The following analysis of select counties of the Utah real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

COVID-19 had a significant impact on employment in Utah, causing the loss of more than 144,000 jobs in March and April and raising the state’s unemployment rate to 10.4%. For comparison, peak unemployment following the Great Recession was only 8%. That said, it appears as if Utah’s massive contraction in employment is behind us (at least for now). Employment in the state rose by 40,400 jobs in May, an increase of 2.8% in just one month, allowing the unemployment rate to drop to 8.5%. Although it is certainly too early to say that we are out of the woods, we seem to be headed in a positive direction.

That said, COVID-19 infection rates in Utah started increasing in June and may slow the economic recovery if the direction is not reversed. Regardless, I do not believe that it is likely to have a significant impact on the housing market.

HOME SALES

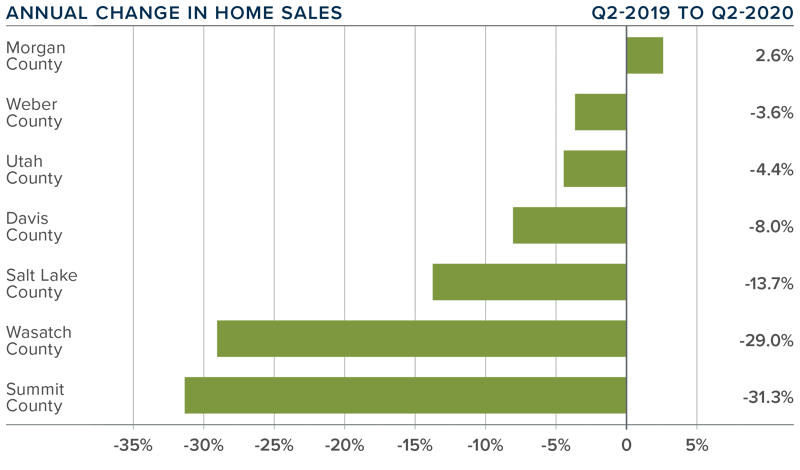

❱ In the second quarter of 2020, 9,320 homes sold, a drop of 10.1% compared to the same period in 2019. However, sales rose by a very significant 33.2% from the first quarter of 2020.

❱ Total sales activity declined in all counties other than the very small Morgan County. Summit and Wasatch counties also experienced notable contractions. I am attributing this to low inventory levels because of COVID-19 and I expect to see a bounce back in the second half of the year.

❱ The number of homes for sale in the second quarter was 28.6% lower than during the same period a year ago but was up 12% compared to the first quarter of this year.

❱ Pending sales in the second quarter were up a significant 41.4% compared to the first quarter of the year. This gives further credence to my view that sales are not low due to a lack of demand; rather it is a function of limited supply.

HOME PRICES

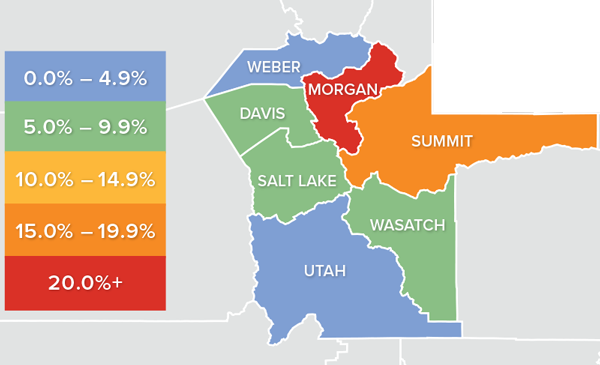

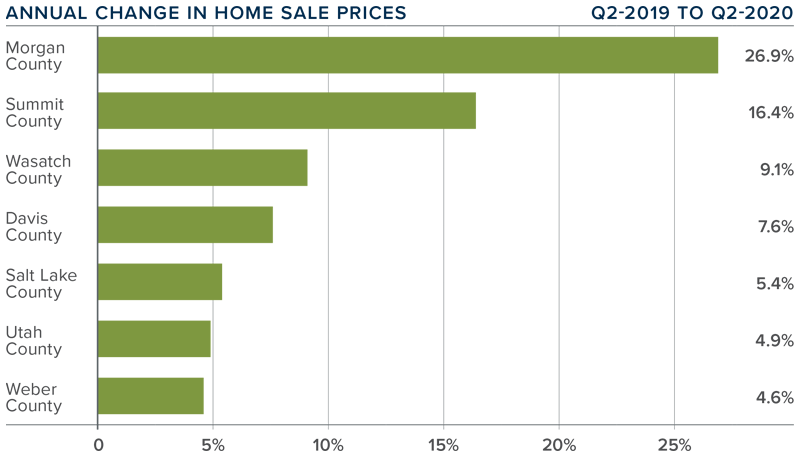

❱ The average home price in the region continued to rise in the second quarter, with a year-over-year increase of 4.5% to $408,602. Home prices were also 1.1% higher than in the first quarter of 2020.

❱ All counties contained in this report saw price increases compared to the same period a year ago.

❱ Price growth was strongest in Morgan County where prices rose 26.9%. However, this is a small area that can be subject to extreme price swings.

❱ The takeaway here is that home prices continued to appreciate at significant rates during the quarter and did not appear to be greatly impacted by COVID-19.

DAYS ON MARKET

❱ The average number of days it took to sell a home in the counties covered by this report dropped five days compared to the second quarter of 2019.

❱ Homes sold fastest in Davis and Salt Lake counties, and slowest in Summit County. It took less time to sell a home in all counties other than Summit.

❱ During the second quarter, it took an average of 48 days to sell a home in the region, down 9 days from the first quarter of 2020.

❱ Lower days on market indicates that buyer demand remains strong regardless of the COVID-19 related drop in sales seen relative to the prior quarter and the same period a year ago.

CONCLUSIONS

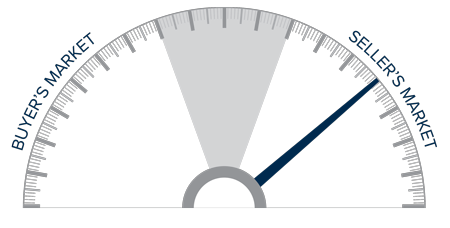

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand is in place but is being hobbled by low levels of inventory. With the combination of solid demand and historically low-interest rates, I expect to see a brisk summer housing market. Assuming that the state gets new infection rates back under control, I do not see why the housing market shouldn’t perform well this summer. As such, I have moved the needle just a little more in favor of home sellers.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link