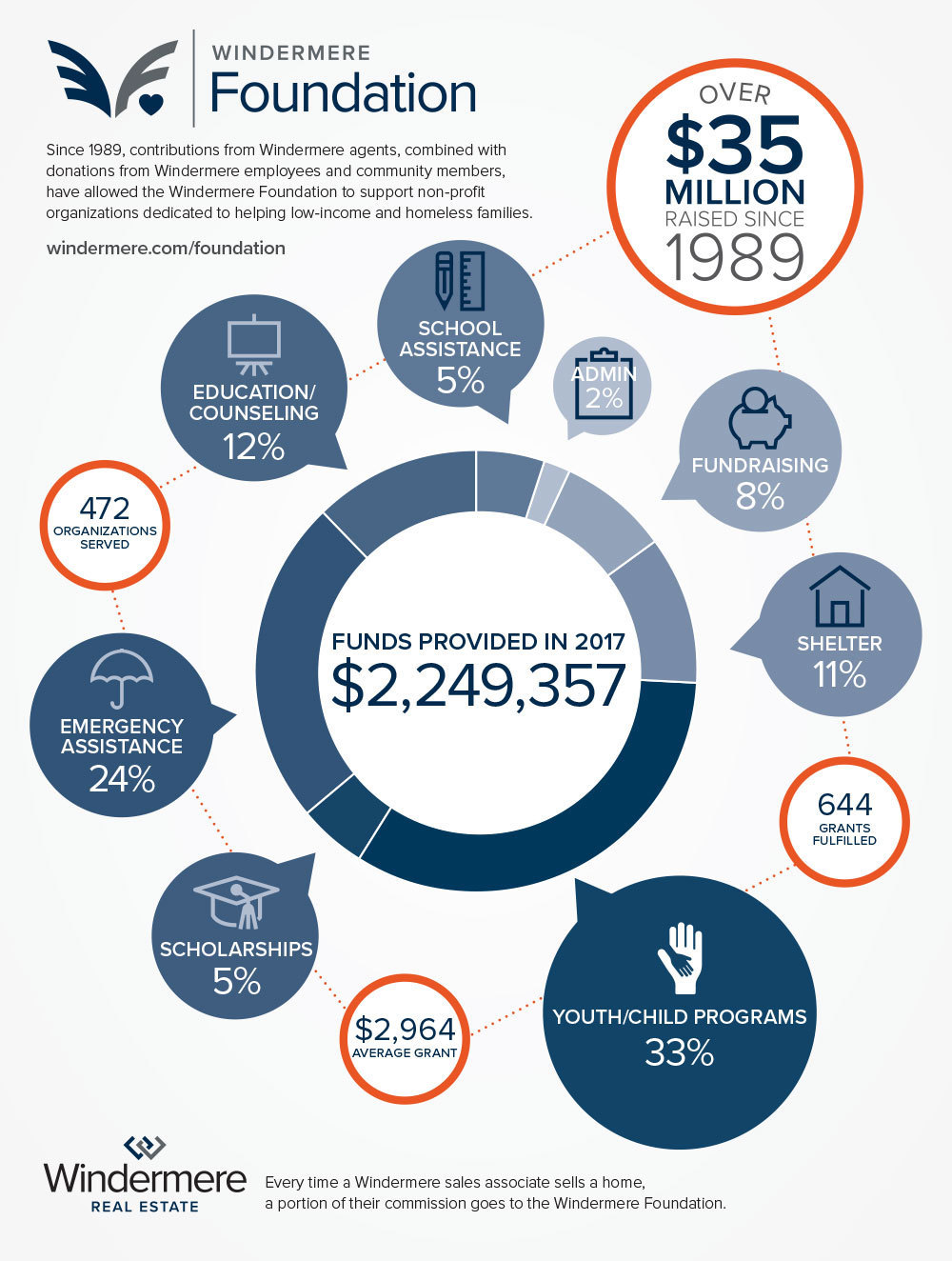

For the past 29 years, the Windermere Foundation has been helping those in need in our communities through donations to local organizations that provide services to low-income and homeless families. In 2017, the Windermere Foundation raised over $2.4 million in donations, bringing the total to over $35 million raised since we started this effort in 1989. The following infographic details exactly how these funds were dispersed in 2017 and the types of organizations that benefited from them. For more information please visit windermere.com/foundation.

