Windermere Real Estate is proud to partner with Gardner Economics on this analysis of the Oregon and Southwest Washington real estate market. This report is designed to offer insight into the realities of the housing market. Numbers alone do not always give an accurate picture of local economic conditions; therefore our goal is to provide an explanation of what the statistics mean and how they impact the Oregon and Southwest Washington housing economy. We hope that this information may assist you with making an informed real estate decision. For further information about the real estate market in your area, please contact your Windermere agent.

Regional Economics

For regular readers of this report, it must be starting to feel as if you are stuck in the movie “Groundhog Day” when reading my commentary on the Oregon and Southwest Washington economy. As I review Gardner Reports from prior quarters, I note terms such as “painfully slow recovery” and “tepid growth” used with monotonous repetitiveness. Unfortunately, inasmuch as I would like to be the bearer of better news on the economy and job growth in the region, we are not quite there yet.

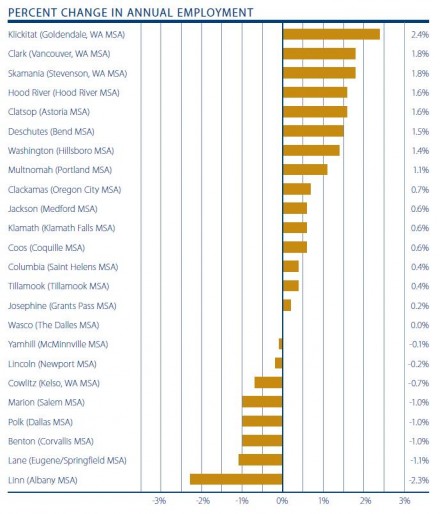

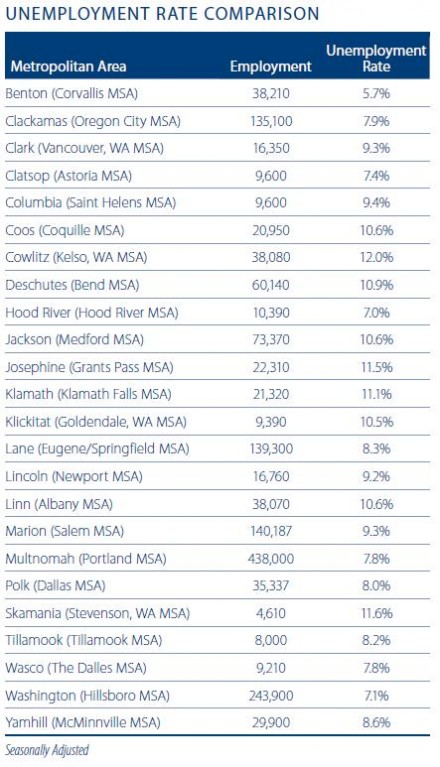

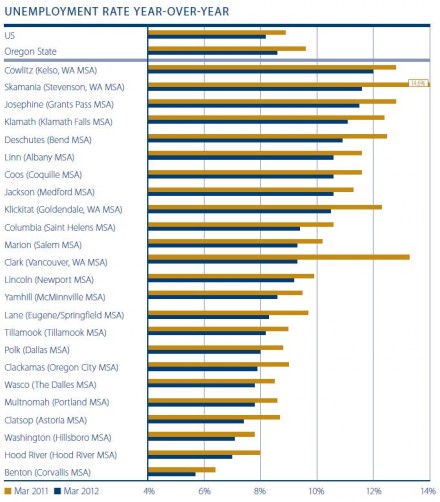

The current employment situation shows that the counties covered by this report grew by 10,272 jobs over the past 12-month period, or a 0.59% growth rate. Although still higher than the state’s overall growth rate of 0.3%, it remains below the U.S. rate of 1.5%. Additionally, it appears as if hiring in the first quarter of this year was actually negative—a trend that I hope is just temporary.

Fifteen of the 24 counties covered in this report did see job growth over the past 12-month period. These were led by Klickitat (+2.4%), Clark and Skamania (+1.8%), Hood River and Clatsop (+1.6%), Deschutes (+1.5%), Washington (+1.4%), and Multnomah (+1.1%) Counties. The number of counties growing year-over-year matched my last report.

On the negative side, job losses were most profound in Linn County (-2.3%), followed by Lane County (-1.1%). Additionally, Benton, Polk, and Marion counties all saw a one percent decline.

As I mentioned previously, quarterly growth was concerning, with 17 counties losing jobs between the end of 2011 and March of 2012. This drop in unemployment is due in no small part to the decline in the labor force participation rate, which suggests that there are fewer people actively looking for work. As such, I am giving the employment situation a grade of “D”, down from “C-” in the last quarter. The increase in jobs that I had anticipated this spring has not yet appeared, but I will be keeping a close eye on the employment situation and hope to have a better report this summer.

Regional Real Estate

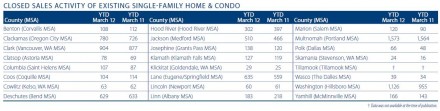

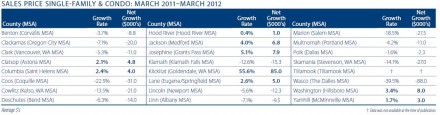

Overall, home sales in the markets covered by this report continued to increase this spring with 7,871 transactions occurring—an increase of five percent from the 7,495 transactions seen in the first quarter of 2011. Year-over-year we note that 11 counties saw an increase in sales, nine did not meet last year’s figures, and three counties saw an identical number of transactions in 2011 as compared to the previous year.

