The following analysis of select counties of the Idaho real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Job growth in Idaho continues to moderate. The state added 19,400 new jobs over the past 12 months, representing an annual growth rate of 2.7%. That said, the growth rate remains well above the national average of 1.7%. In March, Idaho’s unemployment rate was 2.9%, matching the level seen a year ago. The state remains at full employment, and it’s worth noting that the employment rate remained below 3% even as the labor force rose by 2%. This suggests the economy remains very strong as there are still job openings to accommodate new workers. Idaho continues to outperform the nation in terms of economic vitality and will continue to do so for the balance of the year.

HOME SALES

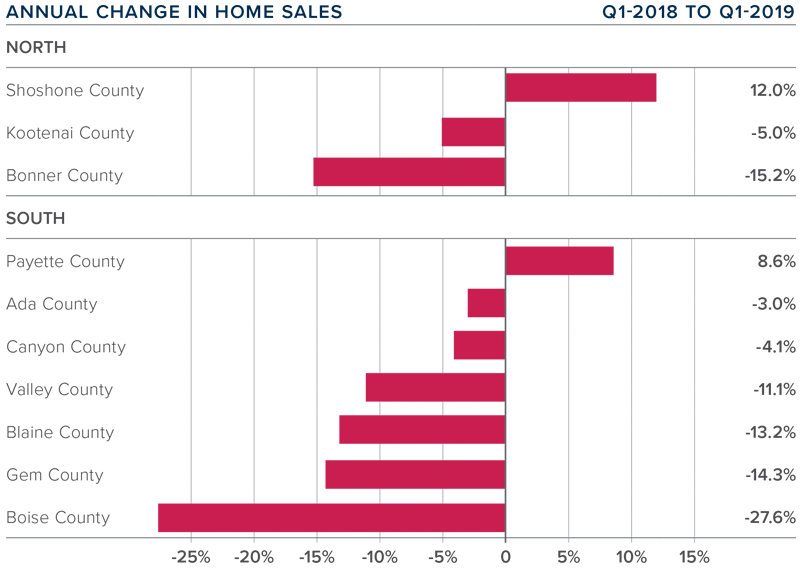

- 4,440 homes were sold during the first quarter of 2019, representing a drop of 4.3% compared to the first quarter of 2018.

- In Northern Idaho, Shoshone County was alone in experiencing sales growth, with an increase of 12% over the first quarter of 2018. There was a substantial drop of more than 15% in Bonner County, but this is a small area, making it prone to significant swings. In Southern Idaho, we saw modest sales growth in Payette County, modest declines in Canyon and Ada counties, and significantly lower sales in the small area of Boise County.

- Year-over-year sales growth was positive in just one Northern Idaho market, and only one of the Southern Idaho markets saw sales rise relative to the same period a year ago.

- When compared to the first quarter of 2018, the number of homes for sale was lower across the board in Northern Idaho and in most Southern Idaho market areas. It’s likely that this contributed to the decline in sales.