New tax legislation was signed into law at the end of 2017, and it included some significant changes for homeowners. These changes took effect in 2018 and do not influence your 2017 taxes. Here’s a brief overview of this year’s tax changes and how they may affect you*.

The amount of mortgage interest you can deduct has decreased.

Under the old law, taxpayers could deduct the interest they paid on a mortgage of up to $1 million. The new law reduces the mortgage interest deduction from $1 million to $750,000. These changes do not affect mortgages taken out before December 15, 2017.

The home equity loan deduction has changed.

The IRS states that, despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELOC) or second mortgage, regardless of how the loan is labeled. The Tax Cuts and Jobs Act of 2017, enacted December 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.

The property tax deduction is capped at $10,000.

Previously taxpayers could deduct all the state, local and foreign real estate taxes they paid with no cap on the amount. The new law limits the deduction for all state and local taxes – including income, sales, real estate, and personal property taxes – to $10,000.

The casualty loss deduction has been repealed.

Homeowners previously could deduct unreimbursed casualty, disaster and theft losses on their property. That deduction has been repealed, with an exception for losses on property located in a federally declared disaster area.

The capital gains exclusion remains unchanged.

Homeowners can continue to exclude up to $500,000 for joint filers or $250,000 for single filers for capital gains when selling their primary residence as long as they have lived in the home for two of the past five years. An earlier proposal would have increased that requirement to five out of the last eight years and phase out the exclusion for high-income households, but it was struck down. Find out more about 2018 tax reform.

How does tax reform affect your plans for buying or selling a home?

The changes in real estate related taxes may change your strategy. Contact your Windermere agent to learn more. If you need help finding an agent, we’re happy to help.

*Please consult your tax advisor if you have any questions about how the new tax reform impacts you

