This is the latest in a series of videos with Windermere Principal Economist Jeff Tucker, where he delivers the key economic numbers to follow to keep you well-informed about what’s going on in the real estate market.

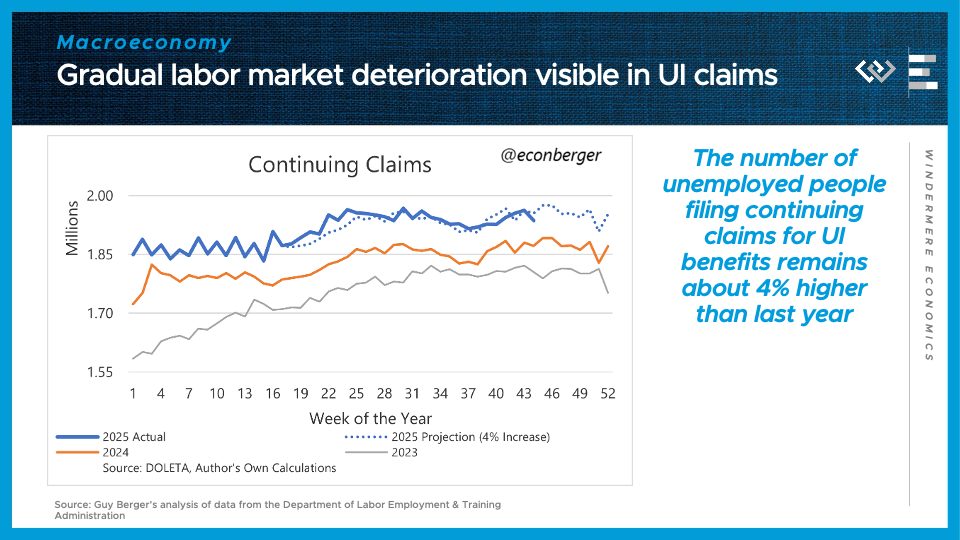

The first number to know this week: 4%. That is how much higher unemployment claims are than this time last year. We don’t actually know the unemployment rate due to the government shutdown, which suspended collection of the household survey it’s based on, so instead economists have turned to state-level data sources. Labor economist Guy Berger shared this chart comparing continuing unemployment claims in 2025, in blue, to the last two years, showing a consistent, gradual 4% year-over-year increase. That’s not great news, but it still doesn’t indicate a sudden breakdown in economic growth. We’ll get a better picture of the economy as the Bureau of Labor Statistics resumes publishing data in the remainder of 2025.

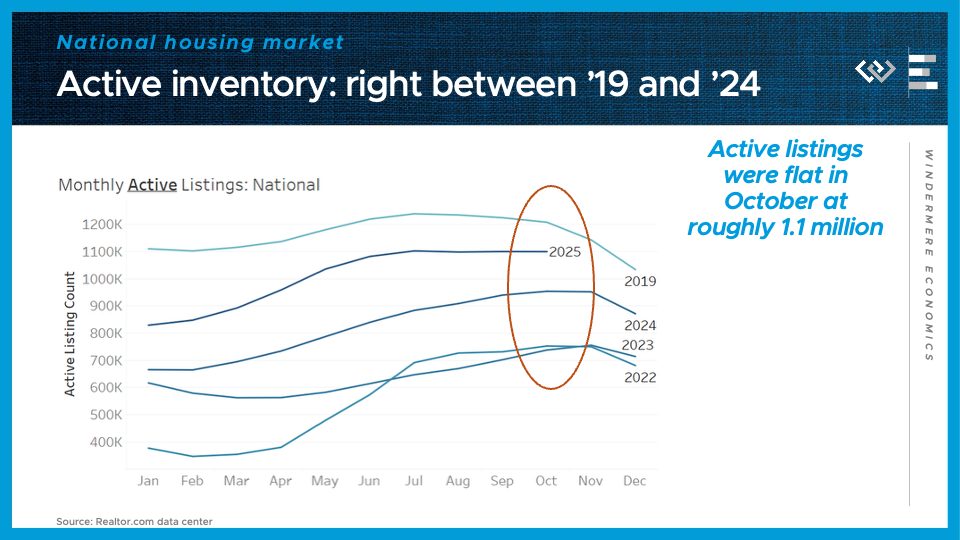

Turning to the housing market: Realtor.com reported almost exactly 1.1 million active listings for sale at the end of October, for the third month in a row. One interesting trend this chart makes clear is that, since 2020, sellers have been more willing to keep listings up later into the fall than they tended to in 2019. That means we are closer now to 2019 inventory levels than at any other time since the pandemic began.

