The following analysis of select counties of the Eastern Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Even though Washington State revised the 2021 total employment level downward, the Eastern Washington job market is still in positive territory after its recovery from the pandemic. The region has recovered all of the jobs that were lost and added 13,000 new jobs. The job count in Whitman and Grant counties remains marginally below their pre-COVID peaks, but I expect that to be resolved by this summer. Unadjusted for seasonality, the regional unemployment rate was 5.9%. However, when adjusted for seasonal shifts, the rate was 4.9%. The highest jobless rate was in Grant County at 6.8%; the lowest rate was in Walla Walla County at 3.9%.

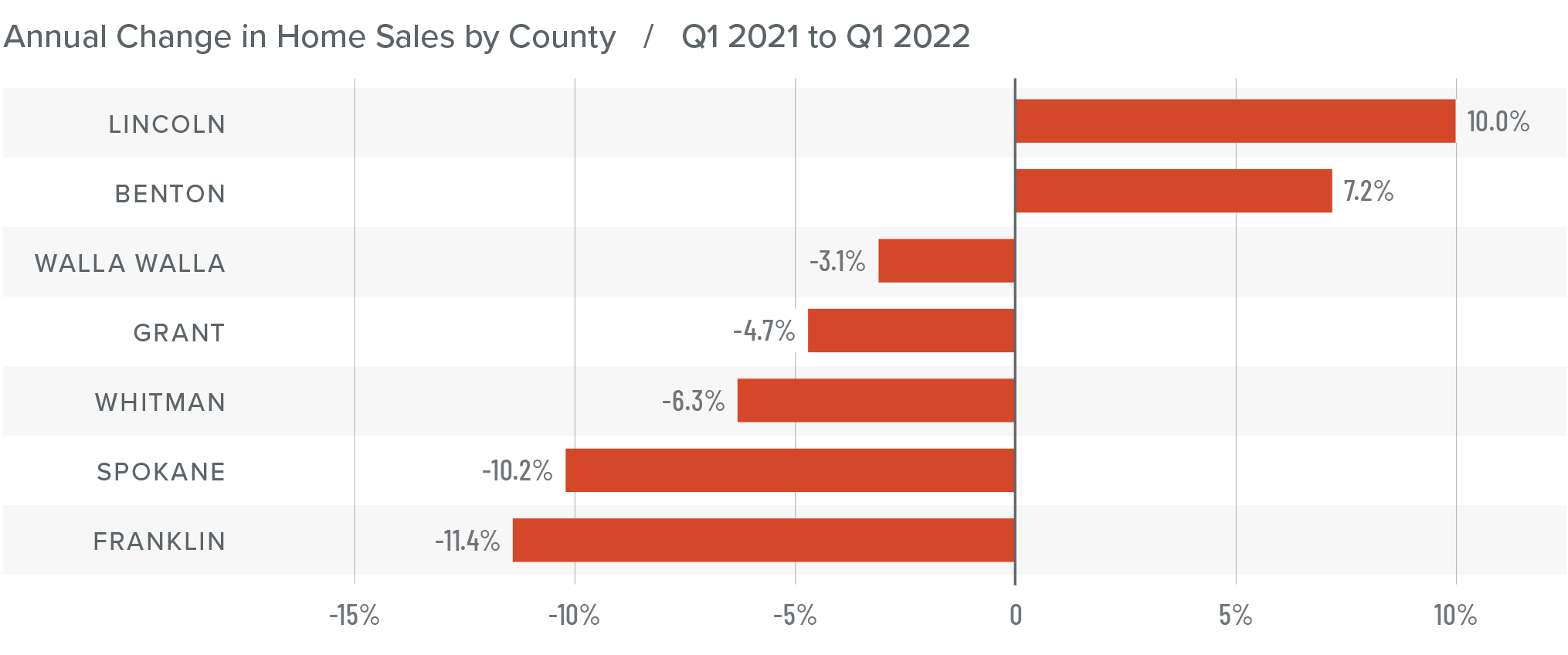

Eastern Washington Home Sales

❱ In the first quarter, 2,353 homes sold, which was down 5.7% from the same period in 2021 and 36.6% lower than in the final quarter of last year.

