The following analysis of select counties of the Central Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Central Washington employment rose 6% year over year. However, with the significant revisions to 2021 employment levels the state made, total employment is down 3,778 jobs from the pre-pandemic peak. The jobs shortfalls are primarily in Kittitas and Yakima counties, with far smaller shortfalls in Okanogan and Chelan counties. Douglas County is the only market where employment levels are higher than the pre-pandemic peak. Unadjusted unemployment levels in Central Washington were 7.6%. When adjusted for seasonality, they were 5.9%. The county with the lowest unemployment rate was Chelan at 4.8%; the highest was Yakima, where 6.5% of the labor force was still without work. I expect that the region will be back to pre-pandemic employment levels by this summer.

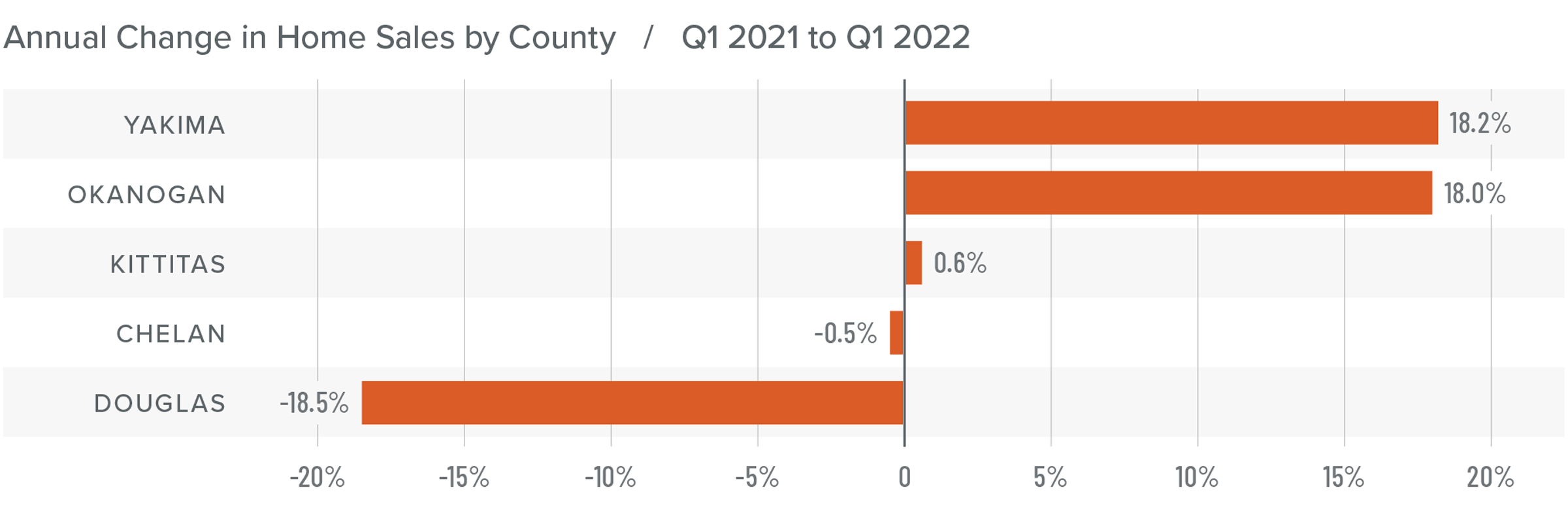

Central Washington Home Sales

❱ Sales in Central Washington rose 6.8% compared to a year ago, with a total of 1,022 homes sold. Sales fell 36.1% compared to the final quarter of 2021, but it is likely that seasonal factors impacted the number.

❱ The drop in sales compared to fourth quarter of 2021 suggests that closings in second quarter of this year will remain tepid.

❱ Compared to a year ago, sales rose in Okanogan, Yakima, and Kittitas counties, but fell in Chelan and Douglas counties. Sales fell across the board compared to the final quarter of last year.

❱ Even though inventory levels rose 4% year over year, there were 33.5% fewer listings in the first quarter than in the prior quarter. This is creating frustrating conditions for buyers who have seen financing costs increase significantly in recent months. I hope more homes will come to market as spring gets underway, but the market is far from balanced.

