The following analysis of select counties of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Year over year, total employment in Eastern Washington rose by more than 17,000 jobs, representing an annual growth rate of 3.5%. Spokane County saw the fastest pace of job growth, rising by 4.7%. All other counties except Lincoln added jobs over the past 12 months. Whitman and Lincoln counties are still marginally below their pre-pandemic employment levels. Unadjusted for seasonality, the regional unemployment rate was 4.4%; the seasonally adjusted rate was 4.6%. The highest jobless rate was in Franklin County at 6.2% and the lowest rate was in Whitman County at 4.1%.

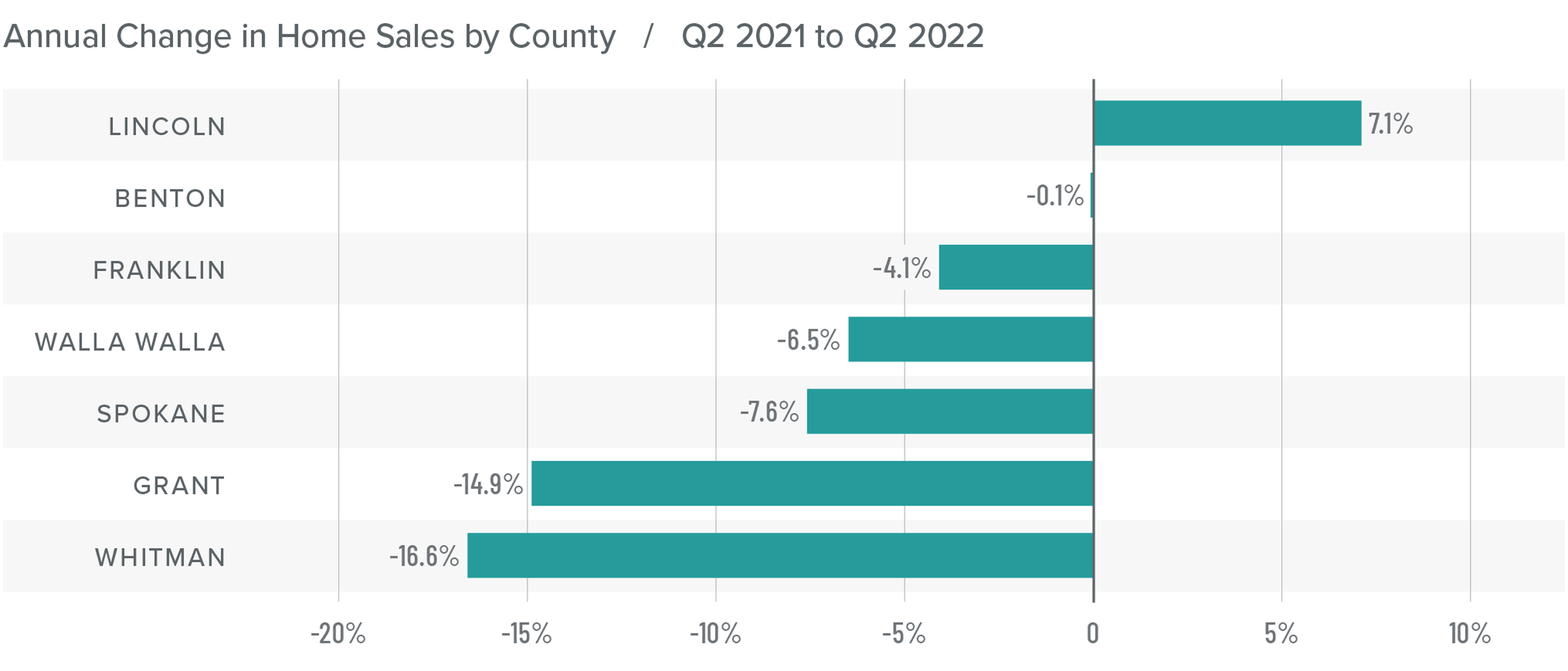

Eastern Washington Home Sales

❱ During second quarter, 3,464 homes sold, which was 6.9% lower than a year ago but more than 47% higher than the first quarter of 2022.

❱ Sales growth this spring came as listing activity jumped. The average number of homes on the market was 131% higher than in the first quarter.

❱ Year over year, sales increased in Lincoln County but fell across the balance of the region. However, compared to the first quarter, sales rose significantly across the board.

❱ Higher inventory levels also allowed pending sales to rise by more than 34% from the first quarter. The spring market was clearly a good one, even as mortgage rates rose.