HOME PRICES

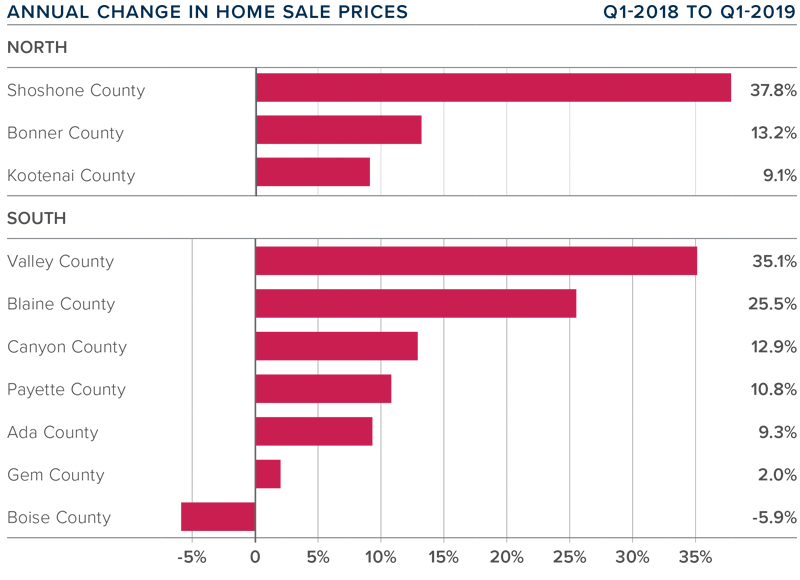

- The average home price in the region rose 10.7% year-over-year to $347,153.

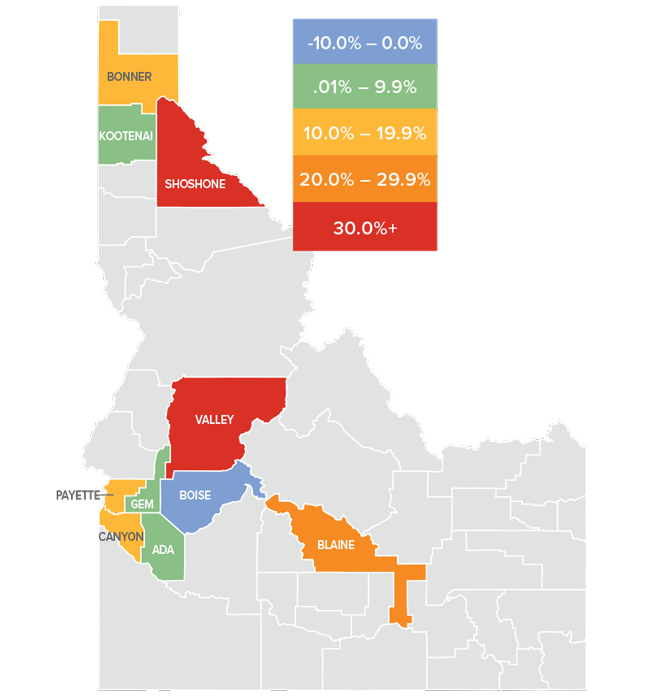

- In Northern Idaho, Shoshone County again led the market with the strongest annual price growth. Both Bonner and Kootenai counties also saw solid, double-digit appreciation. In Southern Idaho, small Valley County saw prices rise a very significant 35.1%, but this is an anomaly.

- There were price increases in all but one county compared to the first quarter of 2018. The outlier was Boise County, where sales prices dropped by 5.9%. Boise County is a very small market that can experience significant swings, so I’m not concerned about this decline.

- Limited levels of inventory continue to drive up home prices at above-average rates. I believe we’ll see more homes come on the market in the late spring, hopefully starting a trend toward a more balanced housing market.

DAYS ON MARKET

- It took an average of 134 days to sell a home in Northern Idaho, and 86 days in the southern part of the state.

- The average number of days it took to sell a home in the region dropped 5 days compared to the first quarter of 2018 but was up 20 days compared to the final quarter of 2018.

- In Northern Idaho, days on market dropped in Kootenai County, but market time rose in the other two counties covered by this report. In Southern Idaho, market time dropped in all but Ada and Blaine counties, but the rise was very modest.

- Homes again sold the fastest in Canyon and Ada counties, where it took an average of 46 and 49 days, respectively.

CONCLUSIONS

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Job growth has slowed from the frenetic pace of 2018, but continued economic growth will lead businesses to hire new workers. This economic vitality is certain to result in ongoing demand for homeownership. Home sales are lower than I would like, but I remain confident that inventory levels will rise in the spring months, providing more choice for buyers.

I expect the number of homes for to sale rise but, until we see that in the data, it remains a sellers’ market, so I have moved the needle just a little more in their direction.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link