The Current State of the U.S. Housing Market

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

Hello there, I’m Windermere’s Chief Economist Matthew Gardner, and welcome to this month’s episode of Monday with Matthew. With home prices continuing to defy gravity, mortgage rates spiking, the Fed raising interest rates significantly, a yield curve that is just keeping its nose above water, and some becoming vocal about the possibility that we are going to enter a recession sooner rather than later, it’s not at all surprising that many of you have been asking me whether the housing market is going to pull back significantly, and a few of you have asked whether we aren’t in some sort of “bubble” again.

Because this topic appears to be giving many of you heartburn, I decided that it’s a good time to reflect on where the housing market is today and give you my thoughts on the impact of rising mortgage rates on what has been an historically hot market.

The Current State of the U.S. Housing Market

Home Sale Prices

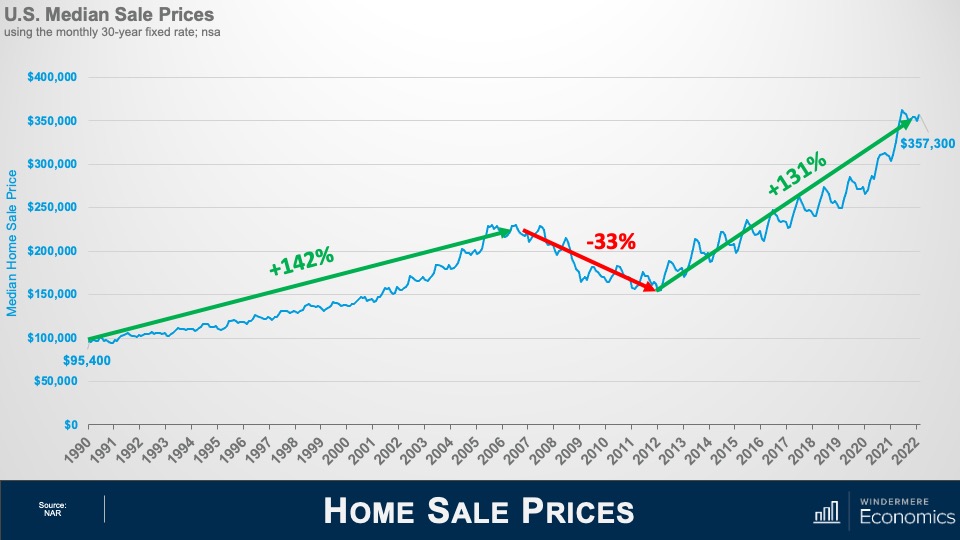

As usual, a little perspective. Between 1990 and the pre-bubble peak in 2006, home prices rose by 142%, which was a pretty impressive annual increase of 5.6% over a 16 1/2-year period. When the market crashed, prices dropped by 33%, but from the 2012 low to today, prices have risen by 131%, or at an even faster annual rate of 8.6% over a shorter period of time—10 years.

You may think that prices rising at an annual rate that exceeds the pace seen before the market crash is what has some brokers and home buyers concerned, but that really isn’t what has many people scared. It’s this.

Mortgage Rates in 2022

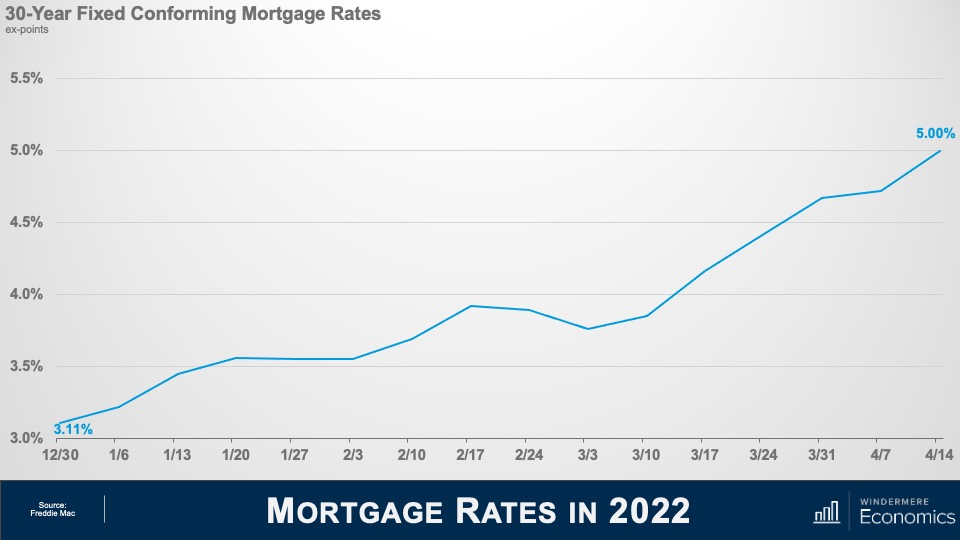

At the start of 2022, the average 30-year fixed mortgage rate was just a little above 3%. But, over a brief 15-week period, they have skyrocketed to 5%. This has led some to worry that the market is about to implode. Of course, nobody can say that the run-up in home prices hasn’t been phenomenal over the past few years, and it’s certainly human nature to think that “what goes up, must come down,” but is there really any reason to panic? I think not, and to explain my reasoning, let’s look back in time to periods when rates rose significantly and see how increasing mortgage rates impacted the marketplace.

Housing and Mortgage Markets During Times of Rising Rates

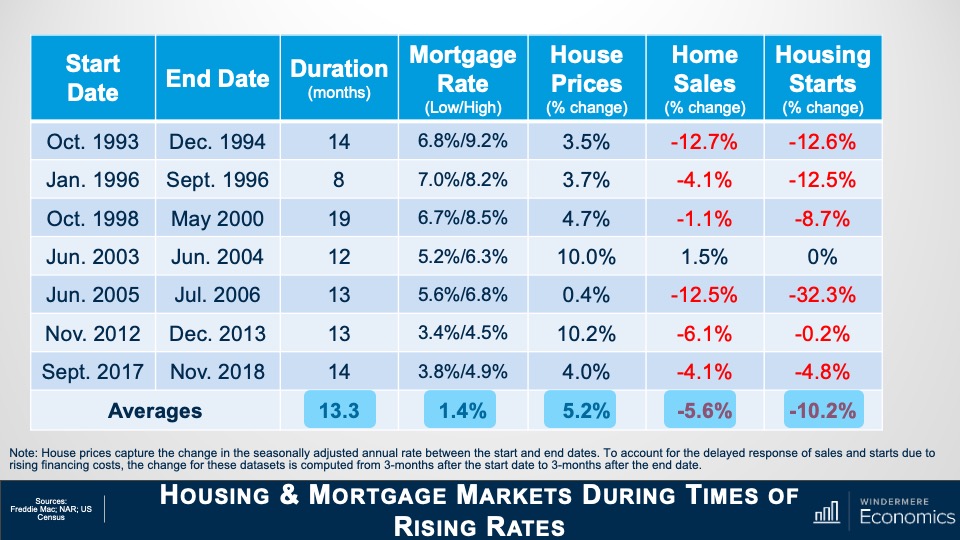

This table shows seven periods over the past 30 years when mortgage rates rose significantly. On average, rates trended higher for just over a year before pulling back, and the average increase was 1.4%. But now look at how it impacted home prices: it really didn’t. On average, during these periods of rising financing costs, home prices still rose by just over 5%. Clearly, not what some might have expected. But there were some negatives from mortgage rates trending higher, and these came in the form of lower sales in all but one period and new housing starts also pulled back.

So, if history is any indicator, the impact of the current jump in mortgage rates is likely to be seen in the form of lower transactions rather than lower prices. And this makes sense. Although rising financing costs puts additional pressure on housing affordability, what people don’t appear to think about is that mortgage rates actually tend to rise during periods of economic prosperity. And what does a flourishing economy bring? That’s right. Rising wages. Increasing incomes can certainly offset at least some of the impacts of rising mortgage rates.

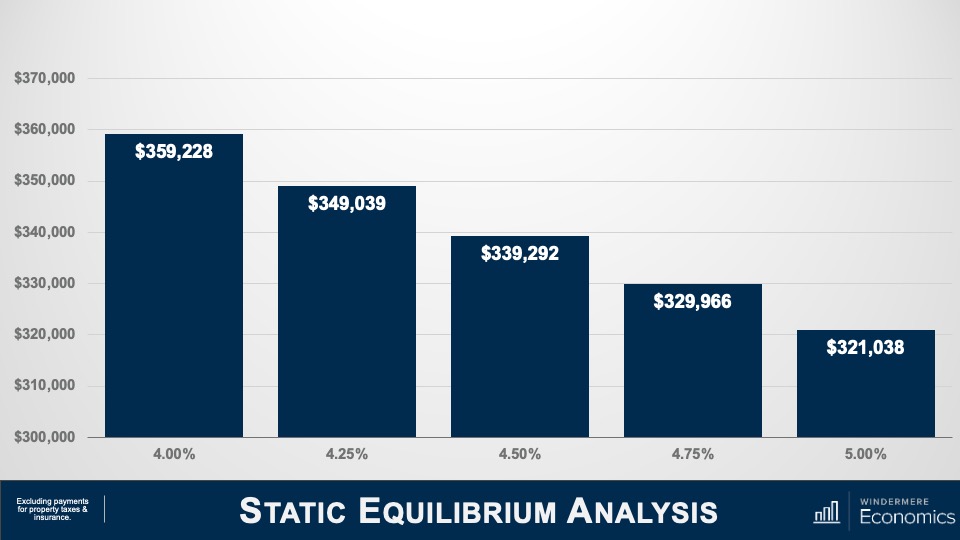

Static Equilibrium Analysis – 1/3

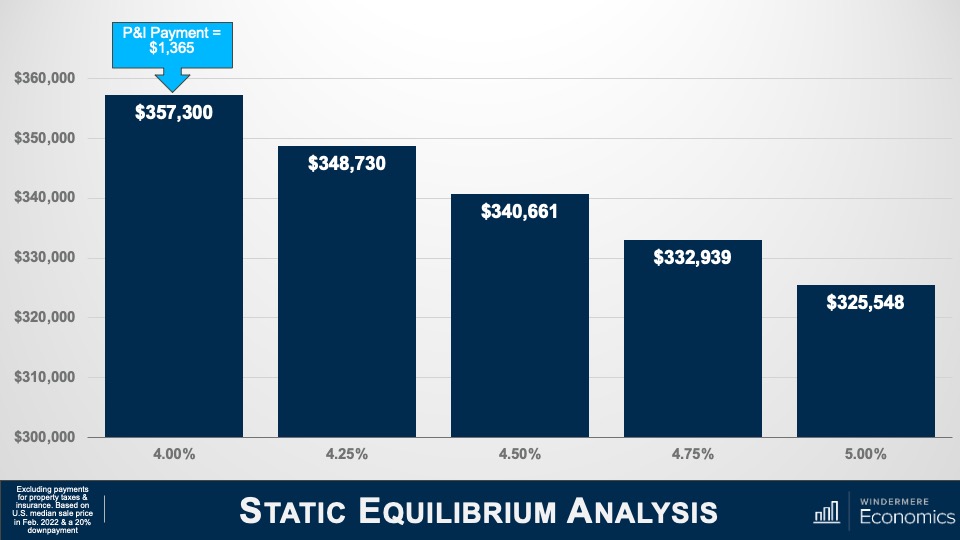

To try and explain this, I’m using the median US sale price in February of this year, assuming a 20% down payment and the mortgage rate of 4%. And you can see that the monthly P&I payment would be $1,365. But as mortgage rates rise, and if buyers wanted to keep the same monthly payment, then they would have to buy a cheaper home. Using a rate of 5%, a buyer could afford a home that was 9% cheaper if they wanted to keep the payment the same as it would have been if rates were still at 4%.

But, as I mentioned earlier, an expanding economy brings higher wages, and this is being felt today more than usual, given the worker shortage that exists and businesses having to raise compensation. Average weekly wages have risen by over five-and-a-half percent over the past year—well above the pre-pandemic average of two-and-a-half percent. Although increasing incomes would not totally offset rising mortgage rates, it does have an impact.

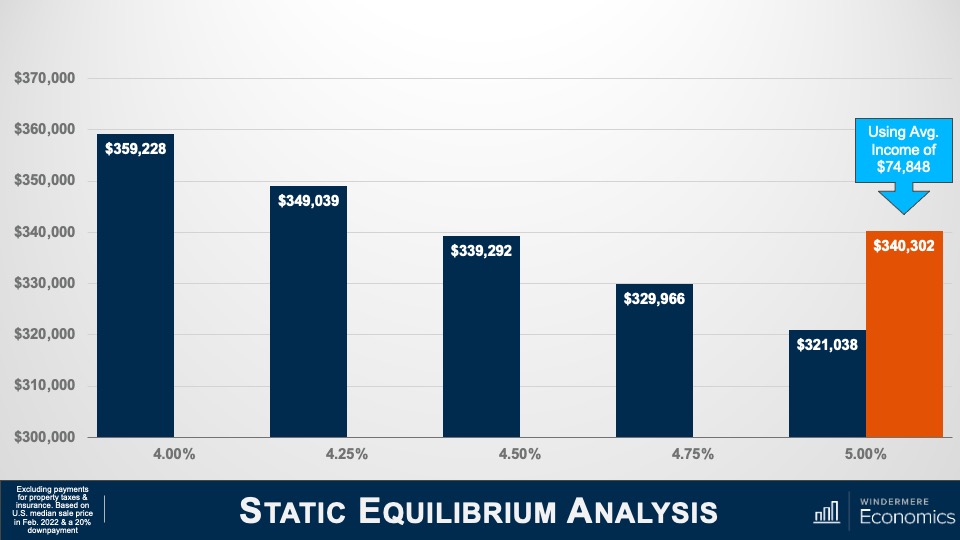

Static Equilibrium Analysis – 2/3

To demonstrate this, let’s use the U.S. average household income of $70,611. Assuming that they’ve put aside 20% of their gross income for a down payment, they could afford a home priced just under $360,000 if mortgage rates were at 4%. As rates rise—and assuming that their income doesn’t—their buying power is reduced by over 10%, or just over $38,000.

Static Equilibrium Analysis – 3/3

But if we believe that incomes will rise, then the picture looks very different. Assuming wages rise by 6%, their buying power drops by just 5% if rates rose from 4% to 5%, or a bit less than $19,000.