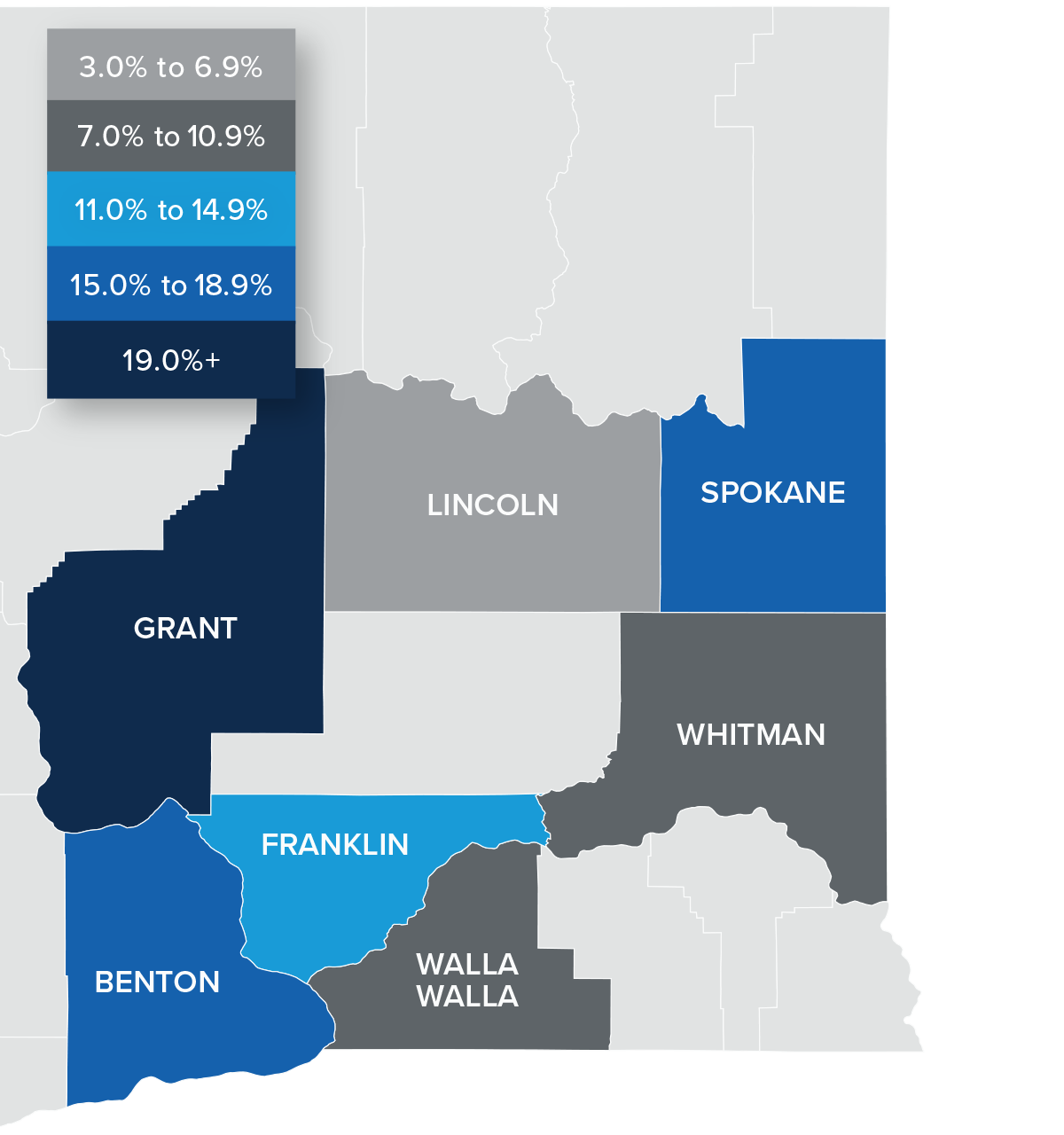

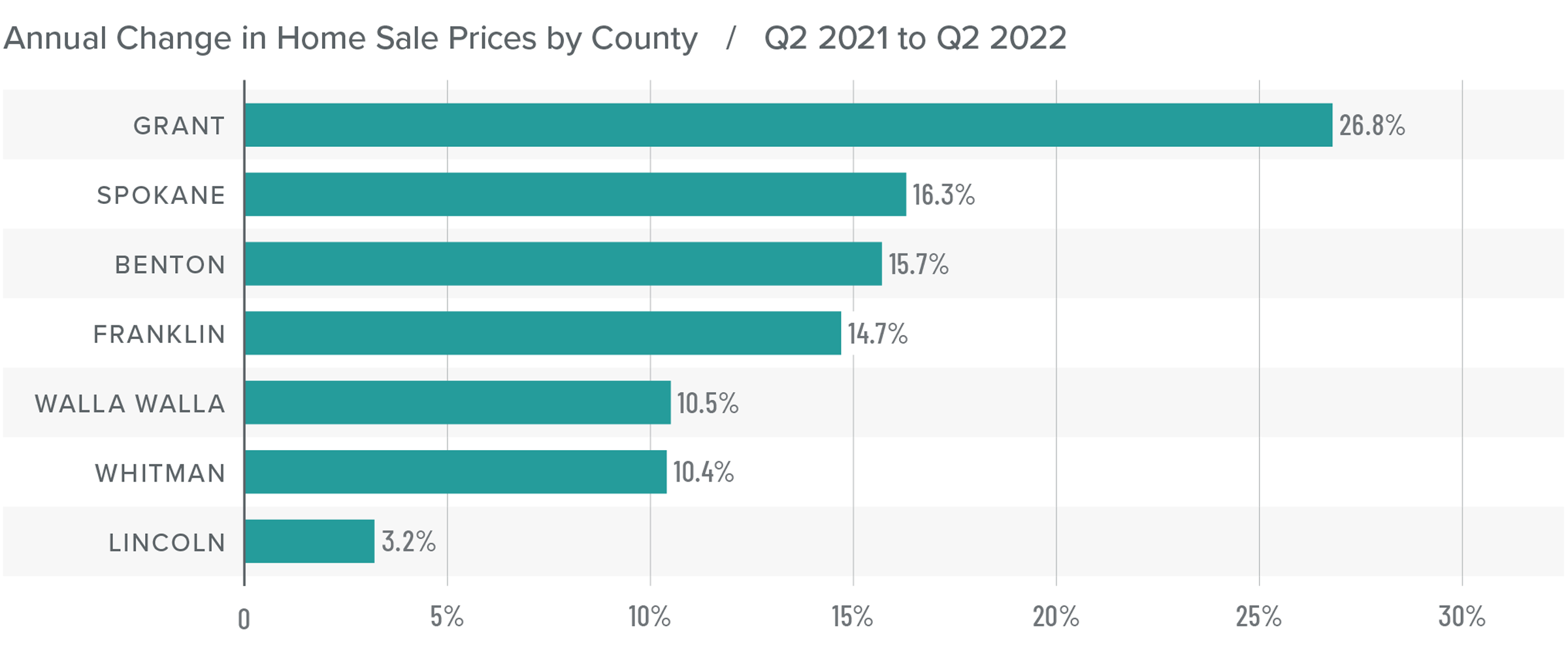

Eastern Washington Home Prices

❱ The average home price in Eastern Washington rose 16.3% from last year to $475,985. Average prices were 9.4% higher than in the first quarter.

❱ Compared to the first quarter of 2022, prices rose in all counties except Benton, where they were down a modest .8%.

❱ Every county other than Lincoln saw average prices rise by more than 10% compared to the same time last year. Grant County prices rose a very impressive 26.8%.

