Six Predictions for 2026

The following is a summary of Windermere Principal Economist Jeff Tucker’s six predictions for the U.S. housing market and economy in 2026. He goes into more detail about his predictions in the video below.

1. Existing Home Sales Will Pick Up (Barely)

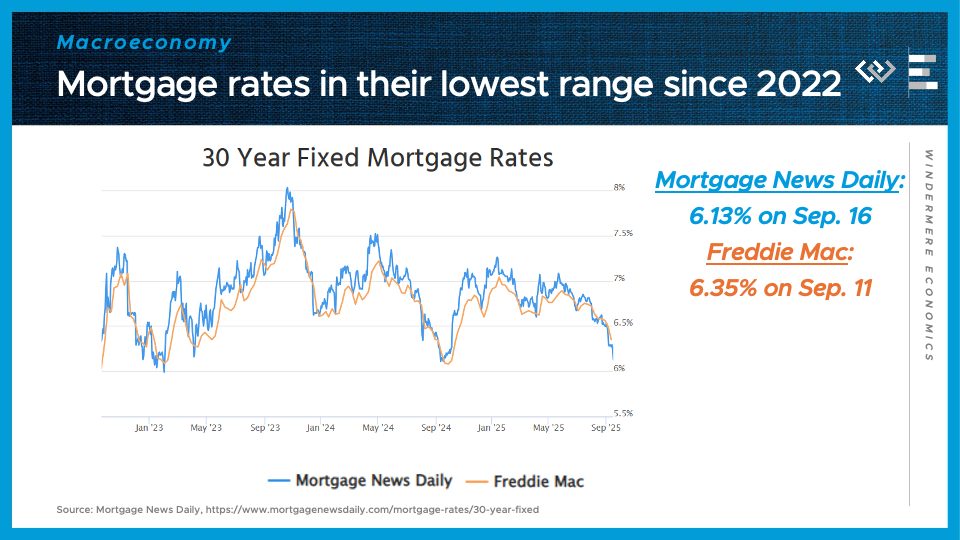

Home sales have hovered near generational lows for three years. While a sharp rebound is unlikely, conditions point to a modest uptick in 2026. Inventory levels are higher than they’ve been since 2019, and mortgage rates are lower than they’ve been since 2022. Together, those factors should lift existing home sales—but not by much.

2. Home Prices Will Be Roughly Flat

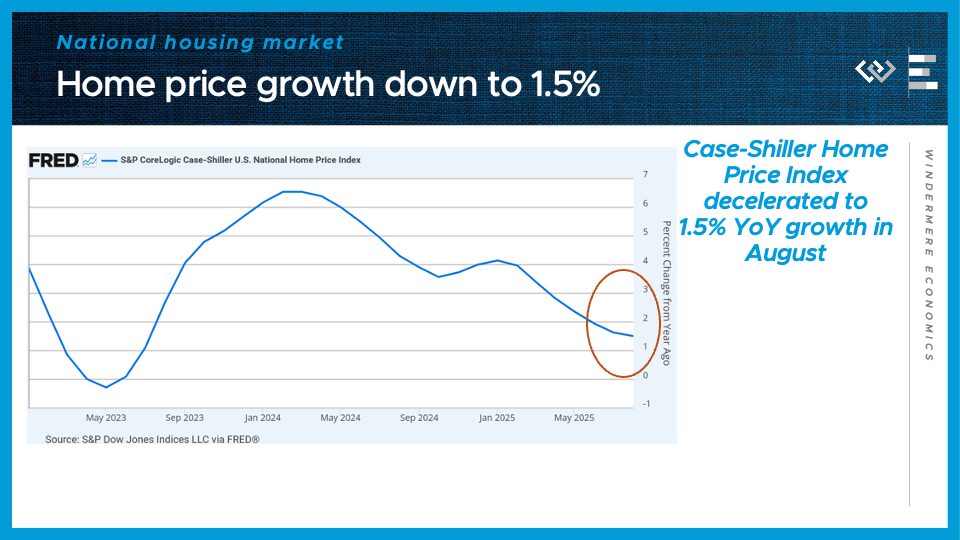

Home prices are likely to remain flat in 2026, largely due to higher inventory putting downward pressure on values. The Case-Shiller Home Price Index showed small declines last summer, though that trend faded by fall. Sellers have been highly responsive to market shifts, often de-listing when offers fall short or holding off on listing altogether. That restraint has kept prices from falling further despite growing supply

3. Inventory Will Climb to Pre-Pandemic Levels

The number of homes for sale will likely return to pre-pandemic levels in 2026, possibly as early as spring. Inventory rose sharply in 2025, and a “shadow supply” of homes—those whose owners are waiting for better conditions—remains in the wings. Many “discretionary sellers” will continue testing the market, holding out for the right price. That behavior should extend average time on market and boost total listings, giving buyers more options and negotiating power.

4. The Homeownership Rate Will Decline

At current prices and interest rates, homeownership remains out of reach for many middle-class Americans who would have bought in different conditions. Slower rent growth has also reduced urgency among would-be buyers, encouraging them to stay put. More renters are opting for single-family homes to enjoy the space and lifestyle of ownership without a mortgage, a shift that will help push the overall homeownership rate slightly lower.

5. Mortgage Rates Will Decline Slightly

Mortgage rates should remain below 6.25% for most of 2026 and could briefly dip under 6%. The Fed’s rate cuts and slower growth have brought 10-year Treasury yields near 4%, while the spread between Treasuries and mortgage rates has narrowed toward its normal range of 2% or less. That trend is expected to continue as refinance risk on mortgage-backed securities gradually fades, but much of the improvement is already reflected in current rates, so significant declines are unlikely.

6. We Will Avoid a Recession in 2026

The U.S. economy weathered several shocks in 2025 but avoided a downturn. Payroll gains have slowed, though more due to shrinking labor supply than weak demand, and unemployment claims have remained stable. After early trade policy turbulence, corporate earnings rebounded strongly, and tariff concerns have faded as court challenges and new trade deals rolled back some of the costliest restrictions.

The Latest Numbers to Know 11/19/25: Jobs, Housing, & Rates

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

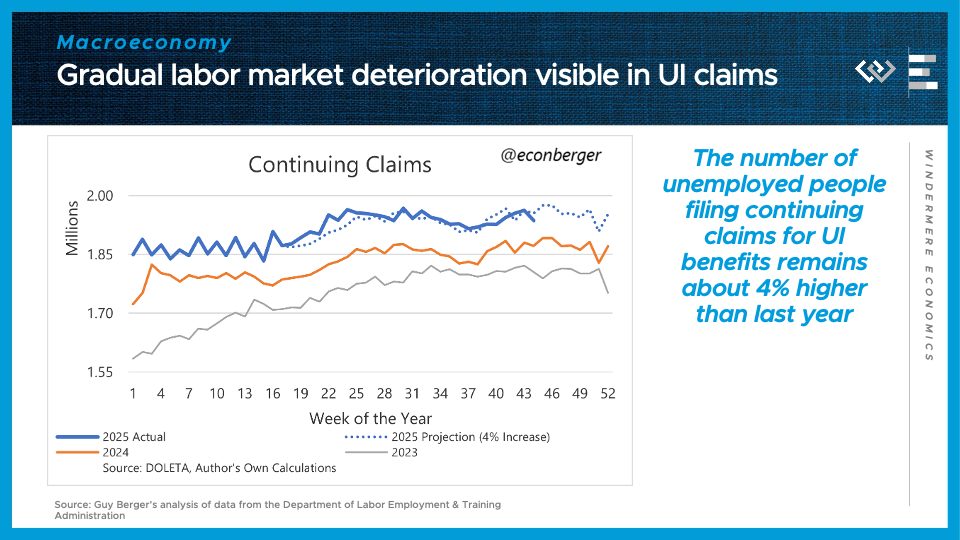

The first number to know this week: 4%. That is how much higher unemployment claims are than this time last year. We don’t actually know the unemployment rate due to the government shutdown, which suspended collection of the household survey it’s based on, so instead economists have turned to state-level data sources. Labor economist Guy Berger shared this chart comparing continuing unemployment claims in 2025, in blue, to the last two years, showing a consistent, gradual 4% year-over-year increase. That’s not great news, but it still doesn’t indicate a sudden breakdown in economic growth. We’ll get a better picture of the economy as the Bureau of Labor Statistics resumes publishing data in the remainder of 2025.

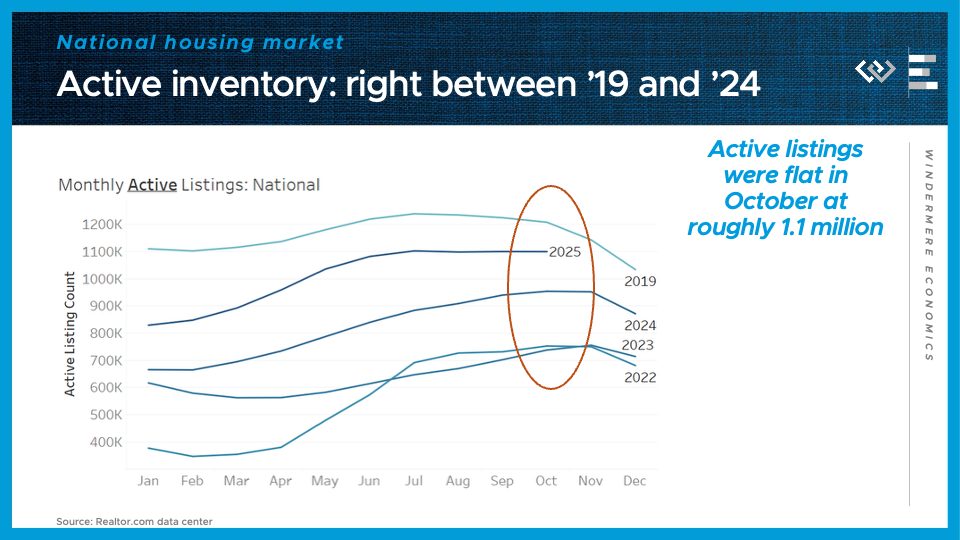

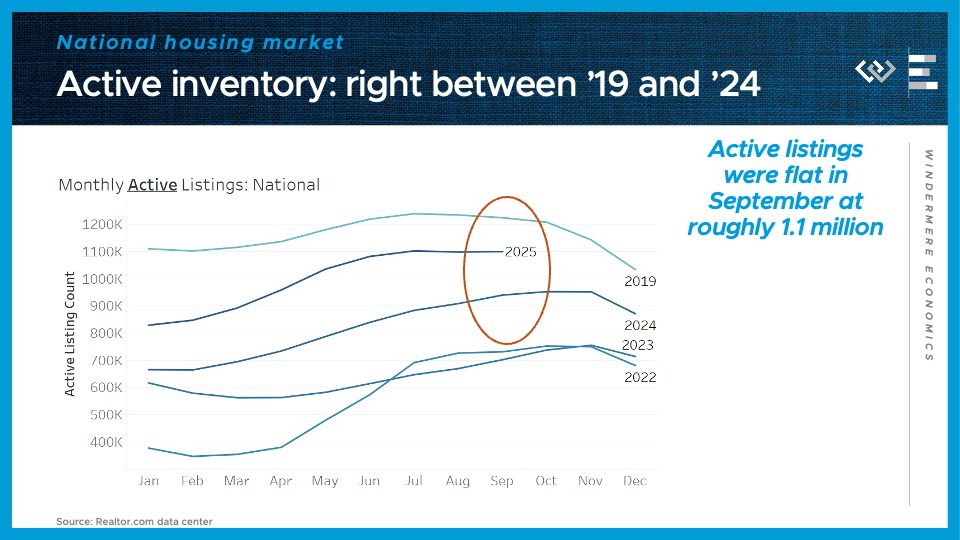

Turning to the housing market: Realtor.com reported almost exactly 1.1 million active listings for sale at the end of October, for the third month in a row. One interesting trend this chart makes clear is that, since 2020, sellers have been more willing to keep listings up later into the fall than they tended to in 2019. That means we are closer now to 2019 inventory levels than at any other time since the pandemic began.

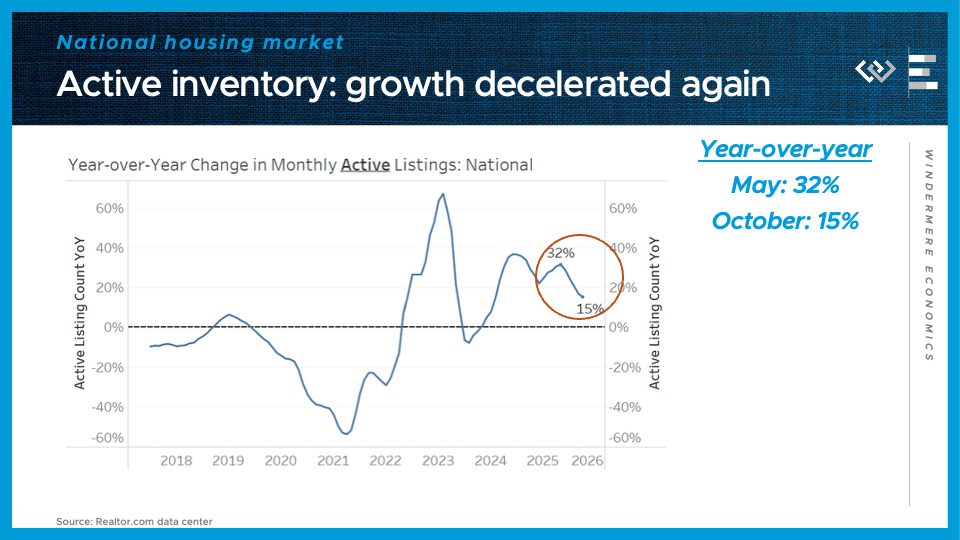

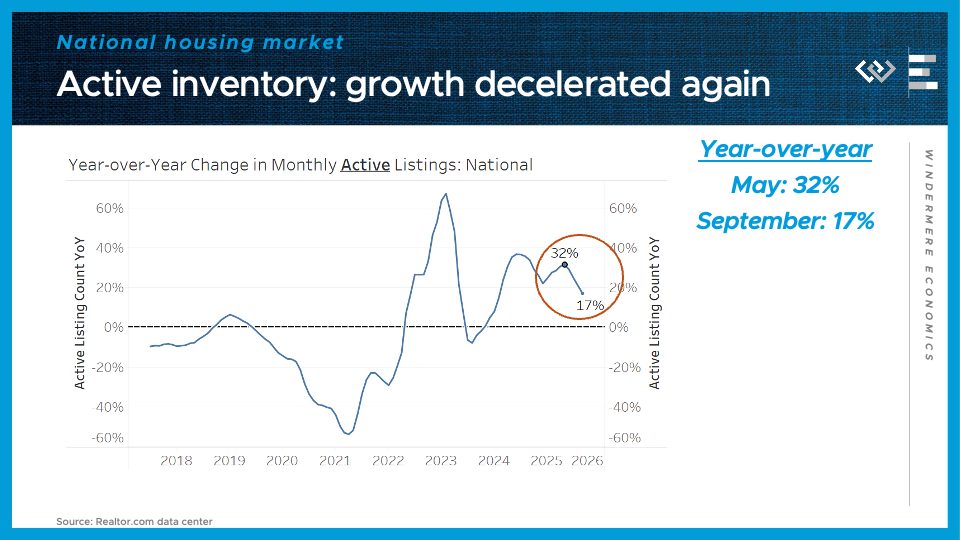

But for the fifth month in a row, the pace of growth of inventory has fallen yet again, now down to just 15% year-over-year. The big growth of active listings this spring and summer helped throw some cold water on price appreciation, pushing it down near to 0, but that inventory growth has slowed down enough that nationally, prices look most likely to flatline next year rather than plunge into negative territory.

That brings me to the next number to know: 1.5%. That’s the most recent year-over-year change in the Case-Shiller Home Price Index, and the slowest pace of home price appreciation since early 2023.

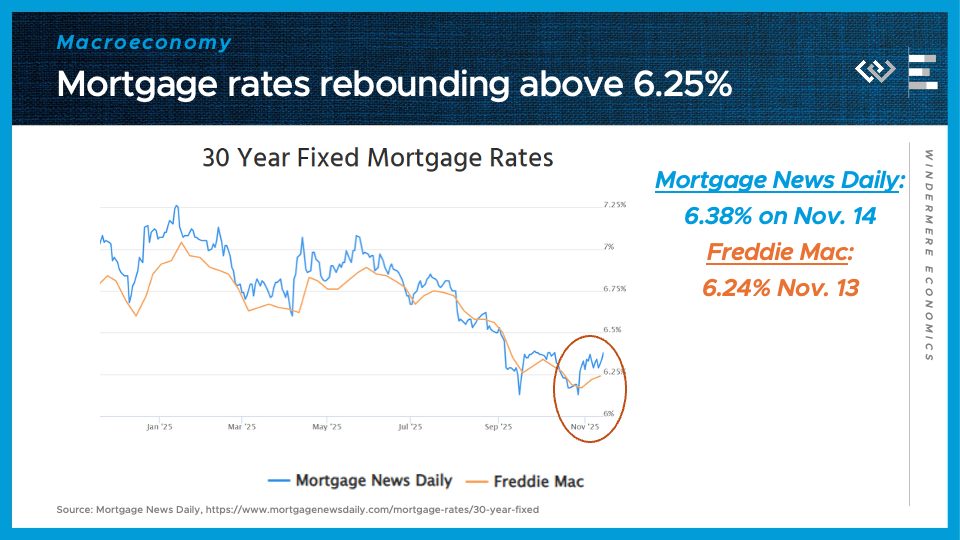

The other puzzle piece for home purchase affordability took a little step in the wrong direction last month: Mortgage rates rebounded from below 6.25% to more like 6 and 3/8, according to Mortgage News Daily. That’s still lower than they were last winter, and it just goes to show that mortgage rates rarely stick to the script and follow a predictable long-term trend.

That is all for this month; I look forward to more economic data in December, and thanks as always for watching!

Local Look Western Washington Housing Update 11/6/2025

Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the October 2025 data from the Northwest MLS.

This October, the Washington housing market began its usual seasonal shift into the cooler 4th quarter. Compared to last year, it looked particularly cool, because last October saw a sudden burst of buying activity in the wake of the Fed finally beginning to cut interest rates.

