The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Employment levels across the Southern Californian counties contained in this report have been significantly impacted by the COVID-19-induced recession. Total employment in the region has dropped by a collective 1.99 million jobs between February and May of this year. With this massive contraction, it’s not surprising to see the unemployment rate rise from 4% in February to 17.6% in May. Unfortunately, as I write this, it appears as if infection rates in many California markets have increased significantly. As such, the likelihood of tangible increases in employment will be further delayed.

HOME SALES

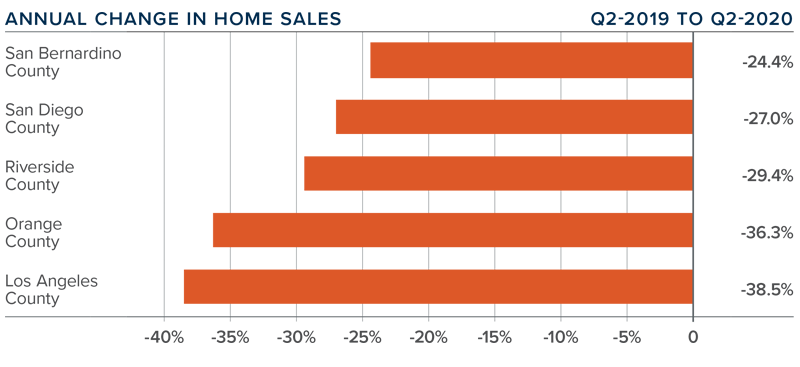

- In the second quarter of 2020, 33,614 homes sold. This was a drop of 32.6% compared to the same period in 2019. Sales were 2.5% lower than in the first quarter of the year.

- If there is some solace in this report, it’s that pending home sales (an indicator of future closings) rose 6.4% over the first quarter of this year, suggesting that sales in the third quarter should pick up modestly from current levels.

- Second quarter home sales activity dropped in all counties contained in this report. Of note was a significant decrease in Los Angeles County, where more than 6,600 fewer homes sold than a year ago.

- There was an average of 26,957 homes for sale in the second quarter—down 32.4% from a year ago but 5.3% higher than in the first quarter of this year.

HOME PRICES

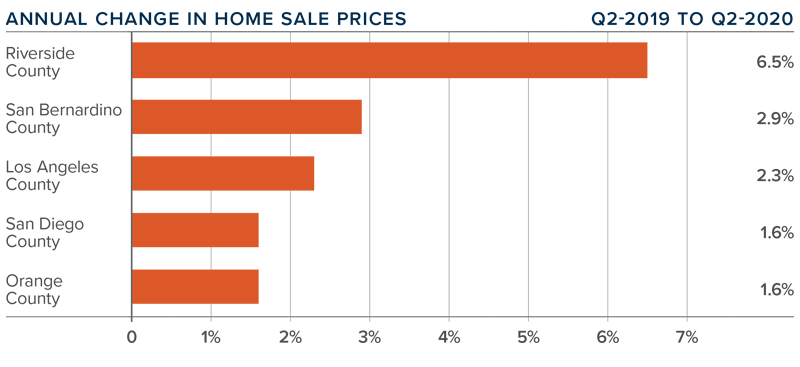

- Year-over-year, the average home sale price in the region was $726,613. This was 0.6% higher than a year ago and 4.5% higher than in the first quarter of 2020.

- Affordability concerns persist, which has had a negative effect on home price growth. Though prices did rise significantly between the first and second quarters, I wonder how much of this can be attributed—if even tangentially—to COVID-19.

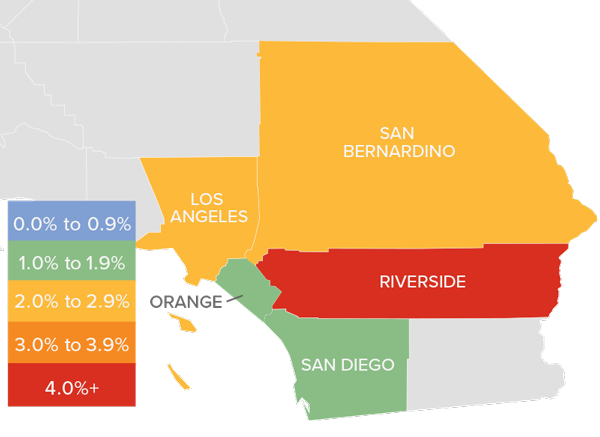

- Sale prices were higher in all counties contained in this report, with a significant increase of 6.5% in the more affordable Riverside County.

- Conventional mortgage rates continue to break through historic lows and will remain that way for the foreseeable future. However, jumbo mortgage rates are still higher than we have seen in over a year. With higher rates, and tighter credit requirements, there will likely be ongoing impact on the counties with more expensive homes.

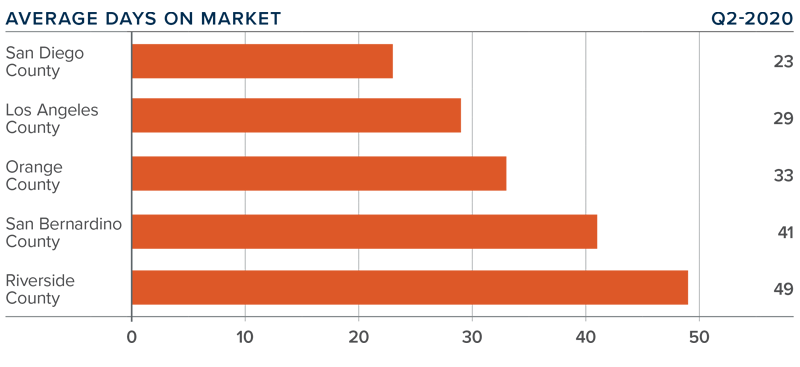

DAYS ON MARKET

- It took an average of 35 days to sell a home in the second quarter, 10 fewer days than a year ago and 9 fewer days than in the first quarter of 2020.

- All markets contained in this report saw the time it took to sell a house drop compared to the second quarter of 2019.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the second quarter, it took an average of 23 days to sell a home there. This is 6 fewer days than a year ago.

- Days on market shows that, although home sales are lower—a function of limited inventory levels—there still appears to be demand for homes when they do come on-line.

CONCLUSIONS

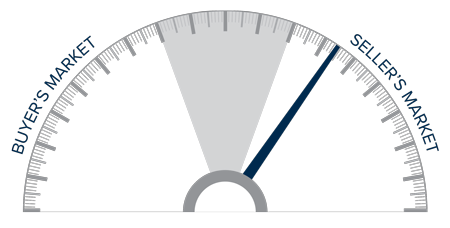

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Although there is demand for homes, the renewed round of shutdowns could dampen that demand until infection rates level out and businesses reopen their doors.

The overall housing market is resilient but will likely not see significant growth until the state gets a handle on COVID-19. For that reason, I am holding the needle in the same position it was in the first quarter. It is still a seller’s market, but uncertainty persists.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link