This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

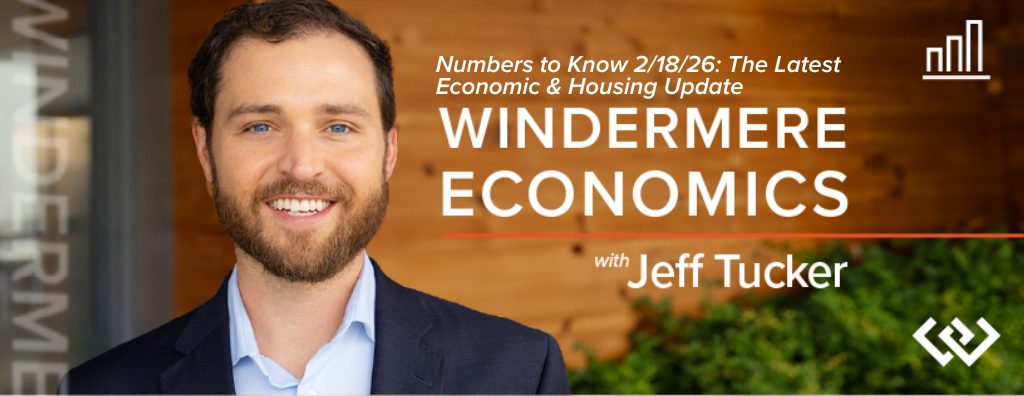

I’ll start with some bad news and some good news from the latest jobs report. The first number to know this week is the bad news: 181,000. That’s the total number of jobs added in the entire year of 2025, according to the latest data from the Bureau of Labor Statistics, which follow a standard annual revision updating their models to match more accurate but less timely data sources. These revisions drove home the conclusion that job growth basically stalled out in 2025, and was much worse than even the weak monthly payrolls reports were showing us. That total job growth compares to previous annual totals in the millions, although the trend of slowing growth has been clear for quite some time.

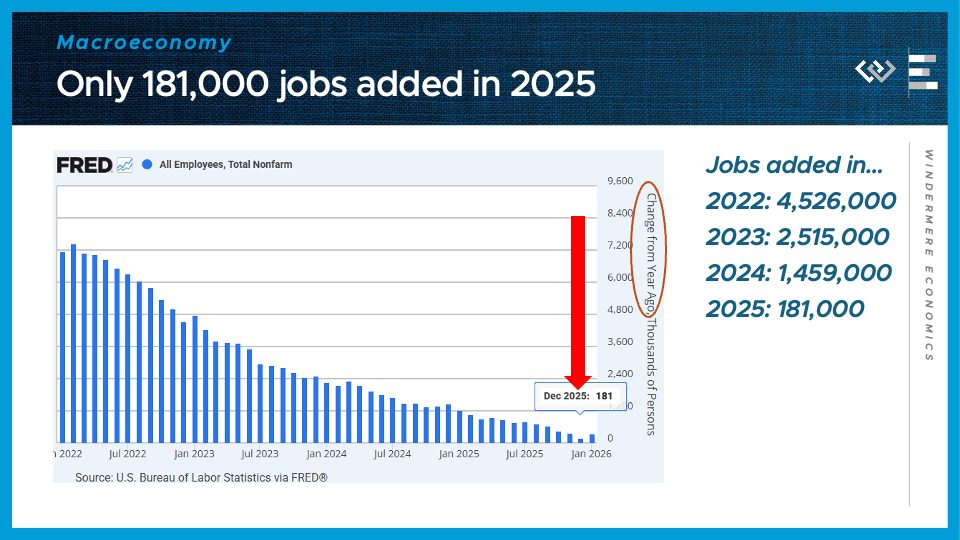

The second number to know this week was the good news in the latest jobs report: 4.3%. That’s the unemployment rate in January, which stepped down again, from a high in November of 4.5%, bringing it back down to summer 2025 levels. That’s one indication that the labor market MAY have begun to turn the corner this winter, with some modest improvement to start the year after several straight months of weakening. These are just preliminary numbers, but coupled with what we know will be strong economic tailwinds from the huge tax cuts in last year’s budget bill, the stage seems to be set for stronger economic growth this spring.

