ECONOMIC OVERVIEW

The Washington State economy has added almost 370,000 jobs since the lowest point of the recession at the start of 2010. Additionally, total employment is 176,000 jobs higher than seen at the 2008 peak. With a vast majority of our metropolitan areas having fully recovered from the job losses seen during the recession, I expect to see somewhat more modest job growth in the coming year. That being said, our economy will continue to expand, which will be a benefit to our region’s housing market.

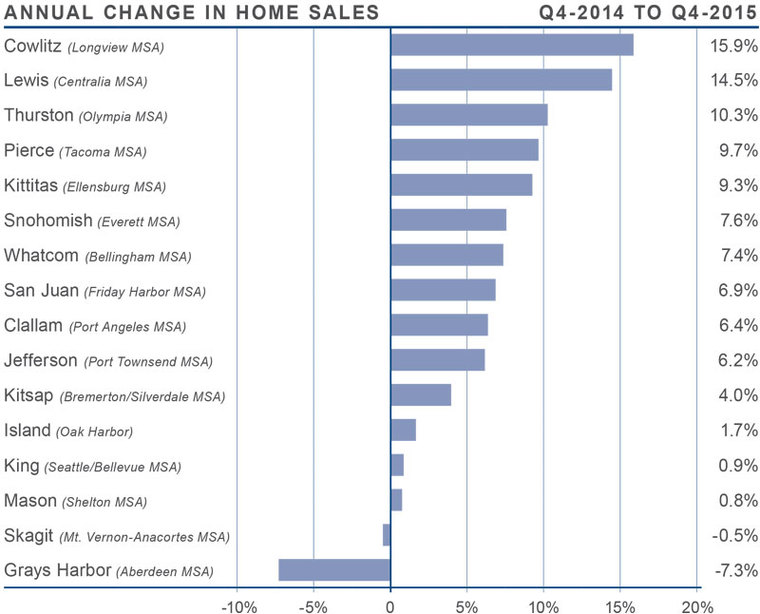

HOME SALES ACTIVITY

- There were 16,895 home sales during the fourth quarter of 2015, up by 4.6% from the same period in 2014. Sales activity is starting to slow somewhat but this is due to inventory constraints.

- The growth in sales was most pronounced in Cowlitz and Lewis Counties and double-digit growth was also seen in Thurston County. Sales declines were seen in Grays Harbor County and Skagit County, but only minimally.

- The number of home sales grew in all but two counties, with the average number of sales up by almost 6% from the same period in 2014.

- I am not surprised to see some decline in sales start to appear. Listing activity was down by 28% compared to the fourth quarter of 2014, and there were no counties where there were more homes for sale in Q4-2015 versus Q4-2014.

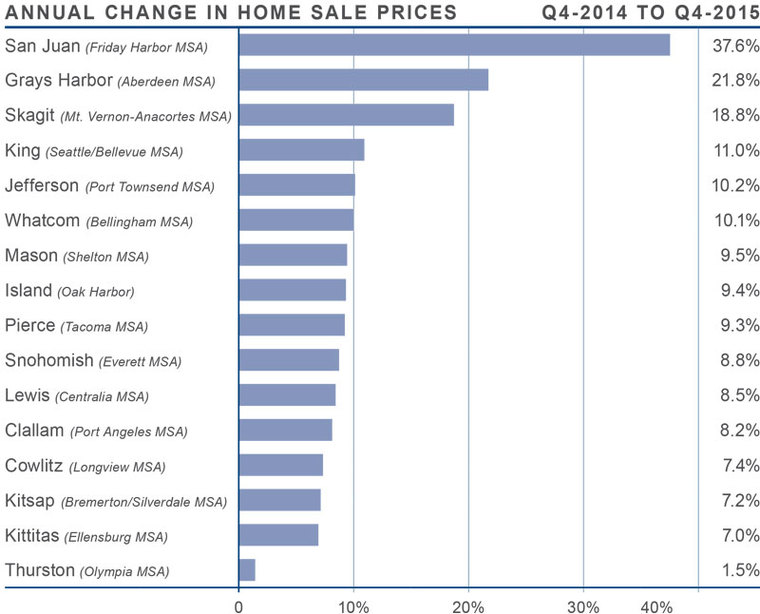

HOME PRICES

- Prices in the region rose by an average of 9.3% on a year-over-year basis but were

- 0.4% lower than seen in the third quarter of 2015.

