The following analysis of the Southern California real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

Last summer’s recovery in the regional employment market that followed losses due to COVID-19 has tapered off because of the rapid increase in new infections. Although the region has recovered 1.25 million of the jobs that were lost, total employment is still down 763,000 jobs from the peak last February. With the slowdown in job growth and additional job losses in November, the current unemployment rate is 8.8%. For perspective, this is down from 12.3% at the end of the third quarter, but still significantly higher than the 4% rate last February.

The latest data available (for November) showed the lowest unemployment rates were in Orange County (6.4%) and San Diego County (6.6%). The highest rate was, unsurprisingly, in Los Angeles County, where it was 10.6%. I suggested in the third quarter Gardner Report that the pace of job growth was going to slow, and that proved accurate. Though I expect to see jobs return this year, most of the improvement will occur in the second half of the year when, hopefully, a vaccine is freely available.

southern california Home Sales

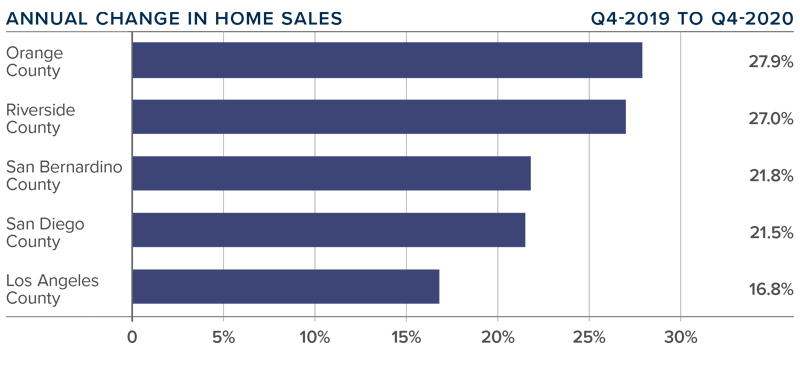

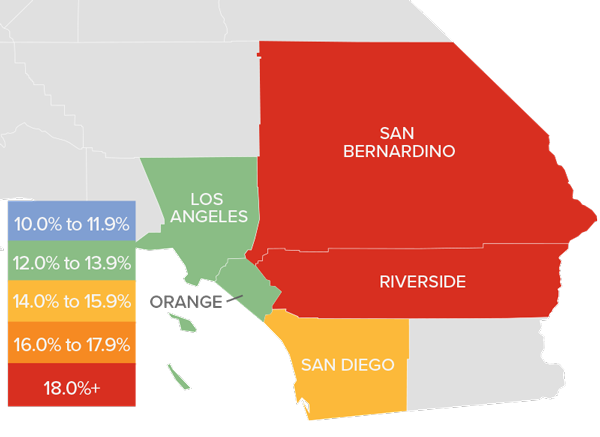

❱ Regardless of the slow economic recovery, the housing market continues to perform well, with 50,114 homes selling in the final quarter of 2020. This is an increase of 21.9% year-over-year.

❱ Pending home sales (an indicator of future closings) were 21.3% lower than in the third quarter, but I attribute this to seasonality and inventory constraints.

❱ Fourth quarter sales rose significantly in all counties relative to a year ago, with very impressive gains in Orange and Riverside counties. That said, all markets saw the number of home sales increase by double digits.

❱ There was an average of only 19,203 homes for sale in the final quarter of the year. This is 35% lower than a year ago and 17.3% lower than in the third quarter of the year.

southern california Home Prices

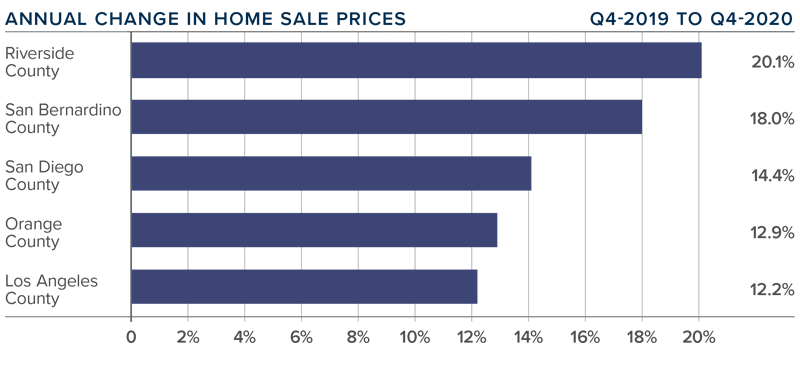

❱ Year-over-year, the average home price in the region was $831,880. This was 13.4% higher than a year ago and 2.4% higher than in the third quarter of 2020.

❱ Mortgage rates have remained at historic lows, which has allowed prices to rise at well-above-average rates. Given that home prices have been rising at a far faster pace than incomes, affordability concerns continue to grow.

❱ The region saw double-digit price growth across all counties contained in this report, with further significant increases in the relatively affordable Riverside County.

❱ Mortgage rates appear to have reached a floor and are unlikely to drop much further. Given that I do not expect to see significant income growth this year, it is likely that the pace of home-price appreciation will start to slow.

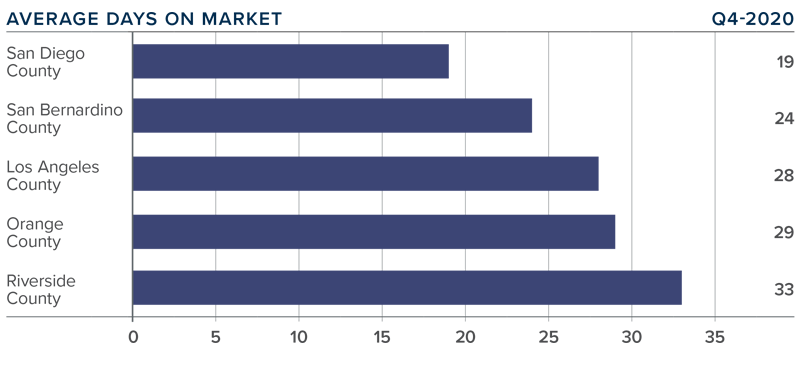

Days on Market

❱ In the final quarter of the year, the average time it took to sell a home in the region was 27 days, which is 19 fewer days than a year ago, and 6 fewer than in the third quarter of 2020.

❱ All markets contained in this report saw the time it took to sell a home drop compared to the fourth quarter of 2019.

❱ Homes in San Diego County continue to sell at a faster rate than other markets in the region. In the fourth quarter, it took an average of only 19 days to sell a home there. This is 12 fewer days than it took a year ago.

❱ The decline in market time is due to limited inventory levels and significant demand.

Conclusions

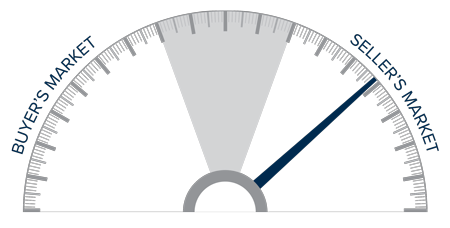

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Home sales and prices are significantly higher, and demand for housing is very much in place. Naturally, this favors home sellers who are still in control of the market. I do expect to see some improvement in listing activity this year, which, in concert with modestly rising interest rates, will likely start to take some of the steam out of the market. However, any moderation in the market has yet to appear.

Even given the possible headwinds mentioned above, I am moving the needle a little more in favor of sellers as solid demand is still in place.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link