The following analysis of the Big Island real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

COVID-19 has significantly impacted employment on the Big Island, causing the loss of 19,800 jobs in April alone and driving the unemployment rate up from 2.9% to 23.4%. The mandatory 14-day self-quarantine proclamation made by Governor Inge remains in place, but some jobs have started to return. In June, 6,950 jobs returned and the unemployment rate dropped modestly to 13.7%. Although it is certainly too early to say we are out of the woods, the direction we seem to be headed is mildly positive. I do expect to see further job gains, but it remains unlikely we will see significant improvement until September when the mandatory pre-travel testing program is scheduled to start. Pre-testing will likely lead to more visitors who are currently staying away because of the self-isolation protocols.

HOME SALES

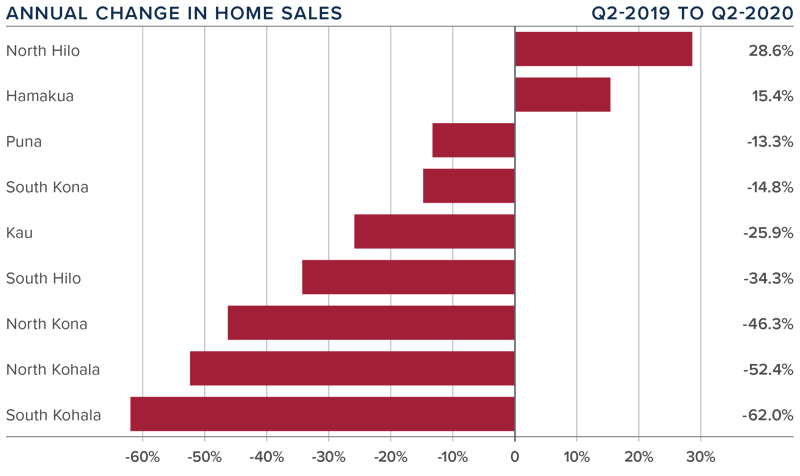

❱ In the second quarter of 2020, 582 homes sold on the Big Island, a drop of 36.7% compared to the second quarter of 2019, and 28.5% lower than in the first quarter of 2020.

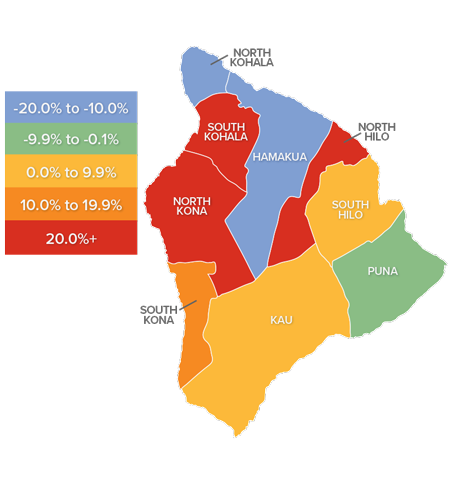

❱ Sales were lower in seven markets but rose in two. The North Hilo and Hamakua markets both experienced sales growth. The greatest declines in sales were in South and North Kohala.

❱ The contraction in sales came as inventory levels dropped 14.5% from a year ago. The average number of homes for sale in the quarter was also down 5.1% from the first quarter of 2020.

❱ Pending home sales were 9.3% lower than in the first quarter, which will likely lead closed sales to drop further in the third quarter.

