The following analysis of select counties of the Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Although employment in the region is still expanding, the pace of growth continues to slow. Over the past year, 103,400 jobs were added, which is the slowest annual pace since the 12-month period ending in July 2022. The unemployment rate in November stood at a very respectable 3.5%. Regionally, unemployment rates ranged from a low of 2.8% in Boulder to a high of 4% in the Grand Junction metropolitan area.

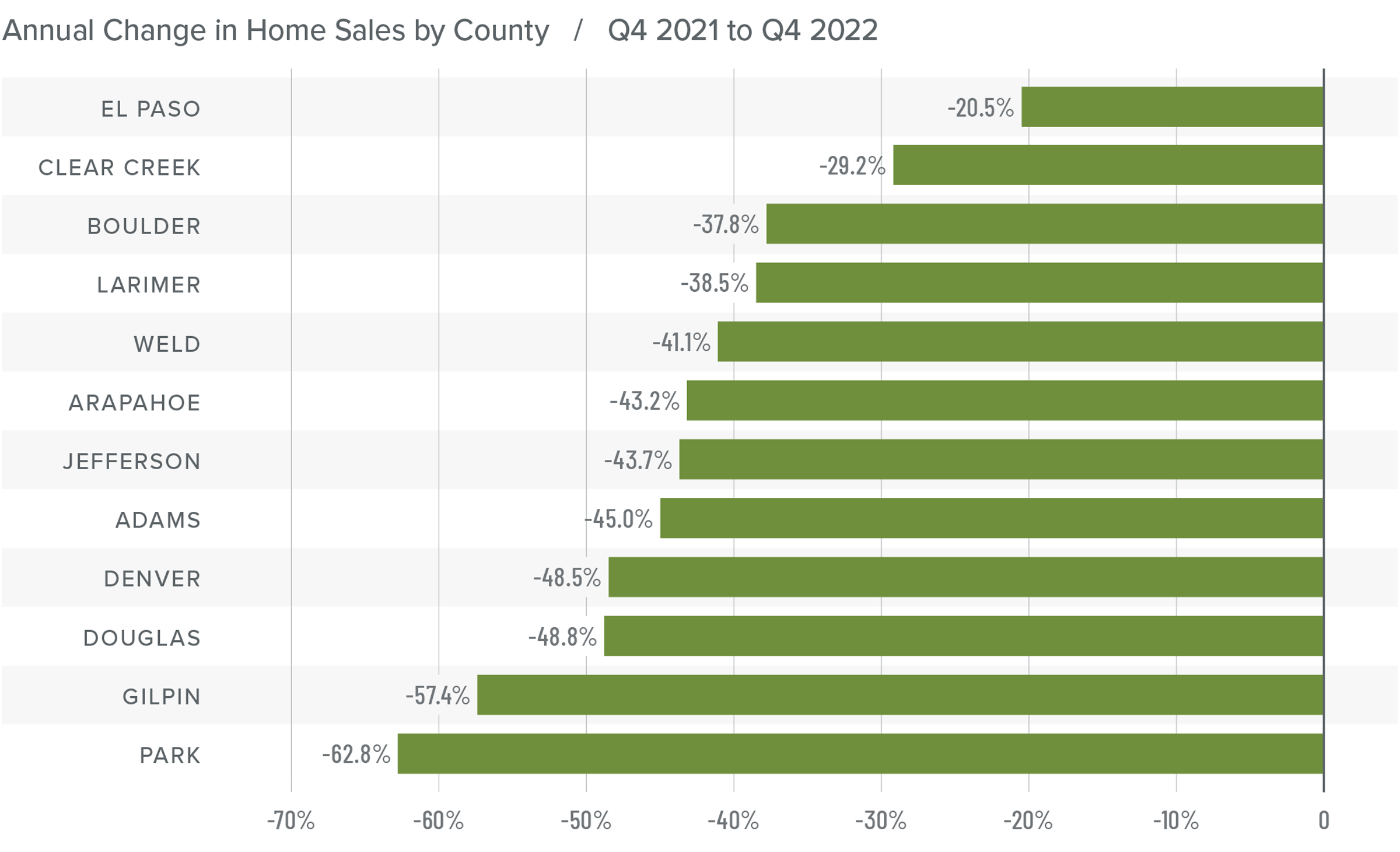

Colorado Home Sales

❱ In the fourth quarter of 2022, 7,097 homes sold, which was 43% fewer sales than in the fourth quarter of 2021 and 34% lower than in the third quarter of 2022.

