Over the last ten years, the U.S. has added more than nine million rental households, increasing demand on apartments throughout the country, escalating rental rates faster than wages. Windermere’s Chief Economist, Matthew Gardner, shares his view on what to expect for future of rental prices and when long-term renters will start to buy.

Should We be Concerned about Another Housing Bubble?

Over the last several years, many of the circumstances that triggered the previous housing bubble have changed. Windermere’s Chief Economist, Matthew Gardner, breaks down how tax policy, bank regulations, interest rates, lending standards, and home equity have improved our ability to avoid another bubble.

How will the 2016 Election Impact the Housing Market?

The 2016 presidential election will absolutely have an impact on the housing market and the U.S. Economy. What those impacts will be are dependent on who occupies the White House in 2017. Here what Windermere’s Chief Economist, Matthew Gardner, has to say about the influence each presidential candidate may have on the market.

What We Know (and Don’t Know) About the Impact of Brexit

Image courtesy of speedpropertybuyers.co.uk/.

The decision of the British public to leave the European Union is a historic one for many reasons, not least of which was the almost uniform belief that there was absolutely no way that the public would vote to dissolve a partnership that had been in existence since the UK became a member nation back in 1973. However, rightly or not, the people decided that it was time to leave.

As both an economist, and native of the UK, I’ve been bombarded with questions from people about what impact Brexit will have on the global economy and U.S. housing market. I’ll start with the economy.

Since last Thursday’s announcement, there have been exceptional ripples around the global economy that were felt here in the U.S. too. This isn’t all that surprising given that the vast majority of us believed that the UK would vote to remain in the EU; however, I believe things will start to settle down as soon as the smoke clears. The only problem is that the smoke remains remarkably dense.

The British government does not appear to be in any hurry to invoke Article 50 of the Lisbon Treaty, which allows a member country to leave the conglomerate. Additionally, nobody appears able to provide any definitive data as to what the effect of the UK leaving will really have on the European or global economies.

As a result, you have those who suggest that it will lead to a “modest” recession in the UK, as well as extremists who are forecasting a return of the 4-horsemen of the apocalypse. But in reality, no one really knows, and it is that type of uncertainty that feeds on itself and can cause wild fluctuations in the market.

It’s important to understand that last Thursday’s vote does not confirm an actual exit from the European Union. There is a prolonged process of leaving that is set out in the EU Treaty which requires a “cooling off” period. And during this time, even confident political leaders, such as Boris Johnson who championed the exit campaign, might be tempted by reforms that would see Great Britain actually remaining in the EU.

The EU itself has been shaken by the vote, and there are already signs that many of its leaders are talking about moving away from the Federal structure of the Union in favor of a looser, intergovernmental agreement, that would allow greater sovereignty for its member states.

This is clearly an obvious attempt to accommodate what is already a groundswell of opposition to the Union that is much wider than just Britain, and now includes France, Spain, Greece and Portugal, all of whom are considering their own exits.

So what does this mean for the U.S.?

As far as any direct impact of the Brexit on the U.S. economy is concerned, I foresee a continued period of volatility given the aforementioned uncertainty. That said, any predictable effects on the U.S. will be limited to a “headwind” to growth, but not enough to drive us into a recession. Our financial system is solid and U.S. exposure to European debt is still limited. I wouldn’t be surprised to see a slowdown in U.S. exports as the dollar continues to gain strength against European currencies, but those effects will be fairly modest.

As for the impact on housing, U.S. real estate markets could actually benefit. Uncertain economic times almost always lead to a “flight to safety”, which means global capital could pour into the United States bond market at an aggressive rate. With this capital injection, the interest rate on bonds would be driven down, resulting in a drop on mortgage rates. And a drop in mortgage rates makes it cheaper to borrow money to buy a home.

On the flip side, one thing that concerns me about lower interest rates is that it could draw more buyers into the market, compounding already competitive conditions, and driving up home prices. And housing affordability would inevitably take yet another hit.

Let’s not fool ourselves; what we’re seeing is a divorce between the UK and a majority of Europe. And like most divorces, there are no good decisions that will make everybody happy. We need to be prepared for the fact that it is going to be a very ugly, nasty, brutal, lawyer-riddled, expensive divorce.

My biggest concern for the U.S. is that the Federal Reserve must now pause in its desire to raise interest rates (I now believe that we will not see another increase this year as a result of Brexit). This is troubling because we need to normalize rates in preparation for a recession that is surely on the way in the next couple of years. The longer we put that off, the less prepared we will be when our economy eventually turns down.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

5 Tips to Improve Indoor-Outdoor Flow

Wouldn’t you love to double the size of your house for the holidays, or when you’re entertaining a large groups of friends? And when the party is over and all the guests have gone home, have your nice, cozy house back just like that?

