The following analysis of select Montana real estate markets is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you in making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

According to the Labor Department, Montana added 4,700 new non-agricultural jobs in 2018, representing an annual growth rate of 1.5%. For perspective, the U.S growth rate is running at about 1.7%. State employment growth was a little frenetic last year, with monthly employment dropping in three of twelve months. I do not see this as a trend but I don’t expect to see any rapid rise in employment in 2019 either. My current forecast suggests that the state will see non-farm employment rise by 1.2% in 2019 (or an additional 5,800 new jobs). In December, the state unemployment rate was a healthy 3.7%, down from 4.1% a year ago.

HOME SALES ACTIVITY

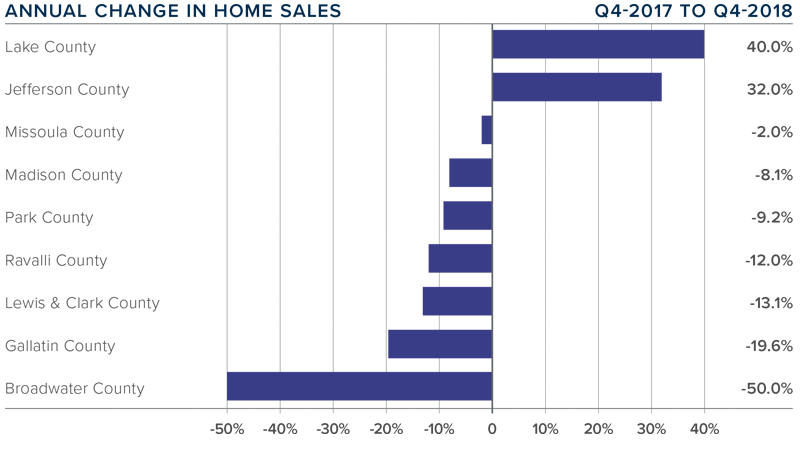

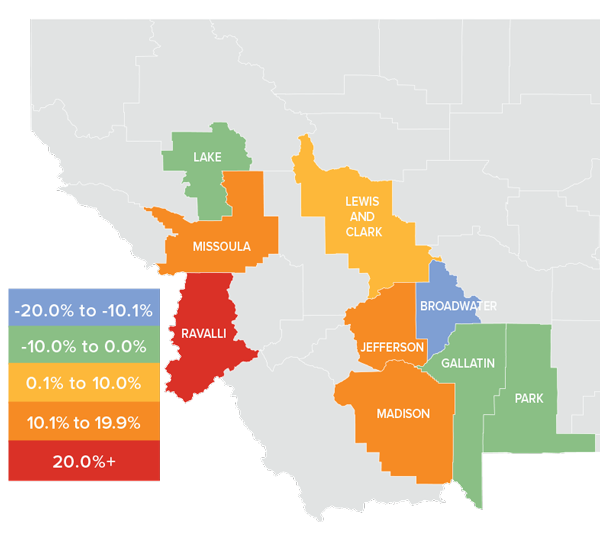

- 1,187 homes sold during the final quarter of 2018, a drop of 13.7% over the same period in 2017.

- Total sales activity rose in two of the counties analyzed in this report. The largest annual increase was in Lake County, which jumped almost 40%, from 22 home sales to 30. Sales fell in the seven remaining counties. The greatest decline was in Broadwater County, where sales were down 50% (though this only represented a drop of 11 units).

- The number of homes for sale remains well below where I would like it to be, with an average of 1,530 active listings in the counties contained in this report.

- Inventory levels continue to hold sales back and are not sufficient to meet demand. I am optimistic that the spring market will bring some relief to buyers by giving them more choice, but this is not a certainty.

HOME PRICES

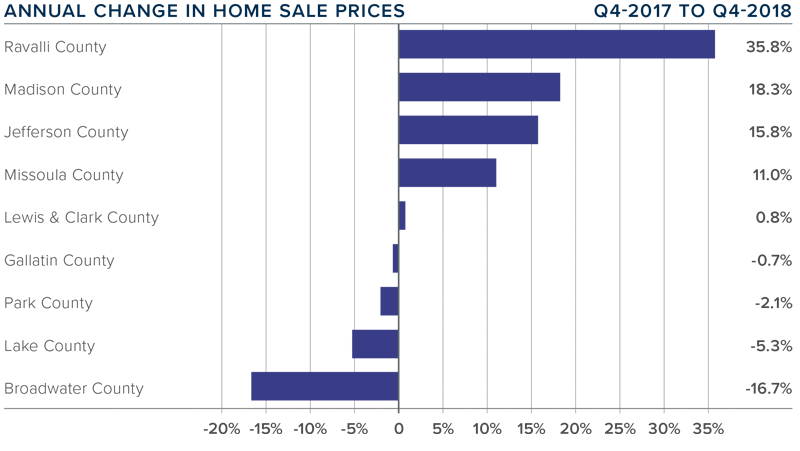

- The average home price in the region continued to rise in fourth quarter, with a modest year-over-year increase of 1.2% to $411,783.

- In addition to Ravalli County, three additional counties experienced double-digit price increases compared to a year ago. Average home prices dropped in four counties, with the largest decline in Broadwater County, but this is a very small market with few transactions so it’s prone to extreme swings.

- Price appreciation was strongest in Ravalli County, where home prices rose by a substantial 35.8%.

- The takeaway from this data is that although demand may be fairly buoyant, housing affordability may be becoming an obstacle.

DAYS ON MARKET

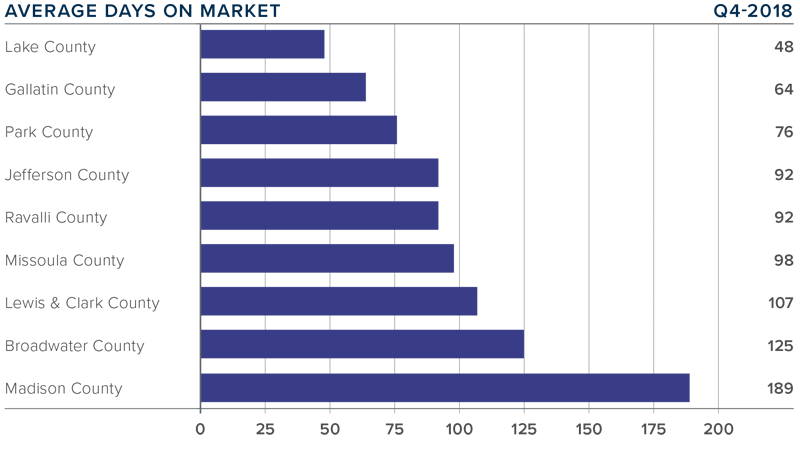

- The average number of days it took to sell a home dropped 45 days compared to the final quarter of 2017.

- Homes sold fastest in Lake County and slowest in Madison County. In five counties — Missoula, Ravalli, Lake, Lewis & Clark, and Jefferson — days on market dropped compared to the final quarter of 2017.

- During the fourth quarter of 2018, it took an average of 99 days to sell a home in the region.

- The takeaway here is that, in most markets, demand continues to exceed supply.

CONCLUSIONS

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the final quarter of 2018, I have moved the needle very slightly toward buyers, although it 76 clearly remains a sellers’ market. Even with the lack of available homes for sale, price growth has tapered, and this will help buyers. Housing affordability remains a concern in some markets, so I will be watching this closely as we move through 2019.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governor's Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link