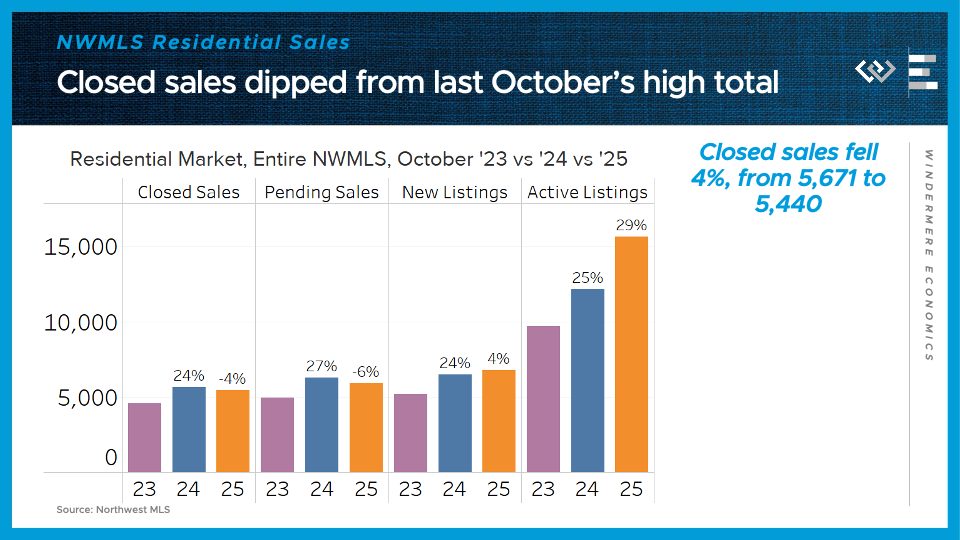

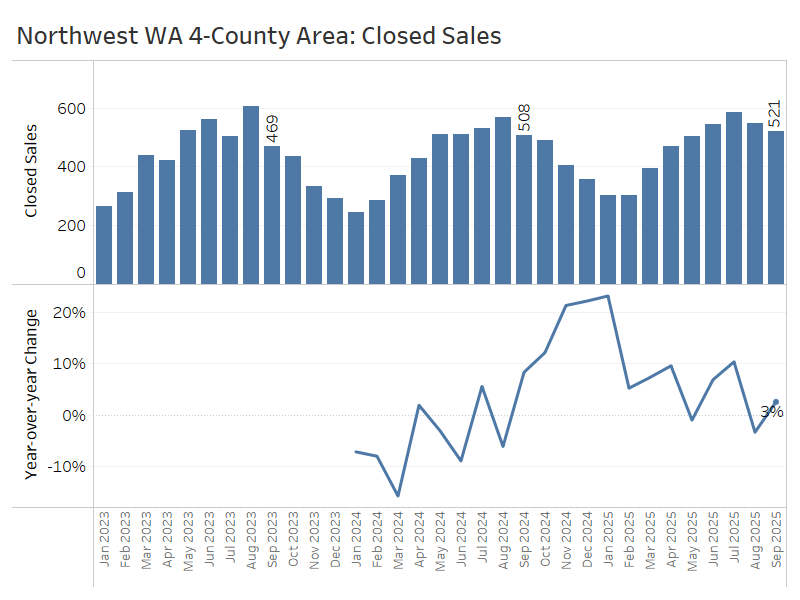

Across the Northwest MLS, closed home sales came in 4% below last October’s total. MLS. Pending sales, which give some signal about next month’s sales, were down 6% from the same time last year.

On the supply side, the flow of new listings remains roughly even with last year’s, or just 4% higher. Finally, the month ended with 29% more active listings than last October, continuing a slowdown in inventory growth but still leaving buyers with more options than they had last year or the year before.

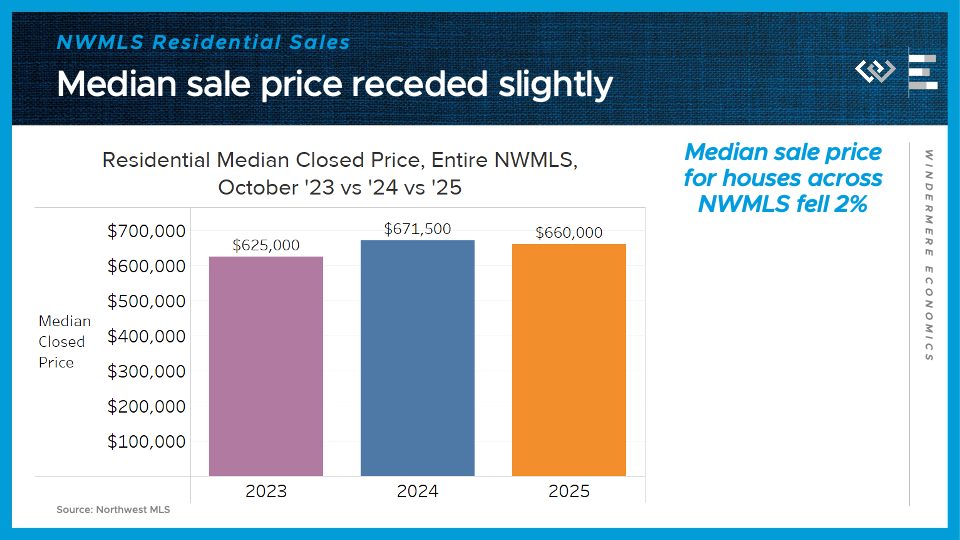

Those higher inventory levels are starting to put some downward pressure on prices, which dipped 2%, to a median of $660,000 for a residential home sale in October.

Now I’ll turn to a closer look at the four counties encompassing the greater Seattle area.

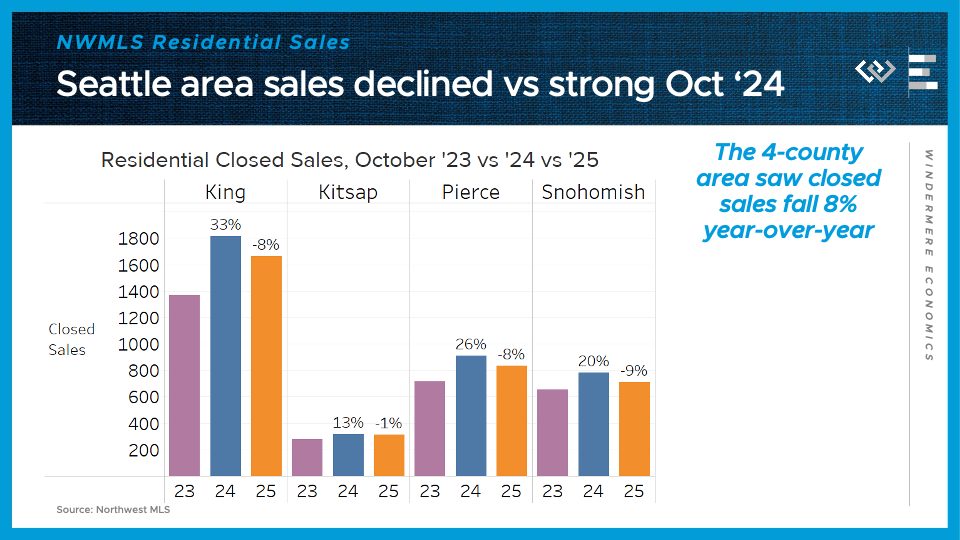

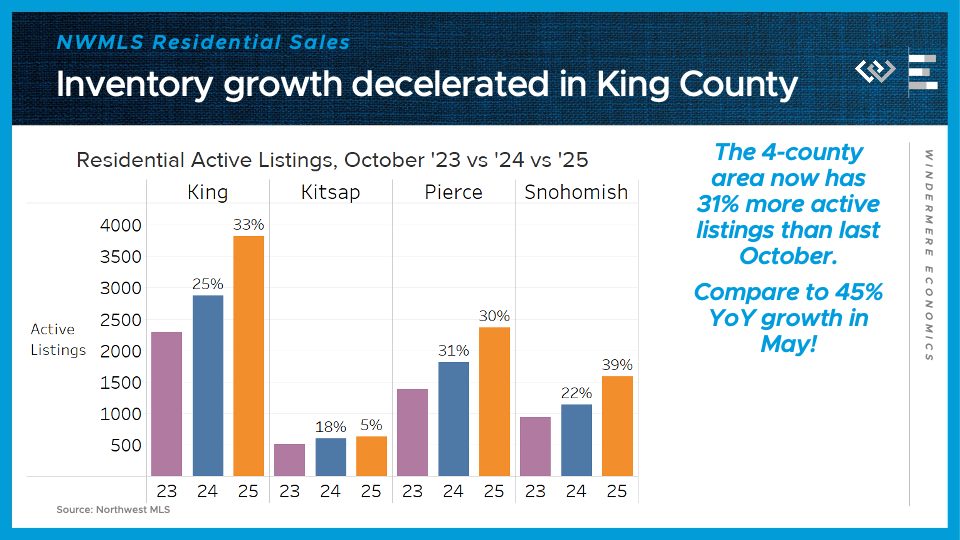

Closed sales stepped down by 8% from last October, although that month last year had unusually high sales, especially in King County, where 2024’s sales were a whopping 33% higher than in 2023.

Median sale prices were split: 4% higher in King; 9% higher in Kitsap; but 2% lower in Pierce, and 5% lower in Snohomish County. That may represent a continued trend of demand retrenching toward the employment center of the region, around Seattle and Bellevue, as new return-to-office policies come into effect.

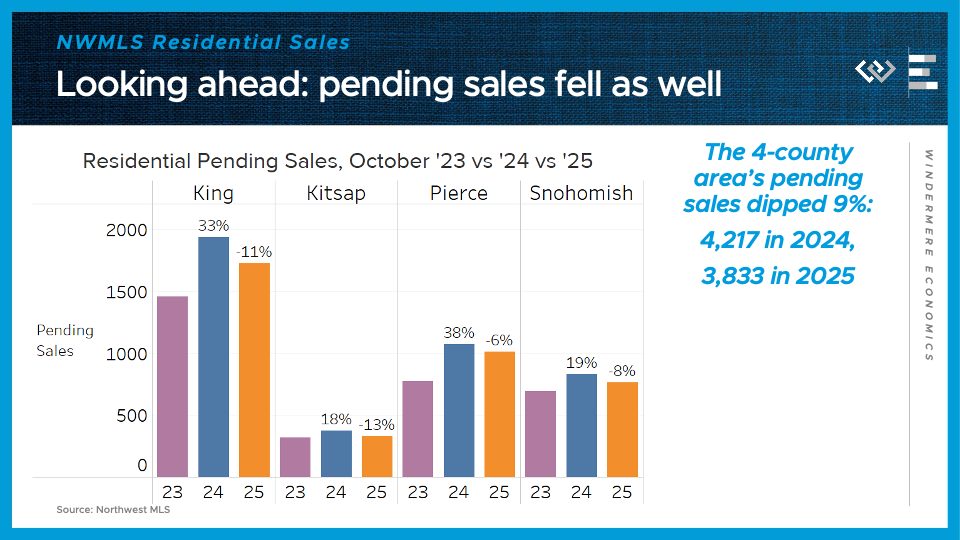

Looking ahead, pending sales fell 9% across the region, although again King County’s sales drop looks a bit like mean reversion after a standout 2024 number.

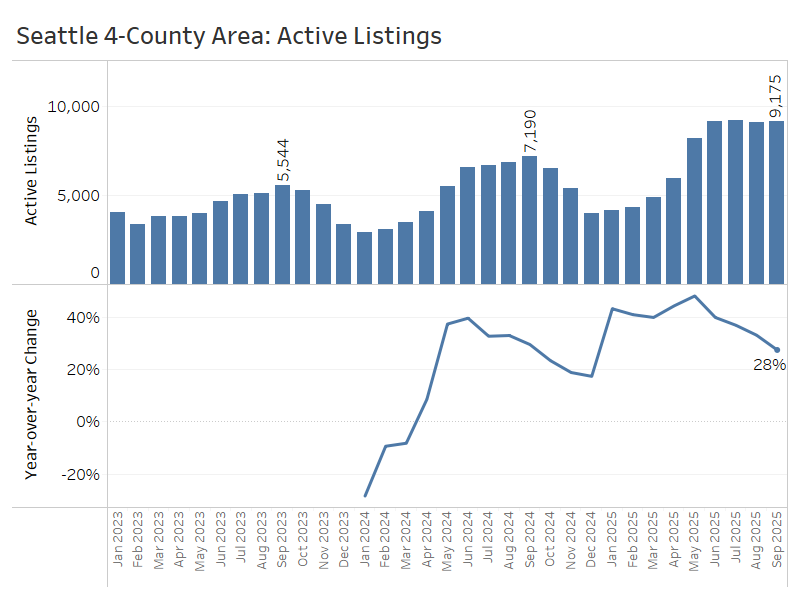

On the supply side, the 4-county greater Seattle area had 31% more active listings than at the end of October 2024. That continues the moderation of inventory growth we’ve seen since May, when this metric peaked at 45% year-over-year growth.

Looking ahead, we are entering one of the best times of the year for savvy buyers and their agents to find a bargain, and with much more inventory than even this time in the last two years. Whether they jump at the opportunity will be revealed in next month’s data!

Numbers to Know 10/22/25: The Latest on Jobs, Housing & Mortgage Rates

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

The government has shut down, and that means most government data publication has paused as well. The monthly CPI inflation report is delayed, and the monthly jobs report is suspended this month. So I’ll have to plan to revisit those when they resume, and in the meantime, I’ll start by checking in on the last publication out of the BLS before the shutdown: the Job Openings and Labor Turnover Survey, or JOLTS for short.

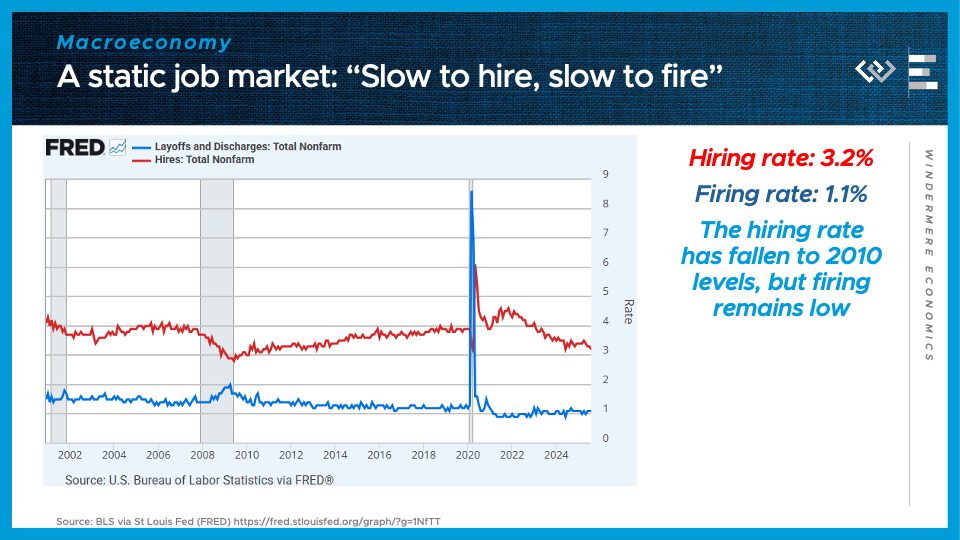

3.2%

That was the hiring rate in August, meaning the share of the workforce that just got hired. It’s around the lowest hiring rate since 2010, when the economy was just beginning to dust itself off and climb out of the Great Recession. It’s one half of a simple summary of the economy that labor economists have been using for a couple years now: “Slow to hire, slow to fire.”

1.1%

That’s the rate of layoffs and discharges, or, broadly, the firing rate, to fit the rhyming scheme. It is not particularly high right now, even if it’s up slightly from the essentially record-low firing rate below 1% we saw briefly in 2022.

Putting it together, what “Slow to hire, slow to fire” means is that employers are essentially hunkering down, hanging on to their workers but not interested in growing those payrolls quickly. For people with jobs, this means the economy feels essentially OK – not great, but OK. But for those without a job, it’s proving unusually hard to break back into the workforce, which makes this a terrible time to be unemployed, and is gradually inflicting stress on the credit system and consumer spending. These are early signs of an economic slowdown, but not yet any indication of a recession.

Turning to the housing market: we’ve got a familiar refrain this month. More inventory means buyers have gained more negotiating leverage, although September likely represented the high-water mark for the year, with about 1.1 million active listings for the 3rd month in a row. That’s 17% more than the same time last year.

Importantly, inventory growth has passed an inflection point: for the fourth month in a row, the pace of growth of inventory has fallen yet again. Growth has now been roughly cut in half, from the 32% annual growth seen in May. That means inventory is not on a runaway growth track toward a glut that would push prices down. Rather, the market is re-equilibrating, as some sellers steer clear of a buyers’ market, or de-list after not getting a satisfactory offer. For buyers, it means conditions have moved in their favor but they shouldn’t count on that trend intensifying much further.

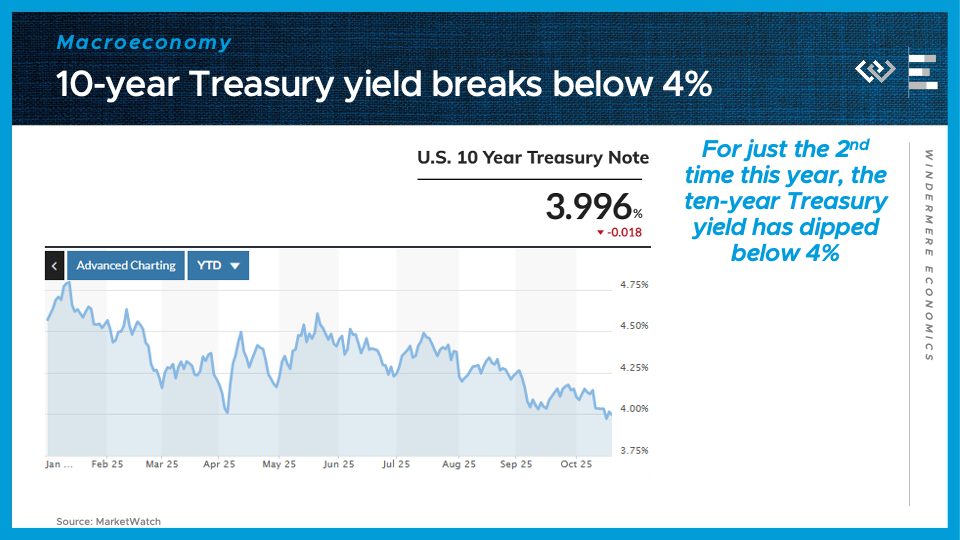

Another helpful factor for buyers, though, is that borrowing costs have continued to fall. The ten-year treasury yield, which is a major benchmark that mortgage rates tend to track, plus about 2 points, has now dipped below 4% for the first time this year. That reflects the combination of lower expected economic growth, and the resulting lower Fed Funds Rates expected over the next few years, as the Fed reacts to try to prevent a recession.

