The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

The counties covered by this report—Los Angeles, San Diego, San Bernardino, Orange, and Riverside—added a very modest 47,400 new jobs between August 2017 and August 2018. Even as job growth slowed, the unemployment rate dropped from 4.9% to 4.4%. Employment growth in Southern California has started to taper, due primarily to a slowing in employment gains in the large Los Angeles County market. As it stands today, I expect employment to continue growing for the balance of the year, but at significantly slower rates than in recent years.

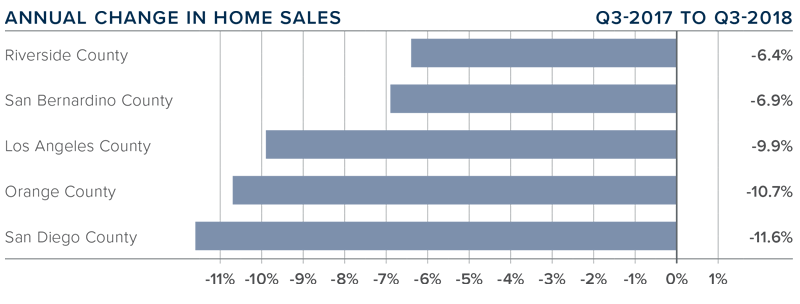

HOME SALES ACTIVITY

- There were 47,347 home sales in the third quarter of 2018. This was 9.4% fewer than the same period in 2017 and 7.7% fewer than the second quarter of this year.

- Pending home sales (an indicator of future closings) were 6.8% lower than during the same period a year ago, which suggests that fourth quarter closings will likely disappoint.

- Home sales dropped across the board, but the most noticeable decline was in San Diego County, which fell 11.6%. This can be attributed to a significant rise in inventory (+33.2%)—a stark contrast to the low level of listings in the second quarter of this year.

- There was an average of 41,654 active listings in the third quarter—up 18.2% from the second quarter—suggesting that the market is trending back toward balance.

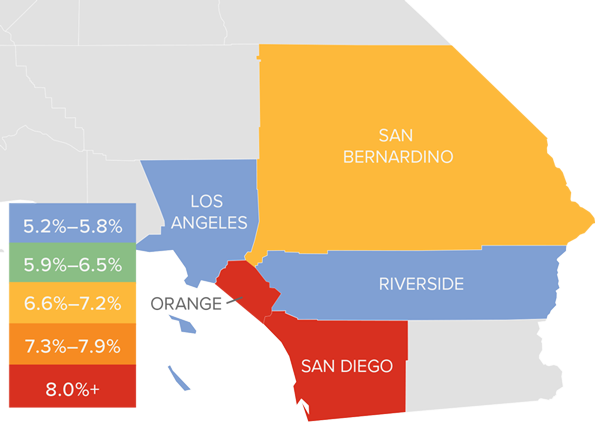

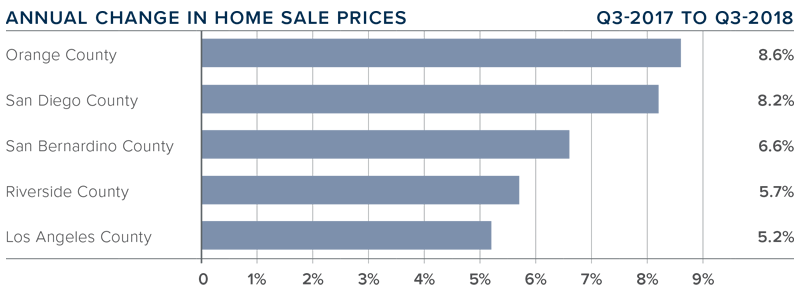

HOME PRICES

- Year-over-year, average prices in the region rose by 6%, but they were 0.7% lower than in the second quarter of this year.

- Affordability continues to be an issue in most of the Southern Californian counties contained in this report, which, in concert with growing inventory, is now starting to slow home price growth.

- Price growth did not vary that dramatically. Orange County showed the greatest annual appreciation (+8.6%). The slowest appreciation was in Los Angeles County, which still saw a respectable 5.2% increase.

- I believe that home prices will continue to rise, but it is clear that the rate of growth is starting to taper, and this is likely to continue as we move through the final quarter of the year.

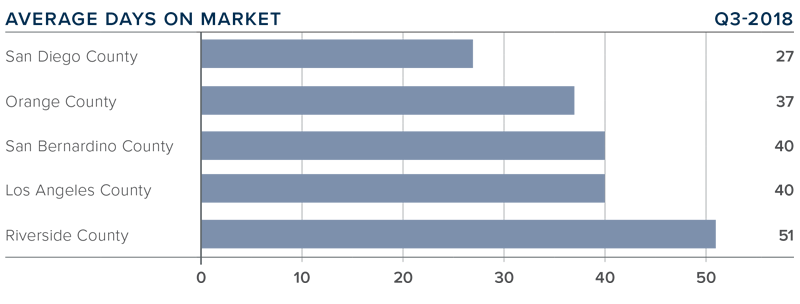

DAYS ON MARKET

- The average time it took to sell a home in the region was 39 days. This is a one-day increase compared to the third quarter of 2017, and two days more than in the second quarter of this year.

- The biggest drop in days on market was in San Bernardino County, where it took three fewer days to sell a home than it did in the same period last year.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the third quarter, it took an average of 27 days to sell a home, which is one day more than it took a year ago.

- Three counties saw an increase in the length of time it took to sell a home when compared to the third quarter of 2017.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The Southern California economy, although still adding jobs, has started to slow. The number of homes for sale in the region is on the rise, which gives buyers more choice. This is reflected in lower sales velocities and tapering home price growth. Given all of these factors, I have moved the needle a little more in favor of buyers

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link