❱ Sales fell across all of the markets covered by this report compared to the same period the year prior and the third quarter of 2022.

❱ Normal seasonal shifts in the market led the number of homes for sale to drop 20.1% compared to the third quarter. However, inventory levels were up by a very significant 164.6% from the fourth quarter of 2021.

❱ Pending sales (an indicator of future closings) dropped 40.1% from the third quarter, which suggests that the market is likely to see little, if any, growth in the early spring of 2023.

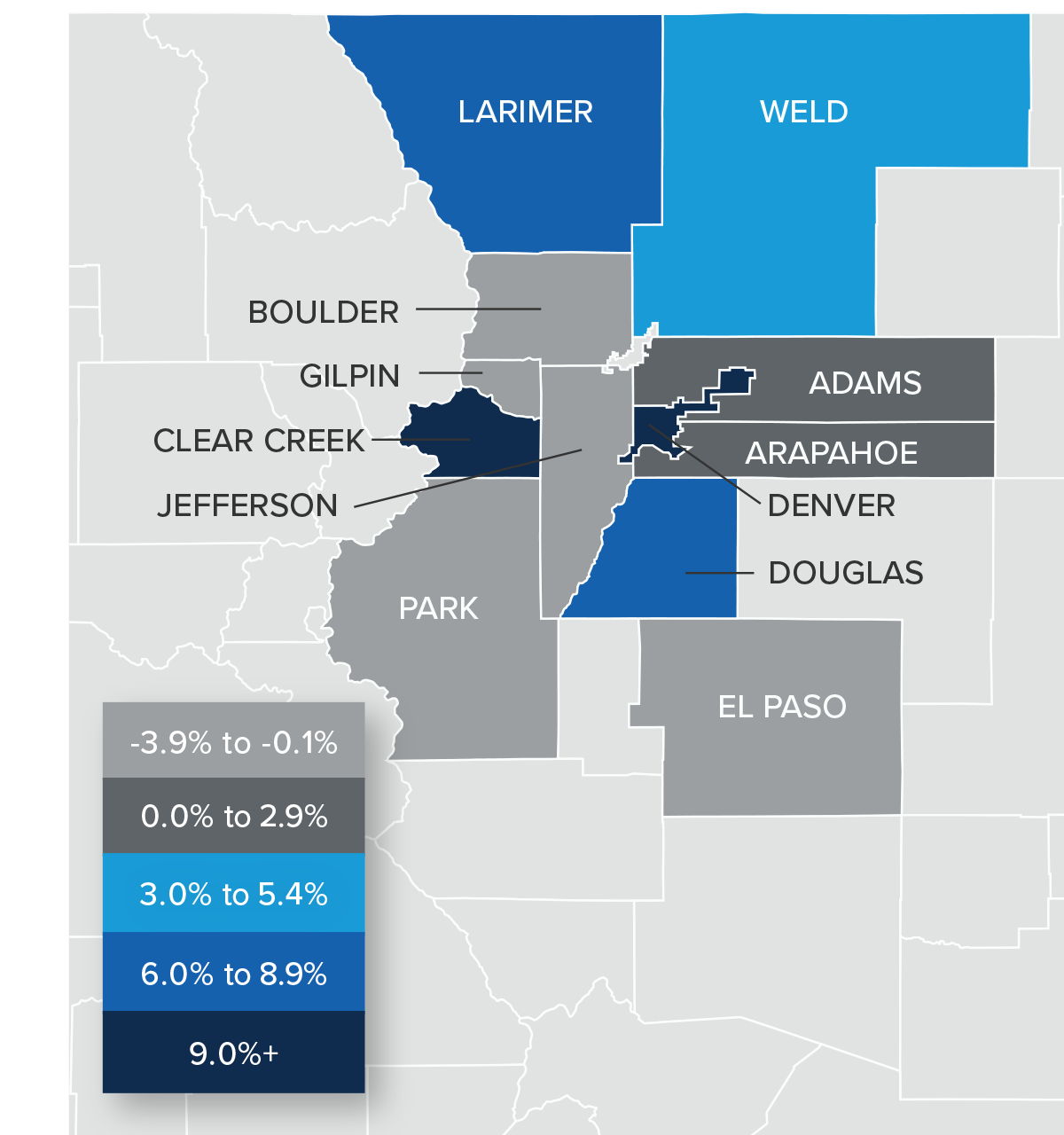