❱ While these numbers don’t appear positive at face value, the drop was due to the lack of homes for sale. Although listing activity was 2.2% higher than the same period in 2021, it was 40% lower than in the final quarter of last year. Limited choice is certainly impacting the market.

❱ Year over year, sales increased in Benton and Lincoln counties, but fell in the rest of the market areas. Sales fell across the board compared to the fourth quarter.

❱ Pending sales were down 12.6% from the final quarter of last year, suggesting that unless we see a surge in the number of homes coming to market, second quarter numbers may disappoint as well.

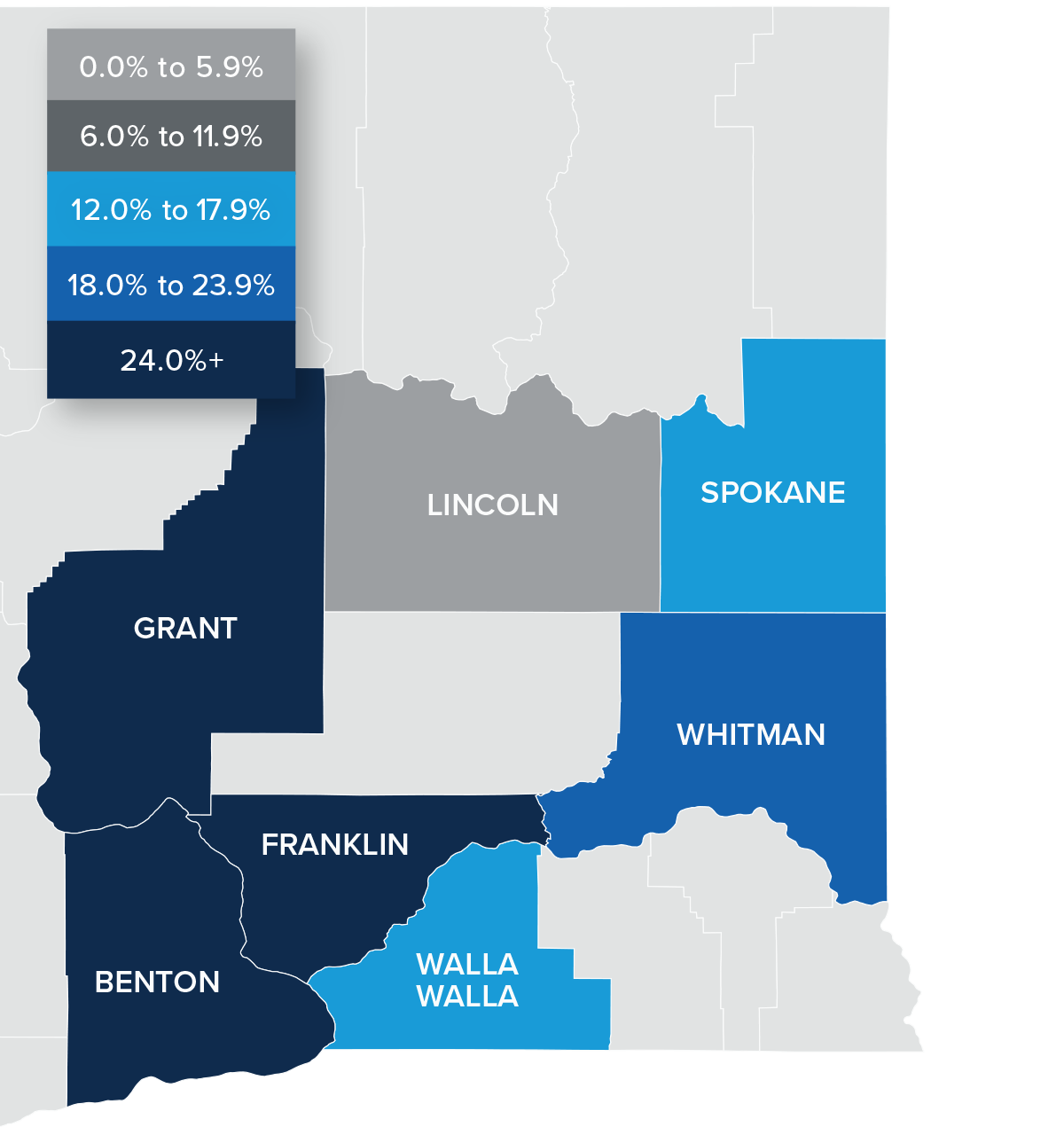

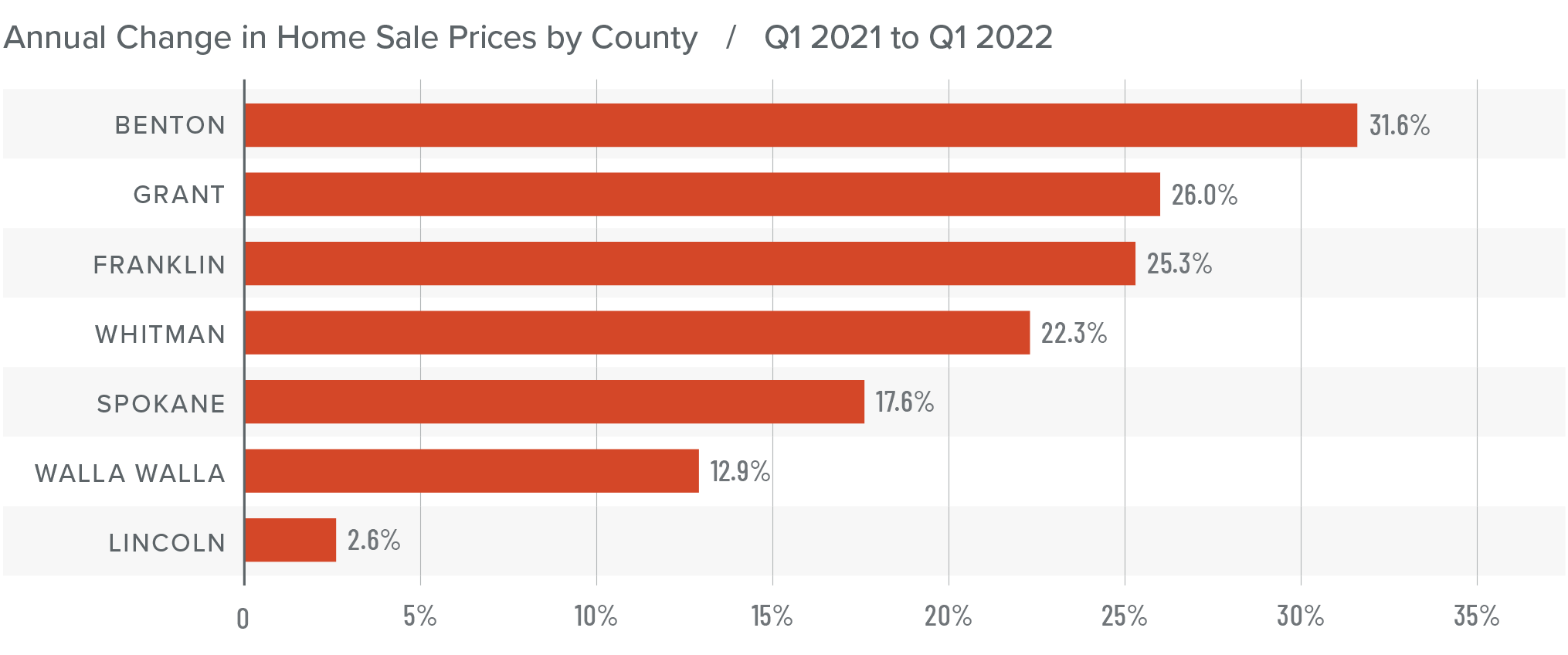

Eastern Washington Home Prices

❱ Year over year the average home price in Eastern Washington rose a very significant 21.4% to $434,921 and was 2.6% higher than the previous quarter.