Although rates have risen dramatically in a short period, because they started from an historic low, the overall impacts are not yet very significant. If history is any indicator, mortgage rates increasing are likely to have a more significant impact on sales, but a far smaller impact on prices.

But there are other factors that come into play, too. Here I’m talking about demand. The only time since 1968 that home prices have dropped on an annualized basis was in 2007 through 2009 and in 2011, and this was due to a massive increase in the supply of homes for sale. When supply exceeds demand, prices drop.

So, how is it different this time around? Well, we know that the supply glut that we saw starting to build in mid-2006 was mainly not just because households were getting mortgages that, quite frankly, they should never have gotten in the first place, but a very large share held adjustable rate mortgages which, when the fixed interest rate floated, they found themselves faced with payments that they could not afford. Many homeowners either listed their homes for sale or simply walked away.

Although it’s true that over the past two or so months more buyers have started taking ARMs as rates rose, it’s not only a far smaller share than we saw before the bubble burst, but down payments and credit quality remained far higher than we saw back then.

So, if we aren’t faced with a surge of inventory, I simply don’t see any reason why the market will see prices pull back significantly. But even if we do see listing activity increase, I still anticipate that there will be more than enough demand from would-be buyers. I say this for several reasons, the first of which is inflation.

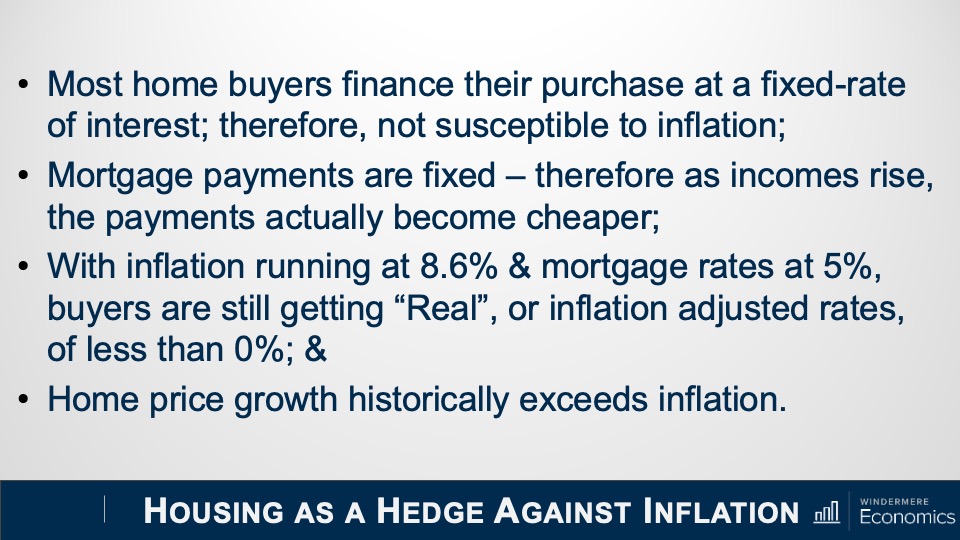

What a lot of people aren’t talking about is the proven fact that owning real estate is a significant hedge against rising inflation. You see, most buyers have a mortgage, and a vast majority use fixed-rate financing. This is the hedge because even as consumer prices are rising, a homeowner’s monthly payments aren’t. They remain static and, more than that, their monthly payments actually become lower over time as the value of the dollar diminishes. Simply put, the value of a dollar in—let’s say 2025—will be lower than the value of a dollar today.

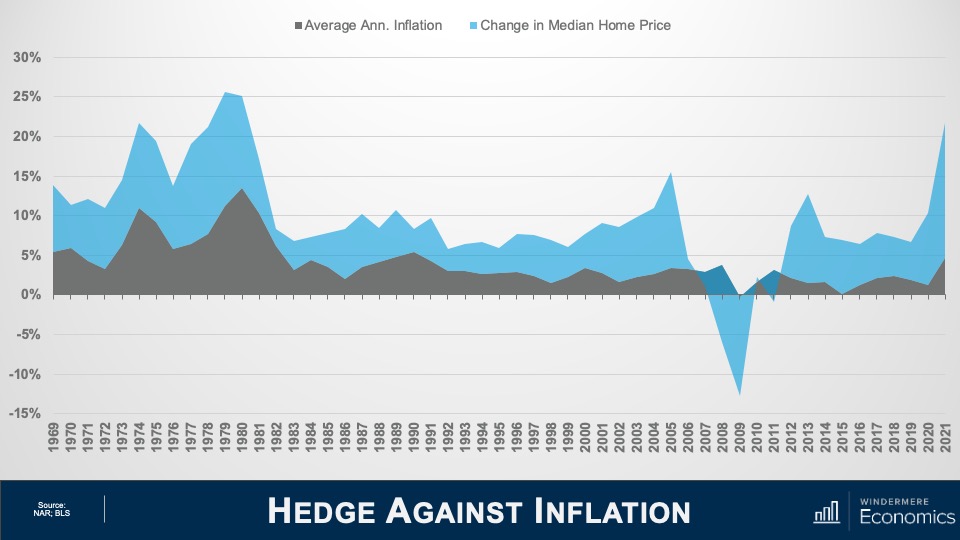

But this isn’t the only reason that inflation can actually stimulate the housing market. Home prices historically have grown at a faster pace than inflation.

Hedge Against Inflation

This chart looks at the annual change in total CPI going back to 1969. Now let’s overlay the annual change in median U.S. home prices over the same time period. Other than when home prices crashed with the bursting of the housing bubble, for more than fifty years home price growth has outpaced inflation. And this means we are offsetting high consumer prices because home values are increasing at an even faster rate.

But inflation has additional impacts on buyers. Now I’m talking about savings. As we all know, the interest paid on savings today is pretty abysmal. In fact, the best money market accounts I could find were offering interest rates between 0.5% and 0.7%. And given that this is significantly below the rate of inflation, it means that dollars saved continue to be worth less and less over time while inflation remains hot.

Now, rather than watching their money drop in value because of rising prices, it’s natural that households would look to put their cash to work by investing in assets where the return is above the rate of inflation—meaning that their money is no longer losing value—and where better place to put it than into a home.

Housing as a Hedge Against Inflation

So, the bottom line here is that inflation supports demand from home buyers because:

- Most are borrowing at a fixed rate that will not be impacted by rising inflation

- Monthly payments are fixed, and these payments going forward become lower as incomes rise, unlike renters out there who continue to see their monthly housing costs increase

- With inflation at a level not seen since the early 1980s, borrowers facing 5% mortgage rates are still getting an amazing deal. In fact, by my calculations, mortgage rates would have to break above 7% to significantly slow demand, which I find highly unlikely, and

- If history holds true, home price appreciation will continue to outpace inflation

Demand appears to still be robust, and supply remains anemic. Although off the all-time low inventory levels we saw in January, the number of homes for sale in March was the lowest of any March since record keeping began in the early 1980’s.

But even though I’m not worried about the impact of rates rising on the market in general, I do worry about first-time buyers. These are households who have never seen mortgage rates above 5% and they just don’t know how to deal with it! Remember that the last time the 30-year fixed averaged more than 5% for a month was back in March of 2010!

And given the fact that these young would-be home buyers have not benefited from rising home prices as existing homeowners have, as well as the fact that they are faced with soaring rents, making it harder for them to save up for a down payment on their first home, many are in a rather tight spot and it’s likely that rising rates will lower their share of the market.

So, the bottom line as far as I am concerned is that mortgage rates normalizing should not lead you to feel any sort of panic, and that current rates are highly unlikely to be the cause of a market correction.

And I will leave you with this one thought. If you agree with me that a systemic drop in home prices has to be caused by a significant increase in supply, and that buyers who are currently taking out adjustable-rate mortgages are more qualified, and therefore able to manage to refinance their homes when rates do revert at some point in the future, then what will cause listings to rise to a point that can negatively impact prices?

It’s true that a significant increase in new home development might cause this, but that is unlikely. And as far as existing owners are concerned, I worry far more about a prolonged lack of inventory. I say this for one very simple reason and that is because a vast majority off homeowners either purchased when mortgage rates were at or near their historic lows, or they refinanced their current homes when rates dropped.

And this could be the biggest problem for the market. Even if rates don’t rise at all from current levels, I question how many owners would think about selling if they were to lose the historically low mortgage rates that they have locked into. It is quite possible that for this one reason, we may experience a tight housing market for several more years.

As always, if you have any questions or comments about this particular topic, please do reach out to me but, in the meantime, stay safe out there and I look forward to visiting with you all again next month.

Bye now.

The Impact of Rising Mortgage Rates

This video is the latest in our Monday with Matthew series with Windermere Chief Economist Matthew Gardner. Each month, he analyzes the most up-to-date U.S. housing data to keep you well-informed about what’s going on in the real estate market.

The Impact of Rising Mortgage Rates

Hello there. I’m Windermere Real Estate’s Chief Economist Matthew Gardner. Welcome to the latest episode of Monday with Matthew.

Over the past several weeks I’ve gotten a lot of messages from you wanting me to discuss the spike in mortgage rates that followed comments by the Federal Reserve, but also asking me if there will be any impacts to the housing market following Russia’s invasion of the Ukraine. This is clearly a hot topic right now, so today we are going to take a look at how these events have impacted mortgage rates, but also look at how this may have changed my mortgage rate outlook for 2022. So, let’s get to it.

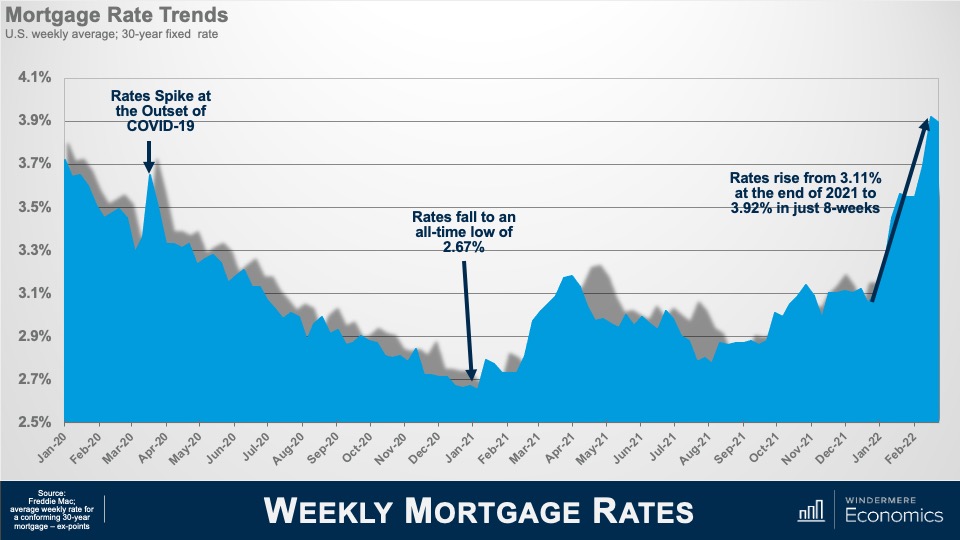

Weekly Mortgage Rates

Here is a chart that shows how rates have moved over the past two years or so using Freddie Mac’s average weekly rate for a conforming 30-year mortgage. You’ll see that rates were falling in early 2020, but when COVID-19 was announced as a pandemic they spiked, but almost immediately the Fed announced their support for the economy by implementing a broad array of actions to keep credit flowing and limit the economic damage that the pandemic would likely create. And part of that support included large purchases of U.S. government and mortgage-backed securities. With the Fed as a major buyer of mortgage securities, rates dropped ending 2020 at a level never seen in the more than 50 years that the 30-year mortgage has been with us.

In early 2021, rates started to rise again as the country became more confident that the pandemic was coming under control, but all that changed with the rise the Delta variant of COVID-19 which pushed rates lower through mid-summer. As we again started to believe that COVID was under control and a booster shot became available, you’ll see rates resumed their upward trend in August.

What has everyone worried today is this spike that really took off at the end of last year. A jump of almost a full percentage point in just eight short weeks understandably has a lot of agents, buyers, and sellers, concerned about what impacts this might have on what has been a remarkably buoyant housing market. Now, rates rising so quickly was unusual, but not unprecedented. If you really wanted to be scared, I’d regale you with stories from 1980 when mortgage rates jumped by over 3.5% in less than eight weeks.

Anyway, before we really dig into this topic, some of you may be thinking to yourselves that my numbers have to be wrong because they differ from the rates you have been looking at. This is due to the fact that the Freddie Mac survey methodology is different from other rate surveys but, even though their rates may not match the ones you’ve been seeing from other data providers, the trend is still consistent.

So, let’s chat for a bit about what caused the spike in rates. You know, it’s always good to have a villain in any story and the primary but certainly not sole culprit responsible for the jump in rates is—you guessed it—the Federal Reserve.

As I mentioned earlier, the Fed was the biggest buyer of pools of home loans (otherwise known as mortgage-backed securities) as we moved through the pandemic, but last December they announced an end to what had been an era of easy money by winding down these purchases in order to lay the groundwork for shrinking their 2.7 trillion—yes I said “trillion”—dollar stockpile of MBS paper they had built up. This decision to move from “quantitative easing” to “quantitative tightening” so rapidly had an almost immediate impact on mortgage rates simply because the market was going to lose its biggest buyer of mortgage bonds.

Immediately on the heels of their announcement, bond sellers raised the interest rate on their bond offerings to try and find buyers other than the Fed, so lenders raised the rates on mortgages housed within these bond offerings. Finally, mortgage brokers moved quickly to raise the rates that they were quoting to the public. The result of all this was that rates leapt. Although we know that the primary party responsible for rates rising was the Fed, there were other players too, and here I am talking about inflation—and as you are no doubt aware—it too started to spike at the beginning of this year and now stands at a level not seen since 1982. And if you’re wondering why inflation is important. Well, high inflation is a disincentive to bond buyers because if the rate of return, or interest on mortgage bonds, is lower than inflation, investors lose interest pretty quickly.

So, we can blame the Fed, we can blame inflation, but what about Russia? Well, their invasion of the Ukraine on February 24 has certainly influenced mortgage rates, but maybe not in the way you might expect. In general, when there’s any sort of global or national geopolitical event, investors tend to gravitate to safety, and this invariably means a shift out of equities and into bonds.

