Windermere Real Estate is proud to partner with Gardner Economics on this analysis of the Western Washington real estate market. This report is designed to offer insight into the realities of the housing market. Numbers alone do not always give an accurate picture of local economic conditions; therefore our goal is to provide an explanation of what the statistics mean and how they impact the Western Washington housing economy. We hope that this information may assist you with making an informed real estate decision. For further information about the real estate market in your area, please contact your Windermere agent.

Regional Economics

As the weather starts to turn in Washington, so do its economy and real estate markets. In all, I was quite pleased with this report inasmuch as it shows, in aggregate, continued improvement on all fronts, but there are headwinds that need to be acknowledged.

The counties included within this report increased the employment base by 50,000 over the past 12 months. That said, we actually lost 7,300 jobs between Q2 and Q3. At present, I am not too worried about this as I am seeing some wild seasonal fluctuations in some government employment sectors that should be ironed out by year’s end. I will, however, be closely watching the figures over the next couple of months.

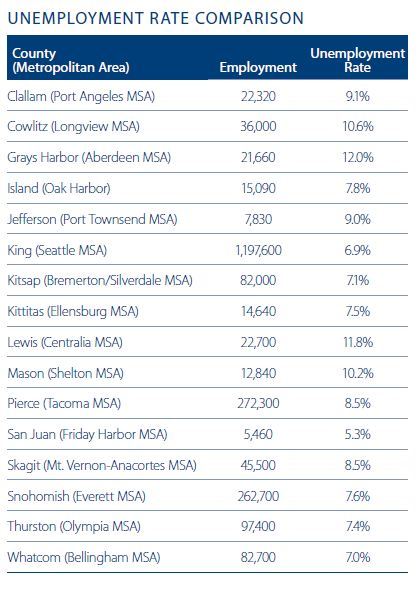

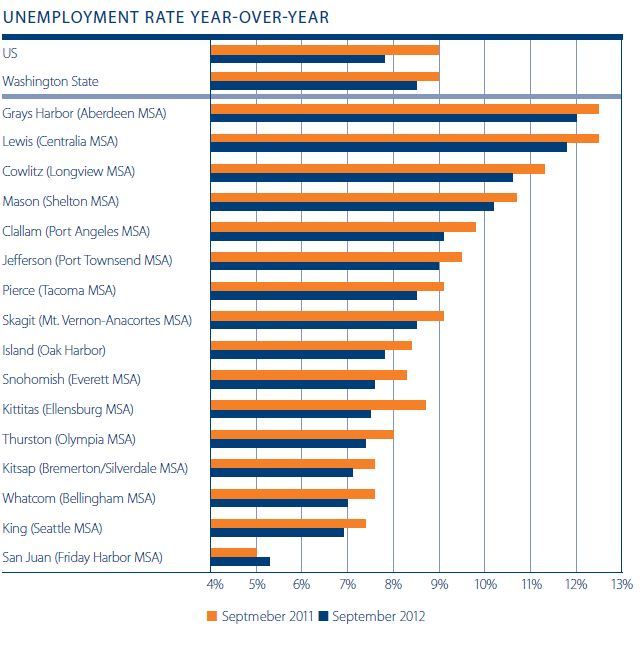

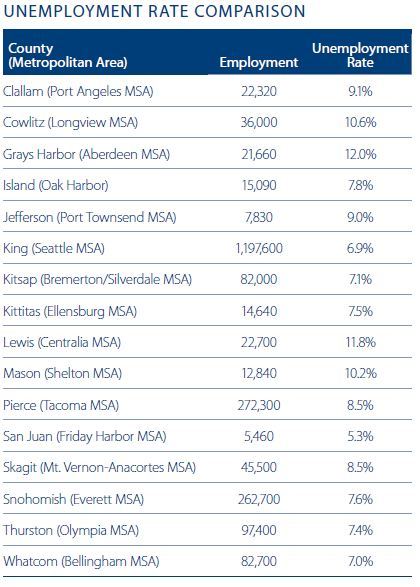

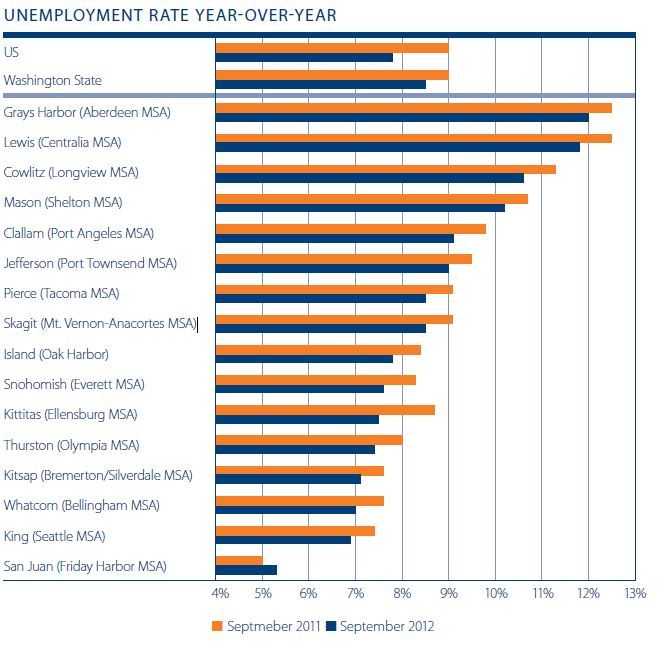

As previously stated, between September of 2011 and September of 2012, the area added 50,000 jobs—a 2.3% growth rate, which comfortably exceeded the state and nation. In our region, eight counties expanded their employment base, one remained flat, and seven showed modest contraction (a total of 3,620 jobs were shed in these counties).

Year-over-year, Whatcom County (+4.2%) grew at the greatest rate—I believe this to be due to the value of the Canadian dollar versus the “greenback”! This was followed by Snohomish and King Counties, which both expanded their job base by 3.1%. Job losses in other counties were modest, with San Juan (-5.9%), Grays Harbor (-4.2%), Kittitas (-4.1%), and Jefferson (-3.7%) Counties suffering the largest percentage losses.

When we look at the unemployment rate across the region, all counties—with the exception of San Juan County—saw the unemployment rates drop from a year ago, a trend that we have been seeing since early this year. Inasmuch as this is certainly pleasing, I do note that we have not been seeing any expansion in the civilian workforce which, undoubtedly, is having an effect on the overall unemployment rate.

The latest data is positive but the expansion appears to be losing some steam. As a result, I am going to leave the economy with the “B” grade that I gave it in the last quarter.