It doesn’t make sense to maintain a large entertaining space that gets used only a couple of times a year. That’s why it’s so practical to have a functional and efficient indoor-outdoor space.

Modern Outdoor Spaces: Blurring the Lines Between Indoors and Outdoors

Having a well-designed outdoor area adjacent to your main entertaining rooms is a great way to get more space when needed and to add value to your home. The indoor-outdoor concept is not a new idea, but when you combine it with an open floor plan, you can create a large entertaining area that your guests will savor.

Here are some tips to make sure you get the most out of your indoor-outdoor design.

Dawna Jones Design, original photo on Houzz

Create a big opening. Don’t be afraid to invest in big openings between your indoor and outdoor spaces. Large pocket or accordion doors are a great way to blur the visual barriers between the two areas. When weather permits, you can open up the exterior wall and instantly double the floor space.

IndoorOutdoor 2: Giulietti Schouten Architects, original photo on Houzz

Keep it covered. It’s always best to have a combination of covered and uncovered outdoor spaces — but be sure to provide a covered entertaining area if at all possible. Essentially, you’ll be creating a series of outdoor rooms that will give you a sense of place without taking away from the fact that you’re outdoors.

Browse Thousands of Outdoor Umbrellas

JMA (Jim Murphy and Associates), original photo on Houzz

Make it level. The goal is to remove any visual or physical barriers between the two spaces — including any changes in floor level. Making sure your indoor and outdoor spaces are on the same plane assures they’ll function as one space when needed.

IndoorOutdoor 4: Horst Architects, original photo on Houzz

Create floor flow. Choosing a flooring material that works well inside and out is another great way to make the two spaces feel connected.

Take advantage of the view. There is nothing more impressive than a large, open space that takes advantage of an incredible view. Make sure you orient your interior to look at the vista through the adjacent outdoor space. This way you’ll get to enjoy the view from both inside and outside the house.

The truth is, great design is less about the way your house looks (although it should look remarkable), and more about how it functions. A well-designed house will work better, cost less to build, be more efficient to run and maintain, and get you more for less.

IndoorOutdoor 5: GM Construction, Inc., original photo on Houzz

Great design doesn’t cost more to build than good design, but it sure feels a million times better to live in.

