As students wrapped up their summer vacations and got ready to head back to school, our Windermere offices were busy collecting back-to-school supplies for low-income and homeless students.

Some offices began their efforts well before the end of summer, like the Windermere Mount Baker office, which assisted the Seattle King County Coalition on Homelessness’ “Project Cool” by collecting supplies during the months of June and July. Then on July 13, 35 agents and their families got together to help stuff backpacks at the Columbia City Church of Hope. This was the office’s third year helping Project Cool provide backpacks filled with school supplies to homeless children. Thanks to the donations and volunteers’ efforts, Project Cool says they will be able to help over 1,450 kids get a good start to their school year.

The Windermere El Sobrante office teamed up with a local lender and collected donations for a school supply and backpack drive. The supplies collected were distributed to two local area schools through Community Cares, serving approximately 1,200 students.

The Windermere West Sound, Inc. offices (Kingston, Poulsbo and Silverdale) supported Sharenet Food Bank’s annual backpack and school supply drive by presenting a $1,000 grant to the Greater Kingston Kiwanis Foundation. The offices also held a Kicks for Kids sneaker drive in August, in which they collected new school shoes for low-income youth.

The Windermere Mercer Island office also held a Kicks for Kids shoe drive this summer. Their goal was to collect 300 pairs of shoes and 50 twenty-dollar gifts cards for kids receiving services at Mary’s Place, an organization that supports homeless women and their children. They exceeded their goal and collected over 330 pairs of shoes and 60 gift cards, which were handed out to the kids at Mary’s Place on August 24 – just in time for the first day of school.

Windermere Van Vleet & Associates, Inc. offices (Ashland, Medford and Jacksonville) participated in the Rogue Valley Association of Realtors’ school drive benefiting the Maslow Project, which provides underprivileged kids with backpacks filled with school supplies. Windermere agents donated over $500 and collected enough funds from individual and office donations for 350 backpacks.

The Windermere Alderwood office supported the Edmonds School District’s Back-to-School and Health Fair on August 27 at Cedar Valley School. With a $1,000 donation through the Windermere Foundation, they helped provide backpacks full of school supplies, as well as volunteering their time at the event. Over 1,100 students registered for the event, with an expected attendance of over 1,300. Along with a backpack of supplies, kids were offered free haircuts, dental and eye exams, free immunizations, and many other helpful services to help them prepare for their first day of school.

The Windermere Salem office used their Windermere Foundation funds to purchase 30 backpacks filled with school supplies for children in need at Liberty Elementary School.

The Seattle-area Windermere Real Estate Company offices in Sand Point, Wedgwood, Lakeview and Northgate partnered with local elementary schools to provide backpacks and school supplies for students from low-income families. Armed with a supply list and a number of backpacks to fill, the offices purchased everything via funds through the Windermere Foundation. Then agents from all of the offices came together to prepare the backpacks for delivery to the schools at the end of August.

The Windermere Tri-Cities Kennewick office supported the Tri-City Union Gospel Mission Women’s and Children’s Back-to-School event on August 15. Using their Windermere Foundation funds, the office purchased backpacks and supplies to donate to the cause.

The Windermere Bellevue Commons office held a back-to-school drive in August and collected school supplies and cash donations to assist 1,600 students in the Bellevue School District.

The Windermere Burien office donated Windermere Foundation funds in support of back-to-school drives for Lutheran Community Services Northwest and the Highline Schools Foundation.

Windermere offices in Spokane (City Group, Cornerstone, Liberty Lake, Manito, North, Valley) hosted their annual Shoes and Socks event for local school kids on August 29. Children referred by Family Promise of Spokane, Spear, and local area schools picked out shoes and received a pair of socks from event partner Big 5 Sporting Goods. The event served around 150 children.

The Windermere Lake Stevens office partnered with the Lake Stevens Family Center to help with their back-to-school event on August 29. Through their Kicks for Kids shoe drive, the office collected over 70 pairs of shoes to give to local children in need.

At the Windermere Northlake office, agent Amanda Mayberry organized a donation drive in support of the YWCA supply drive to benefit homeless youth and kids in transitional housing.

Windermere Relocation, Madison Park and Windermere Coeur d’Alene offices also supported local back-to-school and backpack programs in their areas.

Thanks to the efforts of these offices, thousands of children from low-income families will have the tools they need to be successful and start the school year with dignity. We are very grateful to everyone involved.

