This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

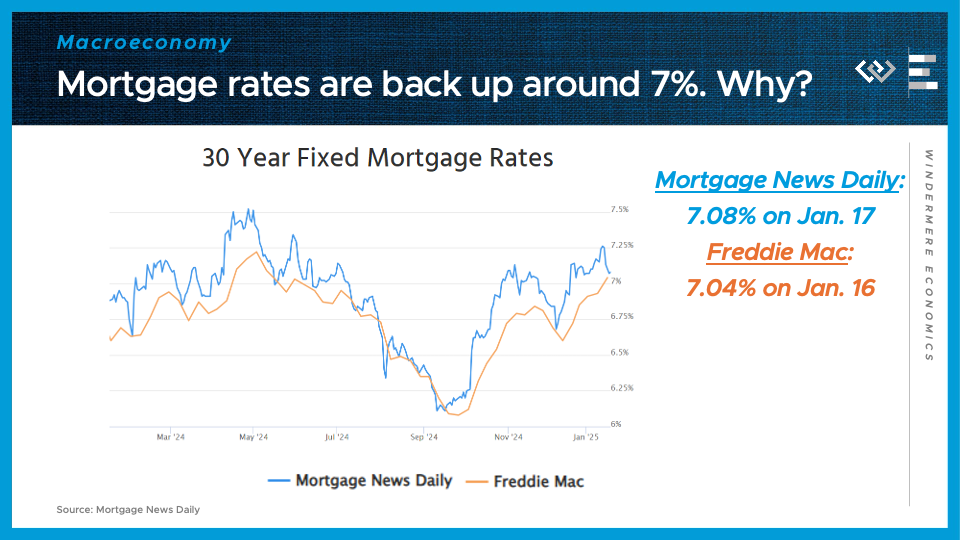

This week the numbers to know are all about mortgage rates and the factors that have pushed them back up over the last few months.

7%

That’s around the typical interest rate on a 30-year fixed rate mortgage right now, according to both Freddie Mac and Mortgage News Daily. That’s also almost a full point higher than it was just 4 months ago, in mid-September. I should add that the daily data have been very volatile lately, with rates jumping up and down by 10 or 15 basis points. But in the bigger picture, this is the first time since last May that Freddie Mac’s weekly survey showed rates above 7%.For the proximate cause of the higher mortgage rates we can look at our 2nd number to know right now:

