Last month I said our local real estate market was on a roller coaster, and that proved true again, this month, as sales trends turned sharply downward after a strong March.

Pending sales fell below last month’s, and last year’s levels, as many buyers pressed “Pause” on their home purchase decisions, in the face of rising economic uncertainty and stock market volatility.

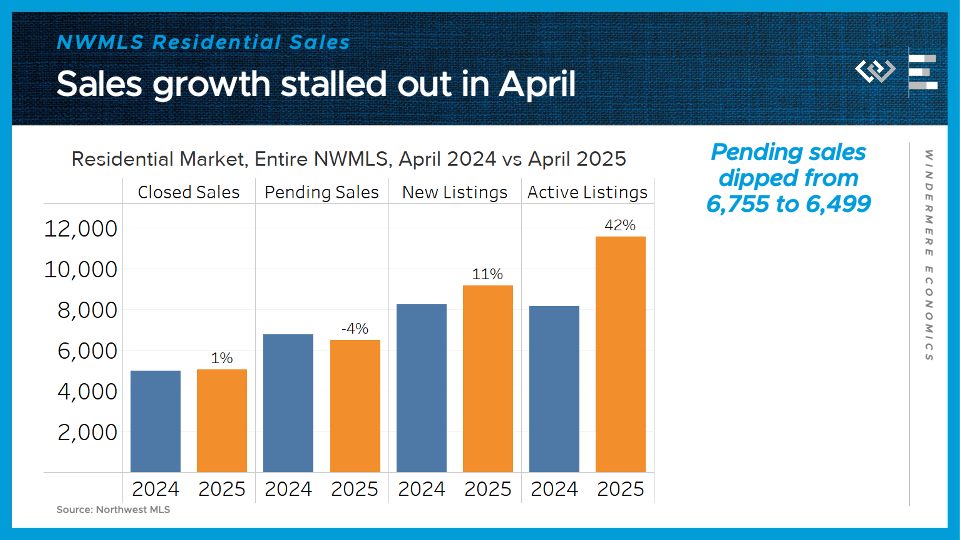

Here are the four key metrics I watch to track supply and demand in the market: closed and pending sales, which tell us a lot about demand; and listings – new and active – which tell us a lot about supply.

Across the Northwest MLS, closed sales of single-family homes grew just 1% in April from their year-ago levels, after growing 5% in March. Pending sales, which are more of a real-time demand indicator, dipped 4% from last year, a disappointing reversal after climbing 7% in March.

On the supply side, about 11% more new listings hit the market this April, and the tally of active listings ended the month 42% higher than April 2024’s inventory. Buyers are still seeing a lot more options than they had last spring.

Finally: the median price for those closed single-family home sales was exactly the same this April as last year: $680,000. The extra inventory and cautious buyers seem to have brought price growth to a halt, for now.

Putting it all together: the market is looking pretty balanced across Washington, now that buyers took a step back in April, as they’re taking time to digest the impact of tariffs and stock market volatility.

Now I’ll dig into the four counties encompassing the greater Seattle area, where buyers pulled back even more.

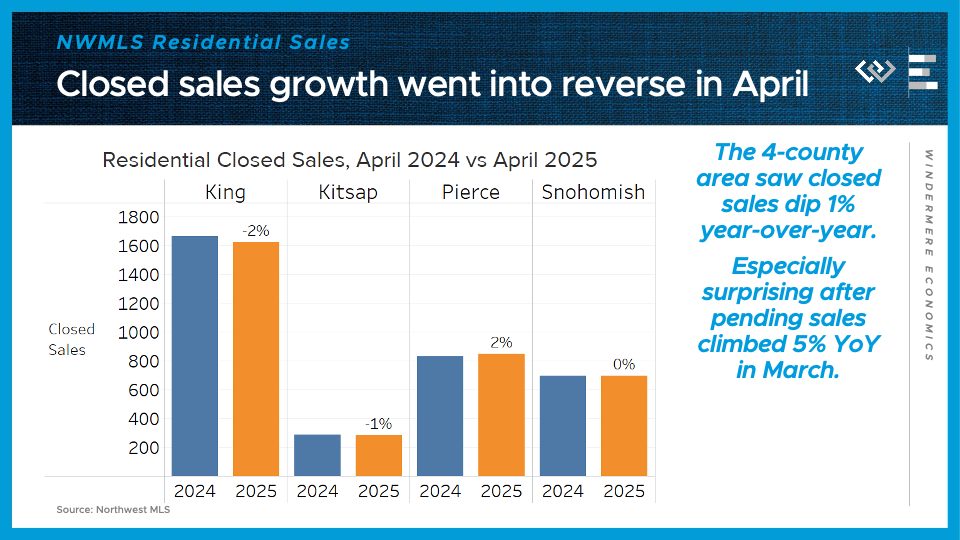

Residential closed sales dipped 1% year over year here in the 4-county region, largely due to a 2% drop in King County. Closed sales dipped 1% in Kitsap County; climbed 2% in Pierce County, including Tacoma; and were flat in Snohomish County, including Everett.

This is especially surprising because there was healthy pending sales growth around the region in March, suggesting either more cancellations, or that this dropoff happened mostly in the end of the month of April.