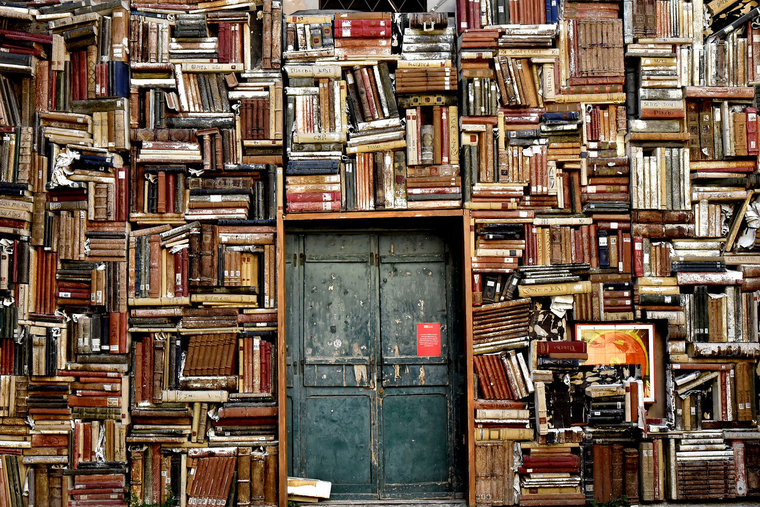

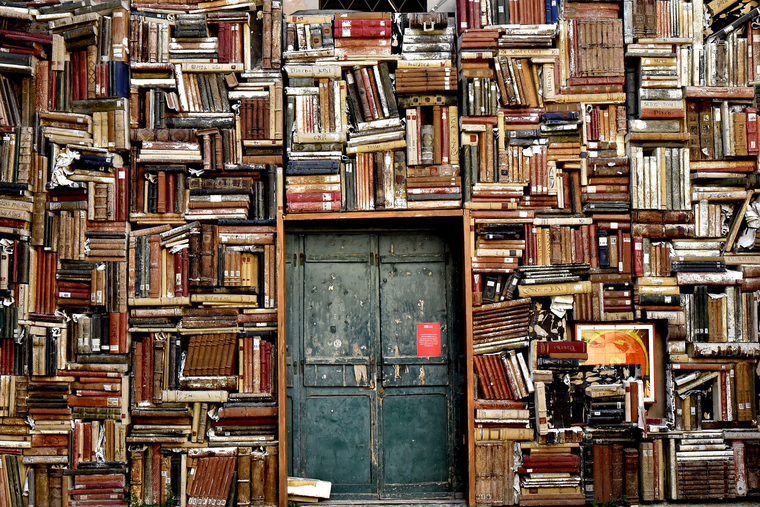

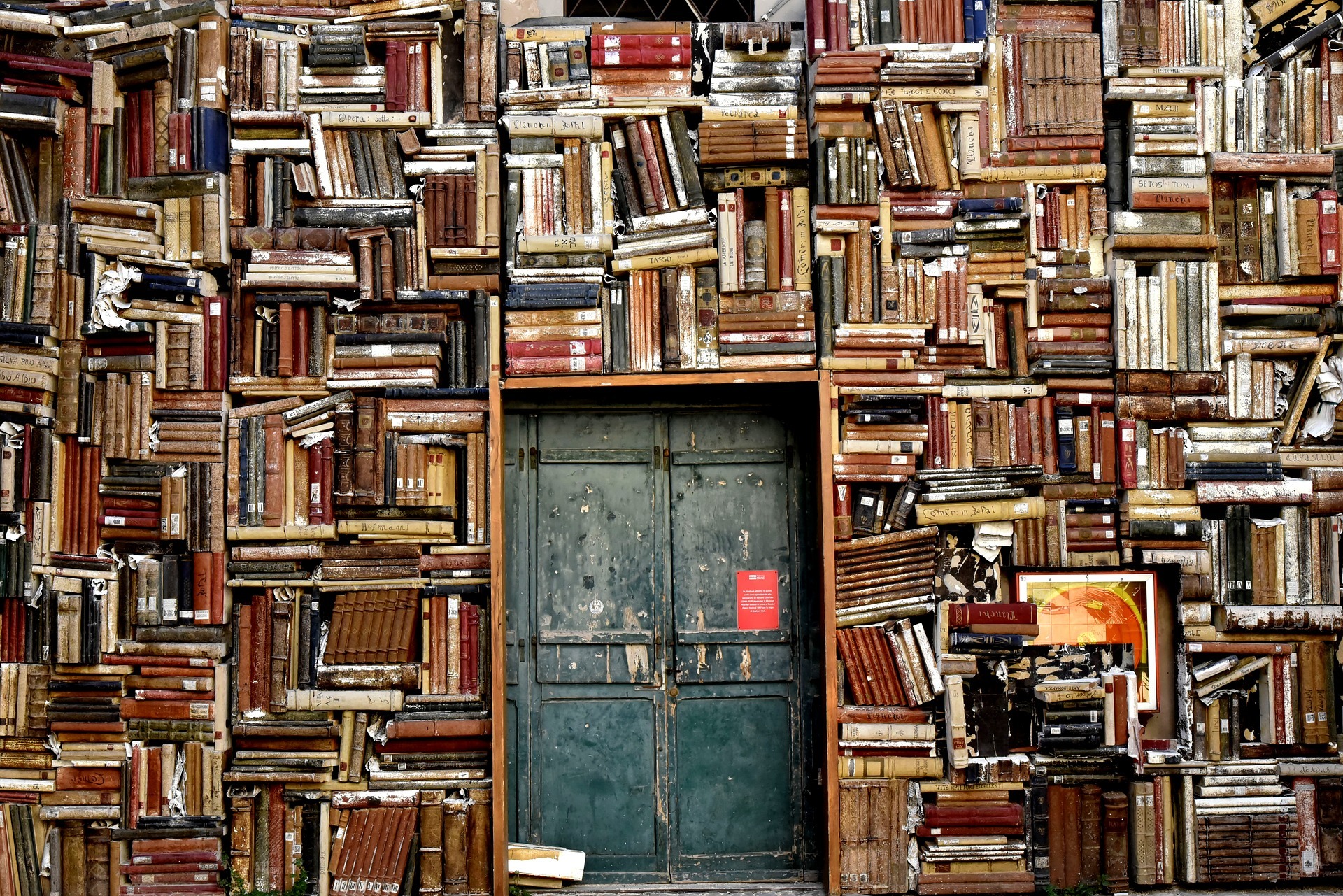

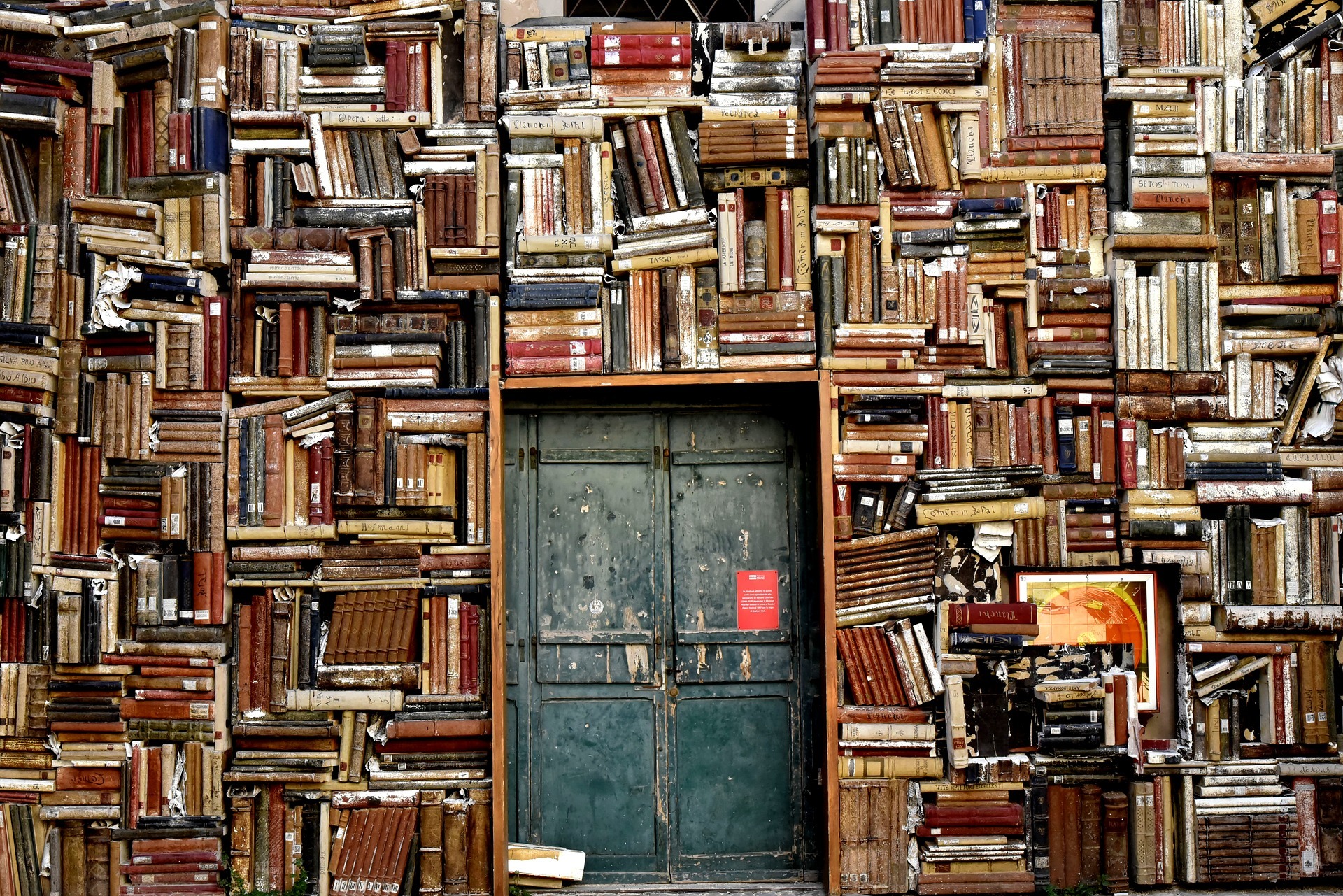

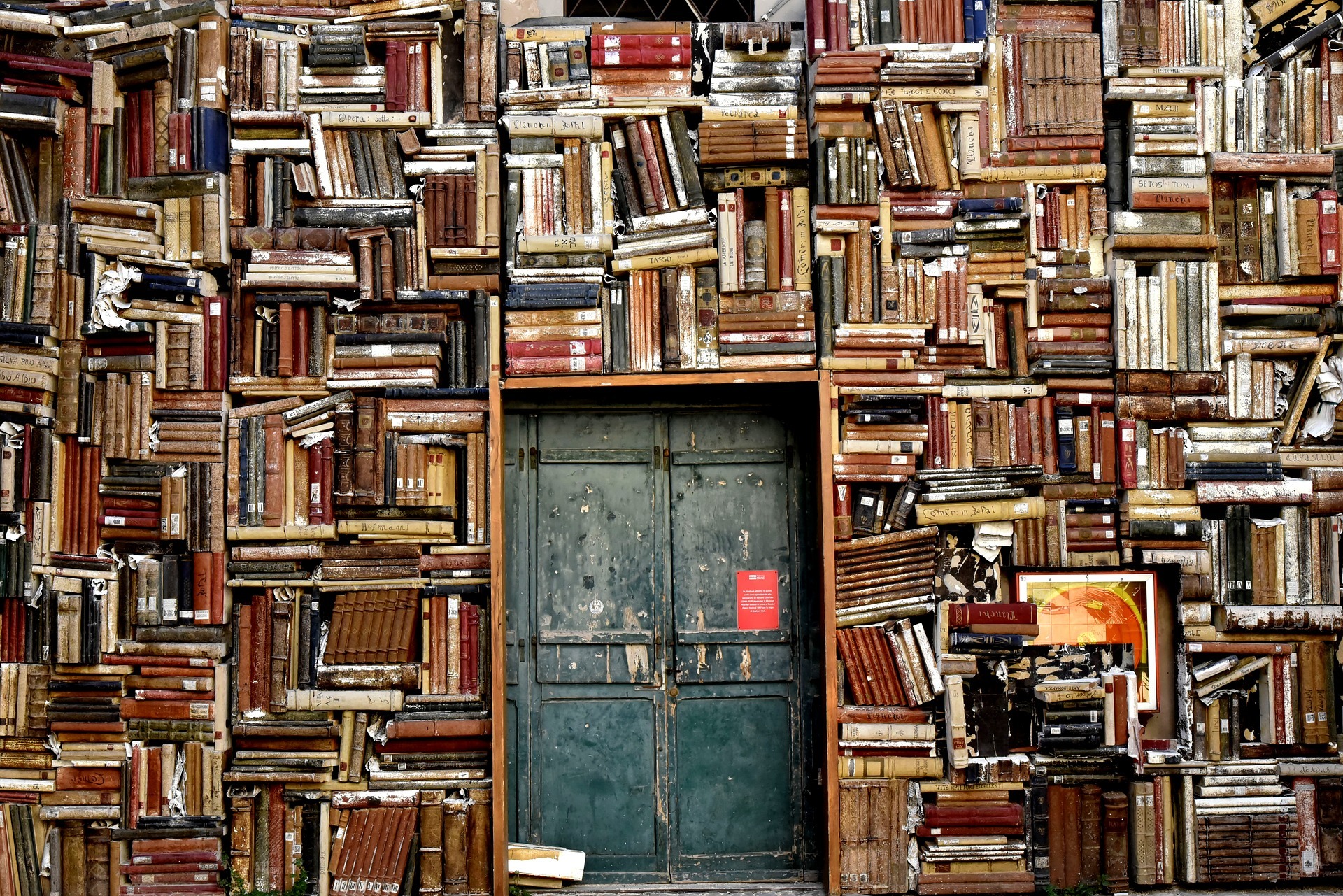

