The following analysis of the greater Las Vegas real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

COVID-19 had an extraordinary impact on employment in Las Vegas, causing the loss of more than 230,000 jobs in April alone and driving the unemployment rate up from 7.2% to 34%. However, although there is a long way to go, jobs have started to return. In May and June, the region regained 93,500 jobs and the unemployment rate dropped modestly to 28.4%. (The most recent Labor Department data I have access to is for May; as I write this, June numbers have not yet been released.) Although it is certainly too early to say we are out of the woods, we seem to be headed in a positive direction. That said, COVID-19 infection rates in Nevada started increasing in June and may slow the economic recovery if the direction is not reversed.

HOME SALES

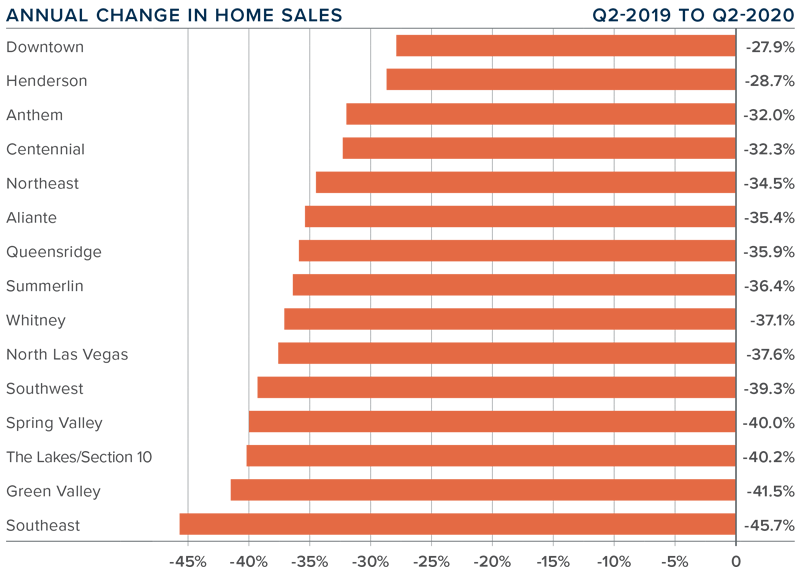

❱ A total of 6,100 homes were sold in the second quarter of 2020, a decrease of 36.1% compared to the same period a year ago, and 22.5% lower than in the first quarter of 2020.

❱ Pending sales were 19.8% lower year-over-year and were 7.4% lower than in the first quarter of 2020. Uncertainty about a recovery is clearly holding buyers—and sellers—back.

❱ Sales dropped significantly across the board, with particularly large drops in the Southeast, Green Valley, and The Lakes/Section 10 neighborhoods.

❱ The significant impacts of COVID-19 across the country are very evident in Las Vegas, specifically because of its major dependence on the leisure and hospitality sectors of the economy. As I suggested in the first quarter Gardner Report, we should assume that market activity will continue to be negatively affected until normal business operations resume.

HOME PRICES

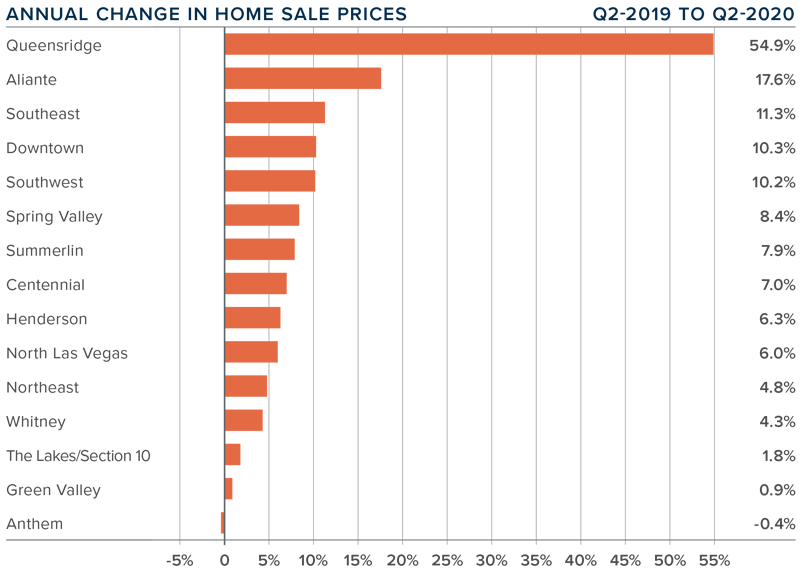

❱ Although home sales have pulled back significantly, it has yet to hit home prices. Regionally, prices rose 7.4% compared to the second quarter of 2019 to an average of $337,642. Sale prices were also up 3.2% compared to the first quarter this year.

❱ Annual home price growth remains impressive, rising at rates well above the national average.

❱ Prices rose in every sub-market other than Anthem compared to the same quarter last year. The strongest price growth was in the Queensridge sub-market. Prices were only slightly lower in Anthem.

❱ Interest rates hit all-time lows in July and were trending lower through the second quarter. This may be part of the reason prices continued to rise. Additionally, inventory levels remain well below where they were a year ago and this can drive prices higher.

DAYS ON MARKET

❱ The average time it took to sell a home in the region dropped five days from the second quarter of 2019.

❱ Regionwide, it took an average of only 38 days to sell a home in the second quarter of 2020, which is 11 fewer days than during the first quarter.

❱ Days-on-market dropped in 12 sub-markets and rose in 3 compared to a year ago.

❱ The greatest drop in market time was in The Lakes/Section 10 and Southwest neighborhoods. In both markets, it took an average of 12 fewer days to sell a home than a year ago. The greatest increase in market time was in North Las Vegas, but the increase was a modest 2 days.

CONCLUSIONS

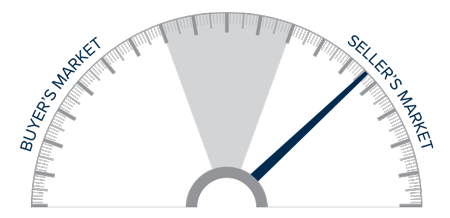

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Clearly, the market is still reacting to the influences of COVID-19. The significant price increases point to buyer demand, but the pandemic is still making the direction of the area’s housing market uncertain. That said, I remain hopeful that we will start to get some clarity as we move through the balance of the year. Assuming the state gets new infection rates back under control, and Las Vegas continues to reopen, I anticipate the market will start to perform at its potential later this year. As such, I am leaving the needle in the same position as last quarter.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link