The following analysis of select Montana real estate markets is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Following a very significant decline in employment between March and April, Montana’s economy has now recovered 36,300 of the 63,500 lost jobs. The job recovery was evident throughout the state, but Missoula has been the quickest to rebound. Current numbers show that Missoula has recovered all but 400 of the 7,400 jobs that were lost. The unemployment rate in the state was 5.6% in August, down from the April peak of 11.9%.

Unemployment estimates across the various metropolitan service areas (MSAs) show Billing’s current rate is 4.9%, Great Falls’ is 5.3%, and Missoula’s is 5.4%. If a headwind exists that may slow the jobs recovery, it is that new COVID-19 infection rates started picking up significantly in September. Unless we see those numbers start to drop, or at least level off, a full employment recovery may be significantly delayed.

HOME SALES

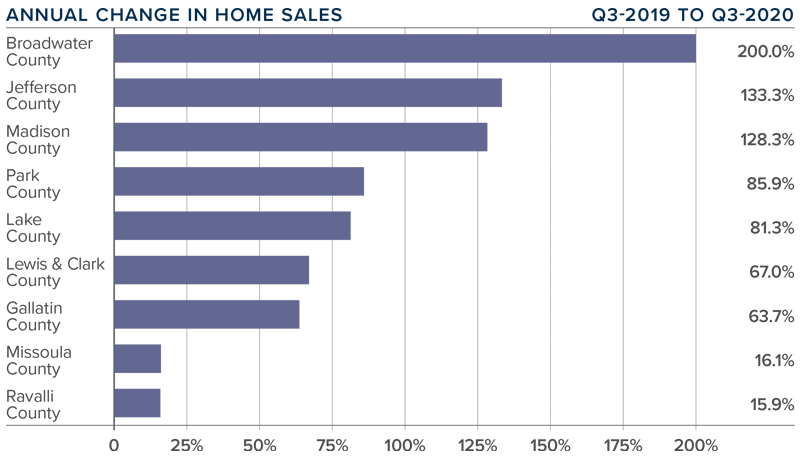

- During the third quarter of 2020, 2,543 homes sold in the markets contained in this report. This is an increase of 46.6% over the same period in 2019 and 203% higher than the second quarter of this year.

- Sales activity was positive across the board, with significant improvement in all counties. The largest annual increase was in very small Broadwater County, where sales were up 200%. However, that meant sales rose from two to six.

- The number of homes for sale remains well below where I would like to see it. That said, although listing activity was 8.9% lower than a year ago, it was up 8.2% from the second quarter of this year.

- I would like to see inventory levels higher, but I was still pleased to see some improvement compared to the second quarter.