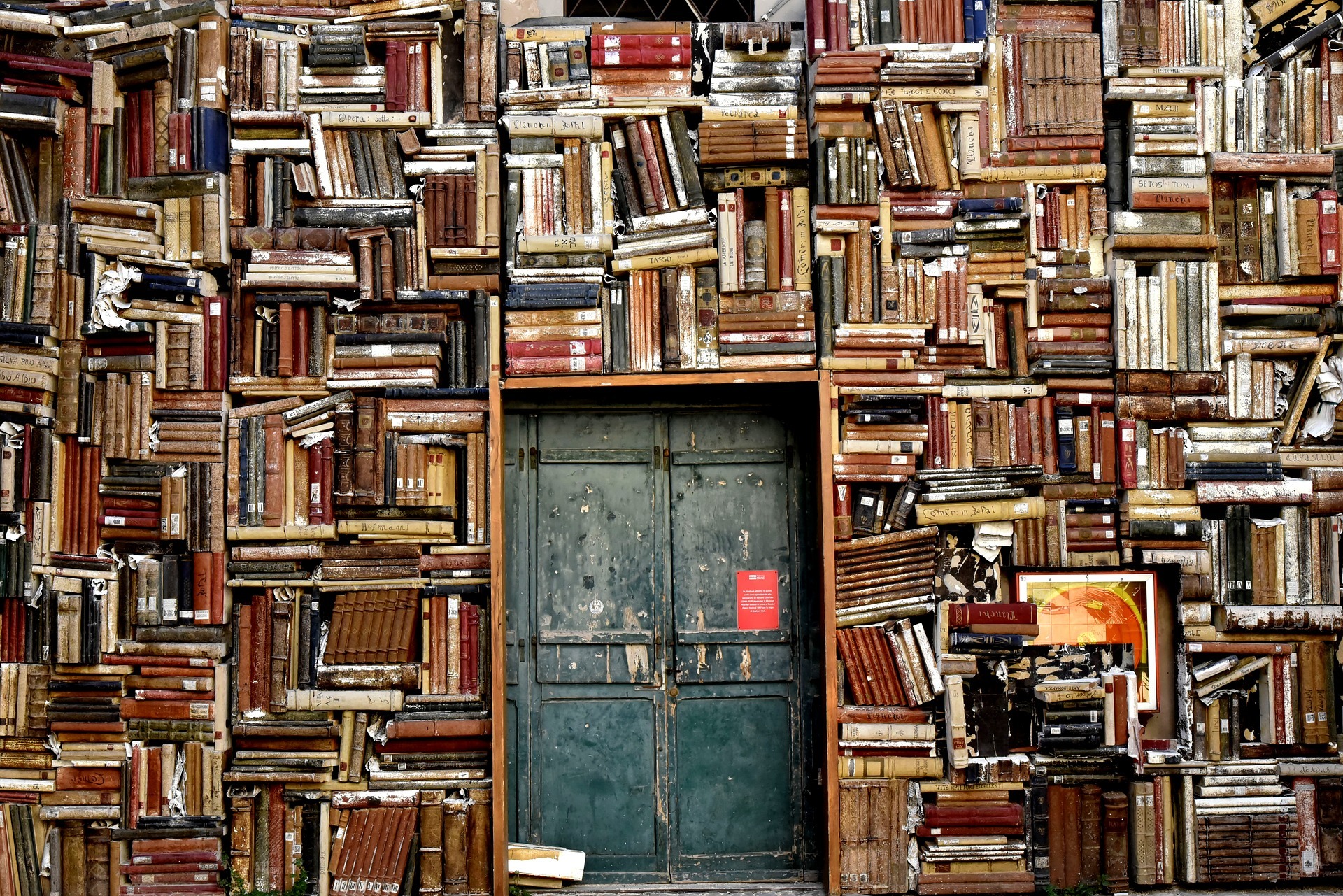

When it comes to organizing a bookshelf, there are a multitude of directions you can go. For example, a simple Pinterest search will turn up endless results of bookshelves stylishly organized by color, but what if that entails separating books from within a series? For some of us, that’s like separating our children. Ultimately, how you organize your bookshelf is a personal choice based on your own aesthetic, but if you’re looking for inspiration, here are some tips to help give your reading space photo-worthy style.