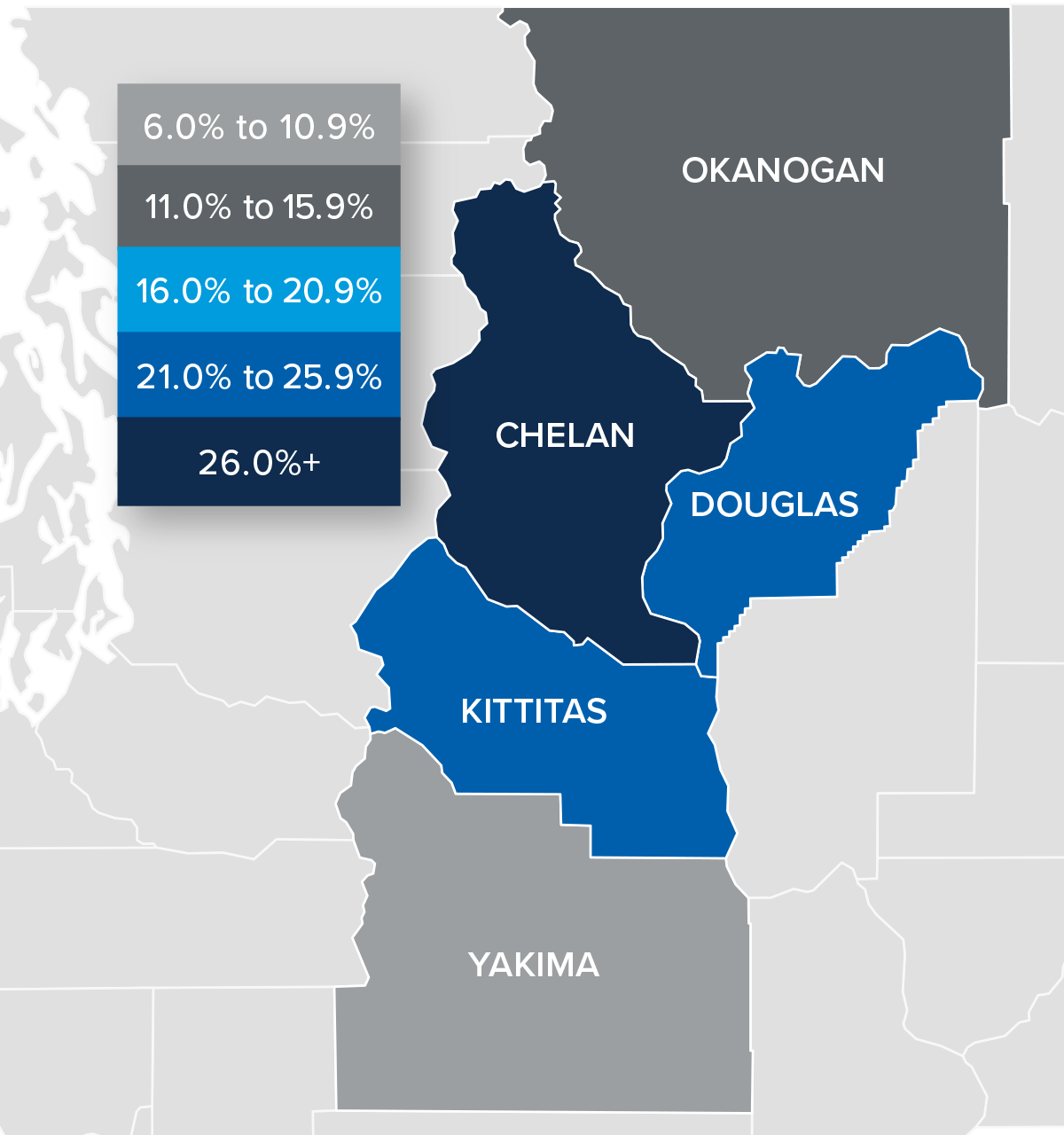

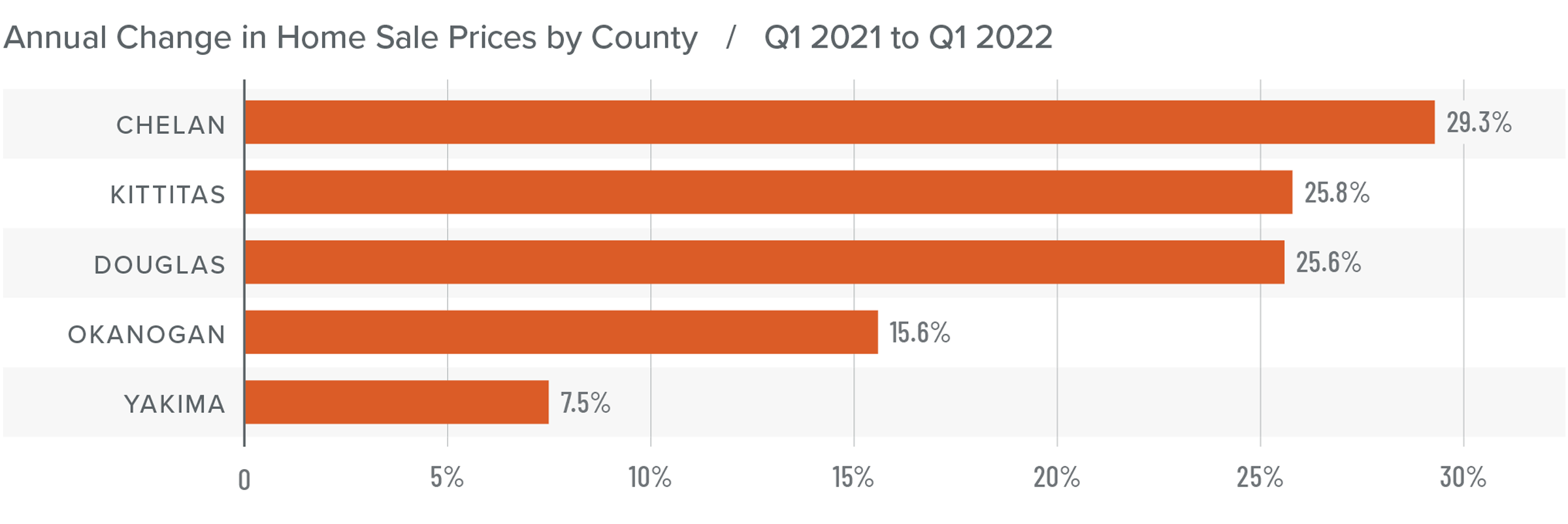

Central Washington Home Prices

❱ The average home price in Central Washington rose 17% year over year to $485,435 but was 0.8% lower than in the final quarter of 2021.

❱ Lower quarter-over-quarter sale prices may be a function of rising mortgage rates, but it’s too soon to tell given that there’s usually a lag between rising financing costs and their impact on prices. Data from the second quarter of this year will give us a better indication.

❱ Every county except Yakima saw double-digit increases in sale prices compared to the first quarter of 2021. Prices were lower in Chelan and Yakima counties than in the previous quarter, but the other three counties saw higher sale prices.

❱ Median list prices have slowed their ascent in many of the markets contained in this report, which could also indicate some softening in the region. That said, the extent to which this is impacting secondhome markets—which are more susceptible to rising mortgage rates—remains uncertain.