- Unsurprisingly, no counties saw a drop in average home prices compared to fourth quarter last year.

- When compared to the fourth quarter of 2014, San Juan County again saw the fastest price growth with an increase of 37.6%. However, this county is notorious for extreme swings given the huge variations in prices in the San Juan Islands. Double-digit percentage gains were also seen in five other counties.

- As long as inventory constraints persist, it is likely that price growth will continue.

- That said, modest increases in interest rates, in combination with declining affordability conditions in several markets, will likely slow price appreciation.

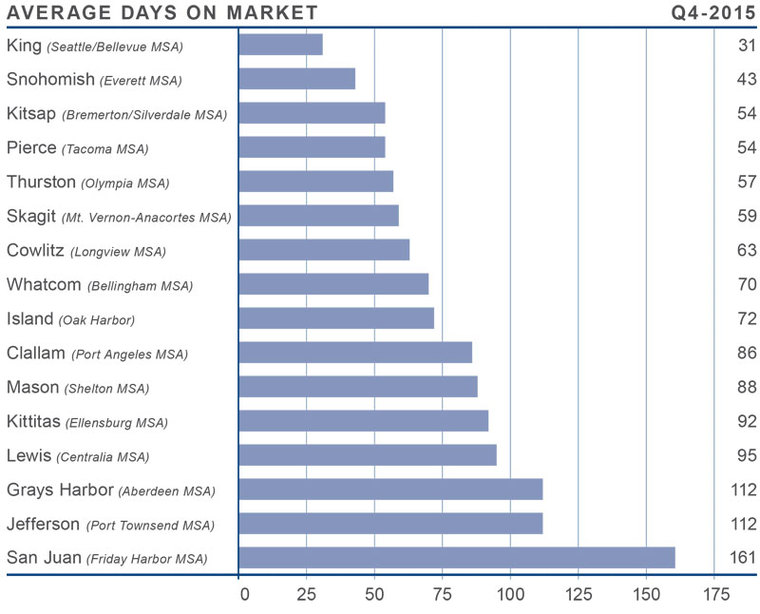

DAYS ON MARKET

- The average number of days it took to sell a home dropped by nine days when compared to the third quarter of 2014.

- It took an average of 78 days to sell a home in the fourth quarter of this year—down from the 91 days it took to sell a home in fourth quarter of last year.

- There were just two markets where the length of time it took to sell a home did rise, but the increases were minimal. Jefferson County saw an increase of eight days while Mason County rose by two days.

- King County remains the only market where it takes less than a month to sell a home.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. For the fourth quarter of 2015, I have left the needle at the same position as the previous quarter. In as much as the market is still very heavily in favor of sellers, I fear that some markets are reaching price points that will test affordability. Furthermore, while inventory levels are likely to see some growth in 2016, it will not be enough to satisfy demand, adding further upward pressure to prices.

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, sales velocities, interest rates, and larger economics factors. For the fourth quarter of 2015, I have left the needle at the same position as the previous quarter. In as much as the market is still very heavily in favor of sellers, I fear that some markets are reaching price points that will test affordability. Furthermore, while inventory levels are likely to see some growth in 2016, it will not be enough to satisfy demand, adding further upward pressure to prices.

Overall, 2015 was a stellar year with sales volumes and home prices moving higher across the board. In 2016, I believe we’ll see some growth in sales activity, as well as continued price growth – just at more modest levels than last year. Interest rates are going to rise moderately through the year, but still remain very competitive when compared to historic averages. In other words, any increase in interest rates should not be a major obstacle for home buyers.

Looking forward, I believe 2016 will be a year of few surprises. Because it is an election year, I do not expect to see any significant governmental moves that would have a major impact on the U.S. economy or the housing market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link