The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The counties covered by this report—Los Angeles, San Diego, San Bernardino, Orange, and Riverside—added 110,200 new jobs between May 2017 and May 2018. As a result, the unemployment rate dropped from 4.2% to 3.6%. Employment growth in Southern California continues to outperform the nation as a whole, and I am confident this will continue as we move through the balance of the year.

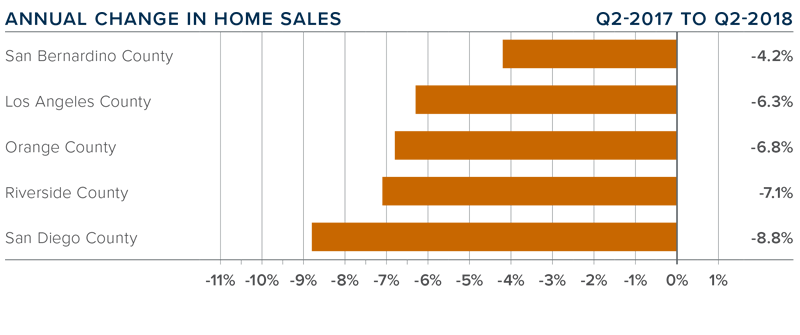

HOME SALES ACTIVITY

- There were 51,320 home sales in the second quarter of 2018. This was 6.8% lower than the same period in 2017 but 32.6% higher than the first quarter of this year.

- Pending home sales (an indicator of future closings) were 3.2% lower than during the same period a year ago, which suggests that third quarter closings may not show much improvement.

- Home sales dropped across the board. The most noticeable decline was in San Diego County, which fell 8.8%. I continue to believe that the decline in sales is directly related to the very low levels of inventory.

- There was an average of 35,238 active listings in the second quarter—well below what is needed to get to a balanced market.

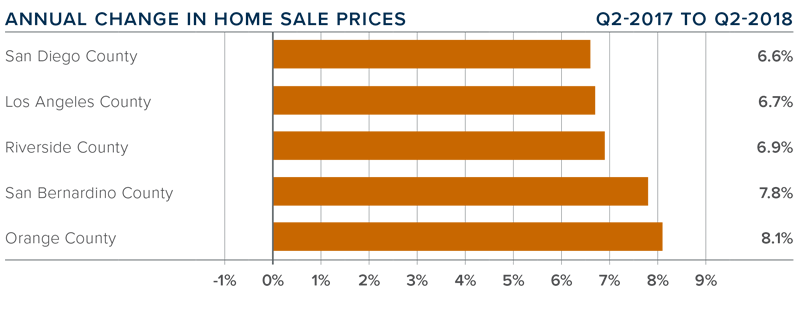

HOME PRICES

- Year-over-year, average prices in the region rose by 7% and were 5.6% higher than in the first quarter of 2018.

- Affordability continues to be an issue, which, in concert with limited inventory, is pushing home prices higher. New construction activity is not meeting the needs of new households, which puts further pressure on home prices.

- Price increases across the region were fairly level, with Orange County showing the greatest annual appreciation in values (+8.1%). The slowest appreciation was in San Diego County, which still saw a respectable 6.6% increase.

- Based on the data in this report, I believe it is highly likely that prices will continue rising at above-average rates for at least the balance of 2018.

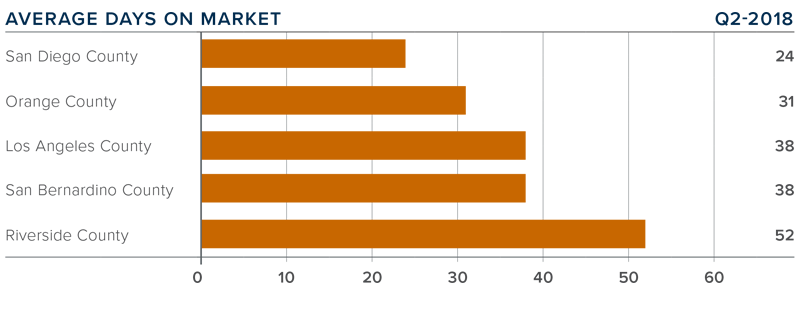

DAYS ON MARKET

- The average time it took to sell a home in the region was 37 days. This is a drop of four days compared to the second quarter of 2017, and seven fewer days than in the first quarter of this year.

- The biggest drop in days on market was in San Bernardino County, where it took six fewer days to sell a home compared to the same period last year.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the second quarter, it took an average of only 24 days to sell a home, which is one day less than it took a year ago.

- All five counties saw a drop in the amount of time it took to sell a home compared to the second quarter of 2017.

CONCLUSIONS

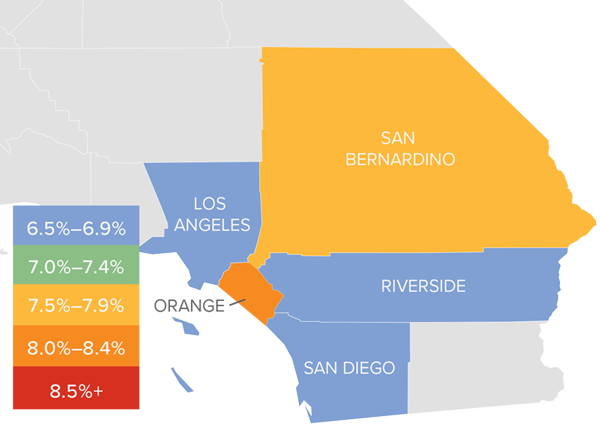

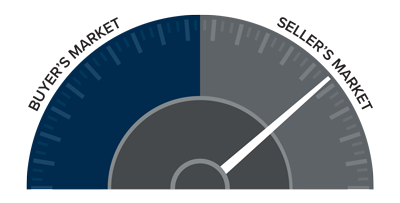

The speedometer reflects the state of the region’s real estate market using housing inventory,

price gains, home sales, interest rates, and larger economic factors.

The Southern California economy continues to add jobs at a very healthy rate, which increases demand for all housing types. Mortgage rates—although rising— are still very favorable when compared to historic averages, and low inventory continues to drive prices higher. The number of homes for sale in the region remains well below the levels needed for a balanced market. Given all of these factors, I have moved the needle a little more in favor of sellers.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link