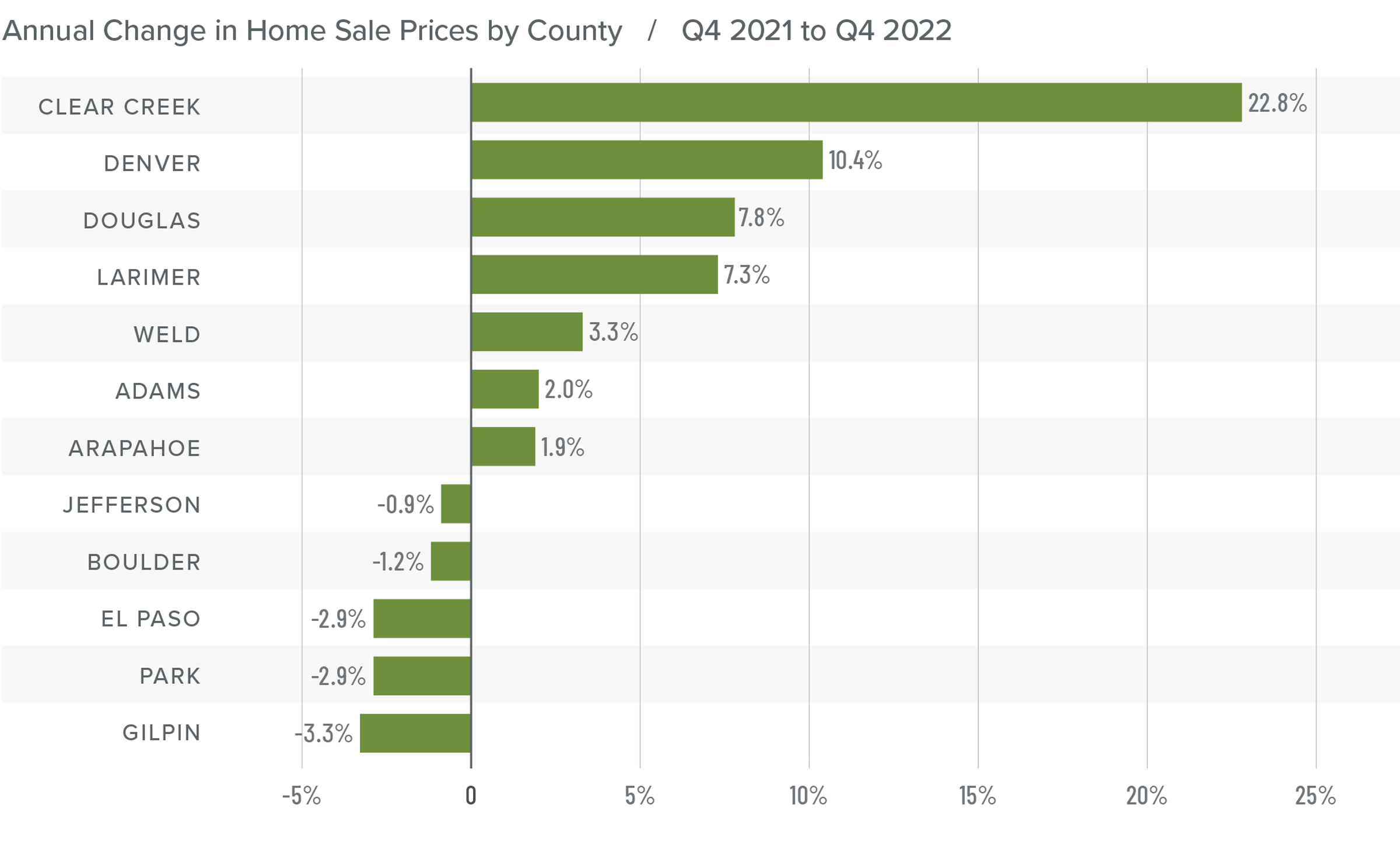

Colorado Home Prices

❱ Home prices rose 3.4% from the same period in 2021 to $628,373. However, prices were 4% lower than in the third quarter in 2022.

❱ Compared to the third quarter, prices fell in all counties other than Larimer, which rose .4%. Listing prices were down in every county other than Clear Creek and Gilpin.

❱ Year over year, prices rose by double digits in Clear Creek and Denver counties. Annual price growth was negative in five of the other ten counties covered by this report.