❱ When compared to the final quarter of last year, prices rose in all counties other than Lincoln and Walla Walla.

❱ All counties contained in this report saw average sale prices rise; every county except Lincoln County had double-digit growth.

❱ The market has yet to feel the impact of rising mortgage rates. Inventory issues persist, so it’s likely prices will continue to rise as buyers compete for what homes are available and seek to lock in a loan rate before they rise any further.

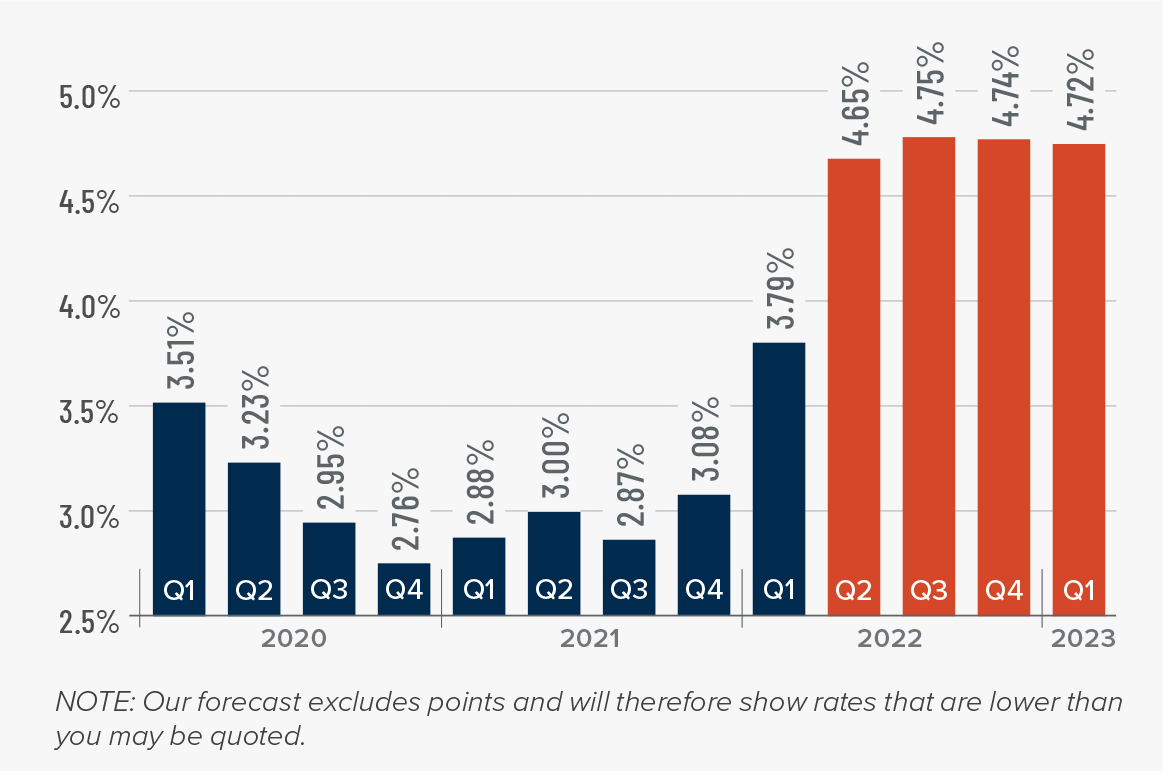

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The speed of the surge in rates is due to the market having quickly priced in the seven-to-eight rate increase that the Fed is expected to implement this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