Seventeen counties registered an increase in sales activity over the first quarter of 2011 with just six seeing declines. In the areas that saw a drop in activity, I was most surprised to see the Bend and Hood River markets included, as most of the larger markets have improved over the past year. Smaller markets, such as Lincoln, Benton, and Coos Counties have fewer homes and are, therefore, historically prone to wild fluctuations.

It appears as if the larger markets are now starting to suffer from a lack of available inventory which is having an adverse effect on sales. This is not unique to Oregon (it has already become an issue in Washington State, too) and I will be interested to see if this issue becomes more prevalent as we move into the peak buying season.

Of the markets that saw an increase in sales, the greatest growth was seen in Skamania County where sales were up by 50 percent—that said, the absolute rise was from just 16 to 24 units. Other notable increases in sales occurred in Polk (+38%), Marion (+33%), Columbia (+23%), and Washington (+18%) Counties.

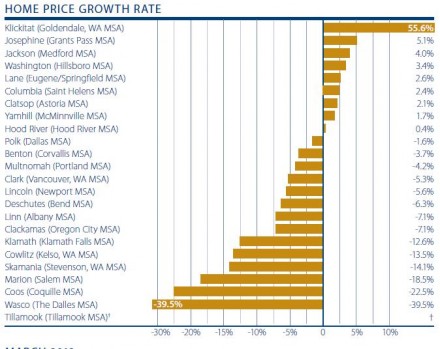

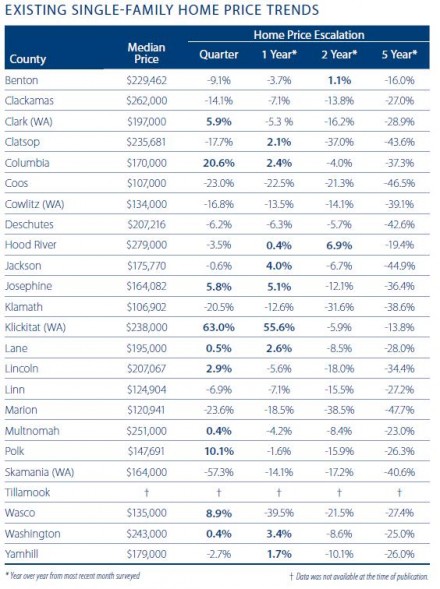

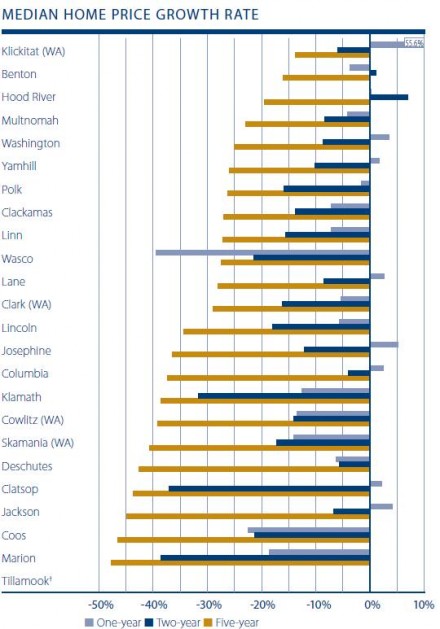

From a value standpoint, nine counties registered year-over-year price increases with 14 showing declines in values from a year ago. In aggregate, the markets surveyed saw values decline by 3.9% over the same period in 2011.

Other than the substantial 55.6% growth in the small Klickitat County area, the other eight counties registered increases in value ranging from 0.4% to 5.1%. The greatest declines in value came in Wasco (-39.5%), Coos (-22.5%), Marion (-18.5%), and Skamania (-14.1%) Counties.

I was interested to see that 10 counties exhibited price growth over the previous quarter, as opposed to nine that saw quarterly appreciation in our last report. That said, the number of counties that have demonstrated higher prices as compared to two years ago, dropped from five to two.

Overall, I give the real estate market a “D” grade this quarter.

Conclusion

The Oregon and Southwest Washington economy and its real estate markets still appear to be in stasis. As I stated in last quarter’s report, they remain, to a degree, reliant on each other and improvement in one will likely lead to improvement in the other.

Employment growth remains slow in the aftermath of the housing crisis since households are spending cautiously, banks are lending cautiously, and businesses are investing cautiously. Along with all the other states in the U.S., weakness persists in the public sector as well as all real-estate-related industries.

The number of workers suffering from long-term unemployment, which is defined as a span of more than a month or two, remains far higher than anything we have seen since the Great Depression. This is true both in Oregon and in most other U.S. states. As our resources sit idle they become less competitive, and the damage done by the recession becomes more permanent. The problem of long-term unemployment is most severe across much of rural Oregon, where many communities have yet to share in the recovery.

As stated previously, I remain concerned about the lack of inventory in all market areas and that this lack of choice may discourage buyers from entering the market. Overall, the housing market has yet to find any real direction, but the increase in pending sales could be an encouraging sign of things to come.

About Matthew Gardner

Mr. Gardner is a land use economist and principal with Gardner Economics and is considered by many to be one of the foremost real estate analysts in the Pacific Northwest.

In addition to managing his consulting practice, Mr. Gardner is a member of the Pacific Real Estate Institute; chairs the Board of Trustees for the Washington State Center for Real Estate Research; the Urban Land Institutes Technical Assistance Panel; and represents the Master Builders Association as an in-house economist.

He has appeared on CNN, NBC and NPR news services to discuss real estate issues, and is regularly cited in the Wall Street Journal and all local media.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link