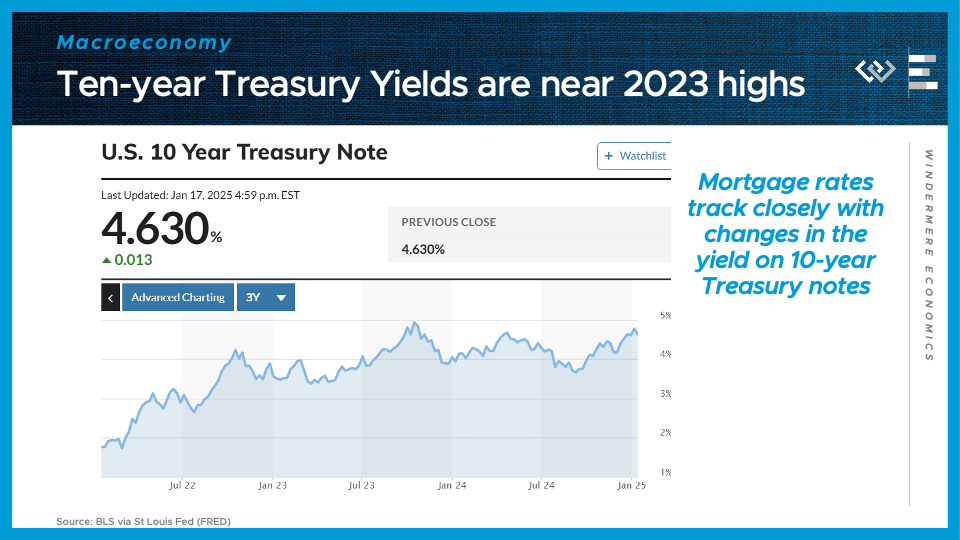

4.63%

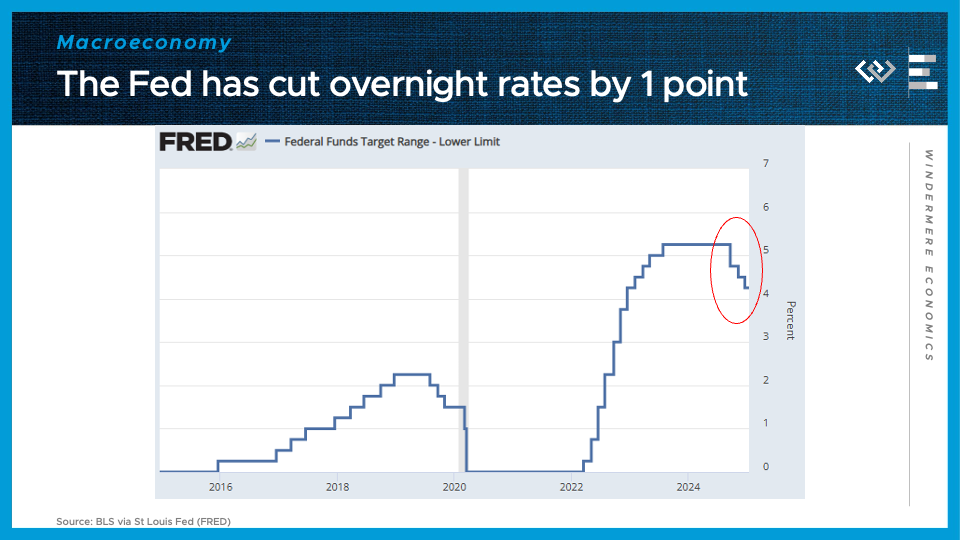

This is the latest 10-year Treasury yield as of January 17. Mortgage rates tend to track closely with this key benchmark long-term yield, plus a spread of a little more than 2 points. There is a bit of a puzzle here, though: the Federal Reserve has been cutting the Federal Funds Rate, an ultra-short term overnight interest rate. They started with a supersized half-point cut in September and then two more quarter-point cuts.

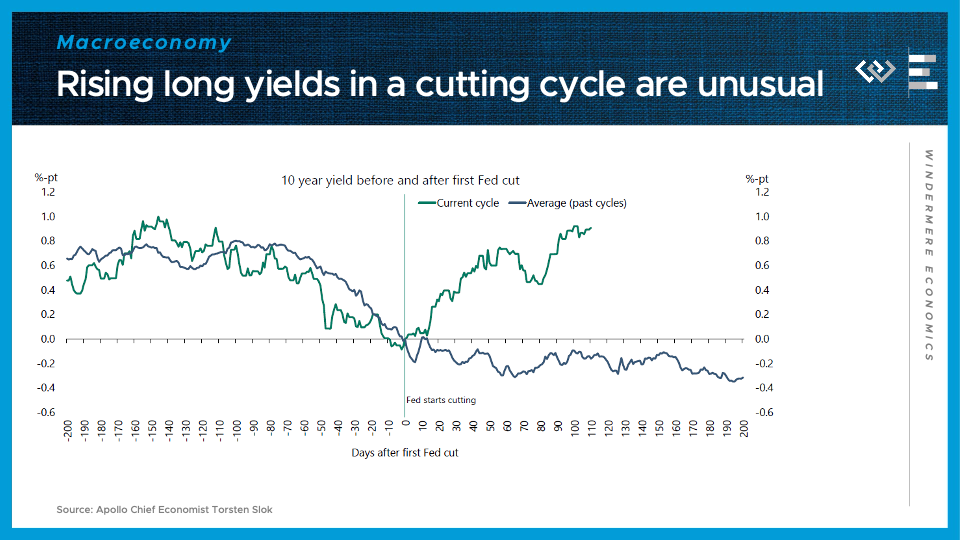

As Torsten Slok, Chief Economist at Apollo Global Management, recently flagged in this chart, historically, 10-year Treasury yields tend to continue declining modestly after the Fed has begun cutting the short-term rate. But this time is sharply different – instead, those long-term rates have more than backtracked all the downward progress they made over the summer. The short answer for why they’ve moved back up is that the outlooks for 3 factors have climbed recently: real economic growth, inflation, and borrowing.

