The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The pace of job growth in Idaho continues to slow. That said, with the addition of 23,800 jobs over the past 12 months, the pace of growth was still an impressive 3%. The Boise metro area grew at a more modest 2.5% rate. The job market there is clearly showing signs of fatigue, adding only 200 new jobs over the past three months. Idaho’s unemployment rate was 3%, down modestly from 3.2% a year ago. In the Boise metro area, 2.6% of the labor force was unemployed, down from 2.8% a year ago. Even if the country enters a recession this year, I expect that Idaho will still add jobs, but at a much slower pace than we have seen since the post-pandemic recovery started. My current forecast shows that the state will add about 114,000 jobs in 2023, which suggests that employment growth will slow to around 2%.

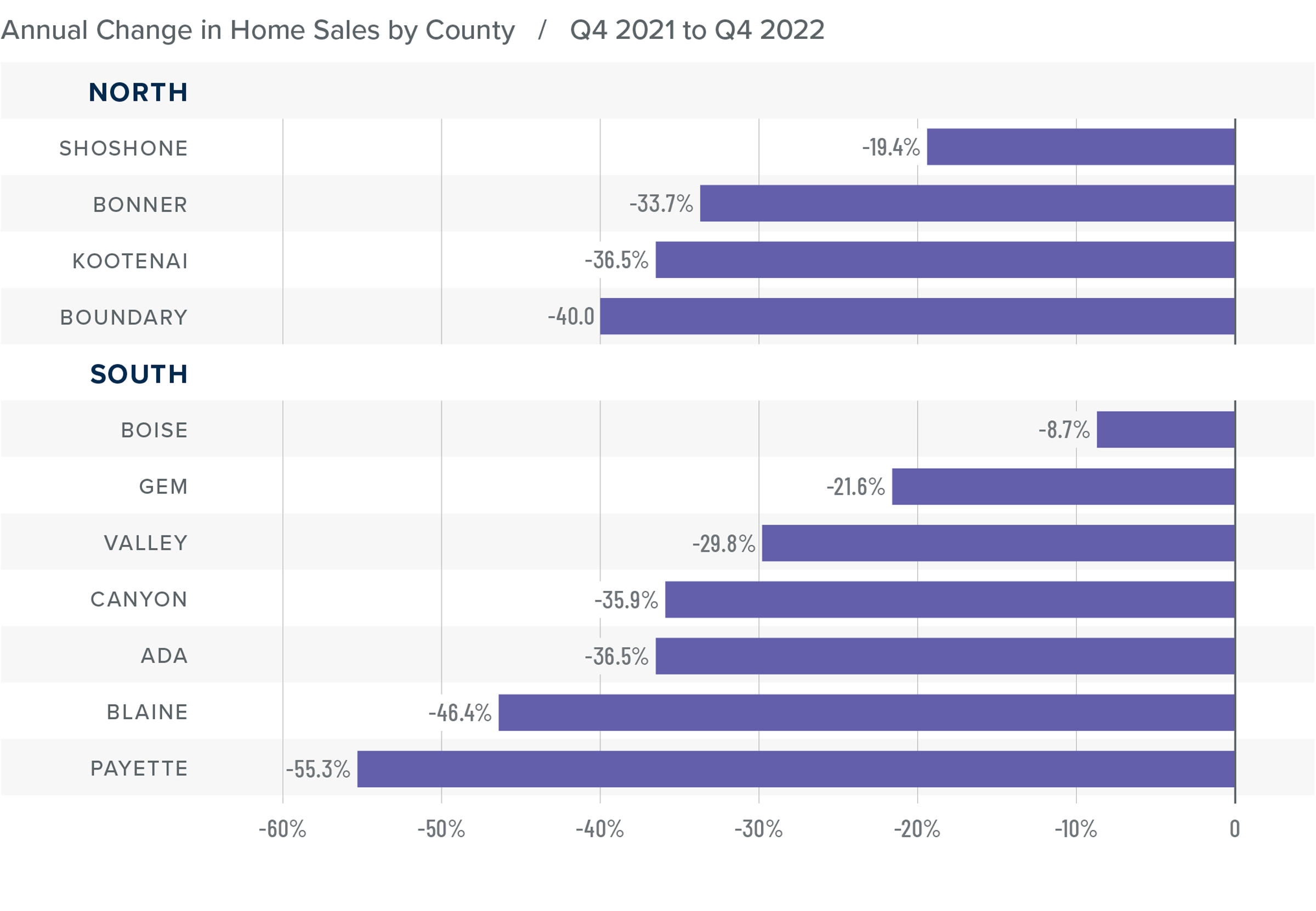

Idaho Home Sales

❱ In the final quarter of 2022, 4,777 homes sold, which was 36.1% lower than in the fourth quarter of 2021 and down 8.9% from the third quarter of 2022.

❱ Listing activity fell 12.7% from the third quarter, but was 52.9% higher than fourth quarter of 2021.

❱ Compared to the same period a year prior, sales fell in all markets covered by this report. Relative to the third quarter of 2022, sales rose in all Northern Idaho markets but fell in every southern market other than Gem County.

❱ Pending sales were 19.2% lower than in the third quarter of the year, which means it’s unlikely that the first quarter of 2023 will show any substantial increase in sales.

