The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

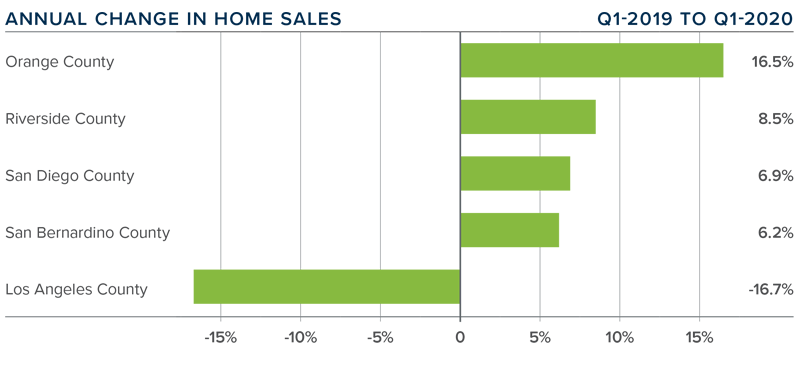

HOME SALES

- 34,487 homes sold in the first quarter of 2020. This was an increase of 0.5% from the same period a year previous, but 21.5% lower than in the fourth quarter of 2019, which is very likely a function of COVID-19.

- Pending home sales (an indicator of future closings) fell 5.8% compared to the final quarter of 2019, suggesting that total sales in the second quarter were already set to slow. The drop is sure to be larger given the fallout from COVID-19.

- First quarter home sales rose in all counties contained in this report other than Los Angeles County. Notably, Orange County experienced a significant increase: more than 840 more units changed hands than in the first quarter of 2019.

- There was an average of 25,608 active listings in the first quarter — down 32% from a year ago and 18.4% lower than in the final quarter of 2019.

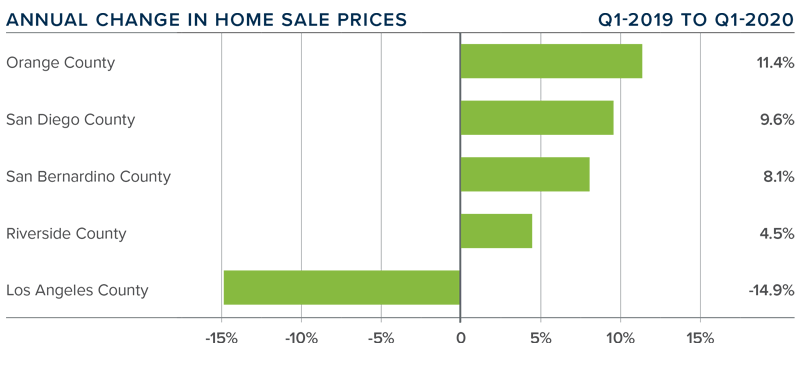

HOME PRICES

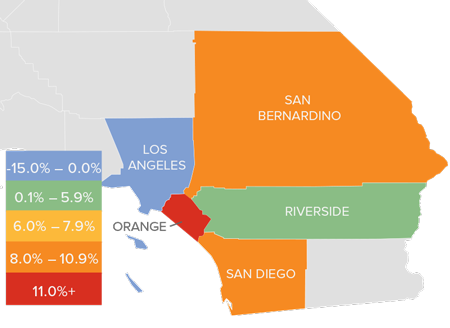

![]() Year-over-year, the average home sale price in the region was $674,764. This was 1.2% lower than a year ago and 8% lower than in the final quarter of 2019.

Year-over-year, the average home sale price in the region was $674,764. This was 1.2% lower than a year ago and 8% lower than in the final quarter of 2019.- Affordability concerns persist in the region, which, when combined with the massive economic interruption from COVID-19, suggests that we are likely to see downward pressure on prices for the next one or two quarters.

- Prices were higher in all counties contained in this report except Los Angeles County. Orange County saw significant price growth.

- Conventional mortgage rates will remain at or close to historically low levels through 2020. Jumbo mortgage rates have risen significantly, which will have an impact on the more expensive Southern California counties.

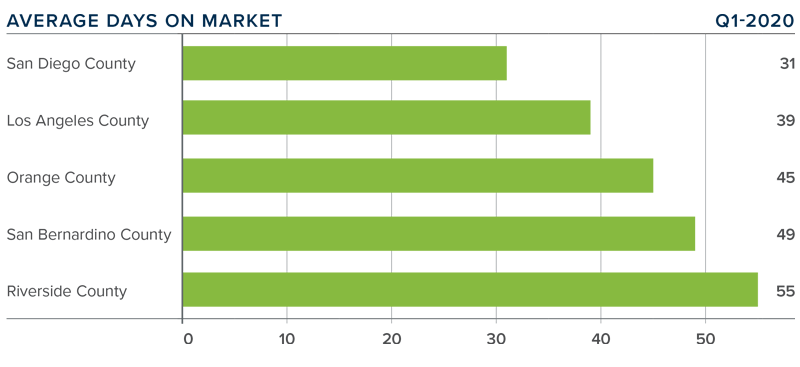

DAYS ON MARKET

- In the first quarter, the average time it took to sell a home in the region was 44 days, which is 9 fewer days than a year ago, and 1 day fewer than in the fourth quarter of 2019.

- Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the first quarter of 2020, it took an average of 31 days to sell a home there — 6 fewer days than it took a year ago.

- All markets contained in this report saw the time it took to sell a house drop compared to the first quarter of 2019.

- Although market time dropped compared to last year and last quarter, this is sure to change in the second quarter due to COVID-19.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Year-over-year, the average home sale price in the region was $674,764. This was 1.2% lower than a year ago and 8% lower than in the final quarter of 2019.

Year-over-year, the average home sale price in the region was $674,764. This was 1.2% lower than a year ago and 8% lower than in the final quarter of 2019.