Sorting by color:

Sorting by size:

Design effects to consider:

At the end of a long day, your bedroom should be a sanctuary of comfort that welcomes you in. But, as a room that guests rarely see and in which homeowners spend most of their time with their eyes closed, its upkeep frequently gets pushed to the bottom of the to-do list. Thankfully, there are some little design tricks that can make a big difference. Turn your bedroom into a restful retreat when you up its coziness factor with a few of these easy ideas.

Flooded with soft lighting, plush textures and other comfy touches, your bedroom environment will envelope you at day’s end. And, perhaps even better than the idea of your bedroom refresh itself, is knowing that none of these tips take longer than a weekend to complete! So, slide into your slippers as you settle on which cozy updates you’ll select for your new favorite room of the house.

Adding on to your current home may be your best bet if you’re short on space, but you don’t want to move or can’t find another house in the area with all the qualities you’re seeking. It’s also an attractive option if the house you have is lacking just one significant element (a family room, another bedroom, a larger kitchen, a separate apartment, etc.).

On the other hand, even a modest addition can turn into a major construction project, with architects and contractors to manage, construction workers traipsing through your home, hammers pounding, and sawdust everywhere. And although new additions can be a very good investment, the cost per-square-foot is typically more than building a new home, and much more than buying a larger existing home.

Define your needs

To determine if an addition makes sense for your particular situation, start by defining exactly what it is you want and need. By focusing on core needs, you won’t get carried away with a wish list that can push the project out of reach financially.

If it’s a matter of needing more space, be specific. For example, instead of just jotting down “more kitchen space,” figure out just how much more space is going to make the difference, e.g., “150 square feet of floor space and six additional feet of counter space.”

If the addition will be for aging parents, consult with their doctors or an age-in-place expert to define exactly what they’ll require for living conditions, both now and over the next five to ten years.

Types of additions

Bump-out addition—“Bumping out” one of more walls to make a first floor room slightly larger is something most homeowners think about at one time or another. However, when you consider the work required, and the limited amount of space created, it often figures to be one of your most expensive approaches.

First floor addition—Adding a whole new room (or rooms) to the first floor of your home is one of the most common ways to add a family room, apartment or sunroom. But this approach can also take away yard space.

Dormer addition—For homes with steep rooflines, adding an upper floor dormer may be all that’s needed to transform an awkward space with limited headroom. The cost is affordable and, when done well, a dormer can also improve the curb-appeal of your house.

Second-story addition—For homes without an upper floor, adding a second story can double the size of the house without reducing surrounding yard space.

Garage addition—Building above the garage is ideal for a space that requires more privacy, such as a rentable apartment, a teen’s bedroom, guest bedroom, guest quarters, or a family bonus room.

Permits required

You’ll need a building permit to construct an addition—which will require professional blueprints. Your local building department will not only want to make sure that the addition adheres to the latest building codes, but also ensure it isn’t too tall for the neighborhood or positioned too close to the property line. Some building departments will also want to ask your neighbors for their input before giving you the go-ahead.

Requirements for a legal apartment

While the idea of having a renter that provides an additional stream of revenue may be enticing, the realities of building and renting a legal add-on apartment can be sobering. Among the things you’ll need to consider:

In addition, renters have special rights while landlords have added responsibilities. You’ll need to learn those rights and responsibilities and be prepared to adhere to them.

Average costs

The cost to construct an addition depends on a wide variety of factors, such as the quality of materials used, the laborers doing the work, the type of addition and its size, the age of your house and its current condition. For ballpark purposes, however, you can figure on spending about $200 per square food if your home is located in a more expensive real estate area, or about $100 per food in a lower-priced market.

You might be wondering how much of that money might the project return if you were to sell the home a couple years later? The answer to that question depends on the aforementioned details; but the average “recoup” rate for a family-room addition is typically more than 80 percent.

The bottom line

While you should certainly research the existing-home marketplace before hiring an architect to map out the plans, building an addition onto your current home can be a great way to expand your living quarters, customize your home, and remain in the same neighborhood.