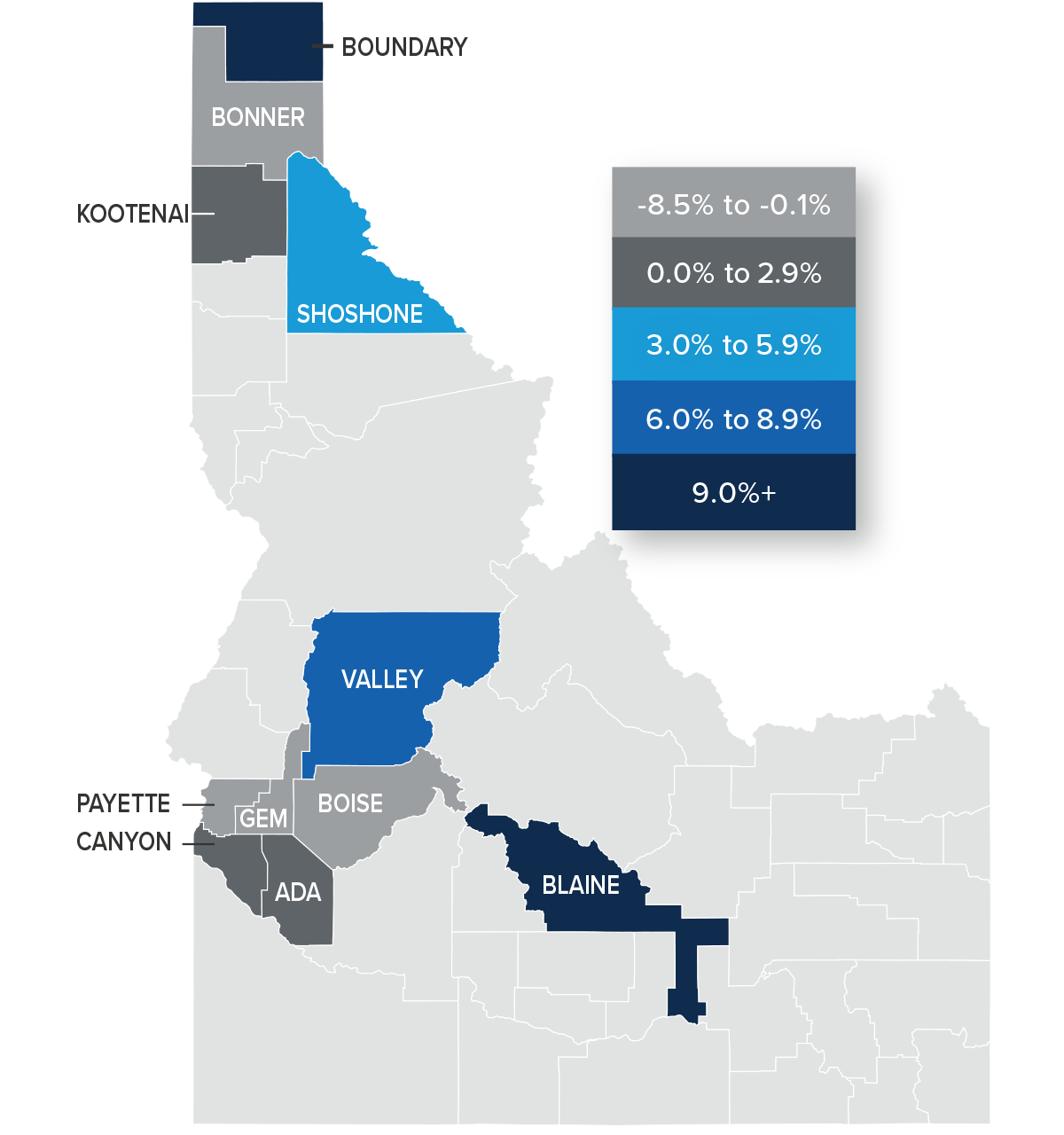

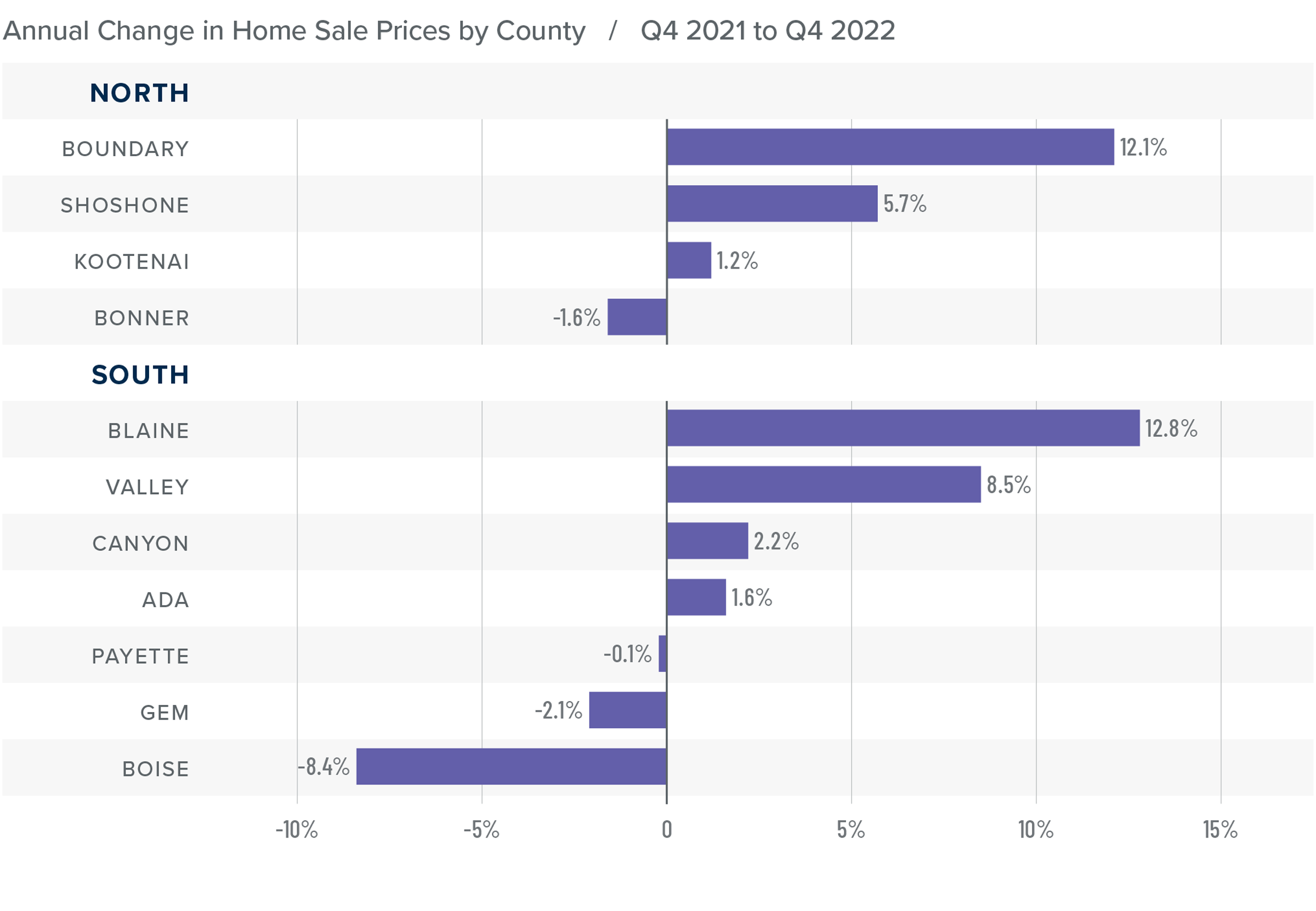

Idaho Home Prices

❱ The average home price in the region rose 1.4% year over year to $614,027. Relative to the third quarter of 2022, prices fell 1.8%.

❱ Compared to the third quarter, prices rose in Bonner and Boundary counties in the northern part of the state. In Southern Idaho, prices fell in all counties other than Blaine and Valley.

❱ Year over year, prices rose by double digits in Boundary County and were higher in all Northern Idaho counties except Bonner. In the southern part of the state, prices rose in four counties but fell in Payette, Gem, and Boise counties.

❱ Median listing prices in the fourth quarter were down 1.6% from the third quarter, but they were higher in Blaine, Valley, and Kootenai counties.