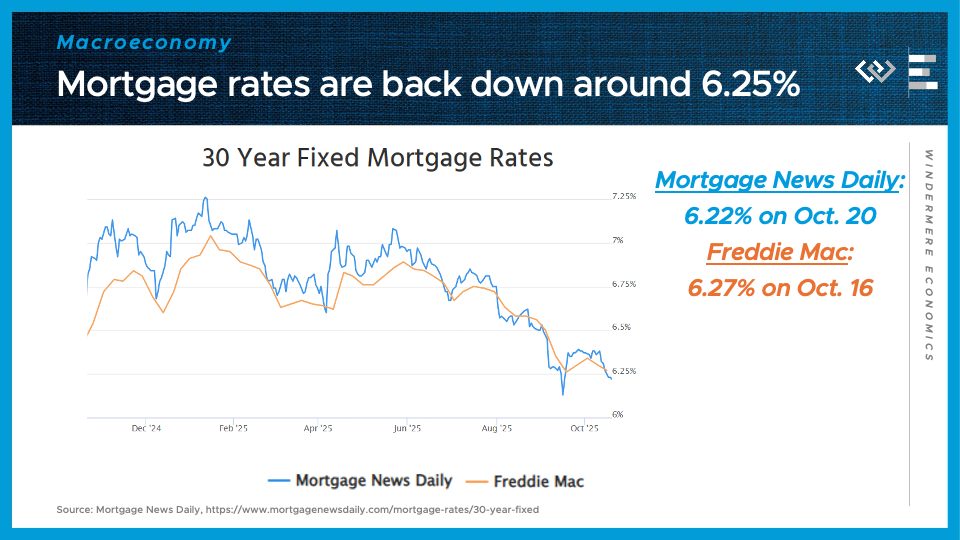

Hand in hand with those lower Treasury yields: Mortgage rates are moving back into their most favorable territory in 12 months, right around 6.25%. That represents significant savings compared to the rates of around 7% to start the year, and is partly driven by investor expectations of interest rate cuts to come. Because those expectations are already factored into the lower rates today, there’s no guarantee that mortgage rates will fall further even if and when the Fed continues cutting its overnight rate.

That is all for this month; I hope we’ll have more BLS data next month, and thanks as always for watching!

Housing Market Cools Alongside Economy in Third Quarter

This is the first in a recurring series of blog posts taking a closer look at the U.S. economy and several major regional markets in Windermere’s nine-state footprint. Updates will be released on a quarterly basis.

Economic Overview

After a slow spring, the U.S. housing market cooled further this summer, with price gains leveling off and sales holding steady. Existing home sales have hovered around an annualized pace of 4 million through August—nearly identical to last year’s unusually low 4.06 million. Mortgage rates dropped in the third quarter, falling from an average of 6.82% in May and June to 6.35% in September. The combination of rising inventory, softer pricing, and lower mortgage rates is making this fall a good time to buy a home.

Source: Freddie Mac via FRED.

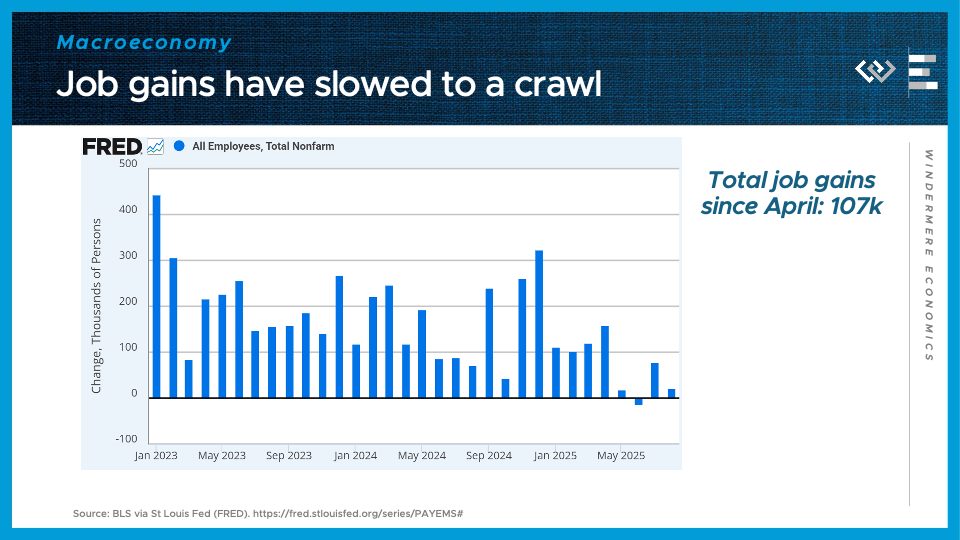

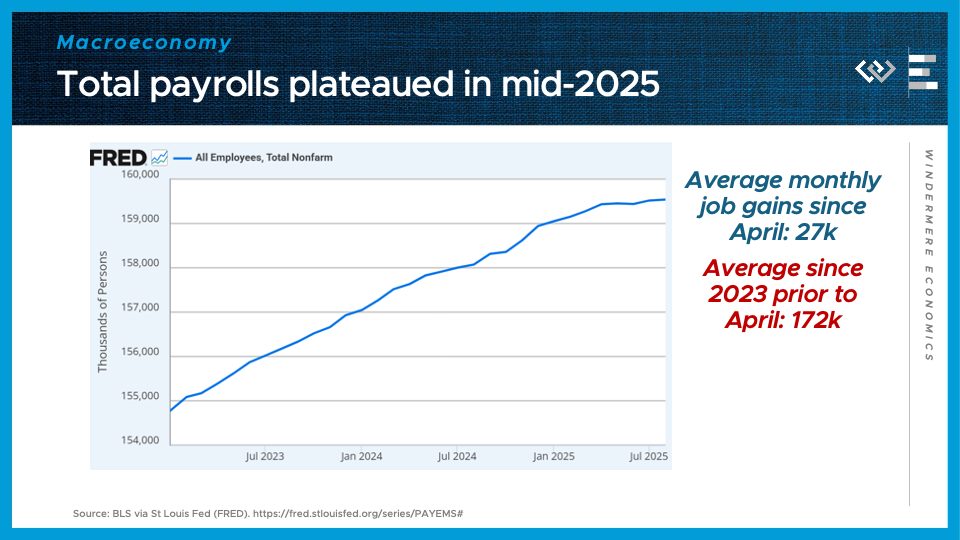

A key driver behind falling mortgage rates is the cooling U.S. economy, following a sharp slowdown in job growth over the summer. After revisions, nonfarm payrolls show little to no growth from April through August, and the next jobs reports are on hold due to the government shutdown. While slower growth poses challenges, it often brings the silver lining of lower interest rates—and this cycle appears to be following that pattern.

The following is a detailed overview of recent housing trends across six regional markets within Windermere’s footprint during the third quarter of 2025. They include Greater Seattle Area, Greater Portland Area, Greater Sacramento Area, Northwest Washington State, Spokane County, and Salt Lake County.

Greater Seattle Area (King, Snohomish, Pierce, and Kitsap Counties)

High inventory in the greater Seattle area has swung the balance of negotiating power in buyers’ favor across the region this year. As of the end of September, buyers could choose from nearly 9,200 active listings—8% more than the same time in 2024. Still, inventory growth has slowed throughout Q3, from a peak of 48% year-over-year growth back in May. Slower inventory growth means we are not headed for a glut of listings, which is good news for sellers.

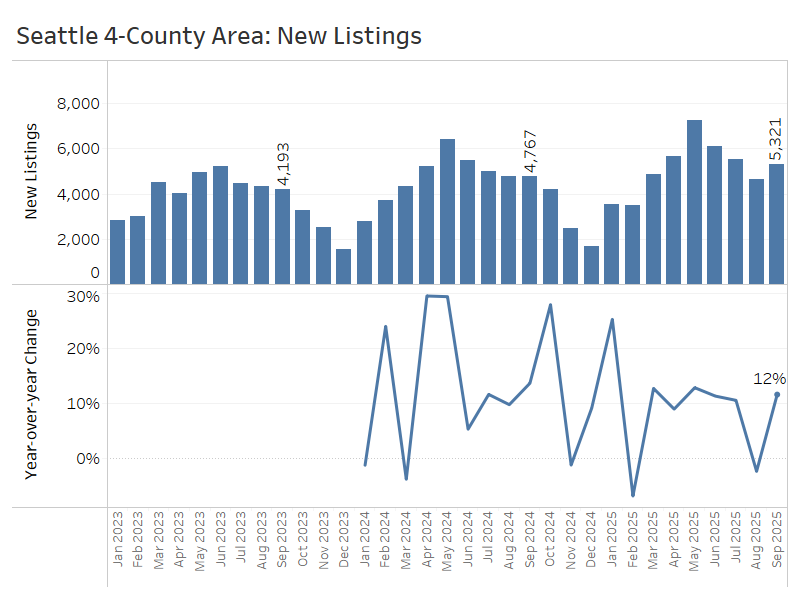

Inventory growth reflects several consecutive months of rising new listings outpacing closed sales, which gradually replenishes the supply of homes for sale. In September, the greater Seattle area had just over 5,300 new listings—about 12% more than last September. The entirety of Q3 reported 15,500 new listings, a 7% increase from Q3 2024.

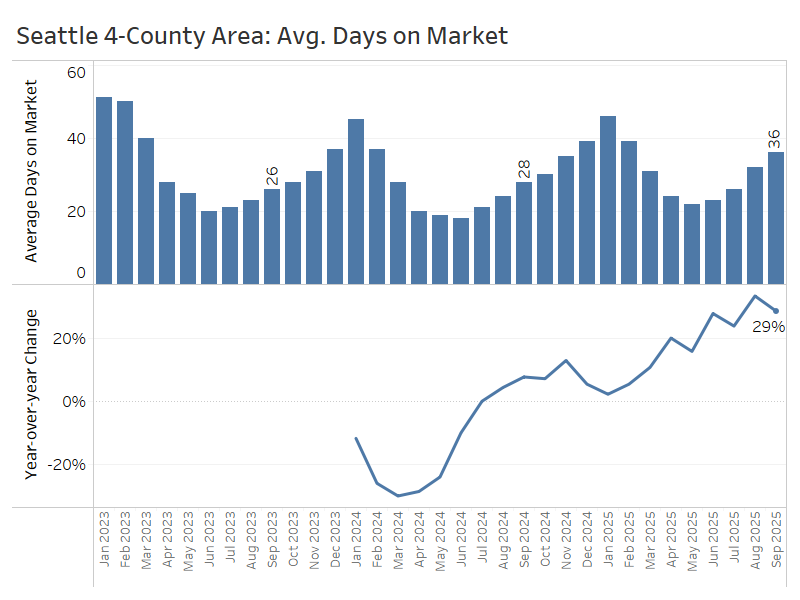

Not only do buyers have more options compared to a year ago, but they are also seeing listings linger on the market longer : an average of 36 days on market in September, up from 28 days last year. Days on market were substantially longer than last year’s levels in each month of Q3.

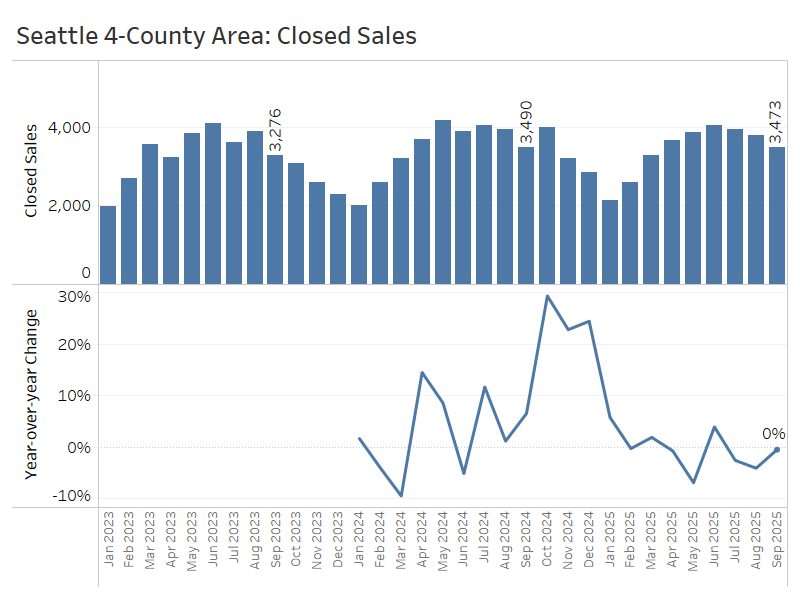

Unfortunately, the growth of inventory and new listings has not done much to generate home sales. Closed sales in September totaled just under 3,500—virtually unchanged from the same period last year—following year-over-year declines of 3% in July and 4% in August.

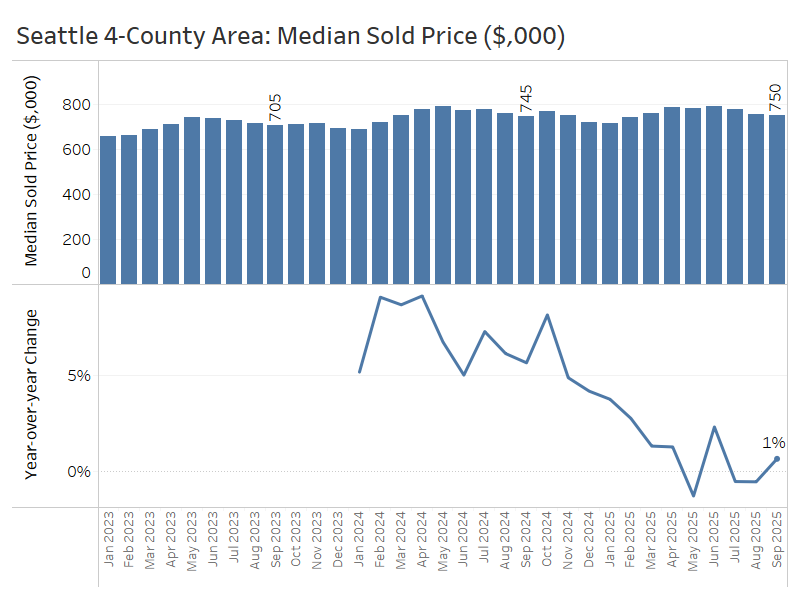

Home prices remain flat alongside sales. September’s median price of $750,000 was up less than 1% from a year ago, after slight declines in July and August. High mortgage rates and affordability challenges are capping price growth, while rising inventory will likely put downward pressure on prices going forward. The wildcard is seller behavior—whether they’ll cut prices to sell or hold firm and wait.

The greater Seattle region is still grappling with elevated inventory, but it has clearly passed an inflection point: inventory growth decelerated over the third quarter, preventing conditions from swinging much further in buyers’ favor. As it stands, they’ll still have ample options and negotiating leverage this fall and winter.

Greater Portland Area (Multnomah, Washington, Clackamas, and Clark Counties)

Broadly speaking, the greater Portland area housing market has entered the same holding pattern as many other Western U.S. cities: flat sales and prices; rising inventory and days on market; more negotiating power and options for buyers.

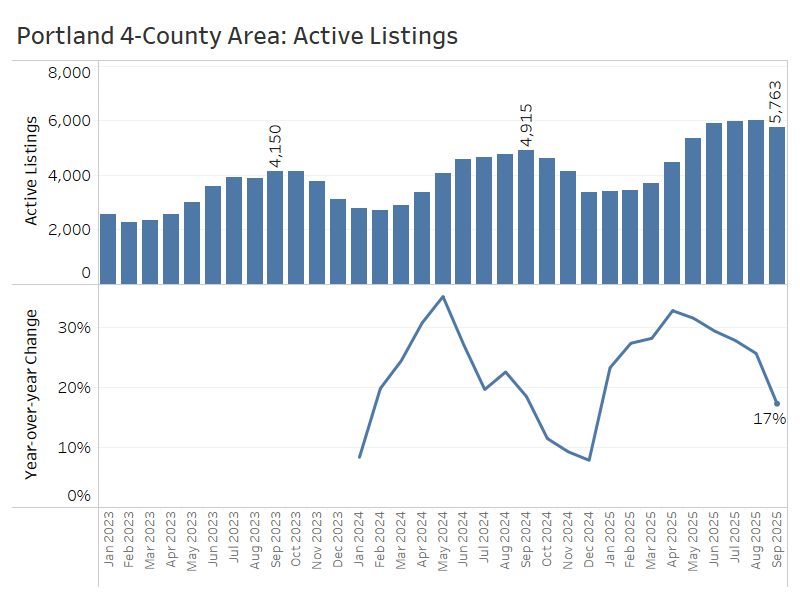

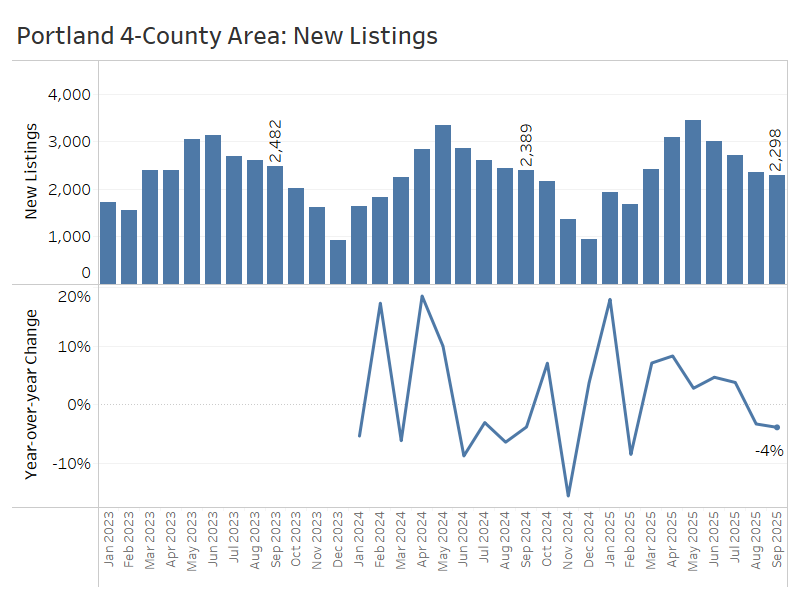

Active listings in the Portland area now stand close to 5,800, or about 17% more than this time last year. But the pace of inventory growth has decreased sharply since hitting 33% in April.

The slowdown in inventory growth can partly be attributed to a lower flow of new listings. The four–county Portland area saw year-over-year declines in new listings in both August and September, as some homeowners balked at listing in a slower market.