So you would be correct is thinking that at face value Russia was actually responsible for the tiny drop in rates we saw following the invasion, and also the more significant drop we saw last week when the market saw the biggest two-day drop in rates in over a decade. But before you start to think that rates are headed back to where they were a year ago, I’ve got some bad news for you. That is almost guaranteed not to happen.

Given what we know today, the terrible conflict in Eastern Europe is highly unlikely to push rates back down to where they were at the start of this year, but they will—at least for now—act as a headwind to rates continuing to head higher at the pace we have seen over recent weeks. That will continue until the conflict is hopefully peaceably concluded. And although the Ukraine situation is unlikely to have any significant impact up or down on mortgage rates, there are some indirect impacts which could negatively hit the housing market. Now I’m talking about oil.

Russia is the third largest energy producer in the world and an already tight global oil supply could get even tighter following newly announced financial sanctions on Russia. A barrel of oil has jumped by almost $20 to $109 a barrel since the start of the occupation and, if the occupation is sustained, and Russia is faced with even greater sanctions, I wouldn’t be surprised to see the price of gas rise by between 20 and 40 cents a gallon. And it’s this, in concert with already high inflation, which will directly hit consumers wallets and this itself could certainly impact mortgage borrowing. So we can blame the Fed, we can blame inflation and we can blame Russia for the jump in rates, but are the rates you are seeing today really something to lose sleep over? I actually don’t think so. At least not yet.

Even with mortgage rates where they are today, I look at them and think to myself that they are still exceptionally low by historic standards and that there really is no need for panic. But let me explain my thinking to you. To do this, we will take a look at the impact of rising mortgage rates, not as it relates to buyers’ ability to finance a home purchase, but on how it impacts their monthly payments.

Hypothetical Home Purchase

For this example, we’ll use the peak sale price for a single-family home in America, which was just over $370,000 back in June of last year. And to finance this purchase, a buyer was lucky enough to lock in the lowest mortgage rate for that month at 2.96%. Assuming that they put 20% down, and are paying the U.S. average homeowners insurance premium and average property taxes a buyer closing on that home in June of last year would have a monthly payment of $1,682.

Now, what if a buyer had bought the exact same house but in February of this year? Well, the average rate for the third week of February was 4.06%—a big jump from last June—and higher mortgage rates would have increased their payment to $1,864. What does this all mean? Well, a jump of over a full percentage point means that the monthly payment is more, but only a relatively modest $182. So, even though rates have risen by almost a full percentage point, the increase in payments was, I think you’ll agree, relatively nominal.

But what if rates had risen to 5%? Well, that would be a very different picture with payments increasing by a far more significant $348. Of course, this is a very simplistic way of looking at it as I have not included any other debt payments that a buyer may have, but I hope that it does demonstrate that, even though mortgage rates are certainly significantly higher than they were last summer, because we started from such a low basis, monthly payments have seen a relatively modest increase. The bottom line is that rates were never going to hold at the record lows we have seen, and we need to just accept the fact that they will continue trending higher as we move through the year but are yet at a level that suggests impending doom for the housing arena. So, where do I think that rates will be by the end of this year? Well, here is my very latest forecast for the rest of this year.

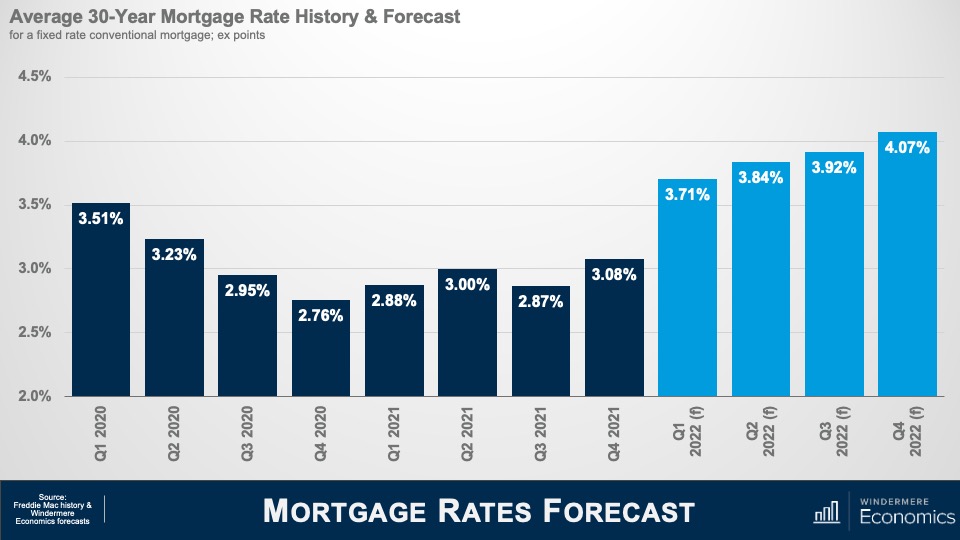

Mortgage Rates Forecast

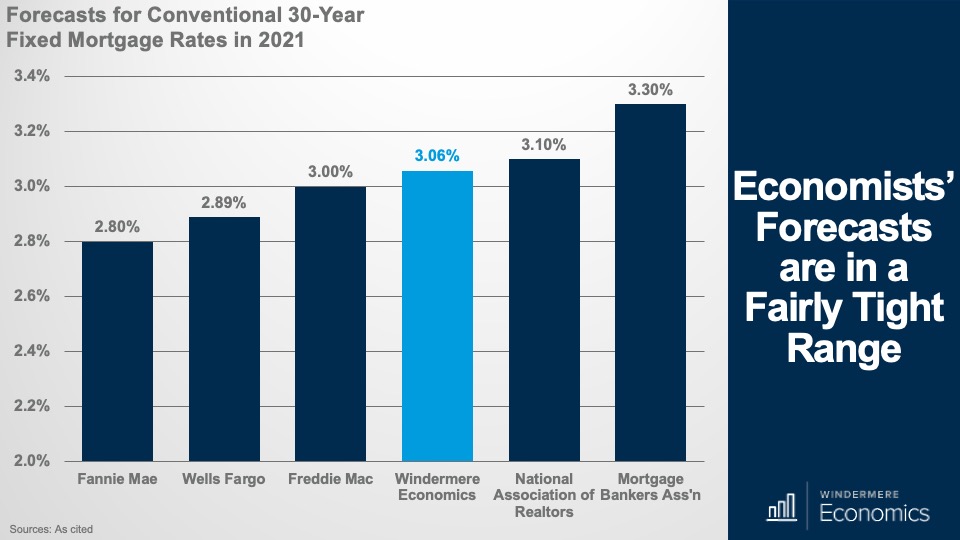

Given all we know in respect to the Fed and the current situation in Ukraine, my model suggests a significant jump in the first quarter, but then the pace of increase slows significantly and we will end this year at a rate that is almost half a percentage point above the forecast I offered at the start of the year.

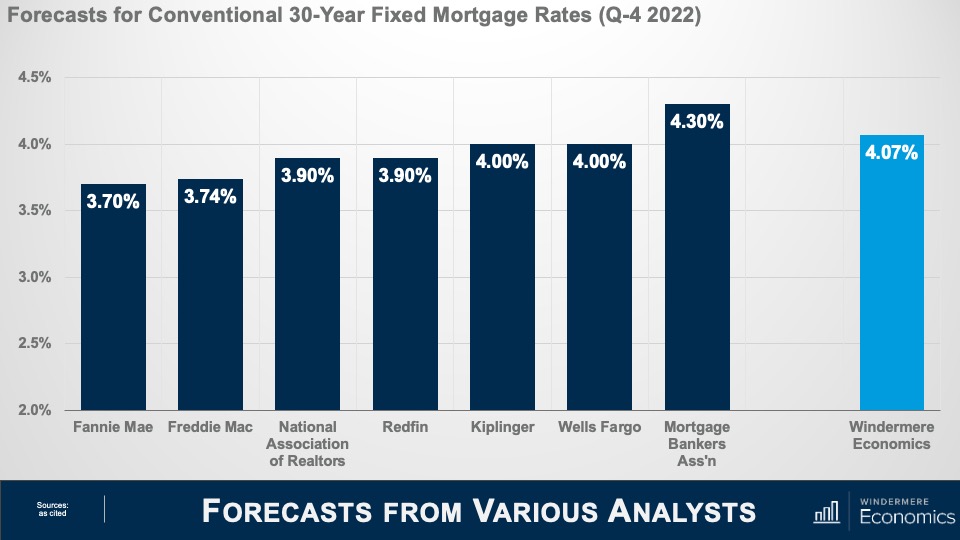

Forecasts From Various Analysts

Of course, this is the opinion of just one economist, so I thought it would be useful for you to see what others are thinking. And amazingly enough, most of us—at least for now—are still in a pretty tight range regarding our expectations for the average rate in the 4th quarter of 2022 with Fannie Mae at the low end of the spectrum and the Mortgage Bankers Association at the high end.

I honestly believe that, all things being equal, the impact of higher mortgage rates is unlikely to significantly impact the U.S. market this year and, even with rates rising, the market will remain tight in terms of supply and will continue to favor home sellers. That said, once we break above 4.5%, I would expect to see the increased cost of financing having a greater impact on not just on demand but on price growth, too.

And if you are wondering why I am so sure about this, it’s simply because we saw the exact same situation in 2018 when rates rose to 4.9% and we saw a palpable pull back in sales; which dropped from an annual rate of 5.4 million to 5 million units and the pace of price growth dropped from 5.9% to 3.3%. Now, I don’t see rates getting close to 5% for quite some time and therefore still expect demand to remain robust—off the all-time highs we have seen—but still solid given demographically-driven demand as well as increasing demand from buyers trying to find a new home before rates much further.

Of course, the impact of rates rising will not be felt equally across all markets. Many areas, and especially in coastal States, have seen home values skyrocket to levels that are well above the national average. Although incomes are generally higher in these markets, buyers in more expensive areas will feel more pain from higher financing costs.

And there you have it. I hope that today’s chat has not only given you some additional tools to use in your day-to-day business but has also given you enough information to hopefully ease some of the worry that many of you are feeling right now. As always, if you have any questions or comments about this particular topic, please do reach out to me but, in the meantime, stay safe out there and I look forward to visiting with you all again next month.

Bye now.

Matthew Gardner COVID-19 Housing & Economic Update: 01/25/2021

Hello there and welcome to the first Mondays with Matthew for 2021. It’s great to be back and I hope that you all had a fantastic holiday season and are getting into the new year groove.

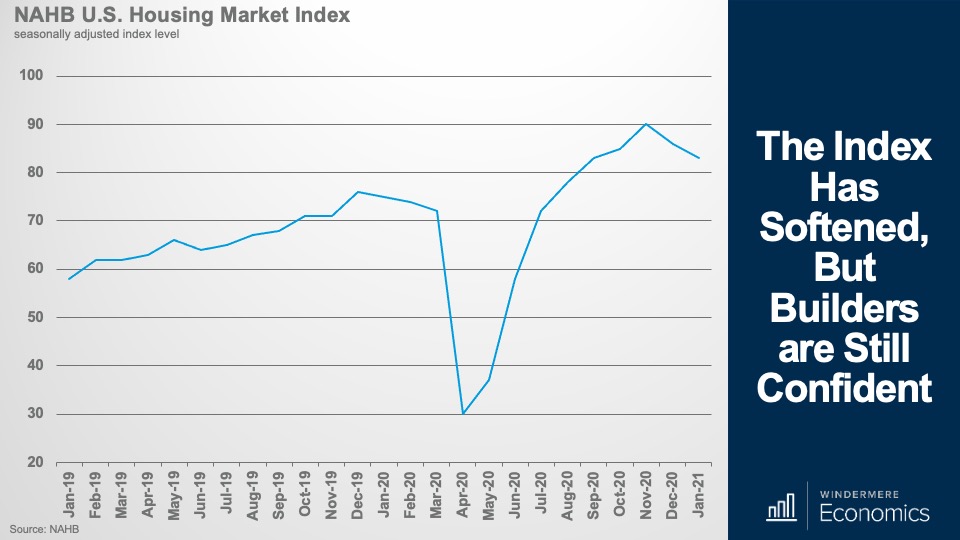

Well, there’s a lot of data releases to talk about today so let’s get to it. First up is the latest National Association of Homebuilders report on builder confidence.

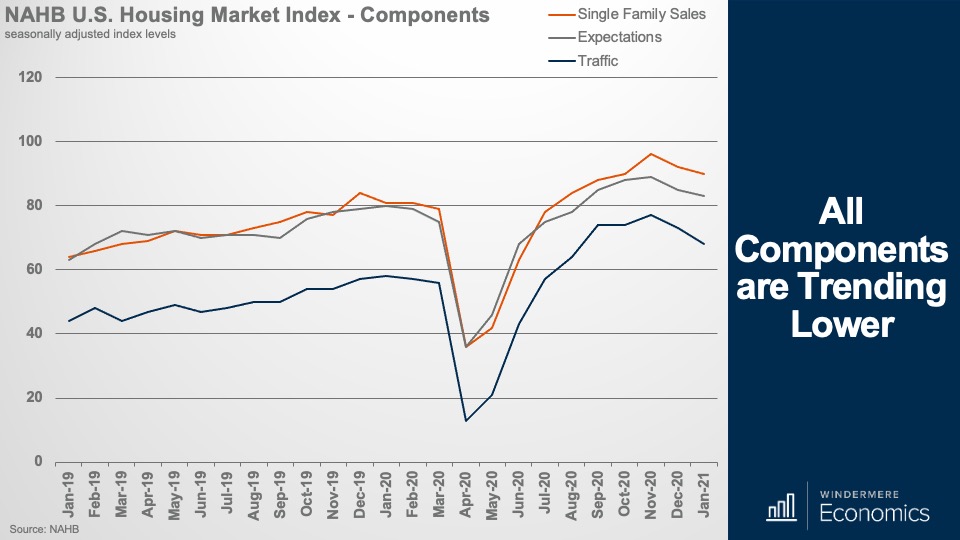

The index slipped to 83 from 86 but, for context, any reading above 50 means more builders view market conditions as favorable than poor.

Now, as you can see, following a very impressive recovery following the start of the pandemic, U.S. homebuilder confidence has trended lower for the past 2-months but, to tell you the truth, I really wasn’t surprised to see this.

Why wasn’t I surprised?