It is not unusual that, in an election year, the private sector tempers its hiring until it knows who will be occupying the White House. I believe that this is the case here in Washington as much as it is anywhere else. Whether we will see marked improvement in the fourth quarter is uncertain, however, I feel optimistic that our market will continue to outperform other West Coast markets as well as the U.S. as a whole.

The market has registered 40,270 home sales year-to-date in 2012—an impressive increase of 15.3% over the number of sales seen in the same period in 2011. In the third quarter, there were close to 15,500 transactions completed—another impressive figure.

All but two counties exhibited improving sales velocities over the same period in 2011. The counties where there were fewer sales, Grays

Harbor and Cowlitz, are an anomaly as both are small areas and the absolute contraction was equally small.

Of the 16 counties contained within this report, half reported doubledigit improvements in sales volumes when compared to the same period a year ago.

From a transactional standpoint, the data is positive but we are starting to see a slowdown in aggregated sales. The second quarter of the year showed an astonishing improvement of 44% in transactions when compared to the first quarter. The growth rate in Q3 has slowed to 6%. As I stated in my last report, “Choice in many markets has become limited which, if it does not improve, will likely lead to a slowdown in transactions in the second half of 2012.”

I am afraid that my fears appear to be turning into reality. I believe it unlikely that we will see much improvement as we move through the fall months, and I am now looking for signs that we will see a strong spring market relative to new listings. We certainly need it.

Regional Real Estate

The market has registered 40,270 home sales year-to-date in 2012—an impressive increase of 15.3% over the number of sales seen in the same period in 2011. In the third quarter, there were close to 15,500 transactions completed—another impressive figure.

All but two counties exhibited improving sales velocities over the same period in 2011. The counties where there were fewer sales, Grays Harbor and Cowlitz, are an anomaly as both are small areas and the absolute contraction was equally small.

Of the 16 counties contained within this report, half reported doubledigit improvements in sales volumes when compared to the same period a year ago. From a transactional standpoint, the data is positive but we are starting to see a slowdown in aggregated sales. The second quarter of the year showed an astonishing improvement of 44% in transactions when compared to the first quarter. The growth rate in Q3 has slowed to 6%.

As I stated in my last report, “Choice in many markets has become limited which, if it does not improve, will likely lead to a slowdown in transactions in the second half of 2012.” I am afraid that my fears appear to be turning into reality. I believe it unlikely that we will see much improvement as we move through the fall months, and I am now looking for signs that we will see a strong spring market relative to new listings. We certainly need it.