❱ Home prices rose at an unsustainable pace during the pandemic but rising mortgage rates, higher inventory levels, and lower affordability are now having an impact. Home sale prices will likely continue to pull back as we enter the spring, but the correction should halt during the summer as mortgage rates continue falling.

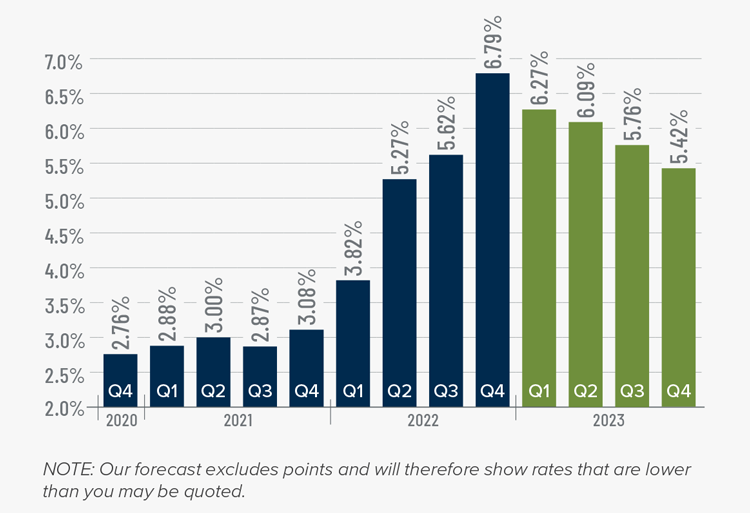

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

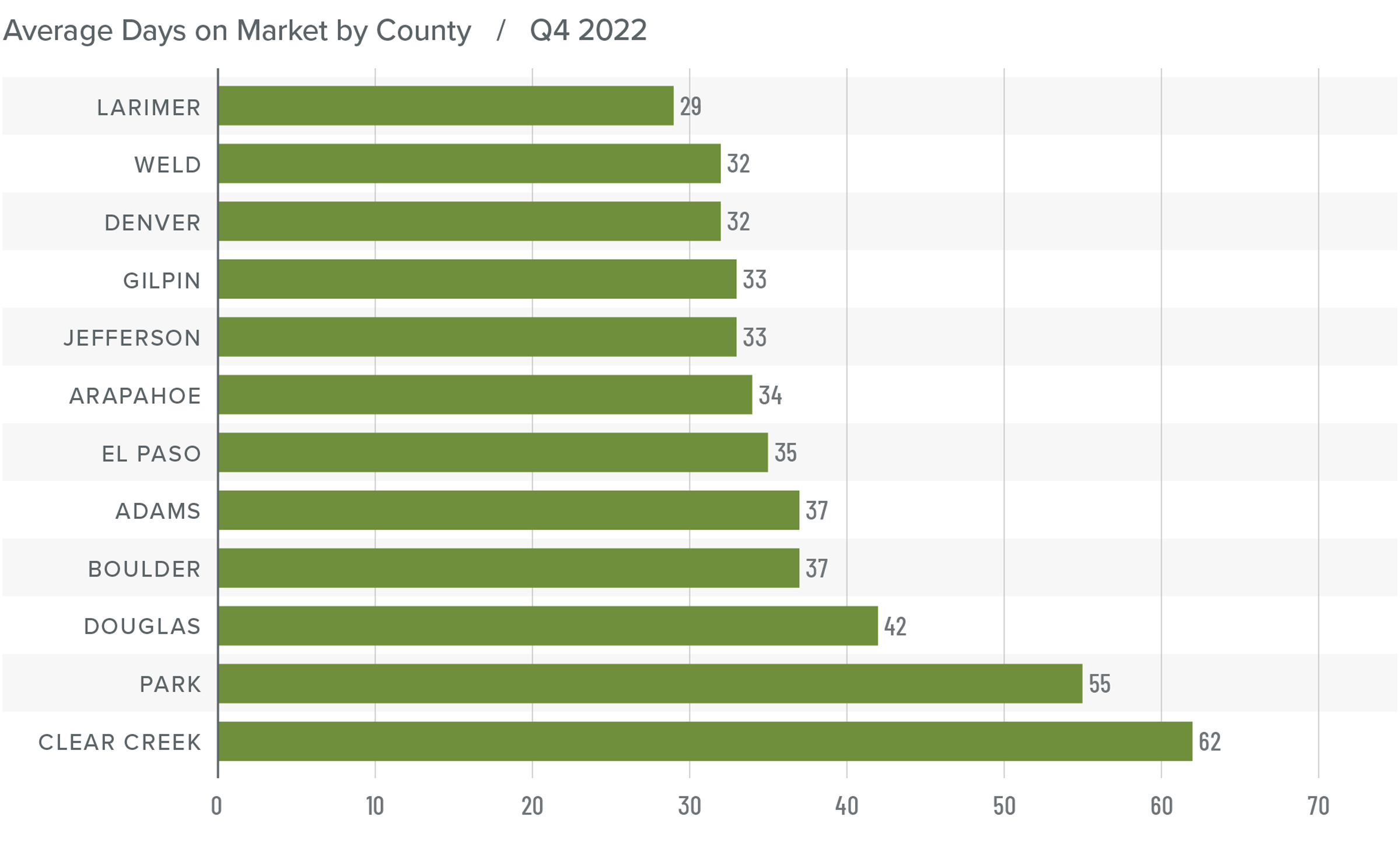

Colorado Days on Market

❱ It took an average of 38 days to sell a home in the region.

❱ The average time it took to sell a home in the markets contained in this report rose 18 days compared to the same period in 2021 and the third quarter of 2022.

❱ Year over year, the length of time it took to sell a home rose across the board.

❱ Buyers have a lot more choice in the market than they have been used to. In addition, uncertainty about the direction of mortgage rates and home prices is likely keeping some buyers sidelined.