❱ I have started tracking list prices, as they are a leading indicator of the direction of the housing market. Thus far, rising mortgage rates and growing inventory levels have yet to dampen seller confidence, with median list prices up an average of 9.9% from the first quarter.

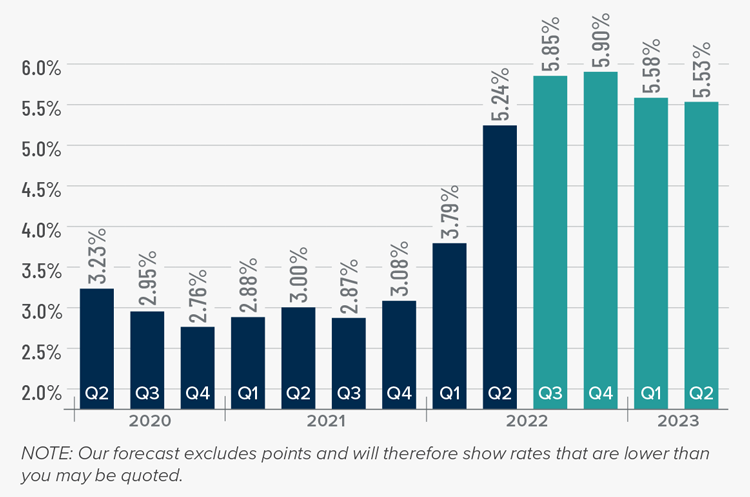

Mortgage Rates

Although mortgage rates did drop in June, the quarterly trend was still moving higher. Inflation—the bane of bonds and, therefore, mortgage rates—has yet to slow, which is putting upward pressure on financing costs.