Well, its actually rather simple. Surging COVID-19 infections in concert with increasing material costs offset record low mortgage rates.

Builders are still grappling with supply-side constraints related to not just material costs, but a lack of affordable lots on which to build, and labor shortages that are all putting upward pressure on new home prices.

It’s very frustrating for builders these days as they see very significant demand for housing – driven by cheaper mortgages as well as an exodus from city centers to the suburbs and other low-density areas as companies allow employees to work from home because of the pandemic.

Oh! Talking of work-from-home, I did see a number put out by the Census Bureau in their Household Pulse Survey that suggested that about 38% of the labor force is now working at least part-time from home. That’s a massive number.

Anyway, all of the component parts of the survey trended lower with the measure of sales expectations in the next six months falling two points to 83, the gauge of current sales conditions also dropping two points to 90, and the prospective buyers index falling by five points to 68.

I am not worried by this as, even at these levels, builders are still pretty bullish about the market, and I say this because of the next dataset I’m going to talk about – the housing permit and starts report.

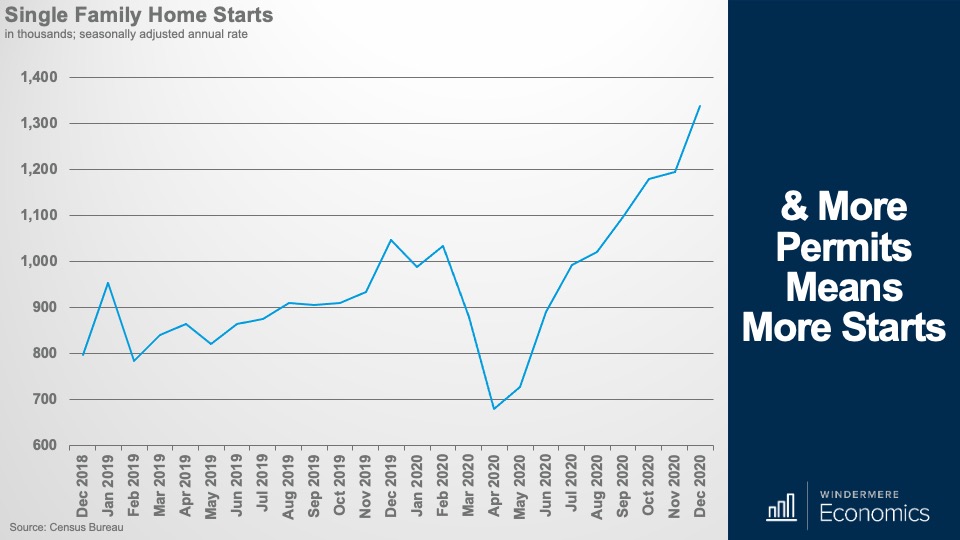

Even if builders were suffering from worries regarding costs. Oh! I should add that their biggest issue as far as material costs are concerned are that lumber prices have risen by 52% versus a year ago! Anyway, this increase in cost, as well as the other issues that we have just talked about didn’t translate into slowing activity when it came to permits and starts which both surged in December.

This chart shows the number of single-family permits issued across the country and the figure rose by 7.8% between November and December to an annual rate of 1.226 million units. That’s 30.4% higher than seen a year ago. And the fastest rate seen since 2007.

And looking now at housing starts, well they impressed too with a 12% month over month gain to an annual rate of 1.338 million units – and that’s 27.8% higher than a year ago.

I would also note that single-family starts have increased for eight straight months now. And – given the data that we have just looked at – it’s not surprising to see a very significant jump in the number of homes under construction.

Now, in case you are a little confused by terminology, I should let you know that housing starts don’t actually relate to the number of homes being built. Starts refer to lots where a foundation has been poured, but it doesn’t mean that vertical construction has commenced. For that we need to look at the under-construction data shown here.

And the number is pleasing. In fact, the current level of ground-up construction is at its highest level since 2007.

The bottom line is that I expect to see the number of starts and homes under construction continue to rise, and new supply of homes is likely to take some of the upward price pressures off the resale market.

In fact, my current forecast is for new home sales to rise this year to about 988,000 units.

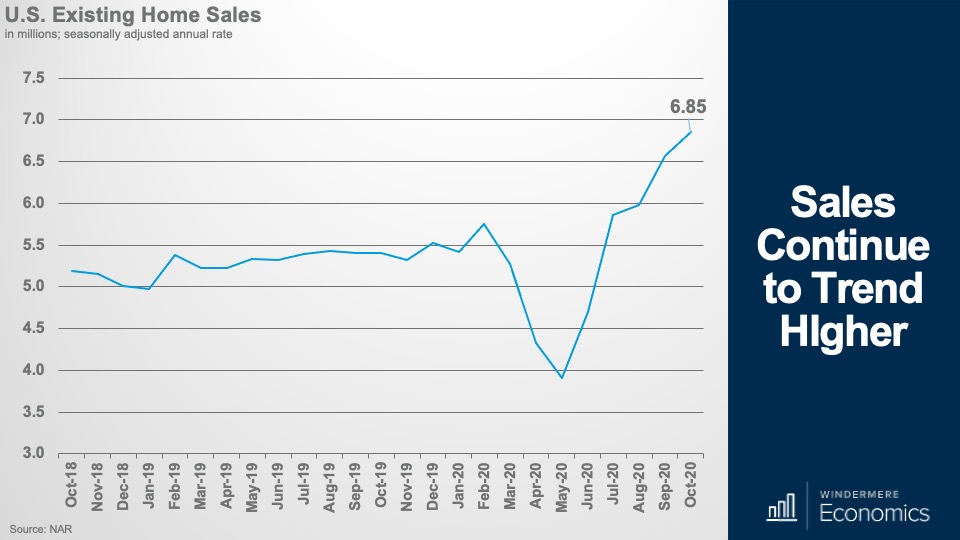

And talking of the resale market, I know that you have all been waiting for the December existing home sales numbers and they were released last Friday.

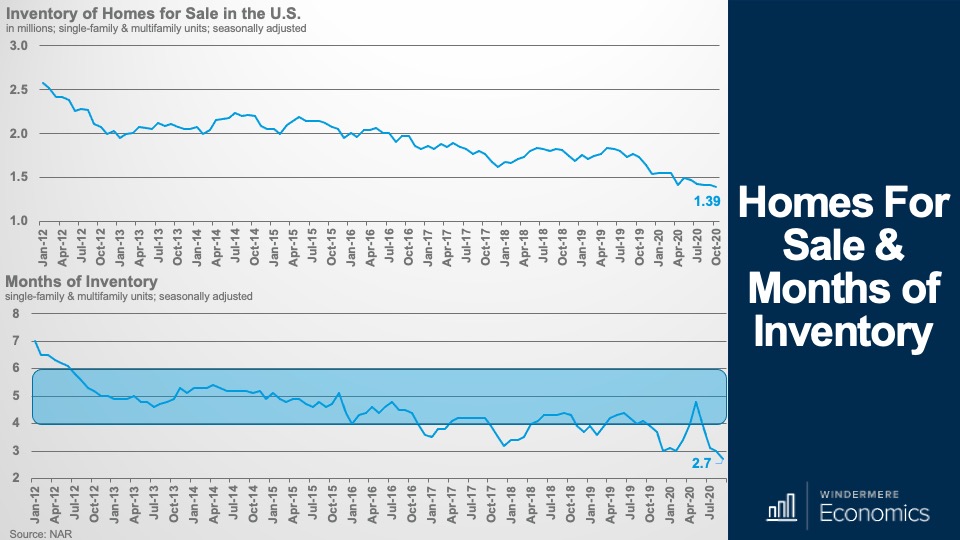

Before we get to the good stuff, I want to start with inventory – or lack of it!

Without seasonal adjustment, the number of homes for sale in December stood at just 1.07 million homes – and that’s down 23% year over year.

For perspective, that is the lowest number of homes on record and, at the current sales place, that represents a 1.9-month supply and that’s the lowest number seen since the National Association of Realtors began tracking this metric back in 1982.

So – we know that there is nothing to buy, but what’s happening to sales?

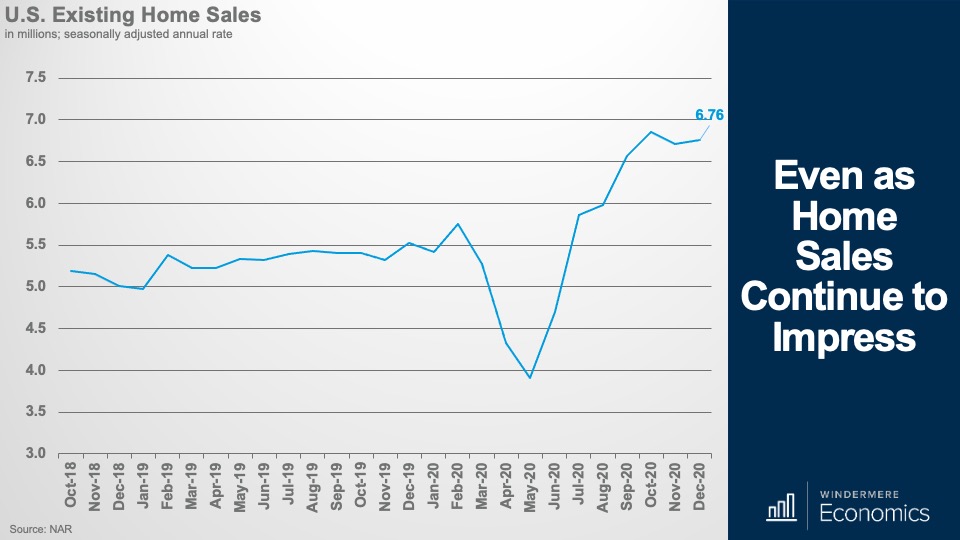

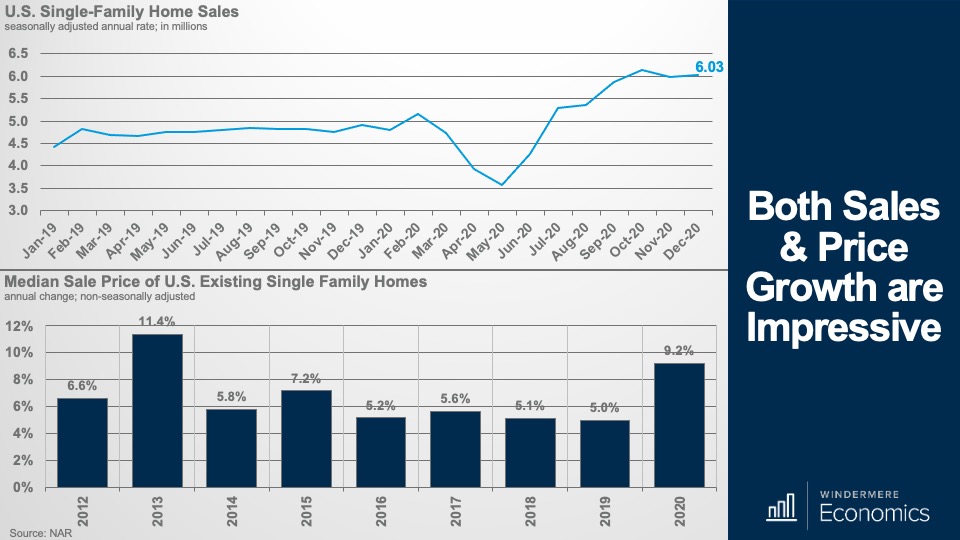

Look at this! Pandemic-driven demand for housing sent total 2020 home sales to the highest level since 2006.

Closed sales of existing homes in December increased just 0.7% from November to a seasonally adjusted annualized rate of 6.76 million units and sales were 22% higher than seen in December of 2019.

As unexpected as a global pandemic was, so too was the reaction of homebuyers. After plummeting in March and April, sales suddenly began to climb.

Total year-end sales volume ended at 5.64 million units, and that was a number far higher than I – or anyone – was predicting before the pandemic started.

COVID-19 drove buyers desire for larger, suburban homes with dedicated spaces not just for working but for schooling as well.

And I will tell you that, in my opinion, sales could have been even higher if there were just more homes to buy! I wouldn’t have been surprised, again, if we had no inventory constraints – to have seen over 7 million sales occurring last year and that would have matched the all-time high seen in 2005.

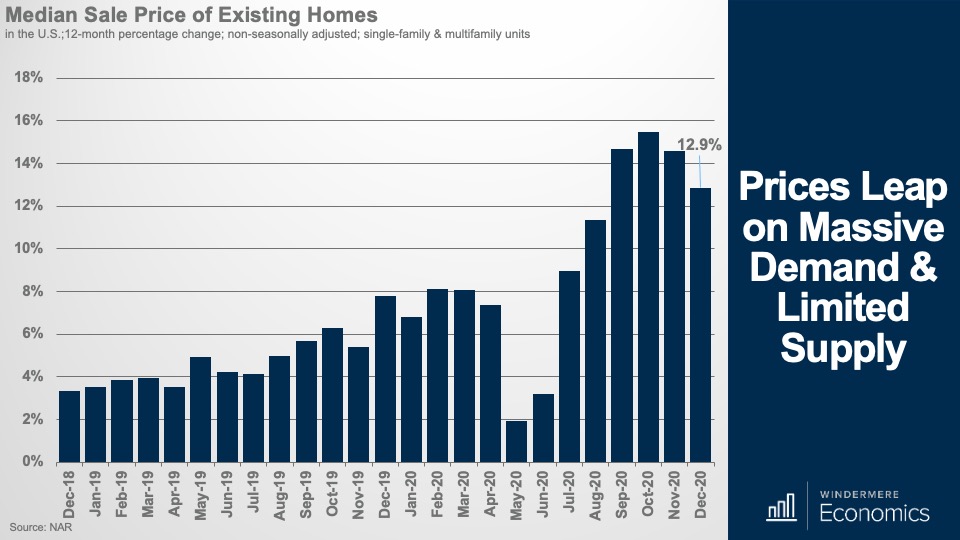

But of course, there is a price to pay when you have so much demand, and so little supply.

That’s right. Prices go up!