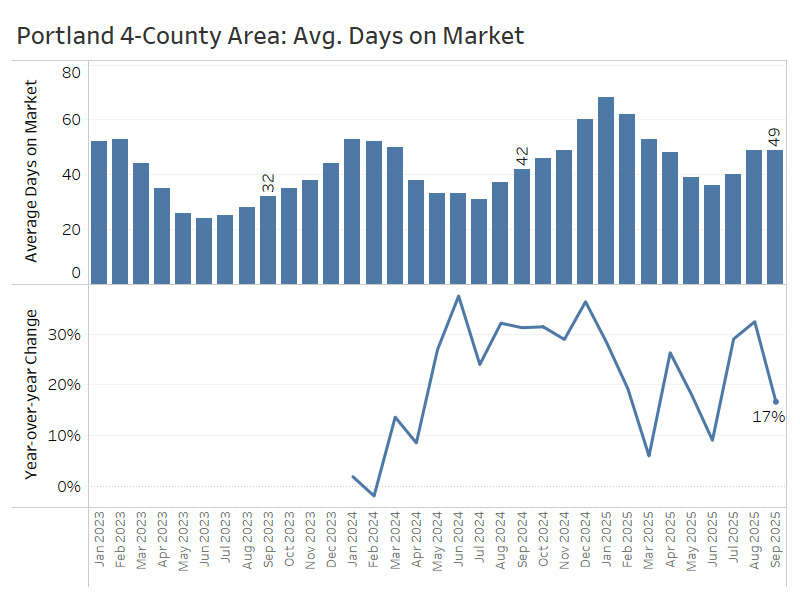

The average home sold after 49 days on the market—about a week longer than last September. This slower pace helps explain the higher inventory levels observed this year.

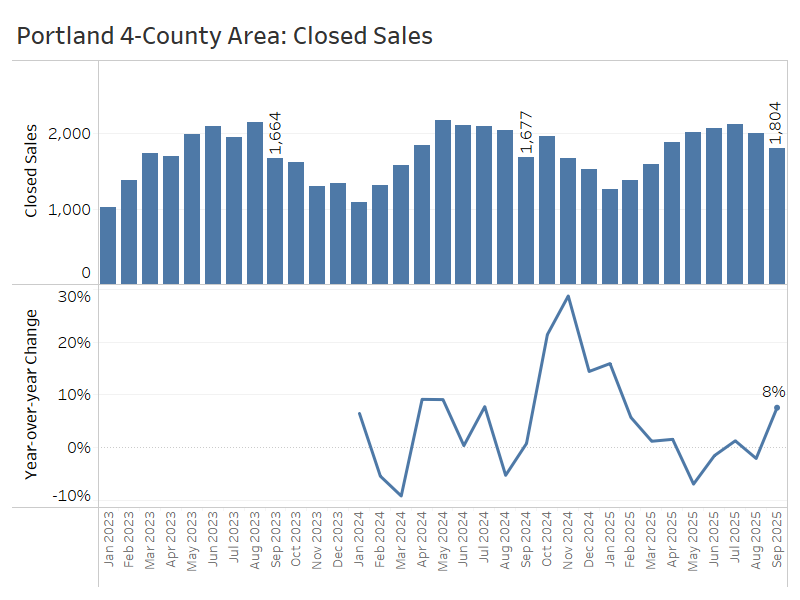

Closed sales of single-family homes climbed 8% year over year in September, following relatively flat activity in July and August. Sales volume momentum dropped sharply in May of this year, after impressive growth in late 2024.

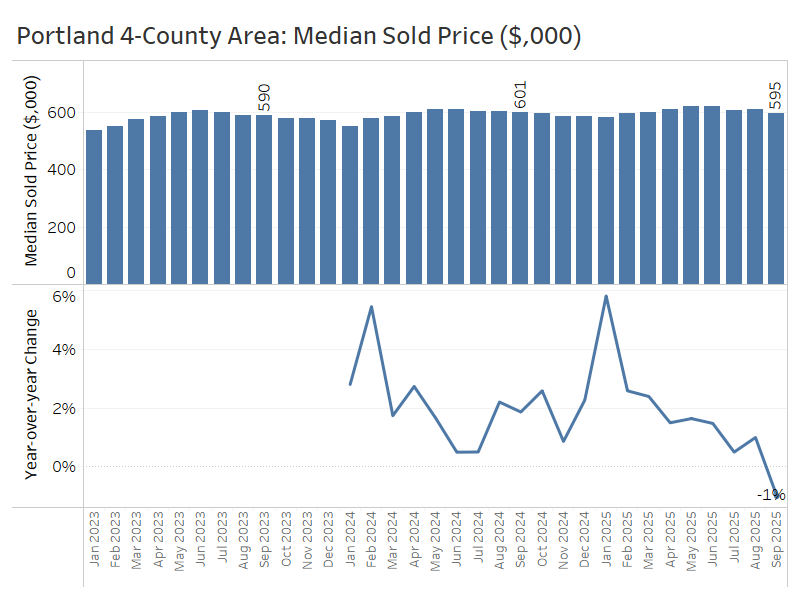

Alongside rebounding sales activity in September, the median home price edged slightly below year-ago levels—slipping from just over $600,000 to about $595,000. This trend of flat or modestly negative price growth is giving household incomes some time to catch up with the higher mortgage costs we’ve seen this year.

All in all, the greater Portland area seems to be working through the early stages of a market cooldown. The buildup of inventory is beginning to put downward pressure on home prices, which appears to be discouraging some would-be sellers while also creating opportunities for buyers.

Greater Sacramento Area (Sacramento, Yolo, El Dorado, and Placer Counties)

The greater Sacramento area has followed a similar trajectory to Portland, with market conditions gradually shifting in favor of buyers. Inventory has climbed, prices have cooled, and sales activity has remained relatively flat. That said, the pace of inventory growth has recently slowed, and home sales perked up in September, hinting at a possible shift in momentum.

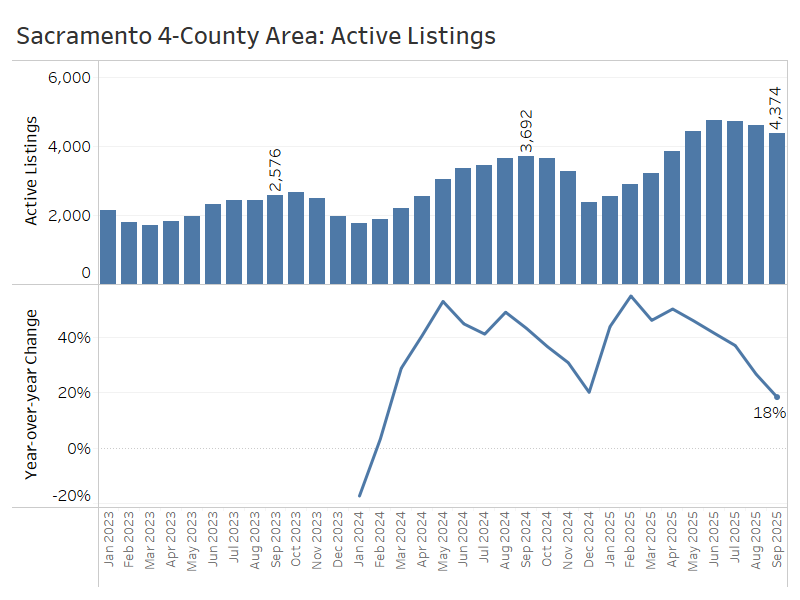

At the end of September, there were nearly 4,400 active listings—an increase of 18% compared to the same time last year. However, the pace of inventory growth has slowed considerably since earlier in the year when year-over-year gains peaked at 55% in February.

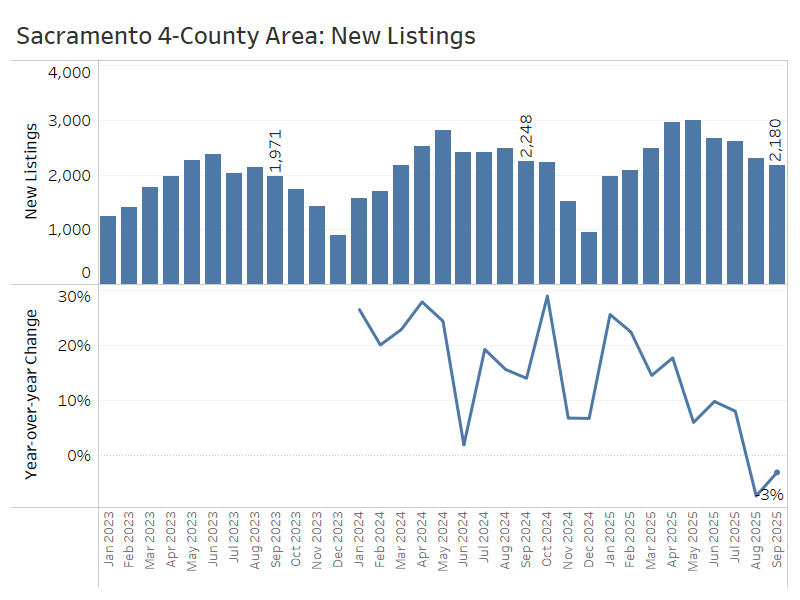

The flow of new listings has fallen below its year-ago pace for two months running now, with about 3% fewer new listings in September than last year.

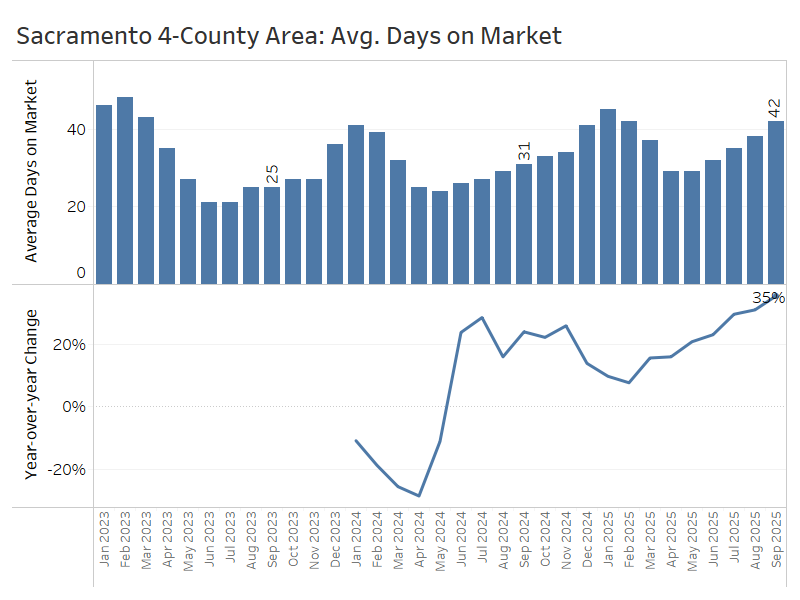

Average days on market rose by about 11 days compared to last year, reaching 42 days in September—a noticeable shift in how long homes are taking to sell.

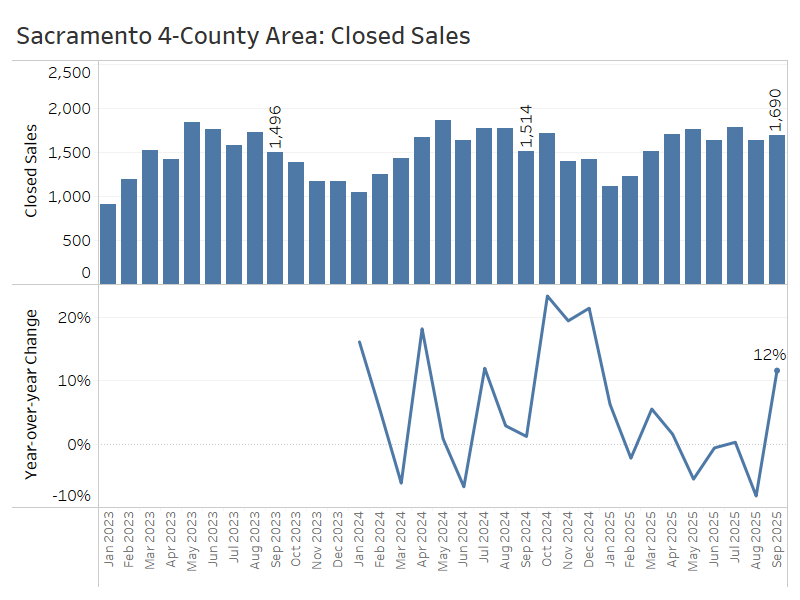

After a period of solid sales growth in Q4 of 2024, the Sacramento region returned to low or negative growth through much of 2025. However, September saw a 12% year-over-year increase in sales, which might reflect a rebound from a weak August or a boost in buyers attracted to lower mortgage rates in the third quarter.

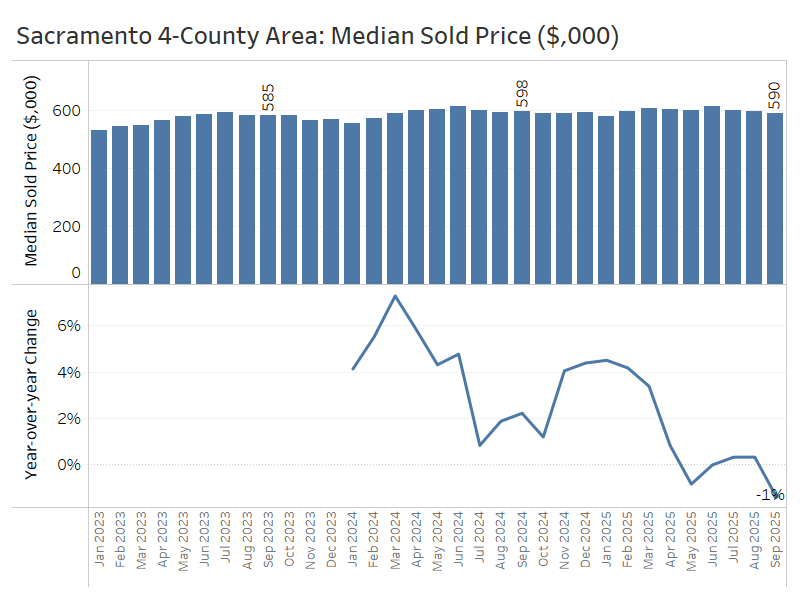

Median sale prices dipped 1%, from about $598,000 last September to $590,000 this year, after staying steady at almost exactly year-ago levels in July and August.

Third-quarter trends in the greater Sacramento area point to a market where rising inventory is finally putting modest downward pressure on prices, even as falling mortgage rates begin to draw some buyers back. That combination could result in an upturn in sales alongside flat price growth.

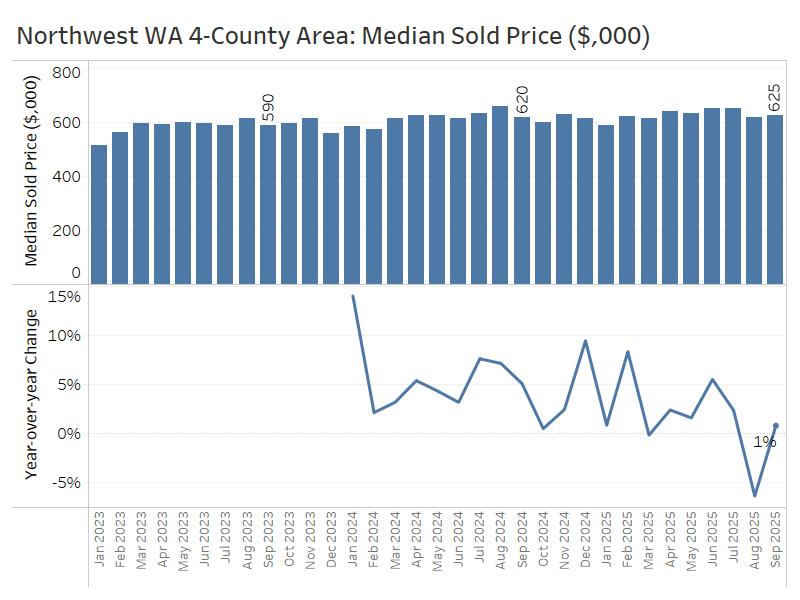

Northwest Washington – Skagit, Whatcom, San Juan, and Island Counties

North of the greater Seattle area, the market conditions in the four northernmost counties of the Puget Sound region are experiencing a major shift in buyers’ favor.

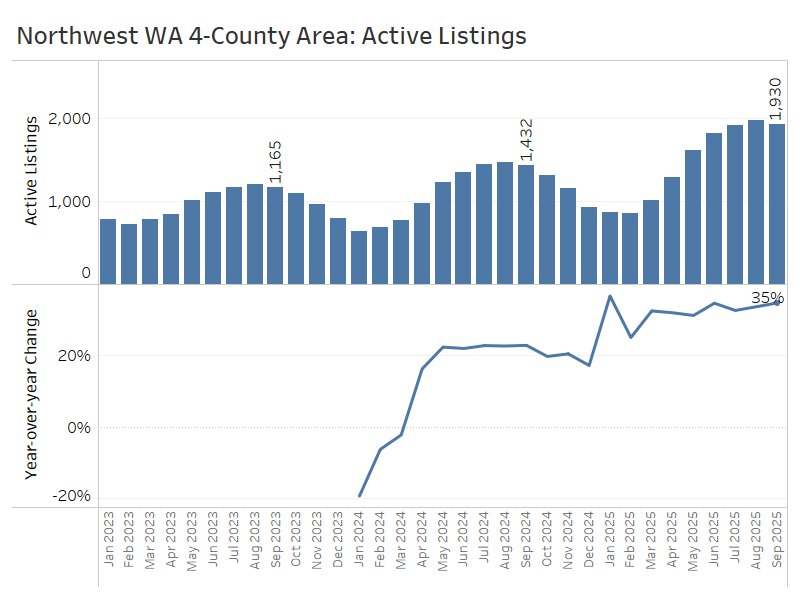

At the end of September, there were 1,900 active listings, up 35% from a year ago. There’s no evidence of a slowdown in inventory growth here, like that of the Seattle area this quarter.