HOME PRICES

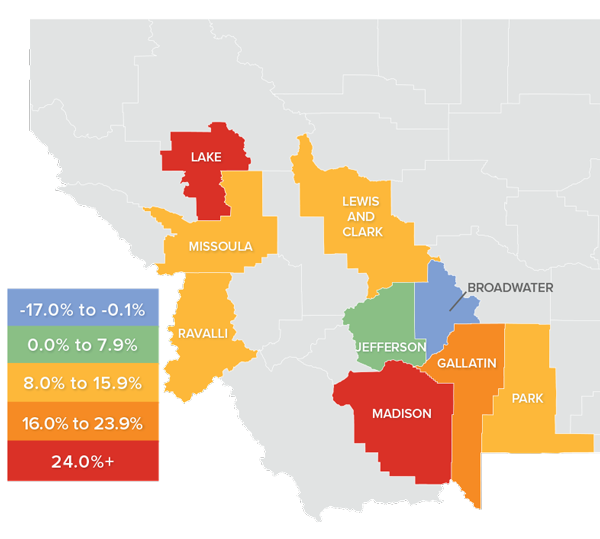

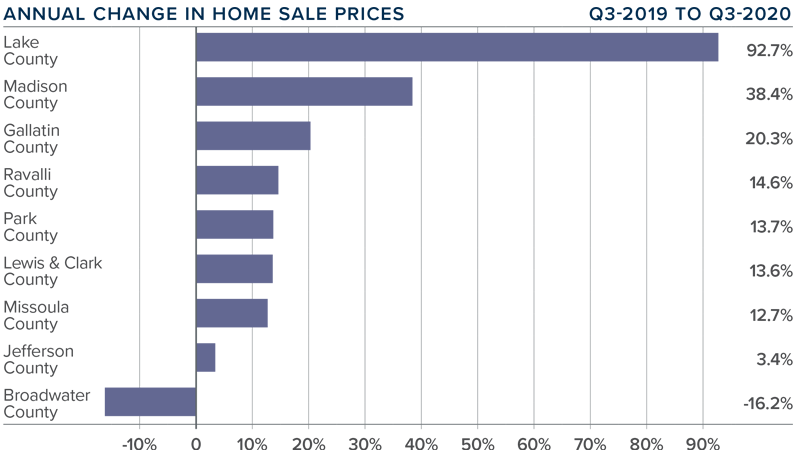

- Year-over-year, home prices rose a significant 30.6% to an average of $499,013. Prices were also 40.4% higher than in the second quarter of this year.

- Average home prices rose everywhere but Broadwater County, though this was likely due to the fact that there were only a handful of sales in that market.

- An improving economy, in concert with rapidly improving demand, gave the housing market the much-needed boost it needed following very poor second-quarter activity.

- As I predicted in the second quarter Gardner Report, summer brought more inventory which not only led to more sales, but also a return of price growth.

DAYS ON MARKET

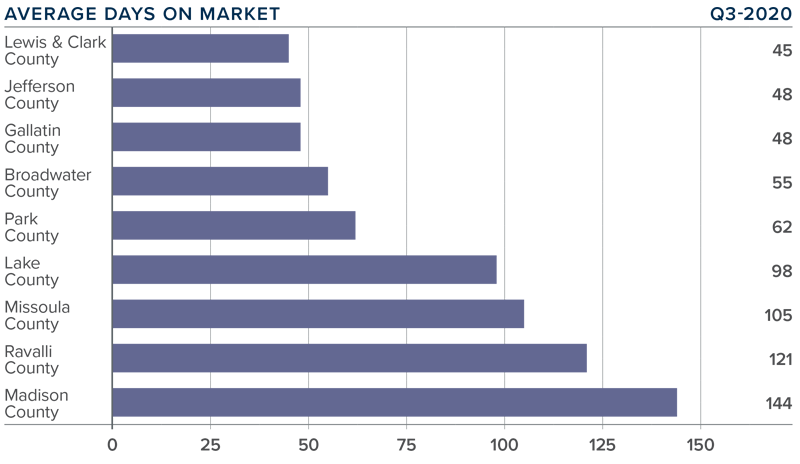

- The average number of days it took to sell a home rose one day compared to the third quarter of 2019.

- Homes sold fastest in Lewis and Clark County and slowest in Madison County. All counties other than Lake and Gallatin saw days on market rise, but the overall average dropped because Lake County saw the time on market drop from 160 days to 98.

- During the quarter, it took an average of 81 days to sell a home in the region.

- The headline here is that although days on market rose in many counties, it was likely due to the increased number of homes on the market that gave buyers more choice.

CONCLUSIONS

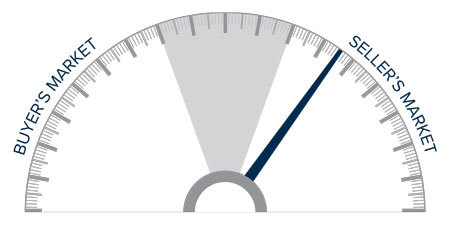

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Pending sales rose even in the face of decreased supply. Price growth has bounced back significantly, signifying strong demand. This, combined with very favorable mortgage rates, suggests the market will continue to be buoyant.

The housing market has recovered, and it remains a seller’s market. As such, I have moved the needle a little further in their favor.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link