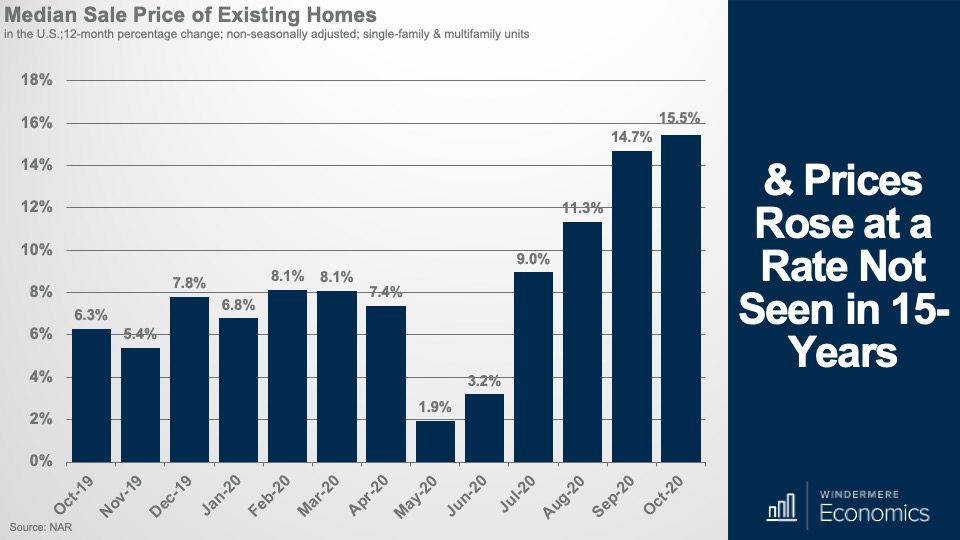

Low supply and very strong demand continued to heat home prices with the median price of an existing home sold in December coming in at $309,800, that’s a 12.9% increase when compared with December 2019 and the highest December median price on record. I would also add that this price is only marginally below the all-time high that was seen last October.

The surge in prices really has been quite remarkable, but I am not too surprised. Yes, demand has risen significantly, and supply has not, but much of the growth was driven by mortgage rates that have dropped precipitously since the pandemic started and are over a full percentage point lower now than they were a year ago.

I would add that part of the reason we say such a sharp increase in price is that home sales were actually very strong at the high end of the market, where there are more homes for sale.

Sales of homes in the US priced below $100,000 were down 15% annually in December, while sales of homes priced between $500,000 and $750,000 were up 65% year over year, and sales of million-dollar-plus homes were up by a whopping 94% from a year ago.

A lot of the growth in the luxury market can also be attributed to mortgage rates with jumbo rates – that spiked with the pandemic – dropping significantly and this has led sales higher.

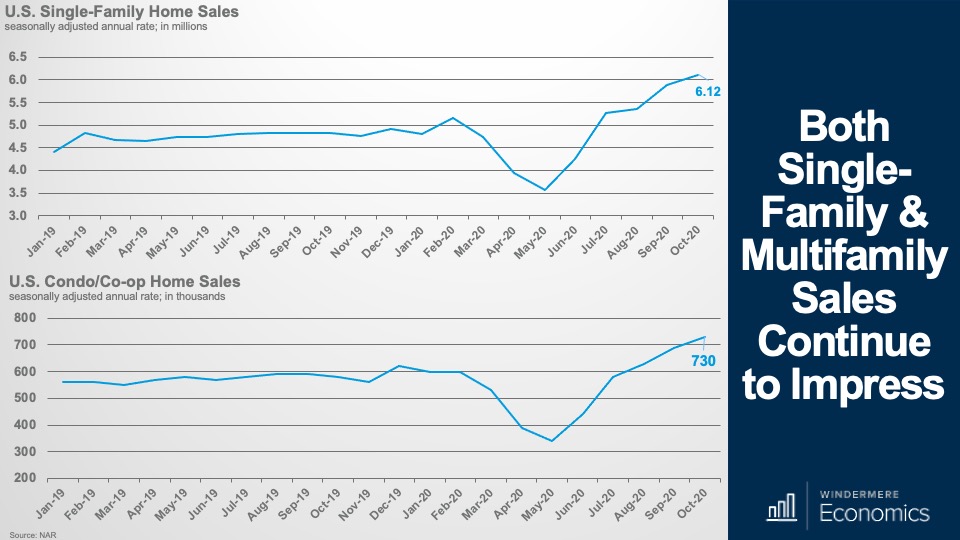

Breaking out the single-family market from condos, sales leapt in the early summer but leveled off in the fall because of – you guessed it – a lack of homes for sale and not a lack of demand.

In 2020, sales of single-family homes rose by 6.3% – a massive number that’s even more impressive given the fact that sales only rose by 0.5% in 2019.

And prices were, naturally on the rise too – increasing by 9.2% last year, and that’s the fastest rate we have seen since 2013, and that was when we were starting to recover from the housing bubble that burst causing home prices to collapse value buyers jumped in causing prices to rise significantly.

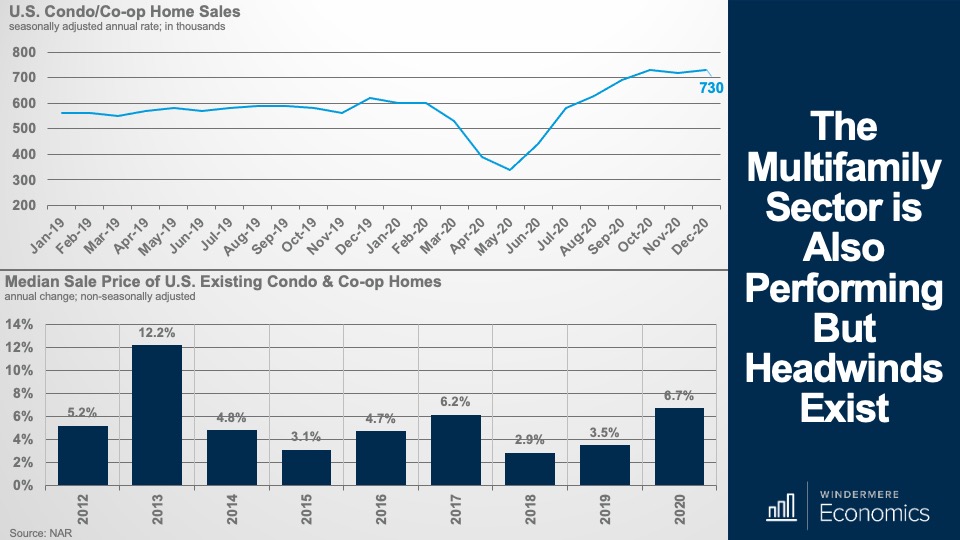

Looking now at condos, we see a somewhat similar picture with the annual rate of sales coming in at over 700,000 units but, interestingly, 2020 total condo sales were actually 0.3% lower than we saw in 2019.

What is happening here is a drop in demand for urban multifamily units with buyers able to work remotely. And this is also reflected by lower price growth than we saw in the single-family market.

As we move forward, I am still positive about the multifamily arena, but we are already seeing softening in demand and price in some market across the nation and here I am directly referring to San Francisco here in the West, and New York and Boston back East.

In as much as we will continuing to see short-term demand and price issues in many urban markets, it doesn’t mean that the overall condo market is going to collapse.

In fact, I think that once we get back to “normal” we may well see demand increase again and, if we see prices start to drop, I expect demand to rise even further as buyers who had previously been priced out of many of these large cities see that they can now afford to buy.

So, there you have it. My take on the January housing related data releases.

As always, if you have any questions or comments about the topics I have discussed today, feel free to reach out – I am only an e-mail away!

In the meantime, thank you for watching, stay safe out there, and I look forward to visiting with you again, next month.

Bye now.

Matthew Gardner COVID-19 Housing & Economic Update: 12/7/2020

Hello and welcome to this rather special episode of Mondays with Matthew. I’m Windermere Real Estate’s Chief Economist, Matthew Gardner.

Now, if you wonder what’s special about this particular episode, well the answer is twofold.

Firstly, I started these videos at the onset of the COVID-19 epidemic back in March and this is the 35th episode of Mondays with Matthew – where has the time gone? Anyway, it will be the last one for this year and I wanted to take just a moment to thank all of you for taking time out of your busy schedules to watch my videos. It makes this economist very happy to think that you are still getting value out of my musings.

But there’s another reason that I am excited and it’s because, after many, many late nights poring over spreadsheets, I am now ready to share my 2021 US housing forecast with you so, without further ado, let’s get to it!

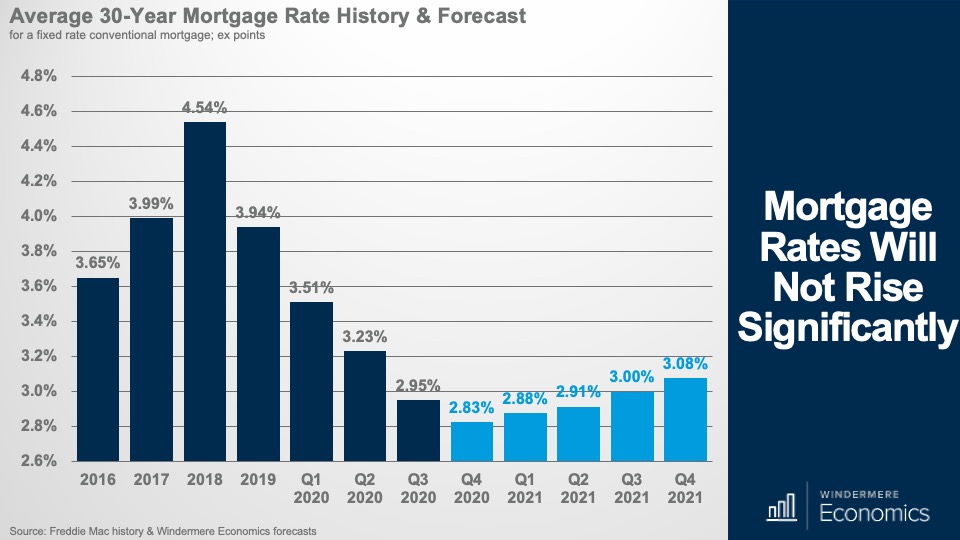

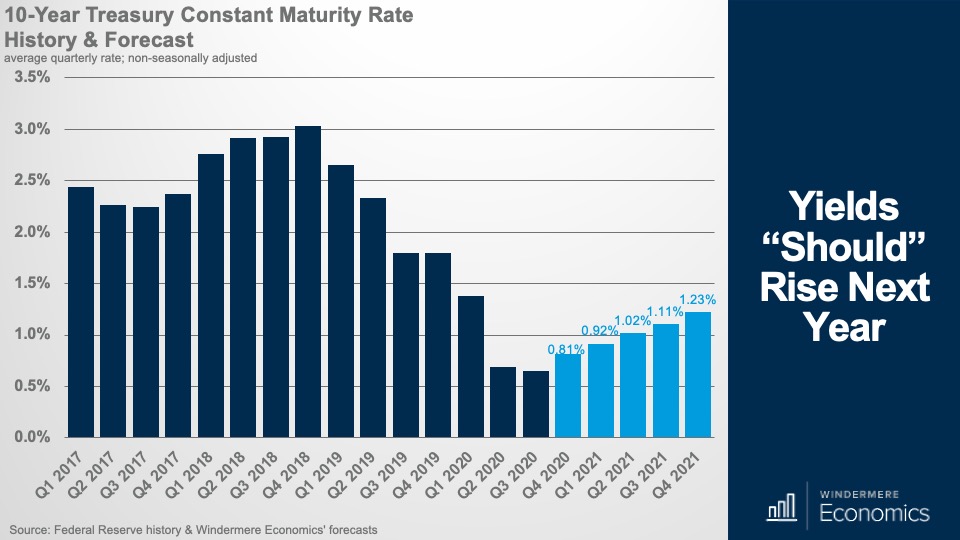

I’m starting off with my mortgage rate forecast.

As you will all be very aware, we have spent the entire year watching mortgage rates break record lows almost every week which, along with other factors, has helped drive housing demand significantly higher, but how low can rates go?

Well, my forecast suggests that rates will likely bottom out in the current quarter but that said, I do not anticipate them rising much as we move through 2021.

Now, I always like to see how my forecasts compare to others, so I spoke with a few housing economists across the country to see where they were regarding rates, and – as you can see – we are all in a pretty tight range for next year. I will tell you that my friends over at Fannie Mae were pretty defensive about their very optimistic forecast – I guess that we will see.

And looking further out – where my crystal ball fogs over just a little – the brave souls who are putting out forecasts for 2022 are showing rates not moving much higher even then, with Fannie Mae at an average of 2.9%, Wells Fargo at 3.1% and the Mortgage Bankers Association a little higher at 3.6%.

The bottom line here is that we are all pretty confident that although rates will start to rise, the increase will be modest, and I personally don’t see it impacting housing demand at all.

And to explain why we will see rates rise, 30-year fixed-rate mortgages are pretty directly correlated with the yield on 10-year treasuries, and you can see here that my forecast shows these rising – albeit modestly – next year and, naturally if this occurs, rates will follow.

But there are 2 reasons that might stop rates rising – at least by too much, even if Treasury yields do head higher. First is the COVID-19 vaccine. You see, if it takes longer to distribute, or if we chose not to take it, then the economy could take another dip and, if that happens, treasury yields will likely pull back, and rates could drop again. But I remain hopeful that this will not be the case.

And second is the Fed. As long as they continue to buy mortgage-backed securities, rates are actually insulated from rising treasury yields.

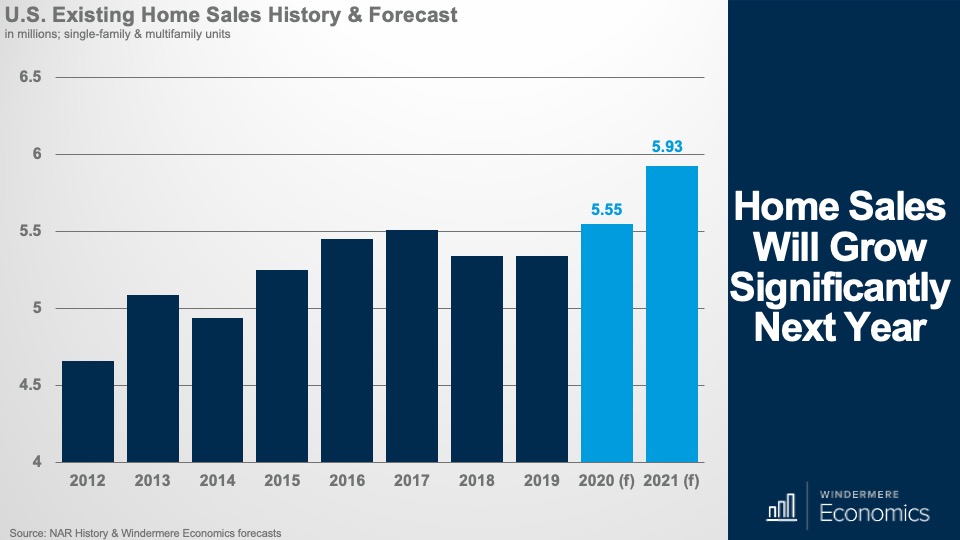

OK – on to sales, and here I am specifically looking at existing homes – I will address new homes shortly.