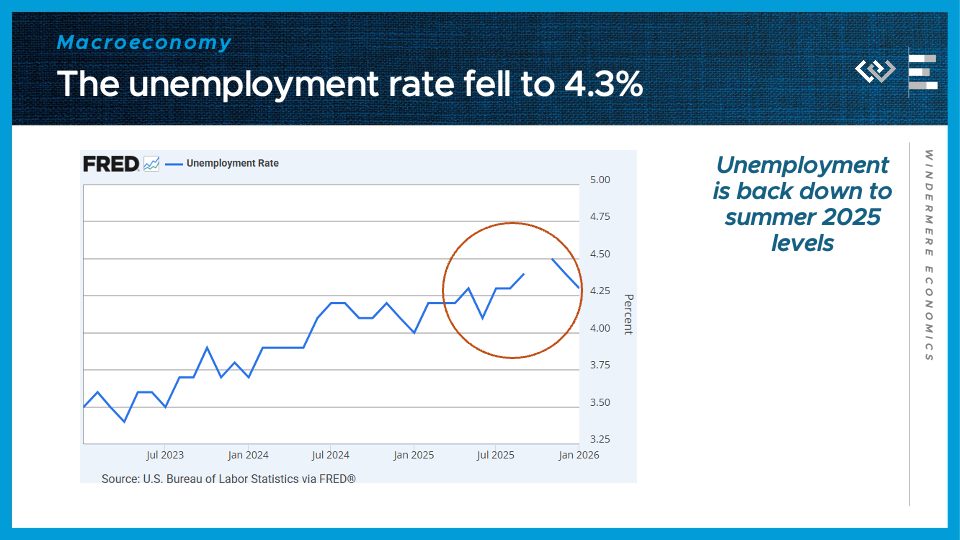

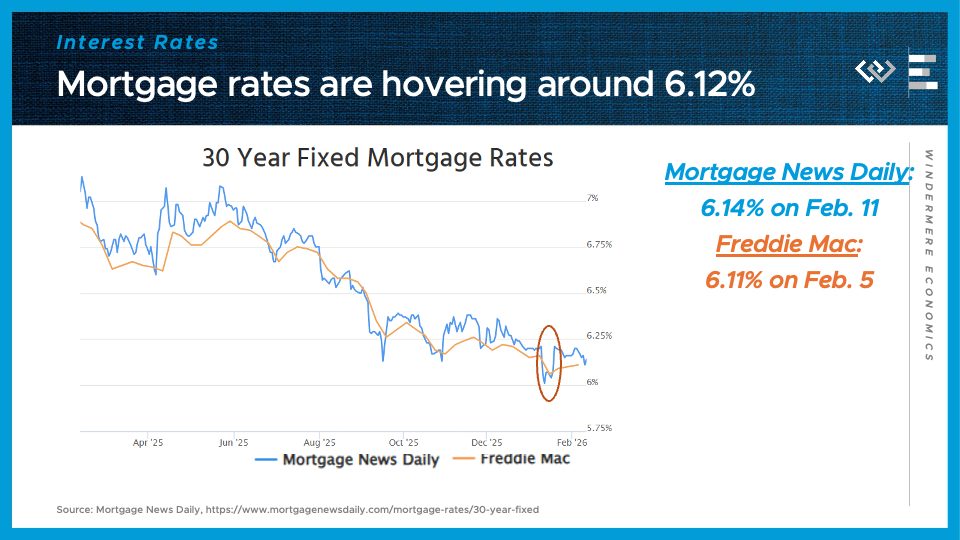

The third number to know right now: 1.84 percentage points. That was the average spread, or how much higher 30-year mortgage rates were than the benchmark 10-year Treasury yield in the first week of February. That means we are knocking at the door of a normal spread after almost four years of a really abnormally wide spread. This was a major culprit in the pain that homebuyers felt trying to get a mortgage. Last month I talked about the surprise announcement that Fannie Mae and Freddie Mac would be buying mortgage-backed securities, and I think the proof is in the pudding that the news of that purchasing plan helped bring this spread down by that last 30 basis points just in the last month.

So where are mortgage rates now? Well, they’ve been hovering around 6 and an eighth all year, which is an improvement from this time in 2025 of at least half a point, maybe ¾ or a whole point, for most borrowers. I think the takeaway here is that we’ve now seen most of the improvement to mortgage rates that we were expecting from that spread closing, which is a little bittersweet – it’s great news that it happened, but now that potential avenue for rate improvement has run its course, which makes me less optimistic about prospects for further rate declines in the near term. It’ll depend instead on the overall interest rate and inflation environment cooling down, and those prospects look a lot dicier: the big increase in borrowing that the budget bill is kicking off this year will tend to push up Treasury yields, and the boost to economic growth should also keep inflation elevated. So my takeaway for anyone considering a mortgage is that rates have come down a lot, and there’s no point waiting on the sidelines in hopes of further declines, given what we can expect in the year ahead.