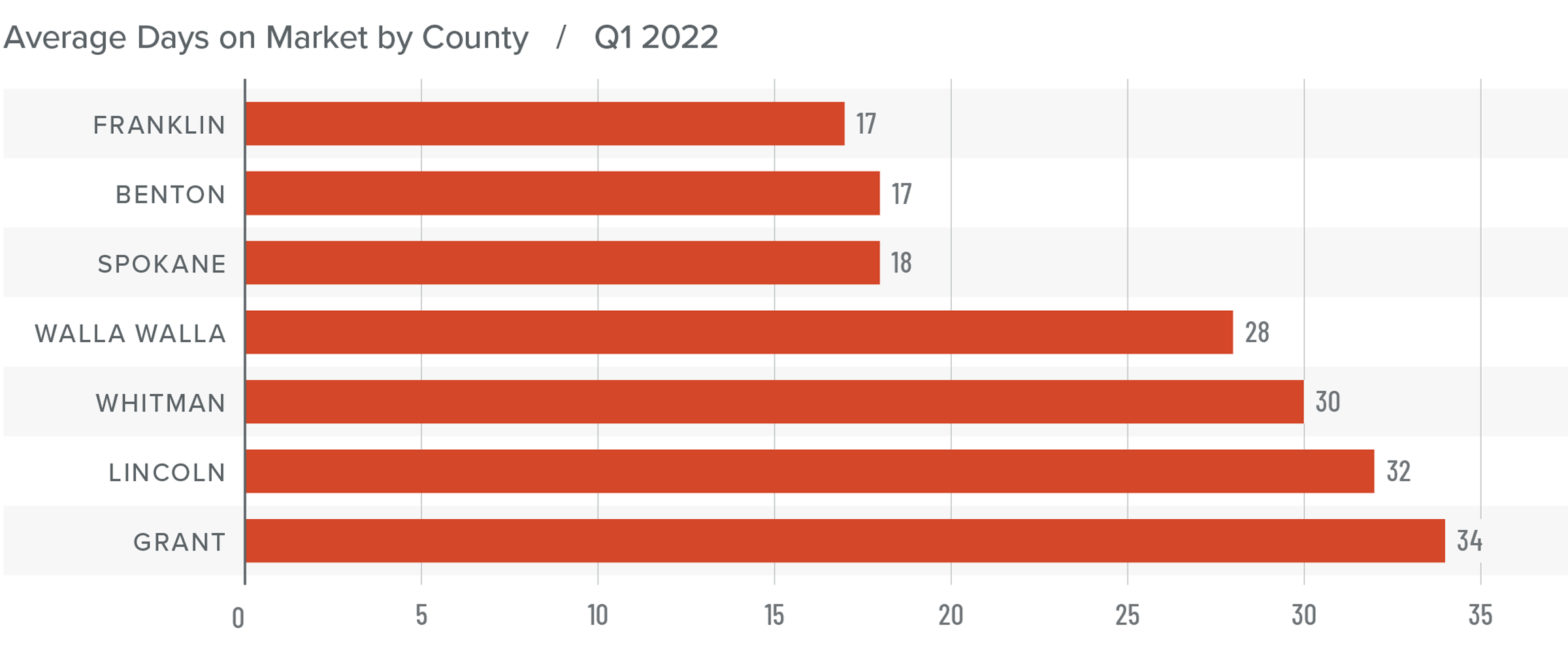

Eastern Washington Days on Market

❱ The average time it took to sell a home in Eastern Washington in the first quarter of 2022 was 25 days. This is 8 fewer days than in the first quarter of 2021.

❱ Compared to the previous quarter, average days on market rose in every county other than Lincoln.

❱ All counties other than Spokane and Franklin saw the average number of days-on-market drop compared to the same period in 2021. That said, the increased market time in Spokane and Franklin counties was modest.

❱ During the first quarter it took an average of only one more day to sell a home than it did during the final quarter of last year.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Employment levels continue to grow in Eastern Washington, but the housing market is still struggling to find its direction. A lack of homes for sale remains a major issue and the region appears to be headed toward a slower pace of sales. For now, though, price growth remains strong. The impact of rising mortgage rates on the housing market lags by about three months. It will be interesting to see how this affects the pace of price growth once the spring market is fully underway.

Given all the factors discussed here, I have chosen to leave the needle in the same position as the previous quarter. Sellers are still in the driver’s seat—as list prices continue to increase—but higher mortgage rates will further exacerbate affordability concerns in several markets, which may move the region toward a period of greater stability. We will have to wait and see.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link