My forecast is for sales this year to have risen by 3.9%, but sales in 2021 should be up by 6.9%, and that’s a level we haven’t seen since 2006.

But in order for sales to rise to this extent, we need more inventory, and I do expect to see more listings next year and it will likely be, at least partially, due to COVID-19 with some household’s new ability to work from home removing the need to live close to their offices. But there will be others who will move simply because their current homes just aren’t set up for remote working.

Although I see a lot of homeowners moving due to work-from-home I believe that a lot of them will not move that far away. You see, the theory that we will all be working from home full-time is – in my opinion – likely overblown – and I would contend that a lot of them will end up blending their workweek with some days at home and some days at their offices and, if I am correct, I see many households still staying within reasonable proximity of their workplaces.

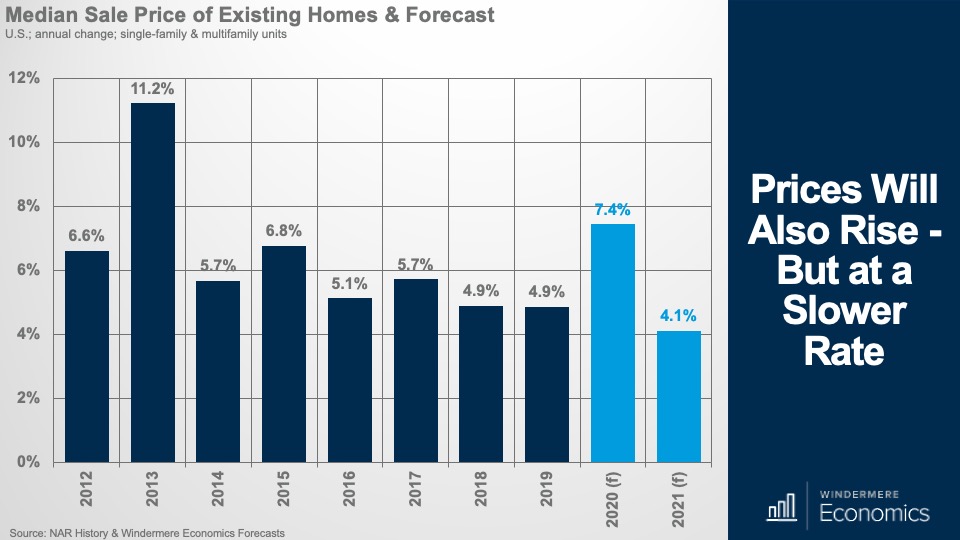

Turning our attention now to sale prices, well this year has been very impressive so far and we should see sale prices in 2020 ending up 7.4% higher than we saw in 2019. Now, this is quite remarkable, and I say this because I took a look at the 2020 forecast, I put out last year and I was forecasting price growth closer to 4% than 7%.

But COVID-19 changed all that. Mortgage rates dropped, households decided for several reasons to move and, in concert with a historically low level of homes available to buy, prices have risen significantly.

Now – and as I have said for years – there must always be a relationship between incomes and home prices, and mortgage rates dropping can only allow prices to rise by so much.

And, along with other factors, it’s partly due to affordability issues that I see prices rising by a more modest 4.1% in 2021.

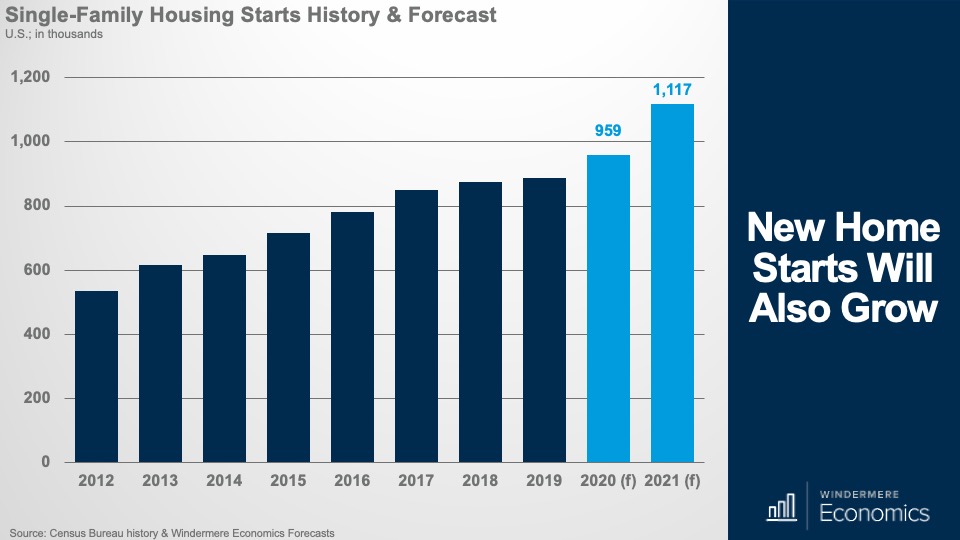

OK – looking now at the new home market – and for the purposes of this discussion I am just looking at the single-family market – so far this year we have seen a significant jump in new home sales and this very robust demand has encouraged builders to start construction of more homes and my forecast for single-family housing starts shows them rising by 8% this year, but next year I’m seeing starts up by a very significant 16.4%.

This is good news for several reasons, the biggest of which is that more new construction will add to supply and that should take some of the demand and price pressure off the resale market.

And with more starts, I expect to see sales rising with an increase of 21.5% this year and a further 18.7% in 2021. Notably, this will put new home sales at a level again that we haven’t seen since 2006.

But I do have one concern regarding the new home market, and my worry is all about cost.

Builders want to do what they do best, and that’s build homes, but they have to reconcile the costs to build a home, which are extremely high today, with the prices that would-be buyers can afford.

Now I see them managing this issue by looking to areas where land is cheaper and where there is still demand from buyers who, as we just talked about, are now looking at markets further away from major job centers.

The bottom line is that the new construction market will see very solid gains next year.

And finally, it would be remiss of me if I weren’t to address the one thing that is troubling a lot of brokers – and their clients –and that’s forbearance.

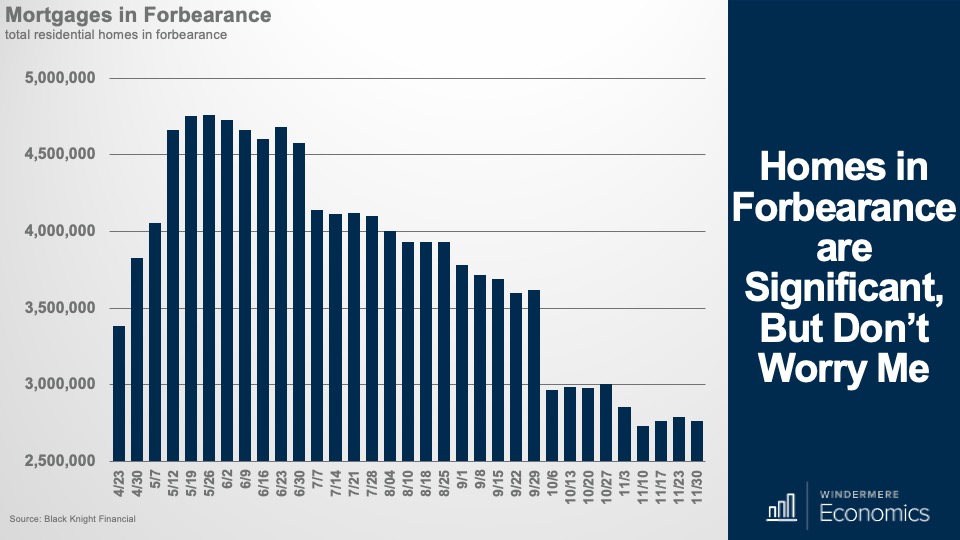

Although we saw a modest uptick in active forbearance plans earlier last month, I think it’s important to put things in perspective.

Despite small increases in the number of homes we saw entering the program, the number of active forbearances is still down by 8% (or 246,000 homes) from the end of October.

In total, as of November 30, there are 2.76 million homeowners in active forbearance plans and that represents approximately 5.2% of all mortgages but again, for perspective, the number of owners in forbearance is down by almost 2 million from the peak back in May – that’s a drop of 42%.

So, let’s talk about this for a bit.

As is human nature, there are some out there predicting that the housing market is going to crash again purely because of the number of owners in forbearance – all 2.76 million of them –will be foreclosed on when forbearance ends next spring, and this flood of foreclosed homes will lead to a spike in supply and this will lead prices to drop in a manner similar to 2008.

I get the theory, and I guess that at face value you might say that it seems plausible, but is it?

Although there’s no getting around the fact that foreclosures will rise next year as forbearance terms end, will it really be that dramatic?I think not.

There are several reasons why I’m not overly pessimistic about this. Although I see foreclosures rising next year, I actually expect the numbers to be very mild when compared to the carnage we saw between 2008 and 2010.

Why do I think this? Well, the housing bubble burst for very different reasons than we are currently experiencing. Back then there was a frenzy of reckless lending, irresponsible borrowing, and the unbridled speculation that did nothing more than set the housing market up for a crash. And crash it did. Home prices collapsed, and millions lost their homes.

But, back in March of this year – when COVID-19 really kicked in – homeowners were actually in a very good place. Credit standards were still very tight, down payments were significant, and the housing market, along with the economy as a whole, was extremely healthy and that’s the difference.

The COVID-19 pandemic has primarily hit renters, but it has impacted a lot of homeowners too and, as much as I am very sorry to say that we will see a rise in mortgage defaults and foreclosures but as the housing market muscles its way through the current economic downturn, I see foreclosures forming more of a trickle rather than a flood.

And, to support this, my colleagues over at ATTOM Data Solutions are currently forecasting more than 200,000 homeowners are likely to default next year but, if there is a longer-term Coronavirus related slowdown in the economy, the foreclosure count could get as high as 500,000 homes.

But as dramatic as their projections may seem, it’s worth noting a few things.

One. During the Great Recession, foreclosure filings spiked with 1.65 million American homes going into foreclosure in the first half of 2010, but this is well above the most pessimistic forecasts for foreclosures next year and even if defaults rise dramatically, they’ll still come in well below the levels we saw following the bursting of the housing bubble.

Two. As I talked about earlier, home prices have risen steadily since 2012 and homeowners have built up large reserves of equity. This is the total opposite of the situation we saw in 2008.

And it’s because home values have been rising, a lot of borrowers in forbearance will be able to escape foreclosure by simply selling – we know that there is more than enough demand and they will sell to make sure that they get the equity out of their homes rather than to potentially lose it because of foreclosure.

Third. Lenders really have no stomach for a repeat of the foreclosure crisis we saw back in 2008.

Today, I am seeing lenders positioning themselves to use a more-cooperative, less-punitive approach to delinquent borrowers and that they will do a better job of keeping people in homes.

And finally. Many, but not all, of the owners in forbearance, will not enter foreclosure because they will be able to catch up on their past-due amounts by paying more each month and some may be allowed to add the past-due amount to the end of the mortgage by lengthening its term.

The bottom line is that the housing market, and homeowners, are in a much better position today than they were back in the bubble days. Homeowners today have far more options to avoid foreclosure, and equity is surely helping to keep many afloat. Put it this way, even if today’s rate of foreclosures doubles, it will still only hit a mark that’s more in line with a historically normalized range.

Ultimately, I’m not concerned that we will see the housing market collapse because of forbearance.

And finally, a few more nuggets to think about.

Even if we ignore concerns over forbearance, there are still some talking about a housing bubble purely because prices have risen so rapidly over the past several years but I, along with my colleagues, just don’t see it. It is true that prices have been rising at above-average rates, but fundamentals are still in place. As I mentioned earlier, borrowers are well qualified, and they have solid equity in their homes.

But, as I have shown you, price growth is set to slow and I think that, because of this slowdown in price increases, there will surely be some homeowners who will think that the market has collapsed just because real estate agents aren’t telling them what they want to hear as far as the value of their home is concerned. What they need to understand is that the market isn’t collapsing, it’s just normalizing.

Sellers have had the upper hand for a very long time now, and many may have forgotten what a normal housing market looks like.

In the early days of the pandemic, it is true that buyers did gravitate toward the suburbs and I know this because 57% of buyers who bought between April and June of this year chose suburban locations and this compares with 50% before the pandemic. But it’s hardly the exodus from cities that some had speculated, and I would also note that there was even a small uptick in urban home purchases in that 3-month period – 12% before the pandemic, and 14% after. Meanwhile, sales actually fell a little in small towns and rural areas in the same timeframe, so I do not anticipate a massive move to the countryside.

Yes! You’ve heard this from me for a long time now. First-time buyers will be a major force again this year – and for years to come – brokers need to figure out how to work with them. Their numbers are only going to grow.

Condos – Hmmm this is interesting. Although I don’t see the condo market collapsing across the country – although I do see significant issues in markets like Manhattan and San Francisco – I am seeing inventory levels rise fairly significantly as opposed to single-family homes for sale whose numbers continues to drop but, for now, there still appears to be demand as sales are higher too. My concern is really in regard to the urban condominium market. You see, for many, the primary reasons to buy a downtown condo are twofold. Convenient access to work, and lifestyle.

Well, some won’t have to live close to work if they are working a majority – or all – of the time from home and secondly, if we lose some of the lifestyle reasons to live in a city – restaurants, retail, and the like, well that takes away some of the rationale behind buying a downtown condo.

There’s no need to panic yet but I will be watching urban condo markets to see if demand continues to keep up with rising supply. If it doesn’t, then we may well see prices softening.