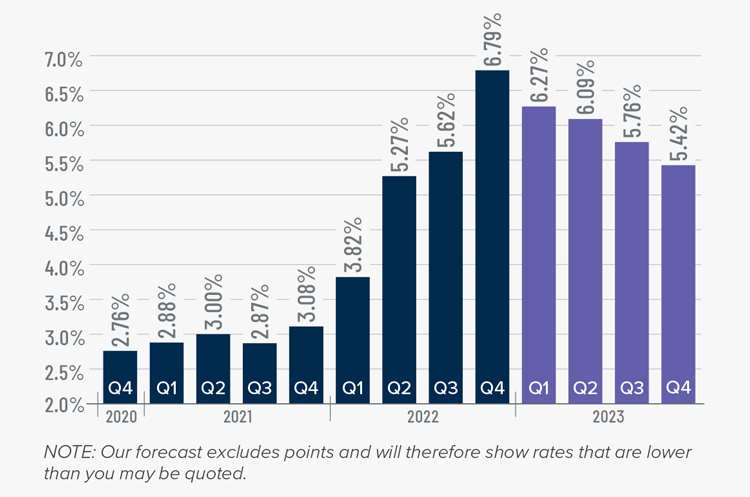

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

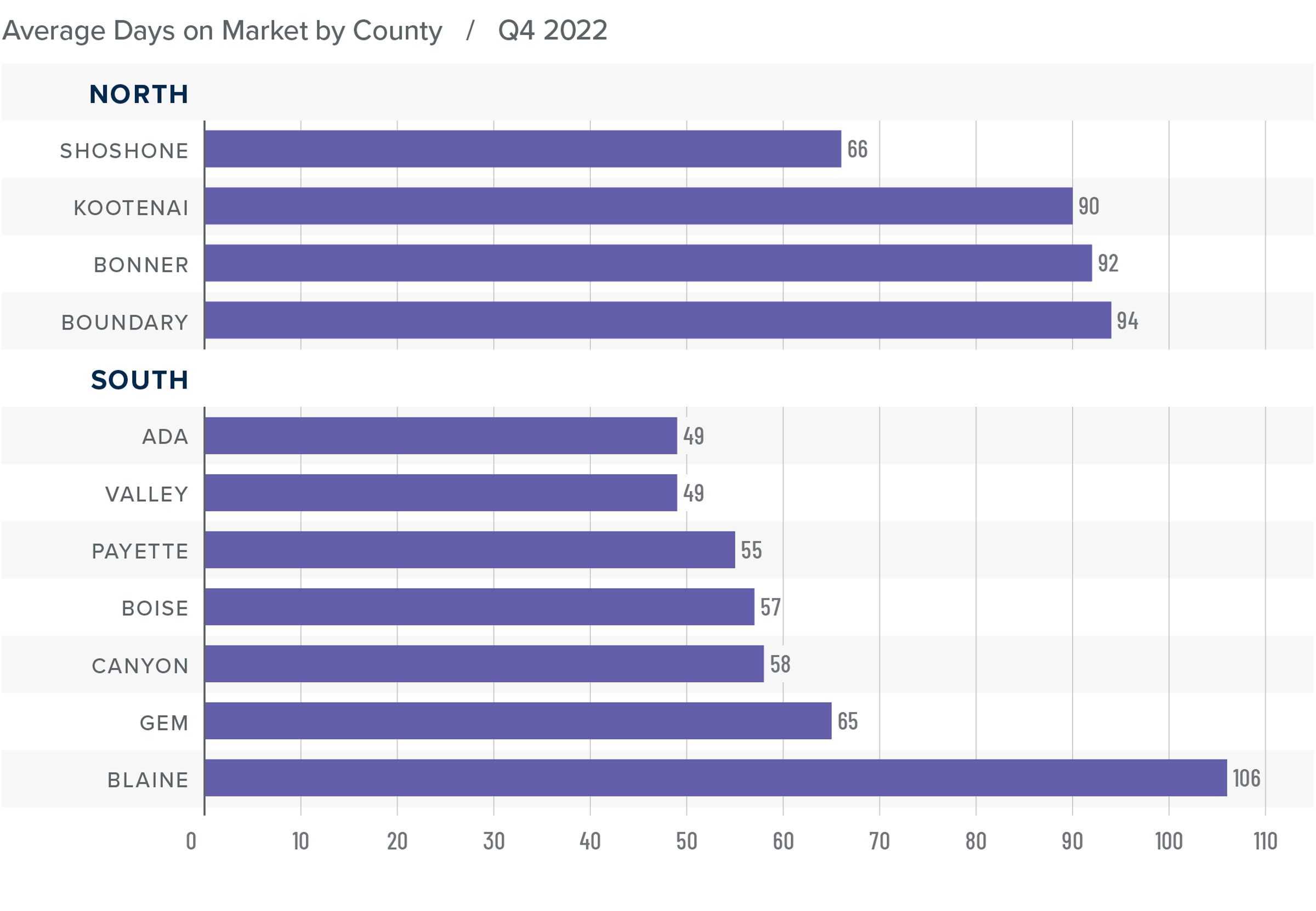

Idaho Days on Market

❱ The average time it took to sell a home in the region rose 14 days compared to the same quarter of 2021. Average days on market rose 21 days from the third quarter of 2022.

❱ Year over year, days on market rose in all Southern Idaho counties. In Northern Idaho, market time rose in every county other than Shoshone.

❱ It took an average of 86 days to sell a home in Northern Idaho and 63 days in the southern counties covered by this report.

❱ Homes again sold the fastest in Ada County in Southern Idaho and in Shoshone County in the northern part of the state.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Housing affordability has become a significant concern in Idaho, and high mortgage rates are impacting the ability for buyers to finance a home at current prices. While mortgage rates are expected to fall later this year, they will still be higher than buyers have become accustomed to. This means prices will likely decline as we move through the year, but they should level off as we enter the fall.

Although there is ample choice for buyers, I am wondering if listing activity will taper in the coming months as sellers hold off until the market improves. It’s also foreseeable that many of them will decide not to sell because they would lose the historically low interest rate on their current mortgage. Given all of this, I am moving the needle towards a more neutral market. If the number of homes for sale rises significantly in the spring, it’s likely the market will start to favor buyers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link