The following analysis of select counties of the Central and Southern Oregon real estate market is provided by Windermere Real Estate. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The Central and Southern Oregon counties covered by this report added 1,180 new jobs over the past 12 months, which represents an annual growth rate of .5%. Deschutes, Jefferson, and Klamath counties had solid job gains, but Jackson, Crook, and Josephine counties saw employment levels fall.

The unemployment rate across the region was 4.2%, down from 5% in the third quarter of 2022. By county, the lowest jobless rate was in Bend, where 3.7% of the labor force was jobless. The highest rate was in Crook County, where 5.4% of the labor force is still without a job.

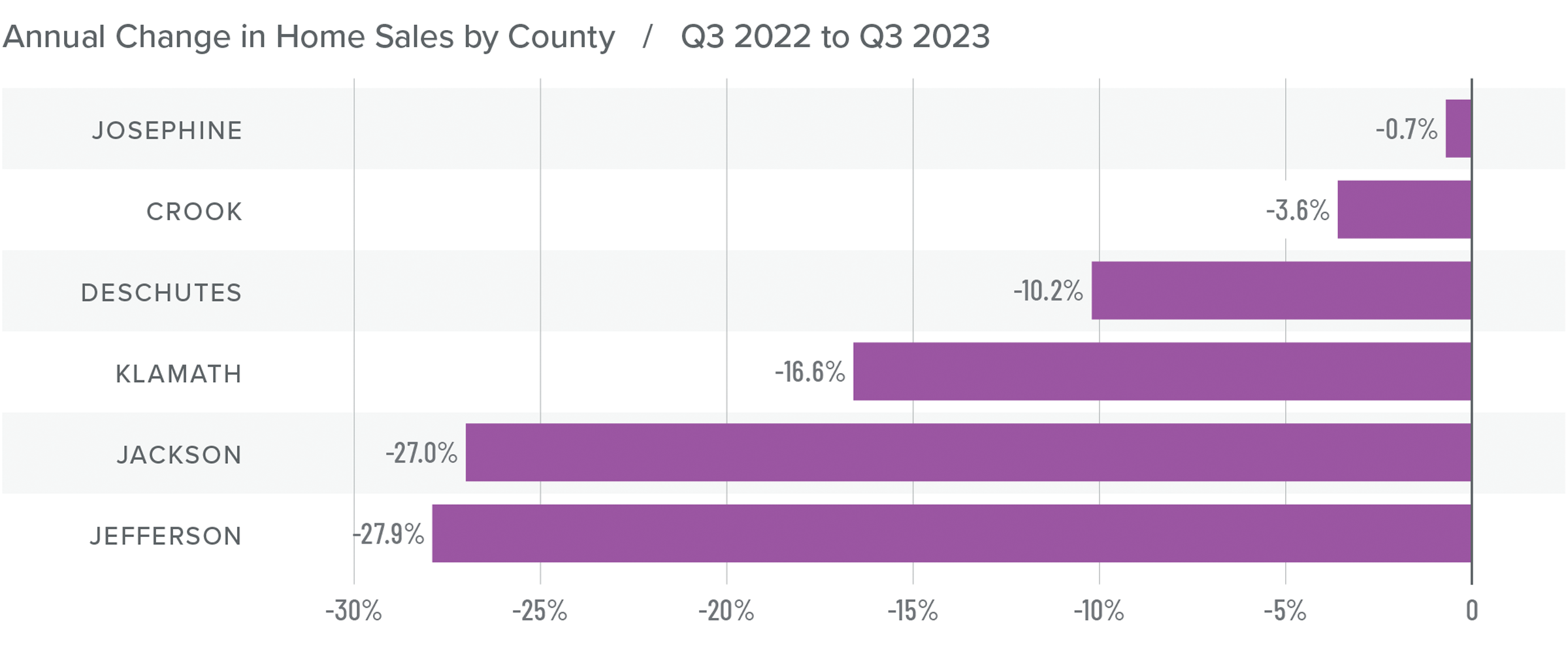

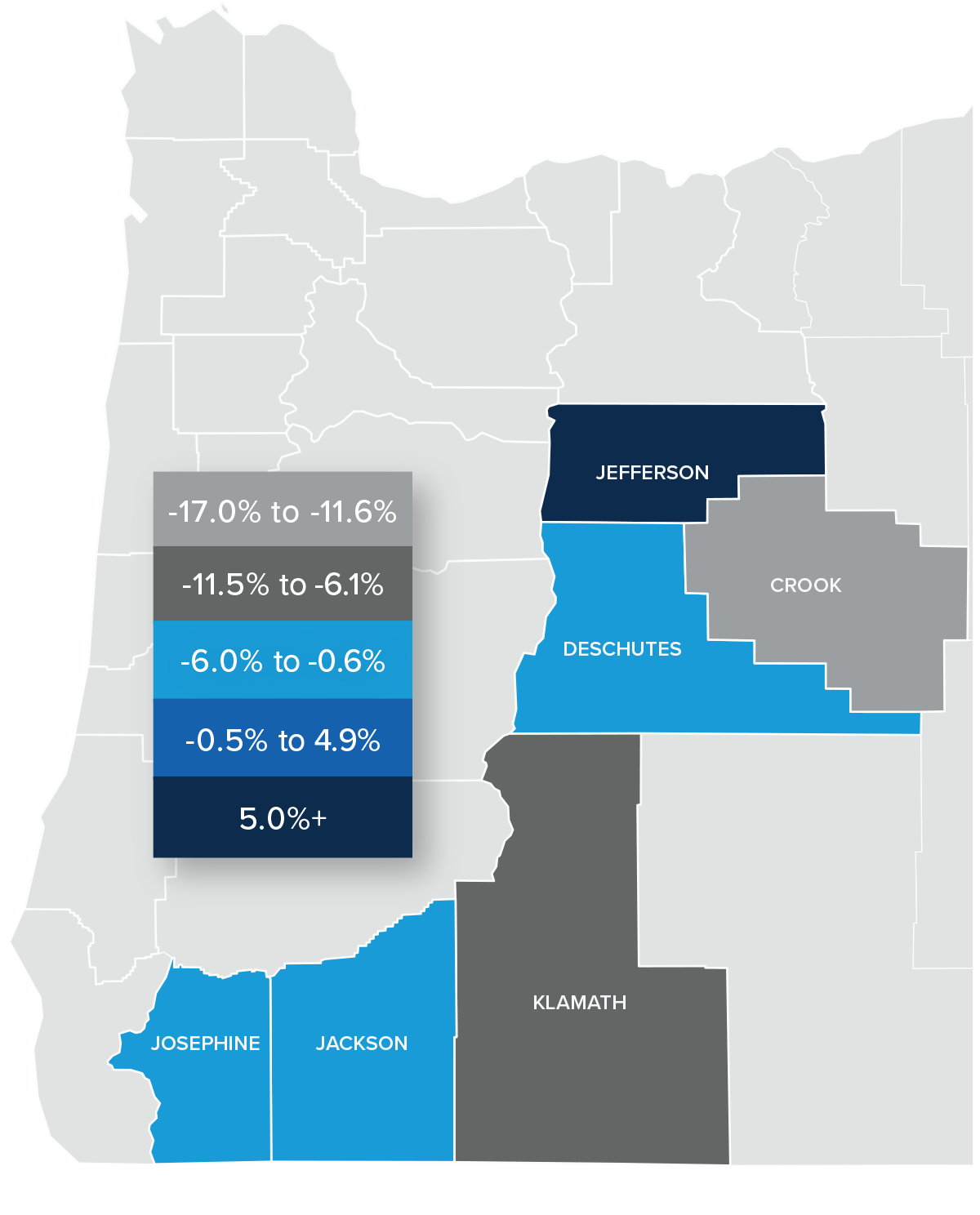

Central and Southern Oregon Home Sales

❱ In the third quarter of 2023, 2,137 homes sold, representing a drop of 15.8% compared to the same period in 2022. However, sales were 7.2% higher than in the second quarter of this year.

❱ Compared to the second quarter of 2023, sales rose in all counties other than Crook and Jefferson, where they fell 1.2% and 10.2%, respectively.

❱ Sales fell across the board in all counties compared to the third quarter of 2022, with significant declines in all markets except Crook and Josephine counties.

❱ A possible explanation for the growth in sales between the second and third quarters could be that buyers saw mortgage rates starting to rise, which spurred sales. Given that we do not expect rates to fall in the fourth quarter, it will be interesting to see if sales continue to grow.