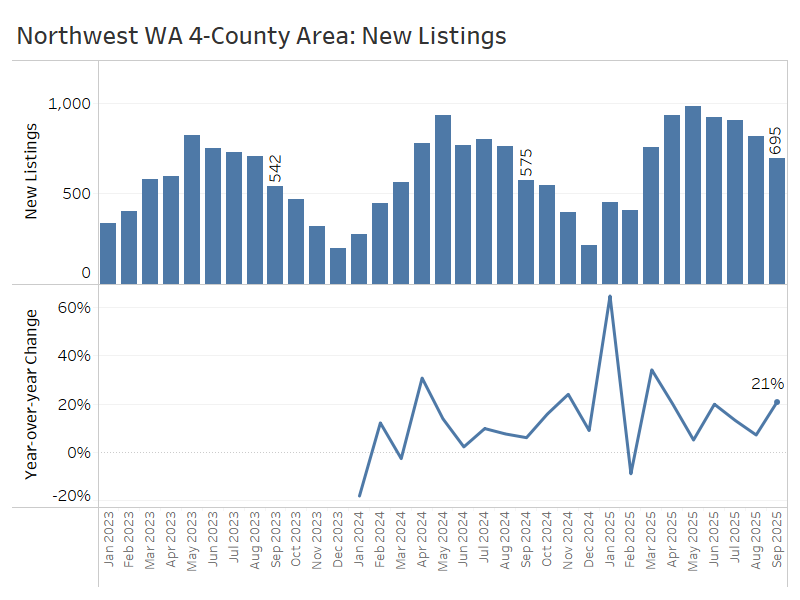

The flow of new listings has experienced healthy growth throughout most of 2025, resulting in a 21% increase compared to September of last year.

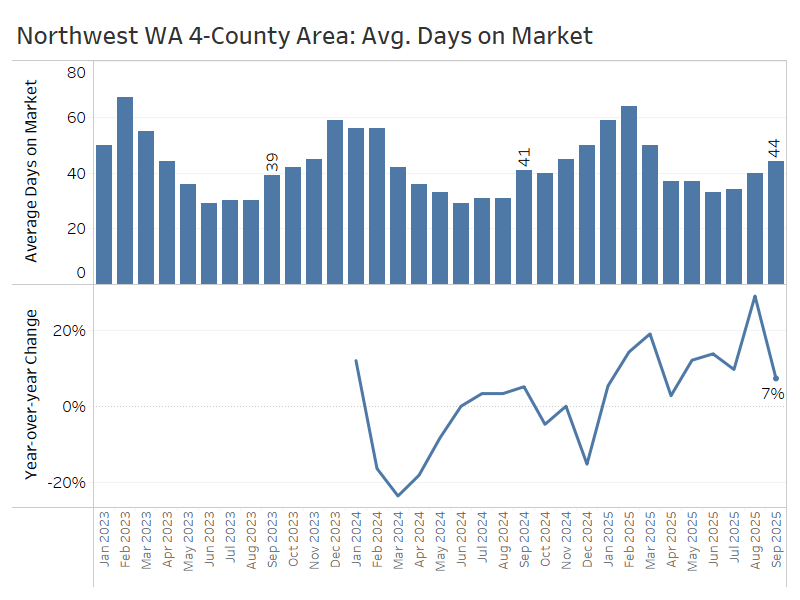

Time on market has climbed modestly but steadily all year, now up to 44 days on average in September, up from 41 days last year.

Closed sales were up 3% year over year in September, after a 3% dip in August and 10% growth in July.

Compared to the same time last year, median home prices rose 2% in July, dipped 6% in August, and then increased 1% in September to $625,000.

Looking ahead, prices will likely cool as buyers take advantage of increased inventory and gain more negotiating power.

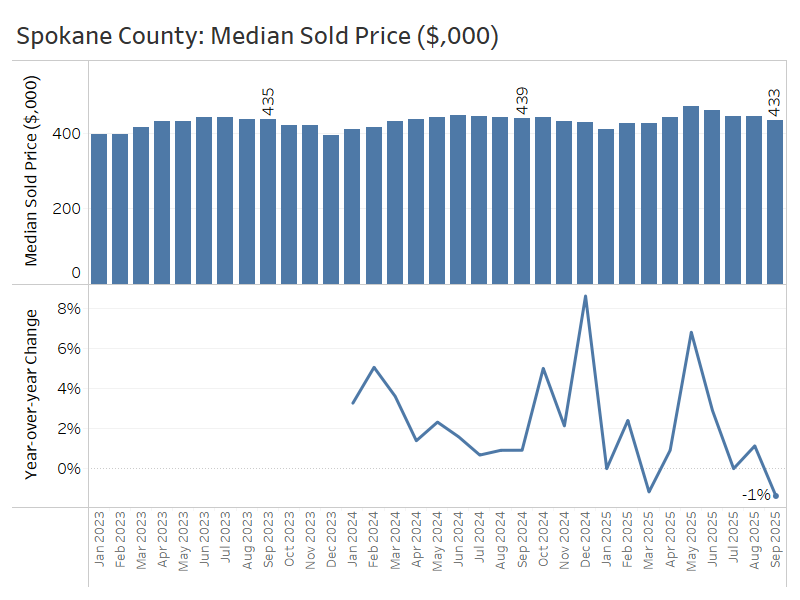

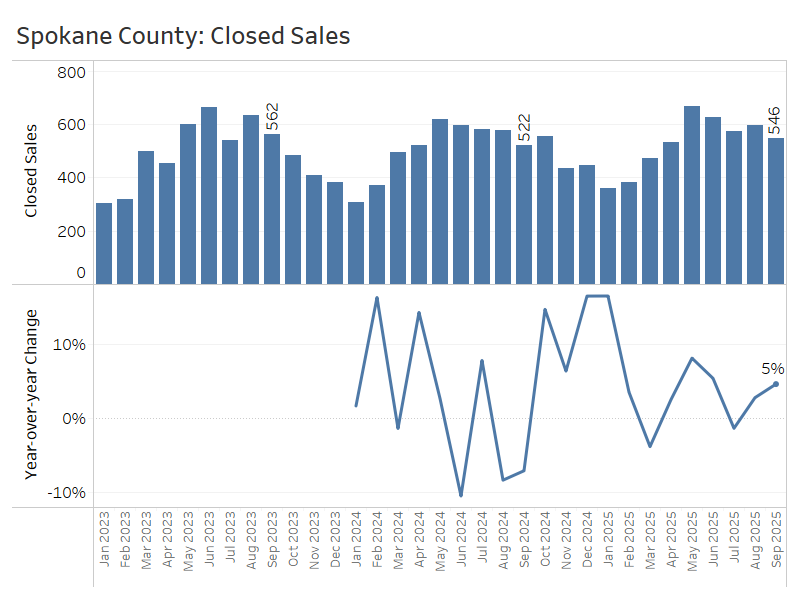

Spokane County, Washington

Spokane County, which anchors Eastern Washington, is experiencing many of the same market trends as Western Washington: higher inventory, softer buyer demand, and flat home prices.

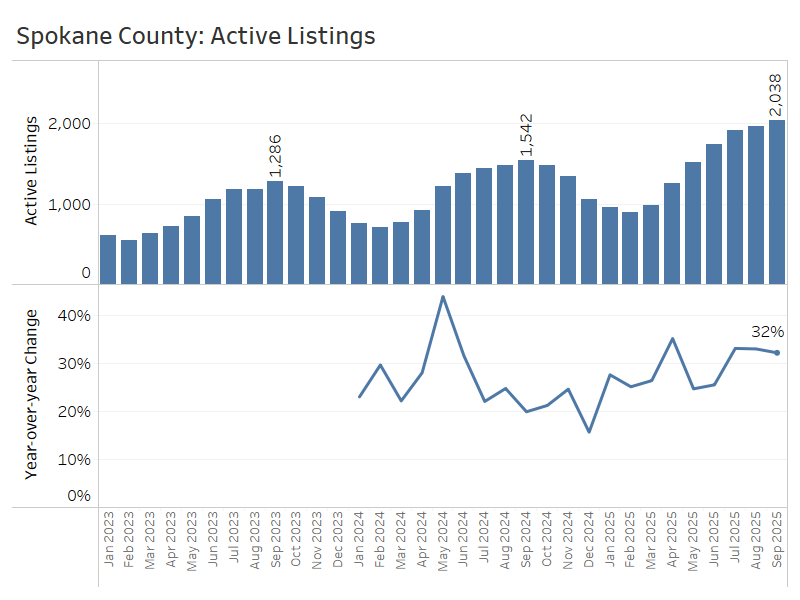

At the end of September, there were just over 2,000 active listings, up 32% from a year ago and significantly higher than two years ago, when there were fewer than 1,300 listings. The pace of inventory growth has only slightly slowed from the 33% year-over-year increases we saw in July and August.

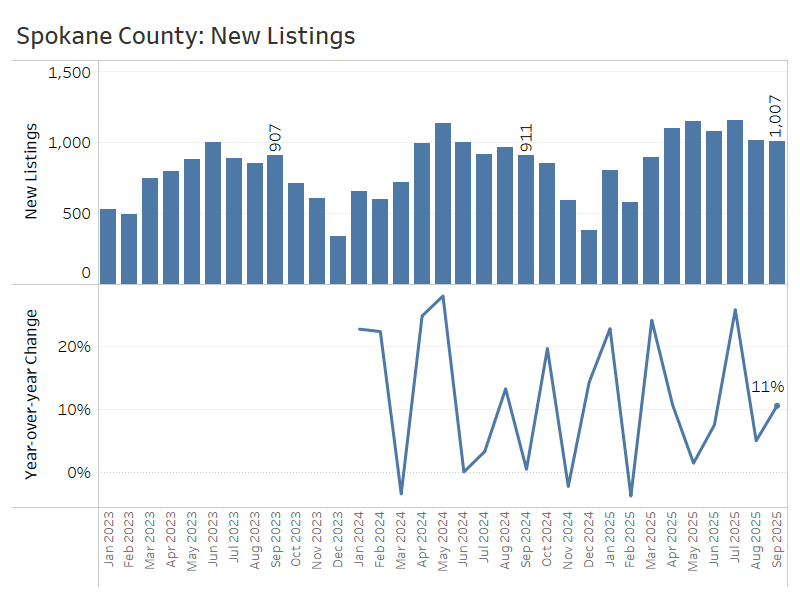

New listings climbed 11% from last September, after increasing 26% in July and 5% in August.

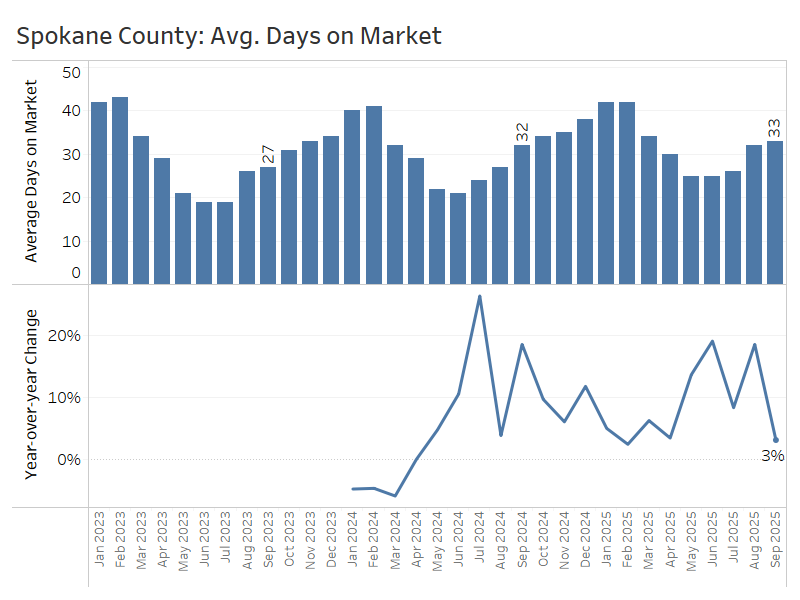

Unlike some of the other markets in this report, Spokane has seen only modest increases in the number of days it takes to sell a home, averaging 33 days this September, up from 32 during the same time last year.

Closed sales in September were up 5% year over year, following a 3% increase in August and relatively flat sales in July.

Compared to last year, median sale prices in September dipped by about 1%, from $439,000 to $433,000. Prices were relatively flat year over year in July and August.

Altogether, the more balanced market conditions in Spokane this summer began to yield more sales activity alongside flat to slightly lower prices— a healthy combination for the market right now.

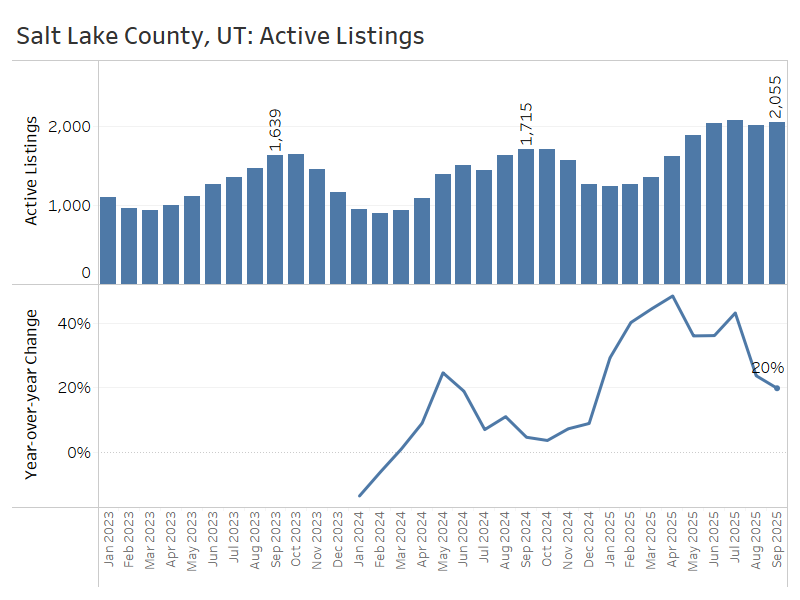

Salt Lake County, Utah

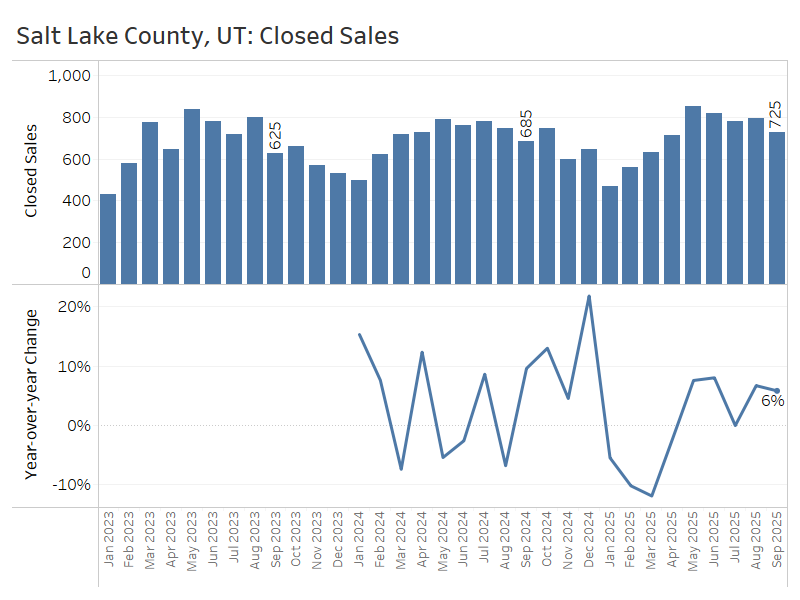

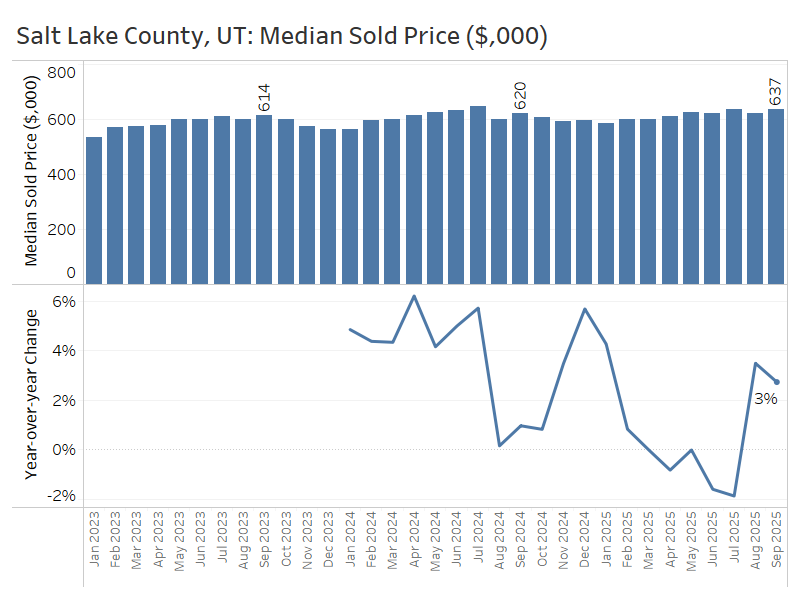

Earlier this year, Salt Lake County experienced an even sharper swing in buyers’ favor than the other markets in this report: higher inventory growth leading to modest price declines. Increasing sales growth in the third quarter shows that buyers have begun to take advantage of these conditions.

Active listings at the end of September stood at over 2,000 homes, up 20% from a year ago—a major slowdown from 43% inventory growth in July.

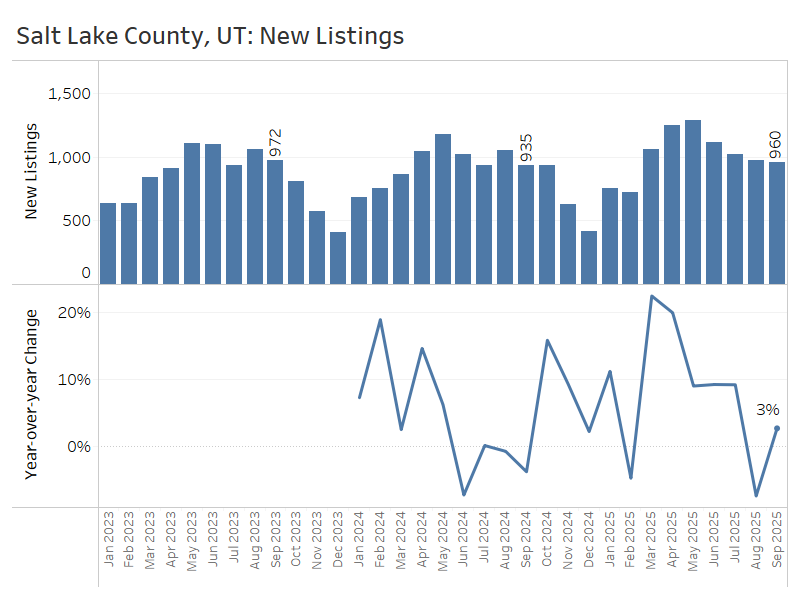

Salt Lake County saw substantial year-over-year growth in new listings earlier this spring, exceeding 20% in March and April, but only 3% growth in September. Selling enthusiasm seems to have faded this summer after the buildup of inventory in late spring.