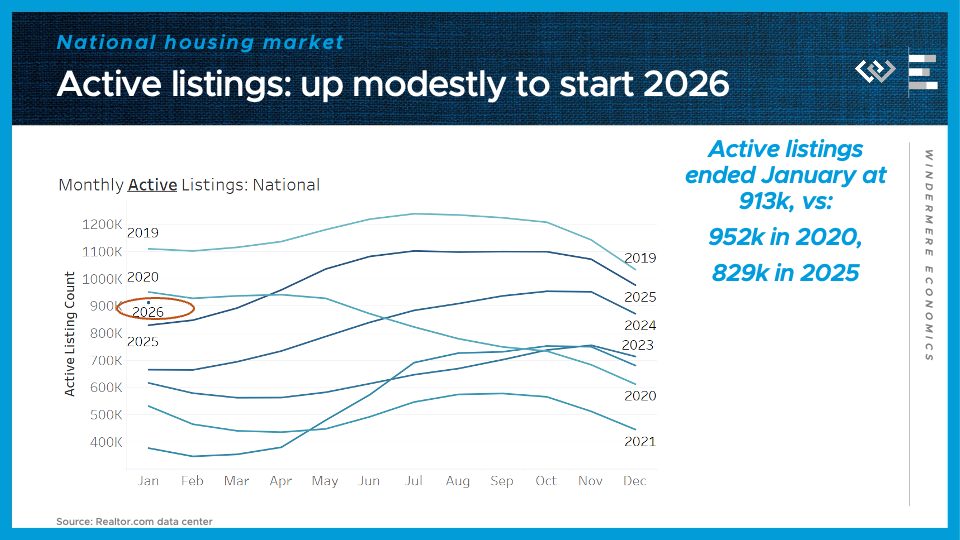

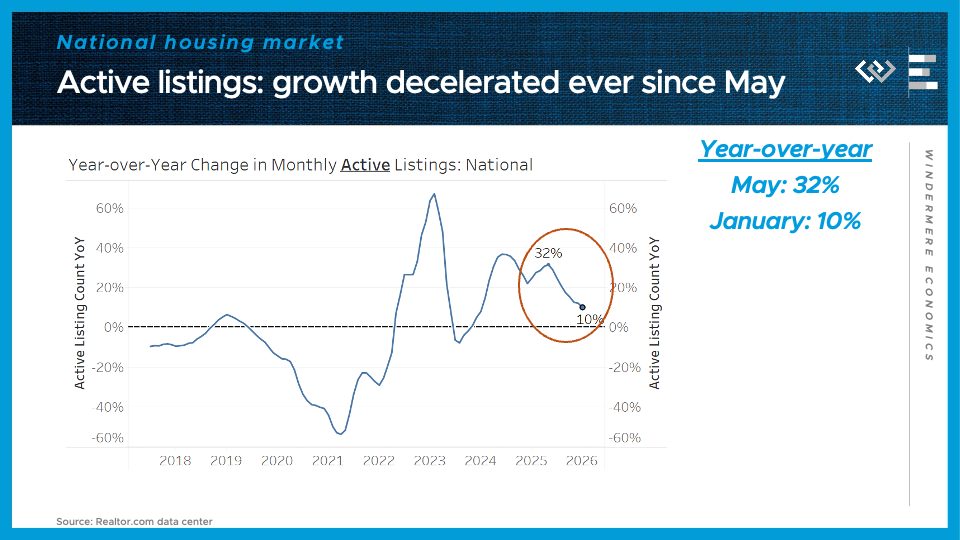

Turning to the housing market, we saw 913,000 active listings at the end of January, which is the most since January 2020, on the eve of the pandemic. In other words, nationally, inventory is finally nearly back to normal.

That 10% growth in inventory continues a consistent trend since last May, of active listings growing but at an ever slower pace. I think there’s good news for everyone in that fact: buyers will have more options to choose from this spring, and sellers don’t need to worry about competing against a glut of inventory, but they should be prepared to put their best foot forward when they list their home this spring, because it’s always worth it to stand out from the competition.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link