The following analysis of the Oregon and Southwest Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Oregon added 42,000 new jobs over the past 12 months, representing a very solid annual growth rate of 2.2%. In the second quarter Gardner Report, I stated that job growth in Oregon was starting to taper, but since then the state has made adjustments to figures from the last three years that now suggest job growth was stronger than originally reported.

The Southwest Washington market (Clark, Cowlitz, Skamania, and Klickitat Counties) added 8,590 new jobs over the past 12 months which represents an annual growth rate of 4.1%.

Oregon’s unemployment rate was 3.8% in August, well below the 4.2% rate of last year. In Southwest Washington, the unemployment rate was 4.6%, down from 5.2% last year.

HOME SALES ACTIVITY

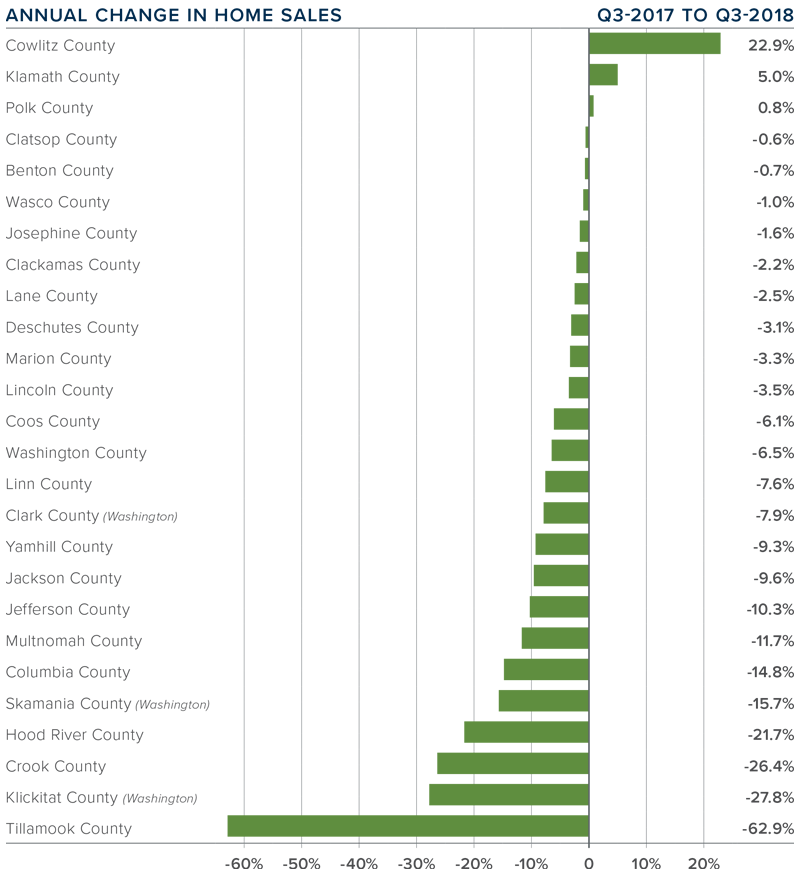

- Third quarter home sales dropped 6.6% when compared to the same period last year, with a total of 18,486 transactions occurring.

- Sales rose the most in Cowlitz County, which saw a 22.9% increase compared to the third quarter of 2017. There was also a solid increase in Klamath County. Home sales fell the most in Tillamook, Klickitat, Crook, and Hood River Counties.

- Year-over-year sales rose in three counties but dropped in the other 23 counties contained in this report.

- The drop in sales is likely not a result of declining demand, rather it is a function of rising inventories in many markets (especially those close to large employment centers).