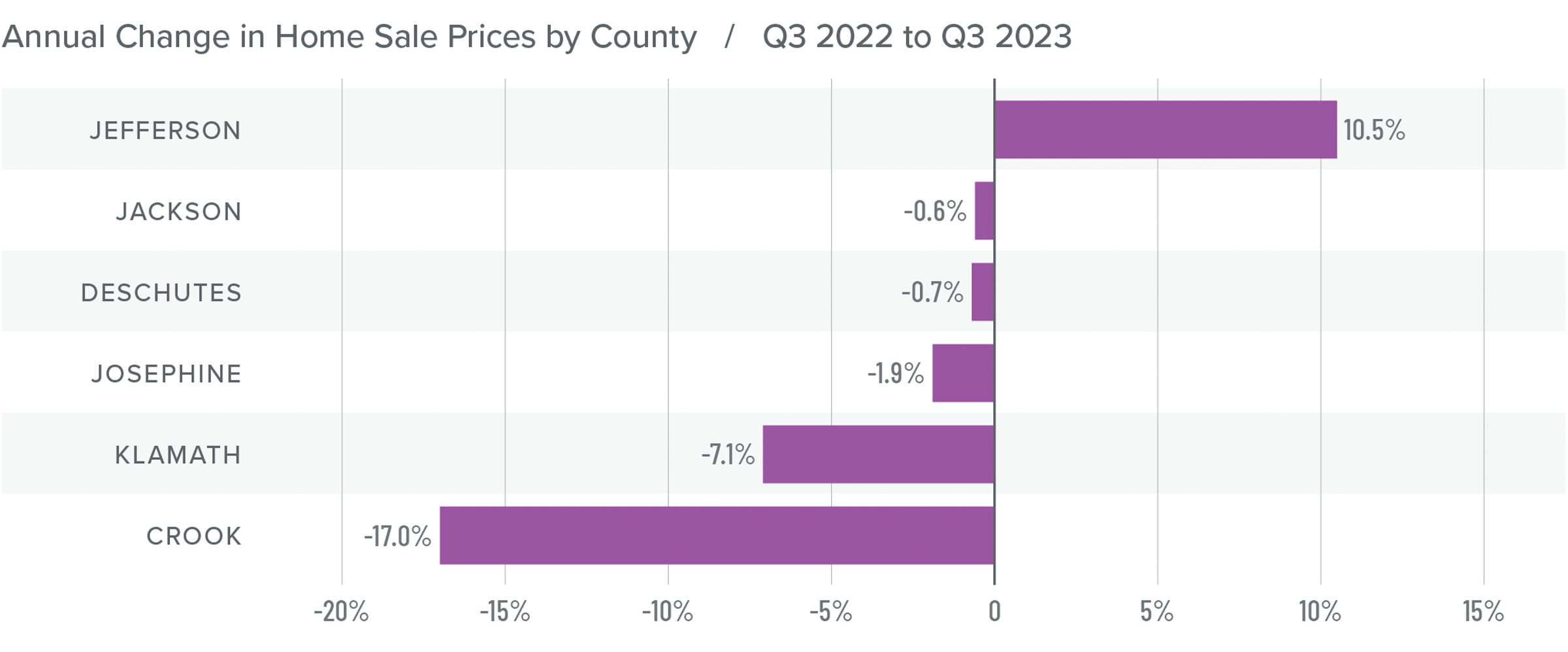

Central and Southern Oregon Home Prices

❱ The average home sale price in the region fell .4% year over year to $599,486. Prices were 1.8% higher than in the second quarter of 2023.

❱ Compared to the second quarter of this year, average prices rose in Deschutes, Jackson, Jefferson, and Josephine counties but fell in Crook and Klamath counties.

❱ Prices in every county other than Jefferson fell year over year. Crook County saw the greatest drop.

❱ The median listing price of a home rose 3.6% compared to the second quarter of this year. All markets except Jackson County raised asking prices.

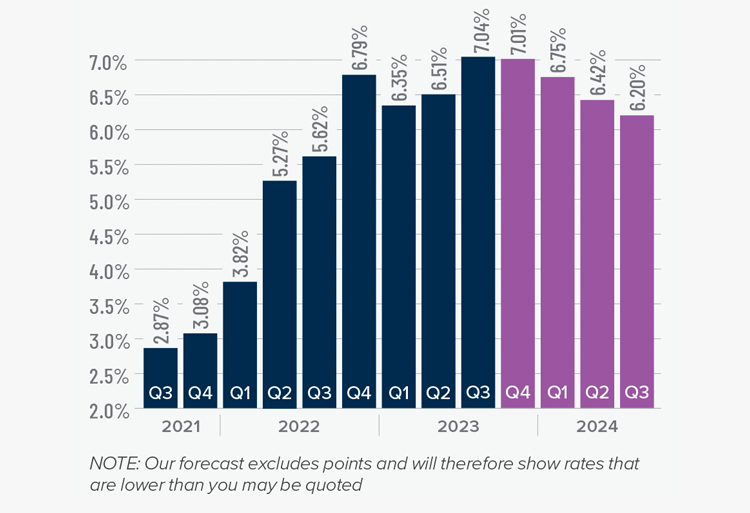

Mortgage Rates

Mortgage rates continued trending higher in the third quarter of 2023 and are now at levels we have not seen since the fall of 2000. Mortgage rates are tied to the interest rate (yield) on 10-year treasuries, and they move in the opposite direction of the economy. Unfortunately for mortgage rates, the economy remains relatively buoyant, and though inflation is down significantly from its high, it is still elevated. These major factors and many minor ones are pushing Treasury yields higher, which is pushing mortgage rates up. Given the current position of the Federal Reserve, which intends to keep rates “higher for longer,” it is unlikely that home buyers will get much reprieve when it comes to borrowing costs any time soon.