And finally, well done, you made it through 2020!

So, there you have it. My 2021 US housing forecast.

I really hope that you have found this video – and the ones I have published before – of use to you and your clients.

As always, take care out there, and remember to wear your masks.

In all seriousness though, it really has been an honor to speak with you all this year and, hopefully, we will meet again –in person this time – at some point next year.

So, between now and then, stay safe, have a wonderful holiday, and here’s to a great 2021 for all of us.

Bye now.

Matthew Gardner COVID-19 Housing & Economic Update: 11/23/2020

Hello there and welcome to the latest episode of Mondays with Matthew. I’m Windermere Real Estate’s Chief Economist, Matthew Gardner.

Today we are going to focus on last Thursday’s data release for US existing home sales activity in October, so let’s get straight to it.

Well, if anyone out there was still thinking that the market was set to slow, they will have to wait a little longer. Existing home sales rose for the 5th consecutive month to an annual rate of 6.85 million units – and that’s up 4.3% from September and sales were 26.6% higher than we saw a year ago.

And it’s not just the annual rate that rose, as monthly sales came in at 573 thousand – and that’s the highest monthly figure since the market “snapped back’ in July following the initial COVID-19 shutdown.

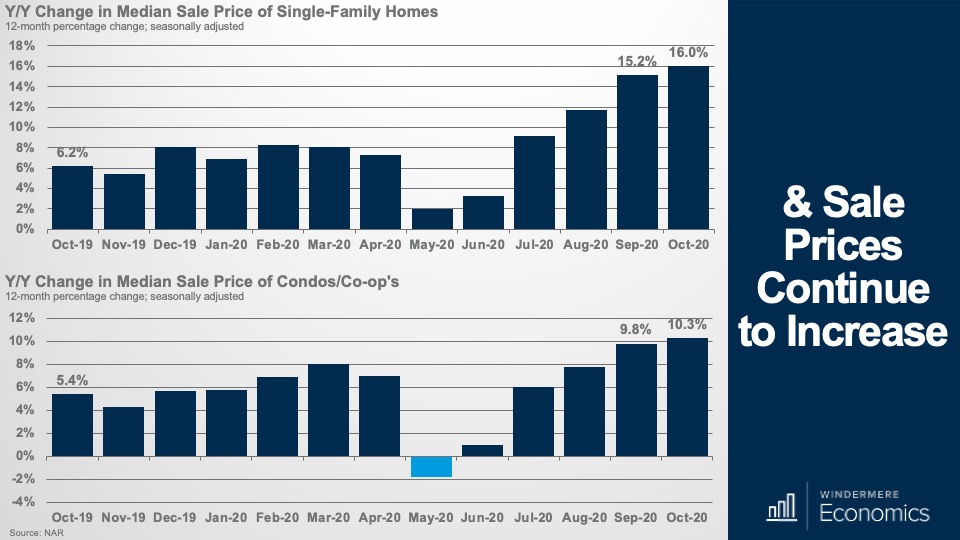

And with sales rising, so did prices, with the median price in October measured at $313,000 and that’s up by a massive 15.5% from a year ago and we haven’t seen that pace of price growth since 2006 and it was also the 104th straight month of year-over-year price gains.

And we are seeing these significant increases in prices not just because mortgage rates are low – although that certainly isn’t hurting – but the bigger reason is that there’s far more demand than there is supply and, if you remember your college economics classes, what happens to prices when you have limited supply but net new demand? That’s right, they rise.

And as you can see here, there were fewer than 1.4 million homes for sale in October – now, I must add that I seasonally adjust my numbers and NAR doesn’t, but even if you use their figures there were just over 1.4 million homes for sale last month so it’s not much better.

And with tight supply and new demand, their is only 2.7 months of inventory at the current sales pace – and that’s an all-time low.

A balanced market – depending on where in the country you are, is between 4 and 6 months so we are a long way from balance.

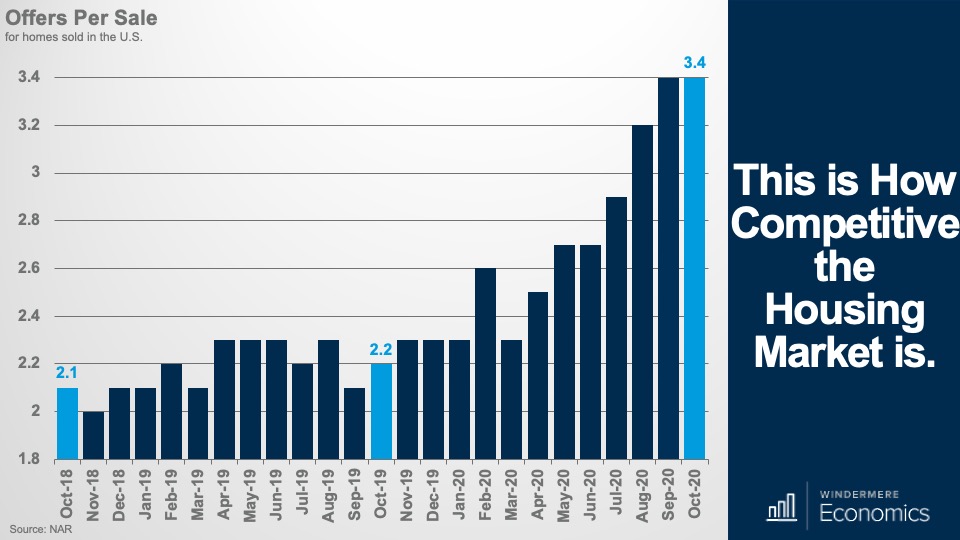

And to give you a different way to see how competitive the market is, there were an average of almost three and a half offers for every deal that was written last month. Additionally, 7 out of 10 homes sold within four weeks and the median market time coming in at just 21 days – it was 36 days a year ago.

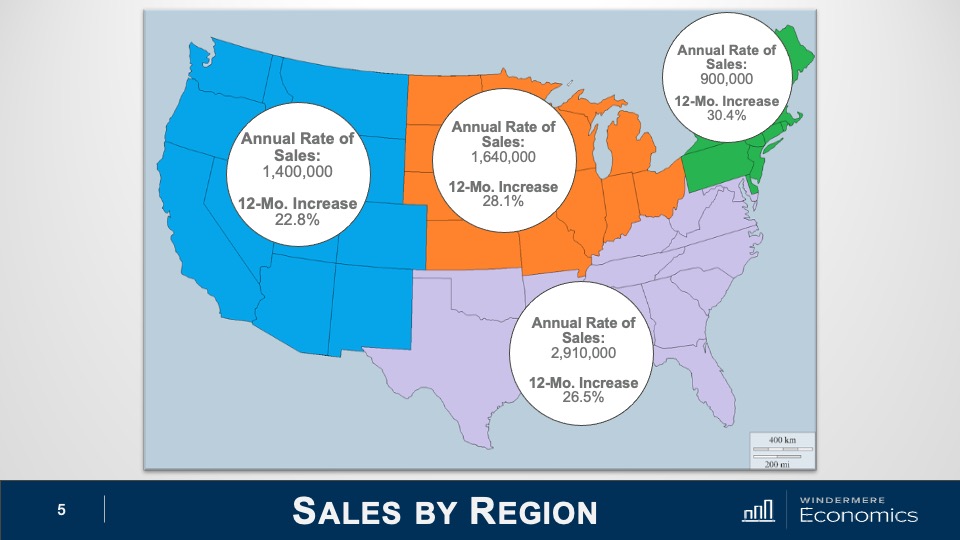

Regionally, sales rose the fastest in the small Northeast region, but all areas saw sales up by over 20 percent.

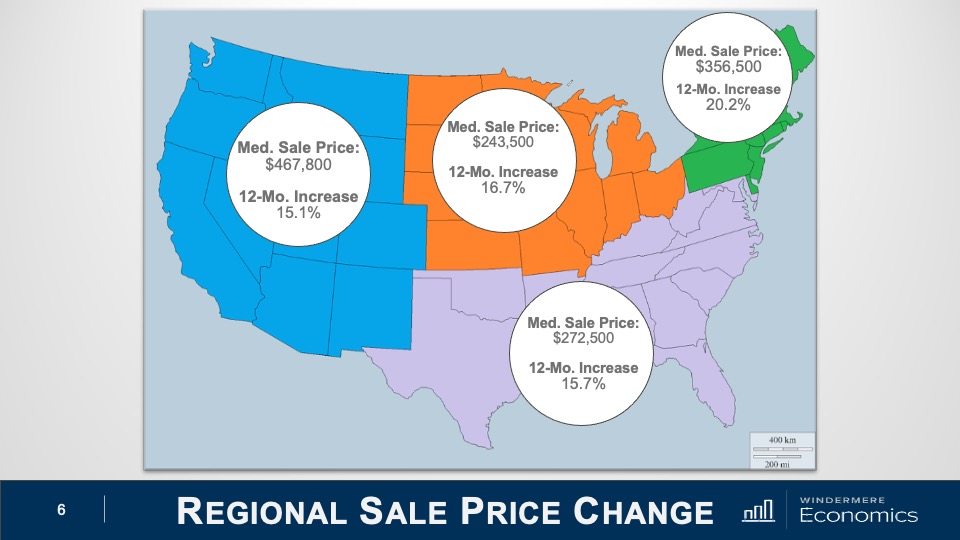

And when we look at sale prices, again, very significant increases across the board. I would note that the Northeast saw the greatest price increases for single-family homes – up 21.7% and condo prices rose the most in the Southern states where prices were up by 13.9% year over year.

Well, that’s the big picture, but you know me, I do love to dig into the dark corners of these data releases and, when I did, I found some pretty interesting nuggets there too.

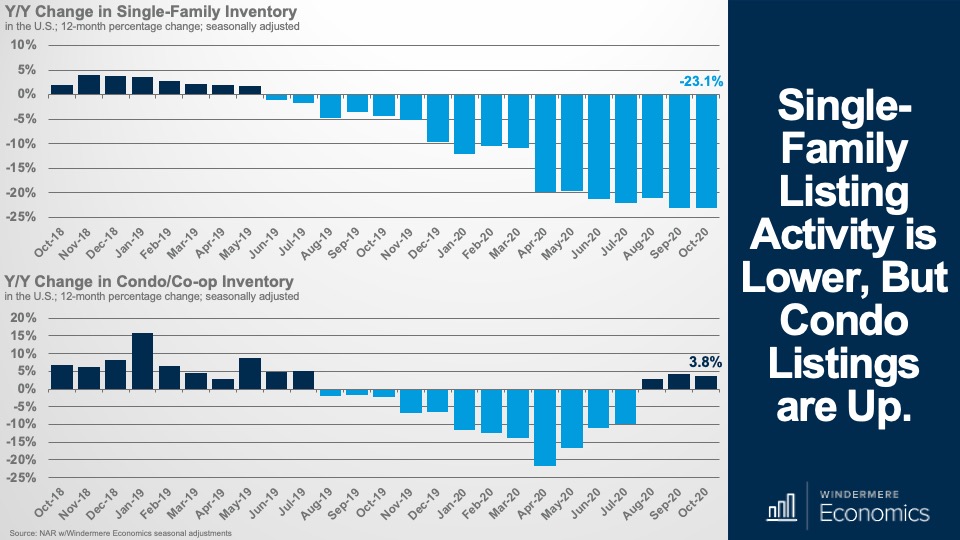

I mentioned single-family and multifamily price growth a moment ago, and when we break out the data, the supply numbers were interesting. Here is the year over year change in available inventory and its not surprising to see the number of single-family homes for sale way down but look at condos. Inventory is higher than it was a year ago.

Now, I think it’s too early to suggest that this is wholly due to COVID-19 and families flocking way from our urban centers, but I will be watching to see if this is an anomaly, or the start of a trend.

And my first reason for not being overly concerned about the condo market is this. Sales are still rising – up by 5.8% versus September and up by 25.9% year over year – even in the face of increasing inventory.

And single-family sales were up by just a little more – 26.7% year over year, but the month over month pace of single-family sales was actually lower than condos and came in 4.1% higher than in September.

And finally, condo prices are still trending higher after turning negative at the outset of COVID-19 – up 10.3% year over year to $273,600. Not quite the pace of price growth seen in the single-family world where the median sale prices were up by 16% to $317,700, but not bad at all.

So, there you have it and I think you’ll agree, these were pretty impressive numbers across the board. Certainly, no sign of a slowdown but, as I suggested earlier, I will be watching the multifamily market to see if inventory levels continue to rise and, if they do, we may see price growth starting to slow even if the single family market continues its upward trajectory.

But, again, I must reinforce my view that this pace of price growth is absolutely not sustainable. Of course, very favorable mortgage rates are still in place. In fact, the 30-year hit another all-time record low last week at 2.72%, but I still believe that we are close to the lows that will be seen in this cycle –we’re just not there yet.

Housing continues to outperform with first time buyers still out in force (32% of all sales went to them) and demand for second homes appears solid too – they accounted for 14% of all sales – a figure that matches October 2019 so no visible signs of COVID-19 stress there either.

The bottom line is that something has to give. I am not saying that prices will retreat, rather the pace of growth has to slow even with very significant demand, and it will happen because of one of two reasons or maybe a combination of both.

Either we will hit an affordability ceiling, which will slow the price increases that we are experiencing OR we will see additional supply which will temper prices.

You see, although I find it highly unlikely we will see a significant increase in the number of resale homes coming to market, I do see builders stepping up and developing more homes.

You see, builders are getting bullish – and we know this from the National Association of Homebuilders Market Index which hit another all-time high earlier this month and I believe that this optimism will lead single-family starts to stay well above 1 million units next year and rising even more after that, which will be a relief to some buyers who remain very frustrated by the limited inventory available.

But I am getting ahead of myself.

You see, in 2 weeks’ time I will be sharing my 2021 US housing forecast with you all so I really shouldn’t give too much away right now.

The housing market is still performing – COVID or no COVID – and this will continue as we close out the year even if we see some States slowing their economies as new coronavirus rates spike.

As always, if you’ve got any questions about my comments today, I’d love to hear from you but in the meantime, take care out there, and I hope that you will join me again in 2 weeks when I will be revealing my US housing market forecast for 2021.

Bye now.