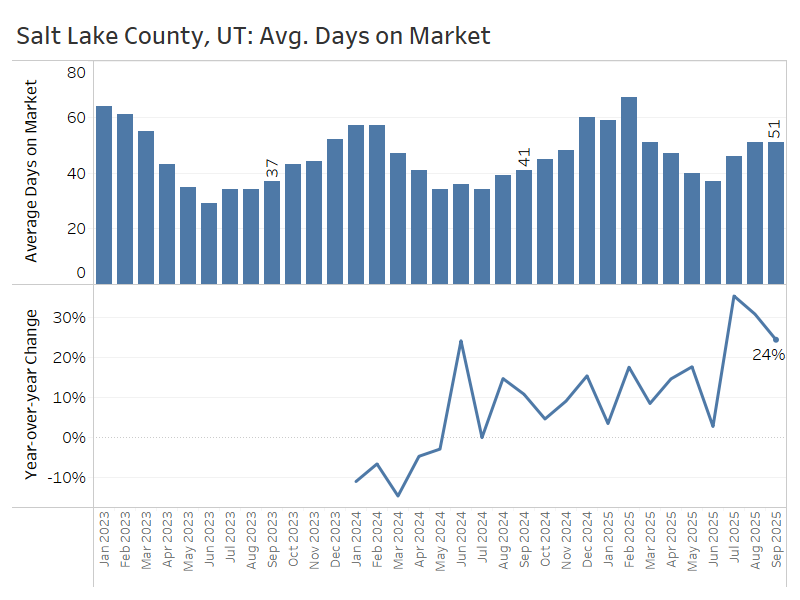

The average number of days it took to sell a home in Salt Lake County was up substantially throughout the third quarter, ending at 51 days in September compared to 41 days the previous year.

Closed sales climbed 6% from a year ago in September, after a 7% increase in August. This is a promising early sign that buyers are responding to improved inventory and mortgage rate conditions.

In September, the median sale price rose 3% year over year—from $620,000 to $637,000. This uptick, along with August’s gain, broke a streak of modest price declines seen earlier in the summer.

All in all, Salt Lake County has begun to show a bit more balance after swinging in buyers’ favor earlier this year: inventory gains slowed down, and rebounding demand showed up in both rising sale counts and prices.

Conclusion:

All of the markets covered in this report have shifted into balanced or buyer-friendly territory, so it’s a good time to plan accordingly.

A consistent theme across the regions is the rise in inventory, paired with flat home sales and relatively flat prices compared to a year ago. This environment offers prospective buyers several advantages: more homes to choose from, greater leverage to negotiate, and less pressure to rush into a decision or compete in bidding wars.

For sellers, it’s important to be aware that the market has changed. Unlike the last several years, buyers now have more options, and home prices have leveled off. Success in today’s market depends on setting a realistic list price and presenting the home in its best possible light. With the right strategy, many homes are still selling quickly—and even above asking price—in every market highlighted in this report.

Sources: TrendGraphix analysis of NWMLS, RMLS, Spokane MLS, MetroList MLS, and Wasatch Front MLS data.

As Principal Economist for Windermere Real Estate, Jeff Tucker is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Jeff has over 10 years of experience as an economist at companies such as Zillow, Amazon, and AirDNA.

Numbers to Know 9/18/25: Why the Fed Cut Rates & What It Means for Housing

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

The Fed has finally started cutting. The two big questions are: Why? And now what?

I’ll start with the why: the labor market has started showing signs of distress. The August jobs report delivered more bad news, continuing a streak of weak job growth since April.

The overall growth of nonfarm payrolls – the number of employed workers in the country – clearly passed a turning point this spring, as growth as slowed to a crawl.

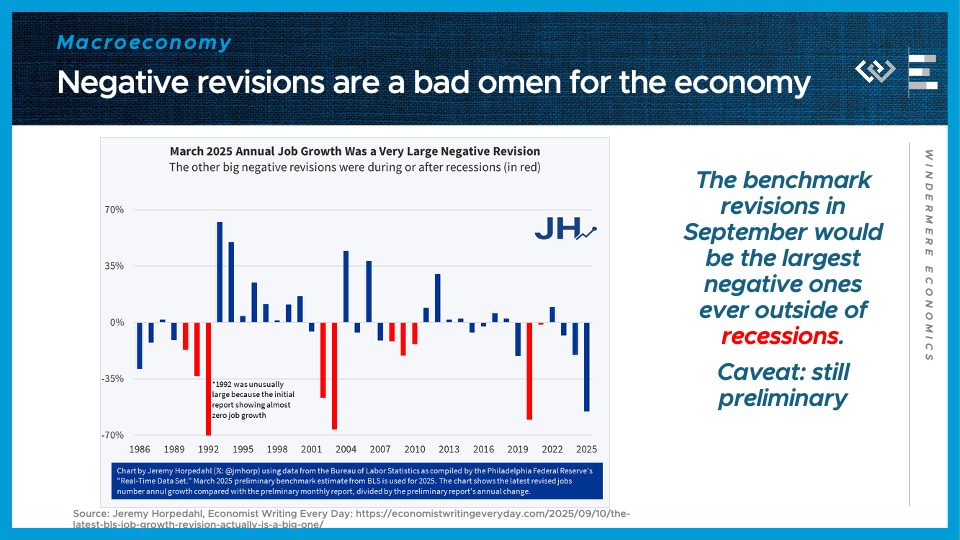

Moreover, the Quarterly Census of Employment and Wages just revised away more than HALF of the job growth previously estimated to have happened in the year ending March 2025, wiping out over 900,000 jobs originally thought to have been added in those 12 months.

Historically, as this chart by Jeremy Horpedahl highlights, big negative benchmark revisions, like the preliminary one released this month, have occurred during recessions. And big negative monthly revisions, like last month’s have been more common just before recessions.

That doesn’t mean a recession is around the corner, but it helps explain why the Fed is changing their posture to try to stop a recession before it gets going.

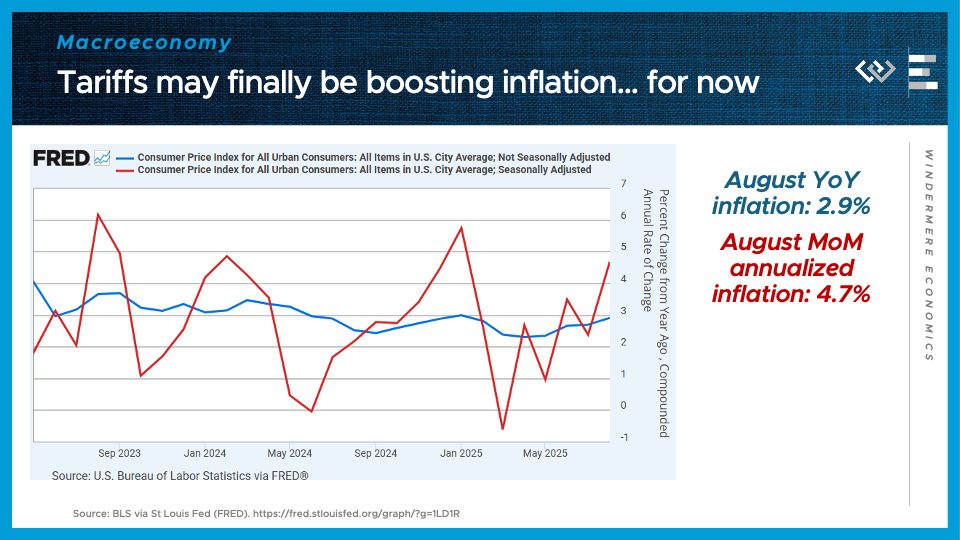

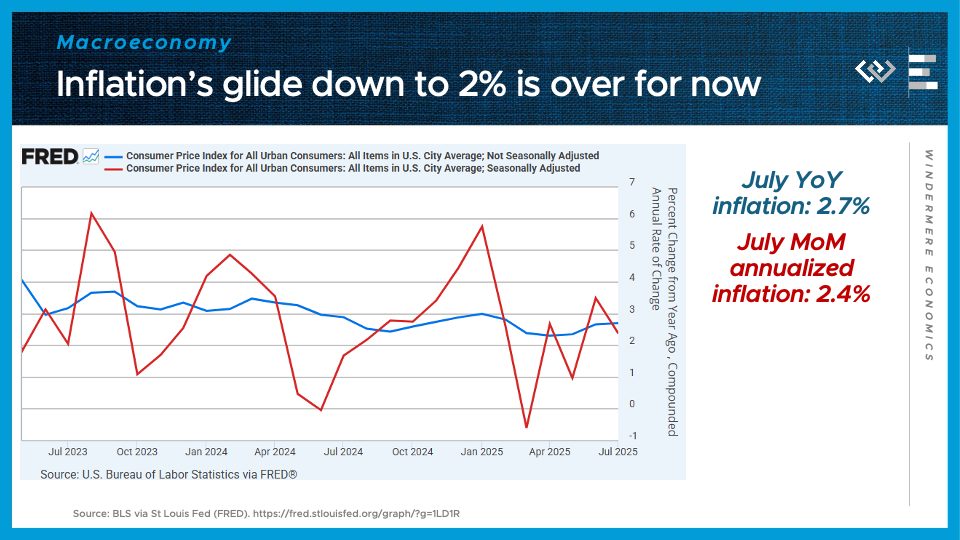

One challenge they’re facing, though, is that they have paused their fight against inflation before it was quite finished: annual inflation stopped falling this spring, and has now re-accelerated to nearly 3%; the more volatile monthly inflation rate is running at 4.7% annualized. Part of the reason the Fed is now willing to cut may be that they view some of this inflation as a transitory, one-time bump from tariffs, that they are willing to look through; but I think the biggest reason is just that the warning sirens in the labor market became too loud to ignore.

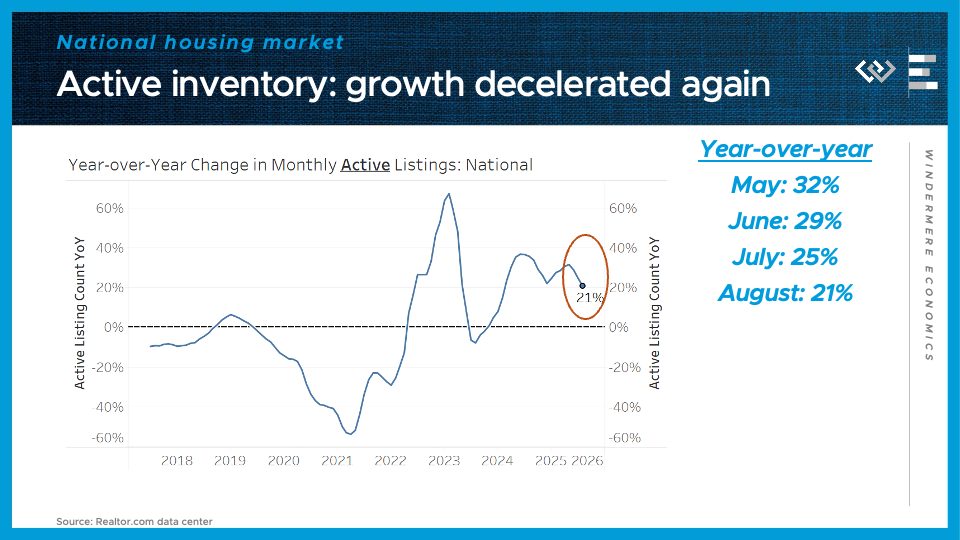

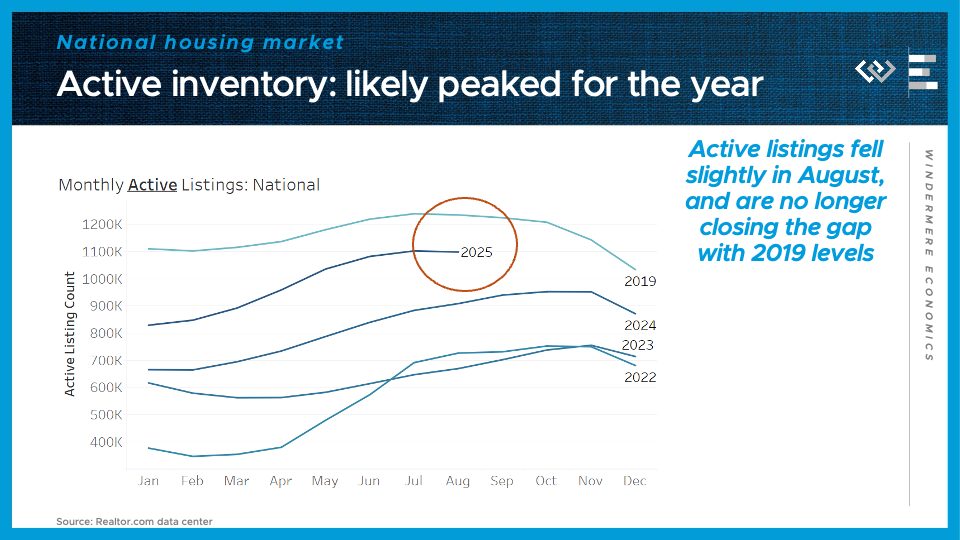

Turning to the housing market: the balance of power has swung in buyers’ favor this year, thanks to higher inventory, but it’s now clear that inventory growth passed an inflection point: for the third month in a row, the pace of growth of inventory has come down again. Now it’s down to just 21% growth from August of last year.

At the end of August, there were just under 1.1 million active listings on the market – down slightly from July, while each of the last 3 years saw inventory grow in August. This means buyers are still favored in many markets, but they can’t count on that pendulum to keep swinging further in their favor.

Especially because of the huge news for everyone in the housing market: mortgage rates have fallen to the neighborhood of 6 and an 8th percent, roughly their lowest level since 2022. Investors were anticipating this rate cut by the Fed, and if anything, the fact that the Fed was willing to press ahead with cutting rates, in spite of firmer inflation data, demonstrates their commitment to focus on helping the labor market with easier monetary policy, while setting aside inflation fighting to another day. Maybe more than anything, that change of posture by the Fed is helping to bring mortgage rates low enough that well-qualified borrowers are starting to see a 5-handle without paying any points. There’s no guarantee that the low rates will last – just look at what happened last October, so I’d advise everyone to strike while the iron’s hot. If rates do fall further this winter, well, you can always refi then.

Local Look Western Washington Housing Update 9/8/25

Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the August 2025 data from the Northwest MLS.

This summer, the local market has decisively swung in buyers’ favor, as home sellers around Washington have had to contend with both softening demand, and more abundant competing listings. That’s good news for home buyers, but we are seeing fewer of them than we saw last year.

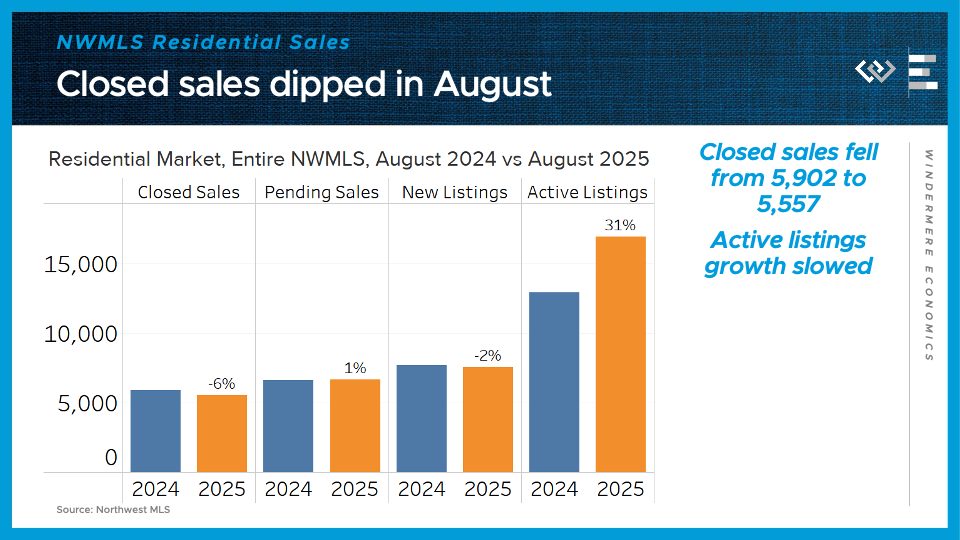

In August, closed sales of residential homes came in 6% below last year’s August total, across the Northwest MLS. Pending sales, which give some signal about next month’s sales, were roughly flat – up just 1% form last year.

On the supply side, we’ve passed an inflection point, where sellers are starting to back away from the market. There were 2% fewer new listings than last August – the first year-over-year decline in new listings since February. The month ended with 31% more active listings than last August, marking a slowdown from the inventory growth of about 36% the last two months. This pullback in supply should put a floor under any potential price decreases that the market shift could bring.

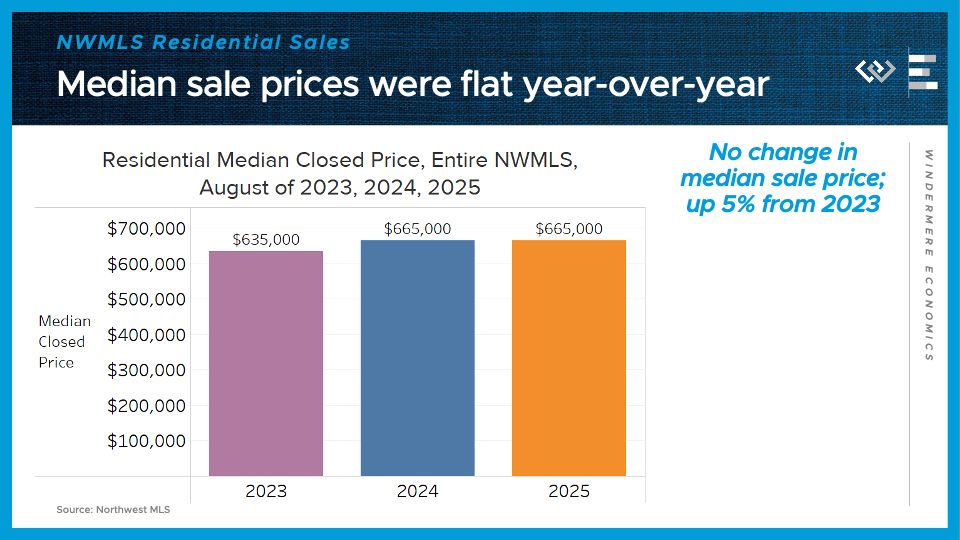

Speaking of which: the steadiest number across the Northwest MLS has been median sale price, which was exactly the same as last August: $665,000. That’s two months in a row of flat annual price changes, but it remains about 5% higher than in 2023.