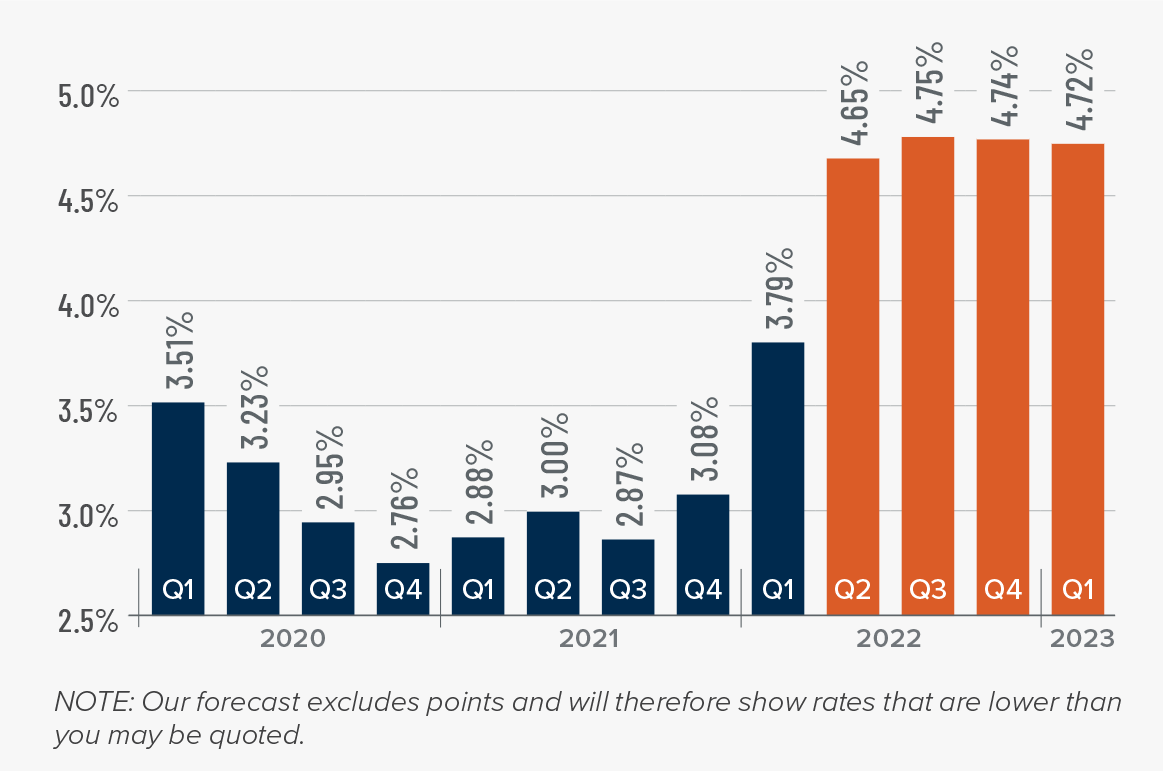

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The speed of the surge in rates is due to the market having quickly priced in the seven-to-eight rate increase that the Fed is expected to implement this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

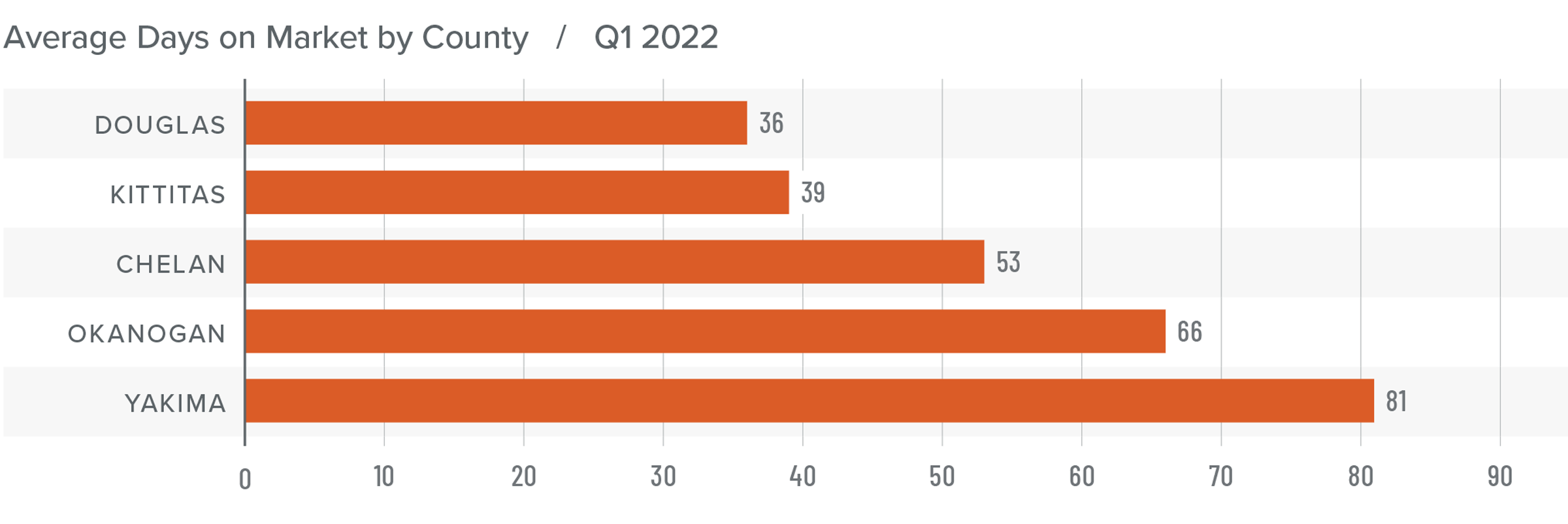

Central Washington Days on Market

❱ The average time it took to sell a home in Central Washington in the first quarter of 2022 was 55 days.

❱ During the first quarter, it took three fewer days to sell a home in Central Washington than it did a year ago.

❱ All counties other than Chelan and Kittitas saw the length of time it took to sell a home drop compared to a year ago, with noticeable improvement in Okanogan County. Compared to the final quarter of 2021, days on market rose in all counties.

❱ It took 17 more days to sell a home in the first quarter than it did in the fourth quarter of last year.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The market remains in a state of imbalance. On one hand, the number of homes for sale increased as we moved into the year, but there were fewer pending sales. This is a little counterintuitive given that rising mortgage rates should have been a stimulant for home buyers. Even so, I believe home sellers remain in the driver’s seat, but the year has not started in the way some may have hoped for. Second quarter data should give us some more clarity as to the direction the market will take in 2022, but it is likely that higher mortgage costs combined with lower affordability may act as a headwind.

As such, I am moving the needle a little more towards buyers but, for the time being, sellers still have the upper hand.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link