That said, there are some signs that inflation is starting to soften and if this starts to show in upcoming Consumer Price Index numbers then rates will likely find a ceiling. I am hopeful this will be the case at some point in the third quarter, which is reflected in my forecast.

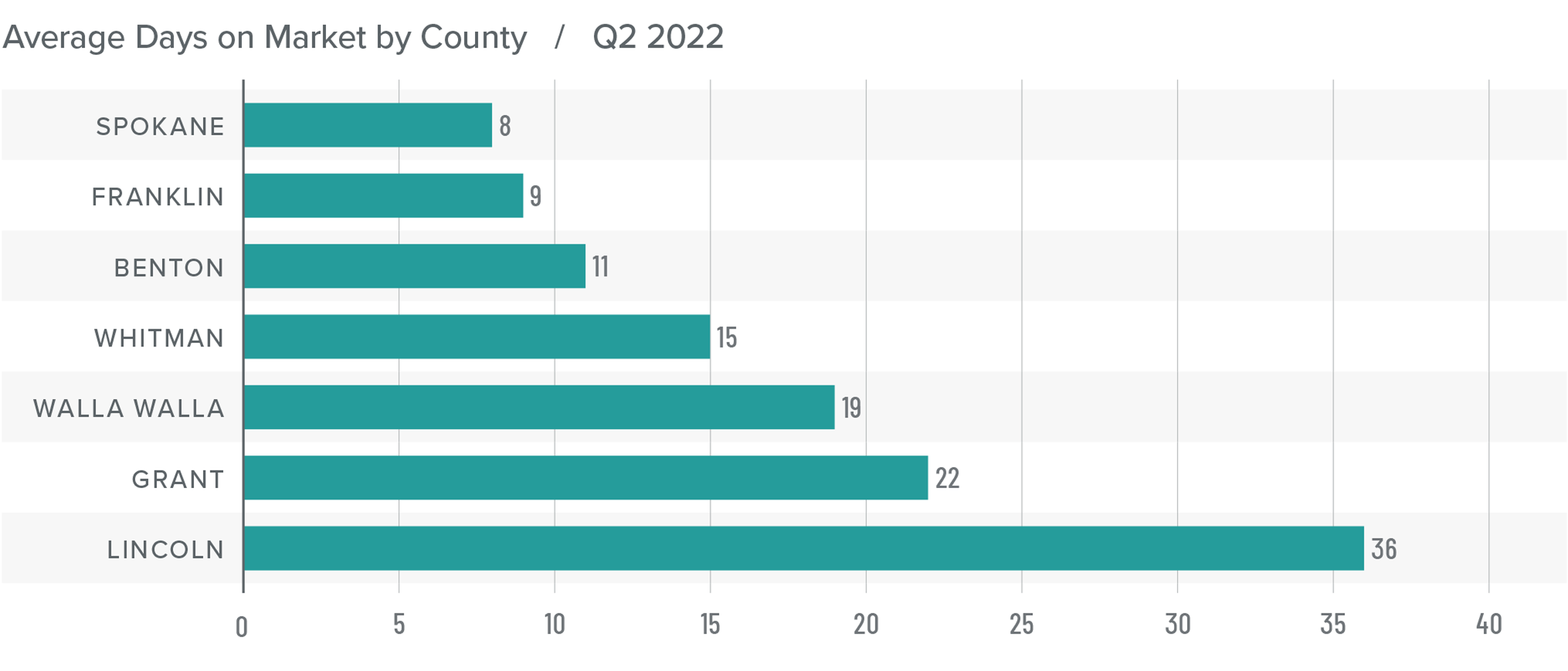

Eastern Washington Days on Market

❱ The average time it took to sell a home in Eastern Washington in the second quarter of 2022 was 17 days, which is 3 fewer days than the same period a year ago.

❱ Compared to the first quarter of this year, average days on market fell in every county other than Lincoln, where it took an average of four more days to sell a home.

❱ All counties other than Spokane (where market time was unchanged) saw the average number of days it took for a house to sell drop compared to a year ago.

❱ It took an average of eight fewer days to sell a home in the quarter than it did during the first quarter of 2022.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Employment in Eastern Washington continues to grow, which is a positive for the housing market. Although the number of homes for sale jumped significantly this spring, which typically favors home buyers, home sales and days on market suggest that demand remains strong, and the market is still competitive.

With list prices continuing to rise, sellers are clearly confident even in the face of rising financing costs. Though the pace of price growth has slowed, sellers are still in the driver’s seat. As such, I have moved the needle a little more in the direction of sellers. Until listing price growth shows further slowing, we will not approach a balanced market.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link