Now I’ll take a closer look at the four counties encompassing the greater Seattle area.

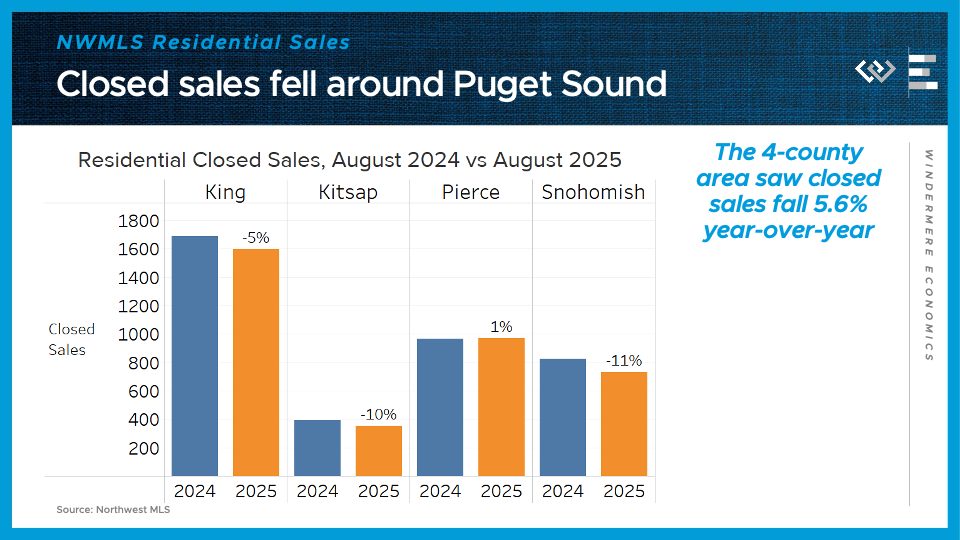

Closed sales dipped by almost 6% from last year. Only Pierce County saw a gain, albeit tiny, from last August.

Median sale prices actually crept upward from last year in all 4 counties: 4% higher in King; 7% higher in Kitsap, 1% higher in Pierce, and 1% higher in Snohomish County.

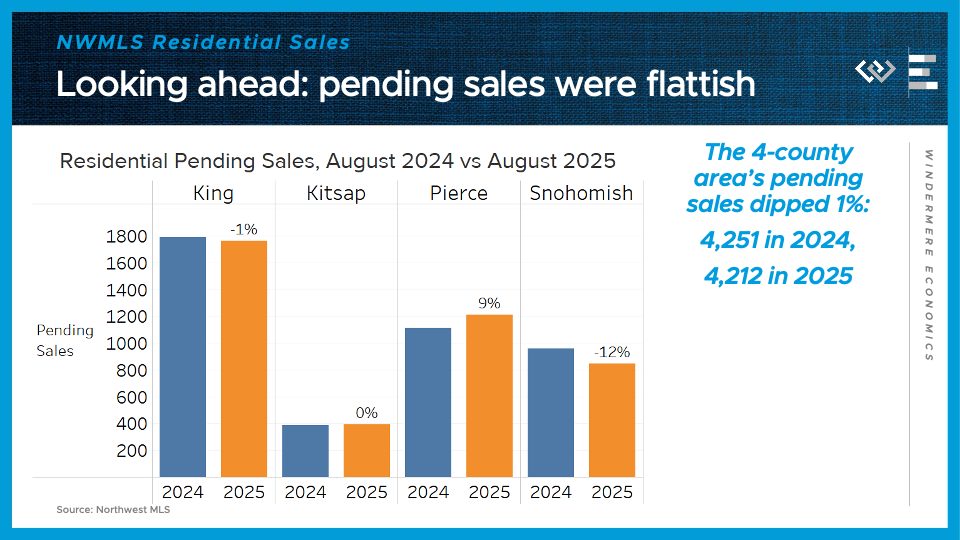

Looking ahead, pending sales dipped 1% across the region, although Pierce County was again the standout for sales, with 9% more pending sales than last year.

On the supply side, the 4-county greater Seattle area had 32% more active listings than at the end of August 2024. That continues the moderation of inventory growth we’ve seen since May, when this metric peaked at 45% year-over-year growth. King County especially has rebalanced, down from 50% growth to just 32% active listings growth.

Looking ahead, the key question is whether buyers begin to come off the sidelines in response to these more favorable conditions: they’ve got lots of inventory to choose from, listings that have lingered on the market, and mortgage rates that have dipped from about 7% to closer to 6.5% this summer. For people in a position to buy, this fall is looking like a sweet spot.

What The Ballooning National Debt Means For Housing

For Americans already struggling with the highest mortgage rates in a generation, new legislation out of Washington promises little relief. The “One Big Beautiful Bill Act” (OBBBA) will add trillions to the national debt over the next decades, further cementing an era of expensive borrowing.

The basic laws of supply and demand suggest this surge in government debt issuance will push interest rates even higher for everyone, straining the already-frozen housing market and increasing costs for all types of credit.

The one silver lining, though, is that the sooner lenders accept our “higher for longer” new world of interest rates, the sooner they can stop worrying so much about prepayment risk, which may shrink the spread they charge above 10-year Treasury yields. Below, we’ll explore how national debt impacts real estate.

As Uncle Sam borrows ever more, everyone’s interest rates will rise

The One Big Beautiful Bill Act, enacted this summer, puts the pedal to the metal for debt accumulation over the next decade in the U.S. The Committee for a Responsible Federal Budget estimates that it will add a cumulative $5.5 trillion to the debt by 2034, under the realistic assumption that its provisions written to expire will instead be extended, as has become normal in federal budgeting.

Even taking the expirations at face value, though, the bill raises deficits by a cumulative $4.1 trillion, an extraordinary choice in the midst of an economic expansion and coming on the heels of the worst bout of inflation in decades.

The issuance of trillions of dollars of additional debt in the next several years is expected to drive up interest rates. The Budget Lab at Yale has estimated that the bill will raise 10-year Treasury yields by about half a point in the next several years and by more than 1.4 points in the very long run.

This is driven in part by their modeling assumption that the Federal Reserve will succeed at keeping inflation close to 2 percent, which will require higher interest rates in the long run. They also expect a higher term premium on long-term debt, like 10-year Treasuries.

Altogether, this paints a picture of government borrowing crowding out private borrowing — as the Treasury issues more debt to finance its deficits, yields must rise to compensate investors. Other debt in the economy, such as mortgages, must yield more as well, in order to compete with Treasury bonds for lenders.

High interest rates have already frozen the housing market

While the U.S. economy continues to grow, the U.S. housing market has been stuck in neutral for over three years. Ever since mortgage interest rates rebounded from all-time lows below 3 percent for 30-year loans in 2020 and 2021, to generational highs above 7 percent in 2023, existing-home sales have been stuck in the neighborhood of 4 million annual sales.

It’s no surprise that fewer homes are changing hands than during the 2021 low-interest-rate boom, but 4 million is much fewer than even prevailed during the 2010s. In fact, 2024’s total of 4.06 million existing-home sales was the lowest total since the 1990s. The housing market is caught in a perfect storm, keeping homeowners frozen in place, thanks to the one-two punch of high price-to-income ratios and high mortgage rates.

While the OBBBA includes some sweeteners for certain homeowners, like the expansion of the state and local tax deduction cap to $40,000, the main long-term effect it promises for housing is just higher interest rates.

One near-term trend likely to help mortgage borrowers: a thinner spread

Bigger deficits, bigger debt, higher interest rates — the long-term fiscal outlook is getting darker. But there’s one silver lining that has begun to shine around the edge of these gathering clouds. The mortgage-Treasuries spread has begun to narrow again, resuming its progress back down toward pre-pandemic levels. The spread, here, refers to how much higher 30-year mortgage rates are averaging than 10-year Treasury yields.

In the 21st century, up to the pandemic, mortgage rates rarely exceeded 10-year Treasury yields by more than 2 percentage points, except during the global financial crisis. When mortgage rates soared back up in 2022, part of their climb was due to the widening spread. The two major reasons for widening spreads are a greater prepayment or refi risk on mortgages and interest rate volatility.

The latter has gradually faded this summer after spiking amidst tariff uncertainty in April. But the prepayment risk component is the bigger factor. For lenders and the investors who buy mortgage-backed securities, mortgages issued at high interest rates are uniquely risky because borrowers are expected to refinance them once mortgage rates fall back down.

The lack of a prepayment penalty for borrowers makes U.S. mortgages uniquely favorable to homebuyers here. If rates rise, they win by virtue of having locked in a lower rate; if rates fall, they can always refinance. Investors and lenders, by the same token, view refinancing as a unique downside to holding mortgages. They want a reliable coupon stream from mortgage holders’ monthly payments.

Seeing their loans wiped out by refinancing, replaced by cash in a new lower-interest-rate world, is a risk for which they must be compensated to make the loan in the first place.

That extra compensation for prepayment risk helped explain why mortgage rates soared even more than 10-year Treasury yields in 2022 and 2023. Now, though, as the reality sets in that we are living in a world where interest rates are “higher for longer,” lenders have gradually brought mortgage rates down relative to Treasuries, from about a 2.9-point spread in 2023 to 2.4 in recent months, or about one-third of the way back to normal.

The sooner investors conclude that refinancing prepayment risks aren’t so high, the sooner the spread can come down. The potential bankshot silver lining of the OBBBA? By putting a nail in the coffin of hopes for low interest rates, it may help further shrink the spread, so that higher 10-year Treasury yields don’t have to mean higher mortgage rates one-for-one.

Ultimately, the nation’s fiscal path points toward a new normal of higher borrowing costs for all. The “One Big Beautiful Bill Act” serves as an accelerant, solidifying a “higher for longer” interest rate environment that will impact everything from car loans to corporate debt. For the beleaguered housing market, this presents a bittersweet trade-off.

The bad news is that the foundational interest rate, the 10-year Treasury yield, is set to climb. The paradoxical good news is that by killing the hope of a return to ultra-low rates, the OBBBA may continue to shrink the risk premium lenders charge on mortgages. This narrowing spread won’t turn 7 percent mortgages back into 3 percent loans, but it might help us work our way back down closer to 6 percent.

Jeff Tucker is the Principal Economist at Windermere Real Estate in Seattle, WA. This blog was originally published on Inman News on 8/26/25.

Numbers to Know 8/21/25: Inventory Up, Prices Down, and Rates Easing

This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

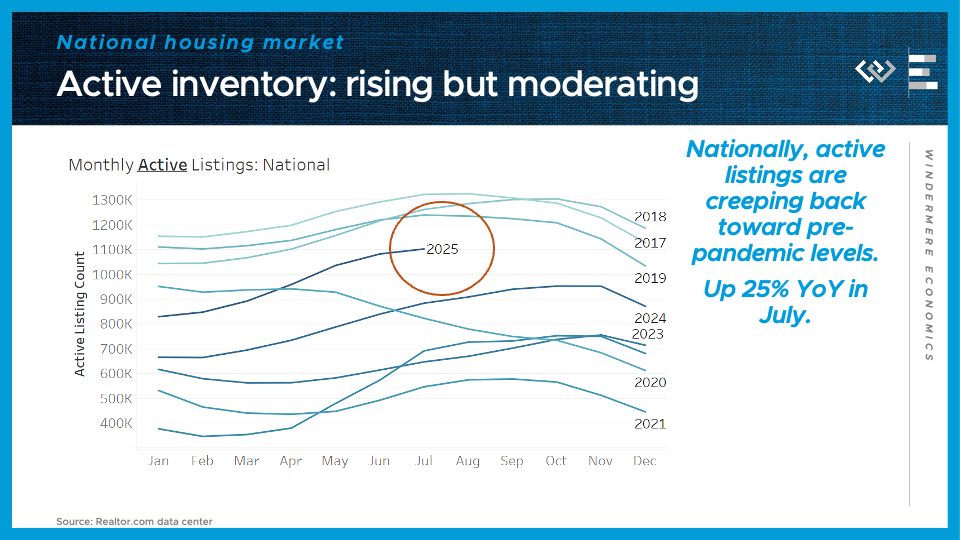

I’ll start this month by checking in on our most important barometer of the housing market: inventory. Active listings continued to grow in July, but at least nationally, they are still below somewhat below pre-pandemic levels for this time of year.

At the end of July, there were just over 1.1 million active listings on the market – below the 1.23 million on the market in July 2019, but up from 884,000 at this time last year.

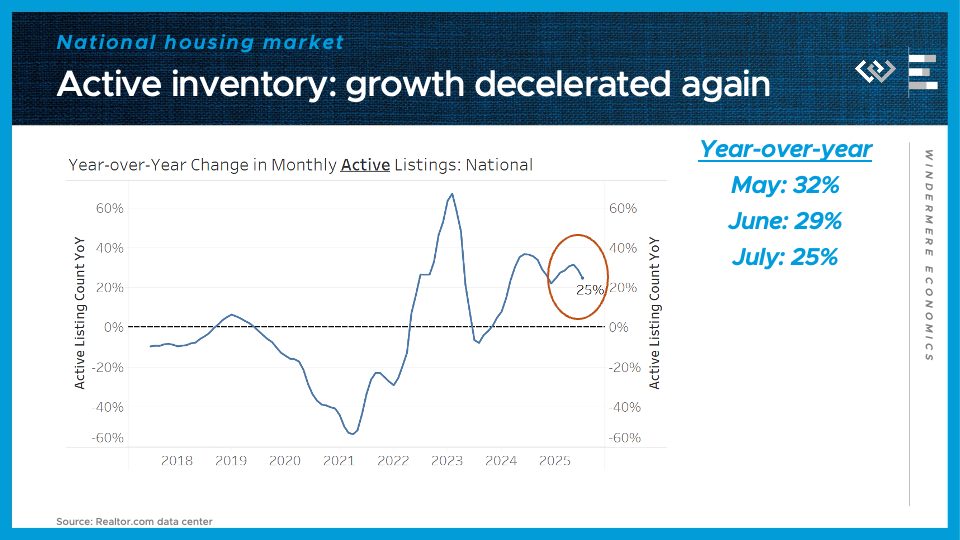

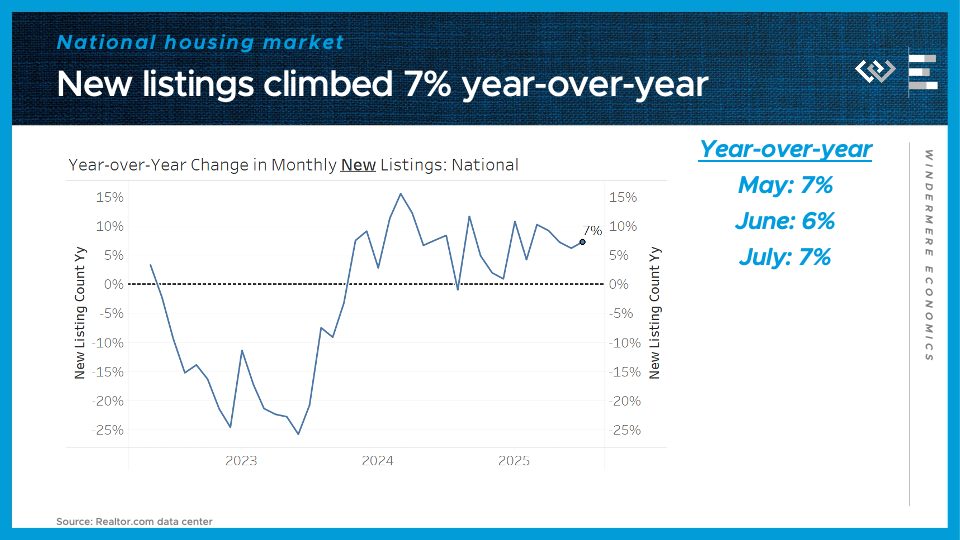

That makes for 25% year-over-year growth, which marks another month of deceleration from a peak of 32% annual growth in May. This continues to make this spring look like an inflection point, where inventory is still growing but at an ever-slower pace.

Maybe surprisingly, we didn’t see any deceleration in the flow of new listings in July – it was up 7% year-over-year, or slightly more than June’s 6%. So if inventory growth is slowing, like we just saw, it points to another rising trend this year: de-listings, or expired listings, where sellers are not getting an acceptable offer and just choosing to walk away.

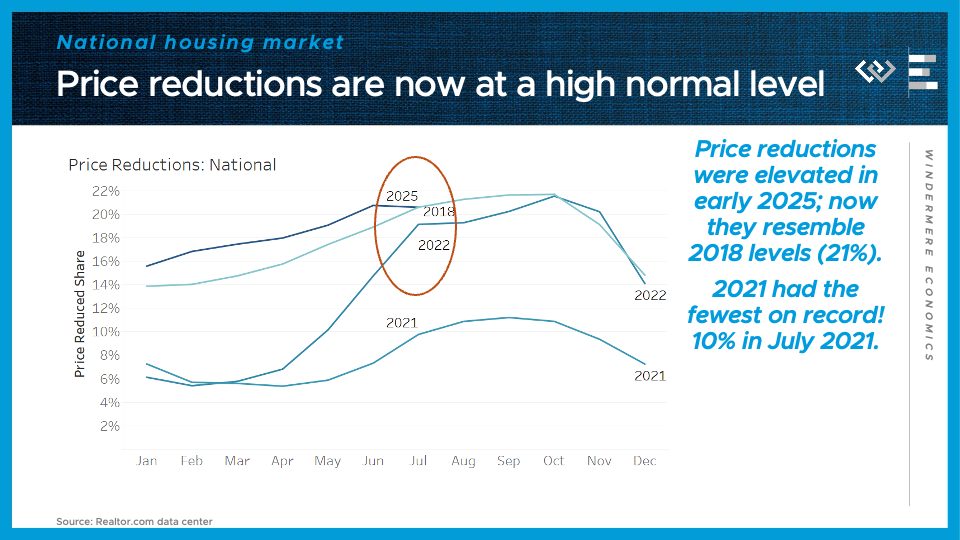

Another sign of sellers being unwilling to bend any further: price reductions. This is the share of active listings where the seller has reduced their asking price. It’s been elevated all year long, but it abruptly stopped rising in July, which is seasonally unusual — so now it’s actually at the exact same share we saw at this time in 2018, 21%, and not far from the share in July 2022.

All in all, the housing market has clearly swung in buyers’ favor, but these signs of an inflection point suggest the momentum in that direction is slowing down.