Conclusions

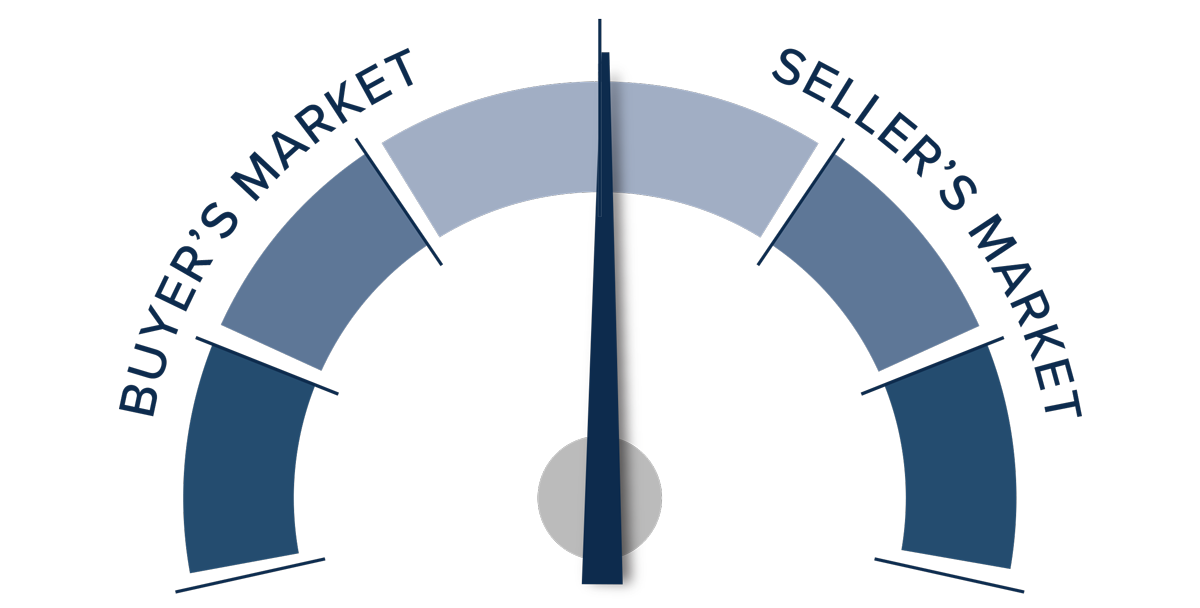

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Slowing job growth, the possibility of a mild recession in 2023, and higher financing costs are all weighing on the housing market. I suggested in the third quarter Gardner Report that the market was likely to continue slowing until prices became more realistic given higher mortgage rates; I am holding to this theory. I still anticipate many markets will see negative annual price growth this year, but prices will only pull back to 2021 levels. In other words, there is no significant cause for concern.

Prices are likely to fall a little further in the first half of the year before starting to rise again in the second half. All things considered, I have moved the needle to a neutral position, favoring neither buyers nor sellers.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link