The following analysis of select Montana real estate markets is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

Regional Economic Overview

Montana continues to see jobs return. As of November, the state had recovered 46,800 of the 63,500 jobs that were shed due to COVID-19. The job recovery was evident across the state, but current numbers show that Missoula’s employment levels are only down by 160 of the 7,400 jobs that were lost. The unemployment rate in the state was 4.9% in November, down from the April peak of 11.9%. Unemployment estimates across the various MSAs shows Billings’ current rate at 4%, Great Falls at 4.5%, and Missoula at 4.1%. New COVID-19 cases in Montana dropped as 2020 came to a close, which may be why the job recovery has been so robust.

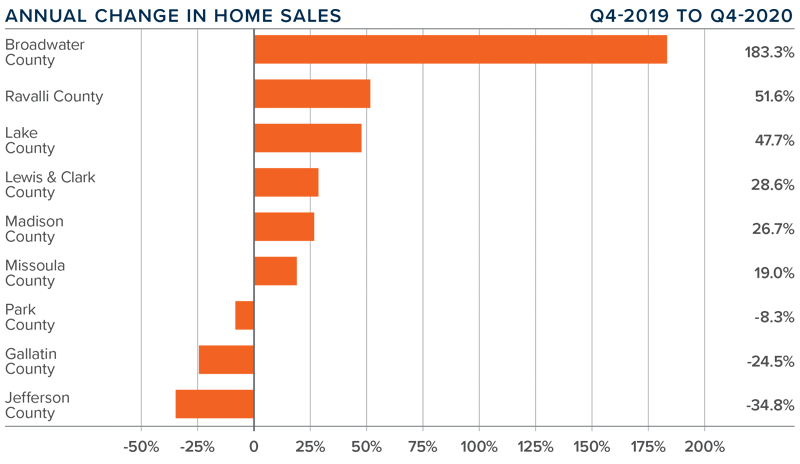

montana Home Sales

❱ During the final quarter of 2020, 1,783 homes sold in the markets contained in this report. This was 3.8% lower than during the same period in 2019 and 29.9% lower than in the third quarter of 2020.

❱ Sales activity rose in six counties but dropped in three. The largest annual increase was in very small Broadwater County, where sales were up by 183%, which was an increase from 12 to 34 home sales.

❱ The overall drop in sales can be attributed to the woefully low number of homes for sale. The average number of listings was 47.1% lower than a year ago and 57.4% lower than in the third quarter of 2020.

❱ I would like to see inventory levels higher, but I do not anticipate that will occur until later in the spring of 2021.

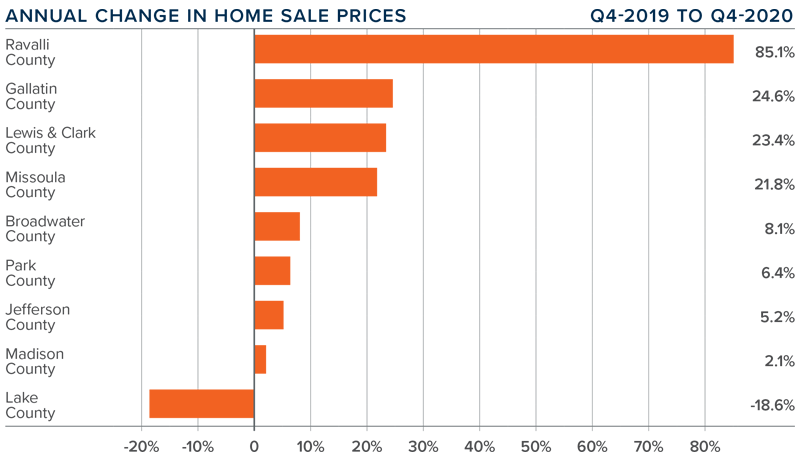

montana Home Prices

❱ Year-over-year, home prices rose 14.2% to an average of $603,845. Prices were also 21% higher than in the third quarter of the year.

❱ Average home prices rose everywhere but Lake County, though this was likely because there were very few sales in that market.

❱ An improving economy, in concert with rapidly growing demand for housing, has driven significant growth in sales prices.

❱ Inventory levels are still well below where they need to be, but I am hopeful we will see more listings come online this year. That, combined with modestly rising mortgage rates, should soften home price growth somewhat.

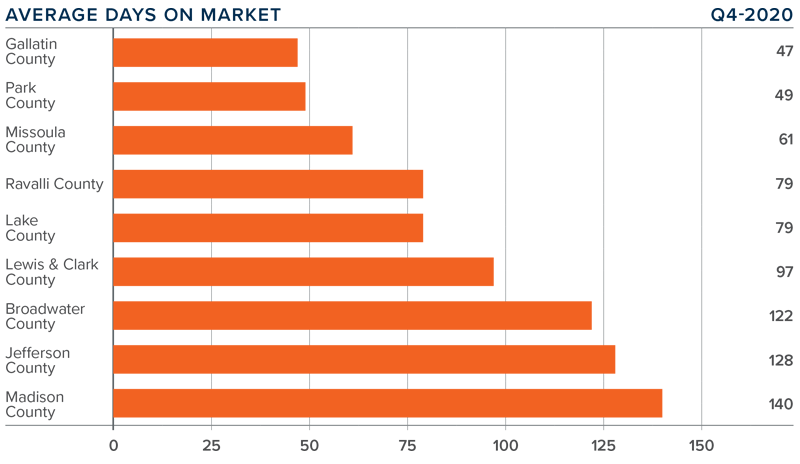

Days on Market

❱ The average number of days it took to sell a home dropped 28 days compared to the final quarter of 2019.

❱ Homes sold fastest in Gallatin and Park counties and slowest in Madison County. Even with the overall drop in market time, it took longer to sell a home in Lewis & Clark, Broadwater, and Jefferson counties than it did a year ago.

❱ During the quarter, it took an average of 89 days to sell a home in the region.

❱ Market time dropped eight days compared to the third quarter of 2020.

Conclusions

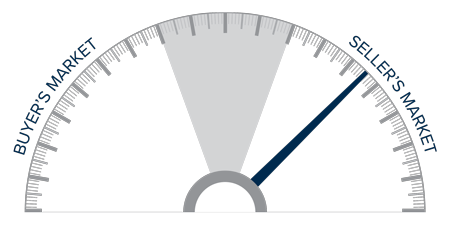

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The economy is recovering nicely, and the housing market is performing very well—if you are a home seller! Price growth is solid due to the lack of homes for sale. I am looking for inventory levels to rise in 2021, which, in concert with mortgage rates that seem to have bottomed out, should mean that price growth will taper somewhat.

It remains a seller’s market, and, given the factors described above, I have moved the needle a little further in their favor.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link