With such a persistently positive economy, I have had to revise my forecast yet again. I now believe rates will hold at current levels before starting to trend down in the spring of next year.

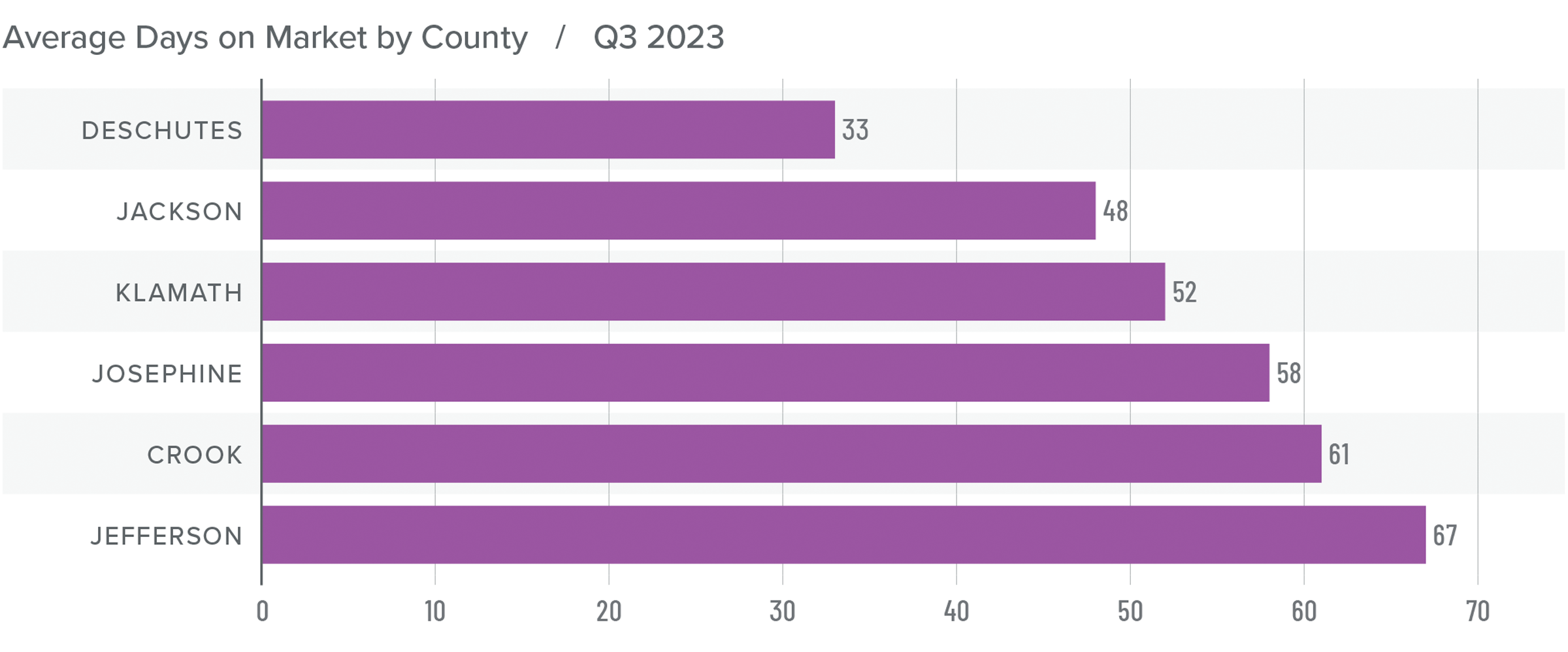

Central and Southern Oregon Days on Market

❱ The average time it took to sell a home in the region rose 21 days compared to the third quarter of 2022. Market time in the third quarter matched what we saw in the second quarter of this year.

❱ The average time it took to sell a home in the third quarter of 2023 was 53 days.

❱ All counties saw market time rise compared to the same period in 2022. Although the average days on market was static between the second and third quarters, this was due to a significant increase in market time in Jefferson County, which offset lower days on market across the balance of the region.

❱ The market appears to still be seeing demand from buyers, but this may not continue if mortgage rates stay at current levels.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Higher sales as well as higher list and sale prices suggest that the market still favors

sellers. That said, it’s unclear whether the market can continue to allow prices to rise

much more given that mortgage rates are unlikely to fall meaningfully in the near future.

As such, the needle stays in the same position as in the second quarter: favoring sellers, but only marginally.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link