HOME PRICES

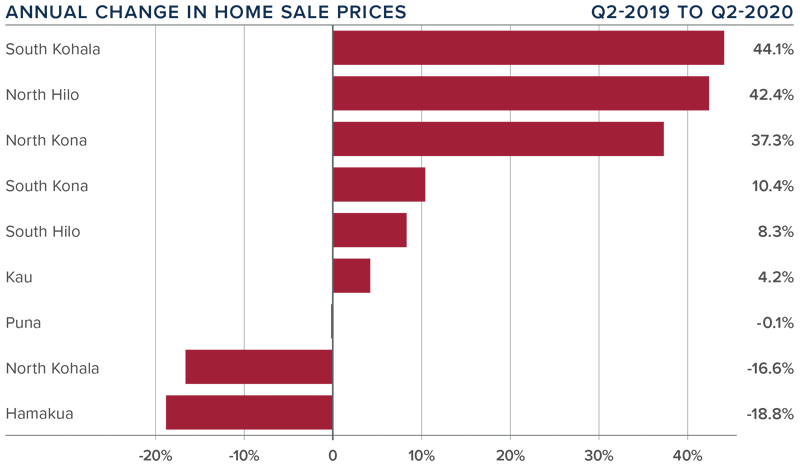

❱ Even as sales activity dropped, the average home price on the Island rose an impressive 10.5% year-over-year to $578,931. However, prices were 6.7% lower compared to the first quarter of 2020.

❱ Affordability remains an issue, and demand from vacation buyers has slowed significantly. I believe buyers will return when allowed, and they will look to take advantage of historically low-interest rates.

❱ Prices rose in six markets and dropped in the other three. Appreciation was again strongest in the small South Kohala market area, but there were also significant price increases in North Hilo and North Kona.

❱ Due to COVID-19, I expect the market to continue underperforming until the state lifts the more onerous travel restrictions.

DAYS ON MARKET

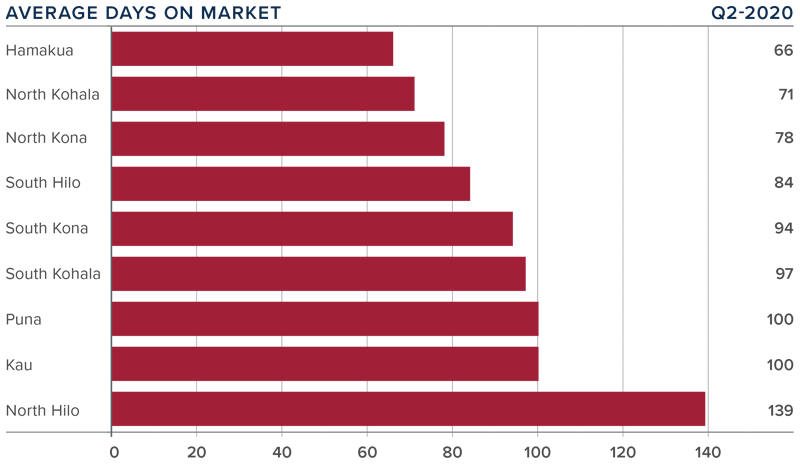

❱ The average time it took to sell a home on the Big Island dropped 16 days compared to the second quarter of 2019.

❱ The amount of time it took to sell a home dropped in Hamakua, North Kohala, South Kohala, North Kona, and Kau, but rose in all other markets.

❱ In the second quarter, it took an average of 92 days to sell a home. Homes sold fastest in Hamakua and slowest in North Hilo.

❱ It took 11 fewer days to sell a home in the second quarter than in the first quarter of this year.

CONCLUSIONS

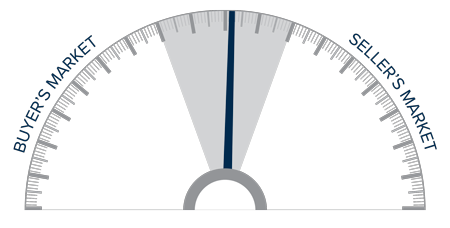

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Unsurprisingly, the Island is still reacting to the influences of COVID-19. Demand has not disappeared completely, though it is significantly lower than it should be. The pandemic is influencing the direction of housing, but I remain hopeful that we will start to see the market return to some sort of normalcy this fall.

With lower demand, I am moving the needle more in favor of home buyers. The lack of homes for sale is keeping it from technically becoming a buyer’s market—but it’s close.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link