For economic growth, our next number to know is

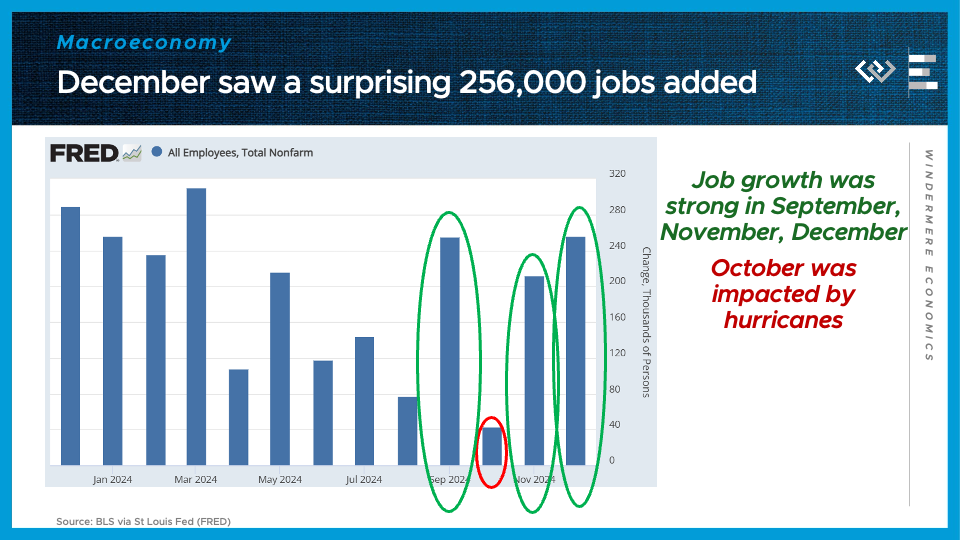

256,000

That’s the surprisingly large number of new payroll jobs added in December, according to the latest jobs report from the Bureau of Labor Statistics. Aside from October’s hurricane-impacted report, that makes three surprisingly strong months of job gains to close out 2024.

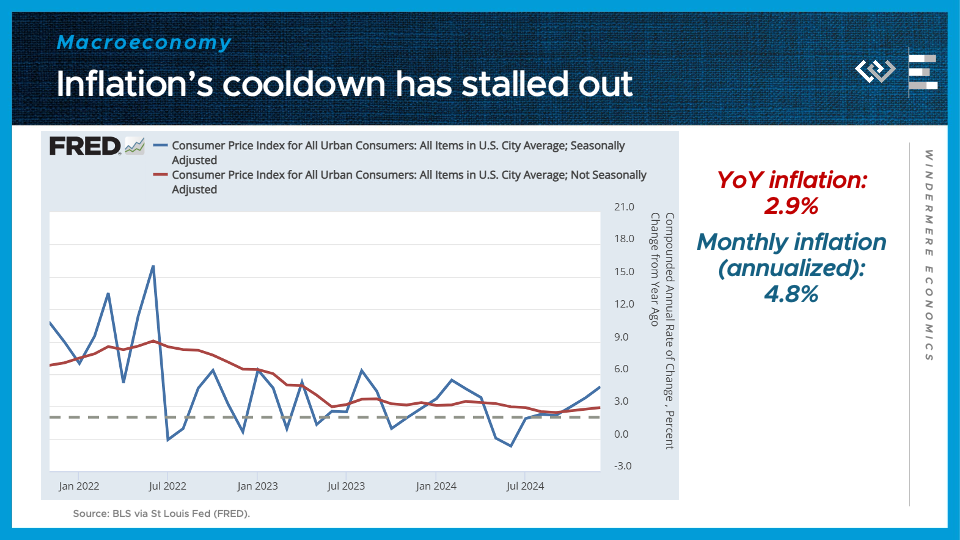

For inflation, our final numbers to know are:

2.9% and 4.8%

Those are the year-over-year inflation rate of the consumer price index, and the latest monthly growth rate compounded out to an annualized rate. Both are running hotter than the Fed’s target of 2%. Combined with the surprisingly resilient labor market, these data are tamping down investors’ expectations for further rate cuts by the Fed – all of which is helping to feed into those higher Treasury yields and therefore higher mortgage rates.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link