The following analysis of the Central Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Washington State continues to be one of the fastest growing states in the nation and there is little to suggest that there will be any marked slowdown in the foreseeable future. Over the past year, the state has added 105,900 new jobs, representing an annual growth rate of 3.2%. This remains well above the national rate of 1.65%. Private sector employment gains continue to be robust, increasing at an annual rate of 3.7%. The strongest growth sectors were Construction (+7.4%), Information (+6.2%), and Professional & Business Services (+6.1%). The state’s unemployment rate was 4.5%, down from 4.8% a year ago.

The counties within Central Washington have added 2,861 new jobs over the past 12 months, representing a growth rate of 1.2%. The local unemployment rate for the area continued to fall, with a drop from 5.6% to 4.9%.

HOME SALES ACTIVITY

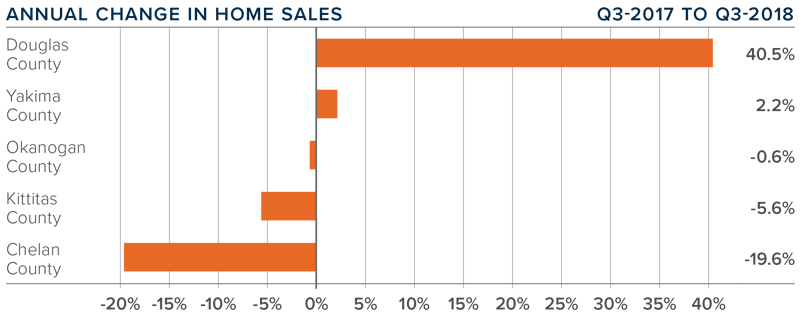

- Last quarter, home sales throughout Central Washington dropped by 1.7% to 1,387 sales, but they were 6.8% higher than the second quarter of this year.

- Sales rose most in Douglas County, which had an impressive 40.5% increase over the third quarter of 2017. Yakima was the only other county that saw sales rise. There was a significant drop in sales in Chelan County, which may be a function of high home prices in that area.

- The number of pending home sales—an indicator of future closings — was up 4.1% compared to the second quarter, indicating that closings will likely rise in the final quarter of the year.

- I have been suggesting that the shortage of homes for sale was an issue, but that appears to be reversing course. Total listings were up 12.1% compared to the second quarter of this year.

HOME PRICES

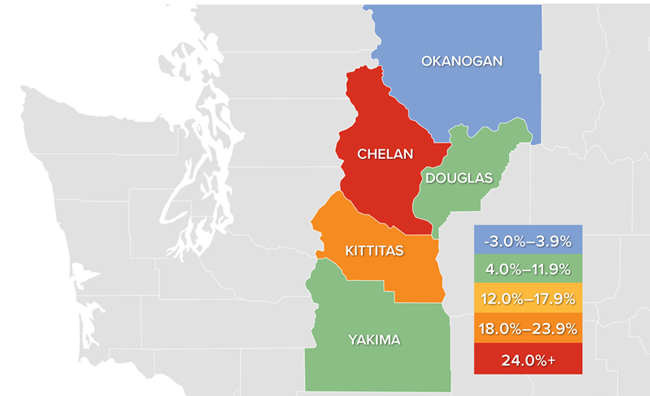

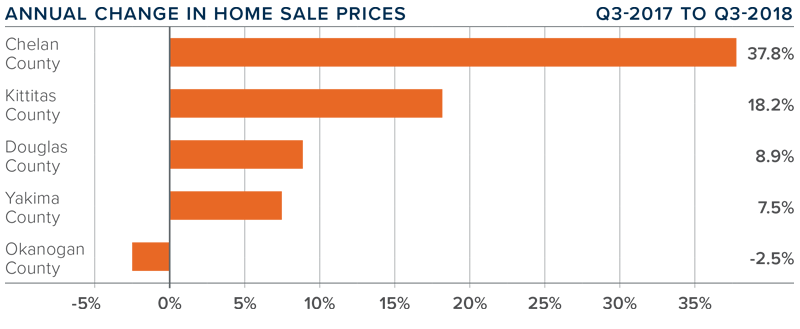

- Year-over-year, the average home price in the region rose 15% to $327,412. Price growth remains well above the long-term average, but I expect that additional inventory will start to cool home price appreciation.

- Okanogan County was the only market that saw average sale prices drop, but small markets can experience significant swings in price. I do not see this as a pervasive issue.

- Prices rose in four of the five counties in this report compared to the third quarter of 2017. Chelan County stood out with a very substantial increase of 37.8%.

- Home-price growth has been increasing at above-average rates due to supply constraints. However, I believe additional inventory will start to taper price increases.

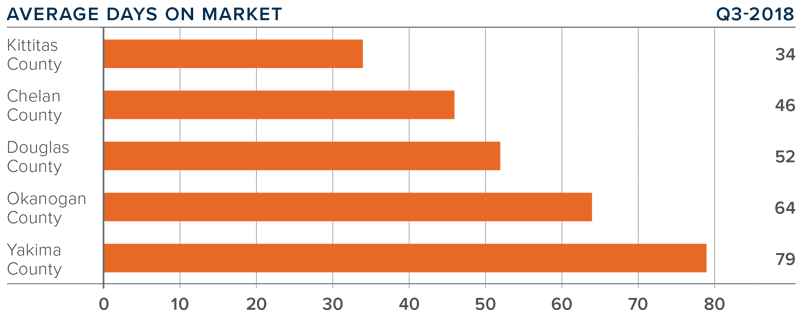

DAYS ON MARKET

- The average number of days it took to sell a home dropped eight days when compared to the third quarter of 2017.

- The average time it took to sell a home in the region was 55 days, down 12 days when compared to the second quarter of 2018.

- All the markets contained in this report, other than Douglas, saw days-on-market drop from the same quarter in 2017.

- Homes again sold fastest in Kittitas County, where it took an average of just 34 days to sell a home. The greatest drop in days on market was in Okanogan County, where it took 43 fewer days than in the third quarter of last year.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the third quarter of 2018, I have moved the needle a little toward buyers. Increases in inventory, together with modestly slowing home price growth, should take some of the “froth” off the market for the balance of the year.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has more than 30 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link