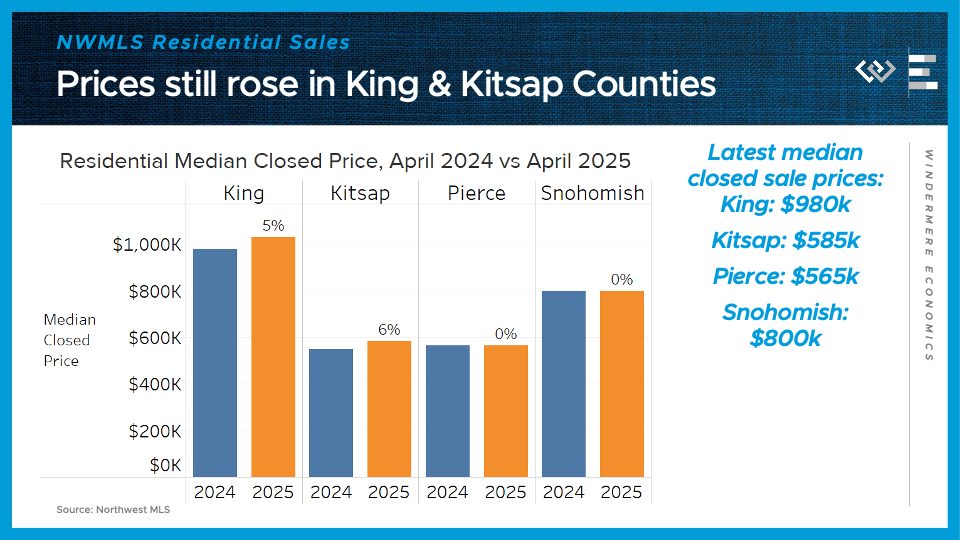

The median sale price kept marching upward in King and Kitsap Counties, by 5-6%, while prices were flat year-over-year in Pierce and Snohomish Counties.

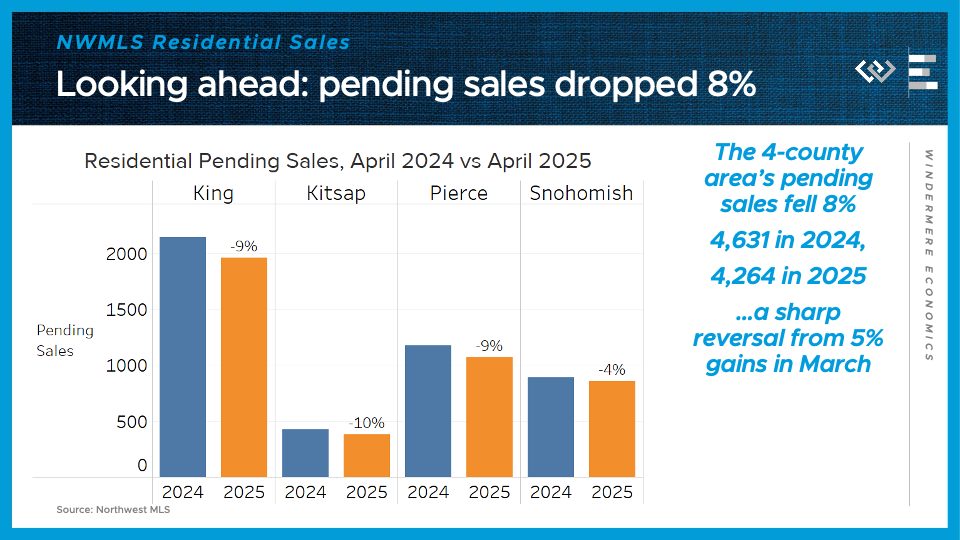

Looking ahead, pending sales dropped 8% in the 4-county area: down 9% in King, down 10% in Kitsap, down 9% in Pierce, and down 4% in Snohomish County. This is a sharp reversal from March’s gains, and suggests we will see closed sales slide in May.

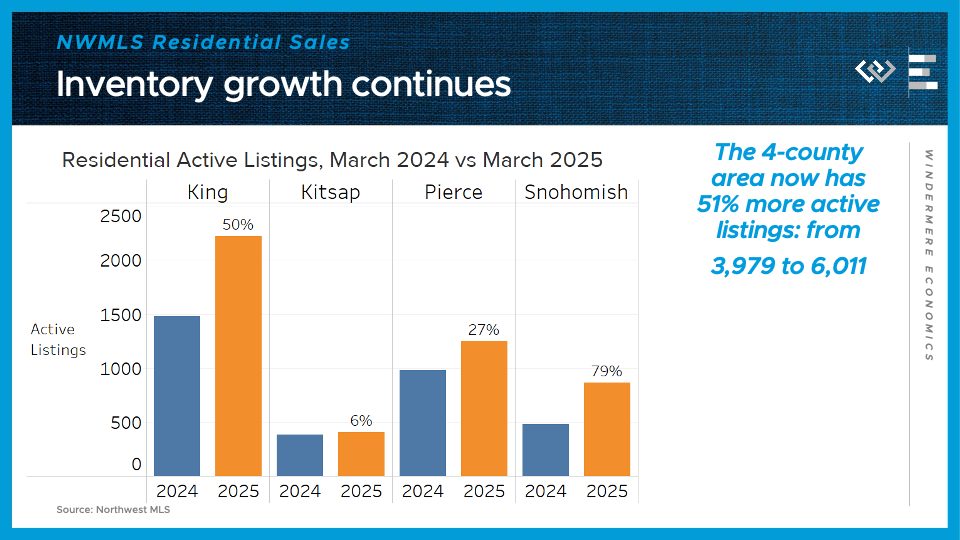

On the supply side, the 4-county greater Seattle area had just over 6,000 active listings at the end of April, up about half from the same time last year. Just like in March, the inventory growth is especially dramatic in King and Snohomish Counties, where listings are up 50% and 79% respectively.

All in all, these indicators from April show that the forward momentum in sales we saw in March has fizzled out for now, at least, because buyers have been hit by economic uncertainty and stock market volatility that’s caused some of them to pause their home buying search. Looking ahead, we saw stock markets actually end April about where they started, after a wild ride down and back up, so that may be cause for optimism that April’s negative shocks start to fade in the rear-view mirror. What comes next depends on whether the economic outlook and stock market movements stabilize and firm up.