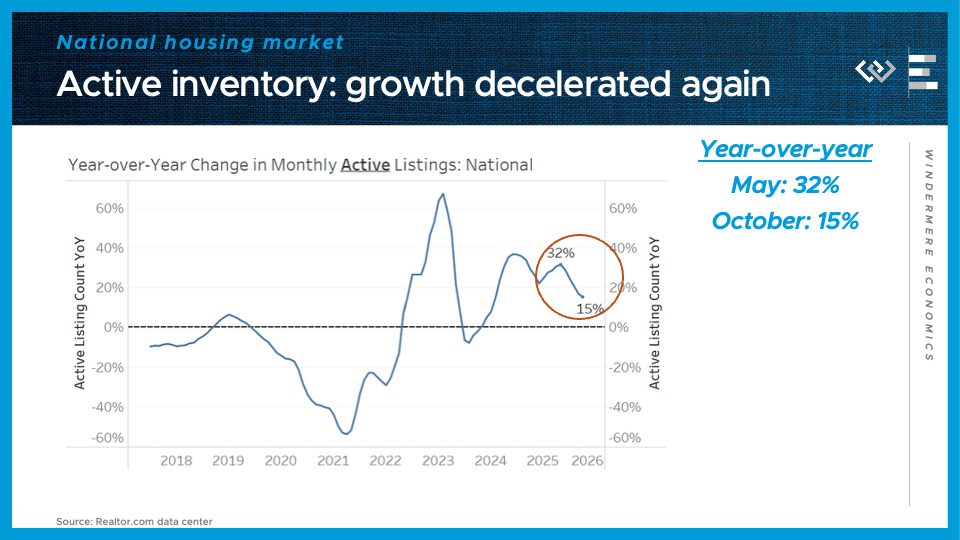

But for the fifth month in a row, the pace of growth of inventory has fallen yet again, now down to just 15% year-over-year. The big growth of active listings this spring and summer helped throw some cold water on price appreciation, pushing it down near to 0, but that inventory growth has slowed down enough that nationally, prices look most likely to flatline next year rather than plunge into negative territory.

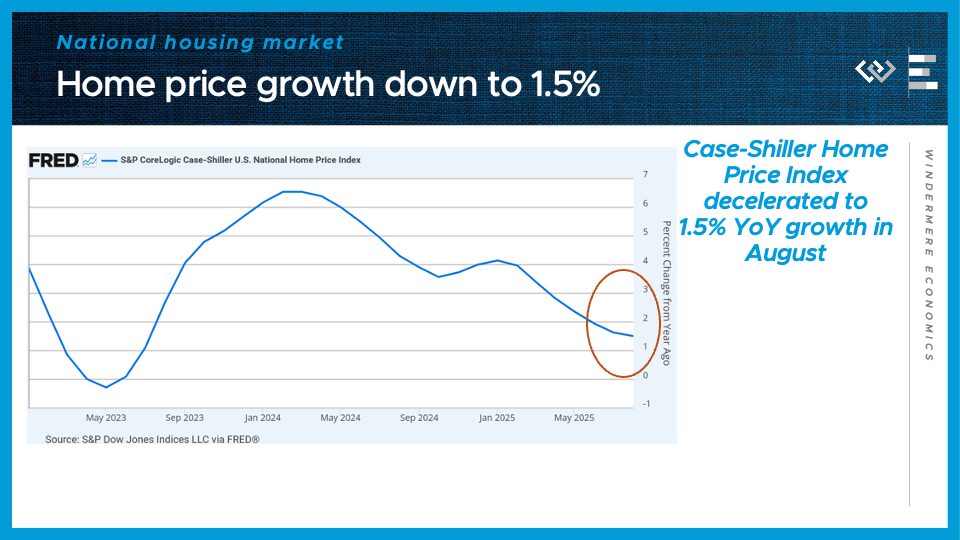

That brings me to the next number to know: 1.5%. That’s the most recent year-over-year change in the Case-Shiller Home Price Index, and the slowest pace of home price appreciation since early 2023.

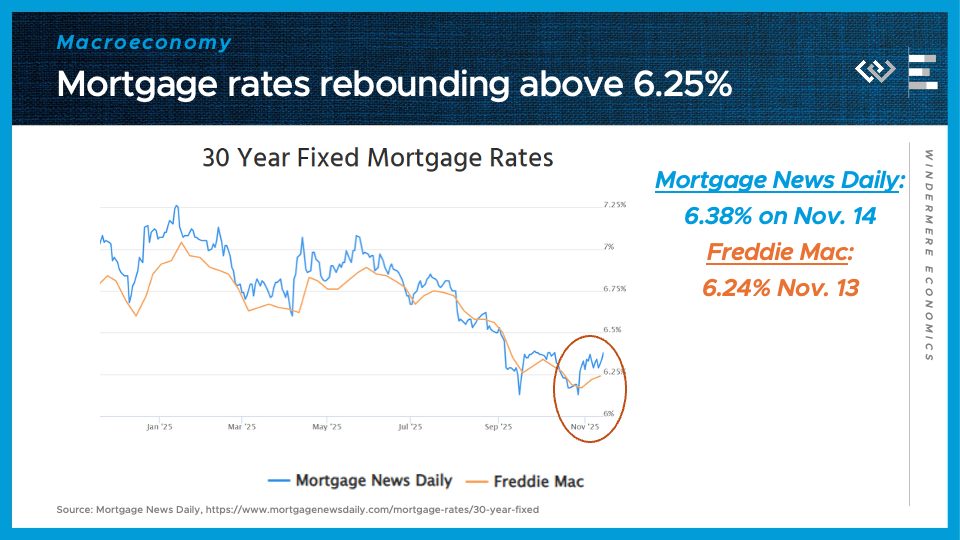

The other puzzle piece for home purchase affordability took a little step in the wrong direction last month: Mortgage rates rebounded from below 6.25% to more like 6 and 3/8, according to Mortgage News Daily. That’s still lower than they were last winter, and it just goes to show that mortgage rates rarely stick to the script and follow a predictable long-term trend.

That is all for this month; I look forward to more economic data in December, and thanks as always for watching!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link