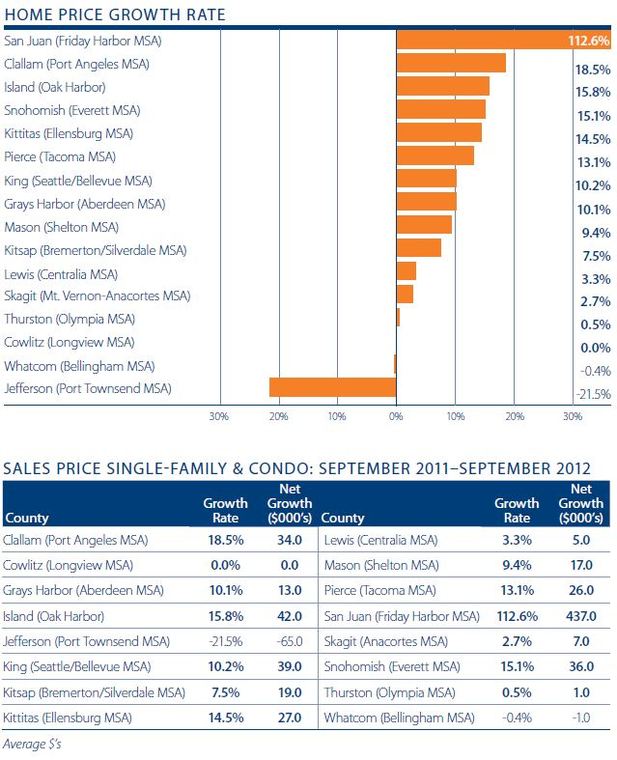

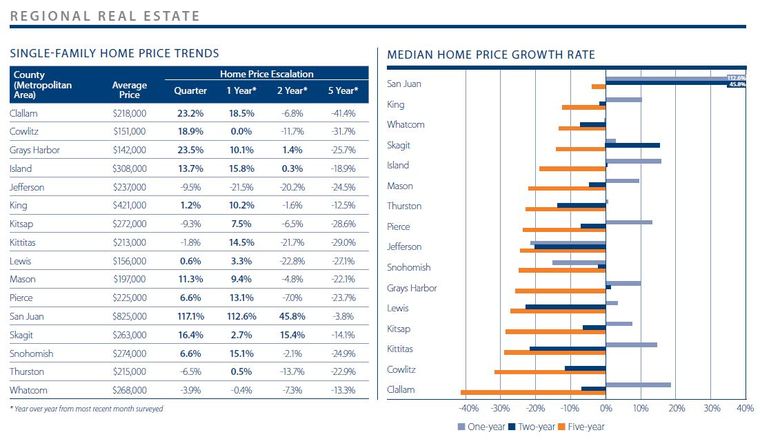

As is shown in the chart to the right, 13 counties saw the average sales prices at levels above that seen a year ago (up from 10 in my last report), just two were lower, and one was static. In aggregate, prices of homes sold in the counties analyzed have turned around with prices 6% higher than those seen in September of 2011. This figure excludes the volatile San Juan County. If we include it, prices paid for homes grew by a whopping 17% year-over-year!

Excluding San Juan County, of the counties that saw appreciation, the most pronounced gains were seen in Clallam (+18.5%), Island (+15.8%), Snohomish (+15.1), and Kittitas (+14.5%). Declines were seen in Jefferson (-21.5%) and Whatcom (-0.4%).

I was also pleased to see that there are some counties where sale prices are now higher than they were two years ago. This is important, as the early summer of 2010 represented the end of the First Time Homebuyer tax credit that functioned to artificially (but temporarily) support home prices.

The choice of homes available to purchase is woefully low across the region and does not look as if it is likely to increase any time soon. Because of this fact, and regardless of the solid price growth that we are witnessing, I cannot raise my grade above the “C” that I gave it last quarter.

Conclusions

There were a lot of interesting data points in this latest report that certainly gave me much to chew on. It is human nature to think positively about the future but to still keep an eye on the past. The economy and real estate market in Washington continue to exhibit positive growth, but the rate of growth has started to taper.

Now, some of this can certainly be attributed to seasonal fluctuations, as well as the current political environment, but it is important to put this into context. Our region continues to outperform not only all other West Coast markets, but also the United States as a whole. The headwinds that do exist, mainly in the form of low levels of housing for sale, are likely to be temporary.

I mentioned that it is in our nature to be of a positive disposition while, at the same time, waiting for something to go awry. Much has been talked about the “shadow inventory” of distressed housing that could flood the market and cause prices to start to sink again.

Inasmuch as there are certainly a substantial number of homes that are in this predicament, I do not see that it is likely that the banks that own these assets will list them en-masse. The market needs homes to buy and there are certainly more buyers than sellers in the market. Distressed inventory will actually play an important part in the housing recovery.

About Matthew Gardner

Mr. Gardner is a land use economist and principal with Gardner Economics and is considered by many to be one of the foremost real estate analysts in the Pacific Northwest.

In addition to managing his consulting practice, Mr. Gardner is a member of the Pacific Real Estate Institute; chairs the Board of Trustees for the Washington State Center for Real Estate Research; the Urban Land Institutes Technical Assistance Panel; and represents the Master Builders Association as an in-house economist.

He has appeared on CNN, NBC and NPR news services to discuss real estate issues, and is regularly cited in the Wall Street Journal and all local media.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link