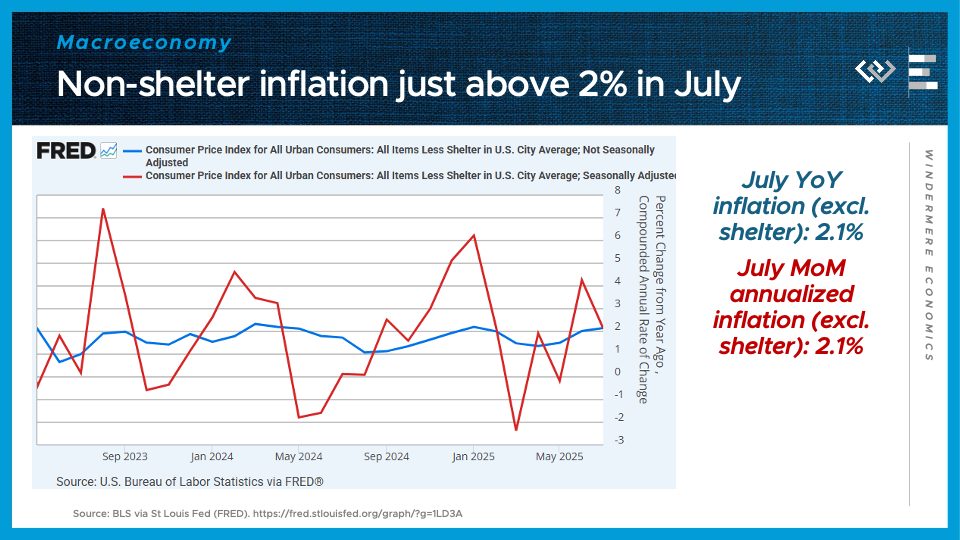

Turning to the macroeconomy, we have a couple of worrying signals of at least a mild form of macroeconomists’ least favorite condition: stagflation. Starting with the “flation” part, we see that inflation is stubbornly stuck closer to 3% than the Fed’s 2% target.

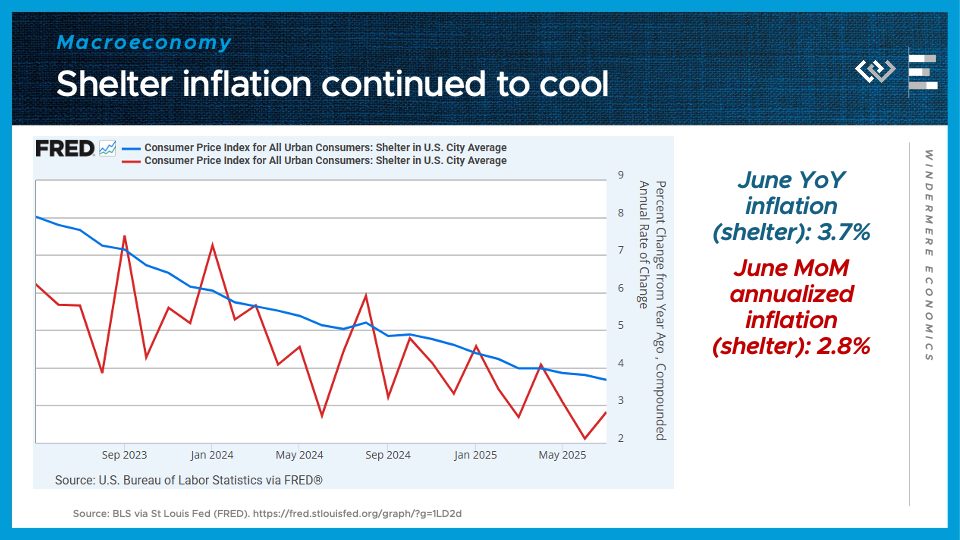

Shelter inflation has kept cooling in a kind of zigzag pattern, finally approaching 2%.

But the rest of the CPI basket, everything BUT shelter, is once again growing at – just barely – faster than 2% annualized.

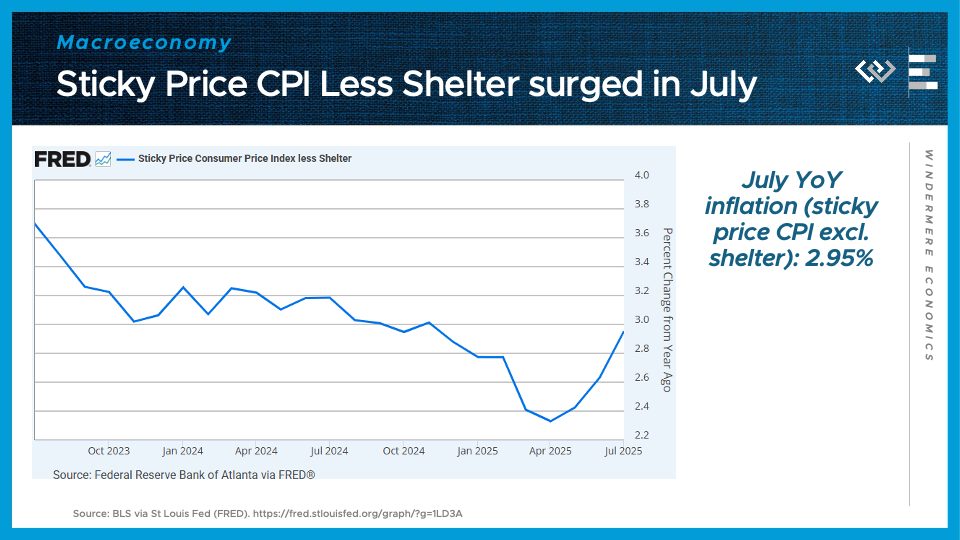

And an especially predictive part of the price index, called the sticky price index less shelter, accelerated sharply to almost 3% annual growth.

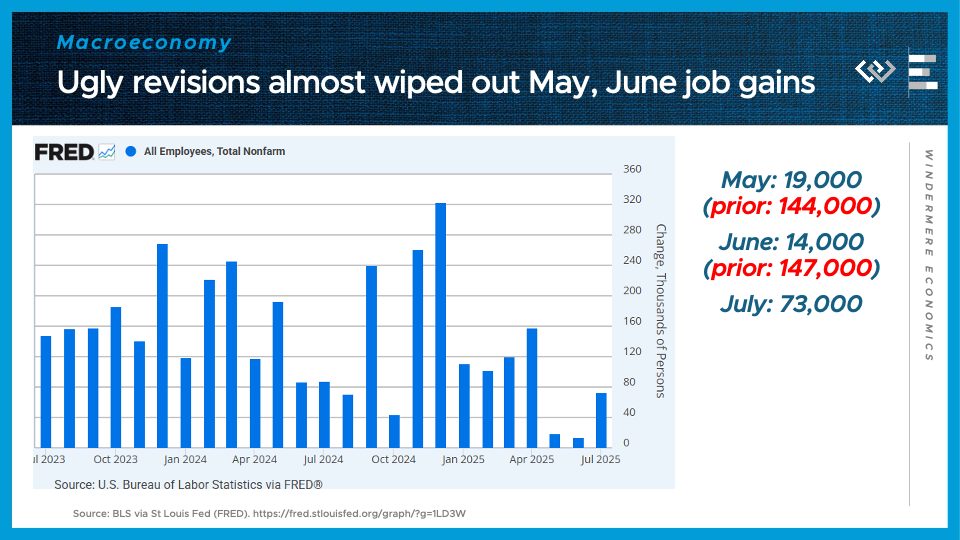

Turning to the stagnation side of things, the jobs report for July, released on August 1st, came in way below expectations. The most concerning part is that job gains for May and June were revised down radically, almost wiping out the healthy job gains the BLS reported just last month. Month-to-month revisions are a normal part of how the Bureau of Labor Statistics reports payroll gains and losses, and a pattern of sharply negative revisions often heralds the beginning of a recession.

Stagflation presents the Fed with a dilemma: the very weak jobs report would give them reason to cut interest rates, but resurgent inflation might give them pause. Markets are betting on at least one interest rate cut, starting in September, but after that it’s anybody’s guess where the data will guide their next decisions.

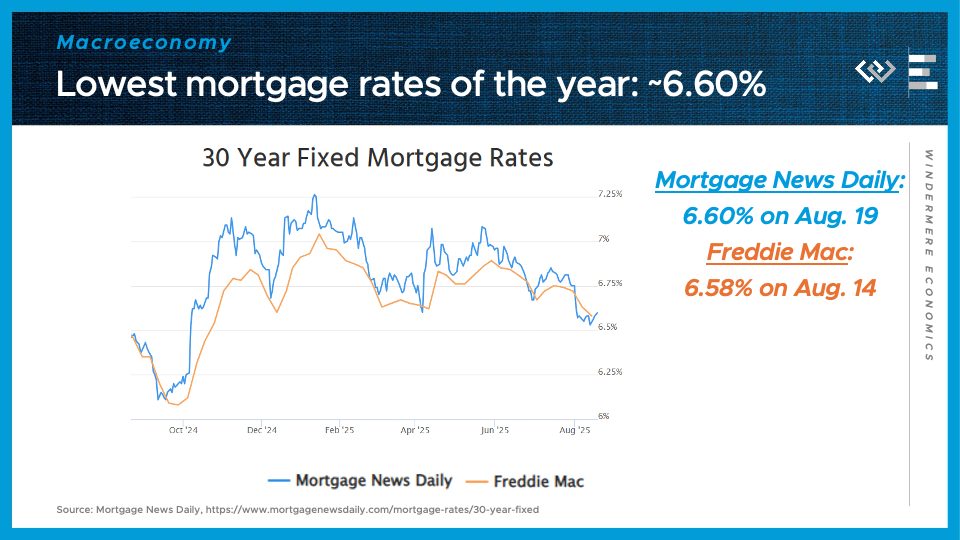

For the housing market, though, what’s most important is mortgage rates, and those have already fallen in the wake of the weak jobs report. Rates swooned, down to just over 6.5%, and while they’ve recovered slightly, this range of around 6.6% is still the best we’ve seen in 2025, so I’ll count that as progress. Buyers seem to be set up for another favorable early autumn housing market – more inventory, plenty of price reductions, and at least some mortgage rate relief.

Local Look Western Washington Housing Update 8/6/25

Hi. I’m Jeff Tucker, principal economist at Windermere Real Estate, and this is a Local Look at the July 2025 data from the Northwest MLS.

After a bit of a roller coaster in the second quarter following the April rollout of Trump’s tariffs, July just looked slow and steady, especially in sales: We saw 4% more closed residential sales across the Northwest MLS in July than last year, and 3% more pending sales.

On the supply side, there were 12% more new listings than July of last year, and the month ended with 36% more active listings than last July. That’s almost identical to the pace of growth we saw in June.

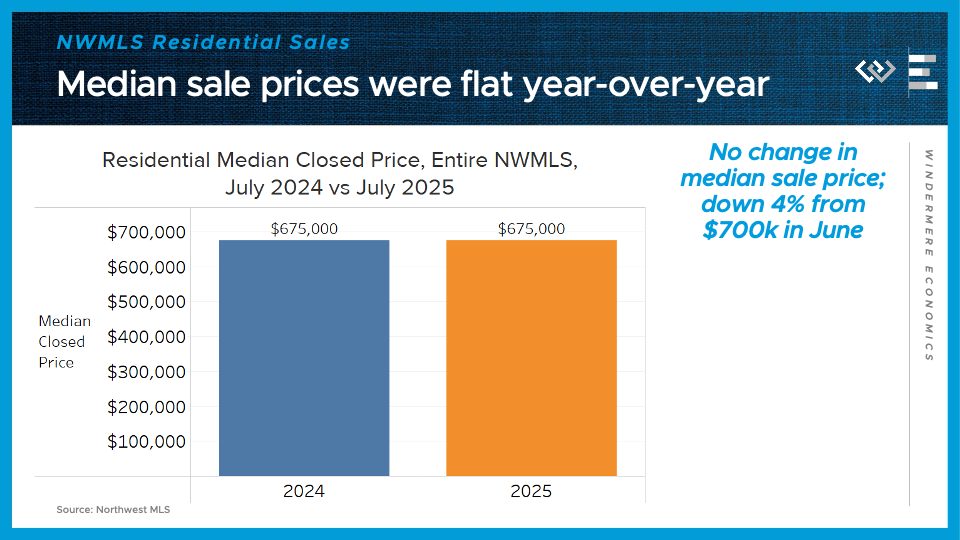

Finally: the most steady number across the Northwest MLS: median sale price, which was exactly the same as last July: $675,000. The growth of active listings has been weighing down price appreciation, and has now brought it down to 0.

This is yet more data showing a market where buyers are gaining negotiating leverage.

Now I’ll take a closer look at the four counties encompassing the greater Seattle area.

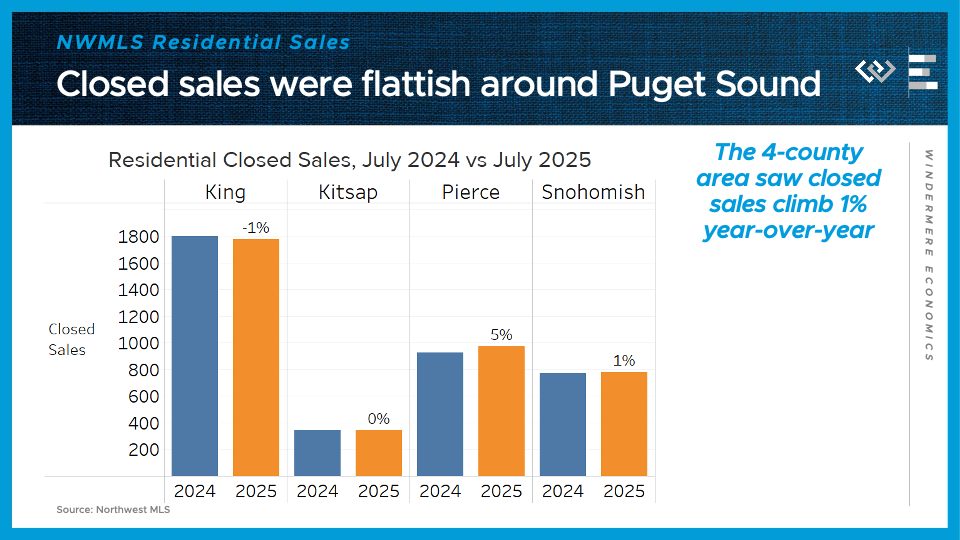

Closed sales climbed here by 1% from last year, led by growth in Pierce County, which offset a tiny decline in King County.

Median sale prices were exactly flat year-over-year here in King County at $1 million; up 10% in Kitsap to almost $600,000; up 1% in Pierece and down 2% in Snohomish County.

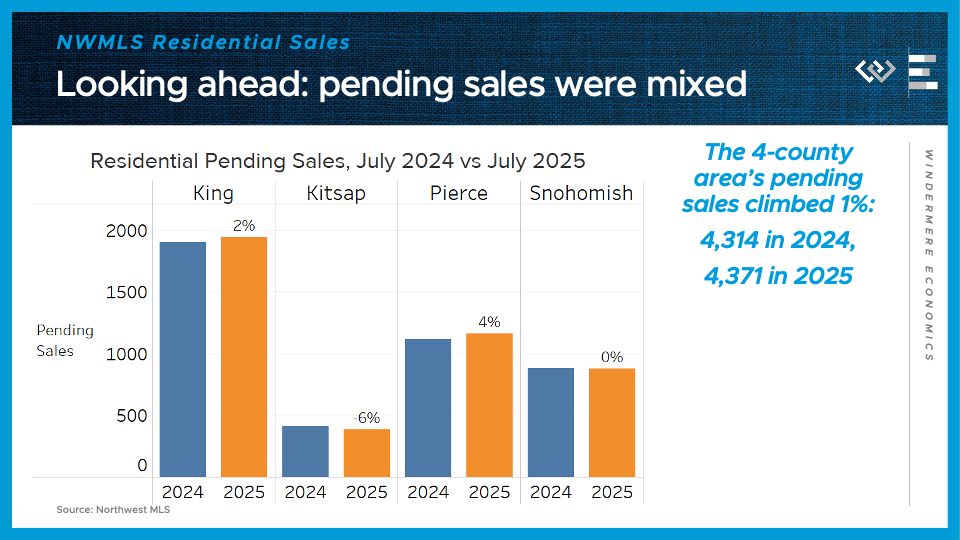

Looking ahead, pending sales climbed a modest 1% across the region, including a 2% gain in King County.

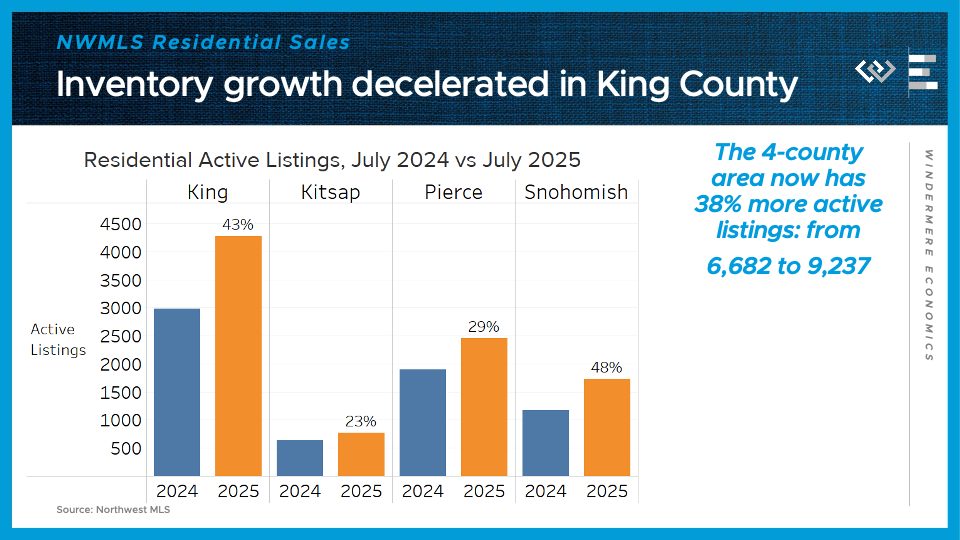

On the supply side, the 4-county greater Seattle area had over 9,000 active listings at the end of July, or 38% more than the same time last year. This is continuing the deceleration in inventory growth since we had 45% year-over-year gains in May; most of the deceleration is thanks to King County, where inventory was up 50% just a couple months ago.

All in all, this market looks like a return to a “new normal” where buyers have gained the upper hand, at least enough to grind price appreciation a halt, but not nearly enough to bring prices down as much as they’d like. Inventory is still up, but not accelerating toward a glut. And new listings are continuing to deliver a lot of new options for buyers here in the dog days of summer.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link