By Dylan Chappell, Houzz

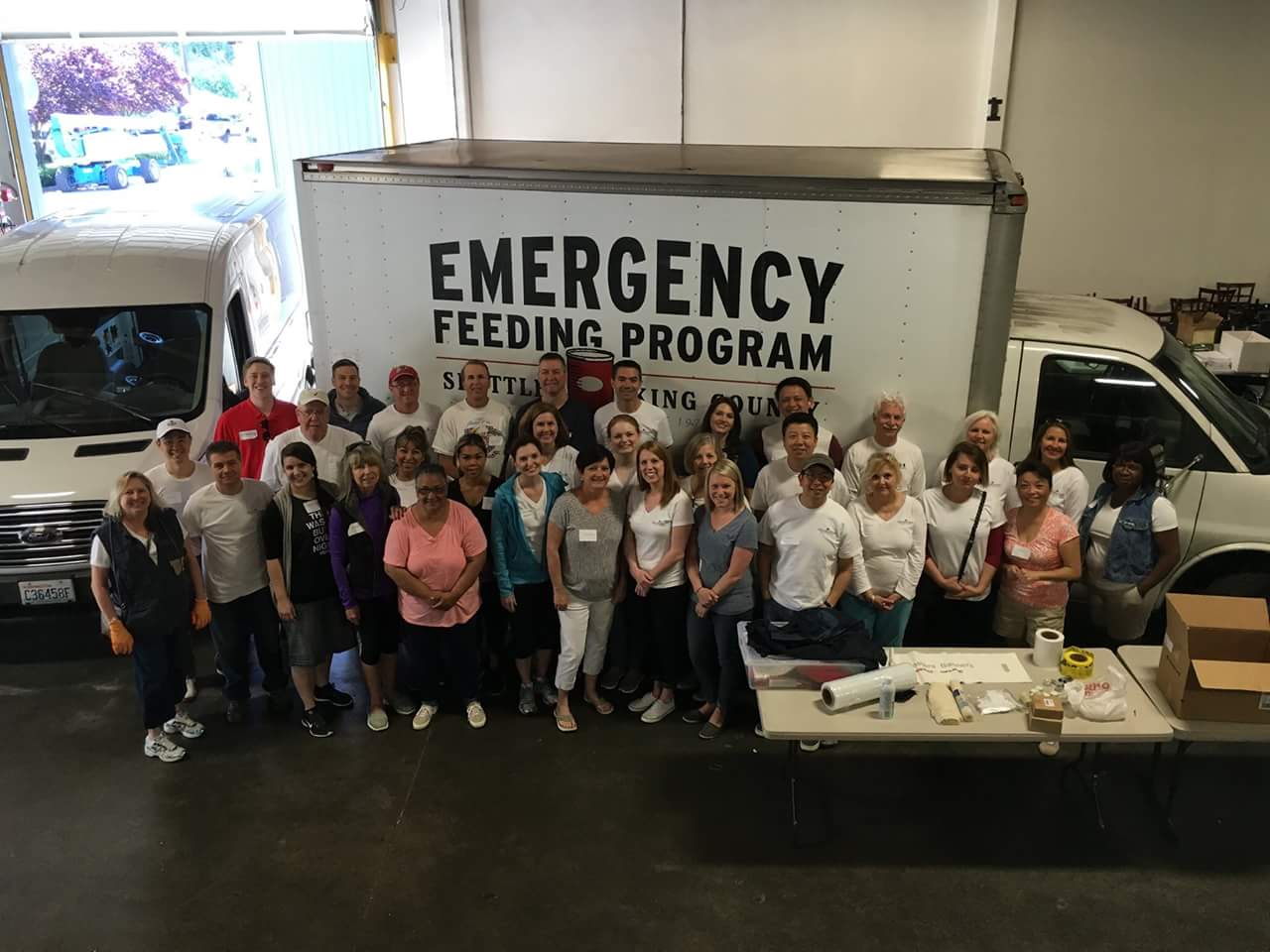

Announcing the Winner of the 2016 Windermere Real Estate Community Service Day Photo Contest!

On Friday, June 3, Windermere offices across the states of Washington, Oregon, Idaho, Montana, Hawaii, Alaska, Utah, California, Colorado, Nevada, and Arizona, all took a day off from selling homes to help make a difference in their local communities.

On Friday, June 3, Windermere offices across the states of Washington, Oregon, Idaho, Montana, Hawaii, Alaska, Utah, California, Colorado, Nevada, and Arizona, all took a day off from selling homes to help make a difference in their local communities.

We challenged our offices to share their community service day photos on Windermere’s CSD contest Facebook page, in order to participate in our fourth-annual voter-driven photo contest. More than 40 offices shared photos, and in turn, they each received a $100 donation to the Windermere Foundation charity of their choice.

To add some competition to this challenge, we offered an additional $1,000 charitable contribution to the office with the most votes on their photo. So, who won?

With a total of 578 votes, the winner of the CSD photo contest is Windermere Renton! The team plans to donate their winnings to the Emergency Feeding Program of King County, Washington.

An honorable mention goes to our Windermere Oak Harbor for coming in a close second place whose photo received 566 votes.

Thank you to all of our Windermere offices and agents who spent the day giving back to local organizations, community centers, and public spaces throughout the Western U.S.

Support Your Local Food Banks During the Summer

Did you know that June is fresh fruits and vegetables month? That’s great if you can afford them. However, they are a luxury for people who struggle to provide even just the basic necessities for their families. Many families rely on their local food banks as a regular supplemental food source. And of those families, 84 percent of households with children report purchasing the cheapest food available, knowing it wasn’t the healthiest option, in order to provide enough food for their family.

And summertime is probably when food banks need your help the most. That’s because children are on break from school and their families have to provide the meals that they normally would get through school meal programs. Six out of seven low-income kids who eat a free or reduced-price school lunch do not get free meals during the summer because they don’t participate in summer meal programs.

And summertime is probably when food banks need your help the most. That’s because children are on break from school and their families have to provide the meals that they normally would get through school meal programs. Six out of seven low-income kids who eat a free or reduced-price school lunch do not get free meals during the summer because they don’t participate in summer meal programs.

So what can you do to help? Does this mean you should go out and buy a bunch of fruits and vegetables to donate to your local food bank? Or maybe donate some extra produce from your home garden? No. The best way that you can help families in need is to donate money to your local food banks. Food banks have agreements or partnerships with distributors/suppliers so that they are able to stretch your donation dollars to purchase more items, usually in bulk. For example, a one-dollar donation—to a food bank hub like Feeding America—can provide 11 meals to families in need. And 68 percent of the foods distributed are healthy foods that align with the USDA Dietary Guidelines.

At Windermere Real Estate, our offices support local food banks through grants from the Windermere Foundation. Here are just a few of the food banks that we have supported over the past year: Idaho Foodbank, Columbia Pacific Food Bank, St. Vincent de Paul Food Bank, Marysville Community Food Bank, The People’s Pantry, Republic, and Maple Valley Food Bank & Emergency Services.

If you’d like to help, consider making a donation to the Windermere Foundation or donating directly to your local food bank or food pantry.

To learn more about the Windermere Foundation, visit http://www.windermere.com/foundation.

Sources: feedingamerica.org, nokidhungry.org

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link