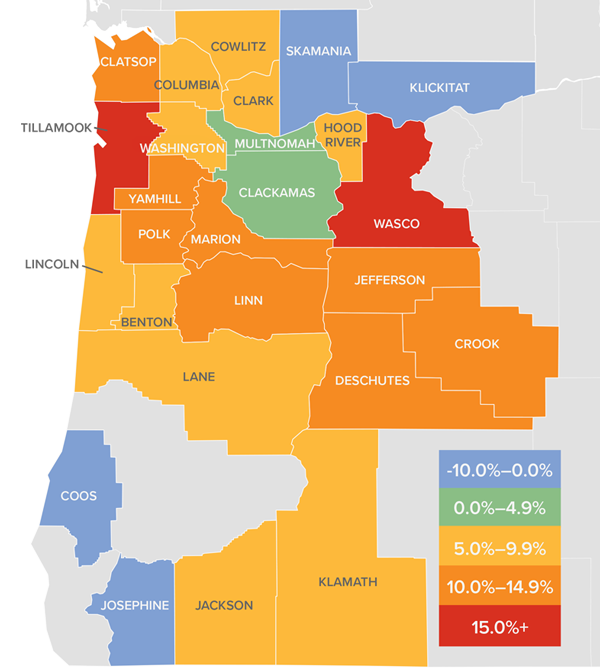

HOME PRICES

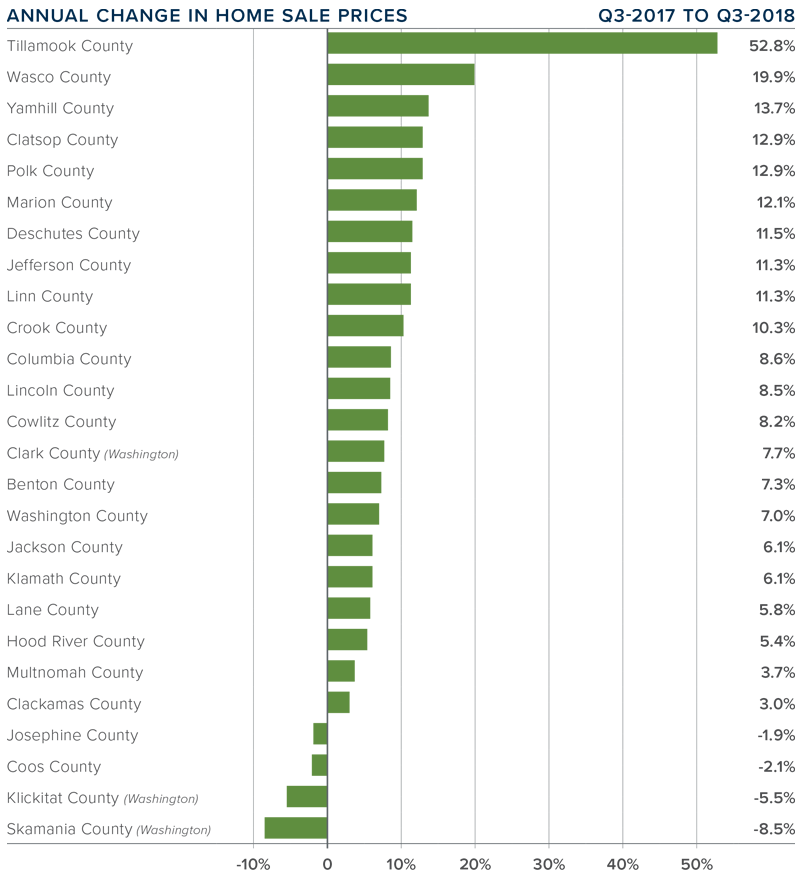

- The average home price in the region rose 6.8% year-over-year to $390,636. However, we did see a modest 0.6% price decline when compared to the second quarter of this year.

- Tillamook County led the market with the strongest annual price growth. Homes there sold for 52.8% more than a year ago, but this is likely because it’s a very small market that can be prone to significant swings.

- Similar to last quarter, all but four counties experienced price growth compared to a year ago, with 10 of them experiencing double-digit increases.

- The takeaway from this section is that price growth is slowing as some markets reach an affordability wall.

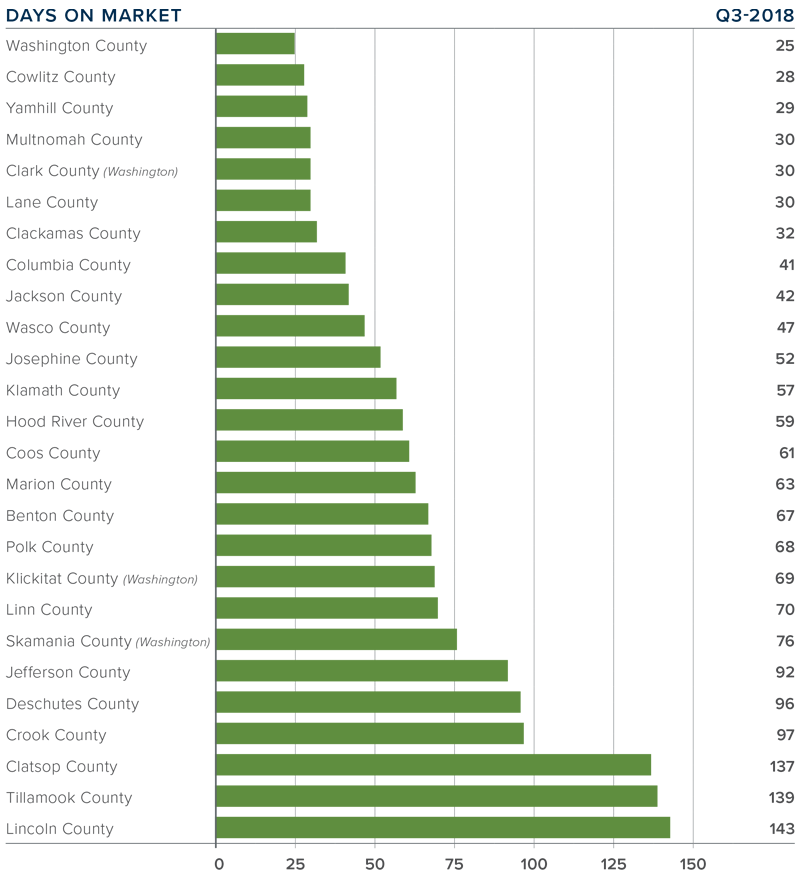

DAYS ON MARKET

- The average number of days it took to sell a home in the region dropped by one day compared to the third quarter of 2017 and was down by six days from the second quarter of 2018.

- The average time it took to sell a home last quarter was 65 days.

- Fourteen counties saw the length of time it took to sell a home drop or remain static compared to a year ago. Twelve counties saw market time rise.

- Homes again sold the fastest in Washington (25days), Cowlitz (28 days), and Yamhill (29 days) Counties.

CONCLUSIONS

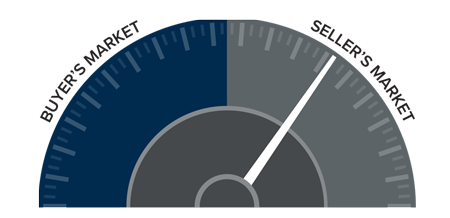

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The region’s economy remains strong and this will continue to drive demand for housing. However, as I review the data, there appears to be a shift in the air, with rising inventory levels and slowing sales. I do not see this as being a cause for concern, but instead a shift toward a more balanced market. The rise in inventory indicates that there are clearly home sellers who believe the housing market in their area has peaked and now is the time to sell. As such, I have moved the needle further toward buyers, but it still remains a seller’s market.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link