To learn more about the Windermere Foundation, visit http://www.windermere.com/foundation

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

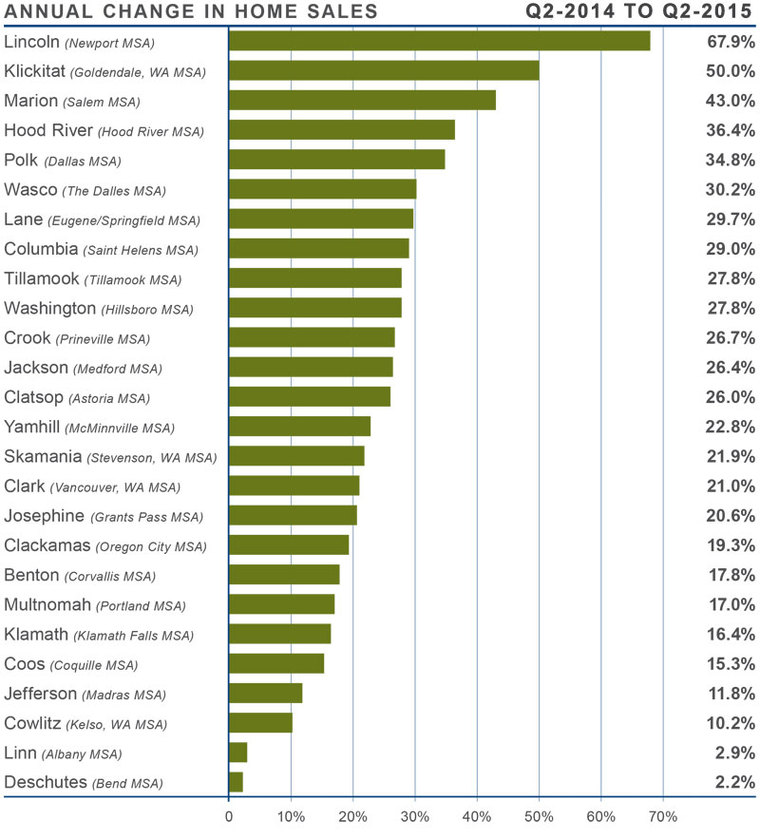

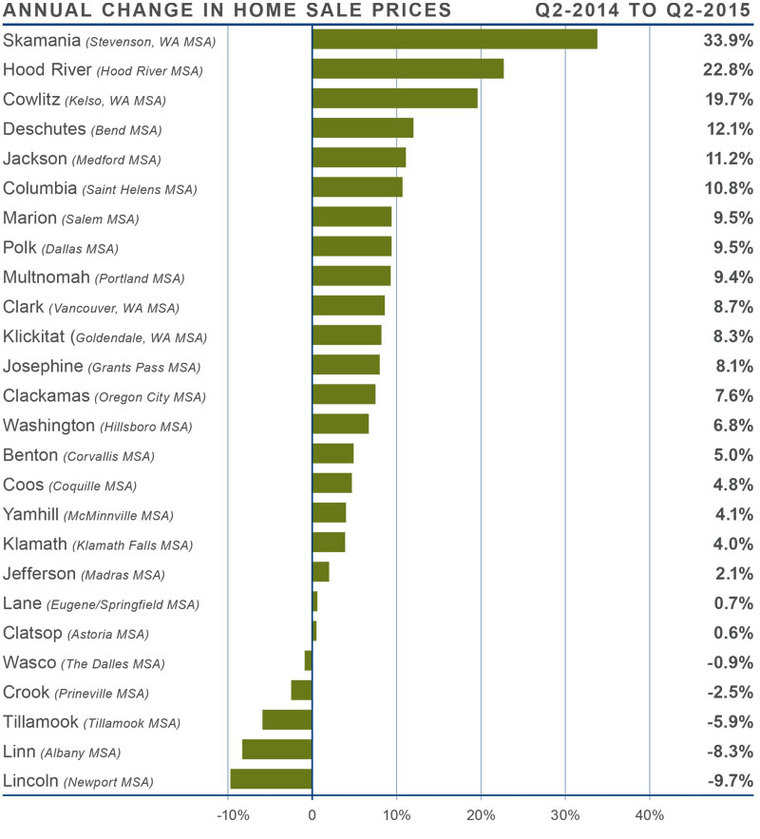

CONCLUSIONS

CONCLUSIONS

Matthew Gardner is the chief economist for

Matthew Gardner is the chief economist for