Matthew Gardner COVID-19 Housing & Economic Update: 11/9/2020

On this week’s episode of “Monday with Matthew,” our Chief Economist, Matthew Gardner, analyzes the surprisingly strong U.S. Job Market Report from October. This video was recorded Friday, November 6th.

On the first Friday of the month, we economists get our hands on the latest US employment report and the October numbers are out and there’s a lot worth discussing, so let’s get to the figures.

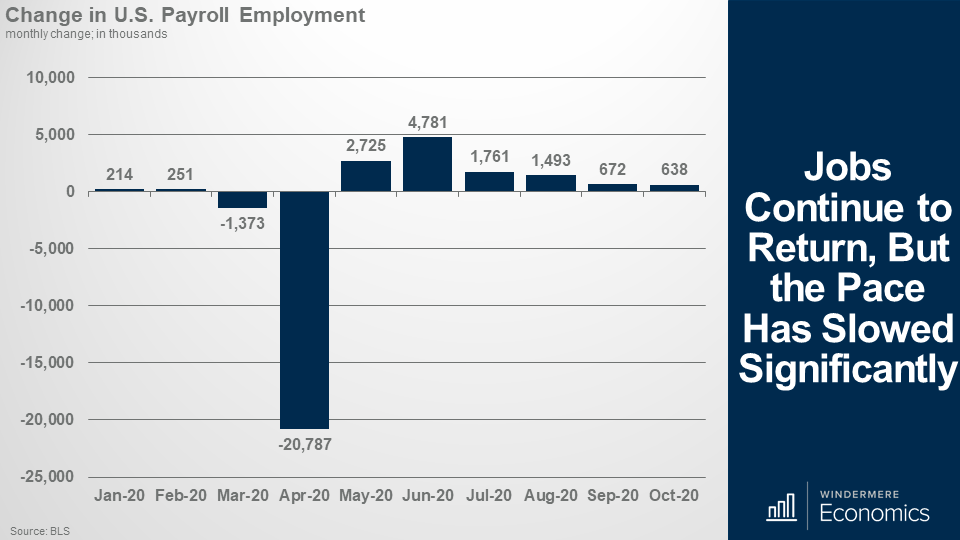

The country added 638,000 jobs in October and, although some would say that it was a mediocre number, it was well above the consensus forecast which anticipated just 530,000 jobs and it also came in above my forecast for 600,000 jobs. You see, 638,000 was actually surprisingly strong. Why? Well, Coronavirus cases are on the increase again and it would be natural to assume that this would impact the number of jobs returning.

But before we all get too carried away – let’s look at it in a slightly different way.

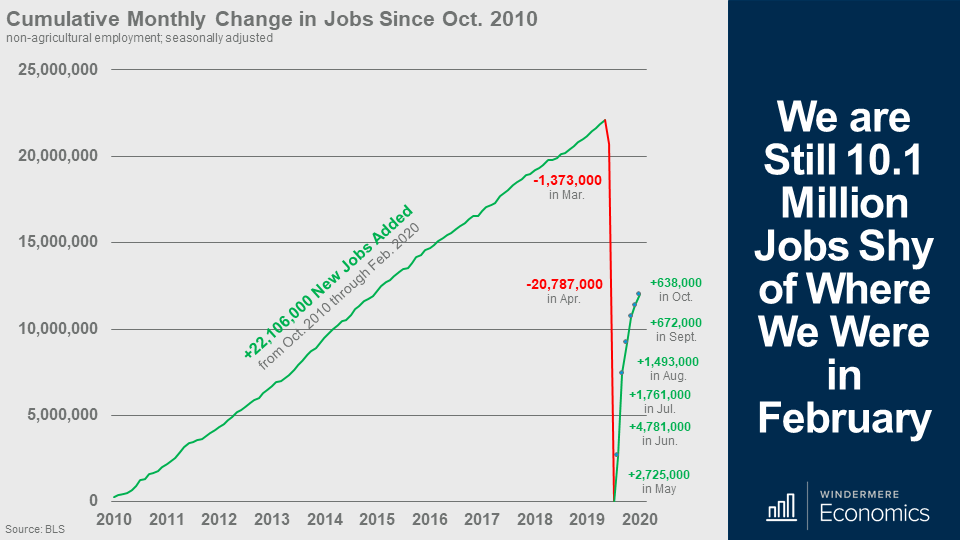

And as you can see here, the country added 22.1 million jobs between the fall of 2010 and February of this year. Now when the pandemic hit, we lost almost the same number, 22.2 million jobs went away but what was remarkable was that we lost almost 10 years of job gains in just 2 months.

And although jobs started to return in May, we are still down by 10.1 million from where we were in February of this year and you can also see that the pace of improvement has certainly slowed.

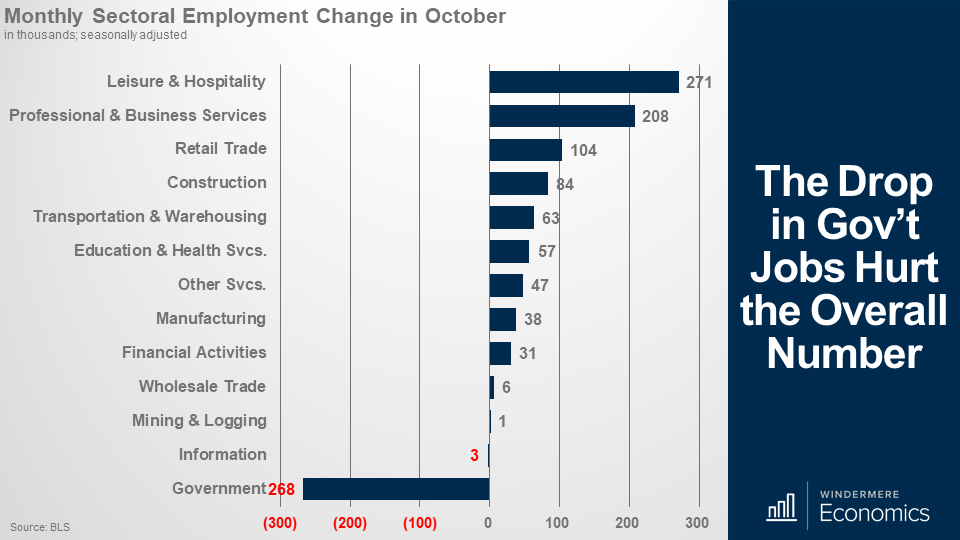

Looking now at where jobs were added, the biggest gains came in what was the hardest-hit sector during the pandemic, leisure and hospitality, with 271,000 jobs returning, but hotels are still suffering as, of that total, bars and restaurants saw 192,000 jobs return, but the country only added 79,000 hotel jobs.

It’s also worth mentioning that the total gain would have been higher but look at government employment. It dropped by 268,000 and was actually inflated because of the loss of 147,000 Census workers.

And you can also see that Professional and Business Services rose 208,000 and retail added 104,000, and that was mostly in electronics and appliance stores because we all appear to be on a buying spree right now, and 31,000 jobs were added in that sub-sector.

Construction also posted a healthy gain, up 84,000, while manufacturing rose by 83,000, even though the sector remains well below its pre-pandemic level.

I would also add that private companies added decent 906,000 workers, which was up by 14,000 from September so the contraction in government jobs certainly impacted the overall growth number.

So far, the numbers could have been worse, but there was some data that wasn’t as pleasing and it concerns furloughed and permanently laid off workers.

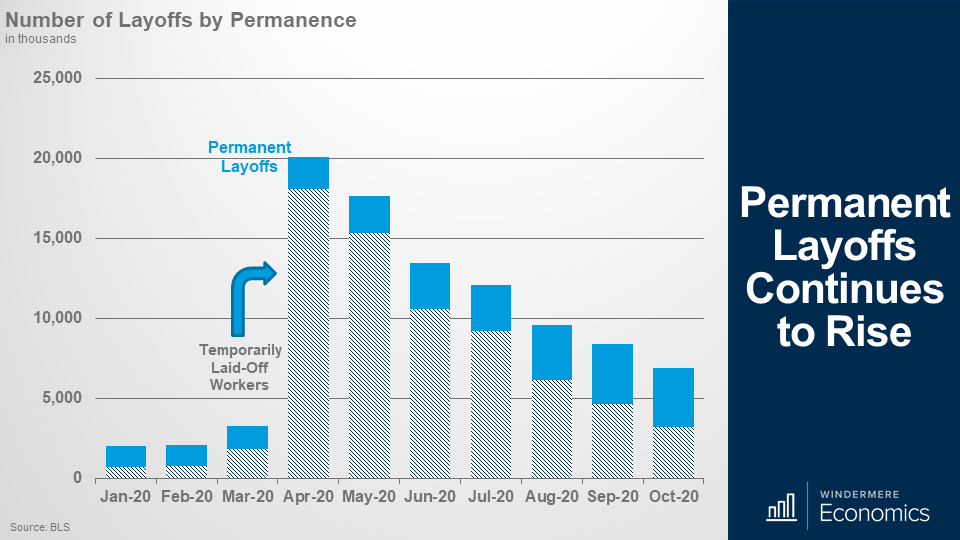

Now, you can see that the number of furloughed – or temporarily laid-off – workers is dropping but it still came in at 3.2 million – even if that is down from a peak of 18 million back in April.

But you will also see that the number of permanent layoffs continues to rise. That number is now at 3.7 million, it is down from 3.8 million seen in September, but the trend is still headed higher.

Now you see, this is very worrying, and gives me another reason to believe that a full recovery in jobs is still a long way away.

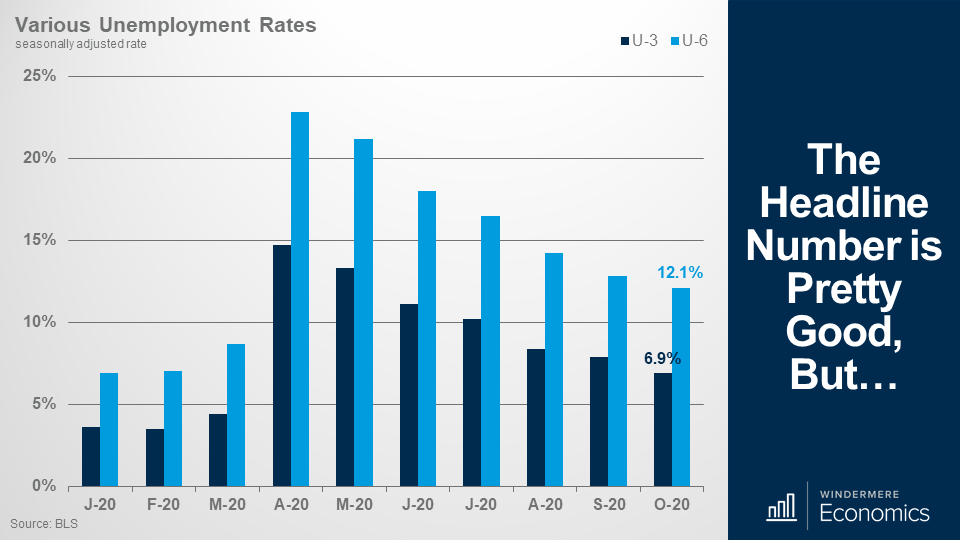

Of course, 1.4 million fewer furloughed workers allowed the unemployment rate to drop a lot – breaking back below 7% and a full percentage point lower than it was in September and I will also add that this too was well below the consensus forecasts which called for the rate to come in at 7.7%.

Additionally, the broader U-6 rate (which includes people out of work but who aren’t actively looking for a job) also pulled back from 12.8% to 12.1%.

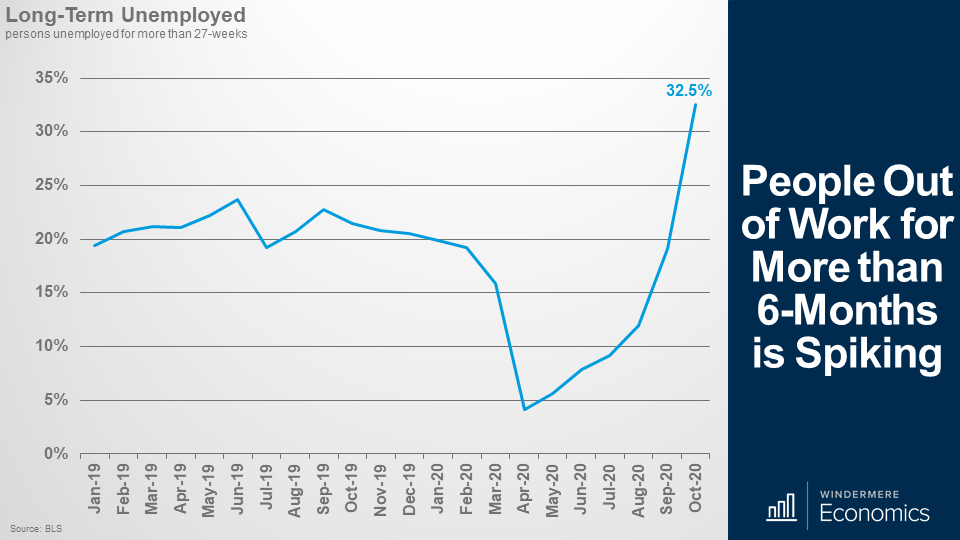

Of course, it was good to see the unemployment rate drop but, again, it wasn’t all good news, because the number of people out of work for more than six months surged by 1.2 million. Today, around a third of all unemployed persons have been out of work for at least six months and the October rate is also quickly approaching the peak seen during the aftermath of the Great Recession when about 45% of unemployed workers were out of work more than half a year.

And this is an important metric because workers who remain out of a job for this long enter a financially precarious period and the contested election reduces the chances of another stimulus package coming this year. But even if more fiscal stimulus is agreed on, it will likely be smaller than is needed.

As I mentioned earlier, even though private payrolls rose by a decent 906,000, the labor market recovery still has a long way to go.

The number of people working in America today is back at a level last seen in late 2015 and, at October’s pace, it would still take about another 16 months for employment to return to its pre-pandemic level.

I still expect that we will see a slow return to work, but the numbers are likely to remain muted until a vaccine or inoculation is not only freely available – but it has to be one that we feel comfortable taking as well.

The bottom line is that the report could have been worse, but it could also have been better too.

With that, as always, if you’ve got any questions about my comments today, I’d love to hear from you but in the meantime, take care out there, and I look forward to seeing you all again – in a couple of weeks.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link